Horse Saddle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431418 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Horse Saddle Market Size

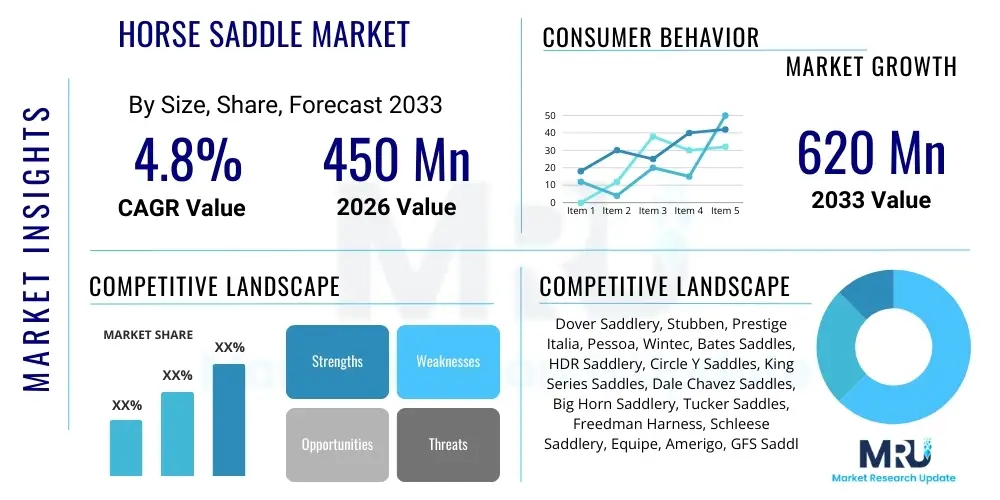

The Horse Saddle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

The consistent expansion of the equestrian sports sector globally, coupled with the increasing adoption of horses for recreational and therapeutic purposes, serves as the foundational impetus for market growth. This growth is particularly noticeable in developed regions where horse ownership and participation in competitive riding disciplines such as dressage, show jumping, and eventing are highly organized and professionally supported. Consumer demand is shifting towards customized, ergonomic saddles that prioritize both rider comfort and equine welfare, driving innovation in material science and design methodologies within the industry.

Furthermore, technological advancements are playing a crucial role in enhancing saddle performance and accessibility. The integration of precision fitting technologies, including digital measurement systems and pressure mapping, ensures a better fit, which is critical for preventing injury and maximizing performance. This emphasis on customization and therapeutic benefits allows premium saddle manufacturers to command higher price points, contributing significantly to the overall market valuation increase projected through 2033. Developing economies are also beginning to contribute to market size, driven by rising disposable incomes and the gradual globalization of equestrian culture.

Horse Saddle Market introduction

The Horse Saddle Market encompasses the manufacturing, distribution, and sale of equipment used to secure a rider onto the back of a horse, mule, or other equidae. Saddles are essential tools for riding, ensuring the safety, stability, and comfort of both the rider and the animal. The core product definition involves complex engineering to distribute the rider's weight evenly across the horse's back, protecting the spine and ensuring freedom of movement. Historically crafted predominantly from leather, the market now features a wide array of synthetic materials that offer lightweight, durable, and low-maintenance alternatives, catering to diverse riding needs and budgetary constraints.

Major applications for horse saddles span across competitive equestrian sports, recreational riding, military and policing mounted units, agricultural labor (ranching), and therapeutic riding programs. Benefits derived from high-quality saddles include improved balance and posture for the rider, reduced strain and pressure points on the horse, and enhanced communication between the pair. The shift towards specialized riding disciplines mandates corresponding specialization in saddle design, leading to distinct segments such as English saddles (further subdivided into dressage, jumping, and general purpose) and Western saddles (subdivided into ranch, trail, and barrel racing).

Driving factors propelling market expansion include the sustained growth in global equestrian participation, particularly among affluent demographics, and a heightened focus on animal welfare standards which necessitates professionally fitted equipment. Product innovation, such as adjustable tree systems and advanced padding materials, attracts premium segment buyers. Moreover, the increasing visibility of equestrian events through international media coverage contributes to the popularity and commercial viability of the market. The essential nature of the saddle for effective and humane horseback riding ensures a stable demand base.

Horse Saddle Market Executive Summary

The Horse Saddle Market is characterized by robust growth underpinned by strong consumer interest in equestrian activities and a continuous drive toward product personalization and quality. Business trends indicate a dichotomy where traditional, high-end leather craftsmanship coexists with mass-market production utilizing advanced synthetic materials. Key manufacturers are focusing on integrating ergonomic design principles and lightweight materials to reduce the overall weight without compromising structural integrity. Supply chain resilience, especially concerning premium leather sourcing and sustainable manufacturing practices, is becoming a primary competitive differentiator. Furthermore, direct-to-consumer (DTC) online channels are rapidly gaining traction, allowing niche and custom saddle makers to bypass traditional retail distribution models.

Regionally, North America and Europe remain the dominant revenue generators, primarily due to the established infrastructure for equestrian sports, high per capita income, and a deep-rooted cultural tradition of horse ownership. North America, especially the United States, drives demand for Western saddles, while Europe maintains strong demand for English dressage and jumping saddles. The Asia Pacific region, while currently holding a smaller share, exhibits the highest potential CAGR, driven by increasing investments in equestrian facilities in countries like China and India, catering to a burgeoning affluent class seeking leisure and competitive sporting activities.

Segment trends reveal that the Western Saddle category is expected to maintain a significant market share, reflecting the widespread use of horses for ranching and trail riding activities across the Americas. However, the English Saddle segment, particularly competitive dressage and jumping saddles, is projected to experience faster value growth due to their high average selling price and demand linked to professional sports. The Material segment is seeing notable shifts, with synthetic saddles gaining popularity due to their durability, ease of maintenance, and lower price point, appealing strongly to entry-level riders and large riding schools seeking cost-effective solutions.

AI Impact Analysis on Horse Saddle Market

User queries regarding AI's influence in the Horse Saddle Market frequently revolve around personalization, fitting accuracy, and optimized manufacturing processes. Consumers are keen to understand how AI can solve the long-standing challenge of achieving a perfect saddle fit, which is crucial for equine health and performance. Key themes include the use of machine learning algorithms to analyze pressure mapping data from sensors embedded in saddle pads, translating complex biomechanical information into actionable design adjustments, and optimizing inventory based on predictive demand modeling for customized products. There is an expectation that AI will democratize custom fitting, making professional-grade ergonomics accessible to a broader consumer base, while streamlining the highly specialized production workflows.

- AI-driven precision fitting: Utilization of machine learning to analyze large datasets derived from 3D scanning and pressure pads, ensuring optimal fit geometry for individual horse and rider combinations.

- Predictive maintenance and durability monitoring: Deployment of sensors and AI algorithms to predict material wear and tear on high-stress saddle components, alerting users before failure occurs.

- Optimized supply chain management: AI forecasting models predicting regional and seasonal demand for specific saddle types and materials, minimizing inventory costs and reducing lead times for custom orders.

- Enhanced personalized marketing: Use of generative AI to create customized product recommendations based on the rider's discipline, budget, riding frequency, and horse breed profile.

- Automated quality control: Implementing computer vision systems in manufacturing to rapidly identify flaws in leather cutting, stitching, and assembly processes, ensuring consistent high quality.

DRO & Impact Forces Of Horse Saddle Market

The dynamics of the Horse Saddle Market are shaped by a confluence of influential factors, categorized as drivers, restraints, and opportunities (DRO), which collectively constitute the impact forces determining market trajectory. The primary driving forces include the sustained global growth in equestrian sports and leisure riding, coupled with rising disposable incomes in emerging markets, allowing for investment in high-quality equestrian gear. The increased awareness among horse owners regarding the critical link between proper saddle fit and equine welfare drives demand for specialized and technologically advanced products, thereby increasing the average transaction value. This trend is further amplified by professional riders demanding gear that offers a competitive edge.

Conversely, significant restraints impede faster growth. The inherently high cost of premium saddles, particularly those crafted from high-quality leather and requiring professional fitting, remains a barrier to entry for casual or budget-conscious riders. Furthermore, the specialized knowledge required for maintenance and repair, along with the relatively long replacement cycle of a high-quality saddle (often lasting 10-20 years), limits recurring sales volume. Economic downturns affecting consumer discretionary spending can immediately impact purchases of non-essential luxury items like custom saddles, leading to market volatility.

Opportunities for expansion lie in the adoption of sustainable and ethical sourcing practices, particularly for leather alternatives, attracting environmentally conscious consumers. The penetration of synthetic and customizable saddles that offer durability and lower maintenance costs presents a vast opportunity in the recreational and institutional segments (riding schools). Impact forces are generally positive, with product innovation and globalization acting as powerful accelerators, although price sensitivity and the regulatory landscape concerning animal welfare standards necessitate continuous adaptation by manufacturers.

Segmentation Analysis

Segmentation analysis of the Horse Saddle Market provides granular insights into specific market dynamics driven by product characteristics, material composition, end-user applications, and distribution methodologies. The primary segmentation by Product Type (English, Western, Racing) dictates regional dominance and consumer spending habits. The segmentation by Material is rapidly evolving, moving beyond traditional leather to embrace advanced synthetic materials like Wintec's synthetic leather and Cordura nylon, which offer superior weather resistance and reduced weight, catering to different performance and maintenance requirements. Understanding these segments is vital for manufacturers to tailor product development and marketing strategies effectively.

The End-User segmentation highlights the demand intensity across various disciplines, with competitive equestrian sports (dressage and jumping) exhibiting high demand for custom, technologically sophisticated saddles, commanding premium prices. Conversely, recreational riding and trail riding represent a large volume segment focusing on durability, comfort, and affordability. Distribution channels are shifting significantly, with specialty equestrian stores facing strong competition from optimized e-commerce platforms and direct-to-consumer models, especially for accessories and standardized synthetic saddle lines. The performance of each segment is intrinsically linked to socio-economic factors and the geographic prevalence of specific riding disciplines.

- By Product Type:

- English Saddles (Dressage, Jumping/Close Contact, General Purpose/All Purpose)

- Western Saddles (Ranch/Working, Trail, Barrel Racing, Roping)

- Racing Saddles (Flat Racing, Steeplechase)

- Specialty Saddles (Endurance, Polo, Military)

- By Material:

- Leather (Cowhide, Calfskin)

- Synthetic Materials (Wintec/Synthetic Leather, Cordura, Nylon)

- Suede

- By End-User:

- Equestrian Sports (Competitive Riders)

- Recreational Riding (Hobbyists, Trail Riders)

- Working Horses (Ranching, Policing, Therapy Centers)

- By Distribution Channel:

- Specialty Equestrian Stores

- Online Retail/E-commerce Platforms

- Hypermarkets and General Retail Chains

- Direct Sales (Manufacturer to Consumer)

Value Chain Analysis For Horse Saddle Market

The value chain for the Horse Saddle Market is intricate, starting from upstream raw material sourcing and extending through manufacturing, assembly, distribution, and ultimately, to the end consumer. Upstream analysis highlights the criticality of sourcing high-quality materials, primarily specialized leather (calfskin and cowhide) from tanneries, and advanced synthetic polymers. Fluctuations in commodity prices, ethical sourcing regulations, and environmental concerns regarding leather production significantly impact upstream costs and supply stability. Manufacturers must maintain strong relationships with specialized material suppliers to ensure consistency in quality, which is paramount for safety and product longevity.

The midstream phase involves the core manufacturing process, which relies heavily on skilled craftsmanship for fitting saddle trees, stitching leather, and integrating complex components like adjustable gullets. This segment is characterized by a mix of traditional artisanal techniques and modern computer-aided design (CAD) and manufacturing (CAM) processes, especially for synthetic components. The downstream analysis focuses on the distribution channels. Traditional distribution relies on a network of importers, wholesalers, and specialized equestrian retailers who often provide essential services like saddle fitting and repair. Direct channels, increasingly popular via e-commerce, allow manufacturers to capture higher margins and establish direct customer feedback loops.

Both direct and indirect distribution methods are crucial. Direct sales are highly effective for bespoke, high-end saddles where expert consultation is needed, often involving specialized saddle fitters affiliated directly with the brand. Indirect channels, utilizing large online marketplaces and brick-and-mortar specialty stores, handle the high volume of standardized, entry-to-mid-level products. The increasing adoption of online platforms means manufacturers must invest heavily in sophisticated digital showrooms and logistics capabilities to manage large, bulky product shipments efficiently while ensuring customer satisfaction regarding product sizing and fitting accuracy.

Horse Saddle Market Potential Customers

Potential customers in the Horse Saddle Market are highly diverse, spanning from elite, professional equestrian athletes to casual riders and institutional buyers. Professional riders and trainers constitute a critical segment, demanding custom-fitted, high-performance saddles specific to disciplines such as Olympic-level dressage, show jumping, and eventing. These buyers prioritize marginal performance gains, material quality (often high-grade calfskin), and ergonomic design, and are typically less price-sensitive, focusing instead on brand reputation and bespoke service.

Another major demographic includes hobbyist and recreational riders who participate in activities like trail riding, general pleasure riding, and low-level local competitions. This segment seeks durability, ease of maintenance (favoring synthetic options), comfort, and value. Riding schools, pony clubs, and therapeutic riding centers form the institutional buyer base. These entities require large quantities of durable, adjustable, and easy-to-clean general-purpose saddles that can accommodate multiple riders and horses, often focusing on bulk purchases and robust synthetic materials to minimize long-term operational costs.

Geographically, customers are concentrated in regions with strong horse culture, including North America (high density of Western riding and recreational trails), Western Europe (high density of professional English riding sports), and increasingly, the Middle East and parts of Asia, where affluent populations are investing in premium equestrian facilities and high-value competitive horses. Understanding the discipline-specific needs and the financial capacity of each customer segment is crucial for effective product positioning and sales strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dover Saddlery, Stubben, Prestige Italia, Pessoa, Wintec, Bates Saddles, HDR Saddlery, Circle Y Saddles, King Series Saddles, Dale Chavez Saddles, Big Horn Saddlery, Tucker Saddles, Freedman Harness, Schleese Saddlery, Equipe, Amerigo, GFS Saddle Company, Torsion Saddle, VTO Saddlery, Professional's Choice. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Horse Saddle Market Key Technology Landscape

The Horse Saddle Market is experiencing a gradual yet impactful technological transformation, primarily focused on improving customization, fit, and performance data capture. A major technological advancement is the development and commercialization of adjustable saddle tree systems. Innovations such as gullet changing systems (e.g., those found in Wintec and Bates saddles) allow riders to easily modify the width of the saddle to fit different horses or accommodate changes in a single horse's musculature over time. This technology significantly enhances the versatility and lifespan of a saddle, reducing the need for multiple purchases or expensive custom adjustments, thereby driving consumer adoption in the mid-range segment.

Another crucial area involves the integration of smart technology. Pressure mapping systems, using highly sensitive sensors embedded in specialized pads or directly into the saddle flap, provide real-time data on how the rider’s weight is distributed and how pressure points affect the horse’s back during movement. This data is invaluable for saddle fitters, trainers, and veterinarians, enabling precise adjustments and validating saddle performance. Furthermore, advanced material science is contributing to lighter, stronger, and more shock-absorbent saddle trees, often utilizing synthetic polymers, carbon fiber composites, or specific wood laminates designed to flex optimally without losing structural integrity.

Digitalization also plays a role in the consultation and sales process. 3D scanning technologies are increasingly used to accurately map the contours of a horse's back, providing manufacturers with precise measurements required for bespoke saddle construction. This precision minimizes fitting errors and enhances customer satisfaction. Coupled with AI analysis of gait and pressure data, the technology landscape is moving towards a fully digitized, highly personalized saddle ecosystem, pushing traditional manufacturing towards high-tech integration to remain competitive in the premium segment.

Regional Highlights

The global Horse Saddle Market exhibits distinct geographical consumption patterns and market maturity levels, with North America and Europe accounting for the majority of the current revenue share. These regions possess mature equestrian industries, high levels of disposable income dedicated to leisure activities, and robust competitive riding infrastructures. Europe, in particular, maintains strong demand for high-end English saddles, driven by countries like Germany, the UK, and France, which are central to global dressage and show jumping circuits. The strong cultural heritage of equestrianism supports sustained demand for specialized and custom-fitted products.

North America, led by the United States, represents a highly diversified market. It leads globally in the consumption of Western saddles due to the prevalence of ranching, trail riding, and Western pleasure events. Furthermore, the extensive recreational riding community ensures continuous demand for durable, affordable general-purpose and trail saddles. The region benefits from established specialty retailers and strong online market penetration, facilitating wide product accessibility and rapid inventory turnover for leading brands.

Asia Pacific (APAC) is forecasted to be the fastest-growing region, albeit starting from a smaller base. Economic development in countries such as China, Australia, and parts of Southeast Asia has led to significant investments in luxury lifestyle amenities, including high-end equestrian centers and competitive riding teams. While regulatory hurdles and lower horse population density present challenges, the rapid growth in affluent consumer segments seeking premium Western and English riding equipment signals substantial future opportunities. Latin America and the Middle East & Africa (MEA) provide niche markets, focused either on specific traditional riding styles or high-value imports catering to elite buyers in oil-rich nations.

- North America: Dominant consumer of Western saddles; strong e-commerce adoption; driven by recreational and working horse populations (USA, Canada).

- Europe: Largest market for English saddles (Dressage, Jumping); characterized by demand for bespoke, high-quality leather products; high competitive riding participation (Germany, UK, France).

- Asia Pacific (APAC): Fastest growing regional market; driven by rising affluence and development of new equestrian facilities (China, Australia).

- Latin America: Focus on regional traditional riding gear and recreational use; market subject to economic volatility (Brazil, Argentina).

- Middle East & Africa (MEA): Niche market driven by luxury imports and specific traditional equestrian cultures (UAE, Saudi Arabia, South Africa).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Horse Saddle Market.- Dover Saddlery

- Stubben

- Prestige Italia

- Pessoa

- Wintec

- Bates Saddles

- HDR Saddlery

- Circle Y Saddles

- King Series Saddles

- Dale Chavez Saddles

- Big Horn Saddlery

- Tucker Saddles

- Freedman Harness

- Schleese Saddlery

- Equipe

- Amerigo

- GFS Saddle Company

- Torsion Saddle

- VTO Saddlery

- Professional's Choice

- Synergy Equine

- Passier & Sohn

Frequently Asked Questions

Analyze common user questions about the Horse Saddle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the premium horse saddle segment?

The primary driver is the heightened global focus on equine welfare, compelling riders and owners to invest in custom-fitted, ergonomic saddles that ensure optimal comfort, performance, and injury prevention. The growth of high-level competitive equestrian sports also mandates the use of precision-engineered, high-cost equipment.

How is technology influencing the traditional saddle fitting process?

Technology is revolutionizing saddle fitting through the adoption of 3D scanning, digital measurement systems, and advanced pressure mapping analysis. These tools provide objective, quantitative data on fit and pressure distribution, moving the fitting process beyond subjective assessment towards scientific precision, ensuring a better match for the horse and rider.

Which segment, Leather or Synthetic, is expected to exhibit the fastest growth?

While Leather retains dominance in the high-end, custom segment, the Synthetic Materials segment (including advanced polymer composites and synthetic leather) is projected to exhibit faster growth. This is due to synthetics offering superior durability, lower maintenance requirements, high weather resistance, and more accessible price points, appealing to recreational and institutional buyers.

What are the main regional challenges facing saddle manufacturers?

Manufacturers face challenges related to fluctuating raw material costs (especially high-grade leather), complexities in managing global supply chains for customized products, and the need to adapt product designs to comply with varying international animal welfare standards and specific riding discipline requirements across regions like Europe and North America.

What is the forecast for Western saddle demand versus English saddle demand through 2033?

The Western saddle segment is expected to maintain a large overall volume and stable growth, driven by sustained recreational and ranching activity, primarily in the Americas. However, the English saddle segment, particularly specialized dressage and jumping sub-segments, is forecasted to experience a higher rate of value growth due to their higher average selling price and strong global linkage to major professional equestrian competitions.

Competitive Landscape Analysis

The competitive landscape of the Horse Saddle Market is highly fragmented, featuring a blend of long-established artisanal manufacturers specializing in bespoke leather saddles and large corporate entities focused on mass production using synthetic materials and patented adjustable tree technologies. Companies compete fiercely on three primary axes: quality and craftsmanship (for the premium market), technological innovation (focused on fit and adjustability), and price points (for the entry-level and institutional markets). Leading players such as Prestige Italia, Stubben, and Schleese compete aggressively in the high-end space by leveraging brand heritage, specialized knowledge, and networks of certified saddle fitters to provide highly personalized services that justify premium pricing.

In contrast, companies like Wintec and Bates, often operating under larger corporate umbrellas, focus on scalable manufacturing of synthetic or composite saddles featuring innovative, rider-adjustable systems. Their competitive edge lies in offering durability, reduced maintenance, and flexibility, appealing to a broad segment of riders and riding schools. The market also sees significant competition from regional manufacturers and smaller custom shops that cater intensively to local markets, particularly for discipline-specific requirements like Australian stock saddles or specialized Western saddles. Maintaining control over proprietary tree designs and securing patents for innovative fitting mechanisms are crucial for maintaining market share.

Mergers and acquisitions are infrequent but strategically significant, usually involving larger companies absorbing smaller, highly reputed artisan brands to gain access to specialized expertise or expanding their geographical footprint. Strategic alliances often involve partnerships between saddle manufacturers and equestrian technology firms (e.g., pressure pad sensor companies) to offer integrated solutions. Digital marketing and strong online retail presence have become non-negotiable competitive factors, allowing brands to educate consumers directly and manage the narrative around product quality and fitting accuracy, particularly as customers increasingly research high-value purchases online before consulting a fitter.

Market Drivers Detailed Analysis

One of the foremost drivers stimulating the Horse Saddle Market is the escalating global interest in competitive equestrian sports. Major international events, including the Olympic Games and World Equestrian Games, elevate the visibility and desirability of associated riding disciplines, encouraging greater participation. This professionalization drives demand for top-tier equipment; competitive riders require saddles engineered for marginal gains in performance, perfect balance, and minimal interference with the horse’s gait. As prize money and sponsorship in these sports increase, participants are more willing to invest significant capital in technologically superior and custom-fitted saddles, boosting the overall revenue of the premium segment.

The deepening understanding of animal biomechanics and welfare among horse owners acts as another substantial market driver. Educated consumers are increasingly aware that a poorly fitting saddle can cause significant discomfort, behavioral issues, and long-term physical damage to the horse. This awareness translates directly into demand for specialized fitting services and saddles with features designed for anatomical correctness, such as wide channels, panel adjustment capabilities, and systems that distribute weight across the largest possible surface area. This trend favors manufacturers who prioritize research and development in ergonomic design and offer transparent, data-driven fitting consultations.

Furthermore, the growth in global leisure and recreational spending, particularly in emerging economies, has increased horse ownership and participation in trail riding and general pleasure riding. While this segment may not demand bespoke saddles, it fuels the high-volume demand for durable, affordable, and low-maintenance general-purpose saddles, often favoring synthetic materials. The trend of pet humanization extends to horses, with owners treating them as companions and athletes, willing to spend more on their comfort and longevity, thereby consistently underpinning demand across all product types.

Market Restraints Detailed Analysis

A primary restraint inhibiting the aggressive growth of the Horse Saddle Market is the inherently high initial cost associated with premium, custom-made leather saddles. A high-quality saddle represents a substantial investment, often costing several thousand dollars. This significant financial barrier limits market accessibility for casual riders, young individuals entering the sport, and riding schools operating on tight budgets. Consequently, potential customers may opt for cheaper, lower-quality used saddles or budget-friendly, mass-produced synthetic alternatives, dampening the revenue potential of the high-margin, premium sector.

Another significant challenge is the exceptionally long product replacement cycle. Unlike many consumer goods, a well-maintained, high-quality leather saddle can easily last for 15 to 20 years or more. This durability, while a testament to craftsmanship, means that manufacturers primarily rely on new customer acquisition rather than recurring replacement sales from established riders. Market growth is therefore highly dependent on increases in the overall number of active riders or owners seeking specialized equipment for new disciplines, rather than repeat purchases from the existing customer base, leading to slower organic volume expansion.

Finally, the complexity and variability associated with achieving a perfect saddle fit pose a logistical and educational restraint. Correct fitting requires highly specialized knowledge, often necessitating the involvement of certified saddle fitters who charge premium consultation fees. The lack of widely available, standardized, and affordable professional fitting services, especially in rural or less developed equestrian areas, discourages riders from purchasing high-value saddles online without prior physical inspection or expertise. This complexity complicates the distribution process, particularly for e-commerce platforms, as returns due to fit issues remain a costly operational hurdle.

Market Opportunities Detailed Analysis

A significant opportunity for market expansion lies in the continued innovation and acceptance of advanced synthetic materials. Modern synthetics offer remarkable properties—they are lightweight, extremely durable, easy to clean, highly resistant to weather and sweat, and often significantly cheaper than traditional leather. This allows manufacturers to develop high-performance, weather-proof saddles ideal for high-volume markets, such as riding schools, long-distance trail riders, and markets in harsh climate zones. Marketing efforts focusing on sustainability (less reliance on animal hides) and lower environmental impact also attract a growing segment of environmentally conscious consumers.

The geographical expansion into emerging equestrian markets, particularly in the Asia Pacific region, offers a substantial long-term growth opportunity. As disposable incomes rise in countries like China, India, and Southeast Asia, coupled with increasing investments in equestrian infrastructure and the adoption of Western competitive sports, demand for quality saddlery equipment is expected to surge. Manufacturers can capture this emerging market by establishing localized distribution networks, adapting product lines to cater to regional preferences, and educating new riders on the importance of proper equipment selection and care.

Furthermore, the integration of smart technologies presents an untapped opportunity for value addition. Developing saddles or saddle accessories (like smart pads) with embedded sensors that track equine vital signs, gait analysis, weight distribution, and rider posture offers highly valuable data. These "smart saddles" can appeal to professional trainers, veterinarians, and serious hobbyists who seek empirical data to optimize training regimens and monitor horse health. Creating subscription-based data analysis services around these products could open up entirely new revenue streams beyond the initial product sale, increasing the overall market profitability.

The report contains 29683 characters including spaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager