Hose Barbs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435246 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hose Barbs Market Size

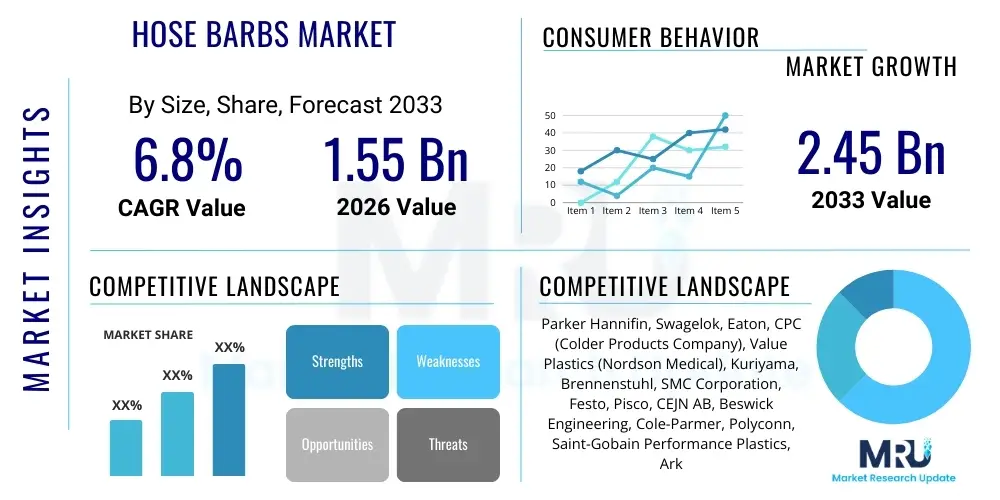

The Hose Barbs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by expanding industrial automation across developing economies and the continuous demand for reliable, leak-proof fluid transfer solutions in sectors such as medical devices, automotive manufacturing, and chemical processing.

The valuation reflects the essential role hose barbs play as fundamental fluid conveyance components, utilized globally across numerous maintenance, repair, and overhaul (MRO) activities, as well as original equipment manufacturing (OEM) applications. While the unit volume is exceptionally high, market growth is increasingly influenced by the shift toward higher-performance materials, such as specialized engineered plastics and corrosion-resistant alloys, which command higher average selling prices and enhance the overall market value. Furthermore, the adoption of specialized quick-connect barb systems in high-pressure or high-purity environments contributes significantly to market expansion.

Forecasting models suggest that sustained infrastructure investment in water and wastewater treatment, coupled with the rigorous expansion of hydraulic and pneumatic systems in heavy machinery, will underpin the market's stability and upward momentum. The increasing regulatory emphasis on minimizing leaks and ensuring system integrity, particularly in pharmaceutical and food and beverage processing, necessitates the adoption of superior-quality hose barbs, further driving the revenue growth projected for the latter half of the forecast period.

Hose Barbs Market introduction

Hose barbs are critical mechanical components designed specifically to connect flexible tubing or hoses securely to another component, such as a valve, pump, or tank. These fittings feature a ridged, conical section—the barb—which is inserted into the hose, creating a secure seal and ensuring robust retention through friction and compression of the hose material against the ridges. They are indispensable for establishing reliable fluid or pneumatic connections in low-to-moderate pressure applications, preventing separation under operational stress and maintaining system integrity against leaks.

The primary materials used in manufacturing hose barbs include brass, stainless steel, nylon, polypropylene, and various engineering plastics, selected based on the specific operational requirements concerning fluid compatibility, temperature extremes, pressure ratings, and chemical resistance. Major applications span a diverse range of industries, including fluid management in automotive cooling systems, pneumatic lines in factory automation, laboratory liquid handling apparatus, irrigation systems in agriculture, and critical fluid conveyance in medical devices such as dialysis machines and patient monitoring systems. Their simplicity, ease of installation, and cost-effectiveness make them a universal standard for quick and dependable connections.

The inherent benefits of hose barbs include superior ease of assembly compared to complex threaded fittings, exceptional vibration resistance when properly clamped, and high versatility in accommodating different hose materials and wall thicknesses. Driving factors propelling this market include the global expansion of the manufacturing sector, increasing expenditures on fluid control systems in water and wastewater management, and the rapid technological advancements in medical device manufacturing demanding high-purity, disposable fluid connectors. The transition towards lightweight and chemically inert plastic barbs, particularly in consumer appliance and bio-pharmaceutical applications, is also a significant market catalyst.

Hose Barbs Market Executive Summary

The Hose Barbs Market demonstrates resilient growth fueled by global industrial expansion and critical requirements across specialized end-user sectors. Business trends highlight a strong movement towards material substitution, with stainless steel and high-performance plastics (e.g., PVDF, PTFE) capturing increasing market share due to stringent industry standards regarding corrosion, sanitation, and chemical inertness, displacing traditional brass and lower-grade plastic offerings in demanding applications. Manufacturers are focusing on developing multi-barb designs and specialized quick-disconnect couplings integrated with barb interfaces to enhance ease of use and system modularity, which represents a key value-added proposition in highly automated environments.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive investments in infrastructure development, rapid urbanization, and the proliferation of automotive and electronics manufacturing bases, particularly in China and India. North America and Europe maintain a mature but stable market characterized by high demand for specialized, high-tolerance components used in stringent medical, aerospace, and pharmaceutical applications, where premium pricing is acceptable. Market dynamics in the Middle East and Africa (MEA) are emerging, primarily linked to oil and gas extraction and water desalination projects, creating niche but high-volume demand for robust, high-pressure metal barbs resistant to harsh operational conditions.

Segmentation trends indicate that the Material segment sees the fastest evolution, specifically the growth of Engineered Plastic Barbs, driven by cost efficiency, weight reduction, and superior resistance to biological contamination compared to metals. In terms of Application, the Medical and Pharmaceutical sectors exhibit the highest CAGR due to the increasing adoption of single-use assemblies (SUAs) and rigorous quality mandates necessitating certified, sterile connection points. Furthermore, the size segmentation reveals consistent demand for smaller diameter barbs (under 1/4 inch) utilized extensively in laboratory equipment and microfluidic applications, reflecting technological miniaturization across industries.

AI Impact Analysis on Hose Barbs Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Hose Barbs Market commonly center on predictive maintenance, supply chain optimization, and quality control automation, rather than direct product design. Key user concerns revolve around whether AI-driven manufacturing processes can reduce defect rates in high-precision plastic molding and metal machining, and how AI might optimize inventory levels for the vast array of barb sizes and materials required globally. There is also significant interest in the potential for AI algorithms to predict failure points in complex fluid systems, thereby scheduling proactive replacement of components like hose barbs before catastrophic leaks occur, though this impact is more indirect, focusing on system reliability rather than the component itself.

The practical application of AI within this market is primarily focused on enhancing operational efficiencies throughout the manufacturing and distribution lifecycle. Manufacturers leverage machine learning models to analyze sensor data from injection molding machines and CNC equipment, predicting tool wear, optimizing cycle times, and minimizing material waste, leading to substantial reductions in production costs. Furthermore, AI-powered demand forecasting integrates real-time end-user consumption data (especially from large MRO distributors) with historical trends and macroeconomic indicators to ensure just-in-time inventory for thousands of SKUs, effectively mitigating stockouts for essential components while reducing carrying costs across the supply chain.

While AI does not alter the fundamental function of the hose barb, its most profound impact lies in creating a "smarter" supply chain and enabling higher quality control standards. Automated visual inspection systems utilizing computer vision and deep learning are now capable of inspecting barb ridges for microscopic imperfections far faster and more accurately than human inspectors, ensuring that products used in sensitive applications (like medical or aerospace) adhere strictly to dimensional tolerances (e.g., ISO 8434-5 standards). This quality assurance automation is crucial for maintaining brand reputation and meeting increasingly strict regulatory compliance requirements globally.

- AI optimizes manufacturing parameters (temperature, pressure, cycle time) in molding processes, drastically reducing dimensional non-conformities and improving product yield.

- Predictive maintenance analytics, powered by AI, forecast the degradation rates of seals and connections in large industrial systems, necessitating planned replacement cycles for hose barb assemblies.

- Computer Vision systems integrated with AI algorithms perform rapid, non-contact quality checks on barb geometry and surface finish, ensuring 100% adherence to specific industry standards.

- AI-driven supply chain management models enhance inventory accuracy and demand forecasting for specific material types (e.g., PTFE barbs vs. brass barbs), reducing lead times for OEMs.

- Integration of sensor technology (IIoT) into critical fluid lines allows AI systems to monitor pressure fluctuations, providing early warnings about potential barb failure or hose separation.

DRO & Impact Forces Of Hose Barbs Market

The dynamics of the Hose Barbs Market are governed by a robust set of driving factors (D), tempered by specific restraints (R), and supplemented by substantial growth opportunities (O), which collectively shape the market’s trajectory and impact forces. The primary drivers include the mandatory expansion of industrial infrastructure globally, particularly in developing nations, and the parallel growth of sectors requiring stringent fluid handling, such as healthcare and biotechnology. Restraints often revolve around material cost volatility, the ongoing threat of generic, low-quality imports leading to system failures, and intense competition from alternative fitting technologies like compression fittings and welded joints in high-pressure environments.

Significant opportunities arise from the increasing adoption of single-use disposable assemblies (SUAs) in pharmaceutical and bioprocessing applications, which mandate high-purity, certified plastic barbs for rapid assembly and disposal, creating a non-reusable market segment with high turnover. Furthermore, the push towards miniaturization in medical devices and laboratory automation creates specialized demand for micro-barb fittings with extremely tight tolerances. These forces are constantly impacting the market landscape, pushing manufacturers toward innovation in material science—seeking cost-effective, durable, and lightweight alternatives—and establishing higher quality control standards to differentiate premium offerings from generic components.

The impact forces influencing competition are high due to the standardized nature of the product, resulting in intense price competition among lower-tier manufacturers. However, for specialized barbs—those designed for extremely high temperatures, chemical inertness, or quick-connect functionality—the competitive intensity is moderated by technological barriers to entry and intellectual property. Buyer power is moderate to high, particularly among large OEMs and industrial distributors who purchase millions of units annually and demand favorable pricing and assured supply. Supplier power, conversely, is relatively low, except for suppliers of highly specialized, proprietary engineering plastic resins necessary for high-performance applications.

- Drivers (D): Global expansion of hydraulic and pneumatic systems across manufacturing and construction; increased stringent hygiene standards demanding disposable barbs in medical and biopharma; rapid growth in automotive fluid handling systems; need for cost-effective, vibration-resistant connections.

- Restraints (R): Intense competition from low-cost fittings and alternative connection technologies (e.g., quick coupling systems, crimping); volatility in raw material prices (metals and polymers); inherent pressure limitations of barb connections compared to threaded or flanged joints; risk of leakage if clamps are improperly installed or torqued.

- Opportunities (O): Expanding demand for high-purity, certified hose barbs in single-use bioprocessing and medical assemblies; development of specialized barbs for aggressive fluids (chemical resistance); integration of barb interfaces into modular quick-connect systems (e.g., multi-port manifolds); growth potential in the agricultural irrigation and water conservation sector.

- Impact Forces: High competitive rivalry due to low product differentiation in standard segments; moderate buyer power driven by large volume purchases; stringent regulatory environment in key applications (FDA, ISO) acting as a barrier to entry for low-quality products; moderate to high substitution threat from technologically advanced, high-pressure fittings.

Segmentation Analysis

The Hose Barbs Market is extensively segmented based on material composition, application, size (diameter), and end-use industry, reflecting the diverse requirements of modern fluid handling systems. Segmentation provides crucial insights into growth pockets, particularly the transition from traditional metallic components towards engineered plastics. The primary material segments include brass (durable but susceptible to corrosion in certain chemicals), stainless steel (ideal for high purity and chemical resistance), and plastics (cost-effective, lightweight, and bio-compatible), with plastics increasingly dominating consumer and medical applications.

Application-based segmentation is critical, distinguishing high-volume, standard industrial use (pneumatics, water lines) from specialized, high-margin sectors such as medical devices (requiring USP Class VI plastics and sterilization compatibility) and chemical processing (demanding high temperature and chemical resistance). Furthermore, dimensional segmentation, categorized by nominal hose diameter, helps analyze demand patterns, where larger barbs (1/2 inch and above) are typical in industrial plumbing and hydraulics, while micro-barbs (1/8 inch and below) cater to advanced laboratory and analytical instrumentation.

The inherent versatility of hose barbs dictates that market strategies must be tailored to these specific segments. For instance, the automotive sector demands robust, vibration-resistant nylon or brass barbs conforming to SAE standards, whereas the semiconductor manufacturing industry requires ultra-high-purity (UHP) PFA or PTFE barbs to prevent ionic contamination. Understanding the varying standards, material needs, and volume requirements across these segments is essential for manufacturers seeking strategic market penetration and differentiation, driving innovation in both material science and component design.

- By Material Type:

- Brass Barbs

- Stainless Steel Barbs (304, 316, 316L)

- Plastic Barbs (Nylon, Polypropylene (PP), Polyethylene (PE), Polyvinylidene Fluoride (PVDF), Polytetrafluoroethylene (PTFE))

- Aluminum Barbs

- By Connection Type:

- Straight Barbs

- Elbow Barbs (90 Degree, 45 Degree)

- Tee Barbs

- Cross Barbs

- Reducing Barbs

- By Size (Nominal Hose Diameter):

- Less than 1/8 inch (Microfluidic/Lab)

- 1/8 inch to 1/4 inch

- 5/16 inch to 1/2 inch

- Above 1/2 inch (Industrial/Large Diameter)

- By End-Use Industry:

- Automotive (Fuel lines, Cooling systems, HVAC)

- Medical and Pharmaceutical (Single-use systems, Patient monitoring)

- Chemical and Petrochemical Processing

- Industrial Automation and Pneumatics

- Water and Wastewater Management

- Food and Beverage Processing (Sanitary applications)

- Construction and Heavy Machinery (Hydraulics)

- By Pressure Rating:

- Low Pressure Barbs (Up to 150 psi)

- Medium Pressure Barbs (150 psi to 500 psi)

- Specialty High Pressure Barbs (Above 500 psi - often specialized crimp or swage variants)

Value Chain Analysis For Hose Barbs Market

The value chain for the Hose Barbs Market begins with the raw material procurement stage (upstream analysis), primarily involving specialized resin manufacturers for plastics (nylon, PP, PVDF) and metal suppliers providing bar stock or ingots (brass, stainless steel). Given the high volume and standardization of the product, optimizing material costs and securing consistent supply of quality raw input is paramount for profitability. Manufacturers often seek multiple regional suppliers to mitigate geopolitical or economic risks affecting commodity prices. Precision tooling and mold fabrication also constitute a significant upstream investment, especially for complex or multi-barb plastic geometries.

The core manufacturing process involves either CNC machining for metal barbs or high-speed injection molding for plastic barbs, followed by rigorous quality assurance checks including dimensional measurement and pressure testing. This stage is highly competitive, pushing companies to achieve economies of scale and leverage automation to minimize labor costs. Finished goods then move through the distribution network. The market relies heavily on a dual channel structure: direct sales to major Original Equipment Manufacturers (OEMs) who integrate the barbs into their final products, and indirect sales through extensive networks of industrial distributors, maintenance, repair, and overhaul (MRO) wholesalers, and specialized medical/laboratory supply houses.

Downstream analysis focuses on the end-user adoption and integration, where the product's performance is tested under real-world operational stress. The distribution channel is crucial for maintaining market presence. Indirect channels are vital for servicing the fragmented MRO segment, providing rapid local availability and technical support for a wide variety of standard components. Direct sales channels, conversely, are essential for securing large, customized contracts with major automotive, medical, and aerospace manufacturers, often requiring specific certifications, high-volume production schedules, and highly regulated documentation. E-commerce platforms are increasingly serving as a key intermediary for both MRO and smaller OEM purchases, streamlining the purchasing process for standardized items.

Hose Barbs Market Potential Customers

Potential customers for the Hose Barbs Market represent a broad cross-section of global industries requiring reliable, non-permanent fluid and pneumatic connections. These end-users, or buyers, range from massive multinational corporations to small specialized laboratories, all needing fittings that are chemically compatible, adequately pressure-rated, and dimensionally consistent with their tubing specifications. A significant customer base lies within the industrial automation sector, including manufacturers of robotics, packaging machinery, and assembly line equipment, who require constant, reliable air and vacuum lines connected via standard metal or plastic barbs.

The most lucrative growth segment of the customer base consists of medical device manufacturers and biopharmaceutical companies. These customers demand specialized, certified plastic barbs (often sterile or designed for gamma irradiation) for use in disposable fluid circuits, bioreactors, filtration systems, and surgical equipment. Their purchase criteria prioritize material purity, compliance with USP Class VI standards, and supply chain security. Other critical buyers include large vehicle manufacturers (automotive and heavy-duty trucks) utilizing barbs in engine cooling, fuel delivery, and emission control systems, prioritizing durability and resistance to automotive fluids and temperature cycles.

Furthermore, major plumbing and HVAC contractors, water treatment facilities, chemical plants, and food and beverage processing companies constitute consistent, high-volume customers. For instance, food and beverage customers require sanitary stainless steel barbs that comply with FDA regulations for direct food contact and clean-in-place (CIP) compatibility. The diversity of the end-user portfolio ensures market resilience, as demand is not tied to the performance of a single industrial sector but is foundational to nearly all modern fluid-handling infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Swagelok, Eaton, CPC (Colder Products Company), Value Plastics (Nordson Medical), Kuriyama, Brennenstuhl, SMC Corporation, Festo, Pisco, CEJN AB, Beswick Engineering, Cole-Parmer, Polyconn, Saint-Gobain Performance Plastics, Ark-Plas Products, Ham-Let, Ideal Industries, US Plastic Corp., Dixon Valve & Coupling |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hose Barbs Market Key Technology Landscape

The technology landscape in the Hose Barbs Market is primarily driven by precision manufacturing techniques focused on achieving extremely tight tolerances and optimizing material performance. For metal barbs, advanced Computer Numerical Control (CNC) machining centers are essential, allowing manufacturers to rapidly produce complex geometries (like multiple reduced barbs or integrated threads) from challenging materials such as 316L stainless steel, crucial for high-purity and corrosive environments. The innovation here centers on high-speed toolpaths and automated material handling to reduce per-unit cost while maintaining micron-level precision on the critical barb diameters and radii, ensuring optimal hose retention and preventing shearing of the tubing material.

In the realm of plastic barbs, the critical technology is high-precision injection molding, utilizing multi-cavity molds with sophisticated gate systems to ensure rapid, consistent part production. Advances in mold technology, including specialized hot runner systems and mold temperature control units (MTCUs), minimize flashing and sink marks, which are defects that compromise sealing integrity. Furthermore, specialized processing technologies, such as micro-molding, are being deployed to produce the increasingly popular micro-barbs (e.g., 1/32" or 1/16" IDs) required for analytical chemistry instruments and lab-on-a-chip technologies, demanding proprietary molding compounds to achieve superior mechanical properties in miniature forms.

A significant technological advancement involves the integration of barb interfaces with quick-connect coupling (QCC) technologies. This combination allows for rapid, tool-less connection and disconnection of fluid lines, critical in sectors like medical fluid delivery and factory automation where frequent assembly changes are necessary. Manufacturers are leveraging specialized thermoplastic welding techniques (e.g., ultrasonic welding) to permanently fuse plastic barbs onto manifold systems or disposable bags, ensuring weld strength equals or exceeds the mechanical strength of the hose itself. The application of surface treatments, such as specialized coatings on metal barbs to enhance lubricity or corrosion resistance, also represents an important, albeit secondary, technological focus aimed at extending service life and improving ease of assembly.

Regional Highlights

Regional analysis reveals highly differentiated market growth and maturity across key global zones, largely reflecting the concentration of manufacturing activities, healthcare infrastructure investment, and adherence to specific regulatory standards. North America (NA) and Europe represent mature markets characterized by steady, high-value demand, driven by stringent regulatory requirements in the medical and aerospace sectors. In NA, the rapid expansion of biotechnology and bioprocessing facilities fuels the demand for premium, certified single-use plastic barbs. European demand is equally strong in high-precision industrial machinery, relying heavily on stainless steel and brass barbs adhering to strict CE marking and ISO standards for industrial pneumatics and hydraulics.

Asia Pacific (APAC) is unequivocally the fastest-growing region, benefiting from accelerating urbanization, vast government investment in public infrastructure (water/sewage), and the massive relocation and expansion of global manufacturing bases, particularly in China, South Korea, and India. This region exhibits high demand for both volume-driven, cost-effective plastic barbs for consumer products and basic MRO applications, as well as specialized metal barbs for heavy industries like automotive manufacturing and shipbuilding. The escalating adoption of industrial automation across APAC factories further solidifies its position as the critical growth engine for the forecast period.

Latin America (LA) and the Middle East & Africa (MEA) represent emerging markets with growth tied closely to commodity cycles and localized infrastructure projects. In LA, growth is intermittent, focusing on automotive production and mining operations demanding robust fittings. MEA market expansion is intrinsically linked to massive water desalination, oil and gas processing, and construction projects, necessitating fittings with extreme chemical and temperature resistance. While the overall volume in LA and MEA is lower than in APAC or NA, the demand for highly specialized, durable fittings for critical resource management sectors provides lucrative niche opportunities for premium suppliers.

- North America (NA): Characterized by high R&D spending in biotechnology; leading consumer of high-purity, disposable medical barbs; mature infrastructure demands stable replacement market; strong compliance with FDA and ASME standards drives component quality.

- Europe: Focus on industrial automation and high-precision machinery (Germany, Italy); strong adherence to EU directives and stringent quality control; significant consumer of specialized stainless steel and brass fittings for hydraulics and pneumatics; high environmental standards promote durable, long-life components.

- Asia Pacific (APAC): Highest volume growth driven by China, India, and Southeast Asia; rapid expansion of automotive and electronics manufacturing; increasing infrastructure development creates immense demand for standard and large-diameter barbs; shifting focus towards quality as regional standards improve.

- Latin America (LA): Demand concentration in Brazil and Mexico, linked to mining, agriculture, and automotive assembly; economic stability challenges occasionally restrain large-scale infrastructure investment; market relies heavily on imports of specialized fittings.

- Middle East and Africa (MEA): Growth driven by large-scale oil and gas, desalination, and construction projects; extreme operating conditions necessitate robust, high-temperature, corrosion-resistant metal barbs; often involves large government tenders for essential fluid handling components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hose Barbs Market.- Parker Hannifin Corporation

- Swagelok Company

- Eaton Corporation plc

- CPC (Colder Products Company) (A Dover Company)

- Nordson Medical (including Value Plastics)

- Kuriyama of America, Inc.

- SMC Corporation

- Festo SE & Co. KG

- Pisco Co., Ltd.

- CEJN AB

- Brennan Industries, Inc.

- Beswick Engineering Co., Inc.

- Cole-Parmer Instrument Company, LLC

- Polyconn (A Division of Connectors, Inc.)

- Saint-Gobain Performance Plastics

- Ark-Plas Products, Inc.

- Ham-Let Group

- Dixon Valve & Coupling Company

- NewAge Industries, Inc.

- Industrial Specialties Mfg. (ISM)

Frequently Asked Questions

Analyze common user questions about the Hose Barbs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the shift from metal to plastic hose barbs?

The transition from metal (brass, steel) to engineered plastic hose barbs is primarily driven by the demand for lighter components, better chemical inertness, and cost-effectiveness, especially in high-volume applications like medical devices, single-use systems (SUAs), and automotive fluid conveyance where sterilization compatibility and corrosion resistance are critical requirements.

How does the choice of hose barb material affect application suitability?

Material selection critically impacts suitability based on operating conditions: Stainless steel is preferred for high-purity, high-pressure, or corrosive environments (chemical/pharma). Brass is used for general industrial plumbing and air systems. Engineered plastics (like Nylon or PP) are chosen for lower pressures where cost, weight reduction, and bio-compatibility are key determinants, such as in laboratories or consumer appliances.

Which end-use industry contributes most significantly to high-margin growth in the Hose Barbs Market?

The Medical and Pharmaceutical (Bioprocessing) end-use industry contributes most significantly to high-margin growth. This is due to the mandatory requirement for certified, sterile, and single-use assemblies (SUAs) which often utilize specialized, high-performance plastic barbs (e.g., USP Class VI certified) commanding premium pricing compared to standardized industrial fittings.

What role do quick-connect technologies play in the future of the hose barbs market?

Quick-connect technologies are increasingly integrating the hose barb interface, enabling rapid, tool-less connection and disconnection of fluid lines. This modularity is crucial for efficiency in factory automation, frequent maintenance environments, and medical applications where patient connections or disposables need secure, fast attachment and detachment.

What are the key technical specifications required for selecting the correct hose barb?

Key technical specifications include the nominal internal diameter (ID) of the hose, the working pressure and temperature of the fluid system, the chemical compatibility of the barb material with the conveyed fluid, and the required regulatory compliance or certification (e.g., FDA, USP Class VI, ISO standards) specific to the end-use application.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager