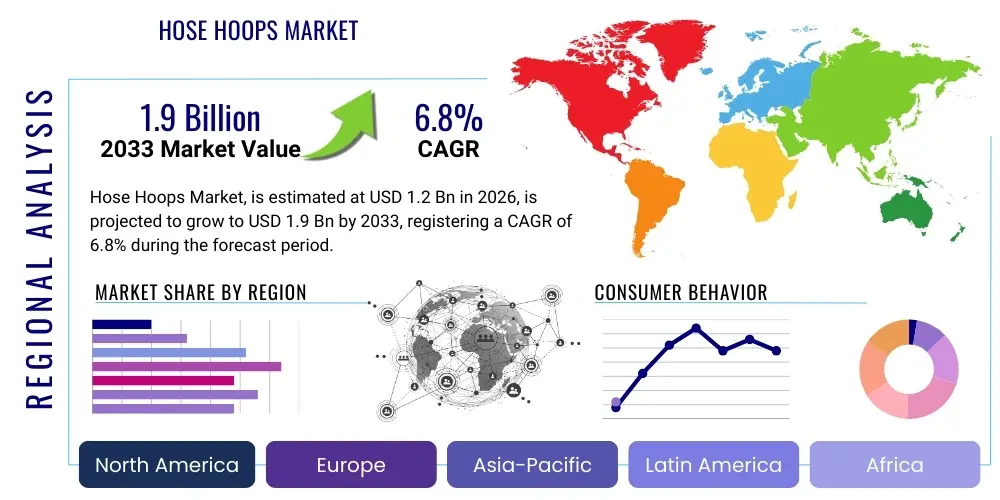

Hose Hoops Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437158 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hose Hoops Market Size

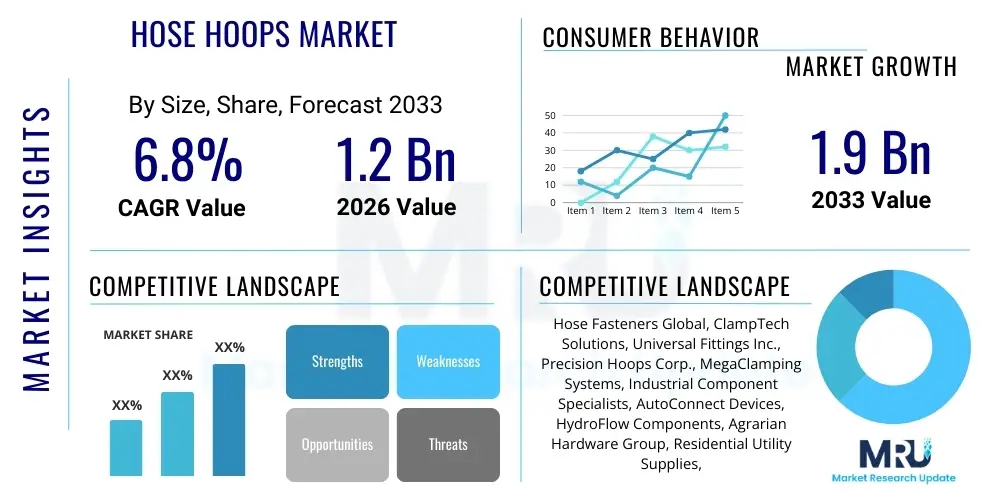

The Hose Hoops Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by sustained demand across core industrial and infrastructure sectors, particularly in burgeoning economies where fluid transfer systems and robust connectivity solutions are essential for modernization and operational efficiency. The market size reflects the cumulative value of various hose clamping and fastening solutions, utilized primarily to secure hoses, pipes, and ducts in high-pressure or critical environments, ensuring leak-proof and durable connections necessary for complex fluid dynamics management.

Hose Hoops Market introduction

The Hose Hoops Market encompasses the global trade and utilization of specialized clamping devices designed to secure hoses onto fittings, preventing leakage and ensuring the integrity of fluid transfer systems across a multitude of industrial and consumer applications. These essential components, often manufactured from materials such as stainless steel, galvanized steel, and high-strength composites, range from simple screw clamps (worm drive) to sophisticated T-bolt clamps and spring clamps, each optimized for specific pressure tolerances, temperature ranges, and material compatibilities. The fundamental purpose of a hose hoop is to provide a concentric sealing force around the circumference of the hose where it meets a barbed or flanged connector, thereby maintaining system pressure and preventing operational failure. The diversity of products within this market directly correlates with the stringent safety and performance requirements mandated by industries such as aerospace, maritime, and oil and gas, driving continuous innovation in clamp design and material science to meet evolving performance standards.

Major applications of hose hoops span critical sectors including automotive manufacturing, where they are vital for securing radiator hoses and fuel lines; industrial machinery, where they manage hydraulic and pneumatic systems; and the infrastructure sector, involving municipal plumbing, HVAC systems, and agricultural irrigation. The enduring requirement for reliable fluid control in these diverse environments acts as a foundational driver for market stability and growth. The performance characteristics of modern hose hoops, such as enhanced corrosion resistance, superior vibration dampening capabilities, and ease of installation, significantly contribute to the overall operational efficiency and longevity of the equipment they serve. Furthermore, the increasing complexity of modern engines and industrial processes often necessitates specialized, high-performance hose hoops capable of handling extreme conditions, creating a premium segment within the overall market structure.

The primary benefits driving the expansion of the Hose Hoops Market include improved system safety, reduced maintenance costs stemming from fewer leak-related failures, and compliance with increasingly rigorous environmental and occupational safety regulations. Key driving factors contributing to the market's trajectory involve the robust global expansion of the automotive sector, particularly in electric and hybrid vehicle manufacturing which requires specific cooling and thermal management systems; rapid industrialization in Asia Pacific, leading to heightened demand for industrial machinery and processing equipment; and large-scale investments in infrastructure development, including water treatment plants and large commercial HVAC installations. These systemic growth drivers ensure that the demand for reliable hose fastening solutions remains resilient throughout the forecast period, positioning the market as a foundational element within the broader industrial hardware ecosystem.

Hose Hoops Market Executive Summary

The Hose Hoops Market is experiencing robust growth fueled by several converging global business trends, including the paradigm shift toward highly automated manufacturing processes which demand zero-failure fluid connectivity, and the escalating use of durable, high-performance materials like 316 stainless steel to ensure longevity in corrosive environments. Technologically, the transition from traditional worm-drive clamps to advanced constant-tension and T-bolt clamps is notable, driven by the need to compensate for cold flow and thermal expansion effects in dynamic systems, thereby maintaining consistent sealing pressure. The market is also heavily influenced by supply chain optimization efforts, with manufacturers focusing on streamlined production and distribution to meet rapid delivery schedules required by Just-In-Time (JIT) manufacturing environments, leading to higher efficiency and competitive pricing structures globally.

Regionally, the market dynamics demonstrate significant concentration in established industrial hubs, particularly North America and Europe, which are characterized by stringent quality standards and high consumption of premium, specialized clamps for aerospace and defense applications. However, the most pronounced growth momentum is observed in the Asia Pacific (APAC) region, specifically China, India, and Southeast Asian nations. This APAC surge is directly attributable to massive investments in infrastructure development, burgeoning domestic automotive production, and the proliferation of heavy industrial manufacturing bases. These emerging markets often prioritize cost-effectiveness alongside functionality, driving demand for both standardized clamps and innovative, locally manufactured alternatives, fundamentally reshaping the global distribution of demand and manufacturing capacity.

Analysis of market segments reveals that the Material Type segment is dominated by Stainless Steel variants, valued for their resistance to rust and degradation, making them essential in marine and chemical processing applications. Within the Application segment, the Automotive sector remains the primary consumer, although Industrial Machinery and Plumbing & HVAC are exhibiting faster growth rates due to modernization and expansion projects. Distribution Channel analysis indicates a steady channel shift, where traditional industrial distributors and offline retail still command significant volume, but online retail platforms are rapidly increasing their market share, particularly for standardized clamps and DIY/residential consumers, enhancing market accessibility and price transparency across geographical boundaries.

AI Impact Analysis on Hose Hoops Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Hose Hoops Market often revolve around optimizing the design and manufacturing processes, predicting component failure, and enhancing quality control standards. Common themes include questions about whether AI can automate the visual inspection of finished clamps for material defects or geometric deviations, how predictive maintenance algorithms could utilize data from fluid systems (pressure, temperature fluctuations) to forecast clamp degradation and potential failure points, and the role of generative design AI in creating lighter yet stronger clamp geometries optimized for specific material stresses. There is a clear expectation that AI will transition clamp manufacturing from a traditional, reactive quality control process to a highly proactive, predictive, and optimized operational model, leading to significant reductions in material waste and improvements in overall product reliability and longevity in critical application areas such as high-performance internal combustion engines or specialized chemical processing pipelines. The synthesis of user concerns highlights a desire for enhanced component reliability and a streamlining of supply chain logistics through smart forecasting and automated inventory management driven by sophisticated computational intelligence.

The immediate and tangible impacts of AI are concentrated primarily in the manufacturing phase. Advanced machine learning models are being deployed to analyze sensor data from stamping, welding, and assembly lines to immediately identify and correct anomalies, far outpacing the speed and consistency of human inspection. For instance, high-resolution cameras coupled with deep learning algorithms can identify micro-cracks or imperfect plating adhesion on finished hoops with near-perfect accuracy, significantly reducing the probability of field failures caused by latent manufacturing defects. Furthermore, AI-driven simulation tools allow engineers to rapidly iterate through thousands of design variations, factoring in complex variables like material elasticity under extreme temperature cycles and vibration loading, resulting in optimized product specifications that require less material while achieving higher performance benchmarks—a critical factor for competitive advantage in a mature hardware market.

Looking ahead, AI's role is expected to extend into strategic areas like demand forecasting and inventory optimization within the distribution network. By analyzing macroeconomic indicators, industrial production outputs, seasonal trends, and historical consumption data across thousands of Stock Keeping Units (SKUs), AI systems can generate highly accurate forecasts for specific clamp types (e.g., T-bolt clamps for heavy construction versus spring clamps for light automotive applications). This predictive capability enables manufacturers and large-scale distributors to maintain optimal inventory levels, reducing carrying costs and minimizing stock-outs, which is crucial given the high number of variations (size, material, style) required in the hose hoops market. This improved efficiency throughout the value chain underscores AI's function not just as a manufacturing tool, but as a strategic business intelligence asset fundamentally modernizing the industry's operational framework.

- AI-powered visual inspection systems enhance quality control, detecting microscopic material defects in finished clamps, reducing failure rates.

- Generative design algorithms optimize clamp geometry, reducing material weight while maintaining or increasing tensile strength and sealing performance.

- Predictive maintenance analytics, driven by ML, forecast clamp degradation in operational systems, enabling timely replacement and preventing catastrophic fluid leaks.

- AI-driven demand forecasting optimizes manufacturing schedules and inventory management for specific clamp types across diverse industrial sectors.

- Automated process control in stamping and welding utilizes real-time sensor data and ML feedback loops to ensure zero-defect production runs, minimizing scrap material.

DRO & Impact Forces Of Hose Hoops Market

The dynamics of the Hose Hoops Market are complexly dictated by a combination of key drivers, inherent restraints, and evolving opportunities, all synthesizing into powerful impact forces that shape market direction and competitive intensity. The primary driving force is the unavoidable and consistent global requirement for effective fluid management and transfer across virtually all manufacturing and service industries, ensuring that hose hoops remain an indispensable component regardless of technological shifts in end-user equipment. However, the market faces significant restraints, notably the intense price sensitivity characteristic of commodity components, especially in high-volume, standard applications, which places constant pressure on profit margins. Opportunities are primarily centered around the development of specialized, high-performance clamps made from advanced materials, catering to niche, high-value applications such as aerospace and electric vehicle thermal management, which prioritize reliability over cost, thereby offsetting the commodity market pressures and offering differentiation capabilities for manufacturers. These factors collectively create a market environment where technological innovation in materials and design is highly rewarded, while operational efficiency and scale are mandatory for success in the mass market segment.

Specific drivers include the vigorous global growth in the construction and infrastructure sectors, necessitating massive amounts of hydraulic and pneumatic equipment, all reliant on secure hose connections. Furthermore, the stringent regulatory environment governing emissions and safety in industries like automotive and marine mandates the use of highly reliable, certified clamping solutions, compelling original equipment manufacturers (OEMs) to invest in premium products. Conversely, a major restraint is the market maturity and the relatively low technological complexity of standard clamps, leading to easy market entry for numerous regional and low-cost manufacturers, particularly in Asia. This fragmentation often results in fierce price competition and complicates efforts by premium manufacturers to capture dominant market share in lower-tier applications. Moreover, the long product lifespan of high-quality clamps occasionally acts as a restraint on replacement demand, shifting focus toward new equipment installation and expansion projects rather than recurring maintenance sales.

The inherent opportunities lie in capitalizing on evolving material requirements and system complexity. The shift towards electrification in vehicles (EVs) creates a need for specialized hose hoops resistant to unique chemical compositions in thermal management fluids and capable of maintaining seal integrity under novel vibration profiles. Another significant opportunity stems from the adoption of smart industrial systems (Industry 4.0), where specialized clamps incorporating sensing capabilities (monitoring tightness or vibration) could potentially integrate into wider predictive maintenance networks, transforming the hose hoop from a simple mechanical component into an intelligent data-generating asset. These impact forces—ranging from robust industrial demand and strict regulatory compliance (Drivers) to pricing pressure and market saturation (Restraints), alongside technological specialization (Opportunities)—define a dynamic market structure where strategic differentiation and operational scale are crucial determinants of long-term commercial success.

Segmentation Analysis

The Hose Hoops Market is meticulously segmented based on Material Type, Product Type, Application, and Distribution Channel, reflecting the diverse operational environments and specialized requirements across various end-user industries. This segmentation provides a granular view of market dynamics, illustrating how different materials and designs cater to specific needs, such as high corrosion resistance in marine applications (stainless steel) versus cost-effectiveness in residential plumbing (galvanized or composite materials). The analysis of these segments is crucial for stakeholders to identify high-growth niches, allocate resources effectively, and tailor product development strategies to align with the stringent performance criteria demanded by sophisticated industries like aerospace and high-pressure hydraulics. Understanding the cross-segment consumption patterns, such as the preference for Constant Tension Clamps in the Automotive sector due to thermal expansion mitigation, is key to formulating competitive market strategies and achieving sustained revenue growth within the forecast period.

The segmentation by Product Type, encompassing Worm Drive (Screw) Clamps, T-Bolt Clamps, Spring Clamps, and Quick-Release Clamps, reveals a technological hierarchy based on application severity and required sealing strength. Worm drive clamps dominate the general-purpose and high-volume segments due to their simplicity and cost-efficiency, while T-bolt and constant tension clamps command premium pricing in heavy-duty and high-vibration applications, valued for superior sealing capability and durability. The Application segmentation clearly defines consumption concentration, with Automotive remaining the largest volume consumer, driven by continuous vehicle production and rigorous maintenance cycles. However, the rapid expansion of the Industrial Machinery and Oil & Gas segments, driven by global capital expenditure on new processing equipment and pipeline infrastructure, promises higher growth rates for specialized, heavy-duty clamping solutions, often requiring certification and meeting stringent industry standards for operational safety and environmental protection.

Furthermore, analysis of the Distribution Channel segment underscores the shifting sales landscape. The traditional channels, comprising industrial distributors and direct OEM supply, maintain control over high-volume and highly technical sales interactions, providing necessary technical support and customization services. Conversely, the rise of e-commerce platforms and specialized industrial online marketplaces has fundamentally altered the procurement landscape for standard and medium-duty clamps, offering greater product selection, price transparency, and rapid logistical fulfillment, particularly appealing to Maintenance, Repair, and Operations (MRO) buyers and the burgeoning DIY sector. This duality in distribution necessitates a hybrid strategy for market players, requiring investment in both dedicated B2B sales teams and optimized digital storefronts to capture the maximum potential market share and maintain competitive relevance in a rapidly evolving procurement environment.

- Material Type:

- Stainless Steel (304, 316, 400 Series)

- Galvanized Steel

- Composite Materials (Nylon, Fiberglass Reinforced Plastics)

- Exotic Alloys (Titanium, Inconel for extreme conditions)

- Product Type:

- Worm Drive (Screw) Clamps

- T-Bolt Clamps

- Spring Clamps

- V-Band Clamps

- Quick-Release Clamps

- Constant Tension Clamps

- Application:

- Automotive (Radiator Hoses, Fuel Lines, Exhaust Systems)

- Industrial Machinery & Equipment (Hydraulic & Pneumatic Systems)

- Plumbing & HVAC

- Agriculture & Irrigation

- Marine & Shipbuilding

- Oil & Gas and Chemical Processing

- Aerospace & Defense

- Distribution Channel:

- Direct Sales (OEMs)

- Industrial Distributors

- Online Retail & E-commerce

- Offline Retail & Hardware Stores

Value Chain Analysis For Hose Hoops Market

The value chain for the Hose Hoops Market begins with the upstream segment, primarily focused on the procurement and processing of raw materials, predominantly high-grade steel (stainless, carbon, galvanized), specialized alloys, and engineering plastics for composite products. Efficiency and cost optimization at this initial stage are paramount, as raw material costs typically constitute the largest variable expense for manufacturers. Key upstream activities involve sourcing steel coils, managing volatility in global commodity markets, and specialized processes like electroplating, heat treating, and chemical passivation required to impart specific performance characteristics, such as enhanced corrosion resistance or spring properties, to the finished components. Strategic relationships with stable, large-volume steel suppliers are critical for securing consistent quality and favorable pricing, directly impacting the final competitiveness of the hose hoop product in the downstream market.

The core manufacturing stage involves specialized processes including stamping, forming, welding, and automated assembly, converting raw materials into finished clamps. Automation investment, particularly in high-speed stamping presses and robotic assembly lines, is a major focus for market leaders to achieve economies of scale and maintain precision required for critical application clamps. Following manufacturing, the distribution channel dictates how products reach end-users. This midstream segment is characterized by a mix of direct sales to Original Equipment Manufacturers (OEMs) who integrate the clamps into new machinery (high-volume, technical sales), and indirect channels utilizing industrial distributors and wholesalers who service the vast Maintenance, Repair, and Operations (MRO) aftermarket. Distributors often play a crucial role by providing local inventory and technical consulting, acting as a crucial interface between manufacturers and diverse smaller industrial customers.

The downstream segment involves the ultimate consumption and aftermarket support. Direct distribution caters efficiently to major automotive and industrial OEMs, ensuring seamless supply chain integration and product customization. Conversely, the indirect distribution channel, spanning large national distributors and increasingly influential online retail platforms, manages the fragmented demand from small and medium enterprises (SMEs), residential users, and independent mechanics. The growth of e-commerce has optimized the downstream process by offering immediate accessibility and competitive pricing for standard products, while high-value, specialized products (e.g., aerospace clamps) remain reliant on highly controlled, authorized distribution networks. This complex distribution structure necessitates rigorous inventory management and logistical excellence to meet the varied demands of a globally distributed customer base effectively.

Hose Hoops Market Potential Customers

Potential customers for the Hose Hoops Market are highly diversified, primarily categorized into Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Operations (MRO) end-users, and the vast residential and DIY consumer segment. OEMs represent the largest volume purchasers, integrating hose hoops directly into new products across sectors such as automotive assembly, heavy construction equipment manufacturing, and industrial fluid processing machinery. These buyers typically prioritize factors like certified quality, long-term supply agreements, technical compliance with stringent standards (e.g., ISO, SAE), and the ability of manufacturers to deliver customized solutions that meet specific thermal, pressure, or vibration requirements unique to their proprietary equipment designs. Establishing strong, long-term relationships with Tier 1 and Tier 2 automotive suppliers and major industrial equipment manufacturers is crucial for sustained revenue generation in the OEM customer base.

The MRO segment encompasses a broad spectrum of industrial, commercial, and governmental entities that purchase clamps for repair, replacement, and system upkeep. This includes chemical plants, power generation facilities, municipal water treatment operations, commercial trucking fleet maintenance shops, and large farming operations. MRO customers often prioritize immediate availability, robust product durability, and ease of installation, as unexpected system failures require rapid resolution. The buying behavior in the MRO segment is characterized by reliance on local industrial distributors who can provide a wide assortment of sizes and materials promptly. The adoption of smart clamps and high-performance materials is increasing within this segment as operational uptime becomes more critical, driving a slight shift toward premium, highly reliable products over sheer cost-minimization.

Finally, the residential, commercial, and DIY customer segment drives significant demand for lower-to-medium duty clamps used in home plumbing repairs, gardening systems, light HVAC maintenance, and general purpose applications. This customer base, primarily accessing products through retail hardware stores and booming online marketplaces, is highly sensitive to pricing and ease of use, often preferring simple worm-drive or spring clamps. The convenience factor is paramount here, with clear packaging, readily available sizes, and competitive retail pricing defining market success. While average transaction value is lower in this segment, the sheer volume of consumption makes it a vital component of the overall market structure, necessitating streamlined packaging, efficient retail supply chain management, and effective digital marketing strategies focusing on instructional content and ease of purchase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hose Fasteners Global, ClampTech Solutions, Universal Fittings Inc., Precision Hoops Corp., MegaClamping Systems, Industrial Component Specialists, AutoConnect Devices, HydroFlow Components, Agrarian Hardware Group, Residential Utility Supplies, Zigma Fasteners, Prime Industrial Clamps, Secure Assembly Ltd., Apex Fluid Control, EnviroHose Fixings, Midwest Sealing Systems, Eastern Clamping Authority, North Star Industrial, Global Pipe Support, Future Fixing Innovations |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hose Hoops Market Key Technology Landscape

The technology landscape of the Hose Hoops Market is characterized less by revolutionary inventions and more by continuous material science refinement and advanced manufacturing precision aimed at maximizing operational integrity and minimizing failure rates in increasingly demanding environments. A central technological focus remains the development of specialized materials, particularly high-grade stainless steels (like 316L) and nickel alloys, designed to withstand extreme corrosion from chemicals, saltwater, and high-temperature exhaust environments prevalent in marine and heavy industrial applications. Innovation in plating and surface treatments, such as specialized coatings for enhanced friction reduction and resistance to harsh fluids, is critical for extending product lifespan and ensuring consistent torque application during installation. Furthermore, the adoption of advanced Finite Element Analysis (FEA) software allows manufacturers to precisely model the stress distribution within the clamp band and housing under various loads and thermal cycles, leading to design optimization that guarantees reliable sealing even in dynamic or high-vibration systems.

Another pivotal technological advancement involves the design and proliferation of Constant Tension (CT) clamps. These clamps incorporate features, often spring-loaded or using specialized Belleville washers, that dynamically adjust the clamping force to compensate for changes in the hose material (e.g., softening at high temperatures, cold flow, or shrinkage) and fitting dimensions caused by thermal expansion or contraction cycles, common in automotive cooling and heating systems. This technological leap addresses one of the primary causes of hose connection failure—loss of seal integrity due to thermal cycling—and represents a significant move toward proactive rather than reactive fastening solutions. The precision required for manufacturing these CT mechanisms necessitates highly sophisticated stamping and heat treatment processes, ensuring the spring elements retain their calibrated force over the product's entire lifespan, thereby securing their premium position in critical application segments.

Emerging technologies include the integration of sensor technology, paving the way for "smart clamps" aligned with Industry 4.0 principles. Although nascent, research is focused on embedding or attaching miniature sensors (e.g., strain gauges or acoustic sensors) that can monitor the clamping force, detect subtle vibrations indicative of connection loosening, or register early signs of fluid leakage. This data, transmitted wirelessly, allows maintenance personnel to predict potential failures before they occur, drastically improving system reliability and reducing catastrophic downtime. While cost remains a barrier for widespread adoption of sensor-equipped clamps in general applications, their viability in high-stakes environments—such as oil rigs, aerospace fluid transfer, and critical medical devices—is driving preliminary research and development efforts, signifying the market's trajectory toward integrated, intelligent hardware components designed for maximum operational foresight and safety compliance.

Regional Highlights

Regional dynamics within the Hose Hoops Market are highly stratified, reflecting global patterns of industrial maturity, infrastructure investment, and regulatory stringency. North America and Europe currently represent the highest consumption markets by value, primarily due to large, established automotive manufacturing bases, stringent environmental regulations necessitating high-quality sealing solutions, and substantial defense and aerospace industries demanding highly specialized, certified clamps. These regions are characterized by a preference for premium materials (like 316 stainless steel) and technologically advanced products (Constant Tension clamps), driving higher average selling prices. Market growth in these areas is steady but largely driven by replacement cycles, technological upgrades, and the increasing complexity of EV thermal management systems, rather than sheer capacity expansion.

The Asia Pacific (APAC) region stands out as the primary engine for volumetric market growth throughout the forecast period. Driven by rapid urbanization, massive government investment in infrastructure (water, power, transportation), and the establishment of global manufacturing hubs in countries like China, India, Vietnam, and Indonesia, the demand for all types of industrial components, including hose hoops, is soaring. While price sensitivity is higher in some mass-market segments within APAC, the burgeoning domestic automotive and heavy industry sectors are increasingly adopting international quality standards, leading to growing demand for medium-to-high quality clamps. This region not only serves as a major consumer but also as the world's leading manufacturing base for standard clamps, profoundly influencing global supply chain dynamics and competitive pricing structures.

Latin America (LATAM) and the Middle East & Africa (MEA) constitute emerging markets with significant, albeit localized, growth potential. Growth in LATAM is closely tied to commodity markets, notably mining, oil and gas, and agriculture, driving demand for heavy-duty industrial clamps suited for harsh operating conditions. In the MEA region, large-scale oil and gas extraction projects, coupled with significant state investments in infrastructure and non-oil industrial diversification initiatives, are fueling demand. These regions often require clamps specifically engineered for extreme temperature fluctuations and severe corrosive environments. Market penetration is often challenging due to complex logistical requirements and varying regulatory landscapes, necessitating a focused, partner-led distribution strategy for market entry and expansion.

- Asia Pacific (APAC): Highest volume growth region, driven by massive infrastructure spending, automotive industry expansion, and industrialization in China, India, and Southeast Asia. Focus on both cost-effective and medium-quality clamps.

- North America: High-value market focused on premium, specialized T-bolt and constant-tension clamps for demanding applications in automotive, aerospace, and defense sectors. Strict regulatory compliance drives quality demand.

- Europe: Mature market characterized by stringent environmental standards (REACH, RoHS) and strong demand from advanced machinery manufacturing (Germany, Italy) and vehicle production. Emphasis on durable, corrosion-resistant products.

- Middle East & Africa (MEA): Growth tied to oil and gas extraction, petrochemical expansion, and regional infrastructure projects. Demand centers on heavy-duty, high-temperature, and corrosion-resistant solutions.

- Latin America (LATAM): Market driven by commodity sectors (mining, agriculture) and domestic automotive production. Highly sensitive to economic cycles and raw material price volatility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hose Hoops Market.- Hose Fasteners Global

- ClampTech Solutions

- Universal Fittings Inc.

- Precision Hoops Corp.

- MegaClamping Systems

- Industrial Component Specialists

- AutoConnect Devices

- HydroFlow Components

- Agrarian Hardware Group

- Residential Utility Supplies

- Zigma Fasteners

- Prime Industrial Clamps

- Secure Assembly Ltd.

- Apex Fluid Control

- EnviroHose Fixings

- Midwest Sealing Systems

- Eastern Clamping Authority

- North Star Industrial

- Global Pipe Support

- Future Fixing Innovations

Frequently Asked Questions

Analyze common user questions about the Hose Hoops market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material types are dominant in the Hose Hoops Market and why?

Stainless steel, particularly grades 304 and 316, dominates the market by value due to its superior corrosion resistance and high tensile strength, making it essential for critical applications in marine, chemical processing, and high-performance automotive environments where longevity and sealing integrity under harsh conditions are paramount. Galvanized steel remains prominent in cost-sensitive, general-purpose applications.

How is the growth of the Electric Vehicle (EV) sector impacting demand for hose hoops?

The EV sector is driving specialized demand for Constant Tension (CT) clamps and specific high-grade materials. EVs utilize complex thermal management systems for batteries and electronics, which involve significant thermal cycling. CT clamps are required to maintain consistent seal pressure despite material expansion and contraction, ensuring the integrity of critical cooling lines.

Which product type exhibits the fastest growth rate and for what applications?

Constant Tension (CT) clamps and T-bolt clamps are experiencing the fastest growth by value. CT clamps are favored in the automotive industry for preventing leak failures caused by temperature fluctuations, while heavy-duty T-bolt clamps are rapidly growing in industrial machinery, heavy truck manufacturing, and infrastructure projects requiring high-pressure, robust, and vibration-resistant connections.

What are the primary factors restraining overall market growth in the hose hoops segment?

Primary restraints include the high price volatility of essential raw materials, particularly steel, which compresses manufacturer profit margins. Additionally, the market for standard worm-drive clamps is highly commoditized and saturated, leading to intense price-based competition, especially from low-cost manufacturers in the Asia Pacific region, challenging profitability for premium suppliers.

How is digital transformation (Industry 4.0) influencing the hose hoops value chain?

Digital transformation is primarily influencing manufacturing efficiency and distribution. AI and machine learning are optimizing design (generative design) and quality control (automated inspection). In distribution, e-commerce platforms are accelerating sales of MRO and residential clamps, offering improved price transparency and faster logistical fulfillment compared to traditional industrial distributors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hose Hoops Market Size Report By Type (Stainless Steel Hoops, Galvanized Hoops, Other Hoops), By Application (Automotive Industry, General Industry, Water Treatment, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hose Hoops Market Statistics 2025 Analysis By Application (Automotive Industry, General Industry, Water Treatment), By Type (Stainless Steel Hoops, Galvanized Hoops, Other Hoops), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager