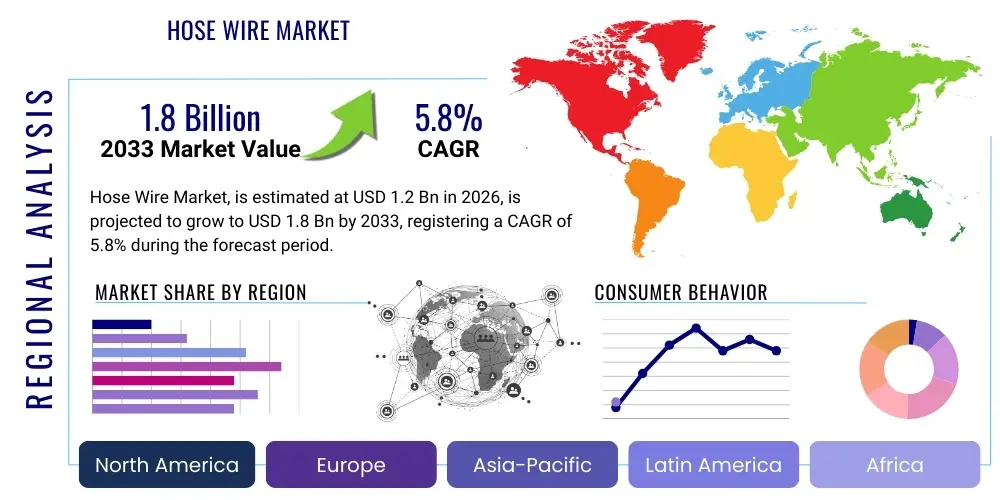

Hose Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436523 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hose Wire Market Size

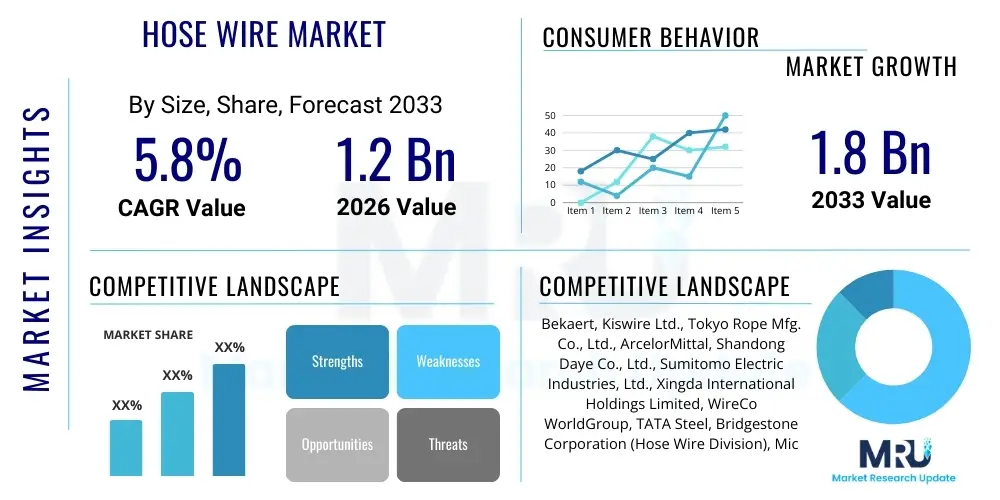

The Hose Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Hose Wire Market introduction

The Hose Wire Market encompasses the production and supply of high-tensile steel wire primarily used as reinforcement material in various types of industrial, hydraulic, and automotive rubber hoses. This crucial reinforcement provides essential structural integrity, flexibility, and resistance against high internal pressures, abrasion, and cyclic fatigue, ensuring the safe and efficient transfer of fluids and gases across diverse operational environments. Modern hose wire production involves complex processes such as specialized drawing, plating (like brass plating for enhanced rubber adhesion), and heat treatment, ensuring the final product meets stringent industry standards for strength and ductility, particularly in critical applications like mining equipment and aircraft hydraulic systems. The escalating demand is fundamentally linked to global industrialization, urbanization, and the continuous expansion of mechanized sectors requiring robust fluid conveyance systems.

Hose wire products are highly specialized, varying significantly based on diameter, tensile strength, and surface treatment, tailored specifically for the application pressure rating and the type of host material (rubber, thermoplastic, or silicone). For instance, high-pressure hydraulic hoses utilized in heavy construction machinery demand ultra-high tensile strength, often achieved through patented steel alloy compositions and advanced brass plating techniques to optimize adhesion to synthetic rubber matrices. The critical nature of these components means that product failure is not merely a replacement cost but often leads to extensive operational downtime and significant safety hazards, thus placing immense emphasis on quality control and certification processes within the manufacturing supply chain. Key applications span across the automotive sector (brake lines, power steering hoses), energy sector (drilling and refining hoses), and industrial machinery (pneumatic and hydraulic transfer systems).

The primary benefits of utilizing specialized hose wire include superior burst resistance, exceptional dimensional stability under pressure fluctuations, and extended service life, which translates directly into reduced maintenance requirements for end-users. Driving factors for market growth include the robust resurgence of the global automotive manufacturing sector, particularly in emerging economies; the sustained growth in large-scale infrastructure projects requiring heavy equipment; and the increasing complexity and efficiency demands in the oil and gas extraction industry, which mandates high-performance, durable hoses capable of handling extreme temperatures and corrosive substances. Furthermore, the transition toward higher operating pressures in next-generation hydraulic systems, aiming for smaller, lighter components, inherently drives the demand for stronger, more sophisticated hose reinforcement wires, pushing manufacturers toward continuous technological innovation in metallurgy and coating processes.

Hose Wire Market Executive Summary

The global Hose Wire Market is experiencing moderate yet stable growth, underpinned by foundational demand from the transportation and heavy machinery sectors. Current business trends indicate a critical shift toward premium, ultra-high tensile strength wires (UHST) necessary for accommodating the pressure intensification in modern hydraulic systems, driven largely by efficiency mandates across construction and mining operations. Furthermore, manufacturers are heavily investing in sustainable production practices, utilizing electric arc furnaces and focusing on improved brass plating chemistries that minimize environmental impact while maximizing rubber adhesion properties. Strategic mergers and acquisitions among key market players are consolidating capacity, especially in Asia Pacific, aiming to streamline supply chains and standardize quality across international markets, while simultaneously introducing advanced monitoring technologies to ensure defect-free production runs.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing market segment, primarily fueled by massive infrastructure development programs in China and India, coupled with the region’s status as a global hub for automotive and heavy machinery manufacturing. North America and Europe, while representing mature markets, exhibit demand concentration in replacement components and specialized high-specification applications, such as aerospace hydraulics and advanced automotive safety systems, emphasizing reliability and stringent adherence to regulatory standards (e.g., ISO, SAE). Latin America and the Middle East & Africa (MEA) are emerging as significant consumption centers, correlated directly with increased activities in mining, oil exploration, and agricultural mechanization, demanding robust and corrosion-resistant wire products tailored for harsh operating climates.

Segment trends reveal that the high-tensile brass-plated wire segment continues to hold the largest market share due to its established efficacy in rubber adhesion and widespread use in standard hydraulic hoses. However, the stainless steel wire segment is projecting the highest CAGR, propelled by its superior corrosion resistance and suitability for niche applications in the chemical processing and marine industries, where standard carbon steel wires degrade rapidly. Application-wise, automotive hoses (including those for electric vehicles, which require specialized thermal management hoses) and industrial high-pressure hoses remain the predominant consumption categories, constantly pushing the boundaries for smaller diameters coupled with increased tensile strength. The market dynamics are compelling manufacturers to balance cost optimization with adherence to increasingly complex material science requirements necessary for next-generation hose performance.

AI Impact Analysis on Hose Wire Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Hose Wire Market predominantly revolve around three critical areas: optimizing the complex manufacturing process, predicting raw material cost volatility, and enhancing quality control measures. Users are keenly interested in how machine learning algorithms can analyze real-time data from wire drawing lines, heat treatment furnaces, and plating baths to achieve unparalleled consistency in tensile strength and coating thickness, thereby minimizing production scrap and maximizing yield efficiency. Concerns often center on the initial investment costs required for implementing advanced sensor infrastructure and data analytics platforms, juxtaposed against the expected return on investment realized through defect reduction and energy efficiency improvements in energy-intensive operations like wire drawing. Furthermore, users seek clarification on AI's potential role in predictive maintenance for complex machinery, aiming to drastically reduce unplanned downtime in high-volume production environments.

The implementation of AI and related predictive analytics in the upstream segment of the hose wire value chain is set to revolutionize operational efficacy. AI-driven systems are now being deployed to model complex metallurgical interactions during the steel alloy formulation and wire drawing processes. By integrating massive datasets encompassing temperature readings, deformation rates, and chemical composition inputs, AI can dynamically adjust parameters in real-time, resulting in hose wire with near-perfect uniformity in mechanical properties across entire production coils. This level of precision is virtually unattainable through traditional statistical process control (SPC) methods, enabling manufacturers to meet increasingly tight tolerances required by tier-one hose producers serving critical automotive and aerospace sectors. The optimization achieved through AI not only improves product quality but significantly reduces energy consumption associated with re-runs and quality failures.

Beyond manufacturing optimization, AI is transforming the strategic decision-making process within the Hose Wire Market. Predictive modeling, utilizing machine learning, is now employed to forecast global steel billet prices, copper and zinc costs (for brass plating), and prevailing logistics expenditures, allowing procurement departments to execute far more profitable and timely hedging strategies. On the demand side, AI analyzes global sales data, economic indicators, and regulatory trends (like shifts in emission standards affecting automotive production) to generate highly accurate demand forecasts, enabling manufacturers to optimize inventory levels and capacity planning. This proactive strategy allows companies to respond rapidly to shifts in key end-user markets, maintaining a competitive edge by avoiding both stockouts and costly overstocking situations. The net impact of AI is a movement towards a more resilient, data-driven, and highly optimized supply chain.

- AI-driven optimization of wire drawing and heat treatment parameters for enhanced tensile strength consistency.

- Predictive maintenance schedules for high-speed winding and plating machinery, minimizing unplanned production downtime.

- Machine Learning (ML) algorithms for real-time defect detection using vision systems, ensuring zero-defect output quality.

- Enhanced forecasting models for raw material procurement (steel, copper, zinc), mitigating price volatility risks.

- Optimization of energy consumption in manufacturing plants through smart operational scheduling and load balancing.

DRO & Impact Forces Of Hose Wire Market

The dynamics of the Hose Wire Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing investment decisions and strategic planning. Key drivers include the robust, non-negotiable need for fluid power transmission in heavy machinery, demanding high-performance reinforcement wires capable of sustaining extreme pressures and harsh environments. Restraints primarily involve the inherent volatility and cyclical nature of raw material prices, particularly steel and non-ferrous metals like copper and zinc, which directly impact manufacturing costs and profitability margins. Opportunities are heavily concentrated in the transition to sustainable energy systems, specifically the emergence of electric vehicles (EVs) and hydrogen fuel cell technology, both requiring new types of specialized, often corrosion-resistant or high-temperature capable, reinforced hoses. These forces collectively shape the competitive landscape and technological investment priorities across the global market.

The principal driving force sustaining market growth is the global acceleration of infrastructure and construction spending, particularly in rapidly developing economies. Large-scale public works projects necessitate continuous operation of earthmoving equipment, cranes, and specialized industrial vehicles, all relying critically on durable hydraulic and pneumatic hose assemblies reinforced with high-quality wire. Concurrently, the increasing complexity and miniaturization in modern automotive systems are driving the demand for smaller diameter hoses that must handle higher pressures, thereby necessitating even stronger reinforcing wire per unit volume. Furthermore, stringent global safety regulations imposed across industries such as oil and gas, requiring hoses to withstand higher burst pressures and longer operational lifecycles, compel manufacturers to utilize premium, certified hose wire products, thus driving value over volume.

Conversely, significant headwinds are presented by the regulatory constraints surrounding environmental emissions from manufacturing processes, particularly in relation to the brass plating processes which involve hazardous chemical handling. Another major restraint is the market saturation in certain developed regions, leading to intense price competition, forcing manufacturers to operate with tighter margins. The most potent impact force influencing the market structure is the intense bargaining power of large, tier-one hose manufacturers who purchase vast volumes of wire and dictate precise technical specifications and often demand just-in-time delivery schedules. However, this restraint is partially offset by the opportunity presented by technological innovation, specifically the development of advanced steel alloys (e.g., micro-alloyed steel) that offer superior strength-to-weight ratios, opening doors for suppliers to differentiate their products and capture high-margin specialized applications.

Segmentation Analysis

The Hose Wire Market segmentation provides a granular view of the industry structure, allowing manufacturers and strategists to target specific high-growth areas based on product attributes, operational requirements, and end-user applications. Segmentation is fundamentally categorized by the type of wire material and treatment, the application pressure level it is designed to withstand, and the ultimate end-use industry utilizing the reinforced hose. This framework is crucial because the performance requirements for hose wire used in a high-pressure mining hydraulic line are vastly different from those used in a standard automotive cooling system hose, dictating variations in tensile strength, plating adhesion, and fatigue resistance specifications. Understanding these distinctions is pivotal for optimizing production lines and ensuring product compliance with rigorous industrial standards.

- By Type:

- High Tensile Brass Plated Wire

- Galvanized Steel Wire

- Stainless Steel Wire

- High Carbon Steel Wire

- Others (e.g., Micro-alloyed Steel)

- By Application:

- Hydraulic Hoses (Ultra-High Pressure, Medium Pressure)

- Industrial Hoses (Air/Water Transfer, Material Handling)

- Automotive Hoses (Brake, Steering, Fuel, Thermal Management)

- Mining Hoses

- Oil & Gas Hoses (Drilling, Offshore)

- By End-Use Industry:

- Automotive & Transportation

- Construction & Mining

- Oil & Gas (Upstream, Midstream, Downstream)

- Agriculture

- Industrial Manufacturing

- Chemical & Marine

- By Diameter:

- Less than 0.30 mm

- 0.30 mm to 0.60 mm

- Above 0.60 mm

Value Chain Analysis For Hose Wire Market

The Hose Wire Market value chain is highly specialized, beginning with the upstream supply of raw materials, primarily high-carbon steel rods or billets, which are sourced from major steel mills globally. The profitability in the upstream segment is heavily influenced by global commodity pricing and the energy costs associated with steel production. Key wire manufacturers then transform these rods through rigorous multi-stage wire drawing and heat treatment processes, ensuring the desired mechanical properties and precise dimensional tolerances are achieved. This stage is capital-intensive and requires high expertise in metallurgy and process control, defining the quality and performance ceiling of the final wire product. Specialized processes, such as electrolytic or hot-dip brass plating, are then applied to enhance adhesion properties essential for embedding the wire effectively into the rubber matrix of the final hose assembly.

The middle segment involves the distribution channels, which are bifurcated into direct sales to large, integrated Tier 1 hose manufacturers (e.g., Parker Hannifin, Gates Corporation) and sales through specialized industrial distributors catering to smaller or regional hose assembly manufacturers. Direct sales dominate the ultra-high-volume, high-specification segments, facilitating close collaboration on technical requirements and quality control protocols. Conversely, distributors manage regional inventory and smaller, diverse orders, playing a crucial role in providing logistical support and market penetration in geographically fragmented areas. Effective inventory management and robust logistics capabilities are vital in this segment due to the just-in-time (JIT) delivery requirements often mandated by major automotive and hydraulic system integrators.

The downstream segment encompasses the hose manufacturers who utilize the hose wire as braiding or spiraling reinforcement within their final product assemblies. These hoses are then sold to the ultimate end-users across diverse sectors like automotive, construction, and mining. The performance of the hose wire directly dictates the competitive edge of the final hose product in terms of pressure rating and service life. Therefore, indirect influence on the market comes from regulatory bodies (such as ISO and SAE) that establish performance benchmarks for the end-use hoses, compelling wire manufacturers to continuously upgrade their material specifications and production techniques. The ultimate value delivery is realized when the reinforced hose performs reliably in high-stakes operational environments, reducing equipment failure and minimizing operational downtime for the end-user.

Hose Wire Market Potential Customers

The primary potential customers and end-users of hose wire are global and regional manufacturers of fluid conveyance systems, specifically those producing high-pressure hydraulic, industrial, and automotive hoses. These customers are categorized mainly as Tier 1 suppliers to Original Equipment Manufacturers (OEMs) in sectors such as heavy equipment, aerospace, and vehicle manufacturing. Their purchasing decisions are driven less by price and more by the wire's certified performance metrics, including ultimate tensile strength, consistent diameter tolerance, and critical brass adhesion strength, which directly correlates to the quality and durability of their finished hose products. The key focus for wire suppliers is maintaining long-term qualification status with these large purchasers, a process that requires strict adherence to international quality management systems and demonstrated reliability in high-volume supply.

A significant customer base resides within the construction and mining sectors, particularly companies that operate extensive fleets of hydraulic excavators, loaders, and drilling equipment. Although they do not purchase the raw hose wire directly, their massive replacement market demand for robust, high-pressure hydraulic hose assemblies drives the purchasing behavior of the hose manufacturers. For example, a failure in a mining hydraulic hose can halt multi-million dollar operations, thus compelling mining operators to specify hoses built with the highest quality reinforcement. Similarly, agricultural equipment manufacturers and industrial machinery producers, requiring reliable power steering, pneumatic, and braking systems, represent continuous demand for medium-pressure wire-reinforced hoses. Therefore, understanding the maintenance cycles and operational intensity of these end-use sectors is key to forecasting demand for potential hose wire customers.

The emerging potential customer segments are increasingly found in specialized, high-growth technological areas. This includes manufacturers of advanced thermal management hoses for battery cooling systems in Electric Vehicles (EVs) and developers of hydrogen fuel infrastructure requiring ultra-high pressure, leak-proof composite hoses. These specialized applications require hose wire that might offer enhanced corrosion resistance (like specific stainless steel grades) or exceptional performance at high temperatures, moving away from traditional carbon steel reinforcement. Targeting these advanced application manufacturers requires suppliers to demonstrate innovation in metallurgy, offering tailored solutions that solve unique engineering challenges posed by new energy technologies, thereby unlocking premium pricing opportunities in high-value niche markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bekaert, Kiswire Ltd., Tokyo Rope Mfg. Co., Ltd., ArcelorMittal, Shandong Daye Co., Ltd., Sumitomo Electric Industries, Ltd., Xingda International Holdings Limited, WireCo WorldGroup, TATA Steel, Bridgestone Corporation (Hose Wire Division), Michelin (Hose Wire Production), Zhaoguan Metal Products Co., Ltd., SWR Group, Hunan Hualian China, Fuxin Special Steel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hose Wire Market Key Technology Landscape

The technological landscape of the Hose Wire Market is dominated by advancements in metallurgy, wire drawing precision, and surface treatment optimization, all aimed at achieving ultra-high tensile strength (UHTS) while maintaining sufficient ductility and adhesion properties. A critical technology is the specialized high-speed drawing process, often conducted through multiple reduction stages using precision diamond or carbide dies, coupled with controlled intermediate heat treatments (patenting) to refine the microstructure of the steel. This precise control over the drawing process minimizes internal defects and strain hardening, maximizing the wire’s fatigue resistance—a non-negotiable requirement for dynamic, high-pressure hydraulic applications. Furthermore, the push towards smaller diameter wires (micro-wire) that still offer robust reinforcement necessitates revolutionary die materials and lubrication systems to prevent premature wear and maintain dimensional consistency over long production runs.

Another pivotal technological area is advanced surface chemistry, specifically the application of brass plating. While traditional brass plating has been standard, modern technology focuses on optimizing the copper-zinc ratio and ensuring highly uniform coating thickness (often measured in nanometers) to enhance the chemical bond between the steel wire and the synthetic rubber compounds used in hose construction. Innovations in electrolytic plating, utilizing advanced bath chemistries and process control, are leading to superior adhesion strength, which is vital for preventing the wire from pulling out or fracturing under extreme pressure cycling. Research is also intensifying into alternative adhesion promoters and composite coatings, particularly for applications involving new rubber compounds like HNBR or FKM, which are used in high-temperature or chemically aggressive environments, thereby future-proofing the wire against evolving material demands in the hose manufacturing sector.

Process automation and quality assurance technologies represent the third major area of innovation. Automated in-line inspection systems, utilizing eddy current testing, laser micrometers, and ultrasonic flaw detection, are standardizing the quality control process. These systems are integrated with sophisticated data logging capabilities to ensure traceability for every spool of wire produced, satisfying the stringent regulatory requirements of end-user industries such as aerospace and defense. Furthermore, the integration of advanced furnace technology, including fluid bed and induction heating methods, allows for exceptionally precise control over the patenting and annealing steps, which are crucial for setting the final mechanical characteristics of the wire. These integrated technologies collectively ensure high manufacturing yields and the production of consistently high-performance reinforcement wire critical for modern high-pressure fluid systems.

Regional Highlights

The global Hose Wire Market exhibits distinct consumption patterns and growth trajectories across major geographical regions, influenced by localized industrial development, regulatory environments, and automotive manufacturing output.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region globally, primarily driven by China and India. The region's dominance stems from its position as the global manufacturing hub for automotive vehicles, construction equipment, and industrial machinery. Massive government investment in infrastructure (roads, railways, power plants) directly fuels demand for hydraulic hoses, requiring vast volumes of high-tensile wire. Key market players are expanding production capacity here, focusing on efficiency and high-volume output to meet the surging demand from local OEMs and international assembly plants.

- North America: Representing a mature but high-value market, North America is characterized by stringent quality standards and a strong focus on replacement demand within the aging infrastructure and industrial sectors. Demand is heavily concentrated in specialized, high-performance wire for heavy-duty applications in the oil and gas (shale drilling), aerospace, and heavy-duty truck manufacturing segments. Regulatory requirements regarding safety and material traceability drive premium pricing for certified, high-specification products.

- Europe: This region is defined by its strong automotive manufacturing base, especially in Germany and Central Europe, alongside a robust demand for industrial automation and machinery. European market growth is spurred by the shift toward advanced, small-diameter, high-pressure hose systems for efficient machinery design. Innovation here often focuses on environmental compliance, pushing manufacturers toward cleaner plating technologies and advanced material science to reduce component weight while maintaining or increasing performance metrics.

- Latin America (LATAM): Growth in LATAM is closely correlated with resource extraction activities, particularly mining in countries like Chile and Peru, and agricultural expansion in Brazil and Argentina. These sectors demand rugged, durable hoses capable of resisting abrasion and cyclic loads in often harsh climatic conditions. The market is highly sensitive to commodity price fluctuations, which directly impact investment in new equipment and subsequent demand for replacement hoses and reinforcement wire.

- Middle East and Africa (MEA): Market expansion in the MEA region is intrinsically linked to ongoing investments in large-scale energy projects (oil and gas exploration and refining) and significant infrastructure development in key urban centers. The demand here is specific, requiring hose wire reinforcement that offers superior thermal and corrosion resistance due to the exposure to extreme temperatures and corrosive environments associated with petrochemical processing and deep-sea drilling operations. Supply chains often rely on imports, making logistics a critical competitive factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hose Wire Market.- Bekaert

- Kiswire Ltd.

- Tokyo Rope Mfg. Co., Ltd.

- ArcelorMittal

- Shandong Daye Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Xingda International Holdings Limited

- WireCo WorldGroup

- TATA Steel

- Bridgestone Corporation (Hose Wire Division)

- Michelin (Hose Wire Production)

- Zhaoguan Metal Products Co., Ltd.

- SWR Group

- Hunan Hualian China

- Fuxin Special Steel

- Hebei Metals

- Precision Wire & Cable

- Zhejiang Hailide New Material Co., Ltd.

- Shandong Sinopower International Co., Ltd.

- Ningbo Jintian Copper (Steel Wire Division)

Frequently Asked Questions

Analyze common user questions about the Hose Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of hose wire in industrial applications?

The primary function of hose wire is to reinforce rubber, thermoplastic, or silicone hoses, providing essential structural integrity to withstand high internal pressures, prevent bursting, and maintain dimensional stability during fluid transfer, particularly in hydraulic and pneumatic systems.

Which specific market segment is projected to experience the highest growth rate?

The Stainless Steel Hose Wire segment is anticipated to register the highest growth CAGR, driven by increasing demand for highly corrosion-resistant reinforcement in specialized applications within the chemical processing, marine, and advanced automotive (EV cooling) industries.

How do fluctuations in raw material prices affect the profitability of hose wire manufacturers?

Raw material volatility, especially in high-carbon steel billets, copper, and zinc, directly impacts the cost of goods sold (COGS). Manufacturers manage this through hedging strategies, long-term procurement contracts, and leveraging advanced AI forecasting models to predict price movements and optimize inventory.

What technological advancements are driving the quality improvement in hose wire production?

Key technological advancements include the use of ultra-precise wire drawing dies, advanced in-line non-destructive testing (NDT) for defect detection, and optimization of brass plating chemistries to significantly enhance the adhesion strength between the steel wire and rubber compound, improving fatigue life.

Where is the largest demand for hose wire geographically concentrated?

The largest demand for hose wire is geographically concentrated in the Asia Pacific (APAC) region, primarily due to expansive manufacturing bases for automotive and heavy construction equipment, alongside extensive ongoing infrastructure development projects in key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager