Hospital Bed Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433372 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hospital Bed Market Size

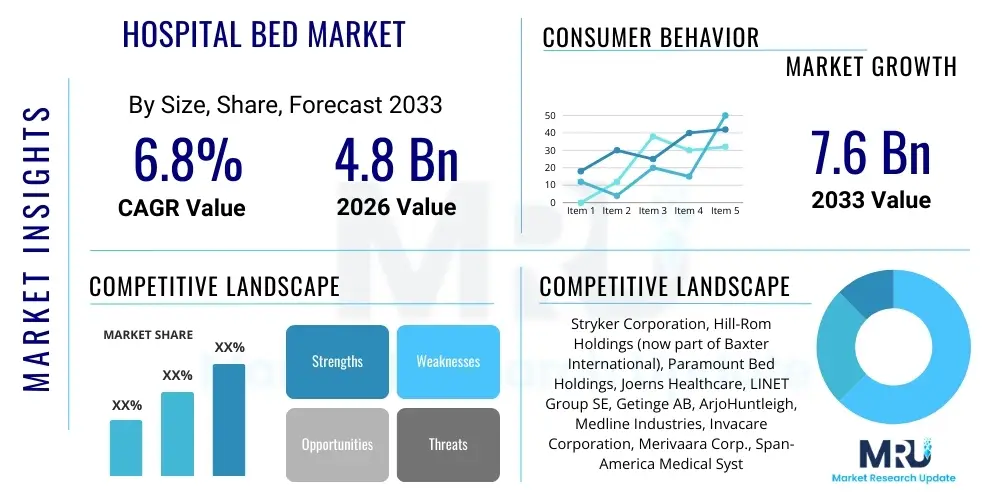

The Hospital Bed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Hospital Bed Market introduction

The Hospital Bed Market encompasses the manufacturing, distribution, and sale of specialized patient beds designed for use in healthcare facilities. These products range from basic manual beds to highly sophisticated electric and smart beds equipped with advanced features such as patient monitoring systems, weight scales, automated positioning, and anti-decubitus pressure redistribution mattresses. The core objective of these products is to enhance patient comfort, safety, and recovery, while also improving the ergonomics and efficiency for caregivers. Product complexity has dramatically increased in recent years, moving standard hospital beds into the realm of complex medical devices integral to acute and critical care environments.

Major applications for hospital beds span the entire healthcare continuum, including intensive care units (ICUs), general wards, long-term care facilities, specialized orthopedic centers, and increasingly, home care settings. The burgeoning geriatric population globally, coupled with the rising prevalence of chronic diseases requiring extended hospitalization or continuous monitoring, serves as a primary driver for market expansion. Furthermore, significant investments by both public and private sectors in upgrading existing healthcare infrastructure, particularly in developing economies, necessitate the procurement of modern, technologically advanced bedding systems that comply with stringent patient safety regulations.

The benefits associated with modern hospital beds are multifaceted. For patients, they offer enhanced comfort, reduced risk of pressure ulcers (bedsores) through sophisticated pressure mapping technology, and improved mobility facilitated by easy adjustment mechanisms. For healthcare providers, these beds integrate features that minimize manual handling injuries for staff, allow seamless data integration with Electronic Health Records (EHRs), and optimize patient flow and resource management. Driving factors include technological advancements (such as remote monitoring capabilities and integration with hospital information systems), increasing regulatory mandates focusing on patient safety, and the global trend toward specialized clinical care demanding specific bed functionalities, such as bariatric or pediatric models.

Hospital Bed Market Executive Summary

The global Hospital Bed Market is characterized by robust growth, primarily driven by demographic shifts, escalating healthcare expenditure, and a persistent focus on patient safety outcomes. Current business trends indicate a strong move toward high-acuity, fully automated electric beds that incorporate sensors for fall prevention and vital sign monitoring. Key manufacturers are focusing heavily on integrating Internet of Medical Things (IoMT) capabilities, transforming static furniture into dynamic clinical platforms. Furthermore, sustainability and infection control are emerging as critical design parameters, leading to the development of modular and easy-to-clean bed systems designed to withstand intensive use and sophisticated decontamination processes.

Regional trends highlight North America and Europe as mature markets, characterized by high adoption rates of premium, smart beds due to established reimbursement structures and high healthcare spending. These regions focus on replacing outdated equipment and complying with strict safety standards enforced by bodies like the FDA and MDR. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rapid expansion of private hospital chains, significant government initiatives aimed at improving healthcare accessibility, particularly in countries like China and India, and the rising demand for sophisticated healthcare services previously unavailable to large segments of the population. This regional dynamism is creating lucrative opportunities for both international corporations and domestic manufacturers specializing in cost-effective, durable solutions.

Segment trends reveal that the electric bed segment dominates the market due to its superior functionality, ease of use for both patients and clinicians, and mandatory inclusion in most new hospital constructions and renovations. Within applications, the acute care segment holds the largest market share, driven by the complexity and critical nature of intensive care and surgical recovery. However, the long-term care and home care segments are experiencing accelerated growth. This acceleration is a direct consequence of shifting care models that prioritize moving patients out of costly hospital settings and into less intensive environments, thereby boosting demand for durable, yet less complex and more cost-effective beds suitable for chronic management and rehabilitation at home.

AI Impact Analysis on Hospital Bed Market

Common user inquiries regarding AI in the Hospital Bed Market center on how artificial intelligence can move beyond simple sensor data collection to proactive clinical intervention and operational efficiency. Users frequently ask about the accuracy and reliability of AI algorithms in predicting patient deterioration (e.g., risk of sepsis or cardiac arrest) based on embedded sensor data (heart rate, respiration, movement patterns) collected by the bed. There is significant interest in understanding the ethical and regulatory challenges associated with using AI-driven alerts that influence direct care decisions. Operational questions often revolve around how AI can optimize bed management, including predicting discharge timing, cleaning cycle optimization, and ensuring specific bed types are allocated efficiently to match patient acuity levels, thereby maximizing hospital capacity utilization and minimizing wait times.

The integration of AI fundamentally redefines the hospital bed from a passive piece of equipment into an active data-generating and decision-support tool. AI algorithms analyze continuous streams of data—including patient movement, physiological metrics, and environmental factors—to identify subtle patterns indicative of risk, such as the initial signs of pressure injury development or the increased likelihood of patient falls during nighttime hours. This predictive capability allows clinicians to intervene proactively, reducing preventable complications and significantly lowering the overall cost of care associated with prolonged stays due to adverse events. Manufacturers are prioritizing machine learning models that integrate seamlessly with hospital EHRs, ensuring that bed-generated insights are immediately accessible within the clinical workflow, thereby bridging the gap between hardware and actionable clinical intelligence.

Furthermore, AI significantly impacts the operational lifecycle and maintenance of the beds themselves. By analyzing usage patterns, load stress, and component performance data, AI predictive maintenance systems can forecast potential mechanical failures, scheduling necessary repairs before equipment breakdown occurs. This predictive capability ensures higher uptime for critical care equipment, reduces capital expenditure on premature replacements, and maintains a consistent standard of safety and reliability. As healthcare systems increasingly demand holistic solutions, AI-powered smart beds are emerging as non-negotiable components of advanced digital hospitals, supporting not just patient care, but comprehensive facility management and resource planning, establishing a new benchmark for interconnected clinical technology.

- AI-Driven Fall Prediction: Utilizing real-time pressure mapping and proximity sensors to analyze high-risk movement and alert staff before a fall occurs.

- Predictive Pressure Ulcer Prevention: Analyzing turning schedules and localized pressure readings against established risk scores (e.g., Braden scale) to recommend optimal repositioning frequency.

- Vital Sign Deviation Detection: Continuous passive monitoring of respiration and heart rate via embedded sensors, using AI to detect minute deviations potentially signaling patient deterioration (e.g., sepsis onset).

- Optimized Bed Fleet Management: Machine learning models predicting required maintenance intervals, ensuring high operational uptime and extending asset life.

- Automated Documentation: Seamless integration of bed utilization data, patient weight, and bed position settings directly into the Electronic Health Record (EHR).

- Voice Command and Control: Utilizing AI to process natural language commands, enabling hands-free adjustment of bed positions by both patients and caregivers.

DRO & Impact Forces Of Hospital Bed Market

The dynamics of the Hospital Bed Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key impact forces influencing strategic decisions. Primary drivers center on the aging global demographic, which necessitates specialized long-term care infrastructure and advanced bedding solutions for managing age-related illnesses and mobility constraints. Concurrent with this, the dramatic increase in the volume of surgical procedures and the global push for enhanced patient safety standards, often codified into strict regulatory mandates, compel hospitals to continuously upgrade their bed fleet to comply with features like adjustable height, anti-entrapment features, and weight-based monitoring. These factors create sustained demand across acute and post-acute care settings globally.

Significant restraints impede market growth, primarily stemming from the high initial capital expenditure associated with purchasing advanced, fully electric and smart hospital beds, particularly in emerging economies where budget constraints are severe. Furthermore, the complexities involved in integrating sophisticated, IoMT-enabled beds with existing legacy hospital information technology (IT) systems present substantial challenges, often requiring significant infrastructure overhaul and extensive cybersecurity protocols. Regulatory harmonization also remains a challenge; while patient safety standards are generally increasing, differing certification requirements across regions can slow down product introduction and increase compliance costs for multinational manufacturers, thereby impacting profitability and market speed.

Opportunities for expansion are abundant, particularly in the realm of specialized care and technological integration. The rising popularity of telehealth and remote patient monitoring creates a niche market for home care beds that feature integrated connectivity and data transmission capabilities, moving clinical-grade functionality outside the traditional hospital environment. Additionally, the focus on sustainable and modular design, enabling easier recycling and quicker component replacement, offers manufacturers a competitive edge and helps healthcare providers meet their environmental, social, and governance (ESG) objectives. Leveraging public-private partnerships to finance large-scale healthcare infrastructure projects in APAC and MEA regions represents a significant avenue for long-term growth and market penetration.

Segmentation Analysis

The Hospital Bed Market is comprehensively segmented based on product type, usage application, and end-user, reflecting the diverse clinical needs and operational environments globally. Product types primarily categorize beds by their mechanism of operation, ranging from basic manual adjustments to fully automated electric platforms, with the latter commanding premium pricing due to integrated technology. Application segmentation differentiates demand based on the clinical environment, recognizing that critical care settings require features such as complex articulation and higher weight capacity, distinct from the requirements of long-term rehabilitation or psychiatric wards. This structured segmentation is vital for manufacturers to tailor their R&D efforts and marketing strategies to specific clinical demand profiles, ensuring relevance and market penetration.

The end-user classification is perhaps the most dynamic, driven by the shift in healthcare delivery models. While traditional hospitals remain the largest segment, accounting for the majority of acute and critical care bed procurements, the fastest growth is observed in non-traditional settings. Ambulatory surgical centers, driven by lower costs and quicker recovery times, are increasingly acquiring specialized recovery beds. Furthermore, the expansion of home healthcare services, accelerated by government policies supporting aging-in-place initiatives, is rapidly boosting the demand for functional, aesthetically pleasing, and easy-to-operate home care beds, which often require specific certification for residential use, thus creating a unique market sub-segment characterized by volume and cost sensitivity.

Geographic segmentation is crucial, highlighting variations in demand influenced by regional healthcare maturity, regulatory frameworks, and economic capacity. North America and Europe prioritize replacement cycles and high-technology integration, driven by stringent regulatory bodies and high levels of insurance coverage. In contrast, the APAC region exhibits demand for a wider range of products, balancing the need for cost-effective, high-volume products in public hospitals with demand for high-end critical care beds in rapidly expanding private medical tourism hubs. Analyzing these segments provides a clear framework for understanding market dynamics, allowing stakeholders to identify high-potential growth pockets and tailor their supply chain and distribution networks accordingly.

- By Type:

- Electric Beds (Fully Automated, High-Acuity)

- Semi-Electric Beds (Manual crank for height, Electric motor for head/foot)

- Manual Beds (Crank-operated, Basic Functionality)

- Specialized Beds (Bariatric, Pediatric, Psychiatric, Birthing)

- By Application:

- Acute Care (ICU, CCU, Emergency Departments)

- Long-Term Care (Nursing Homes, Skilled Nursing Facilities)

- Psychiatric Care

- Maternity and Birthing

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Rehabilitation Centers

Value Chain Analysis For Hospital Bed Market

The value chain of the Hospital Bed Market begins with upstream activities, primarily encompassing raw material sourcing and component manufacturing. Key inputs include high-grade steel and aluminum alloys for frames, durable plastics and composite materials for casings and side rails, and complex electronic components for motors, control systems, and integrated sensors. Strategic relationships with raw material suppliers are critical, as fluctuations in metal prices significantly impact manufacturing costs. Furthermore, specialized component manufacturers—responsible for complex actuator systems, pneumatic components, and integrated patient monitoring electronics—hold substantial bargaining power, driving the need for long-term procurement contracts and vertical integration strategies among large bed manufacturers to secure supply and manage quality control effectively.

Midstream activities involve core manufacturing, assembly, and quality assurance processes. Leading manufacturers employ sophisticated, automated production lines to achieve economies of scale while adhering to stringent international quality standards (e.g., ISO 13485). Differentiation at this stage is achieved through innovative design, modular construction for reduced maintenance complexity, and rigorous testing protocols focusing on durability, electrical safety, and patient load capacity. Post-manufacturing, the focus shifts to robust distribution channels, which are instrumental in bringing the bulky, high-value product to the end-user. Distribution is bifurcated into direct sales models, often utilized for large hospital contracts or specialized bed systems requiring high technical support, and indirect channels.

Downstream activities are dominated by sales, installation, maintenance, and post-sale services. Indirect distribution involves reliance on established medical equipment distributors, specialized dealer networks, and third-party logistics providers, especially for penetrating fragmented or geographically distant markets like home care. For the home care segment, partnerships with durable medical equipment (DME) rental companies are essential for reaching individual consumers. Direct channels, while costly, enable manufacturers to maintain deep customer relationships, offering tailored maintenance contracts, training programs, and rapid spare parts supply, which are critical factors in the highly regulated and service-intensive hospital environment. The profitability of the overall value chain is highly dependent on effective inventory management and optimized logistics to manage the sheer size and weight of the final product.

Hospital Bed Market Potential Customers

The primary and most significant segment of end-users and buyers for hospital beds remains the hospital segment, encompassing public, private, and academic medical centers. These institutions purchase beds based on acuity level: high-specification, multi-functional electric beds for intensive care units (ICUs) and surgical recovery rooms, and standard electric or semi-electric beds for general medical and surgical wards. Procurement decisions within hospitals are often complex, involving multidisciplinary teams including clinical directors, biomed engineering specialists, and procurement officers, focusing heavily on long-term cost of ownership, compliance with patient safety standards (such as reduced patient entrapment risk), and technological compatibility with existing hospital infrastructure, including nurse call systems and electronic health records.

A rapidly expanding customer base includes long-term care (LTC) facilities, such as nursing homes and skilled nursing facilities (SNFs). These facilities require beds optimized for extended stays, focusing on pressure injury prevention features, ease of transfer, and non-institutional aesthetics to enhance the living environment. Unlike hospitals, LTC facilities often prioritize durability and straightforward maintenance over the most advanced integrated monitoring features, seeking a balance between clinical functionality and cost-effectiveness suitable for chronic care management. The purchasing cycle in this segment is driven by patient census fluctuations, insurance reimbursement rates for long-term residential care, and regional regulatory requirements for resident safety and quality of life.

The home care setting represents the fastest-growing cohort of potential customers, propelled by demographic trends and economic pressures to de-hospitalize care. Individual patients or their care agencies purchase or rent beds suitable for home use, demanding products that are easy to assemble, less visually intrusive than institutional beds, and often compatible with basic necessary accessories like over-bed tables and bedside commodes. This market is highly fragmented and often influenced by physician recommendations and durable medical equipment (DME) coverage policies from insurance providers. Furthermore, specialized end-users such as military treatment facilities, temporary emergency response units, and dedicated rehabilitation centers also constitute important, albeit niche, potential customers, often demanding ruggedized, rapidly deployable, or highly specialized bedding solutions tailored to unique environmental or clinical needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Hill-Rom Holdings (now part of Baxter International), Paramount Bed Holdings, Joerns Healthcare, LINET Group SE, Getinge AB, ArjoHuntleigh, Medline Industries, Invacare Corporation, Merivaara Corp., Span-America Medical Systems, Gendron Inc., Savaria, Malvestio Spa, Sismatec, Narang Medical Limited, Fazzini Srl, Novum Medical Products, Graham-Field Health Products, Apex Medical Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Bed Market Key Technology Landscape

The technological landscape of the Hospital Bed Market is rapidly advancing, shifting focus from purely mechanical functionality to complex electronic integration and data connectivity. The most significant technological evolution involves the pervasive integration of the Internet of Medical Things (IoMT), where beds function as sophisticated sensor platforms. These smart beds incorporate load cells for accurate patient weighing and mobility tracking, non-contact vital sign monitors (measuring respiration and heart rate through the mattress), and sophisticated pressure redistribution surface technology. These technologies are crucial for preventive care, automating tasks that were historically reliant on manual nursing checks, thereby increasing staff efficiency and reducing clinical errors associated with high patient volumes and fatigue.

Another major technological trend is the development of advanced mechanical and ergonomic features designed to enhance caregiver safety and reduce the incidence of musculoskeletal injuries. Powered drive systems, known as patient transport support, are being integrated into the base of the beds to assist staff in transporting patients within the facility with minimal physical strain. Furthermore, beds now feature sophisticated articulation mechanisms that enable safe patient egress (getting out of bed) and ingress, often using one-button controls that place the patient in a chair-like position close to the floor. These low-height options and chair positions are not merely comfort features but represent critical engineering responses to reducing the severity and frequency of patient falls, a major quality indicator for hospitals worldwide.

Future technological developments are centered on enhanced connectivity and interoperability. New generation beds are being designed with open architecture platforms, allowing them to communicate seamlessly with diverse hospital systems, including electronic medical records (EMR) and hospital logistics software. Cybersecurity protocols are becoming a foundational design element, ensuring the integrity and privacy of patient data collected by the bed sensors, complying with regulations such as HIPAA and GDPR. Furthermore, the use of advanced materials, including antimicrobial coatings and modular components designed for simplified disinfection routines, underscores the importance of infection control technology in the overall product lifecycle. This shift towards technologically dense, interconnected, and secure platforms is reshaping competitive strategies and driving demand for skilled clinical engineering support within healthcare facilities.

Regional Highlights

North America (United States, Canada, Mexico)

North America currently holds the largest share of the global Hospital Bed Market, driven by high per capita healthcare expenditure, well-established reimbursement policies, and stringent regulatory requirements, particularly in the United States. The market here is characterized by high demand for technologically advanced, specialty beds used in critical care and bariatric units. Manufacturers focus heavily on innovation related to patient safety (e.g., advanced fall detection, anti-entrapment solutions) and electronic integration, ensuring seamless communication between the bed and the hospital’s IT infrastructure. The adoption of smart hospital initiatives and the routine replacement of older equipment, mandated by Joint Commission standards, sustain a consistently strong replacement market. Both the U.S. and Canada show increasing investment in long-term care facilities, boosting the demand for durable, rehabilitation-focused bedding solutions.

- Focus Area: High-acuity electric beds, Bariatric beds, and IoMT integration.

- Driving Factor: Regulatory compliance with patient safety standards and sophisticated reimbursement models.

Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

Europe represents a mature and highly competitive market, distinguished by strong domestic manufacturing capabilities, particularly in Germany and the Czech Republic (home to several global market leaders). European market growth is primarily fueled by the aging population, which necessitates increased capacity in nursing homes and specialized geriatric care units. There is a marked preference for ergonomic design solutions that protect staff from injury, often driven by strong labor union influence and national health system mandates. The implementation of the Medical Device Regulation (MDR) has increased the compliance burden for manufacturers, pushing the market towards higher quality, certified products. Western Europe, notably Germany and the UK, exhibits high adoption of beds with advanced pressure ulcer prevention technologies, while Central and Eastern Europe present opportunities for upgrading public hospital infrastructure with basic to semi-electric models.

- Focus Area: Ergonomic designs, long-term care beds, and adherence to strict EU MDR standards.

- Driving Factor: Demographic pressure from aging populations and government investments in public healthcare system upgrades.

Asia Pacific (APAC) (China, Japan, India, South Korea, Southeast Asia)

The Asia Pacific region is forecast to experience the highest growth rate during the projection period. This rapid expansion is attributed to massive investments in healthcare infrastructure expansion, rising medical tourism, and increasing disposable incomes allowing greater access to private healthcare. China and India, in particular, are witnessing rapid establishment of new hospitals and significant governmental programs aimed at improving regional medical facilities. While the demand for cost-effective manual and semi-electric beds remains high in public sectors, the rapidly expanding private hospital chains in metropolitan areas are driving significant uptake of high-end electric and specialized critical care beds, often imported from Western manufacturers. Japan, being a hyper-aging society, maintains high demand for sophisticated home care and nursing beds, focusing heavily on robotics and mobility assistance features.

- Focus Area: Infrastructure development, balanced demand for low-cost and high-tech beds, and medical tourism growth.

- Driving Factor: Large-scale public and private investments in new hospital construction and increasing population access to formal healthcare.

Latin America (Brazil, Argentina, Rest of LATAM)

The Latin American market is characterized by moderate but steady growth, heavily influenced by economic stability and government healthcare budgets. Brazil represents the largest market, supported by a mix of public and private healthcare systems. Market penetration of advanced beds is slower compared to North America due to budget constraints, favoring durable, standardized semi-electric beds. However, large private hospital groups are actively adopting modern critical care solutions to maintain competitive international standards. Infrastructure development remains a key driver, with regional distributors focusing on providing comprehensive service and maintenance support to offset the higher upfront cost of equipment.

- Focus Area: Standard electric and semi-electric beds, localized manufacturing capabilities, and servicing networks.

- Driving Factor: Privatization of healthcare services and increased efforts to modernize major metropolitan hospitals.

Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

The MEA region demonstrates polarized market growth. The Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Qatar) exhibit extremely high demand for luxury, high-tech hospital beds, reflecting significant government wealth and ambition to establish world-class medical facilities and medical tourism hubs. Procurement in the GCC is often concentrated and prioritizes premium international brands and the latest features, including advanced ICT integration. Conversely, the African continent experiences demand driven largely by international aid programs and NGOs, focusing on robust, easily repairable, and cost-effective manual and semi-electric beds suitable for diverse and often challenging operational environments. South Africa acts as a regional hub, possessing relatively more advanced healthcare infrastructure than surrounding nations, thereby driving specialized demand.

- Focus Area: Premium critical care beds (GCC) and durable basic beds (Africa).

- Driving Factor: Government investment in medical infrastructure and high standards of private healthcare in oil-rich nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Bed Market.- Stryker Corporation (now including legacy assets of Patient Handling divisions)

- Hill-Rom Holdings (now part of Baxter International)

- Paramount Bed Holdings Co., Ltd.

- LINET Group SE

- ArjoHuntleigh

- Joerns Healthcare LLC

- Getinge AB

- Medline Industries, LP

- Invacare Corporation

- Merivaara Corp.

- Span-America Medical Systems

- Gendron Inc.

- Malvestio Spa

- Novum Medical Products

- Fazzini Srl

- Apex Medical Corp.

- Shaver Specialty Co.

- GF Health Products, Inc. (Graham-Field)

- Narayan Surgical Pvt. Ltd.

- Francehopital

Frequently Asked Questions

Analyze common user questions about the Hospital Bed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are driving the growth of the smart hospital bed segment?

The smart hospital bed segment growth is primarily driven by the need for advanced patient monitoring systems (non-contact vital sign tracking), integrated electronic features for fall prevention, and seamless data connectivity with Electronic Health Records (EHRs) via IoMT technology. These features enhance patient safety and operational efficiency for caregivers, justifying the higher capital cost.

How does the shift towards home care affect demand for different types of hospital beds?

The expansion of home care significantly increases the demand for specialized, non-institutional-looking electric or semi-electric beds that are easy to operate, transportable, and often rental-based. These beds prioritize basic clinical functionality, patient comfort, and ease of use in a residential environment over the high-acuity features required in Intensive Care Units (ICUs).

Which geographical region exhibits the highest potential for future market growth?

The Asia Pacific (APAC) region is projected to register the fastest market growth. This rapid expansion is fueled by extensive government-led healthcare infrastructure projects in densely populated countries like China and India, coupled with increasing private investment catering to a growing middle class demanding higher quality medical services and new hospital construction.

What are the primary restraints affecting the profitability of the Hospital Bed Market?

Primary restraints include the significant capital investment required for purchasing high-tech electric and bariatric beds, particularly in budget-constrained public healthcare systems. Additionally, regulatory complexity and the challenge of integrating proprietary sensor technology with existing hospital IT infrastructure pose considerable operational and financial barriers for large-scale adoption.

What is the current regulatory focus for hospital bed manufacturers globally?

Regulatory focus is heavily centered on patient safety, specifically addressing entrapment hazards (FDA guidelines), electrical safety, and fire resistance. Furthermore, European manufacturers must comply with the rigorous requirements of the Medical Device Regulation (MDR), ensuring advanced traceability, clinical performance data, and stringent quality management throughout the product lifecycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Foam Mattress For Hospital Bed Market Statistics 2025 Analysis By Application (Hospitals, Clinics), By Type (General Usage, Specific Usage), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Electrical Hospital Bed Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fully Electrical, Semi-Electrical), By Application (Hospital, Nursing Home, Residential, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager