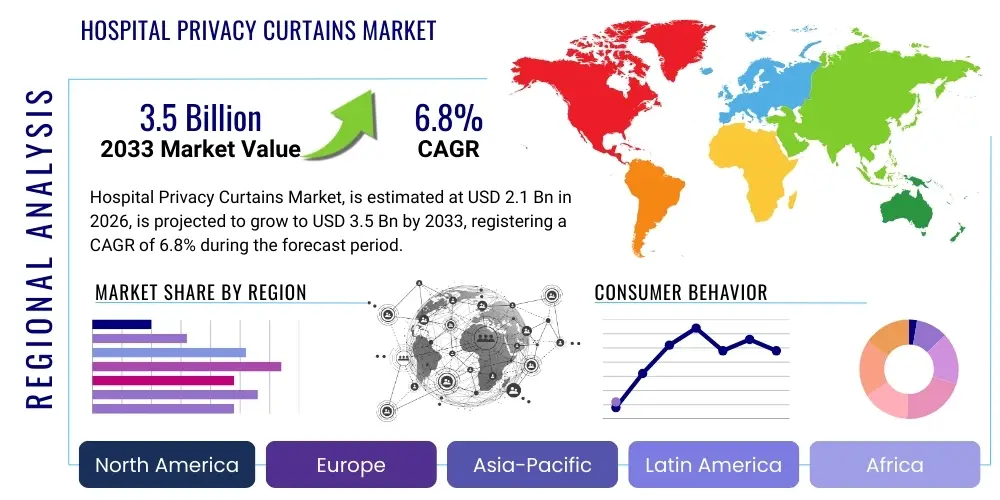

Hospital Privacy Curtains Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437766 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hospital Privacy Curtains Market Size

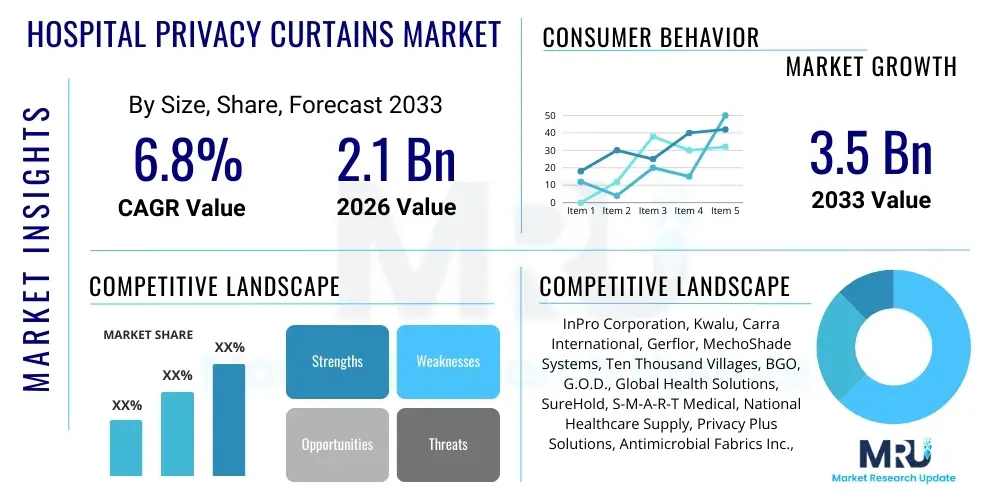

The Hospital Privacy Curtains Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Hospital Privacy Curtains Market introduction

The Hospital Privacy Curtains Market encompasses the manufacturing, distribution, and utilization of specialized curtains designed for use in healthcare environments, primarily to ensure patient dignity, visual privacy, and support infection control protocols. These products range from traditional launderable textile curtains to advanced disposable, antimicrobial-treated systems. Modern privacy curtains are critical components of hospital infrastructure, adhering to stringent fire safety codes and increasingly incorporating features that mitigate the spread of Healthcare-Associated Infections (HAIs).

Major applications include patient rooms, multi-bed wards, emergency departments (EDs), intensive care units (ICUs), and ambulatory surgical centers. Beyond physical separation, these curtains contribute significantly to the overall patient experience by reducing noise, blocking light, and creating psychologically comfortable private spaces within busy clinical settings. The increasing global awareness regarding hygiene standards, coupled with mandates from regulatory bodies such as the Centers for Disease Control and Prevention (CDC) and The Joint Commission, drives the demand for innovative curtain solutions.

Key benefits derived from utilizing high-quality hospital privacy curtains include enhanced infection prevention through antimicrobial coatings and scheduled replacement systems, improved workflow management by defining clinical boundaries, and compliance with privacy regulations (like HIPAA in the US). Driving factors sustaining market growth include the rising prevalence of chronic diseases necessitating frequent hospitalization, significant investments in new healthcare infrastructure across developing economies, and the continuous evolution of material science focusing on lightweight, durable, and highly effective infection control textiles.

Hospital Privacy Curtains Market Executive Summary

The Hospital Privacy Curtains Market exhibits robust growth, primarily propelled by global initiatives to curb Healthcare-Associated Infections (HAIs) and the expansion of modern healthcare facilities globally. Business trends highlight a strong shift toward disposable curtain systems and advanced reusable curtains featuring integrated antimicrobial technologies, reducing laundry costs and infection risks, respectively. Manufacturers are prioritizing innovation in material composition, focusing on sustainable, flame-retardant polymers and textiles that withstand harsh cleaning agents while maintaining integrity. Strategic mergers and acquisitions among established medical supply companies and specialized textile manufacturers are consolidating market share and enhancing global distribution networks, particularly targeting large hospital chains and Group Purchasing Organizations (GPOs).

Regional trends indicate North America and Europe retaining dominant market positions due to highly developed healthcare infrastructures, strict regulatory environments mandating infection control standards, and high disposable income allocated to healthcare spending. However, the Asia Pacific (APAC) region is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR), driven by massive government investments in new hospital construction, rapidly expanding medical tourism sectors in countries like India and China, and increasing adoption of Western hygiene standards. Latin America and MEA are focused on cost-effective, durable solutions, slowly transitioning from conventional textiles to treated materials as awareness and affordability improve.

Segment trends reveal that the disposable curtain segment is gaining traction rapidly, especially in high-turnover clinical areas like emergency rooms, due to ease of replacement and verifiable infection control protocols. The antimicrobial technology segment is witnessing significant investment, with materials utilizing silver ions or copper impregnation becoming standard features. End-user demand is heavily skewed towards large hospitals and tertiary care centers which face the highest risk exposure to HAIs and have the budgetary capacity to implement premium, compliance-driven curtain systems. Furthermore, advancements in curtain tracking and suspension systems, offering quieter operation and easier installation, are becoming key differentiators in competitive tenders.

AI Impact Analysis on Hospital Privacy Curtains Market

Common user questions regarding AI’s impact on hospital privacy curtains generally center on how technology can enhance hygiene monitoring, optimize inventory, and potentially integrate curtains into a smart hospital ecosystem. Users frequently inquire about AI's role in predictive replacement scheduling—determining the optimal time to change disposable curtains based on patient turnover, specific usage patterns, and known infection risks (rather than fixed calendar dates). There is also keen interest in AI-driven supply chain management, ensuring that hospitals never run out of specific curtain types (e.g., specialized ICU antimicrobial versions) and streamlining logistics. The key themes revolve around automation, efficiency gains in infection control compliance documentation, and leveraging AI to move from reactive maintenance to proactive hygiene management, transforming privacy curtains from passive dividers into active components of a smart, safe clinical environment.

- AI integration supports predictive maintenance and replacement scheduling based on real-time occupancy and cleaning cycles.

- Optimized inventory management and logistics for disposable curtains, reducing waste and stockouts in critical care units.

- Real-time sensor data from curtain tracks (usage frequency) feeding into AI algorithms to correlate curtain usage with infection data.

- Automated compliance monitoring, tracking when curtains were last cleaned or replaced, generating alerts for non-compliance with hygiene protocols.

- Enhanced facility design simulations using AI to determine optimal privacy curtain placement for improved patient flow and acoustic privacy in multi-bed rooms.

- AI algorithms analyzing patient movements and occupancy rates to guide maintenance staff efficiency in high-traffic areas like emergency rooms.

DRO & Impact Forces Of Hospital Privacy Curtains Market

The market dynamics are primarily shaped by critical healthcare demands, emphasizing safety and patient confidentiality, juxtaposed with operational cost pressures. The most significant drivers include the escalating global focus on combating Healthcare-Associated Infections (HAIs), which mandates the use of materials with intrinsic antimicrobial properties or high-frequency replacement protocols. Concurrently, substantial expansion in global healthcare infrastructure, particularly the construction of large multi-specialty hospitals in emerging economies, creates a sustained demand foundation. Restraints largely center around the high operational cost associated with managing reusable curtains (laundry, sterilization, and transportation) and, conversely, the environmental concerns and disposal costs linked to high volumes of disposable curtains. Opportunities are abundant in the development of next-generation materials, specifically self-cleaning or viral-inactivating textiles, and the integration of smart features (IoT tracking, embedded sensors) into curtain systems to improve real-time compliance monitoring. These core forces significantly influence procurement decisions, often prioritizing infection control efficacy and durability over initial cost.

Impact forces stemming from technological advancement are pushing manufacturers towards standardized modular systems that are easy to install, replace, and recycle. Regulatory impact is profound; mandates regarding flame resistance (NFPA 701 compliance) and specific hygiene requirements force continuous product iteration and rigorous testing, creating high entry barriers for new players. The competitive intensity is moderate to high, characterized by established textile giants competing on price, quality, and specialized features (e.g., sound dampening). The long-term trajectory of the market suggests increasing stratification, where premium hospitals adopt advanced disposable or antimicrobial systems, while budget-constrained facilities focus on traditional, highly durable launderable curtains, ensuring continuous, albeit differentiated, demand across all segments.

Segmentation Analysis

The Hospital Privacy Curtains Market is segmented based on critical performance attributes and end-user requirements, reflecting the diverse operational needs within healthcare facilities globally. Key segmentation criteria include the type of material (defining longevity and hygiene protocol), the end-user setting (which dictates usage intensity and required features), and the technology incorporated (focusing primarily on infection control mechanisms). The disposable segment, typically made from non-woven polypropylene, is rapidly expanding due to its low cross-contamination risk, while the antimicrobial technology segment is pivotal for facilities aiming for advanced HAI reduction strategies. Analyzing these segments provides a clear pathway for manufacturers to target specific clinical environments, aligning product features with regulatory demands and budgetary constraints inherent in various healthcare subsectors, thereby maximizing market penetration and generating targeted growth.

- Material Type

- Disposable Curtains (Non-Woven Polypropylene)

- Reusable/Launderable Curtains (Polyester, Blended Fabrics, Vinyl)

- Technology

- Antimicrobial Treated Curtains (Silver Ion, Copper Oxide)

- Standard Curtains

- End-User

- Hospitals (Public and Private)

- Clinics and Ambulatory Surgical Centers (ASCs)

- Long-Term Care Facilities (LTCFs)

- Suspension Type

- Ceiling-Mounted Track Systems

- Portable/Free-Standing Systems

Value Chain Analysis For Hospital Privacy Curtains Market

The value chain for hospital privacy curtains begins with upstream activities involving the sourcing of raw materials, predominantly synthetic fibers like polyester and non-woven polymers, and specialized chemical additives such as flame retardants and antimicrobial agents. This initial stage is highly sensitive to commodity price fluctuations and relies on strong relationships with chemical and textile suppliers who meet stringent healthcare material specifications, particularly NFPA 701 fire safety standards. Key upstream challenges involve maintaining a stable supply of materials that possess the necessary durability to withstand repeated industrial laundering (for reusable types) or be cost-effective enough for single-use applications. Efficiency at this stage dictates the final manufacturing cost and the ultimate quality metrics (e.g., tensile strength, pathogen resistance).

The middle segment of the value chain focuses on manufacturing, processing, and assembly. This involves weaving, dyeing, and treating the fabric, followed by the actual fabrication (cutting, sewing, and applying header mesh) and attachment of hardware (hooks, track runners). Quality control is paramount here, ensuring compliance with ISO standards for medical devices and relevant health authority guidelines regarding hygiene and patient safety. Distribution channels represent a critical juncture; these products are typically routed through large specialized medical distributors (indirect channel) who handle logistics, warehousing, and inventory management for large hospital groups, utilizing existing GPO contracts. Direct sales often occur only for highly customized or niche architectural projects.

Downstream activities center on end-user procurement, installation, and lifecycle management (cleaning/disposal). Hospitals, as the primary customers, often utilize Group Purchasing Organizations (GPOs) to negotiate favorable bulk contracts, focusing heavily on total cost of ownership (TCO), which includes purchase price, replacement frequency, and laundry/disposal expenses. The effectiveness of the indirect channel is essential for market penetration, as distributors provide value-added services such as inventory monitoring and technical support regarding installation and material compatibility with hospital cleaning agents. Continuous feedback loops from downstream end-users regarding durability, ease of use, and efficacy of antimicrobial treatments drive R&D efforts in the upstream manufacturing stages, completing the cyclical value chain.

Hospital Privacy Curtains Market Potential Customers

The core customer base for hospital privacy curtains consists predominantly of institutional healthcare providers that require physical barriers for patient privacy and stringent infection control measures. Large general hospitals, including both acute care centers and specialized teaching hospitals, are the largest buyers, characterized by high patient turnover and extensive infrastructure demanding thousands of meters of curtain material across multiple departments (e.g., general surgery, orthopedics, maternity). These institutions frequently utilize GPOs to centralize purchasing, prioritizing long-term durability and advanced features like antimicrobial coatings and fire-retardancy compliance.

Beyond traditional hospitals, the expanding network of clinics, ambulatory surgical centers (ASCs), and diagnostic imaging centers represents a rapidly growing segment of potential customers. These facilities often require flexible, modular solutions, and increasingly prefer disposable curtains due to lower maintenance costs and simplified infection protocols suitable for outpatient settings. Furthermore, specialized long-term care facilities (LTCFs), rehabilitation centers, and psychiatric hospitals constitute a steady market segment, focusing on durable, easily cleanable materials that contribute to a comfortable, non-clinical environment while still meeting safety standards. Procurement decisions across all these segments are highly regulated, placing significant emphasis on product certifications and supplier reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | InPro Corporation, Kwalu, Carra International, Gerflor, MechoShade Systems, Ten Thousand Villages, BGO, G.O.D., Global Health Solutions, SureHold, S-M-A-R-T Medical, National Healthcare Supply, Privacy Plus Solutions, Antimicrobial Fabrics Inc., Healthcare Fabric Solutions, Harken Health, Curtain Solutions Group, Medline Industries, STERIS, Hill-Rom (now Baxter) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Privacy Curtains Market Key Technology Landscape

The technology landscape of the hospital privacy curtains market is characterized by advancements focused primarily on infection prevention, material durability, and operational efficiency. The most significant technological thrust involves the integration of antimicrobial agents directly into the fabric matrix or as a surface coating. These agents, commonly silver ions, copper oxide, or quaternary ammonium compounds, are designed to continuously inhibit the growth of bacteria, fungi, and certain viruses on the curtain surface, thus reducing the curtain’s potential role as a fomite in the transmission of Healthcare-Associated Infections (HAIs). Ongoing research is exploring photocatalytic self-cleaning materials, which use ambient light to break down organic contaminants, offering a passive, continuous disinfection mechanism, though wide-scale commercialization is still emerging. The shift toward specialized textile engineering, ensuring high tensile strength and colorfastness against aggressive hospital cleaning chemicals, is also a continuous technological challenge that manufacturers must overcome.

Beyond material science, technological innovations are transforming the suspension and tracking systems. Modern curtain tracks utilize low-friction polymers and sophisticated roller designs to ensure quiet operation, a critical factor for patient satisfaction and adhering to noise reduction mandates in ICU environments. Modular and quick-release header mesh systems are now standard, enabling rapid replacement of the curtain body without disassembling the entire track, greatly improving staff efficiency during scheduled cleanings or replacements. Furthermore, the rise of smart hospital infrastructure is driving the adoption of embedded IoT technology. This includes track-mounted sensors that monitor curtain usage frequency, cleaning cycles, and replacement status, feeding data directly into hospital facilities management systems. This data integration supports AEO-optimized predictive maintenance, ensuring compliance with regulatory hygiene schedules and minimizing human error in documentation.

The manufacturing technology itself is becoming more sustainable; companies are investing in processes that reduce water usage and chemical effluent. For disposable curtains, technological efforts are centered on creating biodegradable or highly recyclable polymer alternatives to non-woven polypropylene, addressing growing environmental concerns without compromising on infection control efficacy. The interplay between material science (antimicrobial efficacy and fire resistance) and digital integration (IoT tracking) defines the cutting edge of this market, moving the privacy curtain from a purely architectural element to a monitored, active tool in the overall hospital safety and compliance matrix. Standardization bodies continue to refine testing methodologies for antimicrobial performance, compelling manufacturers to continuously upgrade their material science to meet higher performance benchmarks.

Regional Highlights

Regional dynamics in the Hospital Privacy Curtains Market are shaped by healthcare expenditure, regulatory stringency, and infrastructural development patterns. North America, particularly the United States, represents the largest market share owing to its sophisticated and massive healthcare industry, high levels of patient privacy awareness, and stringent enforcement of infection control and fire safety regulations (like NFPA 701). The dominance of large hospital networks and Group Purchasing Organizations (GPOs) accelerates the adoption of premium, technological solutions, especially high-end antimicrobial and disposable systems. High investment in acute care facilities and specialized surgical centers ensures sustained demand for replacement and new installations.

Europe holds the second-largest share, driven by universal healthcare systems and a strong emphasis on patient safety standards established by bodies like the European Centre for Disease Prevention and Control (ECDC). Countries such as Germany, the UK, and France are mature markets prioritizing sustainability (leading to preference for durable, long-life reusable curtains) alongside mandatory hygiene protocols. Regulatory alignment and high standards for material certification are key characteristics of the European procurement landscape. Northern European countries, in particular, show higher adoption rates for aesthetic and acoustic enhancements in curtains to improve the overall patient environment.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid urbanization, significant government and private sector investment in healthcare infrastructure (especially in China, India, and Southeast Asia), and rising demand for medical tourism services. While cost sensitivity remains a factor, the region is quickly adopting Western standards for infection control, driving the transition from basic textiles to affordable disposable and antimicrobial options. The sheer volume of new hospital construction provides a vast greenfield market opportunity. Latin America and the Middle East & Africa (MEA) are emerging markets focusing on establishing basic hospital capacity; procurement decisions often prioritize cost-effectiveness, favoring durable launderable curtains, although affluent MEA nations are rapidly importing advanced technologies to meet high-end healthcare demands.

- North America: Market leader, driven by stringent infection control mandates, significant healthcare IT adoption, and GPO-driven procurement of advanced antimicrobial disposable systems.

- Europe: Mature market characterized by robust regulatory frameworks, a focus on sustainability, and high adoption of acoustic and aesthetically enhanced reusable curtains.

- Asia Pacific (APAC): Fastest growth region, powered by rapid hospital construction, increasing standardization of infection control practices, and rising medical tourism.

- Latin America: Growth driven by healthcare access expansion, favoring cost-effective, durable reusable curtain solutions in public hospitals.

- Middle East & Africa (MEA): Market growth concentrated in Gulf Cooperation Council (GCC) countries investing heavily in advanced, high-tech private hospitals requiring premium, compliance-certified privacy solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Privacy Curtains Market.- InPro Corporation

- Kwalu

- Carra International

- Gerflor

- MechoShade Systems

- Ten Thousand Villages

- BGO

- G.O.D.

- Global Health Solutions

- SureHold

- S-M-A-R-T Medical

- National Healthcare Supply

- Privacy Plus Solutions

- Antimicrobial Fabrics Inc.

- Healthcare Fabric Solutions

- Harken Health

- Curtain Solutions Group

- Medline Industries

- STERIS

- Hill-Rom (now Baxter)

Frequently Asked Questions

Analyze common user questions about the Hospital Privacy Curtains market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between disposable and reusable hospital privacy curtains?

Disposable curtains are non-woven, designed for single-patient use or a short lifespan (e.g., 6 months), eliminating laundry costs and greatly reducing the risk of cross-contamination (HAIs). Reusable curtains are fabric-based, durable, require industrial laundering and sterilization, and offer a longer asset life but pose a higher risk if cleaning schedules are delayed.

How do antimicrobial hospital curtains improve infection control?

Antimicrobial curtains are treated with active agents (like silver or copper compounds) that continuously inhibit the growth of bacteria, mold, and mildew on the curtain surface, ensuring the curtain itself does not become a reservoir for pathogens between cleaning cycles or patient use, significantly reducing environmental contamination risk.

What regulatory compliance standards are critical for hospital privacy curtains?

Critical standards include NFPA 701 (National Fire Protection Association) for flame retardancy, which is mandatory in most developed markets, and adherence to healthcare privacy laws (like HIPAA). Products must also comply with regional standards regarding toxicity, durability, and specific infection control guidelines set by bodies like the CDC or ECDC.

Which material type currently dominates the Hospital Privacy Curtains Market?

While reusable polyester and blended fabric curtains still hold a significant volume share due to their longevity, the disposable curtain segment (typically non-woven polypropylene) is experiencing the fastest growth rate globally, driven by stringent infection control mandates and reduced labor associated with laundering.

How does the integration of IoT technology impact curtain systems?

IoT integration involves adding sensors to curtain tracks or headers to monitor usage frequency, track cleaning dates, and automatically trigger replacement alerts. This ensures real-time compliance reporting, optimizes inventory management, and moves facility maintenance from schedule-based cleaning to data-driven, risk-based hygiene protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager