Hospital Ship Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438394 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hospital Ship Market Size

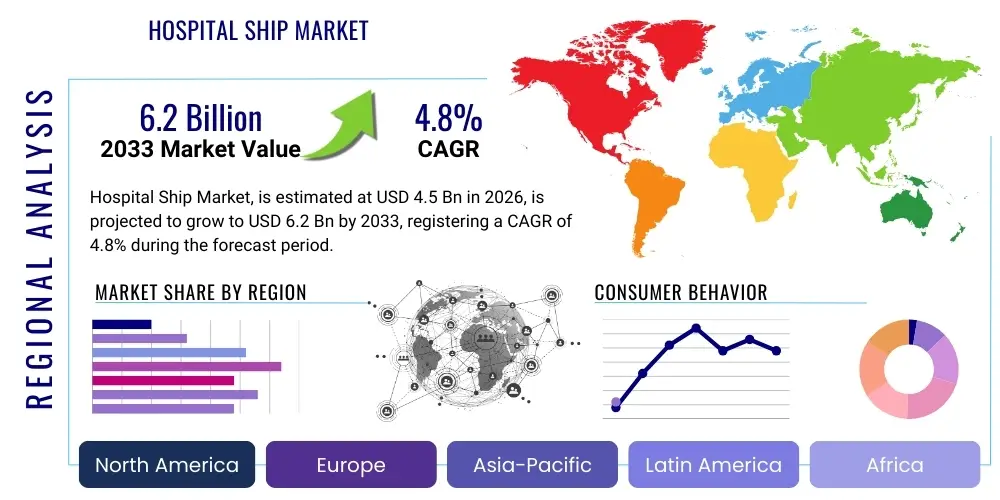

The Hospital Ship Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Hospital Ship Market introduction

Hospital ships are specialized marine vessels designed and equipped to provide extensive medical and surgical care, typically deployed in zones experiencing humanitarian crises, natural disasters, or military conflicts. These vessels function as floating medical centers, possessing facilities comparable to large onshore hospitals, including operating theaters, intensive care units, imaging diagnostics, and pharmacy services. The primary mission of a hospital ship is humanitarian aid, offering crucial support to populations with limited access to robust healthcare infrastructure. They are essential assets for governments, non-governmental organizations (NGOs), and military forces seeking to project rapid and scalable medical capability globally, especially when traditional logistical supply chains are compromised or non-existent.

The core product offering within this market includes the construction, refurbishment, maintenance, and operational support of these complex maritime assets. Major applications span civilian humanitarian missions, such as providing surgical and primary care to underserved communities in coastal regions, and disaster response scenarios, including earthquakes, tsunamis, or mass casualty events where local healthcare facilities are incapacitated. Their inherent mobility allows them to bypass damaged land infrastructure and deliver aid directly where it is most needed, acting as immediate, high-capacity trauma centers. Furthermore, hospital ships are critical components of naval logistics, providing advanced care for military personnel operating in remote or hostile environments.

Driving factors for market growth include the escalating frequency and severity of natural disasters globally, which necessitate pre-positioned or rapidly deployable medical assets. Increased geopolitical instability and the resulting migration crises also amplify the demand for humanitarian medical relief delivered via self-sufficient vessels. The benefits derived from hospital ships are manifold: they offer unparalleled autonomy, capable of generating their own power, water, and waste management; they provide a high standard of medical care inaccessible via temporary field hospitals; and they serve as powerful diplomatic tools, fostering international cooperation and goodwill through humanitarian outreach. Investment in modernization and technological integration, particularly modular hospital concepts and advanced telemedicine capabilities, further fuels market expansion.

Hospital Ship Market Executive Summary

The Hospital Ship Market is characterized by steady governmental investment, driven primarily by national security interests and international humanitarian obligations. Key business trends indicate a shift towards multi-mission vessels capable of serving both military logistical support and high-capacity civilian disaster relief, maximizing asset utilization. There is a growing focus on modular design and flexible internal configuration, allowing ships to rapidly adapt their medical specialty focus based on mission requirements, moving beyond traditional fixed ward layouts. Furthermore, the operational landscape is witnessing greater collaboration between defense contractors responsible for vessel construction and specialized medical equipment providers, integrating high-tech surgical robotics and advanced diagnostic platforms seamlessly into the ship environment.

Regional trends highlight North America and Europe as the primary drivers of demand, particularly due to the robust funding provided by the US Navy (leading the construction and maintenance of large-scale hospital ships like the USNS Mercy class) and European maritime nations focused on proactive global humanitarian outreach, especially in Africa and Asia Pacific. Asia Pacific is emerging as a critical growth region, fueled by increasing naval power projection by nations like China and India, coupled with the region's high vulnerability to natural disasters, specifically typhoons and seismic events, necessitating resilient maritime medical infrastructure. Latin America and the Middle East also demonstrate nascent potential, driven by national requirements to enhance coastal disaster preparedness and secure maritime supply lines.

Segment trends underscore the dominance of the Military/Defense segment in terms of budget allocation and vessel size, yet the Humanitarian Aid segment is exhibiting the fastest operational growth, driven by NGOs and intergovernmental organizations like the UN. In terms of Vessel Type, conversions of existing large commercial vessels (e.g., oil tankers or cruise ships) remain a cost-effective alternative for rapid deployment, though purpose-built ships dominate the high-end market due to superior stability, capacity, and optimized medical workflow design. Technological integration, particularly in imaging equipment and operating room technology, continues to be a key differentiating factor among service providers and vessel constructors, emphasizing the need for robust IT and communication infrastructure suitable for remote operation.

AI Impact Analysis on Hospital Ship Market

User inquiries regarding Artificial Intelligence (AI) in the Hospital Ship Market predominantly revolve around three critical themes: optimizing logistical efficiency, enhancing diagnostic accuracy in remote settings, and improving casualty triage speed during mass casualty incidents (MCIs). Users frequently ask how AI can manage the complex inventory and supply chain of a self-sufficient hospital operating thousands of miles from port, and whether AI-powered diagnostics can compensate for the potential lack of highly specialized personnel onboard. The primary expectation is that AI will transform hospital ships from mere floating infrastructure into highly optimized, autonomous medical platforms, significantly reducing operational costs and increasing the successful treatment rate, particularly under extreme communication constraints or resource limitations inherent in disaster zones. There are also keen interests in the application of predictive maintenance algorithms to ensure the reliability of critical life support and surgical equipment during extended deployments.

The implementation of AI algorithms dramatically enhances the operational efficiency of hospital ships. Machine Learning (ML) models can analyze real-time patient flow data, predicting bottlenecks in surgical scheduling, optimizing resource allocation, and ensuring that critical supplies, blood products, and pharmaceuticals are managed based on anticipated needs rather than simple consumption rates. This is vital in prolonged humanitarian missions where resupply is infrequent and unpredictable. Furthermore, AI-driven decision support systems assist medical personnel in remote diagnostics. By processing large datasets of radiological images, pathology slides, and patient symptoms, AI tools provide second opinions or preliminary assessments, overcoming limitations posed by fatigue or limited specialist access, thereby reducing diagnostic errors and speeding up initial treatment protocols.

Moreover, AI is poised to revolutionize mass casualty management, a core function of hospital ships. During disaster response, rapid and accurate triage is paramount. Computer vision and sensor fusion technologies, powered by AI, can quickly assess patient severity based on vital signs, physical injury patterns identified through scanners, and historical data, providing objective recommendations for treatment priority, thereby saving critical minutes. The integration extends into telemedicine, utilizing Natural Language Processing (NLP) to translate and summarize patient history from local languages or fragmented records, ensuring seamless transition of care. This focus on automation and cognitive assistance ensures that these valuable assets operate at peak efficiency, delivering maximum humanitarian impact even in the most challenging operational environments.

- AI-driven logistical optimization for pharmaceutical and surgical inventory management, ensuring supply chain resilience.

- Machine Learning algorithms enhancing remote diagnostic imaging interpretation (radiology, pathology) onboard.

- Predictive maintenance analytics applied to propulsion systems and critical medical equipment (ventilators, sterilizers) to minimize downtime.

- Natural Language Processing (NLP) facilitating multilingual patient intake and record summarization for faster triage.

- AI-supported decision systems for rapid casualty triage and resource allocation during mass casualty incidents (MCIs).

- Simulation models utilizing AI to train crew and medical staff for complex, high-stress disaster response scenarios.

DRO & Impact Forces Of Hospital Ship Market

The Hospital Ship Market is primarily propelled by the convergence of increasing global humanitarian needs, mandated military readiness requirements, and technological advancements in maritime medicine. The escalating frequency and scale of natural disasters, coupled with persistent global conflicts, exert significant pressure on developed nations and major NGOs to maintain and expand dedicated, high-capacity floating medical assets. This external pressure acts as a powerful driver (D). However, the market faces inherent restraints (R) related to the exorbitant initial capital expenditure required for purpose-built vessels, coupled with the high operational costs associated with maintaining a fully crewed, high-tech hospital at sea. The logistical complexity and political clearances required for global deployment further act as friction points limiting rapid expansion.

Significant opportunities (O) exist in the development of modular, scalable hospital ship concepts that can be rapidly converted from existing commercial vessels, thus lowering barriers to entry for developing nations and philanthropic organizations. Furthermore, the integration of advanced technologies, such as tele-surgery platforms and autonomous drone delivery systems for critical supplies, presents pathways for enhanced efficiency and capability projection. The growing trend towards public-private partnerships, where governments contract specialized civilian firms for the operation and maintenance of these vessels, also opens new commercial avenues. The global focus on pandemics and biological preparedness following recent health crises reinforces the strategic value of mobile, isolated medical facilities, creating a sustained opportunity for specialized infectious disease containment vessels.

The overall impact forces driving the market are overwhelmingly positive but tempered by funding volatility. The primary positive force is the pervasive requirement for resilient disaster response mechanisms, which consistently pushes governments to allocate resources towards naval medical assets. The impact is also strongly influenced by socio-political factors, including international treaty obligations and the desire to project soft power through humanitarian missions. The restraint of high cost is partially mitigated by the long lifespan of these vessels (often exceeding 30 years), allowing costs to be amortized over decades, making them a strategically valuable, though expensive, long-term investment. The interplay between urgent humanitarian need (Driver) and budget constraints (Restraint) dictates the pace of new construction and modernization programs within the forecast period.

Segmentation Analysis

The Hospital Ship Market is systematically segmented based on various technical and application criteria to provide a comprehensive understanding of market dynamics. Key segmentations include differentiating vessels based on their construction methodology—purpose-built for optimized medical function versus converted commercial platforms—and crucially, by their primary end-use application, which determines capacity, specialized equipment, and operational profile. Analyzing the market through these segments reveals targeted investment patterns, such as military dominance in the purpose-built category and NGO preference for converted, lower-cost, high-volume capacity vessels for sustained primary care missions.

Further segmentation includes the Vessel Size, where large hospital ships (over 150 meters) dominate strategic missions due to their expansive capacity for multiple operating theaters and hundreds of beds, while smaller ships serve niche coastal or riverine medical needs. Technology Segmentation focuses on the grade and complexity of medical facilities, differentiating between ships primarily offering Level I (basic triage and primary care) versus Level III/IV care (full trauma surgery, critical care, and advanced diagnostics). These categories are vital for stakeholders planning procurement, ensuring the chosen asset aligns with specific mission requirements—be it rapid trauma stabilization for military operations or long-term chronic illness management for civilian humanitarian missions.

- By Type:

- Purpose-Built Hospital Ships

- Converted Commercial Vessels (Tankers, Cruise Ships, Ro-Ro Vessels)

- By Application/End-User:

- Military & Defense Operations

- Humanitarian Aid & Disaster Relief (HADR)

- Civilian Medical Outreach & Training

- By Size:

- Large Hospital Ships (150m and above)

- Medium Hospital Ships (100m – 150m)

- Small Hospital Ships (Below 100m)

- By Medical Capability:

- Level I/II (Primary Care & Stabilization)

- Level III/IV (Trauma, Surgical & Critical Care)

Value Chain Analysis For Hospital Ship Market

The value chain for the Hospital Ship Market begins with the highly specialized upstream analysis involving raw material procurement, particularly specialized high-tensile steel, propulsion systems, and sophisticated navigation and communication electronics. Shipbuilding contractors occupy a crucial midstream position, where design, engineering, and construction or conversion occur. This stage demands intense collaboration between naval architects and hospital design specialists to ensure seaworthiness, stability, and optimal sterile medical environments. Upstream risks often center on global supply chain reliability for high-specification equipment, emphasizing the need for robust vendor management and quality control processes to ensure compliance with stringent international maritime and medical standards.

The downstream component of the value chain focuses heavily on the integration and provisioning phases. This includes sourcing, installing, and validating specialized medical equipment (e.g., MRI machines, CT scanners, surgical robots) and pharmaceutical stockpiling. Distribution channels in this market are highly centralized, primarily involving direct acquisition and ownership by national governments (Defense Ministries) or large, specific non-governmental organizations (NGOs) that contract directly with shipyards and medical integrators. Unlike typical commercial markets, there is minimal indirect distribution; however, operational support, including long-term maintenance, crewing, and specialized medical staffing, often relies on indirect service contracts with private sector logistics firms and specialized healthcare providers.

Direct engagement dominates the operational phase, where the hospital ship is deployed under the command of the owning entity (e.g., US Navy, UK Royal Fleet Auxiliary, various charitable organizations). Indirect channels primarily facilitate the support structure: specialized engineering firms provide dockside maintenance and refits, while staffing agencies often supply auxiliary medical and non-medical crew for humanitarian missions, particularly for vessels owned by charities. The value proposition is maximized when the integration of medical technology is seamless and the operational costs—which include fuel, personnel, and constant equipment recalibration—are optimized through efficient maintenance and deployment scheduling, ensuring the asset is mission-ready with minimal lead time.

Hospital Ship Market Potential Customers

The primary end-users and buyers of hospital ships are categorized into distinct governmental and non-governmental entities, each driven by specific strategic and humanitarian requirements. National governments, particularly those with significant global naval presence or extensive coastal boundaries, represent the largest segment of potential customers. The Defense Ministries and Naval Forces of major world powers (such as the United States, China, Russia, and key European nations) are continuous buyers, focused on maintaining fleet readiness for military support, casualty evacuation, and large-scale, state-sponsored disaster response missions. Their purchases typically involve expensive, purpose-built, high-capacity ships engineered to withstand harsh operating environments and provide Level III/IV trauma care.

The second major category encompasses global and regional Non-Governmental Organizations (NGOs) and international bodies dedicated to medical humanitarian relief. Organizations like Mercy Ships, and various country-specific Red Cross/Red Crescent societies, constitute crucial potential customers, seeking vessels to conduct long-term, sustained medical outreach programs in developing nations. These entities often favor converted commercial vessels, balancing extensive medical capacity against lower acquisition and operational costs compared to military-spec ships. Their purchasing decisions are highly influenced by philanthropic funding cycles and the cost-effectiveness of delivering comprehensive primary and secondary care to remote populations.

A burgeoning customer segment includes wealthy island nations and coastal states highly susceptible to climate change impacts and natural disasters (e.g., Caribbean nations, Southeast Asian archipelagos). These governments increasingly recognize the strategic necessity of owning or jointly operating mobile medical infrastructure that can survive and operate immediately after catastrophic events when land-based hospitals are destroyed. Furthermore, academic institutions and specialized medical training consortia are emerging as potential customers, utilizing smaller, technologically advanced ships as floating laboratories and training centers for maritime medicine and global health initiatives, offering specialized courses that are often subcontracted or partnered with governmental naval medical commands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fincantieri S.p.A., Huntington Ingalls Industries, General Dynamics NASSCO, Austal, Damen Shipyards Group, Hyundai Heavy Industries, Navantia, BAE Systems, Thales Group, Mitsubishi Heavy Industries, Keppel Corporation, Cochin Shipyard, Samsung Heavy Industries, ST Engineering Marine, China State Shipbuilding Corporation (CSSC), Vard Group, DCNS (Naval Group), Metal Ships & Docks, Vigor Industrial, Bollinger Shipyards. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Ship Market Key Technology Landscape

The modern hospital ship relies heavily on sophisticated technological integration that spans naval architecture, critical care equipment, and advanced communication systems. A central technological focus is on enhancing diagnostic capabilities remotely. This includes the widespread adoption of miniaturized and ruggedized imaging equipment, such as mobile CT and MRI scanners specifically designed to operate effectively in a moving, high-vibration maritime environment while maintaining high image quality. Furthermore, integration of high-bandwidth satellite communication systems (VSAT and low-earth orbit constellations) is paramount, enabling real-time telemedicine consultations and transmission of high-resolution diagnostic data to specialists thousands of miles away, effectively expanding the onboard expertise instantaneously.

In terms of clinical technology, the market is increasingly adopting modular operating theater concepts that allow for rapid reconfiguration and sterilization, crucial for handling diverse patient cohorts, from combat trauma to infectious disease isolation. Advanced life support systems, including next-generation ventilators and extracorporeal membrane oxygenation (ECMO) machines, are mandatory for Level III/IV care vessels. A key emerging trend is the integration of robotic surgical assistance systems. While currently limited due to stability and space constraints, smaller, highly mobile robotic platforms are being piloted to enable precision surgery in environments where surgeon fatigue might be a factor, significantly expanding the complexity of procedures that can be performed at sea.

Beyond medical apparatus, logistical and self-sufficiency technologies define the modern hospital ship. Advanced water purification and sterilization systems (including reverse osmosis and multi-stage filtration) ensure a continuous supply of medical-grade water for procedures and cleaning. State-of-the-art waste management systems, utilizing pyrolysis and plasma gasification, are essential for environmentally responsible disposal of biomedical and hazardous waste, critical for long-duration missions in sensitive marine areas. Finally, sophisticated hospital information systems (HIS) compliant with international security standards (like HIPAA) are necessary to manage patient records, logistical inventory, and crew assignments seamlessly across the deployed vessel network, ensuring operational integrity and data security.

Regional Highlights

- North America: North America, dominated by the United States, holds a commanding position in the Hospital Ship Market, primarily due to the substantial investment made by the US Military (Navy) in maintaining and modernizing its strategic Sealift Command fleet, including the USNS Mercy and USNS Comfort hospital ships. These assets are vital for military operations and highly visible global humanitarian missions. The region’s technological prowess ensures that its vessels are equipped with the most advanced medical and communication technologies, setting the global standard for maritime trauma care and disaster response capability. Furthermore, the strong presence of major shipbuilding contractors and specialized defense electronics suppliers in the US guarantees continuous technological advancement and a steady pipeline for modernization programs, securing its market leadership.

- Europe: Europe represents a mature and technologically sophisticated market, characterized by diverse national naval requirements and a strong tradition of international humanitarian intervention, particularly driven by nations like the United Kingdom, France, Germany, and Italy. Unlike the US focus on extremely large purpose-built vessels, European nations often employ a blend of dedicated hospital support ships (such as the UK’s Royal Fleet Auxiliary vessels) and the strategic conversion of existing governmental or commercial vessels to rapidly acquire medical capabilities during crises. This approach highlights flexibility and cost-efficiency as key strategic goals across the continent.

The European market is heavily influenced by NATO requirements for interoperability and combined defense medical support, necessitating vessels that can integrate seamlessly into multinational operations. A key driver here is the European Union’s collective emphasis on global development aid and responding to the Mediterranean migration crisis, requiring continuous medical presence near volatile regions. This sustained operational tempo boosts the maintenance and service sector of the market, particularly for specialized medical equipment refits and naval architectural consulting services focused on vessel stability and patient handling logistics.

Demand is also bolstered by robust shipbuilding capabilities across countries like Italy (Fincantieri) and the Netherlands (Damen), which actively compete in the global market for both military and NGO clients. The European market leads in advanced modular hospital design and integrated environmental management systems, reflecting strict regional standards on marine waste disposal and operational efficiency. Future growth is anticipated in the conversion segment, driven by philanthropic organizations leveraging European shipbuilding expertise to expand their global reach for medical outreach missions across Africa and Asia.

- Asia Pacific (APAC): The Asia Pacific region is rapidly evolving into a major growth hub, spurred by intense geopolitical competition, expanding naval capabilities among key players (China, India, Japan, South Korea), and the region’s extreme vulnerability to catastrophic natural disasters (e.g., tsunamis, volcanic activity, and massive typhoons). Nations are recognizing the imperative for self-sufficient mobile medical assets capable of immediate deployment when centralized infrastructure is inevitably compromised.

China, through its expanding naval modernization program, is rapidly developing large hospital ships (e.g., the Peace Ark) as crucial components of its soft power projection and military logistical support, driving significant investment in domestic shipbuilding capabilities. Similarly, India is focusing on enhancing its disaster relief fleet, recognizing the vast coastal population susceptible to climate risks. This military-driven demand for sovereign capability is the primary market accelerator. South Korea and Japan, possessing world-class shipbuilding infrastructure, serve as critical suppliers, leveraging their expertise to meet both domestic and regional defense/humanitarian needs.

The APAC humanitarian segment is highly active due to frequent regional disasters, leading NGOs and local governments to seek smaller, more adaptable vessels suitable for navigating archipelagic waters and shallow ports. The focus is increasingly on rapid deployment capabilities and rugged construction suitable for tropical conditions. Challenges remain regarding regulatory harmonization and the sheer logistical scale of deployment across numerous diverse nations, yet the undeniable need for medical readiness in the face of escalating environmental threats ensures strong sustained growth in new construction and conversion projects throughout the forecast period.

- Latin America: The Latin American market for hospital ships is characterized by limited dedicated assets but growing recognition of their strategic necessity, especially in countries with vast river systems (Brazil) or long, disaster-prone coastlines (Chile, Peru). The market is dominated by smaller, multi-purpose patrol vessels with integrated medical modules or conversions of existing naval or governmental vessels, designed primarily for coastal surveillance, interdiction, and basic medical outreach to remote indigenous communities or island territories.

Brazil’s riverine fleet, operating specialized medical vessels along the Amazon, represents a unique, localized segment focusing on endemic disease treatment and primary care provision over extensive logistical networks. The strategic driver for this region is population health and internal security rather than large-scale international disaster relief. Funding remains a constraint, leading most nations to rely on partnerships, international aid, or smaller-scale, localized solutions rather than investing in large, purpose-built global assets.

Market opportunity lies in the refurbishing and upgrading of existing naval auxiliary vessels to meet modern medical standards, often financed through foreign military financing or international development aid programs. Key technological requirements center on robust navigation systems suitable for varied waterways and telecommunications infrastructure capable of operating reliably in areas with poor cellular coverage. While not a primary driver of global market size, the specialized needs of this region ensure a continuous demand for smaller, ruggedized medical modules and support services.

- Middle East and Africa (MEA): The MEA region presents a fragmented but strategically important market segment. Middle Eastern nations, particularly the Gulf Cooperation Council (GCC) countries, are increasingly investing in naval power projection and humanitarian capabilities as part of their broader regional security doctrines. This investment includes modern auxiliary fleets capable of supporting naval operations and providing rapid aid in regional conflicts or disaster zones, creating bespoke demand for high-specification, specialized support vessels.

In Africa, the demand is almost exclusively driven by humanitarian needs, often met by vessels donated or operated by international NGOs (like Mercy Ships) or foreign governments (e.g., US, China, EU missions). African coastal nations are highly vulnerable to health crises and limited infrastructure, making the autonomous capability of hospital ships critically valuable. The market opportunity here is focused on supporting the operations of these philanthropic organizations through provisioning, maintenance, and localized logistics support services.

Future growth in the Middle East will be influenced by state-level procurement to enhance national naval medical readiness and participate in international aid coalitions. In Africa, the market trajectory is tied to global philanthropic funding and bilateral partnerships. Technology requirements across the region focus intensely on infectious disease containment protocols and robust climate control systems essential for operating sophisticated medical equipment in high-heat environments, ensuring reliable sterile conditions despite extreme external temperatures.

The U.S. government’s commitment to projecting global soft power through large-scale humanitarian assistance and disaster relief (HADR) missions consistently drives demand for maintenance, refit, and, occasionally, new purpose-built vessels. This regional expenditure is less reactive to immediate disaster cycles and more aligned with long-term strategic naval objectives. Canada also maintains interest, though its focus tends toward smaller, multi-role vessels capable of serving coastal and arctic communities. The North American market emphasizes resilience, redundancy, and interoperability with multinational forces, leading to specifications requiring high endurance and robust communication infrastructure.

The regional market benefits significantly from high R&D spending focused on telemedicine and autonomous logistics, which are critical for supporting long-range deployments typical of the US fleet. This sustained governmental demand provides stability for the specialized industrial base, including shipyards and medical systems integrators. Regulatory frameworks governing naval acquisitions and international aid missions are well-established, facilitating predictable market growth within the defense and humanitarian sectors. Investment trends indicate future focus on replacing or substantially upgrading aging platforms with assets capable of handling biological threats and maintaining operational stability in contested environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Ship Market.- Fincantieri S.p.A.

- Huntington Ingalls Industries

- General Dynamics NASSCO

- Austal

- Damen Shipyards Group

- Hyundai Heavy Industries

- Navantia

- BAE Systems

- Thales Group

- Mitsubishi Heavy Industries

- Keppel Corporation

- Cochin Shipyard

- Samsung Heavy Industries

- ST Engineering Marine

- China State Shipbuilding Corporation (CSSC)

- Vard Group

- DCNS (Naval Group)

- Metal Ships & Docks

- Vigor Industrial

- Bollinger Shipyards

Frequently Asked Questions

Analyze common user questions about the Hospital Ship market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a purpose-built hospital ship and a converted vessel?

Purpose-built hospital ships are designed from the keel up specifically for medical operations, ensuring optimal stability, redundancy, sterile zones, and patient flow logistics. Converted vessels (e.g., from tankers or cruise ships) are more cost-effective and faster to deploy but often require compromises regarding interior layout, vibration control, and operational resilience necessary for high-end surgical procedures at sea. Purpose-built assets generally offer higher medical capacity and survivability.

How do hospital ships manage power generation and clean water for operations during long deployments?

Hospital ships are autonomous platforms equipped with highly redundant internal power generation systems (diesel or gas turbine engines) capable of supplying the extensive energy required for clinical equipment and life support. Clean water is produced via onboard, high-capacity reverse osmosis (RO) desalinization plants, often incorporating multi-stage purification processes and UV sterilization to ensure medical-grade water quality for surgical use and general consumption, making the vessels independent of shore utilities.

Which geographical regions are currently experiencing the highest demand for hospital ship services?

The highest demand for hospital ship deployment and services is concentrated in the Asia Pacific (APAC) region, driven by its high vulnerability to major natural disasters, and key coastal regions of Africa, where sustained humanitarian medical outreach is required due to severe infrastructure deficits. Military-driven demand for construction and modernization remains strongest in North America and Europe, supporting strategic naval readiness and global deployment capabilities.

What technological advancements are most crucial for the future efficiency of hospital ships?

The most crucial advancements center on improving remote operational capabilities and efficiency. These include enhanced telemedicine platforms and high-throughput satellite communication for remote diagnostics, AI-driven logistical and triage systems to optimize resource allocation during mass casualty events, and the implementation of modular, rapidly configurable operating theaters to adapt quickly to diverse medical mission requirements, ranging from trauma care to infectious disease isolation.

What is the main challenge faced by organizations operating humanitarian hospital ships?

The main challenge is securing sustained, long-term operational funding to cover specialized staffing, maintenance, and the exorbitant fuel costs associated with global deployment. Unlike capital expenditure (initial build cost), operational costs require continuous fundraising or governmental allocation. Additionally, securing diplomatic clearances and complying with the diverse regulatory requirements of host nations for medical practice and maritime entry pose significant logistical and political hurdles for humanitarian missions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager