Hospital Viewing Windows Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432982 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hospital Viewing Windows Market Size

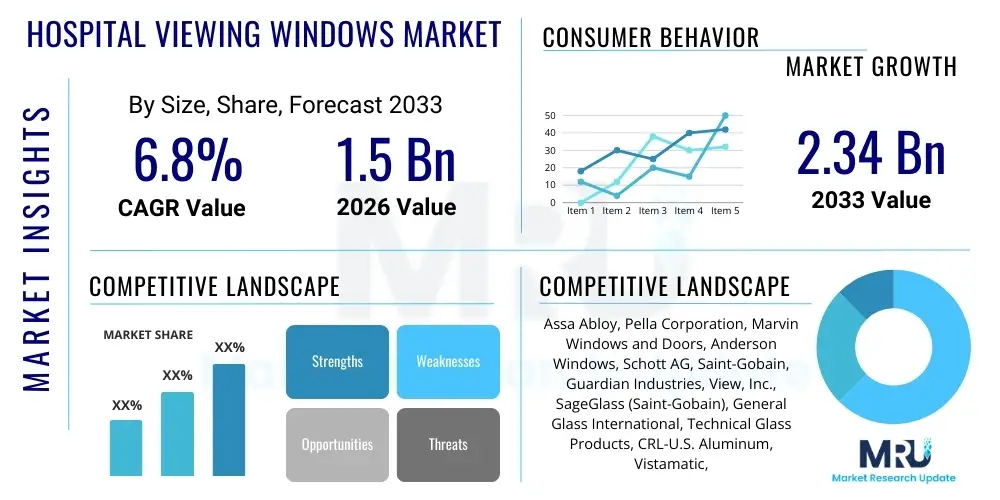

The Hospital Viewing Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.34 Billion by the end of the forecast period in 2033.

Hospital Viewing Windows Market introduction

The Hospital Viewing Windows Market encompasses the manufacturing, distribution, and installation of specialized window systems designed specifically for healthcare environments, including inpatient rooms, operating theaters, intensive care units, and clinical laboratories. These windows are distinct from standard commercial windows due to stringent requirements related to infection control, privacy management, acoustic insulation, thermal performance, and, crucially, regulatory compliance, particularly concerning fire safety and radiation shielding. The product portfolio ranges from basic fixed windows to highly advanced systems such as switchable smart glass and radiation-shielding leaded glass panels used in X-ray rooms and cath labs.

Major applications include facilitating visual monitoring of patients by healthcare staff in critical care settings, enhancing patient well-being by maximizing natural light exposure (a key element of evidence-based design), and maintaining sterile environments. The inherent benefits of specialized hospital windows include improved energy efficiency through high-performance glazing, enhanced safety due to impact resistance, and critical functionalities like seamless transition between clear visibility and absolute privacy, often managed electronically. This specialized market segment is characterized by long product lifecycles and high initial investment costs driven by the need to meet rigorous healthcare construction standards.

Key driving factors accelerating market growth involve the global surge in hospital infrastructure development and modernization projects, especially the transition toward patient-centric facility design that prioritizes natural light and exterior views for recovery acceleration. Furthermore, evolving strict building codes mandating specific fire ratings, impact resistance (for security and safety), and the increasing adoption of antimicrobial coatings and non-porous frame materials to mitigate Hospital-Acquired Infections (HAIs) are propelling demand for specialized, high-performance window solutions tailored for acute care settings.

Hospital Viewing Windows Market Executive Summary

The Hospital Viewing Windows Market is experiencing robust expansion driven by global trends in healthcare infrastructure modernization, focusing heavily on patient safety and therapeutic environment optimization. Business trends indicate a strong shift towards incorporating smart technology, specifically electrochromic and polymer dispersed liquid crystal (PDLC) glass, to offer dynamic control over light transmission and privacy, thereby reducing the need for traditional blinds or curtains which can harbor pathogens. Manufacturers are increasingly prioritizing supply chain resilience and developing composite materials that balance antimicrobial properties with high structural integrity and energy efficiency. Strategic partnerships between specialized glass manufacturers and architectural firms focusing on healthcare design are defining the competitive landscape, pushing innovation in seamless integration and standardization of high-performance glass units.

Regional trends highlight North America and Europe as mature markets characterized by strict regulatory compliance regarding energy performance and safety, driving demand for premium, high-specification products, including advanced radiation shielding windows. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, fueled by substantial government investment in constructing new healthcare facilities and expanding medical tourism infrastructure, leading to high volume demand for standardized, yet quality-compliant, viewing window solutions. Latin America and the Middle East and Africa (MEA) are focused on incorporating modular and cost-effective fire-rated and highly insulating windows suitable for rapidly expanding urban medical centers.

Segment trends underscore the dominance of the Specialized Windows category, particularly those featuring radiation shielding (lead glass) and extreme fire ratings (90-minute and 120-minute certifications), critical for diagnostic and procedural areas. The By End-User segment shows substantial growth in demand from Intensive Care Units (ICUs) and Operating Theatres (ORs), where viewing windows are integral for constant, yet unobtrusive, patient monitoring. Material innovation is concentrated on aluminum and high-grade vinyl frames treated with durable, infection-resistant finishes, replacing traditional wood or non-compliance materials in new hospital construction.

AI Impact Analysis on Hospital Viewing Windows Market

User queries regarding AI’s influence in this market commonly revolve around predictive maintenance for smart windows, the integration of AI-driven environmental controls, and the optimization of energy consumption based on occupancy and ambient light conditions detected via smart window sensors. Key concerns include cybersecurity risks associated with networked smart glass systems and the complexity of integrating these advanced controls with existing Building Management Systems (BMS). Users are highly interested in how AI can automate privacy settings and ensure regulatory compliance (e.g., maintaining specific lighting levels during night shifts) without manual intervention. This analysis suggests users anticipate AI shifting the function of hospital windows from passive architectural components to active, intelligent interfaces capable of autonomous climate management and facility security monitoring.

- AI-Powered Predictive Maintenance: Utilizing sensor data embedded within smart windows to anticipate hardware failure (e.g., electronic mechanisms, sealing degradation) and scheduling maintenance proactively, reducing downtime in critical patient areas.

- Automated Environmental Optimization: AI algorithms integrating data from external weather stations and internal occupancy sensors to dynamically adjust the tint or opacity of electrochromic windows, maximizing natural light intake while minimizing glare and solar heat gain, significantly lowering HVAC loads.

- Enhanced Security and Surveillance Integration: Linking smart window sensor arrays (vibration, heat) to hospital security AI systems to detect unauthorized access attempts or unusual physical stress on the frame or glass structure, providing real-time alerts.

- Compliance and Documentation Automation: AI systems monitoring and logging window status (e.g., privacy mode activation, fire rating integrity) to automatically generate reports required for regulatory compliance and accreditation audits.

- Optimized Energy Management: Using machine learning to refine energy usage patterns associated with switchable glass operation, ensuring efficiency across large hospital campuses based on historical usage and predictive modeling.

DRO & Impact Forces Of Hospital Viewing Windows Market

The Hospital Viewing Windows Market is profoundly shaped by a confluence of stringent regulatory demands, technological innovation, and inherent operational complexities within healthcare environments. The primary drivers include the global mandate for improved infection control, necessitating easy-to-clean, antimicrobial-treated surfaces, alongside the architectural push for evidence-based design that utilizes natural light to enhance patient recovery and staff well-being. However, the market faces significant restraints, chiefly the extremely high capital investment required for specialized products like radiation-shielding glass and electronically switchable privacy glass, coupled with the extended certification and qualification processes necessary for integrating new window technologies into heavily regulated hospital infrastructure projects.

Opportunities in this sector are vast, particularly in the development of cost-effective, modular smart window solutions and the expansion into emerging economies undergoing rapid hospital infrastructure build-outs. Innovation around integrated smart features that combine multiple functionalities (e.g., fire-rating, acoustic dampening, and switchable privacy) into a single unit presents a major avenue for competitive differentiation. Key impact forces, such as the increasing global focus on sustainability and green building standards (e.g., LEED certification), are forcing manufacturers to adopt sustainable materials and develop products that contribute positively to a facility’s overall energy performance score, thereby accelerating the replacement cycle of older, less efficient window systems in existing facilities.

Another crucial impact force is the continuous evolution of safety standards, particularly the International Fire Code (IFC) and local healthcare accreditation requirements (like JCI or CMS in the US), which dictate specific performance criteria for glazing and framing materials used in egress paths and smoke compartments. Furthermore, the persistent threat of healthcare-associated infections (HAIs) ensures that material science innovations related to antimicrobial coatings and hermetically sealed units remain a critical differentiator and driver of new product adoption, often superseding initial cost concerns in high-risk areas like ORs and ICUs.

Segmentation Analysis

The segmentation of the Hospital Viewing Windows Market provides a granular view of diverse product requirements driven by specific clinical needs and architectural mandates within healthcare facilities. Products are primarily categorized based on their functional characteristics, such as whether they are fixed or operable, the advanced materials used (ranging from standard tempered glass to specialized lead-lined composites), and the distinct hospital area in which they are deployed, each demanding unique performance criteria related to hygiene, radiation protection, and light control. This complex segmentation reflects the high level of specialization required in modern medical construction, distinguishing standard architectural glazing from mission-critical healthcare viewing panels.

- By Type:

- Fixed Windows

- Operable Windows (Limited opening for ventilation/maintenance)

- Specialized Windows (Radiation Shielding Windows, Fire-Rated Windows, Acoustic Control Windows)

- By Material:

- Glazing Material (Laminated Glass, Tempered Glass, Insulated Glass Units (IGUs), Lead Glass/Lead-Lined Composites, Polycarbonate)

- Frame Material (Aluminum, Vinyl/PVC, Composite Materials, Steel)

- By Technology:

- Standard/Conventional Windows

- Smart/Switchable Glass (Electrochromic, PDLC, Thermochromic)

- By Application/End-User Area:

- Patient Rooms (Standard and Semi-critical)

- Intensive Care Units (ICUs) and Critical Care Units (CCUs)

- Operating Theatres (ORs) and Surgical Suites

- Diagnostic and Imaging Centers (X-Ray Rooms, MRI Suites, CT Scans)

- Laboratories and Pharmacies

- Administrative Areas

Value Chain Analysis For Hospital Viewing Windows Market

The value chain for the Hospital Viewing Windows Market begins with upstream material suppliers, including raw glass manufacturers, specialized chemical coaters, and frame component producers (aluminum, vinyl extrusions). The primary upstream activities involve advanced processing of raw materials to meet healthcare-specific requirements, such as producing low-emissivity (Low-E) coatings for energy efficiency, laminating glass for security and impact resistance, and synthesizing lead-lined glass panels for radiation protection. Strategic control over the supply of specialized materials, particularly lead composites and electronic components for smart glass, is a key competitive advantage at this stage. Efficient material procurement and quality control adherence to medical standards are essential for maintaining margin and product integrity.

Midstream activities are centered on manufacturing and assembly, where specialized window fabricators custom-cut, assemble, and test the finished insulated glass units (IGUs) and framing systems. This stage requires meticulous certification processes, ensuring the final product meets fire rating, acoustic, and thermal performance specifications specific to hospital construction codes (e.g., FEMA standards, UL certifications). The complexity of hospital window installation often necessitates highly specialized fabrication to accommodate large sizes, curved designs, or integration with advanced wall systems, driving up fabrication costs and requiring strict quality assurance protocols before distribution.

The downstream sector involves distribution and installation, often managed through dedicated commercial glazing contractors and specialized hospital construction firms. Due to the high-value and custom nature of these products, the distribution channel tends to be direct or highly controlled, minimizing the role of generic wholesalers. Direct sales models are often used for high-tech products like smart glass, where manufacturers provide installation support and technical training directly to the hospital facilities management teams. The long-term value chain extends to post-installation services, including specialized maintenance contracts for electronic components and regulatory-mandated inspections for fire-rated and radiation-shielding barriers, ensuring continuous compliance and optimal performance throughout the window’s lifecycle.

Hospital Viewing Windows Market Potential Customers

The primary customers and buyers in the Hospital Viewing Windows Market are generally institutional and organizational entities involved in the development, operation, and renovation of healthcare facilities. This includes large private and public hospital systems, regional healthcare networks, and specialized medical centers (such as cancer treatment centers and pediatric hospitals) that require high-performance, compliant window solutions for their buildings. Purchasing decisions are typically driven by large-scale construction or renovation budgets, heavily influenced by architectural specifications that mandate specific performance criteria (e.g., acoustic ratings of STC 40+, 120-minute fire ratings, specific U-values for energy performance) rather than simple cost minimization.

Secondary buyers include government health ministries or national health services responsible for state-funded healthcare infrastructure projects, where bulk procurement and adherence to national safety standards are paramount. Furthermore, specialized end-users like clinical laboratories, research facilities, and pharmaceutical manufacturing cleanrooms also constitute potential customers, especially for products demanding exceptional airtightness, chemical resistance, and precise environmental control viewing capabilities. The decision-making unit for major procurements often includes hospital administrators, facility managers, infection control specialists, and external healthcare architectural consultants, making the sales cycle complex and requirements highly technical.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.34 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Assa Abloy, Pella Corporation, Marvin Windows and Doors, Anderson Windows, Schott AG, Saint-Gobain, Guardian Industries, View, Inc., SageGlass (Saint-Gobain), General Glass International, Technical Glass Products, CRL-U.S. Aluminum, Vistamatic, Polyvision, Ray-Bar Engineering, Customview, MedGlass Systems, Specialty Window Systems, Privacy Glass Solutions, Architectural Glazing Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospital Viewing Windows Market Key Technology Landscape

The technology landscape of the Hospital Viewing Windows Market is dominated by advancements in material science focused on improving safety, hygiene, and dynamic functionality. A major area of technological focus is the development and commercialization of Smart Glass technology, primarily utilizing Polymer Dispersed Liquid Crystal (PDLC) and Electrochromic (EC) systems. PDLC allows for instantaneous switching from clear to opaque for privacy, critical in examination rooms and ICUs, typically activated via a low-voltage electrical current. EC glass, while slower, provides dynamic tinting capabilities, effectively managing solar glare and heat gain, which is vital for maintaining thermal comfort and energy efficiency within large hospital complexes, often integrating seamlessly with the facility's overall energy management system.

Another critical technology involves high-performance protective glazing, specifically related to radiation shielding and fire resistance. Radiation shielding windows incorporate specialized lead glass or leaded acrylic composites to block X-rays and gamma rays in diagnostic and treatment areas without sacrificing visibility. This requires precise engineering to maintain structural integrity and ensure the lead equivalence is certified to stringent medical physics standards. Similarly, fire-rated window systems rely on advanced intumescent interlayers or ceramic glass to compartmentalize fire, offering protection periods ranging from 20 minutes up to 120 minutes, which is non-negotiable for egress paths and patient-occupied areas in multi-story healthcare facilities.

Furthermore, hygienic and acoustic performance technologies are rapidly gaining prominence. Manufacturers are employing vacuum insulated glass (VIG) units and multi-pane assemblies to achieve superior acoustic dampening, creating quiet healing environments in patient rooms adjacent to high-traffic hallways or helipads. For hygiene, the industry is seeing the proliferation of permanently bonded antimicrobial coatings (e.g., silver-ion technology) applied to both the glass surface and non-porous frame materials. These technologies actively inhibit microbial growth, addressing one of the core challenges in hospital environments—reducing the risk of HAIs associated with surface contamination and moving parts typically found in traditional window treatments like blinds or shutters.

Regional Highlights

- North America: The North American market is characterized by high demand for premium, high-specification windows driven by rigorous building codes (e.g., seismic resistance, hurricane mitigation in coastal areas) and advanced facility accreditation standards. The focus is heavily placed on energy efficiency, LEED certification compatibility, and widespread adoption of specialized smart glass and advanced acoustic solutions for maximum patient comfort and recovery. The U.S. remains the largest spender globally on sophisticated medical construction projects, guaranteeing sustained demand for innovative, compliant viewing windows.

- Europe: European countries, particularly Germany, the UK, and France, exhibit strong market maturity with an emphasis on sustainability, stringent thermal performance requirements (driven by high energy costs), and adherence to EU directives regarding materials safety and environmental impact. The region shows robust adoption of sophisticated fire-rated glazing and vacuum insulated glass (VIG) technology, often integrated into refurbishment projects aimed at upgrading aging healthcare infrastructure to meet modern efficiency standards.

- Asia Pacific (APAC): APAC represents the fastest-growing market, largely due to massive government and private sector investment in new hospital infrastructure, especially in China, India, and Southeast Asian nations. While price sensitivity exists, the rapid adoption of international building standards is driving increasing demand for basic fire-rated and laminated safety glass. Japan and South Korea, however, lead in the integration of domestic smart technology and advanced seismic-resistant framing systems within their high-tech medical facilities.

- Latin America: The market in Latin America is driven by urbanization and the expansion of private healthcare services. Demand is focused on durable, cost-effective solutions that meet basic safety and thermal requirements. Market growth is sporadic, often dependent on government funding cycles for public hospital projects, but shows growing interest in incorporating imported specialized glass for critical areas like ORs and imaging centers.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia), is a high-value market segment fueled by large-scale, luxury medical city development projects. Demand is exceptionally high for high-performance thermal glass to combat extreme heat, coupled with aesthetic architectural requirements, leading to significant uptake of electrochromic glass and bespoke, highly customized frame systems that meet international safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospital Viewing Windows Market.- Assa Abloy

- Pella Corporation

- Marvin Windows and Doors

- Anderson Windows

- Schott AG

- Saint-Gobain

- Guardian Industries

- View, Inc.

- SageGlass (Saint-Gobain)

- General Glass International

- Technical Glass Products

- CRL-U.S. Aluminum

- Vistamatic

- Polyvision

- Ray-Bar Engineering

- Customview Glazing Solutions

- MedGlass Systems Inc.

- Specialty Window Systems

- Privacy Glass Solutions

- Architectural Glazing Systems

Frequently Asked Questions

Analyze common user questions about the Hospital Viewing Windows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between standard commercial windows and hospital viewing windows?

Hospital viewing windows are fundamentally different due to stringent regulatory demands for performance, safety, and hygiene. Key differences include mandatory fire ratings (up to 120 minutes), specialized radiation shielding properties, high acoustic dampening, non-porous antimicrobial frame materials, and the use of switchable privacy glass, which are typically unnecessary in standard commercial applications.

How does smart glass technology benefit Intensive Care Units (ICUs) and Operating Theatres (ORs)?

Smart glass (electrochromic or PDLC) provides instantaneous privacy control for patients in ICUs and ORs without requiring blinds or curtains, which minimizes infection risk and facilitates seamless, discreet visual monitoring by clinical staff. This dynamic capability improves hygiene compliance and enhances operational efficiency during critical procedures.

What role do antimicrobial coatings play in hospital window systems?

Antimicrobial coatings, often based on silver-ion technology integrated into the glass and frame surfaces, are crucial for reducing the proliferation of pathogens and minimizing the risk of Healthcare-Acquired Infections (HAIs). These coatings contribute to the overall infection control strategy, especially in high-touch or sterile environments.

What are the main regulatory requirements governing hospital windows in major markets?

In major markets like North America and Europe, hospital viewing windows must comply with strict regulations including specific fire and life safety codes (e.g., NFPA 101, UL certifications), mandatory thermal and energy performance standards (e.g., local building codes, LEED criteria), and specialized medical standards for radiation protection (for imaging areas) and impact resistance (for security and safety).

What is the future outlook for sustainable materials in hospital window manufacturing?

The future outlook points toward increased adoption of sustainable materials, including recycled aluminum frames, low-VOC (Volatile Organic Compound) sealants, and highly insulating glass units (like Triple Glazing or VIG) that significantly reduce a hospital's energy footprint. Manufacturers are prioritizing products that contribute positively to green building certifications and overall facility sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager