Hospitality Architecture Design Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434732 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Hospitality Architecture Design Market Size

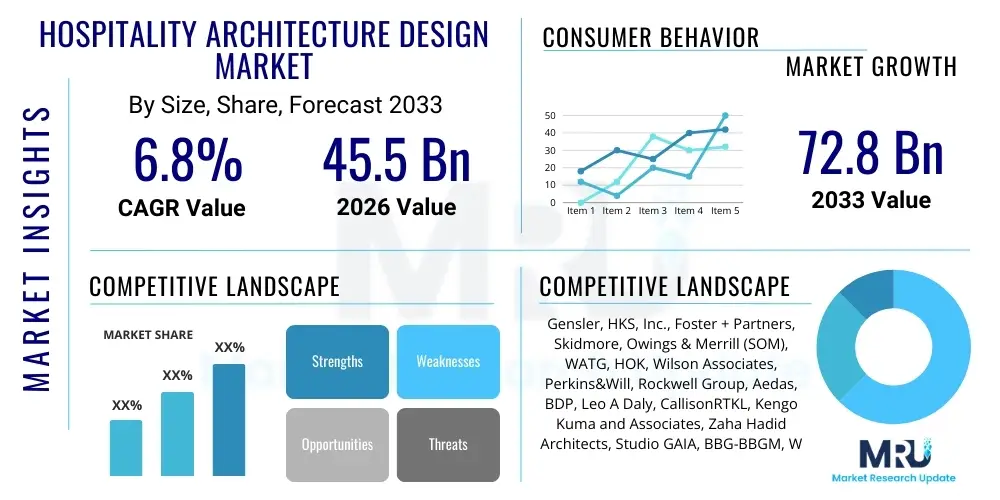

The Hospitality Architecture Design Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is primarily fueled by the accelerating globalization of travel, the increasing demand for unique, experience-driven accommodations, and significant investment in sustainable and technologically integrated building practices across developing and developed economies. The architectural landscape in the hospitality sector is undergoing a transformation, prioritizing wellness, flexibility, and operational efficiency, thereby necessitating advanced design services.

The market is estimated at USD 45.5 Billion in 2026, benefiting from a post-pandemic resurgence in travel and the urgent need for renovation and rebranding projects globally. It is projected to reach USD 72.8 Billion by the end of the forecast period in 2033. This valuation reflects the growing complexity of hospitality projects, which increasingly incorporate mixed-use developments, sophisticated digital integration (Smart Hotels), and adherence to stringent international sustainability standards like LEED and WELL certification. The high-value segment, encompassing luxury resorts and major urban hotel complexes, will remain a critical revenue driver throughout the forecast period.

Hospitality Architecture Design Market introduction

The Hospitality Architecture Design Market involves professional services dedicated to the planning, design, and construction oversight of various accommodation and leisure facilities, including hotels, resorts, serviced apartments, casinos, themed entertainment venues, and related infrastructure. This sector is characterized by the need to balance aesthetic appeal and brand identity with rigorous functional requirements, structural integrity, and strict adherence to local and international building codes. The core product description revolves around delivering comprehensive design packages, ranging from master planning and conceptual visualization to detailed technical drawings, interior design integration, and post-construction evaluation, ensuring the final structure maximizes guest experience and owner return on investment. Major applications span new construction, large-scale refurbishment, adaptive reuse of existing properties, and specialized designs for unique travel segments such as eco-tourism and adventure lodging. Key benefits derived from professional hospitality architecture include enhanced operational efficiency, superior guest satisfaction driving repeat business, compliance with stringent environmental, social, and governance (ESG) criteria, and the creation of distinctive architectural landmarks that contribute positively to the competitive market landscape. Driving factors include rising disposable incomes globally, the proliferation of international hotel chains seeking standardized yet locally contextualized designs, and technological advancements in Building Information Modeling (BIM) and sustainable material science, which streamline complex project delivery while minimizing environmental impact.

Architectural design in the hospitality industry is intrinsically linked to evolving consumer behavior. Modern travelers prioritize authenticity, sustainability, and integrated technology, compelling architects to move beyond mere functional structure creation towards holistic 'experience architecture.' This involves designing flexible spaces that can adapt to different uses, incorporating local cultural narratives into the design fabric, and ensuring seamless integration of smart room technologies and energy management systems. Furthermore, the market is profoundly influenced by macroeconomic stability and government policies related to infrastructure development and tourism promotion. Regions investing heavily in tourism infrastructure, such as parts of Asia Pacific and the Middle East, present lucrative opportunities for specialized architectural firms. The necessity for resilient design, capable of withstanding extreme weather events and adapting to public health imperatives, such as enhanced ventilation and contactless services, further dictates the current scope of architectural commissions.

The design process often acts as a critical interface between developers, hotel operators, and local regulatory bodies, translating commercial objectives into physical space. Successful execution requires specialized expertise in acoustics, lighting design, flow management (back-of-house operations), and maximizing the view potential, all while adhering to strict budget constraints and aggressive timelines. The increasing complexity of mixed-use hospitality projects—combining residential, retail, and hotel components—also necessitates advanced multi-disciplinary coordination, positioning architectural firms as pivotal project facilitators. Ultimately, the market thrives on innovation in material science, construction methodologies (like modular and prefabricated construction), and the continuous pursuit of unique, marketable guest experiences that differentiate properties in a highly competitive global market.

Hospitality Architecture Design Market Executive Summary

The Hospitality Architecture Design Market is poised for significant expansion, driven fundamentally by shifting global business trends towards experiential luxury and wellness-focused design, alongside critical regional trends emphasizing infrastructure development in emerging economies. Current business trends highlight a strong mandate for sustainable and resilient design, with developers increasingly seeking Net-Zero carbon buildings and projects certified by green standards, necessitating specialized architectural expertise in energy efficiency and material sourcing. Furthermore, the convergence of technology and physical space—manifested through requirements for integrated IoT systems, digital lobbies, and virtual reality (VR) driven design previews—is reshaping project delivery methodologies and enhancing the complexity of architectural briefs. Regional trends indicate robust capital expenditure in the Asia Pacific region, particularly for integrated resorts and urban hotel revitalization projects, while North America and Europe focus predominantly on high-end niche markets, renovation of historic properties, and the implementation of advanced prefabrication techniques to address skilled labor shortages and accelerate construction timelines. Regulatory environments, especially those promoting sustainable development goals (SDGs), are influencing design choices globally, making compliance and certification a core market requirement.

Segment trends reveal that the luxury and upscale hotel categories remain the primary consumers of high-value architectural services, demanding bespoke designs that reflect elite branding and personalized guest experiences. Conversely, the economy and mid-scale segments are increasingly adopting modular construction techniques to achieve cost efficiency and rapid deployment across standardized formats. Geographically, the Middle East and Africa (MEA) region is exhibiting accelerated growth, primarily fueled by major tourism initiatives and global events that necessitate large-scale, iconic architectural developments, positioning it as a hot spot for international design firms. The refurbishment and renovation segment is also gaining momentum globally, driven by the need for existing assets to meet modern technological and sustainability expectations, often requiring delicate structural modifications and advanced adaptive reuse strategies, contrasting sharply with the 'greenfield' requirements of new builds. This focus on renewal ensures sustained revenue streams for architectural practices specializing in complex retrofitting and historical preservation, highlighting market maturity and diversification.

In summary, the market's trajectory is defined by a dual emphasis: technological modernization aimed at optimizing operational performance and an experiential pivot focused on creating unique, culturally resonant, and environmentally conscious guest environments. The overarching strategic imperative for architectural firms is to master the integration of digital tools like generative design and advanced data analytics into the creative process, while simultaneously navigating the diverse regional regulatory landscapes. Successful market players are those that can deliver highly customized, sustainable, and flexible designs under tight budget and scheduling constraints, ensuring that the physical design directly supports the client's commercial and brand objectives in an increasingly competitive global hospitality landscape.

AI Impact Analysis on Hospitality Architecture Design Market

User inquiries regarding AI's impact on the Hospitality Architecture Design Market predominantly focus on four key themes: efficiency gains, creative displacement, predictive design capabilities, and the integration of AI-driven operational intelligence into the final built environment. Users frequently question how AI and generative design tools will compress the traditional design timeline, asking if conceptualization, schematic design, and material selection will become automated processes, leading to cost reductions but also potentially reducing the need for junior architectural staff. A major concern revolves around the preservation of creative uniqueness; designers are keen to understand how AI tools can be used to augment, rather than replace, human creativity, specifically in delivering highly context-specific and culturally sensitive designs that characterize premium hospitality projects. Furthermore, stakeholders are highly interested in AI’s ability to conduct predictive modeling—forecasting guest flow, optimal space utilization, energy consumption patterns, and maintenance schedules—allowing architects to design buildings that are inherently more efficient and commercially viable from day one. There is also significant interest in the use of AI during the operational phase, such as using machine learning algorithms fed by sensor data (Internet of Things, IoT) to dynamically adjust building systems (HVAC, lighting, security) in response to real-time occupancy and environmental conditions, thereby demanding that architects design highly instrumented buildings ready for 'smart' operation.

This collective user sentiment confirms that AI is not viewed merely as a disruptive technology but rather as a transformative co-pilot that enhances data-driven decision-making throughout the design lifecycle. The analysis indicates a strong expectation that AI will standardize routine tasks, such as code compliance checks, parametric modeling iterations, and large-scale data synthesis regarding site constraints and material performance, thereby allowing human architects to dedicate more time to complex conceptual challenges and client-facing communication. The market anticipates that AI will democratize access to advanced simulation capabilities, enabling smaller firms to compete on the basis of optimized designs previously only achievable by firms with extensive computational resources. However, the adoption curve is expected to be gradual, contingent upon the development of user-friendly interfaces, standardized training protocols, and clear legal frameworks defining intellectual property rights related to AI-generated architectural outputs. The market's future competitiveness will largely depend on the architectural firm's ability to seamlessly integrate these sophisticated computational tools into their creative workflows while maintaining a high degree of artistic differentiation and adherence to brand guidelines.

The impact of AI extends significantly into the client delivery process, enhancing visualization and client feedback loops. AI-powered tools are now capable of generating numerous design alternatives almost instantaneously based on predefined parameters (budget, square footage, branding requirements, sustainability targets), drastically shortening the schematic design phase. This rapid iteration capacity allows clients to explore a wider range of possibilities and make informed decisions earlier in the project timeline, reducing costly design changes during later construction stages. Crucially, AI is pivotal in optimizing sustainable design performance; algorithms can analyze complex climate data, solar orientation, and material embodied carbon values to suggest optimal building forms and facade systems that minimize the environmental footprint. This convergence of efficiency, creative augmentation, and performance optimization is cementing AI's role as an indispensable tool for future hospitality architectural design.

- Generative Design Optimization: AI facilitates the rapid generation and evaluation of hundreds of design alternatives based on parameters like budget, energy performance, and spatial flow, significantly compressing the conceptual design phase.

- Predictive Performance Modeling: Machine learning algorithms analyze historical operational data and environmental factors to predict guest behavior, maintenance needs, and optimal resource allocation, leading to buildings inherently designed for operational efficiency.

- Automation of Routine Tasks: AI accelerates mundane tasks such as code checking, drawing documentation, scheduling, and clash detection in BIM models, freeing up professional architects for higher-value creative and strategic work.

- Enhanced Sustainability Analysis: AI tools instantly calculate the embodied and operational carbon footprint of design choices, enabling architects to make data-backed decisions favouring low-impact materials and highly efficient systems.

- Personalized Guest Experience Integration: Design mandates now include integrating AI-ready infrastructure, ensuring the physical space can accommodate dynamic adjustments to lighting, temperature, and service flows based on real-time guest preferences and occupancy levels (Smart Hotel Design).

- Improved Risk Management: AI analyzes complex regulatory data and potential supply chain disruptions, allowing firms to proactively design resilience and regulatory compliance into the project from the outset, mitigating financial and legal risks.

- Advanced Client Visualization: Utilizing VR/AR driven by AI rendering engines allows for highly immersive client presentations and rapid feedback cycles, improving client alignment and reducing costly revisions during construction.

DRO & Impact Forces Of Hospitality Architecture Design Market

The Hospitality Architecture Design Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and Impact Forces that determine its growth trajectory and competitive landscape. Key drivers include the exponential growth in global tourism and business travel, which necessitates continuous investment in new hotels and the refurbishment of existing inventory, especially in fast-growing regional markets like APAC and MEA. The increasing consumer demand for unique, highly personalized, and experience-driven accommodations compels hotel owners to commission cutting-edge, differentiated architectural designs, moving away from standardized templates. Technological drivers, such as the maturation of BIM workflows, integration of modular construction techniques, and the mandated incorporation of smart building systems, further accelerate project complexity and the demand for specialized design services. These combined factors create a robust and persistent need for innovative architectural solutions that seamlessly blend aesthetics, operational efficiency, and technological integration.

However, significant restraints impede uniform market expansion. Foremost among these is the inherent cyclical nature of the global economy and its immediate impact on capital expenditure for large-scale construction projects; economic downturns or geopolitical instability often lead to project cancellations or delays. Regulatory complexity and lengthy approval processes in highly sought-after urban and historical locations pose substantial roadblocks, increasing both the time-to-market and overall project costs. Furthermore, the specialized nature of hospitality architecture demands highly skilled talent, and a persistent shortage of architects with combined expertise in sustainable design, digital engineering, and specialized hospitality functional requirements creates bottlenecks for project scaling. Cost volatility in construction materials and labor markets also introduces financial uncertainty, pressuring design firms to develop cost-efficient and value-engineered solutions without compromising design quality or required certifications.

Opportunities for market growth are vast and concentrated in several strategic areas. The strong global emphasis on sustainability and climate action presents a massive opportunity for architects specializing in Net-Zero design, retrofitting for efficiency, and circular economy principles, commanding premium fees for expertise in green certifications (LEED, BREEAM, WELL). The adaptive reuse segment, converting unused commercial spaces (e.g., defunct office buildings or retail complexes) into new hotel assets, offers a sustainable and expedited route for urban development. Furthermore, the expansion of niche markets, such such as wellness retreats, specialized medical tourism facilities, and experiential glamping sites, opens new creative avenues beyond traditional hotel formats. The pervasive impact forces include intense competitive pressure from global multidisciplinary engineering and design firms, the necessity to rapidly adopt digital twins for post-occupancy facility management, and continuous pressure to innovate in areas of guest health and safety, particularly post-pandemic design strategies focusing on air quality and spatial distancing flexibility. These forces dictate that firms must continuously invest in both technological capabilities and deep sector-specific knowledge to maintain relevance and competitive advantage.

Segmentation Analysis

The Hospitality Architecture Design Market is systematically segmented based on facility type, service type, construction type, and geographic region, reflecting the diverse scope and specialized requirements within the industry. Understanding these segments is crucial for firms to tailor their offerings, allocate resources effectively, and identify high-growth sub-markets. The facility type segmentation distinguishes between highly complex, large-scale projects like integrated resorts (casinos, convention centers, and hotels) and more standardized, scalable projects such as mid-scale hotels and serviced apartments. Service type segmentation differentiates between core architectural planning, detailed engineering (MEP, structural), and specialized services like interior design and landscape architecture, often offered as integrated packages. The construction type category highlights the growing dichotomy between traditional stick-built construction, which dominates high-end luxury projects, and the rapidly expanding use of modular and prefabricated construction methods, which are becoming standard for budget and economy segments seeking speed and cost control. Overall, the segmentation analysis reveals a market moving towards greater specialization, where firms either become experts in complex, bespoke luxury projects or leaders in standardized, high-volume efficient designs.

The segmentation structure is highly informative regarding market demand dynamics. For instance, the growing demand for sustainable construction significantly influences the materials and engineering services required across all facility types, increasing the value of segments focusing on green building certification consulting. Within service types, the integration of BIM and digital twin technologies is increasingly mandated, positioning firms that offer comprehensive digital project delivery (DPD) services ahead of those relying on traditional 2D documentation. Furthermore, the construction type segment is critical in analyzing labor and cost structures. Modular construction, for instance, significantly reduces on-site labor requirements and construction timelines, making it particularly attractive in regions facing severe construction labor shortages or stringent weather constraints, such as certain areas of North America and Northern Europe. Conversely, high-density urban developments often require bespoke, site-specific solutions due to regulatory restrictions and plot size limitations, keeping traditional construction methodologies relevant in the luxury urban segment. These cross-segment influences define strategic opportunities for market participation.

Geographic segmentation remains paramount, as regional trends dictate stylistic preferences, material availability, and regulatory compliance requirements. The demand for architectural services in Asia Pacific is heavily skewed toward new construction and mega-projects, whereas the European market focuses more intently on conservation, renovation, and adaptive reuse of heritage properties. Firms operating globally must therefore demonstrate both scalability in design standardization and deep local knowledge to successfully navigate varied regulatory and cultural landscapes. Analyzing the interplay between facility type and regional preferences—for example, the high demand for integrated luxury resorts in the Middle East versus the focus on boutique, experiential hotels in established European capitals—allows market participants to forecast capital flows and direct strategic investment towards the most promising geographical niches. This nuanced segmentation approach provides a high-resolution view of market opportunities and competitive positioning.

- By Facility Type:

- Luxury & Upscale Hotels

- Mid-Scale & Economy Hotels

- Resorts & Integrated Resorts (IRs)

- Serviced Apartments & Extended Stay Facilities

- Boutique & Lifestyle Hotels

- Themed Entertainment and Specialized Lodging (e.g., Glamping, Eco-Lodges)

- By Service Type:

- Architectural Planning & Schematic Design

- Detailed Engineering & Technical Design (Structural, MEP)

- Interior Design & FF&E Procurement Consultation

- Project Management & Construction Administration

- Sustainable Design & Certification Consulting

- Adaptive Reuse & Renovation Services

- By Construction Type:

- New Construction (Greenfield Projects)

- Renovation & Refurbishment (Brownfield Projects)

- Modular & Prefabricated Construction

- By Application:

- Urban Developments

- Coastal & Resort Locations

- Rural & Specialty Sites

Value Chain Analysis For Hospitality Architecture Design Market

The value chain for the Hospitality Architecture Design Market begins with Upstream Analysis, which focuses on the providers of raw intellectual capital and supporting technology. This includes architecture schools and universities that supply the professional workforce, software providers specializing in BIM (Building Information Modeling), computational design tools, and AI-driven platforms that form the digital backbone of the industry. Further upstream components involve specialized consultants providing expertise in areas like geotechnical engineering, environmental impact assessment, and regulatory compliance. The quality and efficiency of the entire design process are heavily reliant on the seamless integration and interoperability of these upstream inputs. Architects must constantly invest in the latest software licenses and professional development to leverage cutting-edge analytical and visualization capabilities, which are essential for competitive project bidding and execution, particularly in complex projects requiring high levels of structural and systems coordination.

The core value creation stage involves the architectural and engineering firms themselves, who transform client briefs into detailed construction documents. This stage encompasses conceptual design, schematic development, design development, and contract documentation, often requiring extensive collaboration between specialized internal teams (e.g., façade engineering, sustainable design specialists, interior designers). Distribution channels for architectural services are predominantly direct, involving architectural firms interacting directly with the project owner (developer, investment fund, or hotel operator). Indirect channels, though less common for initial design, include collaboration through Project Management Consultants (PMCs) or large Engineering, Procurement, and Construction (EPC) contractors who subcontract the design work. The relationship between the architectural firm and the client is typically long-term and consultative, emphasizing trust and reputation, particularly for high-profile luxury or complex mixed-use developments where design excellence is a primary differentiator. The effectiveness of the firm's in-house project management capabilities and ability to manage multi-disciplinary teams dictates the efficiency of the design process and adherence to project timelines.

Downstream Analysis involves the implementation and operational phases of the project. This stage includes the construction contractors who execute the design, material suppliers, and specialized subcontractors (e.g., lighting, HVAC systems). The architect's role continues through construction administration, ensuring the build adheres to the design specifications. The final downstream users are the hotel operators and the guests. The quality of the architecture directly impacts the operator’s ability to maximize revenue, minimize maintenance costs, and deliver the intended guest experience. Therefore, the architectural firm's service package often extends into post-occupancy evaluation and the creation of digital twins for facility management (FM), offering ongoing value. The trend towards integrated project delivery (IPD) models is increasingly blurring the lines between these stages, promoting greater collaboration between upstream designers, midstream contractors, and downstream operators to optimize the overall life-cycle cost and performance of the hospitality asset.

Hospitality Architecture Design Market Potential Customers

The primary consumers and End-Users/Buyers in the Hospitality Architecture Design Market are diverse entities unified by the need to develop, own, or operate income-generating accommodation and leisure assets. These include major international hotel chains and brand operators, such as Marriott, Hilton, and Hyatt, who require standardized yet flexible architectural templates for global expansion and consistent brand identity. These operators frequently commission large-scale new builds and extensive renovations tailored to specific brand guidelines (e.g., Luxury Collection versus Select Service). Investment and Development firms (Real Estate Investment Trusts - REITs, private equity funds, and sovereign wealth funds) constitute another critical customer segment. These financial entities commission designs based purely on optimizing asset value, requiring designs that prioritize high efficiency, durability, and maximum Net Operating Income (NOI). Their procurement decisions are heavily influenced by the architect’s proven track record in delivering projects on time and within stringent budgetary constraints.

A burgeoning customer segment involves independent boutique hotel owners and localized regional chains. Unlike major international brands, these clients prioritize unique, bespoke architectural solutions that provide a strong, differentiated local identity and an experiential narrative to attract niche travelers. They often seek architectural firms that specialize in contextual design, adaptive reuse, and sustainable practices, placing a premium on creativity and artistic vision over standardized efficiency. Furthermore, governmental bodies and public-private partnerships (PPPs) act as buyers, especially in the context of major urban regeneration projects, convention centers, airport hotels, and integrated national tourism infrastructure schemes. These buyers require designs that meet public safety standards, serve civic functions, and comply with comprehensive urban planning mandates, often involving complex stakeholder management and lengthy regulatory processes.

Finally, specialized end-users, such as casino operators, cruise line companies (for shoreside facilities), and developers of themed resorts and wellness retreats, represent high-value niche segments. These customers demand highly specialized architectural and engineering expertise tailored to unique operational complexities—for instance, high security and complex public flow management in casinos, or specialized therapeutic environments in wellness centers. The selection criteria for potential customers across all segments increasingly include the architectural firm's sustainability credentials, technological proficiency (especially BIM proficiency and experience with digital twins), and the ability to integrate diverse functionalities (e.g., F&B, retail, conferencing) seamlessly within the hospitality structure. The market's success hinges on the architect's ability to navigate the distinct financial, operational, and branding requirements of these varied clientele.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 72.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gensler, HKS, Inc., Foster + Partners, Skidmore, Owings & Merrill (SOM), WATG, HOK, Wilson Associates, Perkins&Will, Rockwell Group, Aedas, BDP, Leo A Daly, CallisonRTKL, Kengo Kuma and Associates, Zaha Hadid Architects, Studio GAIA, BBG-BBGM, Wimberly Interiors, Pelli Clarke & Partners, Arquitectonica |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hospitality Architecture Design Market Key Technology Landscape

The technological landscape of the Hospitality Architecture Design Market is fundamentally defined by the adoption of advanced digital modeling and data analytics tools, moving the industry toward a highly integrated and performance-driven design methodology. Building Information Modeling (BIM) remains the cornerstone technology, enabling multi-disciplinary coordination, precise quantity take-offs, and sophisticated clash detection, significantly reducing errors and rework during the construction phase. Modern BIM platforms are increasingly cloud-based, facilitating real-time collaboration among globally dispersed design teams, critical for international hotel projects. Beyond basic modeling, the integration of parametric and generative design tools, often leveraging artificial intelligence (AI) and machine learning (ML) algorithms, allows architects to explore optimal floorplate layouts, facade designs, and structural systems almost instantaneously based on predefined commercial and aesthetic criteria, accelerating the conceptualization phase while maximizing performance metrics like daylighting and energy efficiency. Furthermore, Virtual Reality (VR) and Augmented Reality (AR) technologies are now standard for client presentations, allowing developers and operators to virtually walk through the design before ground is broken, facilitating immediate feedback and greater client confidence in the final product. This technological shift requires substantial investment in both software licenses and specialized computational design training for architectural staff.

A second critical dimension of the technological landscape is the increasing reliance on sustainable building technology and data-driven performance analysis. Architects utilize complex simulation software for energy modeling, daylight analysis, and fluid dynamics (CFD) to predict and optimize the long-term operational costs and environmental impact of the structure. The focus is shifting towards passive design strategies and the integration of renewable energy sources, requiring deep technical knowledge of solar photovoltaic integration, geothermal systems, and advanced façade materials that dynamically respond to climate variations. Furthermore, the concept of the Digital Twin—a highly accurate virtual replica of the built asset—is gaining traction. This twin is developed during the design phase using BIM data and then connected to the physical building's operational sensors (IoT) post-construction. This enables facility managers to use the digital model for predictive maintenance, real-time energy monitoring, and long-term asset management, creating a continuous feedback loop that informs future architectural projects about actual in-use performance, fundamentally linking design intention with operational reality. This full lifecycle digital integration represents a significant value proposition for architectural services.

Finally, the proliferation of off-site construction technologies, notably modular and prefabricated construction, represents a crucial technological shift influencing architectural design. Architects specializing in hospitality are increasingly designing for manufacture and assembly (DfMA), where standardization and dimensional precision are paramount. This involves utilizing advanced digital fabrication techniques and specialized software to detail components that are produced in factory settings and then rapidly assembled on site. This methodology addresses challenges related to construction speed, quality control, and labor scarcity, particularly relevant for repeatable hospitality asset classes like extended-stay and mid-scale hotels. The market's technological evolution demands a shift from traditional drafting skills to computational and systems integration expertise, positioning the architect not just as a spatial designer but as a manager of complex, data-rich building systems, ensuring that the physical design is technologically resilient and operationally intelligent throughout its entire lifespan.

Regional Highlights

- North America (NA): The market in North America is mature and highly competitive, characterized by high demand for renovation and adaptive reuse projects in major urban centers such as New York, Los Angeles, and Toronto, targeting historical preservation and upgrading existing assets to meet modern technological and sustainability mandates. New construction is heavily focused on specialized, high-end segments, including luxury lifestyle hotels, integrated mixed-use developments (combining hospitality with residential and retail), and wellness retreats. A significant regional trend is the rapid adoption of modular construction, particularly in the mid-scale and extended-stay segments, driven by pressures to reduce construction timelines and combat persistent labor shortages. Regulatory compliance, particularly concerning seismic requirements and accessibility (ADA), significantly influences design parameters, necessitating highly specialized architectural expertise and robust BIM implementation for compliance verification and streamlined permitting.

- Europe: The European hospitality architecture market is characterized by a strong emphasis on sustainability (driven by EU directives such as the Green Deal), energy efficiency, and preservation of heritage. Demand is robust for boutique hotels, conversions of historic buildings into luxury accommodations, and sustainable tourism infrastructure, especially in regions like the Mediterranean and Scandinavia. Architectural projects here often require deep expertise in retrofitting services to meet strict EU energy performance standards without compromising the historical integrity of the structure. The market is fragmented but highly specialized, with strong growth in countries prioritizing eco-tourism, such as Iceland and Switzerland, where net-zero and timber-based construction solutions are increasingly sought after. Political and economic stability fluctuations, however, particularly in Eastern and Southern Europe, can occasionally impact large capital development projects.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by burgeoning middle-class wealth, rapid urbanization, and massive government investment in tourism infrastructure (e.g., China's Belt and Road Initiative, Japan's renewed focus on inbound tourism). The demand is concentrated in large-scale new construction, including mega-resorts, iconic urban hotels, and convention centers, particularly in key metros like Shanghai, Singapore, Dubai (Middle East overlaps), and Sydney. Architectural design in APAC often balances globally recognized branded standards with deep incorporation of local cultural motifs and responsiveness to extreme climate conditions (monsoons, high humidity). The pace of construction demands efficient project delivery models, making firms with strong local partnerships and advanced digital capabilities (like digital twin deployment for large complexes) highly valued.

- Latin America (LATAM): The LATAM market, while subject to higher economic volatility, demonstrates strong potential, driven by increased international investment in niche tourism segments, including ecotourism, cultural heritage tourism, and luxury resort development along coastal areas (Mexico, Brazil, Caribbean). Architectural projects often emphasize resilience against natural disasters and the use of locally sourced, sustainable materials to minimize environmental impact and appeal to conscious travelers. Development is often concentrated in high-traffic tourist zones, but regulatory complexity and varied building standards across different countries require architectural firms to maintain flexible project management and strong local legal compliance teams.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, represents a major global hub for mega-project architectural design, fueled by vast sovereign wealth fund investments aiming to diversify economies away from fossil fuels through luxury tourism (e.g., NEOM in Saudi Arabia, continuous development in Dubai and Qatar). Demand is exceptionally high for iconic, landmark architecture—large-scale hotels, integrated entertainment districts, and climate-controlled resorts. Architects here specialize in managing complex, highly customized, and technologically advanced designs that address severe climatic challenges (extreme heat) and high luxury expectations. The African market is primarily driven by expanding business travel and rising intra-regional tourism, focusing on mid-scale brand expansion and infrastructure support related to resource extraction and connectivity hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hospitality Architecture Design Market.- Gensler

- HKS, Inc.

- Foster + Partners

- Skidmore, Owings & Merrill (SOM)

- WATG

- HOK

- Wilson Associates

- Perkins&Will

- Rockwell Group

- Aedas

- BDP

- Leo A Daly

- CallisonRTKL

- Kengo Kuma and Associates

- Zaha Hadid Architects

- Studio GAIA

- BBG-BBGM

- Wimberly Interiors

- Pelli Clarke & Partners

- Arquitectonica

- Woods Bagot

- Stantec

- DP Architects

- Sasaki Associates

Frequently Asked Questions

Analyze common user questions about the Hospitality Architecture Design market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most significant trends currently driving architectural innovation in the luxury hospitality sector?

The luxury hospitality sector is primarily driven by the demand for hyper-personalized experiential design, advanced integration of wellness features (e.g., biophilic design, air purification systems), and achieving premium sustainability credentials such as Net-Zero carbon status and WELL Building Standard certification. Architects are focusing on unique, narrative-driven designs that maximize local context and authenticity, moving away from standardized luxury templates to deliver highly differentiated, high-performing assets.

How is modular construction impacting the design strategies for mid-scale and economy hotels?

Modular and prefabricated construction fundamentally changes the design strategy for mid-scale and economy hotels by prioritizing Design for Manufacture and Assembly (DfMA). This approach accelerates speed-to-market, ensures consistent quality control, and offers significant cost predictability. Architects are adapting their designs to standardized unit dimensions and repeatable floor plans, focusing on optimized factory production and assembly efficiency while maintaining brand standards.

What role does Building Information Modeling (BIM) play in reducing project risk in large-scale resort developments?

BIM plays a critical role in mitigating project risk in large-scale resort developments by providing a comprehensive, data-rich 3D model that facilitates multi-disciplinary coordination, precise clash detection among structural, mechanical, and architectural systems, and accurate quantity surveying. This minimizes on-site construction errors, streamlines regulatory approvals, and allows for precise forecasting of materials and labor, thereby controlling budget and schedule adherence throughout the project lifecycle.

Which geographical region is expected to demonstrate the highest growth rate for new hospitality architectural commissions?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate for new hospitality architectural commissions, fueled by aggressive urbanization, increasing middle-class travel, and substantial infrastructure investment in countries like China, India, and emerging Southeast Asian nations. The Middle East, particularly the GCC countries, also shows exceptional growth due to strategic mega-tourism projects aiming for economic diversification, creating intense demand for iconic and large-scale resort architecture.

What are the key considerations for architects when designing hospitality projects focused on adaptive reuse?

Key considerations for adaptive reuse projects include meticulous structural analysis and assessment of existing building systems, navigating complex historical preservation regulations, and creatively integrating modern operational requirements (e.g., enhanced vertical transportation, technological infrastructure) within the existing physical envelope. Architects must balance the preservation of the building's historical character with the functional needs of a contemporary hotel operation, often resulting in intricate, site-specific design solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager