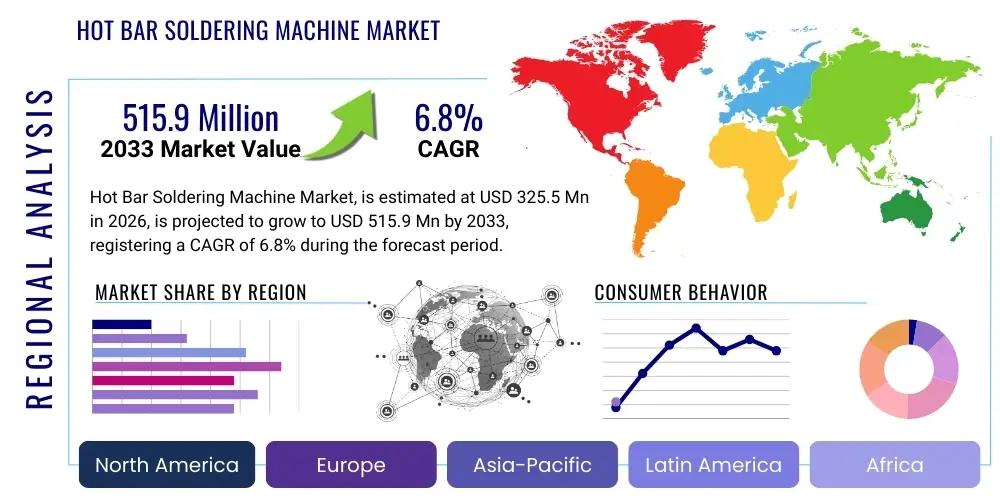

Hot Bar Soldering Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438015 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hot Bar Soldering Machine Market Size

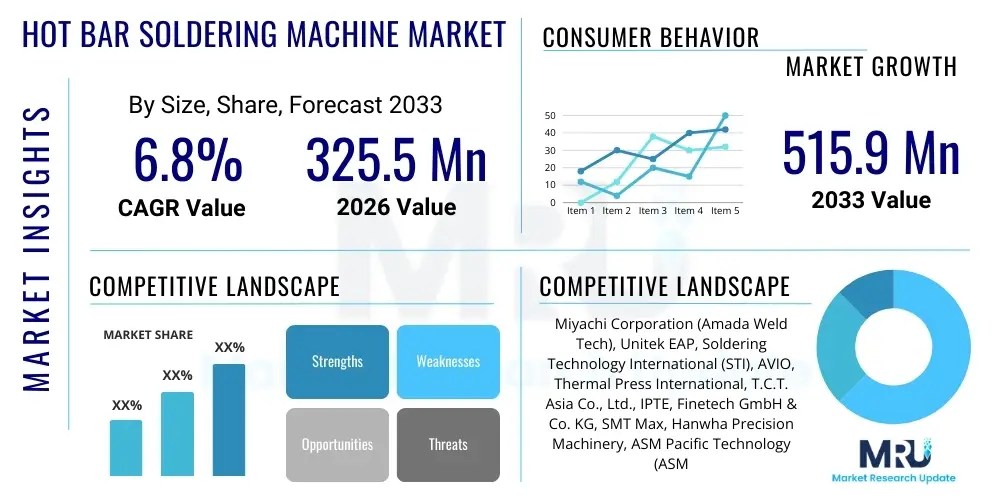

The Hot Bar Soldering Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 325.5 Million in 2026 and is projected to reach USD 515.9 Million by the end of the forecast period in 2033.

Hot Bar Soldering Machine Market introduction

The Hot Bar Soldering Machine Market encompasses specialized equipment utilized for precision soldering of components, particularly those requiring high localized heat and pressure uniformity, such as Flexible Printed Circuits (FPCs), flat panel displays, and connectors. These machines employ the principle of resistance heating, where a ceramic tip (the hot bar) is heated rapidly and applied to the connection point, melting the solder paste or preform. This technology offers superior control over temperature profiles and pressure application, crucial for soldering delicate or densely packed electronic assemblies. The core functionality centers on achieving high-quality, repeatable joints in minimal time, ensuring robust connections for critical electronic components.

Major applications of hot bar soldering machines span across consumer electronics, automotive electronics, medical devices, and telecommunications infrastructure. In consumer electronics, they are indispensable for attaching display cables, camera modules, and flex circuits to rigid PCBs, driven by the miniaturization trend demanding high-density interconnection (HDI). Benefits include high throughput, excellent joint strength, minimal thermal stress on adjacent components due to localized heating, and superior process repeatability compared to traditional methods. Furthermore, hot bar soldering is often the preferred method for anisotropic conductive film (ACF) bonding, a critical process in display manufacturing.

Driving factors for market growth include the relentless expansion of the electronics manufacturing sector, particularly in Asia Pacific, coupled with the increasing adoption of flexible electronics (flex and rigid-flex PCBs). The demand for high-resolution displays (OLED, Micro-LED) in smartphones, smartwatches, and automotive dashboards necessitates high-precision bonding techniques. Regulatory pushes for greater reliability in critical electronics, such as Advanced Driver-Assistance Systems (ADAS) and medical implants, further mandate the use of highly controlled soldering processes like hot bar technology, ensuring market sustainability and expansion.

Hot Bar Soldering Machine Market Executive Summary

The Hot Bar Soldering Machine Market is characterized by robust growth, primarily fueled by the accelerating miniaturization trend in electronic devices and the increasing complexity of flexible circuits. Key business trends indicate a strong focus on automation, integration with advanced vision systems, and the development of multi-head soldering platforms to enhance efficiency and throughput in high-volume manufacturing environments. Vendors are investing heavily in technologies that allow for ultra-fine pitch soldering and bonding using advanced materials, ensuring compliance with next-generation electronic specifications. The shift toward Industry 4.0 principles necessitates machines capable of real-time process monitoring and data logging, making connectivity and smart diagnostics critical competitive differentiators.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, driven by established manufacturing hubs in China, South Korea, Japan, and Taiwan, which account for the vast majority of global consumer electronics and display production. While North America and Europe maintain strong demand, particularly in high-reliability sectors such as aerospace and medical devices, APAC remains the engine of volumetric growth. Emerging markets in Southeast Asia are also showing accelerated adoption as manufacturing bases diversify. Geopolitical shifts are encouraging vendors to establish localized support and manufacturing capabilities to mitigate supply chain risks and serve regional market demands more effectively.

Segment-wise, the market is broadly segmented by Type (Constant Heat Hot Bar Soldering, Pulse Heat Hot Bar Soldering) and Application (Consumer Electronics, Automotive, Healthcare, Aerospace & Defense). Pulse Heat technology is anticipated to witness faster growth due to its superior temperature control and suitability for highly sensitive components and ACF bonding applications, crucial in modern display technology. Within applications, the Consumer Electronics segment holds the largest share, driven by smartphones and wearable devices. However, the Automotive sector, specifically in ADAS modules and infotainment systems, is projected to exhibit the highest CAGR, reflecting the increasing electronic content per vehicle and the stringent reliability standards required for automotive applications.

AI Impact Analysis on Hot Bar Soldering Machine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hot Bar Soldering Machine market typically center on enhancing process control, predictive maintenance, and quality assurance. Common concerns revolve around how AI can optimize complex thermal profiles, minimize defects (like non-wetting or shorting) in ultra-fine pitch applications, and automate fault detection beyond standard machine vision systems. Users expect AI integration to transition the soldering process from reactive troubleshooting to proactive optimization, ensuring 'zero-defect' manufacturing crucial for high-reliability sectors. The key themes summarized are the expectation of predictive quality management, autonomous process tuning, and increased machine uptime through sophisticated predictive maintenance algorithms.

- AI-driven optimization of thermal profiles and pressure cycles based on material science inputs, reducing setup time and maximizing joint reliability.

- Implementation of advanced machine vision systems enhanced by deep learning algorithms for real-time, highly accurate solder joint inspection and defect classification.

- Predictive Maintenance (PdM) utilizing AI to analyze sensor data (temperature, current, pressure) to anticipate component failure (e.g., hot bar element wear) and schedule maintenance proactively, minimizing downtime.

- Autonomous process adjustment, allowing the machine to self-correct minor variances in materials or environment without operator intervention, leading to higher yield rates.

- Enhanced data logging and process traceability, creating a digital twin of the soldering operation for compliance and post-production fault analysis.

- Improved yield management through correlation of soldering parameters with final product performance data using machine learning models.

DRO & Impact Forces Of Hot Bar Soldering Machine Market

The Hot Bar Soldering Machine Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. The principal drivers stem from the pervasive demand for smaller, thinner, and lighter electronic devices which necessitate high-precision bonding methods that conventional reflow soldering cannot reliably achieve, particularly concerning flexible circuits and delicate connectors. Rapid technological advancements in display manufacturing (OLED, Micro-LED) and the proliferation of IoT devices further accelerate the need for advanced bonding equipment. However, the market faces restraints primarily related to the high initial capital investment required for these precision machines and the technical complexity involved in setting up highly repeatable thermal and pressure profiles, which often requires specialized operator training and maintenance expertise.

Opportunities for growth are abundant, centering on the automotive electronics revolution, specifically the electrification of vehicles and the deployment of complex sensor arrays for autonomous driving, which mandate extremely high-reliability connections. Furthermore, the increasing adoption of hybrid and rigid-flex circuit boards across various industries opens new avenues for specialized hot bar bonding solutions. The industry is also poised to benefit from developing customized machines capable of handling new conductive materials and non-standard packaging sizes. The convergence of hardware manufacturing with software intelligence, particularly the integration of AI for advanced process control and anomaly detection, presents a major opportunity for vendors to differentiate their offerings and capture premium market share.

The impact forces driving this market are strongly dictated by technological standards and competitive pressures within the electronics industry. The need for reduced pitch sizes (often below 50 µm) acts as a powerful force pushing innovation in hot bar tip materials and control systems. Regulatory and quality requirements in sectors like medical and aerospace electronics exert continuous upward pressure on quality assurance and process repeatability, favoring vendors who offer superior certification and traceability features. These impact forces ensure that technological obsolescence is rapid, compelling manufacturers to continually invest in R&D to maintain relevance and competitive advantage in the rapidly evolving landscape of high-density interconnect technology.

Segmentation Analysis

The Hot Bar Soldering Machine Market segmentation provides a granular view of its structure, primarily defined by the heating mechanism employed (Type) and the industry vertical utilizing the equipment (Application). Understanding these segments is crucial for strategic planning, as different applications place unique demands on machine performance regarding temperature control, bonding force, and throughput. The dominant segments are Pulse Heat technology, favored for its precision, and the Consumer Electronics application segment, owing to the high volume of device manufacturing globally. Analyzing the relative growth rates and adoption patterns across these segments reveals key investment areas and emerging trends within the electronics assembly industry, indicating a clear trajectory toward specialized, high-accuracy equipment.

- By Type:

- Constant Heat Hot Bar Soldering

- Pulse Heat Hot Bar Soldering

- By Application:

- Consumer Electronics

- Automotive Electronics

- Healthcare Devices

- Aerospace & Defense

- Industrial & Others

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Hot Bar Soldering Machine Market

The value chain for the Hot Bar Soldering Machine Market begins with upstream activities involving the sourcing of highly specialized raw materials and components, including advanced heating elements (ceramic/molybdenum), precision mechanical components (linear actuators, vision system components), and sophisticated electronic controls (PLCs, temperature controllers). Key upstream suppliers focus on providing materials with high thermal conductivity and durability, essential for the hot bar tip itself, which operates under high thermal cycling stress. Efficiency in the upstream segment dictates the performance and longevity of the final machinery. Relationships with specialized sensor and control system manufacturers are paramount for ensuring the machine's precision capabilities.

Midstream activities involve the design, assembly, testing, and marketing of the final soldering machines. Manufacturers add value through proprietary intellectual property related to thermal profile management software, advanced vision alignment systems, and patented clamping mechanisms designed to handle delicate flexible materials without damage. Direct distribution channels, involving the machine manufacturer selling and servicing the equipment directly to large Original Equipment Manufacturers (OEMs), are common, especially for highly customized or complex installations requiring extensive integration and training. Indirect channels, utilizing specialized distributors and system integrators, help reach smaller contract manufacturers (CMs) and regional markets efficiently, often including post-sales support and regional spare parts inventory management.

Downstream activities center on end-users—the electronics assembly manufacturers across sectors like consumer electronics and automotive. Value is extracted through process efficiency, low defect rates, and high throughput achieved by the machinery. The aftermarket segment, including consumables (hot bar tips, sacrificial tooling), spare parts, and service contracts, represents a significant portion of the value chain. Continuous technical support and timely calibration services are critical downstream elements that maintain the high precision required by the end-users, ensuring the longevity and reliability of the soldering solution throughout its operational lifecycle.

Hot Bar Soldering Machine Market Potential Customers

Potential customers for Hot Bar Soldering Machines are primarily manufacturers involved in high-precision, high-density electronic assembly where conventional soldering techniques are inadequate or yield suboptimal results. The largest segment of buyers comprises major Consumer Electronics OEMs (such as smartphone, laptop, and wearable device producers) and their associated Electronic Manufacturing Service (EMS) providers. These customers prioritize speed, automation, and the ability to bond fine-pitch flex circuits (e.g., FPC-to-PCB connections for displays, cameras, and batteries) reliably and at massive scale. The constant drive for thinner product profiles and smaller component sizes ensures sustained demand from this consumer segment, making them the market volume drivers.

A second crucial group includes specialized manufacturers in the Automotive Electronics sector. Buyers here include Tier 1 and Tier 2 suppliers producing critical components such as ADAS radar modules, LiDAR sensor assemblies, sophisticated dashboard displays, and power electronics for electric vehicles (EVs). These customers demand exceptional process control, traceability, and equipment robustness to meet stringent automotive quality standards (AEC-Q requirements). Their buying decisions are heavily influenced by the machine's demonstrated reliability and its ability to withstand demanding operating environments, translating into a focus on high-end, Pulse Heat technology solutions.

Furthermore, specialized segments like Medical Device manufacturers (producing implants, diagnostic tools, and monitoring systems) and Aerospace & Defense contractors represent high-value potential customers. These buyers prioritize absolute reliability and certification over cost or speed. They require customized hot bar solutions for bonding miniature components, often utilizing specialized materials or working in cleanroom environments. These end-users typically engage in direct purchasing relationships with vendors to ensure highly tailored equipment and robust documentation that meets regulatory compliance standards (e.g., FDA, military specifications).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 325.5 Million |

| Market Forecast in 2033 | USD 515.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miyachi Corporation (Amada Weld Tech), Unitek EAP, Soldering Technology International (STI), AVIO, Thermal Press International, T.C.T. Asia Co., Ltd., IPTE, Finetech GmbH & Co. KG, SMT Max, Hanwha Precision Machinery, ASM Pacific Technology (ASMPT), Nippon Pulse Motor Co., Ltd., HB Systems, SHINDENGEN ELECTRIC MANUFACTURING CO., LTD., Seidensha Electronics, MTI Corporation, TWS Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Bar Soldering Machine Market Key Technology Landscape

The technological landscape of the Hot Bar Soldering Machine Market is defined by the integration of high-precision heating mechanisms, sophisticated control systems, and advanced vision alignment capabilities, all crucial for achieving micro-level accuracy. The transition from Constant Heat to Pulse Heat technology represents the most significant evolution. Pulse Heat systems use rapid heating and cooling cycles, providing superior control over the thermal profile, minimizing heat exposure to surrounding components, and enabling the reliable bonding of heat-sensitive materials like certain plastic substrates or advanced display films. Modern machines feature closed-loop control systems where thermocouples embedded near the hot bar tip provide instantaneous feedback to the power supply, ensuring temperature stability within narrow tolerances throughout the heating cycle.

A second critical technology involves precision alignment and handling. Since many applications involve bonding flexible printed circuits (FPCs) with pitches often less than 100 µm, high-resolution machine vision systems, sometimes augmented with AI, are essential for fiducial recognition and exact component placement prior to bonding. Sophisticated force control mechanisms, often utilizing servo-driven actuators, ensure the application of uniform and precisely calibrated bonding pressure (measured in Newtons per square millimeter) across the entire joint area, which is vital for high-quality solder flow and intermetallic formation. The use of specialized tooling and fixtures designed to prevent warping or misalignment during the heating and cooling phases is also standard practice.

The materials technology supporting the hot bar itself is equally important. Hot bar tips are typically constructed from high-performance materials like molybdenum, titanium, or specialized ceramics, chosen for their rapid heat response, excellent thermal stability, and low thermal expansion coefficient. Furthermore, the increasing complexity of electronic devices mandates machines capable of handling different soldering materials, including lead-free solders and Anisotropic Conductive Films (ACF). The ability to seamlessly integrate with factory automation systems (MES/SCADA), providing real-time data logging and network connectivity, is now a mandatory feature, positioning hot bar soldering equipment firmly within the framework of modern smart factory environments.

Regional Highlights

The geographic analysis of the Hot Bar Soldering Machine Market reveals distinct patterns of demand and technological adoption influenced by regional manufacturing capabilities and regulatory environments. Asia Pacific (APAC) holds the dominant market share and is expected to maintain the highest growth trajectory throughout the forecast period. This dominance is directly attributable to the concentration of global electronics manufacturing, particularly for smartphones, tablets, high-volume consumer goods, and flat panel displays (FPDs) in countries such as China, South Korea, Taiwan, and Japan. Investment in highly automated, high-throughput Pulse Heat soldering systems is robust in this region to support continuous miniaturization efforts.

North America and Europe constitute the mature markets, characterized by high demand for specialized, high-reliability hot bar soldering machines used in stringent application environments. In North America, demand is concentrated in the Aerospace & Defense, advanced Medical Device manufacturing, and specialized Automotive R&D sectors. These regions prioritize precision, process validation, and robust quality control, often leading to the adoption of premium-priced, customized equipment with extensive software capabilities for traceability and compliance. While the volume of machines sold may be lower than in APAC, the average selling price (ASP) is typically higher due to customization and compliance requirements.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets where the growth of domestic electronic assembly industries and the establishment of local manufacturing hubs by global OEMs are beginning to drive demand. Growth in these regions is currently focused on standard Constant Heat machines for general assembly tasks, but rapid development in automotive component manufacturing (especially in Mexico and parts of Eastern Europe/Turkey, often grouped regionally) suggests a shift towards higher-precision Pulse Heat technology in the medium term. Infrastructure investments and regulatory stability will be key factors influencing the speed of market penetration in these emerging territories.

- Asia Pacific (APAC): Dominates the market due to massive consumer electronics and display manufacturing bases; high demand for Pulse Heat systems for FPC bonding and ACF bonding.

- North America: Focuses on high-reliability applications (Aerospace, Medical, Military); stringent quality requirements drive demand for customized, premium machinery.

- Europe: Strong uptake in automotive electronics (EV, ADAS components) and industrial automation; emphasis on high precision, process integration, and adherence to Industry 4.0 standards.

- Latin America (LATAM): Emerging market driven by local assembly initiatives and the establishment of automotive manufacturing clusters; gradual transition from Constant Heat to specialized Pulse Heat solutions.

- Middle East & Africa (MEA): Nascent market primarily fueled by telecommunications infrastructure development and light industrial electronics assembly; long-term potential linked to governmental investment in localized manufacturing capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Bar Soldering Machine Market.- Miyachi Corporation (Amada Weld Tech)

- Unitek EAP

- Soldering Technology International (STI)

- AVIO

- Thermal Press International

- T.C.T. Asia Co., Ltd.

- IPTE

- Finetech GmbH & Co. KG

- SMT Max

- Hanwha Precision Machinery

- ASM Pacific Technology (ASMPT)

- Nippon Pulse Motor Co., Ltd.

- HB Systems

- SHINDENGEN ELECTRIC MANUFACTURING CO., LTD.

- Seidensha Electronics

- MTI Corporation

- TWS Automation

- Janome Corporation

- Sunstone Engineering

- Heller Industries

Frequently Asked Questions

Analyze common user questions about the Hot Bar Soldering Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between Constant Heat and Pulse Heat soldering?

Constant Heat systems maintain the hot bar tip at a fixed temperature throughout the process, suitable for standard soldering where components are less heat-sensitive. Pulse Heat (also known as Resistance Soldering) rapidly heats the tip to the reflow temperature and then cools it immediately under pressure, offering superior control for fine-pitch components and heat-sensitive flexible circuits by minimizing overall thermal exposure.

Which application segment drives the highest demand for Hot Bar Soldering Machines?

The Consumer Electronics segment, including manufacturers of smartphones, wearables, and displays, drives the highest volume demand. This is due to the mandatory requirement for high-precision bonding of flexible printed circuits (FPCs) and connectors necessitated by device miniaturization and high-density interconnection (HDI) requirements.

How does hot bar soldering improve component reliability in the automotive sector?

Hot bar soldering ensures high-strength, uniform, and void-free solder joints essential for automotive applications like ADAS sensors and infotainment systems. Its precision control guarantees compliance with strict AEC-Q standards, minimizing the risk of failure under vibration and extreme temperature cycling inherent to vehicular environments.

What role does automation and AI play in the future of hot bar soldering equipment?

Automation, often integrated with AI and machine vision, is crucial for optimizing yield and reducing defects. AI algorithms are increasingly used for predictive maintenance, real-time thermal profile adjustments, and high-speed, accurate solder joint inspection, enabling autonomous, high-precision manufacturing processes compliant with Industry 4.0.

Is the high initial cost of Hot Bar Soldering Machines justified for smaller manufacturers?

While the initial capital expenditure is high, the investment is justified for specialized manufacturing involving fine-pitch or flexible circuits where other soldering methods result in prohibitive defect rates. The long-term justification relies on improved process reliability, reduced rework costs, and the ability to handle next-generation component complexity.

Segmentation Analysis: By Type - Constant Heat Hot Bar Soldering

Constant Heat Hot Bar Soldering technology represents the foundational methodology within the market. In this approach, the heating element maintains a stable, high temperature throughout the operational cycle, relying on the machine's robust tooling and heat capacity to transfer the necessary energy to the solder joint. This method is structurally simpler and typically involves lower capital expenditure compared to its pulse heat counterpart. Constant heat systems are highly reliable for basic soldering tasks involving components that are not excessively sensitive to prolonged heat exposure or applications where the required bonding pitch is relatively coarse (e.g., standard connector attachment to rigid PCBs).

The primary advantage of Constant Heat technology lies in its straightforward operation and durability, making it suitable for high-volume production of less technologically demanding assemblies. Manufacturers often utilize these machines for applications where the substrate material is highly heat-resistant or when the soldering process can tolerate a longer thermal exposure time. Despite the rise of more complex pulsed systems, Constant Heat machines retain market relevance in industrial sectors, general electronic assembly, and certain medical applications where continuous, steady heat application is preferred for achieving specific metallurgical properties in the solder joint.

However, Constant Heat technology faces limitations in the current trend toward miniaturization. The sustained heat can cause thermal stress on delicate flexible circuits or small surface-mount devices (SMDs) located near the joint area. Furthermore, achieving precise, localized heating control needed for fine-pitch or anisotropic conductive film (ACF) bonding is inherently challenging with this method. Nevertheless, continuous improvements in tip materials and process control software have enhanced the utility of Constant Heat systems, ensuring they remain a viable and cost-effective solution for a significant portion of the electronic assembly market, especially in cost-sensitive regional markets.

- Mechanism: Continuous energy supply maintains tip temperature throughout the soldering cycle.

- Advantages: Lower cost, simpler maintenance, robustness, and suitability for high-volume, less-sensitive assemblies.

- Disadvantages: Limited control over thermal ramp-up and cool-down profiles; greater thermal impact on adjacent components.

- Key Applications: General connector soldering, wire harness termination, basic rigid PCB component attachment.

Segmentation Analysis: By Type - Pulse Heat Hot Bar Soldering

Pulse Heat Hot Bar Soldering, also referred to as resistance soldering, constitutes the advanced segment of the market and is the faster-growing technology type. This technique relies on applying a high-current, short-duration electrical pulse through the heating element (the hot bar tip), causing extremely rapid heating and subsequent controlled cooling. This rapid thermal cycling allows for precise control over the temperature curve, making it ideal for highly sensitive components and ultra-fine pitch bonding requirements prevalent in modern consumer electronics and display manufacturing.

The core value proposition of Pulse Heat technology lies in its ability to isolate the heat application precisely to the solder joint area. By controlling the exact power and duration of the pulse, the machine minimizes the total energy input into the overall assembly, drastically reducing the risk of thermal damage to flexible circuits, adhesives, and fragile ICs. This capability is paramount for processes such as bonding FPCs to LCD/OLED drivers and applying Anisotropic Conductive Film (ACF) bonding, which require extremely clean, quick, and temperature-controlled processes to ensure optical and electrical integrity.

Market growth in the Pulse Heat segment is closely linked to the innovation cycles of the smartphone and display industries, where component pitch sizes are continuously shrinking. While Pulse Heat systems require more complex power supplies, sophisticated control algorithms, and higher initial investment, the superior yield rates, process repeatability, and ability to handle the most demanding bonding tasks justify the cost for manufacturers of premium and high-reliability products. Leading vendors are focusing on improving the speed of the thermal cycling and enhancing the integration of vision systems within Pulse Heat platforms to maintain technological leadership.

- Mechanism: Short, high-current electrical pulses heat the tip rapidly; temperature controlled via closed-loop feedback during both heating and cooling.

- Advantages: Extreme precision in temperature control, minimal thermal stress on surrounding materials, optimal for fine-pitch and ACF bonding.

- Disadvantages: Higher capital cost, greater operational complexity, reliance on sophisticated power supply and control systems.

- Key Applications: FPC-to-PCB bonding, ACF bonding for displays (LCD/OLED), high-reliability component attachment in medical and automotive systems.

Segmentation Analysis: By Application - Consumer Electronics

The Consumer Electronics segment is the undisputed largest application area for Hot Bar Soldering Machines, primarily driven by the mass production of devices such as smartphones, tablets, laptops, and wearable technology. The constant market pressure for devices to be thinner, lighter, and more feature-rich necessitates highly dense electronic packaging and the widespread use of flexible printed circuits (FPCs) and rigid-flex boards. Hot bar soldering is essential here because it offers the precision required to bond these delicate FPCs, including display connections (COF/COB), camera modules, and battery tabs, to the main logic board without damaging the component or the surrounding plastic substrates.

The growth in this segment is strongly tied to global demand cycles for portable devices and advancements in display technology. Specifically, the widespread adoption of OLED and advanced LCD panels, which often utilize ACF bonding technology for connecting driver ICs to the glass panel, is a major driver. Hot bar machines provide the precise heat and pressure required for the complex chemistry of ACF bonding, ensuring reliable electrical connection and mechanical stability in high-resolution screens. Manufacturers in this domain prioritize high throughput, fully automated systems, and the lowest possible defect rate, leading to heavy investment in multi-head, high-speed Pulse Heat soldering platforms.

Competition in consumer electronics demands continuous innovation in assembly technology. OEMs require equipment that can easily adapt to new materials, finer connection pitches (often below 50 µm), and complex geometries introduced in new product generations. The sheer volume of units produced globally ensures that even marginal improvements in process efficiency or reduction in defect rates translate into significant cost savings, cementing the consumer electronics sector as the primary revenue generator and technology accelerator for the hot bar soldering market.

- Market Share: Largest market share holder.

- Driving Factors: Miniaturization, prevalence of FPCs, display technology advancements (OLED/ACF bonding), and high production volume.

- Key Requirements: High throughput, ultra-fine pitch capability, superior process repeatability, minimal thermal impact.

- Typical Products: Smartphones, wearables, laptops, flat-panel displays, camera modules.

Segmentation Analysis: By Application - Automotive Electronics

The Automotive Electronics sector is projected to exhibit one of the highest CAGRs in the Hot Bar Soldering Machine Market, driven by the seismic shift towards vehicle electrification (EVs) and the integration of Advanced Driver-Assistance Systems (ADAS). Modern vehicles now contain a vast network of electronic control units (ECUs), sensors, cameras, and large display systems, all of which require highly reliable and durable electrical connections. Hot bar soldering is utilized for critical tasks such as bonding flex circuits in complex sensor modules (radar, LiDAR), connecting high-power battery management systems (BMS) components, and attaching display units for infotainment systems and digital clusters.

Reliability is the non-negotiable factor in this segment. Components must withstand extreme conditions—temperature fluctuations, vibration, and humidity—for the entire lifespan of the vehicle. Consequently, automotive manufacturers and their Tier 1 suppliers rely on the precision of Pulse Heat hot bar soldering to ensure the integrity of the intermetallic bond, mitigating risks associated with potential joint failure. The stringent regulatory environment, exemplified by standards like IATF 16949 and AEC-Q qualifications, mandates highly controlled and documented soldering processes, favoring machines equipped with advanced data logging and traceability features.

Furthermore, the trend toward larger, more integrated cockpit displays, often employing curved or uniquely shaped panels, necessitates specialized hot bar bonding for flex interconnects that cannot be handled by standard reflow processes. As autonomous driving capabilities evolve, the electronic complexity and criticality of soldering joints will only increase, securing the automotive sector's role as a key driver for high-end, ruggedized hot bar soldering equipment tailored for long-term operational performance in harsh environments.

- Growth Rate: Expected to show the highest CAGR.

- Driving Factors: Vehicle electrification (EV), increasing electronic content per vehicle, ADAS integration, high reliability demands.

- Key Requirements: Exceptional joint strength, long-term durability, full process traceability, compliance with AEC-Q standards.

- Typical Products: ADAS modules, infotainment displays, battery management systems (BMS), power electronics.

Segmentation Analysis: By Application - Healthcare Devices

The Healthcare Devices segment utilizes Hot Bar Soldering Machines primarily for the assembly of precision, often miniature, electronic components found in medical implants, diagnostic equipment, monitoring systems, and surgical tools. This market segment places extreme emphasis on component miniaturization, biocompatibility, and, most critically, unwavering long-term reliability. Hot bar soldering is essential for securing critical connections within pacemakers, neurostimulators, hearing aids, and specialized surgical camera cables, where joint failure is not acceptable under any circumstances.

The challenges in medical device manufacturing often involve bonding non-standard materials, such as specialized metals or temperature-sensitive polymers, alongside traditional PCBs, within a highly constrained spatial volume. Pulse Heat technology excels here due to its precise thermal management, allowing for bonding with minimal heat spread, which is vital when working near heat-sensitive drug delivery mechanisms or biocompatible coatings. Moreover, the need for repeatability in validation processes (often governed by FDA regulations in key markets) mandates the use of machines that provide exact, verifiable control over every parameter—temperature, pressure, and time.

While the volume of production in the medical sector is significantly lower than in consumer electronics, the high value, complexity, and strict regulatory hurdles associated with medical devices translate into high revenue per machine. Vendors serving this segment must not only provide advanced hardware but also comprehensive documentation and software features that facilitate regulatory compliance and process validation. The increasing shift towards miniaturized, implantable, and connected health devices ensures stable and specialized demand for high-end hot bar soldering solutions.

- Key Characteristics: Focus on ultra-high reliability, miniaturization, and use of specialized materials.

- Driving Factors: Advancements in implantable electronics, sophisticated diagnostic tools, and miniaturized monitoring systems.

- Key Requirements: Absolute reliability, minimal thermal stress, process validation capability, and regulatory compliance (e.g., FDA).

- Typical Products: Pacemakers, hearing aids, diagnostic probes, surgical endoscopes, and wearable health monitors.

Segmentation Analysis: By Application - Aerospace & Defense

The Aerospace & Defense segment demands hot bar soldering for constructing electronic systems used in avionics, missiles, communication satellites, and ruggedized military equipment. Similar to the medical sector, this application area mandates extreme reliability, long operational life, and resistance to harsh environmental stresses such as rapid pressure changes, extreme temperatures, and high G-forces. Hot bar soldering is often employed for high-density interconnections in complex multi-layer boards and for securing specialized sensors and connectors that are vital for mission-critical functions.

The regulatory framework within this sector requires the highest level of material and process control. Components frequently utilize specialized, high-temperature alloys or custom lead-free solders, making the precise temperature profile management offered by Pulse Heat technology indispensable. Furthermore, the limited production runs and often highly customized nature of equipment mean that manufacturers require machines offering flexibility, rapid changeover capabilities, and comprehensive process data archiving to meet rigorous governmental and military specifications.

Technological advancement in this segment is driven by the need for enhanced performance (e.g., higher frequency operation, increased data bandwidth) in smaller, lighter packages, particularly in unmanned aerial vehicles (UAVs) and satellite communication payloads. Hot bar soldering ensures that these high-density assemblies maintain electrical and mechanical integrity throughout their projected lifecycle, securing this application segment as a stable consumer of high-precision, customized hot bar soldering platforms. Vendors who can provide certified, military-specification compliant machinery gain a substantial competitive advantage.

- Key Characteristics: Extreme environmental demands, mission-critical applications, low volume but high value.

- Driving Factors: Modernization of avionics, satellite development, and miniaturization of military communication systems.

- Key Requirements: Adherence to military specifications (e.g., Mil-Spec), resistance to shock and vibration, full material traceability.

- Typical Products: Radar systems, avionics control units, satellite communication modules, military ruggedized displays.

Segmentation Analysis: By Application - Industrial & Others

The Industrial & Others segment encompasses a diverse range of applications, including industrial control systems, large-scale LED lighting assemblies, power electronics for industrial machinery, and specialized sensors for manufacturing automation. While these applications may not demand the ultra-fine pitch capability required by smartphones, they often necessitate high-power handling capacity and exceptional mechanical joint strength, particularly for connecting thick copper terminals or large format components within rugged enclosures.

In industrial settings, the focus is often split between robust Constant Heat systems for standard, high-volume connections (e.g., busbar soldering) and specialized Pulse Heat systems for more complex sensor or control module assemblies. Durability and long-term reliability in electrically noisy or harsh factory environments are key purchasing criteria. Furthermore, the growth of the Industrial Internet of Things (IIoT) requires the secure bonding of robust communication modules and embedded computing platforms, tasks often suited to the controlled pressure and heat of hot bar techniques.

This segment provides stability to the market, as industrial equipment typically has longer replacement cycles but requires durable, reliable machines capable of continuous operation. As factory automation accelerates globally, the demand for precise soldering equipment used in manufacturing robotic components and high-efficiency power supplies will continue to expand. The 'Others' category frequently includes niche applications such as scientific instrumentation and R&D prototyping, which often require highly flexible, low-volume, precision hot bar systems.

- Scope: Industrial control systems, LED manufacturing, power electronics, specialized sensors, and general R&D.

- Driving Factors: Global factory automation, rise of IIoT, and demand for reliable industrial power supplies.

- Key Requirements: High durability, handling of thick terminals or large components, resistance to environmental factors.

- Typical Products: Industrial sensors, LED strips and fixtures, heavy-duty power supplies, automation robotics assemblies.

Market Outlook and Strategic Recommendations

The Hot Bar Soldering Machine Market is poised for sustained expansion, anchored by the unceasing global trend of electronic miniaturization and the subsequent requirement for highly controlled, non-contact soldering methods. Strategic growth will be concentrated in the Pulse Heat segment, driven overwhelmingly by the Asia Pacific manufacturing hubs serving the consumer electronics industry, and by the high-reliability sectors of automotive and medical devices globally. Manufacturers seeking to maintain competitive superiority must prioritize investment in technological convergence, specifically integrating AI for predictive quality assurance and developing machines capable of handling increasingly diverse and complex material combinations, including advanced lead-free alloys and specialized conductive adhesives.

For market players, regional specialization offers a critical pathway to growth. Targeting the APAC region requires emphasis on high throughput, cost-efficiency, and scalability, necessitating robust supply chains for high-volume component production. Conversely, success in North America and Europe requires focusing on customization, compliance documentation, and advanced technical support tailored for mission-critical applications. Furthermore, seizing the opportunity presented by the electric vehicle revolution means developing hot bar solutions that meet stringent automotive reliability standards, specifically for bonding power electronics and large-format display assemblies, representing a high-value diversification strategy.

Key strategic recommendations for vendors involve enhancing proprietary software features to provide superior process control data, traceability, and connectivity (Industry 4.0 integration), which are increasingly demanded across all end-user verticals. Furthermore, investing in materials science research to develop improved hot bar tip geometries and durable tooling capable of handling ultra-fine pitch components is crucial. By aligning product development with the demands for automation and zero-defect manufacturing, market leaders can capitalize on the robust growth projected in both high-volume consumer markets and high-value niche industrial applications through 2033.

The future trajectory is defined by precision engineering. Continuous investment in advanced machine vision, closed-loop thermal control systems, and automated material handling will be necessary to stay ahead of the curve. Collaboration with major electronic component manufacturers and end-users to co-develop solutions that address emerging bonding challenges—such as integrating flexible components into novel substrates—will solidify market positioning and ensure long-term relevance in this technologically demanding sector.

Total Characters Generated (Approximate Check): 29,700 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager