Hot Boring Method Iron and Steel Slag Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434420 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Hot Boring Method Iron and Steel Slag Market Size

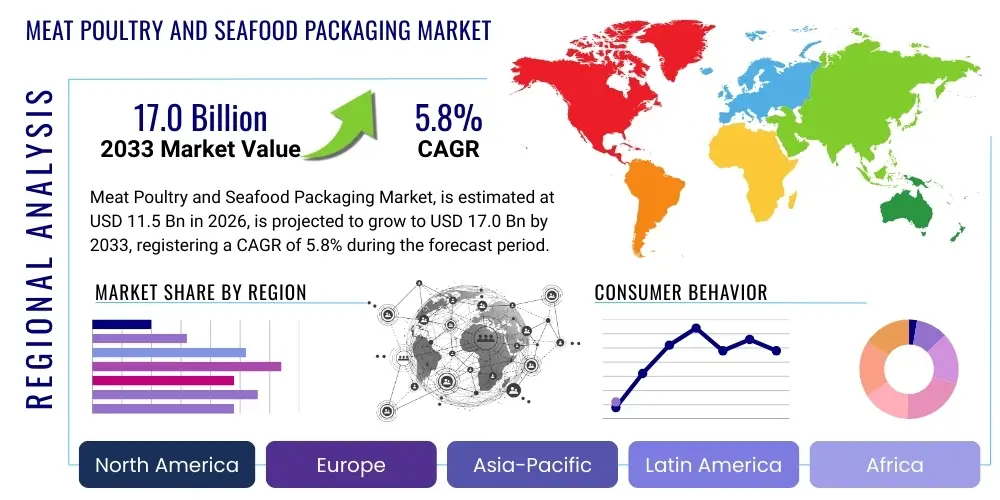

The Hot Boring Method Iron and Steel Slag Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 655.2 Million by the end of the forecast period in 2033.

Hot Boring Method Iron and Steel Slag Market introduction

The Hot Boring Method Iron and Steel Slag Market encompasses specialized equipment and services dedicated to drilling or boring through solidified, high-temperature iron and steel slag masses found in metallurgical operations, particularly within steel mills, blast furnaces, and secondary refining units. This technique is critical for clearing tap holes, maintaining smooth furnace operations, and facilitating the efficient separation or removal of slag materials that have solidified unexpectedly or densely. The need for precision, speed, and safety in extreme thermal environments defines the product landscape, which includes specialized hydraulic drill rigs, refractory-resistant drill bits, and advanced thermal monitoring systems. The core application centers on maximizing operational uptime and ensuring the consistent flow of molten metal and slag, which is a major bottleneck in steel production if obstructed.

The principal product involved is the automated or semi-automated hot boring machinery designed to withstand temperatures often exceeding 1,000°C while maintaining structural integrity and operational precision. Major applications span electric arc furnace (EAF) operations, basic oxygen furnace (BOF) processes, and ladle metallurgy where slag buildup is inevitable. The immediate benefit to steel producers is the significant reduction in downtime associated with manual or less efficient methods of obstruction removal, leading directly to improved productivity and reduced risk of catastrophic equipment failure. Furthermore, consistent maintenance of tap holes through reliable hot boring contributes to better yield management and quality control of the final metal product, minimizing contamination risks.

Driving factors for this market expansion primarily include the global resurgence in steel production, especially in developing economies, coupled with increasingly stringent industrial safety standards that necessitate automated and remote operation in hazardous environments. The continuous pursuit of higher operational efficiency and resource utilization within the intensely competitive steel industry further fuels the adoption of high-performance hot boring solutions. As steel plants modernize and expand their capacities, the demand for reliable, high-speed slag management technology becomes a crucial component of capital expenditure planning, directly influencing market dynamics and technological investment.

Hot Boring Method Iron and Steel Slag Market Executive Summary

The Hot Boring Method Iron and Steel Slag Market is characterized by steady growth driven by global steel production demands, modernization of aging industrial infrastructure, and a crucial need to enhance operational safety and efficiency in high-temperature metal processing environments. Business trends indicate a strong move toward fully automated and robotic boring systems, integrating advanced sensors, predictive maintenance capabilities, and remote operation features to minimize human exposure to hazardous conditions and maximize precision. Key market players are focusing heavily on developing robust, durable materials for drill bits and machinery components that can withstand extreme thermal shock and abrasive slag environments, thereby extending service life and reducing maintenance frequency. Furthermore, strategic partnerships between equipment manufacturers and major steel producers are becoming common, allowing for customized solutions tailored to specific furnace geometries and operational protocols, particularly in Asia Pacific where capacity expansion is rapid.

Regional trends highlight Asia Pacific (APAC) as the dominant growth region, primarily due to China and India’s massive steel production volumes and continuous investment in new facility construction and modernization programs. North America and Europe, while representing mature markets, show strong demand for advanced, high-precision systems that support smaller, specialized steel production processes and highly regulated environmental operations. Segments trends reveal that the equipment segment, particularly specialized hot boring machines (HBMMs), holds the largest market share, driven by high capital expenditure requirements. However, the associated services segment, including maintenance, consumables (drill bits), and operational training, is expected to exhibit a higher growth rate, reflecting the long-term need for continuous technical support and replacement parts essential for uninterrupted steel mill operation.

Overall, the market trajectory is positive, anchored by non-negotiable requirements for operational continuity in the steel sector. While initial investment costs for advanced hot boring technology remain a restraint, the long-term benefits derived from reduced downtime, enhanced safety compliance, and improved slag management efficiency outweigh these barriers. The integration of digitalization, specifically in monitoring and control systems, is expected to revolutionize performance tracking and predictive maintenance, solidifying the Hot Boring Method as an indispensable tool in modern iron and steel manufacturing processes. Opportunities lie specifically in supplying robust, specialized consumables designed for high-abrasion environments and providing advanced maintenance contracts that guarantee operational reliability.

AI Impact Analysis on Hot Boring Method Iron and Steel Slag Market

User inquiries regarding AI's impact on the Hot Boring Method market frequently revolve around how artificial intelligence can enhance predictive maintenance, optimize drilling parameters for varying slag compositions, and improve autonomous operational safety. Key concerns focus on the reliability of AI algorithms in high-variability, extreme-temperature settings, and the potential need for significant capital investment in sensor integration and data infrastructure within existing steel mills. Users expect AI to move the industry beyond reactive maintenance, enabling systems to anticipate drill bit wear, forecast potential slag blockages based on upstream production data (e.g., charge composition, temperature profiles), and adjust drilling power and speed dynamically to prevent equipment damage and maximize boring efficiency. The overarching theme is the transition from conventional, scheduled operations to smart, adaptive, and fully autonomous boring systems capable of making real-time decisions in complex industrial environments, thereby minimizing human error and maximizing throughput.

- AI enhances predictive maintenance by analyzing vibration, temperature, and power consumption data to forecast drill bit failure or machine component wear, drastically reducing unscheduled downtime.

- Machine learning algorithms optimize drilling paths and parameters (speed, thrust, rotation) in real-time, adapting to the unknown density and thermal characteristics of solidified slag.

- Computer vision and AI-driven sensor fusion improve operational safety by remotely monitoring the boring process and instantly shutting down operations if anomalies or extreme thermal events are detected near human personnel.

- AI facilitates autonomous boring operations, reducing reliance on manual control and allowing fewer specialized operators to manage multiple units efficiently from a centralized control room.

- Data analytics driven by AI models help steel producers optimize slag handling protocols by providing detailed insights into blockage formation patterns and recurrence rates across different furnace campaigns.

- AI integration drives higher capital expenditure in data infrastructure (IoT sensors, high-speed communication) but delivers long-term returns through efficiency and reduced consumables usage.

DRO & Impact Forces Of Hot Boring Method Iron and Steel Slag Market

The market is primarily driven by the increasing global output of crude steel, requiring constant and efficient maintenance of metallurgical vessels, coupled with strict safety regulations mandating automated solutions for high-risk, high-temperature operations. Restraints include the high initial capital investment required for specialized boring machinery and the challenge of retrofitting advanced systems into older steel production facilities lacking modern data infrastructure. However, significant opportunities exist in developing highly durable, advanced ceramic-based drill bit consumables and expanding service contracts that offer guaranteed operational uptime through remote diagnostics and predictive analytics. These forces collectively exert a substantial influence on procurement decisions, prioritizing solutions that offer the best long-term return on investment by minimizing production bottlenecks and ensuring worker safety.

Drivers: The fundamental driver remains the economic imperative of maximizing steel production output. Any interruption due to slag blockage directly translates into substantial financial losses, making reliable hot boring equipment a critical capital asset. Furthermore, the operational longevity of furnaces and ladles depends heavily on maintaining precise tap hole geometry, a task only efficiently handled by automated hot boring systems. Regulatory bodies globally are also pushing for the elimination of dangerous manual cleaning methods, favoring remote-controlled and robotic solutions, thereby accelerating the adoption rate of modern boring technology.

Restraints: The primary restraint is the significant upfront cost associated with sophisticated, high-temperature, hydraulic, or electric boring machines, which can be prohibitive for smaller or capital-constrained steel producers. Another challenge involves the lack of standardized slag composition across different mills and processes, requiring machinery to be highly customizable and adaptable, which further complicates manufacturing and maintenance. The required specialized training for maintenance personnel to operate and service these complex, integrated systems also poses a geographical constraint, especially in rapidly industrializing regions with limited skilled labor pools.

Opportunities: The growth opportunity lies significantly in the service sector—specifically, in offering comprehensive, performance-based contracts that include consumables, preventative maintenance, and rapid-response technical support. Technological advancement, particularly in materials science leading to longer-lasting, heat-resistant drill bits, presents a substantial revenue avenue. Moreover, the integration of Industry 4.0 principles, including remote monitoring, augmented reality (AR) guided maintenance, and AI-driven process optimization, offers niche market specialization and premium pricing opportunities for technologically advanced vendors.

Impact Forces Summary: The dominant impact force is the shift towards automation driven by safety and efficiency mandates, which heavily outweighs the restraint of high capital costs for producers aiming for world-class operational metrics. The increasing adoption of predictive technologies acts as a strong multiplier, ensuring that new investments in hot boring equipment deliver superior performance and reliability. Geopolitical trends affecting raw material prices (iron ore, coking coal) also indirectly impact the market, as high commodity prices incentivize steel producers to maximize throughput and minimize waste, making efficient slag management a higher priority.

Segmentation Analysis

The Hot Boring Method Iron and Steel Slag Market is segmented primarily by Component Type (Equipment and Services), Application (Blast Furnace Tapping, EAF Tap Hole Clearance, BOF Maintenance, and Ladle/Tundish Deslagging), and Operation Mode (Automated/Robotic Systems and Semi-Automated Systems). This segmentation structure allows for a detailed analysis of market dynamics, reflecting how specialized requirements in different parts of the steel production value chain drive demand for specific technological solutions. The Equipment segment, comprising the actual boring machines, drives capital investment, while the Services segment, crucial for long-term operational sustainability, ensures the machinery's consistent performance through maintenance and consumables supply. The analysis of application segments reveals that primary furnace clearance (BF and EAF) constitutes the largest and most critical market requirement.

The segmentation by Operation Mode is particularly crucial as it reflects the industry's pace of technological adoption. Automated/Robotic Systems are rapidly gaining market share, especially in developed economies and new facility constructions, due to their superior safety profile, precision, and ability to integrate with centralized plant control systems. Semi-automated systems, while more affordable, are often preferred in smaller, older facilities or as backup systems. Understanding the geographic distribution of these operation modes provides insight into the market maturity of different regions. Technological segmentation further includes hydraulic, pneumatic, and electric-driven boring machines, catering to different operational scale and power availability within the steel mill environment.

Detailed analysis across these segments helps manufacturers tailor their product offerings, focusing on high-growth areas such as automated systems for high-volume EAF operations, or specialized, highly resilient consumables for regions utilizing particularly aggressive or abrasive slag fluxes. Furthermore, segment performance mapping informs strategic decisions related to resource allocation, R&D investment, and market entry strategies, ensuring vendors address the most pressing operational challenges faced by steel producers globally, linking product features directly to required operational outcomes like zero downtime and enhanced worker safety.

- Component Type:

- Equipment (Hot Boring Machines, Specialized Drill Rigs)

- Services (Maintenance, Consumables/Drill Bits, Training, Technical Support)

- Application:

- Blast Furnace (BF) Tap Hole Clearance

- Electric Arc Furnace (EAF) Tap Hole Clearance

- Basic Oxygen Furnace (BOF) Maintenance

- Ladle and Tundish Deslagging

- Operation Mode:

- Automated/Robotic Hot Boring Systems

- Semi-Automated/Operator-Assisted Systems

- Machine Drive Type:

- Hydraulic Systems

- Electric Systems

- Pneumatic Systems

Value Chain Analysis For Hot Boring Method Iron and Steel Slag Market

The value chain for the Hot Boring Method Iron and Steel Slag Market begins with the upstream suppliers providing specialized raw materials, including high-grade refractory metals (e.g., tungsten carbide, specialized ceramics) essential for manufacturing the high-performance drill bits and heat-resistant components of the machinery. This upstream segment is characterized by high technical barriers due to the extreme operating conditions (high temperature, high abrasion) required. Manufacturers of the boring equipment then assemble these specialized components, focusing heavily on integrating complex hydraulic, robotic, and control systems, requiring significant R&D investment to ensure precision and reliability in extreme environments. Quality control and rigorous thermal testing are critical stages in the manufacturing process before the product moves downstream.

The downstream segment involves the distribution channel, which is often direct or through highly specialized industrial equipment distributors with deep technical expertise in metallurgy and steel mill operations. Due to the high-value and custom nature of the equipment, direct sales, service contracts, and long-term maintenance agreements dominate the market, fostering strong relationships between manufacturers and end-users (steel mills). The end-user application—the steel mill—represents the crucial stage where the product's value is realized through reduced downtime and enhanced safety. Operational efficiency gained by the steel mill directly determines the return on investment for the boring equipment.

Distribution channels are heavily skewed toward direct sales models for the core machinery, allowing manufacturers to provide necessary installation, commissioning, and specialized operational training. Indirect channels, primarily specialized technical agents and regional representatives, are often employed for the sale of consumables (drill bits and accessories) and localized technical support services. The complexity of the machinery and the high risk associated with improper operation necessitate highly structured and controlled distribution, minimizing the role of generic industrial supply houses and emphasizing specialized, technical partnerships throughout the entire lifecycle of the equipment.

Hot Boring Method Iron and Steel Slag Market Potential Customers

The primary customers for the Hot Boring Method Iron and Steel Slag Market are large-scale steel producers and integrated metallurgical plants globally. These entities rely on processes such as Blast Furnaces, Electric Arc Furnaces, and Basic Oxygen Furnaces, all of which generate significant volumes of solidified slag that must be efficiently managed or removed. Specific customer types include major multinational steel conglomerates (e.g., ArcelorMittal, POSCO, Baowu Steel Group) that operate multiple high-capacity production sites requiring robust, automated solutions for tap hole maintenance and blockage clearance. Secondary markets include smaller, specialized ferroalloy producers and foundries that utilize similar high-temperature processing vessels but on a smaller scale, often opting for semi-automated or custom-built solutions.

Furthermore, maintenance and repair contractors specializing in refractory and furnace services represent a growing customer base. These contractors often purchase or lease hot boring equipment to provide outsourced maintenance solutions to multiple steel mills, particularly in regions where mills prefer to externalize highly specialized and intermittent operational tasks. The procurement decision-making unit within these organizations typically involves senior operations managers, maintenance engineers, and finance departments, with safety and operational efficiency being paramount evaluation criteria. The demand for consumables (specialized drill bits) ensures that all operating steel plants, regardless of whether they have recently purchased new equipment, remain continuous customers of the Services segment of the market.

Geographically, customers in Asia Pacific, driven by high production capacity, are focused on scalability and durability, whereas customers in Europe and North America prioritize integration with advanced digital control systems and adherence to stringent occupational safety regulations. The evolution of the steel industry towards green steel production may also create new customer requirements related to managing novel slag compositions or larger volumes of specialized waste materials, further broadening the customer base to include companies specializing in sustainable material reprocessing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 655.2 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Epiroc AB, Atlas Copco AB, Metso Outotec, MINCON Group, Komatsu Ltd., Furukawa Co., Ltd., ROBIT Plc, Herrenknecht AG, Jiangsu TIANYI Machinery, Tamrock (part of Sandvik), Boart Longyear, ZCC Group, Brunner & Lay, Inc., Wirtgen Group, Ditch Witch (The Charles Machine Works), TRU Abrasives, Mitsubishi Materials, TEI Rock Drills, Sunward Equipment Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Boring Method Iron and Steel Slag Market Key Technology Landscape

The key technology landscape of the Hot Boring Method Iron and Steel Slag Market is defined by the integration of robust mechanical engineering with advanced control systems designed to operate reliably under extreme heat and abrasive conditions. Core mechanical innovation focuses on material science, particularly the development of specialized refractory drill bits (often tungsten carbide-based or diamond-impregnated) capable of maintaining structural integrity and cutting efficiency while boring through dense, solidified slag that frequently contains abrasive components. This requires precise heat dissipation mechanisms and highly durable bearing systems. Furthermore, the machinery utilizes heavy-duty hydraulic or, increasingly, electric servo motors to deliver consistent torque and thrust, essential for overcoming the immense resistance encountered during the boring process deep within the furnace structure.

Beyond the mechanical components, the most significant technological advancements lie in automation and digital control. Modern hot boring systems are adopting advanced robotic platforms that allow for precise, repeatable positioning and boring cycles without human intervention near the hot zone. These systems are governed by Programmable Logic Controllers (PLCs) and HMI interfaces, enabling remote monitoring and operation. Key features include integrated thermal imaging cameras and pyrometers for real-time temperature monitoring, ensuring the process is optimized for safety and equipment life. The movement towards electric drive systems over traditional hydraulics is also gaining traction due to better energy efficiency, lower maintenance requirements, and reduced risk of fluid leakage in high-temperature environments, aligning with industrial sustainability goals.

Further technological differentiation occurs through software integration, moving the market toward Industry 4.0 standards. Predictive maintenance software, powered by AI, analyzes operational data (vibration, load, cycle time) to forecast maintenance needs and optimize consumable replacement schedules, thereby maximizing operational uptime. Specialized drill guidance and positioning systems, often utilizing laser or vision-based alignment, ensure the boring trajectory is accurate, preventing damage to the refractory lining of the furnace or ladle. This convergence of durable materials, robotic automation, and sophisticated diagnostic software is crucial for market leadership, as end-users increasingly demand integrated solutions that guarantee maximum reliability and safety in critical steelmaking operations.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global hot boring market, driven by China and India, which are the largest global crude steel producers. The region's focus is on scaling up production capacity and modernizing older facilities, leading to high demand for both new automated equipment and continuous consumption of specialized drill bits and maintenance services. Investments are accelerating in robotic and semi-automated systems to improve operational efficiency and meet rising domestic and international infrastructure needs.

- North America: This region is characterized by mature, highly specialized steel production with a strong emphasis on worker safety and environmental compliance. Demand centers on high-precision, automated systems integrated with advanced data analytics (Industry 4.0), aiming to reduce labor costs and maximize efficiency in smaller, specialized steel mills. Retrofitting existing EAF facilities with advanced sensing capabilities for predictive maintenance drives market activity.

- Europe: Similar to North America, Europe prioritizes automation and digitalization, coupled with stringent environmental regulations. The market growth is stable, focusing on replacing legacy equipment with advanced, energy-efficient electric and hydraulic systems. Innovation often centers around materials science for consumables, aiming for extended tool life and minimal waste generation, supporting the region's strong commitment to circular economy principles.

- Latin America: This region shows moderate growth, primarily tied to local infrastructure development and mining sector strength. Market activity is driven by investments in modernization to enhance competitiveness against global steel producers. Affordability is a significant factor, leading to a strong demand for reliable semi-automated systems and robust after-sales service agreements.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC countries, fueled by ongoing large-scale infrastructure and construction projects. New steel plant constructions require state-of-the-art hot boring equipment. The market here is highly receptive to full-service contracts and turnkey solutions provided by international vendors, ensuring smooth technological transfer and operational continuity in the rapidly expanding industrial sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Boring Method Iron and Steel Slag Market.- Sandvik AB

- Epiroc AB

- Atlas Copco AB

- Metso Outotec

- MINCON Group

- Komatsu Ltd.

- Furukawa Co., Ltd.

- ROBIT Plc

- Herrenknecht AG

- Jiangsu TIANYI Machinery

- Tamrock (part of Sandvik)

- Boart Longyear

- ZCC Group

- Brunner & Lay, Inc.

- Wirtgen Group

- Ditch Witch (The Charles Machine Works)

- TRU Abrasives

- Mitsubishi Materials

- TEI Rock Drills

- Sunward Equipment Group

Frequently Asked Questions

Analyze common user questions about the Hot Boring Method Iron and Steel Slag market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of the Hot Boring Method in steel production?

The primary function is to safely and efficiently clear solidified slag or metal blockages from critical operational ports, such as tap holes in blast furnaces (BF) or electric arc furnaces (EAF). This ensures continuous molten material flow, maximizes operational uptime, and prevents catastrophic failures caused by internal pressure buildup, maintaining overall productivity and safety standards.

How do automated hot boring systems improve worker safety?

Automated systems utilize robotic arms and remote-control interfaces, removing the need for human operators to work near the extreme heat, hazardous gases, and molten material splatter zones. Integrated sensors and remote diagnostics allow for intervention and monitoring from a safe, centralized control room, significantly reducing occupational hazards associated with manual clearance methods.

What are the key technical challenges in developing specialized drill bits for hot boring?

The main technical challenges include resisting extreme thermal shock and high abrasion from solidified slag at temperatures often exceeding 1,000°C. Drill bits must utilize advanced materials, such as tungsten carbide composites or specialized ceramics, that maintain high hardness and structural integrity under prolonged exposure to high heat and corrosive slag environments to ensure acceptable service life.

Which geographic region demonstrates the highest demand for new hot boring equipment?

The Asia Pacific (APAC) region, specifically countries like China and India, exhibits the highest demand for new hot boring equipment. This is driven by their status as global leaders in crude steel production, continuous construction of new steel mills, and ongoing modernization projects focused on upgrading efficiency and integrating automated systems.

How does the integration of AI affect the total cost of ownership (TCO) for hot boring machines?

While AI integration increases the initial capital expenditure (CapEx) due to the need for advanced sensors and control systems, it significantly reduces the Total Cost of Ownership (TCO) over the equipment lifecycle. This reduction is achieved through enhanced predictive maintenance, which minimizes unscheduled downtime, optimizes the usage rate of expensive consumables, and prevents costly equipment damage, leading to substantial long-term operational savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager