Hot Foil Stamping Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434089 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hot Foil Stamping Machine Market Size

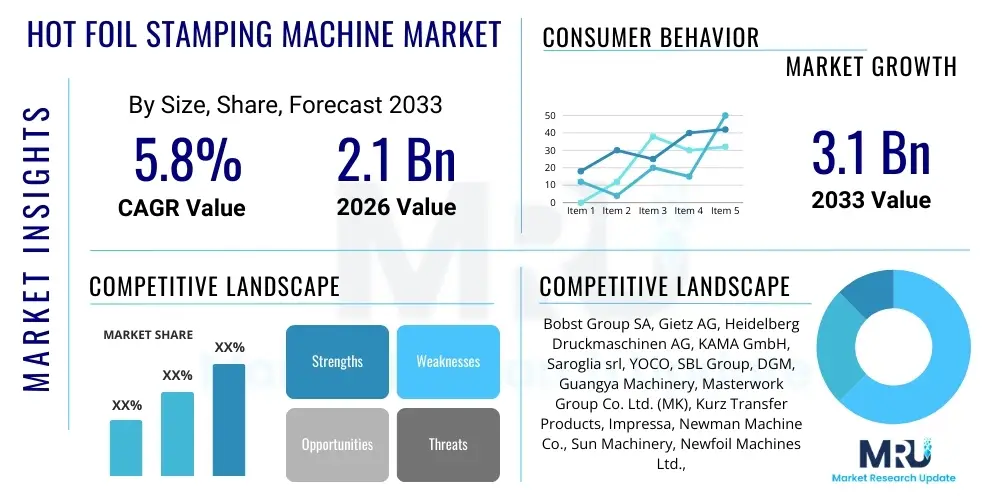

The Hot Foil Stamping Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Hot Foil Stamping Machine Market introduction

The Hot Foil Stamping Machine Market encompasses equipment designed to apply metallic or pigmented foil onto various substrates, including paper, cardboard, plastics, and leather, using heat and pressure. This machinery is critical for enhancing product aesthetics, providing premium visual appeal, and incorporating security features such as holograms or specialized security foils. The fundamental mechanism involves a heated die pressing the foil against the substrate, transferring the decorative layer only to the area defined by the die's design. These machines range from small, manually operated desktop units used for specialized craft or prototyping to large, high-speed automated systems integrated into sophisticated printing and packaging lines.

Major applications for hot foil stamping technology span across several high-value industries. The packaging sector—especially cosmetics, spirits, confectionery, and high-end pharmaceuticals—utilizes stamping extensively to achieve shelf differentiation and brand luxury. Furthermore, the graphics arts industry employs these machines for producing luxury stationery, business cards, book covers, and certificates. The versatility of hot foil stamping, allowing for intricate detail and vibrant metallic finishes unavailable through conventional printing methods, solidifies its indispensable role in premium finishing processes. This demand is intrinsically linked to rising consumer preferences for high-quality, aesthetically pleasing products that convey a sense of exclusivity.

The market is currently being driven by global economic recovery, coupled with rapid urbanization in emerging economies, which translates into increased consumption of packaged goods and luxury items. Technological advancements, particularly in the integration of servo motors, automated registration systems, and digital controls, have significantly improved the efficiency, precision, and throughput of modern hot foil stamping machines. These enhancements enable manufacturers to handle complex designs and larger production volumes with reduced material waste and setup times, further driving adoption across various manufacturing verticals seeking operational excellence and superior product finishing.

Hot Foil Stamping Machine Market Executive Summary

The Hot Foil Stamping Machine Market is characterized by robust technological development centered on automation, integration with digital workflows, and enhanced energy efficiency. Current business trends indicate a strong move toward high-specification automatic machines capable of integrating processes like die-cutting, embossing, and stamping in a single pass, appealing heavily to large-scale packaging converters and commercial printers. Sustainability is also emerging as a pivotal factor, with key players focusing on developing equipment compatible with eco-friendly foils and minimizing energy consumption during the heating process. Mergers and acquisitions remain strategic levers for market consolidation, allowing dominant firms to expand their geographical footprint and incorporate specialized technologies, particularly in flexible packaging finishing.

Geographically, the Asia Pacific region (APAC) is projected to dominate market growth, driven primarily by the massive expansion of the consumer goods, electronics, and food and beverage packaging industries in China, India, and Southeast Asian nations. North America and Europe, while mature markets, emphasize the replacement and upgrade cycle, focusing on acquiring advanced, highly automated machinery that complies with stringent labor and safety regulations, prioritizing precision and speed for short-run, high-mix production demands. Regional trends also show a segmentation of demand, with developing regions prioritizing cost-effective semi-automatic solutions, while developed regions invest heavily in fully integrated, Industry 4.0-compatible systems.

Segment trends reveal that the Automatic Hot Foil Stamping Machine segment maintains the largest market share and highest growth rate due to its superiority in mass production and consistency. The application segment growth is robustly led by the Packaging industry, particularly the demand for luxury packaging for cosmetics and premium alcoholic beverages, where metallic finishes are essential branding elements. Furthermore, the adoption of specialized machines for stamping non-traditional substrates like leather goods and advanced plastics is creating lucrative niche opportunities. The continuous innovation in foil materials, including holographic and highly refractive options, further stimulates demand for sophisticated stamping equipment capable of handling complex registration requirements accurately.

AI Impact Analysis on Hot Foil Stamping Machine Market

User queries regarding AI in the hot foil stamping sector primarily revolve around optimizing operational efficiency, predicting maintenance needs, and improving the precision of complex stamping jobs. Key themes observed include: the potential for AI-driven quality control systems to detect micro-defects instantaneously; the use of machine learning algorithms to optimize die temperature, pressure, and dwell time based on real-time substrate variance; and the integration of predictive maintenance scheduling to reduce unplanned downtime. Users are concerned about the high initial investment required for retrofitting older equipment with AI capabilities but are highly optimistic about AI’s role in minimizing material waste and enhancing overall throughput and registration accuracy, especially for multi-color or complex holographic foils.

The application of Artificial Intelligence within hot foil stamping machines is fundamentally transformative, moving the process from rigid settings to adaptive manufacturing. AI algorithms can process vast amounts of data collected from embedded sensors—monitoring vibration, heat distribution, web tension, and stamping pressure—to dynamically adjust machine parameters. This dynamic optimization ensures consistent quality across large production runs, significantly reducing the impact of environmental variables such as humidity or temperature fluctuations on the stamping outcome. For highly detailed or security-focused applications, AI-powered vision systems are paramount in achieving zero-defect production, classifying and automatically rejecting faulty products faster and more accurately than human operators.

Furthermore, AI plays a crucial role in predictive modeling for consumables. By analyzing historical usage patterns, wear rates of stamping dies, and foil consumption relative to the job complexity, AI systems can accurately forecast maintenance requirements and inventory needs. This capability translates directly into higher uptime and streamlined supply chain management. While the physical stamping process remains electromechanical, the integration of deep learning and neural networks provides the cognitive layer necessary for achieving genuine Industry 4.0 standards, making stamping operations smarter, self-optimizing, and fully integrated into enterprise resource planning (ERP) systems.

- AI-driven Quality Control: Real-time defect detection and automated rejection systems.

- Predictive Maintenance: Forecasting equipment failure (dies, heaters) based on sensor data.

- Parameter Optimization: Machine learning adjusting pressure, temperature, and speed based on substrate input.

- Waste Reduction: Algorithms minimizing foil consumption and registration errors.

- Workflow Integration: Seamless data flow between the machine and MES/ERP systems for job scheduling.

DRO & Impact Forces Of Hot Foil Stamping Machine Market

The market dynamics are shaped by a strong push from premiumization trends in consumer sectors (Drivers), balanced by high capital costs and the complexity of integrating advanced machinery (Restraints). Opportunities are primarily concentrated in the digital enhancement sector, specifically digital foil stamping and hybrid printing solutions, which offer greater flexibility for short-run customization. The key impact forces dictating market movement include the relentless demand for aesthetically superior packaging, the increasing adoption of sustainable stamping materials, and the rapid pace of automation across manufacturing industries globally. The combined effect of these forces suggests a sustained investment cycle in high-precision, automatic equipment.

Drivers: The dominant driver is the escalating global demand for luxury and specialty packaging, particularly in the cosmetics, alcoholic beverages, and pharmaceutical sectors, where hot foil stamping is essential for brand differentiation and anti-counterfeiting measures. Additionally, the continuous innovation in foil technology, introducing new textures, colors, and holographic effects, keeps the hot foil stamping process relevant and highly desired. The efficiency gains delivered by fully automated machines, including faster setup times (quick-change dies), higher running speeds, and reduced labor requirements, further compel large converters to upgrade their equipment base.

Restraints: Significant restraints include the substantial initial capital investment required for purchasing high-end automatic stamping machines, making entry challenging for smaller printing houses. Furthermore, the perceived environmental impact of traditional metallic foils and the complexity associated with recycling foil-stamped substrates pose regulatory and consumer perception challenges. The market also faces technical restraints related to the difficulty in achieving perfect registration on highly sensitive or flexible materials at very high speeds, demanding highly skilled technicians for operation and maintenance.

Opportunities: Opportunities lie prominently in the development and commercialization of digital foil stamping technology, which eliminates the need for physical dies, reducing setup costs and enabling cost-effective personalization and variable data printing for short runs. Expanding applications into niche areas, such as security printing (e.g., banknotes, government documents), textile finishing, and automotive interior components, offers substantial growth avenues. Furthermore, manufacturers are focusing on designing machines specifically tailored for handling sustainable and bio-degradable foils, aligning with global green manufacturing initiatives.

Segmentation Analysis

The Hot Foil Stamping Machine Market is comprehensively segmented based on machine type (level of automation), the substrate material processed, and the specific application sector. This structured segmentation is vital for understanding diverse end-user requirements and market saturation across different industrial settings. The Type segmentation (Manual, Semi-Automatic, Automatic) directly correlates with production volume needs and investment capacity, highlighting the shift towards higher automation for efficiency. The Application segmentation (Packaging, Printing, Others) reflects the diverse end-market demand, with packaging consistently being the dominant and fastest-growing segment globally due to the intense focus on aesthetic appeal in retail sectors.

Analyzing the segmentation reveals that Automatic Hot Foil Stamping Machines are expected to witness the highest CAGR, predominantly driven by Tier 1 and Tier 2 packaging companies requiring continuous, high-volume output with minimal human intervention. Geographically, segmentation analysis emphasizes the maturity of regional markets, where Europe and North America focus on specialized, high-precision equipment (e.g., for security printing and premium luxury packaging), while the APAC region drives volume growth in standard automatic and semi-automatic categories for general consumer packaging needs. The segmentation by Substrate also highlights emerging growth areas, particularly in flexible plastics and sophisticated synthetic materials.

- By Type: Manual, Semi-Automatic, Automatic

- By Application: Packaging, Printing & Graphics, Textile & Leather Goods, Security & Authentication, Others

- By Substrate: Paper & Cardboard, Plastics (Rigid and Flexible), Leather, Synthetic Materials

- By Process: Flatbed Stamping, Rotary Stamping, Cylinder Stamping

Value Chain Analysis For Hot Foil Stamping Machine Market

The value chain for the Hot Foil Stamping Machine Market begins with upstream activities, dominated by specialized component manufacturers supplying critical parts such as precision heating elements, servo motors, hydraulic or pneumatic systems, and advanced computerized numerical control (CNC) systems. Key raw material suppliers also provide specialized metals and alloys for producing high-durability stamping dies. The upstream success hinges on access to reliable, high-precision components that ensure the consistent pressure and temperature required for quality stamping. Relationship management between machine manufacturers and component suppliers is critical for incorporating the latest technology and maintaining quality control.

Midstream activities involve the machine manufacturing process itself, including R&D, design, assembly, and rigorous quality testing. Machine builders often specialize in a particular automation level (e.g., high-speed rotary presses vs. versatile flatbed systems) or application (e.g., narrow web label stamping vs. wide format sheet-fed). Distribution channels are diverse, involving both direct sales models for large, custom-built automatic machines and indirect sales through specialized regional distributors or agents who provide local maintenance support and consumables. The indirect channel is particularly crucial in fragmented markets where local expertise in installation and servicing is paramount.

Downstream activities focus on the end-users—the commercial printers, packaging converters, and manufacturing facilities utilizing the machines. Post-sale services, including installation, operator training, maintenance contracts, and the supply of ongoing consumables (foils, dies, counter dies), represent a significant revenue stream. Customer engagement and technical support are critical for maximizing machine uptime and ensuring high-quality output, thereby solidifying brand loyalty within the highly technical printing and finishing industry. The downstream interaction also drives future innovation, as end-user feedback regarding efficiency and substrate compatibility often dictates next-generation machine design.

Hot Foil Stamping Machine Market Potential Customers

The primary consumers of hot foil stamping machines are large-scale commercial printing firms and specialized packaging converters that serve industries demanding high-quality, decorative finishes. This includes converters focusing on folding cartons, rigid boxes, and flexible packaging used predominantly by the cosmetics, spirits, and tobacco sectors. These businesses require high-throughput, automatic machines capable of integrating seamlessly with their existing printing and finishing lines, emphasizing speed, precision registration, and reliability for large production volumes.

A secondary, yet rapidly growing, customer base consists of small to medium enterprises (SMEs) specializing in boutique packaging, custom stationery, and personalized leather goods. These customers often opt for manual or semi-automatic machines due to lower initial capital expenditure and the need for versatility across shorter, highly customized runs. Additionally, manufacturers in the textile and footwear industries, seeking to brand or embellish products like synthetic leather, apparel tags, or specialty fabrics, represent niche, high-value end-users requiring specialized flatbed or clam-shell style presses.

Furthermore, security printing operations—including government agencies, passport manufacturers, and organizations producing authentication labels—constitute a critical segment. These users demand the highest levels of precision and consistency, often employing hot foil stamping to apply holographic security features that are nearly impossible to replicate. Their purchasing decisions are highly sensitive to machine certification, anti-counterfeiting capabilities, and long-term service agreements, ensuring the integrity of high-security applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst Group SA, Gietz AG, Heidelberg Druckmaschinen AG, KAMA GmbH, Saroglia srl, YOCO, SBL Group, DGM, Guangya Machinery, Masterwork Group Co. Ltd. (MK), Kurz Transfer Products, Impressa, Newman Machine Co., Sun Machinery, Newfoil Machines Ltd., IIJIMA MFG. CO., LTD., Wenzhou Keguang Machinery Co., Ltd., ZHENGRUN PACKAGING MACHINERY CO., LTD. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Foil Stamping Machine Market Key Technology Landscape

The technological landscape of the Hot Foil Stamping Machine Market is primarily focused on enhancing precision, automation, and operational integration. Modern machines heavily utilize servo motor technology for precise web feeding and die movement, ensuring unparalleled registration accuracy, which is critical when applying foil to pre-printed materials, especially in multi-pass jobs. Computerized Numerical Control (CNC) systems govern pressure, temperature, and cycle time with micro-level adjustments, dramatically reducing setup waste and improving repeatability. Furthermore, innovations in quick-change tooling systems, such as magnetic cylinders and clamping mechanisms, minimize downtime associated with job changeovers, making short-run jobs economically viable.

A significant trend driving technological investment is the integration of digital finishing solutions. While traditional hot foil stamping uses physical dies, hybrid solutions now exist that combine conventional stamping with digital embellishment technologies. Digital foiling, using toner or inkjet-based systems to create a raised texture that accepts foil, offers customization and variable data printing capabilities without the cost and time associated with die manufacturing. This technological convergence addresses the growing market need for personalized packaging and shorter turnaround times, challenging the dominance of purely analogue stamping processes, particularly for highly variable commercial printing applications.

Moreover, sensor technology and closed-loop feedback systems are becoming standard features in high-end machinery. Infrared and thermal sensors continuously monitor the temperature profile of the die and substrate, ensuring optimal adhesion and preventing foil cracking or uneven transfer. Vision inspection systems, often enhanced by AI as noted previously, are integrated inline to check registration and detect flaws instantly. This technological ecosystem moves the hot foil stamping process closer to a zero-defect, highly efficient operation, requiring advanced software interfaces that allow operators to manage complex jobs with greater ease and predictive insight into material behavior.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of volume growth, driven by massive manufacturing bases in China and India. The rapid expansion of the middle class and subsequent explosion in consumption of packaged food, electronics, and cosmetics fuels demand for both semi-automatic and high-speed automatic machines. Low labor costs initially favored manual machines, but increasing quality demands and urbanization-driven labor cost hikes are now accelerating the adoption of fully automated systems across the region.

- North America: This region is characterized by high demand for quality, quick turnaround times, and strict regulatory compliance. The focus here is on purchasing replacement machinery with state-of-the-art automation, high throughput, and seamless integration with existing Industry 4.0 infrastructure. Key applications include pharmaceutical packaging, high-end retail gift cards, and specialized labels, prioritizing efficiency and minimizing material waste.

- Europe: Europe represents a mature market known for high aesthetic standards, particularly in luxury goods (fashion, perfumes, spirits) and security printing. Demand is concentrated on high-precision, environmentally compliant machines. European manufacturers are leaders in developing hybrid and digital embellishment technologies, ensuring the stamping process remains competitive against other finishing methods while adhering to stringent sustainability goals.

- Latin America (LATAM): Market growth in LATAM is variable, tied closely to the economic stability of major economies like Brazil and Mexico. There is a balanced demand for semi-automatic cost-effective solutions for local businesses and specific high-end automatic machines for international packaging subsidiaries. Expansion of the consumer durable goods sector is a primary demand driver.

- Middle East and Africa (MEA): The MEA market shows promising growth, fueled by construction boom and rising disposable incomes leading to increased luxury consumption, particularly in the UAE and Saudi Arabia. Investment is heavily directed towards packaging machinery for domestic food production and regional cosmetic branding, often sourcing equipment that offers robust performance in challenging climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Foil Stamping Machine Market.- Bobst Group SA

- Gietz AG

- Heidelberg Druckmaschinen AG

- KAMA GmbH

- Saroglia srl

- YOCO

- SBL Group

- DGM

- Guangya Machinery

- Masterwork Group Co. Ltd. (MK)

- Kurz Transfer Products

- Impressa

- Newman Machine Co.

- Sun Machinery

- Newfoil Machines Ltd.

- IIJIMA MFG. CO., LTD.

- Wenzhou Keguang Machinery Co., Ltd.

- ZHENGRUN PACKAGING MACHINERY CO., LTD.

- Cerutti Packaging Equipment S.p.A.

- Manroland Sheetfed GmbH

Frequently Asked Questions

Analyze common user questions about the Hot Foil Stamping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hot foil stamping and cold foil stamping?

Hot foil stamping utilizes a heated die and pressure to transfer metallic or pigmented foil onto a substrate, offering high gloss and deep embossing effects. Cold foil stamping uses adhesive (UV-cured) to adhere the foil without heat or dies, often used in inline printing processes for flexibility, though it typically offers less dimensionality and gloss compared to the hot stamping method.

How does automation impact the profitability of hot foil stamping operations?

Automation, particularly through the use of automatic sheet-fed or rotary machines, drastically improves profitability by reducing labor costs, ensuring superior registration accuracy, and increasing production speed. Automated quick-change tooling systems minimize non-productive setup time, making shorter, high-mix job runs economically feasible for converters.

Which end-user segment drives the highest demand for hot foil stamping machines?

The Packaging industry, specifically the cosmetics, spirits, and high-end food and beverage sectors, drives the highest demand. These industries rely heavily on metallic finishes and premium embellishments to enhance brand value, create shelf appeal, and incorporate necessary anti-counterfeiting features, necessitating continuous investment in high-performance stamping equipment.

Are digital foiling technologies replacing traditional hot foil stamping?

Digital foiling is not entirely replacing traditional hot stamping but is serving as a complementary technology, particularly for short-run customization, prototyping, and variable data applications where the cost and time of creating a physical die are prohibitive. Traditional hot stamping remains essential for maximum gloss, deep embossing, and high-volume, continuous production runs.

What are the key technical specifications to consider when purchasing a new hot foil stamping machine?

Key technical considerations include the maximum stamping area and material thickness compatibility, the speed (impressions per hour), the precision of the registration system (crucial for pre-printed stock), the type of automation (manual, semi-automatic, or automatic), and the capacity for integrated finishing processes such as die-cutting or embossing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager