Hot Forging Press Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433174 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hot Forging Press Machine Market Size

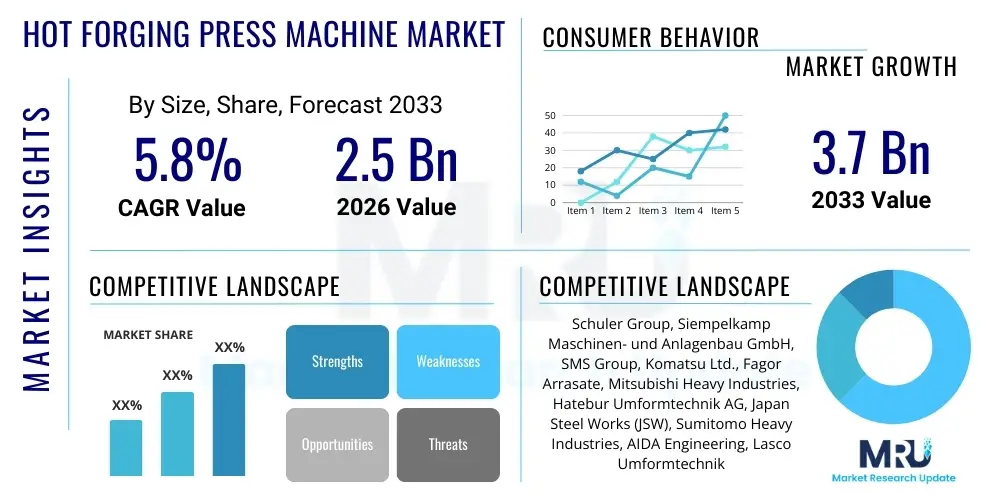

The Hot Forging Press Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033.

Hot Forging Press Machine Market introduction

The Hot Forging Press Machine Market encompasses the manufacturing and distribution of specialized industrial machinery designed to shape metals above their recrystallization temperature. These machines utilize immense pressure and controlled temperature to produce components with superior mechanical properties, high strength, and excellent structural integrity, minimizing internal defects such as porosity. Hot forging is essential in industries requiring high-performance, critical components, primarily due to its ability to yield complex shapes efficiently and align grain flow for maximum resistance to fatigue and impact stresses. The fundamental mechanism involves the controlled deformation of billets between dies under high energy, driven by mechanical, hydraulic, or screw press systems, each offering distinct advantages in terms of speed, force control, and energy consumption.

The primary applications driving the demand for hot forging presses are the automotive, aerospace, and general machinery sectors. In the automotive industry, these presses are crucial for producing drivetrain components, crankshafts, connecting rods, and gear blanks, where reliability and weight reduction are paramount. Aerospace relies on hot forging for high-stress parts like turbine blades and structural members made from specialized alloys (e.g., titanium, nickel). The inherent benefits of hot forging, including material savings, enhanced material properties, and high production rates, cement the position of these machines as indispensable capital goods. Furthermore, advancements in automation and digitalization are making modern forging presses faster, more precise, and significantly energy efficient, expanding their utility across diverse manufacturing environments requiring large-volume, high-quality metallic components.

Market growth is predominantly propelled by rapid industrialization in emerging economies, particularly the escalating production volumes in the global automotive sector, coupled with stringent safety and quality standards demanding forged parts over cast alternatives. The continuous investment in infrastructure and defense sectors also stimulates demand for large-capacity forging presses. Key driving factors include the transition towards lightweight materials processing (e.g., aluminum and high-strength steels) to meet stricter fuel efficiency and emissions regulations, requiring presses capable of precise temperature and deformation control. The longevity and robustness of parts produced via hot forging ensure sustained adoption, overriding the initial high investment cost associated with the machinery.

Hot Forging Press Machine Market Executive Summary

The Hot Forging Press Machine Market is poised for stable expansion, underpinned by robust global industrial output and mandatory performance enhancements in critical end-use applications like automotive and aerospace. Business trends indicate a strong move toward advanced press technologies, specifically servo-driven mechanical presses and hybrid hydraulic systems, which offer superior energy efficiency, reduced maintenance, and improved controllability compared to traditional flywheel presses. Manufacturers are increasingly focusing on integrating Industry 4.0 capabilities, including real-time monitoring, predictive analytics, and automated material handling, to maximize throughput and minimize operational variability. The competitive landscape is characterized by established European and Japanese manufacturers facing intensified pressure from rapidly innovating Chinese and South Korean counterparts who are offering cost-effective and increasingly sophisticated machinery solutions, leading to pricing pressures in lower tonnage segments.

Regionally, the Asia Pacific (APAC) stands as the dominant market, driven overwhelmingly by the sheer scale of manufacturing in China and India, particularly in vehicle production and general infrastructure development. The region's commitment to industrial modernization and domestic component manufacturing mandates significant investments in advanced forging technology. North America and Europe maintain a mature market status, focusing on high-precision, customized forging presses tailored for high-value applications, such as large structural aerospace parts and specialized machinery. These developed regions prioritize sustainability and operational efficiency, driving demand for electric and highly automated presses that minimize energy expenditure and scrap rates. Regulatory trends, especially relating to workplace safety and noise reduction, also significantly influence the design specifications of new machinery deployed in these areas.

Segmentation trends highlight the continued dominance of mechanical presses in high-speed, high-volume operations due to their rapid cycle times, while hydraulic presses maintain essential status for complex, deep-drawing applications requiring precise control over the deformation speed and force throughout the entire stroke. The 1,000 to 5,000 Tons tonnage segment commands the largest market share, serving the core requirements of the automotive chassis and powertrain component manufacturing. Furthermore, the burgeoning demand for electric vehicle (EV) components, which require high-strength, lightweight aluminum and high-nickel alloy forgings for battery housings and specialized motor shafts, presents a critical long-term growth segment for highly specialized hot forging equipment capable of handling these challenging materials with high repeatability and stringent tolerance levels.

AI Impact Analysis on Hot Forging Press Machine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hot Forging Press Machine Market commonly center on improving process control, predictive maintenance, and optimizing complex forging simulations. Users frequently ask: "How can AI minimize material waste and energy consumption in forging?", "What are the real-time quality control applications of machine learning in hot forging?", and "Will AI integration reduce the skill requirements for press operators?" These concerns highlight a collective expectation that AI will move forging from a process often reliant on operator experience to a data-driven, highly optimized manufacturing step. The key themes revolve around achieving 'zero-defect' production, extending equipment lifespan through advanced diagnostics, and rapidly adjusting process parameters (e.g., temperature, pressure application curve) in real-time based on material input variations, thereby maximizing yield and reducing reliance on costly manual inspection post-forging.

- AI-powered Predictive Maintenance: Utilizes sensor data (vibration, temperature, pressure) to forecast potential component failures (e.g., ram guides, clutch/brake systems) accurately, dramatically reducing unplanned downtime and optimizing maintenance schedules.

- Real-time Process Optimization: Machine learning algorithms analyze press performance data and material behavior during the stroke to instantaneously adjust control parameters, ensuring consistent metallurgical quality despite input variances.

- Digital Twin and Simulation Enhancement: AI improves the accuracy and speed of forging simulation software, allowing manufacturers to optimize die design and process sequencing virtually, reducing physical try-outs and time-to-market for new parts.

- Automated Quality Inspection: Vision systems and AI leverage deep learning models to perform non-contact, high-speed inspection of forged parts immediately post-process, identifying surface defects, dimensional inconsistencies, and potential internal flaws with unparalleled consistency.

- Energy Consumption Management: AI algorithms optimize the operational schedule and press utilization based on energy tariffs and production requirements, leading to significant reductions in overall power usage, especially for high-capacity hydraulic and screw presses.

- Optimized Material Utilization: AI models predict the minimum viable billet size required for a specific component based on geometry and material properties, leading to reduced material waste (flash) and subsequent trimming operations.

DRO & Impact Forces Of Hot Forging Press Machine Market

The Hot Forging Press Machine Market is driven by the increasing global demand for high-performance and lightweight components, particularly within the automotive and aerospace industries which demand superior material integrity for safety-critical applications. The primary restraint is the extremely high capital investment required for purchasing, installing, and maintaining large-capacity forging presses, coupled with the necessity for highly skilled labor to operate and program these sophisticated machines. Significant opportunities lie in the growing electrification of the automotive sector, which necessitates specialized forging equipment for producing lightweight battery trays, motor shafts, and complex structural parts from aluminum and advanced non-ferrous alloys. These forces—Drivers, Restraints, and Opportunities—create a dynamic competitive environment, influencing procurement decisions, R&D priorities, and shaping the future technological trajectory toward high-efficiency, automated, and digitally integrated press systems.

Drivers: A major catalyst is the relentless push for fuel efficiency and reduced emissions globally, compelling manufacturers to substitute heavy cast components with lightweight, high-strength forged alternatives. Hot forging is instrumental in achieving the necessary strength-to-weight ratio. Furthermore, the stringent safety regulations imposed across transportation sectors mandate components with superior mechanical reliability, which only the grain structure alignment achieved through hot forging can reliably provide. The massive investment in global infrastructure development, including specialized machinery for mining and construction, also fuels demand for robust, large-scale forged parts, thus driving the market for high-tonnage presses. The rapid expansion of defense expenditures in several Asian and Middle Eastern countries similarly contributes to demand for precision-forged components.

Restraints: The market faces substantial hurdles, most notably the cyclical nature of end-user industries (e.g., automotive and construction), making market demand susceptible to economic downturns, which often leads to delayed capital expenditure on new press equipment. Moreover, the inherent complexity and energy intensity of the hot forging process pose operational challenges; maintaining the precise high temperature requires significant energy input and sophisticated temperature monitoring systems. The competition from advanced casting methods, such as high-pressure die casting for aluminum, which can offer competitive cycle times for certain non-critical components, occasionally restrains the adoption rate of forging, particularly where maximum material strength is not the overriding factor.

Opportunities and Impact Forces: The most compelling long-term opportunity is the integration of Industry 4.0 technologies—specifically IoT sensors, real-time data processing, and cloud connectivity—allowing for unprecedented levels of process control and optimization, transforming traditional forging plants into smart factories. Additionally, the development of new material alloys, particularly those used in extreme environments (high temperatures, corrosive substances) like those found in advanced energy generation (e.g., nuclear, gas turbines), opens specialized, high-margin niches for press manufacturers. The impact forces are driving manufacturers toward developing hybrid press solutions that combine the precision of hydraulic control with the high speed of mechanical systems, seeking to address both productivity and flexibility demands simultaneously, thus creating a strong technological shift in the market.

Segmentation Analysis

The Hot Forging Press Machine Market is comprehensively segmented based on machine Type, Tonnage capacity, and end-user Application, providing a clear picture of demand distribution across various operational requirements and industry verticals. The segmentation by Type is critical, differentiating between mechanical, hydraulic, and screw presses, which fundamentally dictates operational speed, force application profile, and initial investment cost. Mechanical presses, utilizing a flywheel and clutch system, are preferred for high-speed, repeatable strokes in mass production settings, while hydraulic presses offer superior control over ram speed and pressure throughout the stroke, essential for deep drawing and complex geometries. Screw presses, often used for hot and warm forging, balance speed and flexibility, providing energy-efficient solutions for mid-range applications.

Tonnage capacity segmentation reflects the scale of components produced, directly linking capacity segments to specific end-user industry demands. Low-tonnage presses (under 1,000 tons) are typically utilized for smaller, high-volume components like fasteners and small gear blanks. The mid-range (1,000 to 5,000 tons) is the market backbone, catering predominantly to automotive powertrain and chassis components. High-tonnage machines (above 5,000 tons) are crucial for large structural members, heavy truck axles, specialized oil and gas fittings, and massive aerospace components. The end-user Application segment reveals the dominance of the automotive sector, which accounts for the largest volume consumption of forged parts globally, followed closely by the construction, mining, and aerospace industries, each imposing specific material and quality demands on the press machinery.

The strategic analysis of these segments demonstrates that while the automotive application drives volume growth, the aerospace and oil & gas segments offer higher average selling prices (ASPs) for specialized presses due to the need for higher precision, specialized heating systems, and the ability to process exotic alloys (e.g., titanium and superalloys). Manufacturers are strategically optimizing their product portfolios to offer highly modular presses that can be customized with advanced automation and tooling systems, allowing them to capture demand across different tonnage segments efficiently. The ongoing shift towards sustainability is also prompting the development of smaller, highly localized forging facilities, driving demand for compact, highly efficient screw and servo-mechanical presses that minimize environmental footprint.

- By Type:

- Mechanical Forging Presses

- Hydraulic Forging Presses

- Screw Forging Presses (Friction & Direct-drive)

- By Tonnage Capacity:

- Less than 1,000 Tons

- 1,000 to 5,000 Tons

- Above 5,000 Tons

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Aerospace & Defense

- Oil & Gas

- Construction & Mining

- General Manufacturing & Machinery

Value Chain Analysis For Hot Forging Press Machine Market

The value chain of the Hot Forging Press Machine Market begins with the upstream suppliers of critical raw materials and specialized components, transitioning through the complex manufacturing and assembly phase, and concluding with downstream distribution, installation, and after-sales service provided to the end-users. Upstream analysis focuses on the procurement of high-grade steel and composite materials required for the press frame, dies, and critical moving parts (e.g., crankshafts, cylinders). Suppliers of advanced electrical control systems, hydraulic components (pumps, valves), and specialized high-performance motors are crucial, as the reliability and precision of the press machine are directly dependent on the quality and integration of these specialized inputs. Strong, collaborative relationships with trusted component suppliers are necessary to maintain competitive lead times and ensure the robust functioning of machinery operating under immense stresses.

The core manufacturing stage involves specialized engineering and fabrication, where press manufacturers design, assemble, and rigorously test the equipment. This phase is characterized by high capital intensity and a dependence on highly skilled technical labor for precision machining and complex system integration, particularly for large, custom-built presses. The distribution channel is multifaceted, relying on both direct and indirect sales methods. Direct distribution is favored for large, custom, high-value presses sold to major Tier 1 automotive suppliers or aerospace giants, allowing the manufacturer to offer bespoke installation, training, and long-term maintenance contracts. Indirect distribution utilizes established regional distributors or sales agents, particularly for standardized, mid-range machines, enabling manufacturers to penetrate geographically diverse markets without incurring excessive operational overheads.

The downstream segment includes the forge shops, component manufacturers, and final end-users. After-sales support, encompassing maintenance, spare parts supply, and retrofitting services, constitutes a significant, high-margin revenue stream. The trend towards digitalization is embedding press manufacturers deeper into the downstream operations, as they offer remote diagnostic services and performance monitoring platforms (often via subscription models), ensuring maximized uptime for customers. This integrated service approach strengthens customer loyalty and provides valuable feedback for future product development. Therefore, managing the complexity of upstream component supply while building a resilient, service-oriented distribution network is key to sustained profitability within this capital equipment market.

Hot Forging Press Machine Market Potential Customers

Potential customers, or the primary end-users/buyers of hot forging press machines, are highly concentrated within industries that require components exhibiting exceptional mechanical strength, fatigue resistance, and durability under extreme operating conditions. The largest segment of buyers comprises Tier 1 and Tier 2 suppliers in the global automotive supply chain who specialize in manufacturing critical components such as engine parts (crankshafts, connecting rods), transmission elements (gears, shafts), and chassis components (wheel hubs, knuckles). These customers prioritize high-speed mechanical presses and highly automated production lines to meet the massive volume demands and stringent quality standards set by original equipment manufacturers (OEMs).

Another crucial customer group consists of aerospace and defense contractors. These buyers require specialized hydraulic or screw presses capable of handling high-temperature alloys (e.g., titanium, nickel-based superalloys) used for turbine disks, structural bulkheads, and landing gear components. Their purchasing decisions are driven by precision, control, traceability, and the press machine's ability to maintain high temperatures and tolerances over complex shapes, often justifying investments in extremely large-tonnage, custom-engineered equipment. Furthermore, companies involved in heavy machinery manufacturing for construction, mining (e.g., specialized gear sets, track links, large pins), and the oil & gas sector (pipeline flanges, valves, drilling components) constitute a stable customer base for robust, high-force hydraulic presses designed for reliability in harsh industrial environments. These potential customers frequently assess the total cost of ownership (TCO) including energy consumption and expected lifespan, alongside the press machine's operational efficiency and technological modernity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler Group, Siempelkamp Maschinen- und Anlagenbau GmbH, SMS Group, Komatsu Ltd., Fagor Arrasate, Mitsubishi Heavy Industries, Hatebur Umformtechnik AG, Japan Steel Works (JSW), Sumitomo Heavy Industries, AIDA Engineering, Lasco Umformtechnik GmbH, Kurimoto, Phoenix Press, TMP (Taylor-Winfield Technologies), Hefei Metalforming Machine Tool Co., Ltd., China National Erzhong Group Co., Qingdao Forging Machinery Co., Ltd., Butech Bliss, Beckwood Press Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Forging Press Machine Market Key Technology Landscape

The technological landscape of the Hot Forging Press Machine Market is undergoing a rapid evolution, primarily driven by the imperative for enhanced precision, higher efficiency, and seamless integration into digital manufacturing ecosystems (Industry 4.0). One major development is the rise of servo-mechanical presses, which utilize high-torque electric motors instead of traditional flywheels. This technology offers superior control over the ram's velocity and position throughout the entire stroke, translating into reduced energy consumption, lower noise levels, and improved component quality compared to conventional mechanical presses. Servo technology allows for customized stroke profiles for different materials and forging tasks, optimizing deformation and ensuring consistent material flow, thereby minimizing residual stresses and maximizing die life, which is a major operational cost component.

The shift towards intelligent monitoring and process simulation is another critical technological advancement. Modern forging presses are heavily instrumented with IoT sensors that collect vast amounts of data regarding temperature, pressure, vibration, and energy usage in real-time. This data feeds into integrated Manufacturing Execution Systems (MES) and AI-driven platforms for advanced analytics, enabling predictive maintenance models that anticipate failure before it occurs, significantly boosting uptime. Furthermore, sophisticated simulation software (Finite Element Method, FEM) is now routinely employed pre-production to validate die designs and optimize billet heating and deformation sequences, drastically reducing the physical prototyping phase and accelerating product launch for new, complex forged parts, particularly those made from challenging alloys like titanium or specialized stainless steels.

In terms of component handling and safety, the market is seeing increased adoption of fully automated forging cells, integrating robotic manipulators for billet loading, transfer, and unloading, reducing the need for human intervention in the hazardous hot zone and improving cycle time repeatability. Innovations in heating technology, such as the increasing use of high-efficiency induction heating over traditional gas furnaces, ensure rapid, precise, and highly localized heating of the billet material, minimizing scaling and decarburization. These advancements collectively underscore a market trend away from brute force mechanical action towards highly controlled, digitally synchronized forging systems that prioritize metallurgical quality, energy efficiency, and operational flexibility to meet the demanding specifications of the modern aerospace and electric vehicle supply chains.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for hot forging press machines globally, primarily fueled by the robust manufacturing base in China, India, Japan, and South Korea. China, in particular, dominates the regional market due to its massive automotive production, burgeoning infrastructure projects, and strategic focus on becoming self-reliant in advanced manufacturing, leading to substantial investments in domestic press machine production and imports of high-end European and Japanese machinery. The demand in India is rapidly increasing, driven by rising vehicle production and defense sector modernization. The region is seeing a high volume demand for mid-to-high tonnage mechanical and screw presses tailored for high-volume automotive component production. The regional focus is balancing cost-effectiveness with increasing automation and energy efficiency standards.

- Europe: Europe holds a mature, high-value market position, characterized by a strong emphasis on precision engineering, advanced material processing, and technological sophistication. Countries like Germany, Italy, and France are leaders in the production and adoption of highly specialized forging presses, especially hydraulic and advanced servo-mechanical systems designed for aerospace, specialized industrial machinery, and premium automotive components (including those for luxury and high-performance vehicles). The European market is highly regulated concerning environmental and safety standards, driving continuous innovation toward low-noise, energy-efficient, and highly integrated smart forging solutions. Investment is often targeted at press upgrades and retrofits to implement Industry 4.0 capabilities rather than purely volume expansion.

- North America: The North American market, centered predominantly in the United States, is driven by significant demands from the aerospace, heavy truck, and oil & gas sectors. This region often requires extremely large-tonnage hydraulic presses for forging complex, large structural components from challenging materials like titanium and specialized steels. While the automotive sector remains significant, the focus is increasingly shifting towards specialized, high-specification equipment needed for high-value industries. The market is recovering from previous cycles and sees renewed investment in press modernization, leveraging government initiatives aimed at strengthening domestic manufacturing capabilities and supply chain resilience.

- Latin America: This region presents a market with moderate growth potential, heavily influenced by the economic cycles of key economies like Brazil and Mexico. Demand is largely tied to domestic automotive assembly and mining equipment manufacturing. The market generally favors reliable, established mechanical press technologies due to budget constraints, though there is an emerging interest in modern hydraulic presses to improve component quality and reduce reliance on imports. Investment is often cautious, focusing on capacity replacement rather than large-scale technological adoption.

- Middle East & Africa (MEA): The MEA region is a niche but growing market, primarily driven by investment in the oil & gas industry (requiring forged pipes, flanges, and fittings) and localized industrialization efforts, particularly in the Gulf Cooperation Council (GCC) countries. The demand is sporadic and heavily dependent on global energy prices and infrastructure spending, favoring robust hydraulic presses capable of handling specialized materials required for high-pressure, high-temperature applications. South Africa is a key manufacturing hub, generating stable regional demand for general industrial components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Forging Press Machine Market.- Schuler Group GmbH

- Siempelkamp Maschinen- und Anlagenbau GmbH

- SMS Group GmbH

- Komatsu Ltd.

- Fagor Arrasate S. Coop.

- Mitsubishi Heavy Industries, Ltd.

- Hatebur Umformtechnik AG

- Japan Steel Works (JSW)

- Sumitomo Heavy Industries, Ltd.

- AIDA Engineering, Ltd.

- Lasco Umformtechnik GmbH

- Kurimoto, Ltd.

- Phoenix Press Systems

- TMP (Taylor-Winfield Technologies)

- Hefei Metalforming Machine Tool Co., Ltd.

- China National Erzhong Group Co. (Deyang Wanhang)

- Qingdao Forging Machinery Co., Ltd.

- Butech Bliss

- Beckwood Press Co.

- Erie Press Systems

Frequently Asked Questions

Analyze common user questions about the Hot Forging Press Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of servo-mechanical forging presses?

The primary driver is the necessity for superior energy efficiency and enhanced process control. Servo presses allow precise management of ram speed and stroke profile, reducing energy waste and significantly improving the quality and consistency of complex forged parts compared to conventional mechanical presses.

How does the shift to Electric Vehicles (EVs) impact the demand for hot forging presses?

The EV shift increases demand for specialized hot forging presses capable of handling lightweight non-ferrous alloys, such as aluminum and specific steels. These presses are required to manufacture critical EV components like high-strength battery casings, specialized motor shafts, and lightweight chassis elements, demanding high precision and tight tolerances.

Which regional market holds the largest share for hot forging press machines?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by extensive manufacturing activities, particularly in the automotive and general machinery sectors in China and India, which necessitate continuous investment in high-volume forging capacity.

What are the main technical differences between hydraulic and mechanical forging presses?

Mechanical presses offer high speed and high energy capacity for mass production but have a fixed stroke length and force profile. Hydraulic presses offer full adjustability and precise control over force and ram speed throughout the entire stroke, making them ideal for deep drawing, complex shapes, and processing temperature-sensitive alloys, albeit typically at slower cycle times.

What is the role of Industry 4.0 in modern hot forging operations?

Industry 4.0 integrates IoT, sensors, and AI into forging presses to enable real-time performance monitoring, AI-driven predictive maintenance, automated quality inspection (via vision systems), and remote diagnostics, maximizing uptime and achieving 'zero-defect' manufacturing goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager