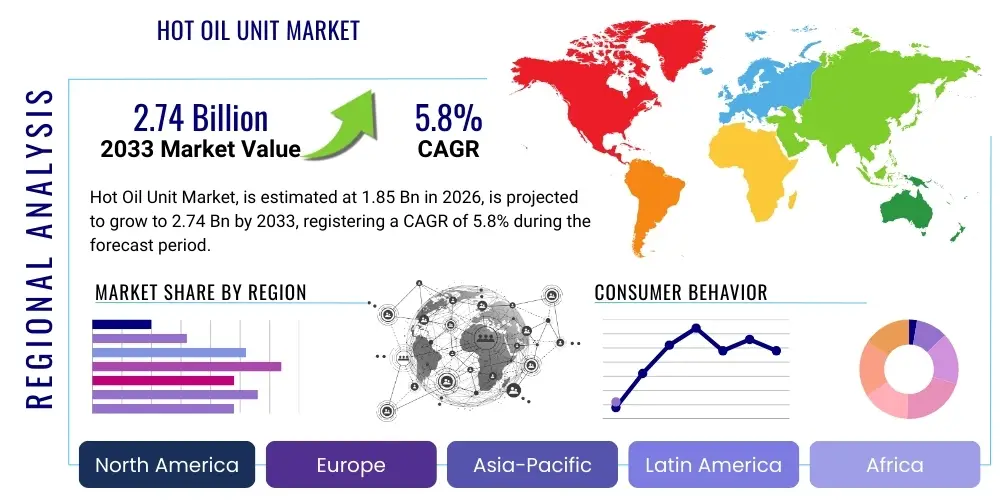

Hot Oil Unit Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440286 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Hot Oil Unit Market Size

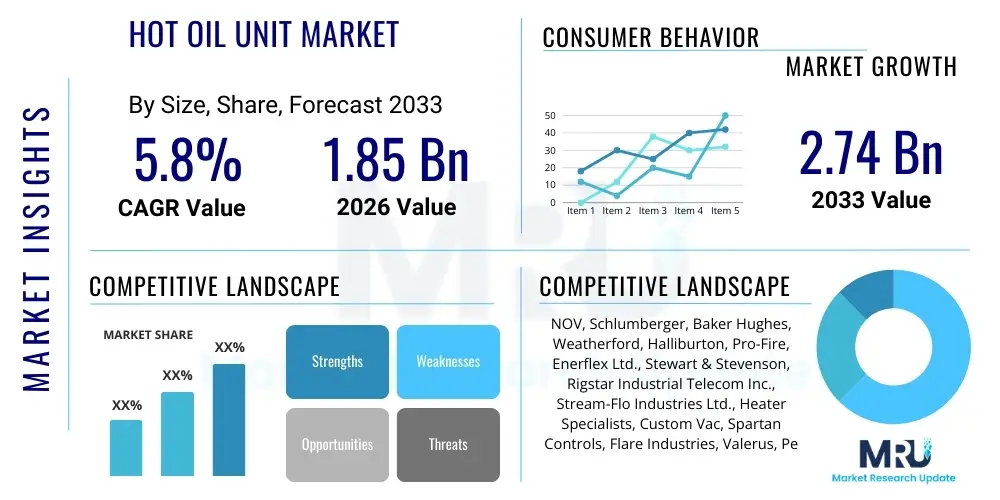

The Hot Oil Unit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.74 Billion by the end of the forecast period in 2033.

Hot Oil Unit Market introduction

Hot oil units are specialized pieces of equipment essential in the oil and gas industry, primarily used for heating various components to maintain operational efficiency and prevent blockages. These units circulate a heated transfer fluid, typically crude oil, diesel, or glycol, through a coil to transfer thermal energy to wellbores, pipelines, tanks, and other surface equipment. Their core function revolves around mitigating issues such as paraffin wax deposition, hydrate formation, and viscosity challenges in crude oil, especially in colder environments or during enhanced oil recovery (EOR) operations.

The product's versatility extends to numerous applications across the upstream and midstream sectors. Major applications include well stimulation to improve flow rates by reducing crude viscosity, pipeline heating to ensure consistent flow, frac water heating for hydraulic fracturing operations in cold climates, and tank heating for storage and processing. The significant benefits of deploying hot oil units include enhanced production rates, reduced downtime due to blockages, improved fluid flow characteristics, and extended equipment lifespan. These units are critical for maintaining the integrity and efficiency of oil and gas infrastructure, contributing directly to operational profitability.

Several factors are driving the demand for hot oil units. The continuous global demand for energy fuels exploration and production activities in challenging environments, including arctic regions and deepwater fields, where temperature management is crucial. The increasing focus on enhanced oil recovery techniques, which often require heating to mobilize viscous crude, further propels market growth. Moreover, the need to maintain existing aging infrastructure and prevent costly interruptions due to cold weather or heavy crude properties ensures a steady demand for these robust heating solutions. Technological advancements aimed at improving fuel efficiency and reducing emissions also contribute to their sustained market relevance.

Hot Oil Unit Market Executive Summary

The Hot Oil Unit Market is experiencing robust expansion driven by sustained global energy demand and the imperative for operational efficiency in the oil and gas sector. Business trends indicate a strong focus on enhancing existing assets through maintenance and intervention services, where hot oil units play a pivotal role in preventing flow assurance issues. Companies are increasingly investing in units with advanced automation and remote monitoring capabilities to reduce operational costs and improve safety. Furthermore, the market is witnessing a shift towards more environmentally compliant units, with innovations in burner technology and emissions control systems gaining traction. This drive for efficiency and sustainability is shaping procurement decisions and driving R&D efforts within the industry.

Regionally, North America continues to dominate the market, primarily due to extensive shale oil and gas production, requiring significant well stimulation and pipeline maintenance. The Asia Pacific region is emerging as a high-growth market, propelled by new exploration projects, increasing energy consumption, and the expansion of midstream infrastructure in countries like China, India, and Indonesia. Latin America, with its considerable heavy oil reserves and deepwater activities, also presents substantial opportunities for market players. The Middle East and Africa maintain a steady demand due to vast mature fields and ongoing development projects, ensuring a consistent need for flow assurance solutions.

Segmentation trends highlight a growing preference for trailer-mounted and skid-mounted units offering mobility and ease of deployment for diverse field operations. In terms of application, well stimulation and pipeline heating remain the largest segments, underscoring the critical role of hot oil units in production optimization and transport integrity. The market is also seeing increased demand for units capable of handling frac water heating in unconventional plays, especially in regions experiencing extreme winter conditions. Capacity-wise, there's a balanced demand across small, medium, and large units, reflecting the varied scale of operational needs, from individual well maintenance to large-scale pipeline heating projects.

AI Impact Analysis on Hot Oil Unit Market

The impact of Artificial Intelligence (AI) on the Hot Oil Unit Market is a topic of significant interest among industry stakeholders, frequently leading to questions about efficiency gains, predictive capabilities, and safety improvements. Users are primarily concerned with how AI can optimize the operational performance of hot oil units, enhance their reliability, and reduce maintenance costs. Key themes often revolve around the integration of AI-powered sensors for real-time monitoring, machine learning algorithms for predicting equipment failures, and autonomous control systems to optimize heating processes. Expectations are high regarding AI's potential to transform routine operations into data-driven, highly efficient, and safer practices.

Users also frequently inquire about the return on investment for AI integration, the complexity of implementation, and the cybersecurity implications of connecting these critical field assets to advanced networks. There's a strong desire to understand how AI can assist in proactive problem-solving, such as identifying early signs of paraffin buildup or anticipating component wear before it leads to costly downtime. The potential for AI to support remote operations, especially in hazardous or difficult-to-access locations, is another area of keen interest, promising reduced human exposure to risks and improved response times. Overall, the market anticipates AI will deliver significant advancements in operational intelligence, making hot oil unit deployment more strategic and economically viable.

- AI-driven predictive maintenance for hot oil unit components, reducing unscheduled downtime.

- Real-time operational optimization through machine learning algorithms, enhancing fuel efficiency and heating accuracy.

- Integration of IoT sensors and AI for remote monitoring and diagnostics, improving safety and response times.

- Automated control systems enabling precise temperature regulation and energy management.

- Data analytics for identifying optimal operating parameters and predicting flow assurance issues in pipelines.

- Enhanced safety protocols through AI-powered anomaly detection and early warning systems.

- Improved resource allocation and scheduling for hot oil unit deployment based on predictive models.

- Streamlined regulatory compliance and reporting through automated data collection and analysis.

DRO & Impact Forces Of Hot Oil Unit Market

The Hot Oil Unit Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively influenced by various impact forces. A primary driver is the persistent global demand for crude oil and natural gas, which necessitates continuous exploration and production activities, often in challenging environments where temperature control is crucial. The increasing prevalence of heavy oil and unconventional resources also boosts demand, as these resources frequently require heating to reduce viscosity for extraction and transport. Furthermore, the aging infrastructure in many mature oil and gas fields necessitates regular maintenance and intervention, including hot oil treatments, to sustain production and prevent operational disruptions. The growing emphasis on enhanced oil recovery (EOR) techniques, many of which depend on thermal processes, further contributes to market growth.

However, the market faces several significant restraints. Volatility in global oil and gas prices profoundly impacts investment decisions, leading to project delays or cancellations that can dampen demand for new equipment and services. Stringent environmental regulations aimed at reducing emissions and improving safety standards impose additional compliance costs on manufacturers and operators, potentially slowing market adoption. The high capital expenditure associated with purchasing and maintaining hot oil units, coupled with their operational costs, can be a barrier for smaller operators. Additionally, the emergence of alternative flow assurance technologies and heating methods, while currently limited, poses a potential long-term competitive threat.

Despite these restraints, substantial opportunities exist for market expansion and innovation. The development of new offshore and deepwater fields globally presents complex flow assurance challenges that hot oil units are well-suited to address. Advancements in digitalization, automation, and IoT integration offer avenues for improving unit efficiency, safety, and remote operability, attracting new investments. The growing focus on retrofitting older units with modern, more efficient, and environmentally compliant technologies creates a significant upgrade market. Furthermore, the expansion of midstream infrastructure, particularly pipelines in remote or cold regions, generates ongoing demand for heating solutions to ensure smooth transportation of hydrocarbons. The confluence of these factors determines the market's trajectory, compelling stakeholders to innovate and adapt to evolving industry landscapes and regulatory demands.

Segmentation Analysis

The Hot Oil Unit Market is comprehensively segmented to provide a granular understanding of its diverse components, allowing for targeted strategic planning and market analysis. These segmentations are critical for identifying specific market niches, understanding customer preferences, and assessing competitive landscapes. The market can be dissected based on various attributes, including the unit type, the heating medium employed, specific applications, the operational capacity of the units, and the end-user industries they serve. Each segment reflects unique demand patterns, technological requirements, and regional influences, collectively shaping the overall market dynamics and growth trajectories across different operational scenarios in the oil and gas sector.

- By Type:

- Skid-mounted Units

- Trailer-mounted Units

- Truck-mounted Units

- By Heating Medium:

- Direct-fired Units

- Indirect-fired Units

- By Application:

- Well Stimulation

- Pipeline Heating

- Tank Heating

- Frac Water Heating

- Glycol Regeneration

- Other Process Heating

- By Capacity:

- Small Capacity (typically less than 5 MMBtu/hr)

- Medium Capacity (typically 5-15 MMBtu/hr)

- Large Capacity (typically greater than 15 MMBtu/hr)

- By End-User:

- Upstream Oil & Gas

- Midstream Oil & Gas

- Downstream Oil & Gas (for specific industrial heating needs)

Value Chain Analysis For Hot Oil Unit Market

The value chain for the Hot Oil Unit Market encompasses a series of interconnected activities, beginning with the sourcing of raw materials and extending through manufacturing, distribution, deployment, and post-sales services. Upstream analysis focuses on the procurement of essential components such as heat exchangers, burners, pumps, control systems, and structural steel. Key suppliers in this phase include specialized manufacturers of industrial heating components, electrical and instrumentation suppliers, and steel fabricators. The quality and availability of these raw materials and components directly influence the manufacturing costs, reliability, and lead times of hot oil units. Strong relationships with reliable upstream suppliers are crucial for maintaining a competitive edge and ensuring consistent production quality.

In the midstream of the value chain, manufacturing and assembly processes take center stage. This involves designing, fabricating, assembling, and rigorously testing the hot oil units according to industry standards and customer specifications. Manufacturers often integrate advanced technologies for fuel efficiency, emissions control, and automation during this stage. Following manufacturing, units move into the distribution phase, which can involve direct sales from manufacturers, or more commonly, sales through a network of specialized distributors, rental companies, or equipment leasing firms. The choice of distribution channel often depends on the scale of operation, geographical reach, and the specific needs of end-users, such as short-term rental for specific projects or long-term ownership for continuous operations.

Downstream activities primarily involve the deployment, operation, maintenance, and servicing of hot oil units at client sites. This stage includes transportation to the field, installation, commissioning, and ongoing operational support. Direct channels for distribution might involve large oil and gas companies purchasing units directly from manufacturers for their extensive operations. Indirect channels typically involve third-party service providers, contractors, and rental companies who acquire units and then offer them as part of a broader service package to various oil and gas operators. Post-sales services, including parts supply, repair, and technical support, are vital for maintaining customer satisfaction and unit uptime, playing a critical role in the overall value proposition and ensuring the longevity and efficiency of the units in the field.

Hot Oil Unit Market Potential Customers

The Hot Oil Unit Market primarily serves a specialized clientele within the energy sector, encompassing entities deeply involved in the exploration, production, processing, and transportation of hydrocarbons. The core potential customers are upstream oil and gas exploration and production (E&P) companies. These companies require hot oil units for critical operations such as well stimulation, paraffin removal from wellbores, and maintaining flow assurance in producing wells, particularly in fields with heavy crude oil or in regions prone to cold weather. Their investment in these units is driven by the need to optimize production rates, prevent costly downtime, and extend the economic life of oil and gas assets. As E&P activities expand into more challenging environments, the demand from this segment continues to be a significant market driver.

Midstream oil and gas companies represent another substantial segment of potential customers. These entities are responsible for the transportation and storage of crude oil, natural gas, and natural gas liquids. Hot oil units are indispensable for pipeline heating to prevent hydrate formation and wax deposition, ensuring the smooth and efficient flow of hydrocarbons over long distances. They are also used for heating storage tanks and processing facilities to maintain desired temperatures for operational integrity. Companies involved in pipeline construction, operation, and maintenance, as well as those managing large-scale storage terminals, regularly procure or rent hot oil units to safeguard their infrastructure investments and ensure uninterrupted service delivery.

Furthermore, oilfield service companies and equipment rental firms constitute an indirect but critical segment of potential customers. These companies often purchase hot oil units from manufacturers to provide comprehensive services to the direct end-users, offering specialized expertise and equipment on a project-by-project or contractual basis. By acting as intermediaries, they enable a wider reach for hot oil unit technologies, especially to smaller operators or for short-term operational needs. The growth of these service providers is intrinsically linked to the overall activity levels in the upstream and midstream sectors, making them key enablers and consumers of hot oil unit technologies within the broader energy ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.74 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NOV, Schlumberger, Baker Hughes, Weatherford, Halliburton, Pro-Fire, Enerflex Ltd., Stewart & Stevenson, Rigstar Industrial Telecom Inc., Stream-Flo Industries Ltd., Heater Specialists, Custom Vac, Spartan Controls, Flare Industries, Valerus, Petro-King, Dragon Products, KSB SE & Co. KGaA, Universal Plant Services, Expro Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Oil Unit Market Key Technology Landscape

The Hot Oil Unit Market is continuously evolving with significant advancements in technological landscapes, driven by the need for enhanced efficiency, environmental compliance, and operational safety. A critical technological focus is on optimizing combustion systems to improve fuel efficiency and reduce emissions. Modern hot oil units are incorporating advanced burner designs, often with low-NOx capabilities, and sophisticated combustion control systems that automatically adjust air-fuel mixtures for optimal performance. This not only cuts down on operational costs by reducing fuel consumption but also helps meet increasingly stringent environmental regulations, particularly in regions with strict air quality standards, making them more attractive to environmentally conscious operators.

Another prominent technological trend involves the integration of digitalization, automation, and Internet of Things (IoT) technologies. Hot oil units are now equipped with advanced sensors for real-time monitoring of parameters such as temperature, pressure, flow rates, and fuel levels. These sensors transmit data to centralized control systems or cloud platforms, enabling remote monitoring and diagnostics. This remote capability allows operators to manage units from a central control room, minimizing human exposure to hazardous environments and facilitating predictive maintenance by identifying potential issues before they lead to failures. Automation features also allow for precise control over heating processes, ensuring consistent performance and preventing overheating or underheating conditions.

Furthermore, there is a growing emphasis on modular and compact designs, making units easier to transport, deploy, and configure for various field conditions. Innovations in material science are also contributing to the development of more durable and corrosion-resistant components, extending the lifespan of the units and reducing maintenance frequency. The adoption of advanced safety features, including automated shutdown systems, leak detection, and fire suppression, is paramount to protect personnel and assets. These technological advancements collectively enhance the overall performance, reliability, and cost-effectiveness of hot oil units, ensuring their continued relevance as essential tools in the modern oil and gas industry, while also addressing evolving operational and regulatory challenges effectively.

Regional Highlights

-

North America: North America stands as the dominant market for hot oil units, largely attributed to the extensive unconventional oil and gas exploration and production activities, particularly in shale formations across the United States and Canada. The vast network of pipelines and the need for well intervention services in mature fields further contribute to the high demand. The region’s severe winter conditions in many production areas necessitate constant heating solutions to prevent wax and hydrate formation, ensuring continuous operation.

Investments in new pipeline infrastructure and the ongoing optimization of existing assets drive the procurement of both new units and maintenance services for hot oil units. The region also benefits from a robust ecosystem of technology providers and service companies that are constantly innovating to meet the evolving demands for efficiency and environmental compliance. This strong operational landscape and technological leadership solidify North America's position as a key market.

-

Europe: The European hot oil unit market is primarily driven by mature oil and gas fields, particularly in the North Sea, where asset integrity and enhanced recovery operations are paramount. Countries like Norway and the United Kingdom continue to invest in maintaining their offshore infrastructure, which includes the deployment of hot oil units for flow assurance and well stimulation. The focus here is often on retrofitting existing units with more environmentally friendly and energy-efficient technologies to comply with stringent European regulations.

While new exploration activities are limited compared to other regions, decommissioning efforts in mature fields also present unique challenges for which hot oil units might be utilized to prepare infrastructure. The emphasis on safety and environmental performance pushes technological advancements, albeit within a more constrained growth environment influenced by regional energy transition policies. Eastern European countries with existing oil and gas infrastructure also contribute to a steady, albeit slower, demand.

-

Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as one of the fastest-growing markets for hot oil units, fueled by increasing energy demand and significant investments in new oil and gas projects. Countries such as China, India, Indonesia, and Australia are expanding their upstream and midstream capabilities, leading to a surge in demand for flow assurance solutions. New discoveries and the development of challenging fields, including those with heavy oil or in remote locations, necessitate robust heating equipment.

The expansion of pipeline networks to support growing energy consumption also creates substantial opportunities for hot oil unit deployment to ensure efficient hydrocarbon transportation. Furthermore, the region's diverse climate, ranging from temperate to tropical, still presents scenarios where heating is essential for maintaining viscosity and preventing blockages. Localized manufacturing capabilities are also developing, providing cost-effective solutions tailored to regional needs, contributing to sustained market growth.

-

Latin America: Latin America presents a dynamic market for hot oil units, characterized by significant heavy oil reserves, extensive offshore activities, and developing unconventional plays. Countries like Brazil, Mexico, Argentina, and Venezuela are key contributors to regional demand. Offshore projects in the pre-salt layers of Brazil and the deep waters of the Gulf of Mexico require advanced flow assurance technologies, including specialized hot oil units, to manage highly viscous crude and prevent hydrate formation.

The region's focus on unlocking heavy oil potential, which often requires thermal methods to enhance recovery and transport, directly boosts the market. Additionally, ongoing infrastructure development and maintenance in existing fields ensure a consistent need for hot oil units. Economic stability and foreign investment in the energy sector play a crucial role in shaping the market's growth trajectory and the adoption of modern, efficient hot oil unit technologies.

-

Middle East and Africa (MEA): The Middle East and Africa region maintains a strong and consistent demand for hot oil units, largely driven by its status as a major global oil and gas producing hub. Countries such as Saudi Arabia, UAE, Kuwait, and Nigeria are continuously engaged in field development, maintenance, and enhanced oil recovery projects in their vast mature fields. The high volume of production and extensive pipeline networks necessitate reliable flow assurance solutions to maintain operational efficiency.

While the climate in the Middle East is generally warm, hot oil units are critical for managing wax deposition and maintaining optimal crude viscosity for processing and export. In Africa, particularly in countries with offshore production and developing infrastructure, these units are vital for ensuring uninterrupted flow from challenging reservoirs. Significant investments in expanding production capacity and upgrading existing facilities in both sub-regions ensure a sustained and robust market for hot oil units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Oil Unit Market.- NOV

- Schlumberger

- Baker Hughes

- Weatherford

- Halliburton

- Pro-Fire

- Enerflex Ltd.

- Stewart & Stevenson

- Rigstar Industrial Telecom Inc.

- Stream-Flo Industries Ltd.

- Heater Specialists

- Custom Vac

- Spartan Controls

- Flare Industries

- Valerus

- Petro-King

- Dragon Products

- KSB SE & Co. KGaA

- Universal Plant Services

- Expro Group

Frequently Asked Questions

Analyze common user questions about the Hot Oil Unit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a hot oil unit and what are its primary functions in the oil and gas industry?

A hot oil unit is a specialized piece of equipment designed to circulate heated fluid, typically oil or glycol, through a coil or heat exchanger to transfer thermal energy. Its primary functions in the oil and gas industry include preventing and removing paraffin wax deposition and hydrate formation in wellbores and pipelines, reducing the viscosity of crude oil to improve flow rates during production or transport, and providing heat for various process applications like frac water heating or glycol regeneration. These units are critical for maintaining flow assurance, optimizing production, and ensuring the operational integrity of oil and gas infrastructure, particularly in colder environments or with heavy crude properties.

How do hot oil units contribute to enhanced oil recovery (EOR) efforts?

Hot oil units significantly contribute to enhanced oil recovery (EOR) efforts by providing the necessary thermal energy to mobilize viscous crude oil that would otherwise be difficult to extract. In many EOR methods, such as steam injection or hot water flooding, increasing the reservoir temperature reduces oil viscosity, allowing it to flow more easily towards production wells. While hot oil units typically operate at the wellbore or surface, they are crucial for pre-heating injection fluids or stimulating production wells to maximize the effectiveness of EOR processes. By ensuring optimal flow characteristics, these units help improve sweep efficiency and ultimately increase the overall recovery factor from mature fields, making them integral to modern EOR strategies and improving economic viability of complex reservoirs.

What are the key factors driving the growth of the Hot Oil Unit Market?

The Hot Oil Unit Market's growth is primarily driven by several critical factors. Firstly, the sustained global demand for energy necessitates continuous exploration and production activities, often extending into challenging and remote environments where temperature control is vital. Secondly, the increasing development of unconventional oil and gas resources and heavy oil fields, which intrinsically require heating to facilitate extraction and transportation due to high viscosity. Thirdly, the imperative to maintain and optimize aging oil and gas infrastructure globally, where hot oil units are essential for preventative maintenance and intervention services to prevent costly downtime. Lastly, the growing adoption of enhanced oil recovery (EOR) techniques, many of which rely on thermal processes, further bolsters demand for these specialized heating solutions across the upstream and midstream sectors. These drivers collectively underpin the market's robust expansion and technological evolution.

What are the environmental and safety considerations associated with hot oil units?

Environmental and safety considerations are paramount in the operation of hot oil units. Environmentally, key concerns include greenhouse gas emissions from combustion processes and potential fluid spills. Manufacturers are increasingly integrating low-NOx burners and advanced emissions control technologies to minimize air pollution, while operators adhere to strict protocols for spill prevention and waste management. From a safety perspective, the high operating temperatures and pressures pose risks of burns, fires, and explosions. Therefore, modern units incorporate advanced safety features such as automated shutdown systems, pressure relief valves, leak detection systems, and robust fire suppression equipment. Rigorous training for personnel, adherence to industry safety standards, and regular maintenance are crucial to mitigate these risks, ensuring both operational reliability and the protection of workers and the environment, reflecting a strong industry focus on responsible operations.

How is technology, particularly AI and IoT, transforming the Hot Oil Unit Market?

Technology, especially AI and IoT, is significantly transforming the Hot Oil Unit Market by enhancing efficiency, predictive capabilities, and safety. IoT sensors enable real-time monitoring of critical operational parameters like temperature, pressure, and fuel consumption, transmitting data for immediate analysis. AI algorithms leverage this data for predictive maintenance, anticipating potential equipment failures before they occur, thereby reducing unscheduled downtime and optimizing maintenance schedules. Furthermore, AI-powered systems can optimize combustion processes for improved fuel efficiency and reduced emissions, automatically adjusting operating parameters based on real-time conditions. Remote monitoring and control capabilities enhance operational safety by minimizing the need for human presence in hazardous environments. This integration of AI and IoT is leading to more intelligent, autonomous, and cost-effective hot oil unit operations, representing a major leap forward in field asset management and overall operational excellence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager