Hot Rolled Coil Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437752 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hot Rolled Coil Steel Market Size

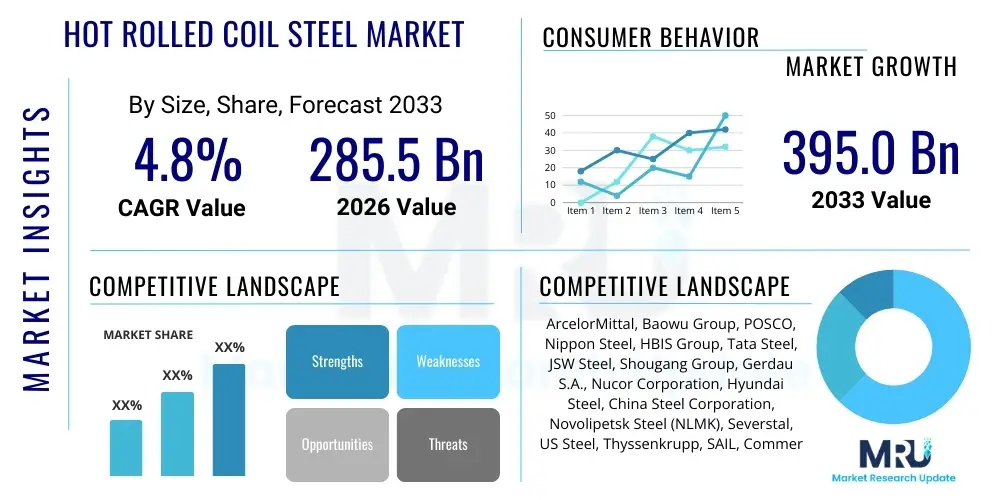

The Hot Rolled Coil Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 285.5 Billion in 2026 and is projected to reach USD 395.0 Billion by the end of the forecast period in 2033.

Hot Rolled Coil Steel Market introduction

The Hot Rolled Coil (HRC) Steel market encompasses the global production, complex distribution, and widespread consumption of flat carbon steel products that have been processed at exceptionally high temperatures, typically exceeding 920°C (1,690°F), which is above the recrystallization point of steel. This thermal treatment fundamentally alters the material's microstructure, eliminating casting defects, relieving internal stresses, and conferring high ductility and excellent formability, making it ideal for large-scale industrial use where structural integrity and cost-efficiency are prioritized over fine surface aesthetics or ultra-tight dimensional precision. The standardized manufacturing process begins with continuous casting of thick slabs, which are subsequently heated in massive reheat furnaces and subjected to intense pressure from a sequence of reducing rollers in the hot strip mill, ultimately forming a long, continuous strip that is coiled at the end of the line. The resulting HRC product is characterized by a dark, oxidized scale surface, large tonnage capacity, and suitability for substantial downstream processing, establishing its foundational role as the backbone material for countless manufacturing and construction applications across all major global economic zones, defining its pivotal importance in assessing worldwide industrial health and capital deployment cycles.

Major applications of Hot Rolled Coil Steel span across the entirety of the heavy and light industrial spectrum, demonstrating its unparalleled material versatility and structural necessity. In the crucial construction and infrastructure sector, HRC is indispensable, forming the basis for structural steel components, reinforcing plates, large-diameter piping, and foundational elements used in high-rise commercial buildings, industrial complexes, and extensive civil engineering projects like bridges and dams. The automotive industry represents another high-volume consumer, utilizing HRC primarily for complex structural parts such as vehicle chassis, frames, heavy-duty wheels, and crucial internal safety components that require high energy absorption characteristics and robust fatigue resistance. Furthermore, the machinery and equipment manufacturing sectors rely heavily on HRC for producing industrial tools, pressure vessels designed for high-temperature and high-pressure environments, railway components, and robust agricultural implements, demanding materials with high yield strength and exceptional weldability for intricate fabrication processes. The ubiquity of HRC across such diverse, capital-intensive end-uses underscores its profound connection to global GDP growth and industrial modernization trajectories, ensuring stable long-term demand predicated on infrastructural expansion and replacement cycles in developed markets.

The primary benefits driving the sustained, robust demand for HRC include its fundamental cost advantage relative to highly processed steel forms, its superior mechanical performance under stress, and its inherent metallurgical qualities that facilitate subsequent manufacturing processes. Hot rolling enhances the internal structure, making the steel uniformly strong and easily workable, minimizing the potential for brittle failure under dynamic loads. Driving factors propelling market growth are multilayered: foremost is the unrelenting governmental commitment to massive infrastructure rejuvenation and new construction projects in rapidly urbanizing regions, such as Southeast Asia and Sub-Saharan Africa, which fuels consistent bulk demand. Additionally, the technological advancements in steelmaking now permit the affordable production of specialty HRC grades, notably various High-Strength Low-Alloy (HSLA) and Advanced High-Strength Steel (AHSS) variants, essential for meeting the stringent safety and lightweighting requirements of the rapidly expanding electric vehicle (EV) market. These combined market forces—sustained macro-demand from construction coupled with innovative material adoption in transportation—collectively overcome inflationary pressures and regulatory hurdles, sustaining the positive Compound Annual Growth Rate projected through 2033, necessitating continuous technological refinement in rolling mill efficiency and output quality control.

Hot Rolled Coil Steel Market Executive Summary

The global Hot Rolled Coil Steel market is experiencing a complex strategic evolution characterized by significant shifts in business operations, pronounced regional divergence in consumption patterns, and critical segment-specific preferences driven by regulatory mandates and technological necessity. Key business trends are heavily focused on navigating the duality of high global demand and stringent environmental governance, manifesting in an aggressive pursuit of operational excellence through digital integration and advanced automation in mill processes, particularly utilizing AI for quality assurance and predictive maintenance to reduce high operational costs. Strategic business consolidation, evidenced by mergers and acquisitions among top-tier global producers, continues to redefine market power, allowing these entities to secure upstream supply chains (raw materials) and strategically control downstream distribution networks, thereby mitigating the severe impact of commodity price volatility and maximizing price realization in specialized product categories like AHSS coils. The enduring push towards sustainable steelmaking is transforming the investment landscape, with capital increasingly allocated towards EAF capacity expansions and hydrogen pilot projects, fundamentally restructuring the competitive criteria from purely price-based competition to a sophisticated balancing act between cost, quality, and environmental credentials.

Analysis of regional trends starkly highlights the economic disparity and varying developmental stages across the global market. Asia Pacific (APAC) firmly retains its position as the engine of the HRC market, primarily due to the vast scale of China's and India’s industrial base and persistent government-backed expenditure on new infrastructure and massive housing projects, ensuring an unparalleled volume requirement for commodity-grade HRC. Conversely, the mature markets of North America and Europe, while consuming lower volumes overall, exhibit a far higher demand concentration for premium, value-added HRC products, such as complex phase steels and highly engineered structural grades, essential for sophisticated manufacturing and adherence to exacting safety standards in the aerospace and advanced machinery sectors. These Western markets are further differentiated by their pioneering response to climate change regulations, often prioritizing locally sourced, lower-carbon intensity steel, which introduces new layers of complexity to cross-border trade and pricing structures. Emerging regions, notably Latin America and MEA, are witnessing accelerated market development fueled by natural resource extraction and state-backed megaprojects, driving high import dependency but simultaneously initiating domestic capacity buildup to secure future national material requirements and industrial independence.

Segmentation trends within the HRC market reveal a critical pivot towards specialized products and high-performance materials, moving beyond the traditional reliance on standardized low-carbon coils. The Product Type segment shows AHSS gaining rapid market traction, propelled by the automotive industry’s urgent need for lightweight materials that enhance vehicle efficiency and crash safety, commanding a significant pricing premium over conventional HRC. In terms of Application, while Construction remains the largest volume consumer, the Energy and Renewables sector—including specialized HRC for offshore wind turbine towers, solar mounting structures, and high-pressure oil and gas pipelines—is demonstrating the fastest expansion rate, signaling a shift in future capital allocation among HRC producers. Furthermore, the segmentation by distribution channel emphasizes the growing importance of integrated steel service centers; these centers function not merely as distributors but as value-added processing hubs, providing customized coil processing services (slitting, leveling, pickling) that facilitate just-in-time inventory management for mid-sized fabricators, enhancing the overall efficiency and responsiveness of the downstream supply chain to highly specific industrial requirements.

AI Impact Analysis on Hot Rolled Coil Steel Market

User queries and industry discussions concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Hot Rolled Coil Steel market predominantly reflect a strong industrial focus on leveraging these advanced technologies to achieve profound operational efficiencies, drastically improve the uniformity and quality of the final product, and enhance strategic decision-making in volatile market conditions. A major theme centers on the application of AI in minimizing energy consumption within energy-intensive processes, such as reheating furnaces and rolling operations, where subtle, real-time adjustments based on predictive models can translate into massive annual savings and contribute significantly to required decarbonization targets. Furthermore, there is intense user interest in how sophisticated AI-powered computer vision systems, integrated directly into the high-speed rolling line, can supersede human limitations in detecting microscopic or subtle surface defects, instantly classifying and correlating these anomalies back to specific process parameters, ensuring only coils meeting the absolute highest standards proceed to high-value applications like automotive body panels, thus reducing waste and bolstering overall quality assurance metrics across the entire product portfolio.

The second major cluster of user concerns revolves around the utilization of AI for strategic supply chain resilience and complex market risk management, critical functionalities given the extreme cyclicality and high capital requirements of the steel industry. Users frequently inquire about deploying ML algorithms capable of processing vast amounts of global economic indicators, commodity exchange data (iron ore, scrap, coking coal), and geopolitical risk signals to generate highly accurate short-term and medium-term price forecasts for both raw materials and finished HRC products. Such predictive capabilities allow steel producers to optimize procurement timing, implement effective financial hedging strategies, and dynamically adjust inventory levels and production schedules to maximize profitability during periods of rapid market fluctuation. This proactive approach, powered by advanced analytics, allows major stakeholders to transition from reactive management of supply shocks to a preemptive, data-informed strategic posture, safeguarding margins and ensuring supply stability for key long-term customers, particularly those in critical industries like defense and energy that require guaranteed material availability irrespective of global market turbulence.

- AI-driven Predictive Maintenance: Utilizing deep learning models to analyze vibration, thermal, and acoustic signatures from crucial hot strip mill machinery (e.g., rolling stands, downcoilers) to forecast impending mechanical failures with high precision, dramatically reducing unplanned, costly downtime events and optimizing resource allocation for scheduled maintenance interventions.

- Quality Control Enhancement: Implementation of high-resolution machine vision systems coupled with convolutional neural networks (CNNs) to instantaneously scan the entire coil surface during high-speed rolling, identifying, classifying, and mapping surface defects (e.g., scale, pits, wrinkles) with accuracy far exceeding human capacity, leading to superior final product quality certification.

- Process Optimization: Employing advanced reinforcement learning (RL) techniques to dynamically adjust crucial operating parameters—including rolling force distribution, inter-stand tension, and run-out table cooling strategies—to achieve optimal mechanical properties and energy consumption based on real-time feedback and specific target metallurgical specifications for specialized HRC grades.

- Supply Chain and Logistics Optimization: Leveraging AI for sophisticated multi-factor forecasting of raw material prices (iron ore fines, coking coal spot prices) and optimizing complex, multi-modal transportation logistics for global HRC distribution, minimizing demurrage charges and ensuring just-in-time inventory fulfillment for key service center partners.

- Energy Management: Utilizing smart grid integration and AI-based controllers to precisely regulate power usage in energy-intensive steps like reheat furnaces and motor drives, minimizing peak load demand and maximizing energy efficiency, contributing directly to the steel plant's sustainability KPIs and operational cost reduction efforts.

- Digital Twin Technology: Creation of virtual, high-fidelity digital models of the entire hot rolling facility, powered by continuous data streams, allowing engineers to simulate complex new product runs, test process changes, and train operational personnel in a risk-free environment, accelerating the adoption rate of new manufacturing standards and technological innovations.

DRO & Impact Forces Of Hot Rolled Coil Steel Market

The intrinsic dynamics of the Hot Rolled Coil Steel market are meticulously defined by the synergistic relationship between its primary Drivers, systemic Restraints, and emerging Opportunities (DRO), which collectively constitute the fundamental Impact Forces guiding industry strategic formulation and investment decisions across global jurisdictions. Foremost among the Drivers is the massive, sustained surge in global infrastructure capital expenditure, particularly the ambitious, multi-trillion dollar projects aimed at urbanizing emerging economies and replacing aging public works in developed nations; these projects require foundational, high-volume HRC for essential structural components, providing an unwavering demand floor. A parallel driver is the technological pivot in the automotive sector, where mandatory lightweighting initiatives and the shift toward electric vehicle production necessitate the rapid adoption of specialized AHSS and HSLA HRC grades, demanding higher technical quality and precision from steel producers, thus creating a dual growth trajectory for both volume and value within the market segment.

However, the upward trajectory driven by these macro-trends is severely checked by significant systemic Restraints inherent to the steel industry's structure and regulatory environment. The most acute restraint is the relentless, unpredictable volatility in the international pricing of key metallurgical inputs—specifically iron ore and coking coal—which subjects producers to intense margin pressure, making long-term capital planning highly challenging. Compounding this financial constraint is the escalating global regulatory pressure concerning carbon emissions; traditional integrated steelmaking is one of the world's most carbon-intensive processes, and stringent climate targets (e.g., those in the EU and North America) necessitate costly investments in decarbonization technologies (such as hydrogen-DRI) and potentially incurring punitive carbon taxes, which significantly increases the total cost of ownership and production for conventional mills, restraining expansion plans based on existing technologies.

These challenges simultaneously carve out substantial strategic Opportunities that define the forward-looking viability of the industry. The primary opportunity lies in the aggressive market penetration of advanced green steel technologies, enabling producers to differentiate their product based on lower embodied carbon, capturing premium pricing and securing long-term contracts with environmentally conscious OEMs and construction firms seeking to meet their own Scope 3 emission targets. Furthermore, the relentless innovation in material science, leading to the commercialization of new generations of specialized HRC—characterized by ultra-high strength, superior corrosion resistance, and specific thermal performance—allows companies to move up the value chain, away from highly competitive commodity HRC markets. The cumulative Impact Forces therefore dictate that successful market participants must strategically manage the delicate balance between securing stable, low-cost raw material supplies and making timely, large-scale investments in both advanced rolling technology and carbon-reducing production methods to meet the bifurcated demands of a volume-driven global market and a value-driven, environmentally sensitive regulatory landscape.

Segmentation Analysis

The Hot Rolled Coil Steel market segmentation provides a granular framework for understanding diverse industrial consumption patterns, technological requirements, and pricing strategies across different end-use sectors, enabling producers to optimize their product mix and market entry strategies effectively. Segmentation by Product Type is foundational, distinguishing materials based on chemical composition and mechanical performance—ranging from commodity low-carbon HRC suitable for simple fabrication to highly engineered Alloy Steels and AHSS grades used in critical safety applications. The increasing market share of AHSS reflects the industrial push for material efficiency and lightweighting, particularly in transportation, creating a distinct, high-margin niche that requires specialized rolling protocols and strict quality control, necessitating targeted capital expenditure by leading steel manufacturers to ensure compliance with demanding specifications.

Analysis of the Application segment confirms the Construction and Infrastructure sector as the bedrock of HRC demand, consuming the largest tonnage for foundational structural applications, pipes, and large-scale architectural projects, linking this segment directly to governmental fiscal spending and macroeconomic cycles. However, the fastest growth is consistently observed in the secondary applications of Automotive, Machinery, and especially the Energy sector, where HRC is critical for the manufacturing of wind turbine components, solar tracking systems, and crucial pipeline infrastructure, demanding HRC with guaranteed strength, weldability, and resistance to environmental fatigue. Understanding these application differentials allows producers to forecast not only volume but also the specific technical complexity required, impacting profitability based on the cost of production for each distinct segment.

The End-User segmentation provides insight into the distribution architecture, dividing consumption between large-scale direct buyers (Original Equipment Manufacturers or Heavy Fabrication yards) and indirect channels served by Distributors/Service Centers. Service centers act as market multipliers, providing indispensable downstream processing (slitting, cutting-to-length) for light fabrication industries, allowing smaller businesses access to customized HRC derived from mass-produced coils. This structure necessitates distinct logistical and sales strategies: direct sales rely on long-term contracts and bulk volumes, while service center sales demand high responsiveness, superior inventory management, and technical support regarding secondary processing, emphasizing the strategic importance of efficient distribution networks in maintaining market liquidity and servicing the heterogeneous needs of the global HRC consumption base efficiently.

- Product Type: Low Carbon Steel, Medium Carbon Steel, High Carbon Steel, Alloy Steel, Advanced High-Strength Steel (AHSS).

- Application: Construction and Infrastructure, Automotive and Transportation, Machinery and Equipment, Pipes and Tubes, Shipbuilding, Energy and Power Generation (Oil and Gas, Renewables).

- End-User: Heavy Fabrication, Light Fabrication, Distributors/Service Centers, Original Equipment Manufacturers (OEMs).

- Grade: Commercial Quality (CQ), Drawing Quality (DQ), Structural Quality (SQ), High-Strength Low-Alloy (HSLA).

- Thickness: Thin Gauge HRC (1.5mm to 3.0mm), Medium Gauge HRC (3.0mm to 8.0mm), Thick Gauge HRC (Above 8.0mm).

Value Chain Analysis For Hot Rolled Coil Steel Market

The complexity of the Hot Rolled Coil Steel market value chain originates in the highly capital-intensive and globally distributed upstream phase, which primarily involves the extraction, beneficiation, and transportation of critical raw materials—chiefly iron ore (pellets/fines), metallurgical coking coal, and processed scrap steel. Upstream analysis focuses intensely on supply chain security and cost stabilization; integrated steel producers rely heavily on these volatile commodities, making backward integration—securing ownership or long-term purchase agreements with major mining operations—a paramount strategic objective to mitigate risks associated with geopolitical trade disruptions and drastic commodity price swings. The energy inputs, including natural gas and electricity, are also critical components of upstream cost, driving significant investment into optimized handling, beneficiation processes, and secured energy generation to ensure the consistent, high-volume feed required for continuous casting and subsequent hot rolling operations, establishing material procurement efficiency as a core competitive metric.

The intermediate manufacturing process, encompassing primary steelmaking (BOF or EAF) and the sophisticated hot rolling operation, constitutes the highest value-addition stage within the chain. This phase demands state-of-the-art rolling mill technology, high precision process control, and advanced metallurgical knowledge to transform liquid steel into high-quality HRC, meeting increasingly stringent specifications, especially for specialized grades. The distribution channel subsequently dictates market reach and logistical efficiency. Large, vertically integrated mills often engage in direct sales, establishing dedicated long-term supply contracts with major Original Equipment Manufacturers (OEMs) in the automotive and machinery sectors, providing tailor-made, just-in-time delivery of large-tonnage orders. Conversely, the indirect distribution channel, centered around specialized steel service centers, plays a crucial role in market democratization by purchasing bulk coils and then processing them into specific lengths, widths, and surface conditions (e.g., pickled and oiled), serving the fragmented demand of thousands of small and medium enterprises (SMEs) across diverse fabrication industries, requiring robust inventory management and logistical speed.

Downstream analysis highlights the ultimate use and further processing of HRC, which acts either as a finished product for heavy structural applications (e.g., construction beams, railway components) or as the primary feedstock for Cold Rolled Coil (CRC) mills and galvanizing lines, creating higher-value finished steel products used in consumer goods and visible automotive panels. Potential customers, spanning infrastructure developers to appliance manufacturers, drive the final market demand, linking the chain's profitability to global construction starts and consumer confidence indices. The strategic importance of the downstream phase is escalating due to end-user demand for sustainable sourcing; companies demonstrating supply chain transparency and lower-carbon HRC production can capture a growing share of premium downstream markets. Successful value chain management requires holistic integration, digital tracking from mine to coil, and optimized inventory buffering at the service center level to efficiently serve the divergent quality, volume, and logistical demands placed by the extensive portfolio of direct and indirect customers globally, reinforcing the foundational and pervasive role of HRC in industrial economies.

Hot Rolled Coil Steel Market Potential Customers

The Hot Rolled Coil Steel market’s potential customer base is exceptionally broad and deeply integrated into the global capital goods and manufacturing ecosystems, ensuring highly diversified demand across various industrial cycles and economic regions. The predominant buyer segment includes massive infrastructure developers and major civil construction firms that utilize HRC for fundamental structural components, large-diameter transmission pipes, and reinforcing materials in large-scale projects such as skyscrapers, expansive bridge networks, and port facilities; these buyers are typically price-sensitive due to the sheer volume required but prioritize materials certified for structural integrity and standardized compliance. Closely following are the global automotive Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, which constitute a strategically vital customer segment, demanding specialized AHSS HRC for vehicle frames, suspension systems, and safety cages, placing intense emphasis on material consistency, yield strength, and ultra-precise delivery scheduling to maintain lean manufacturing operations, driving demand for technologically advanced HRC products.

Furthermore, the industrial machinery and equipment manufacturers form a substantial and stable customer cohort, purchasing HRC for the fabrication of complex, robust equipment utilized in sectors such as agriculture (tractors, implements), mining (heavy earth-moving equipment), and energy production (pressure vessels, heat exchangers). These customers prioritize material durability, resistance to fatigue, and excellent weldability, often requiring specific alloyed HRC grades to withstand severe operating environments and demanding continuous supply stability over multi-year equipment production cycles. Finally, the network of independent steel service centers and smaller regional distributors represents the vital link to the Small and Medium-sized Enterprise (SME) fabrication market. These intermediaries purchase commodity HRC in bulk, adding critical value through custom processing services—slitting coils to narrow widths, cutting sheets to specific lengths, or pickling to remove scale—thereby servicing thousands of smaller-volume users across appliance manufacturing, general fabrication, and localized construction, ensuring the high-volume output of steel mills is efficiently dispersed across the heterogeneous industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 Billion |

| Market Forecast in 2033 | USD 395.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Baowu Group, POSCO, Nippon Steel, HBIS Group, Tata Steel, JSW Steel, Shougang Group, Gerdau S.A., Nucor Corporation, Hyundai Steel, China Steel Corporation, Novolipetsk Steel (NLMK), Severstal, US Steel, Thyssenkrupp, SAIL, Commercial Metals Company (CMC), EVRAZ, Steel Dynamics Inc. (SDI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Rolled Coil Steel Market Key Technology Landscape

The technological evolution defining the Hot Rolled Coil Steel market is highly focused on achieving extreme operational efficiency, precision material characteristics, and, increasingly, radical sustainability in the steelmaking process, thereby reshaping the competitive advantage among global producers. Core innovations within the traditional manufacturing phase center on advanced hot strip mill technologies, including continuous rolling methods and sophisticated laminar flow cooling systems. Continuous rolling, often coupled with modern coiling equipment, minimizes yield loss and maximizes throughput, ensuring a consistent product stream. The integration of high-precision gauge control systems, utilizing X-ray or isotope measurements and hydraulic adjustment mechanisms, allows producers to maintain exceptionally tight thickness tolerances across the entire length of the coil, a necessity for subsequent processing (like cold rolling) and meeting the demanding specifications of automotive and aerospace customers, who cannot tolerate significant variations in material dimensions or internal structure.

The most transformative area of technological investment is centered on decarbonization and achieving 'green steel' status, directly addressing the industry's significant environmental footprint. This paradigm shift involves accelerating the transition away from traditional Blast Furnace/Basic Oxygen Furnace (BF/BOF) routes—which rely heavily on coking coal—towards low-carbon alternatives. Prominent among these is the expansion and optimization of Electric Arc Furnace (EAF) technology, which utilizes ferrous scrap steel, leading to significantly lower CO2 emissions per ton of HRC, provided the electrical grid source is renewable. Furthermore, the development and scaling of Hydrogen Direct Reduction Iron (H-DRI) processes are viewed as the long-term, zero-emission solution, involving substantial governmental and private sector investment across Europe and East Asia. H-DRI technology uses green hydrogen as the reducing agent instead of coal or natural gas, fundamentally altering the chemistry of steel production and promising a compliant path forward for producers targeting highly regulated, premium environmental markets.

Beyond the core production process, the incorporation of comprehensive digitalization technologies—aligned with Industry 4.0 principles—is fundamentally enhancing operational intelligence and quality traceability. This includes the pervasive use of Internet of Things (IoT) sensors throughout the mill, generating massive data streams that are analyzed by machine learning algorithms for real-time process control, predictive anomaly detection, and energy management optimization across multiple subsystems (e.g., reheat temperature profiles, cooling cycle rates). The deployment of advanced non-destructive testing (NDT) techniques, often involving ultrasonic or magnetic particle inspection integrated into the final quality assurance stage, ensures the internal structural integrity of the HRC, especially critical for high-stress applications in pipelines and critical infrastructure. This confluence of metallurgical process control, sustainable resource management, and digital automation defines the cutting edge of the HRC market landscape, differentiating leading companies by their ability to produce high-quality, specialized products at maximized efficiency while minimizing their environmental impact, setting the technological standard for global competition.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share globally due to the colossal production and consumption capacities of China and India, driven by continuous, large-scale infrastructure investment, robust real estate development, and the region's status as the world’s manufacturing hub. Growth is sustained by rapid urbanization, massive government initiatives aimed at infrastructure modernization (e.g., China's Belt and Road, India's National Infrastructure Pipeline), and strong domestic automotive production, making it the primary volume driver and central to global HRC pricing dynamics and supply stability.

- North America: This region is characterized by high demand for specialized, high-margin HRC grades, particularly AHSS for the automotive sector focused on vehicle lightweighting and stringent safety standards, and structural grades for renewing aging infrastructure (e.g., bridges, pipelines). Growth is supported by substantial domestic manufacturing output and strategic investments in EAF technology to meet lower-carbon mandates and reduce reliance on volatile international supply chains, emphasizing quality, sustainability, and regional production security over purely cost-driven imported alternatives.

- Europe: The European market is highly influenced by rigorous environmental regulations, particularly the European Green Deal and associated carbon border adjustment mechanisms (CBAM), forcing a rapid acceleration toward green steel production technologies (hydrogen-based DRI). Demand remains strong in construction and premium automotive segments, but regional competitiveness depends increasingly on technological compliance and strategic collaboration among producers to pool resources for zero-carbon steel innovation, leading to potentially higher HRC pricing reflective of premium sustainable production costs and complex regulatory navigation strategies.

- Latin America: This region shows stable demand tied to domestic construction activity, resource extraction projects (mining, oil and gas), and localized automotive production, particularly in Brazil and Mexico. The market often acts as a critical link in global supply chains, exporting raw materials and semi-finished steel, while domestic HRC consumption is highly susceptible to macroeconomic instability, currency fluctuations, and political risks which impact major capital projects and investment flows, necessitating careful risk assessment for regional market participants.

- Middle East and Africa (MEA): Growth in MEA is propelled by ambitious governmental diversification strategies, focusing on massive construction megaprojects (e.g., NEOM in Saudi Arabia) and expansion of the energy infrastructure (pipelines, refineries). While resource-rich countries benefit from abundant energy for steel production, the region remains a net importer of specialized HRC, presenting substantial opportunities for capacity expansion and technology transfer to establish regional self-sufficiency in meeting burgeoning localized industrial and infrastructure needs efficiently, driving long-term investment in new rolling mill complexes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Rolled Coil Steel Market.- ArcelorMittal

- Baowu Group

- POSCO

- Nippon Steel

- HBIS Group

- Tata Steel

- JSW Steel

- Shougang Group

- Gerdau S.A.

- Nucor Corporation

- Hyundai Steel

- China Steel Corporation

- Novolipetsk Steel (NLMK)

- Severstal

- US Steel

- Thyssenkrupp

- SAIL (Steel Authority of India Limited)

- Commercial Metals Company (CMC)

- EVRAZ

- Steel Dynamics Inc. (SDI)

Frequently Asked Questions

Analyze common user questions about the Hot Rolled Coil steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Hot Rolled Coil Steel market?

The central driver is massive global infrastructure investment and urban development projects, particularly across the Asia Pacific region, coupled with escalating demand for advanced high-strength steel (AHSS) variants from the recovering and evolving automotive sector, focused on electric vehicle production and lightweighting initiatives.

How do volatile raw material prices impact the HRC steel production process?

High volatility in the cost of iron ore and coking coal significantly compresses the operating margins of integrated steel producers, forcing strategic procurement adjustments, increased backward integration, and the adoption of scrap-intensive EAF methods to stabilize input costs and manage pricing risk effectively across the supply chain.

What role does green steel technology play in the future of HRC production?

Green steel technologies, particularly hydrogen-based direct reduction iron (H-DRI) and enhanced Electric Arc Furnace (EAF) usage, are critical for achieving sustainability mandates and regulatory compliance, especially in Europe. These technologies are essential for reducing carbon emissions, establishing a low-carbon product differentiator, and securing future market access.

Which geographical region dominates the consumption of Hot Rolled Coil Steel?

The Asia Pacific (APAC) region, led by China and India, dominates both the production and consumption of HRC, driven by unprecedented industrial manufacturing output and sustained, heavy government spending on essential transportation, energy, and urbanization infrastructure projects throughout the forecast period.

What are the key differences between Hot Rolled Coil (HRC) and Cold Rolled Coil (CRC)?

HRC is processed above the steel's recrystallization temperature, yielding a more ductile, less expensive product with a rougher finish, primarily used for structural components; CRC is processed at room temperature, resulting in tighter tolerances, a smoother surface finish, and higher strength, typically utilized for visible panels and high-precision applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager