Hot Rolled Pickled and Oiled Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432385 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hot Rolled Pickled and Oiled Market Size

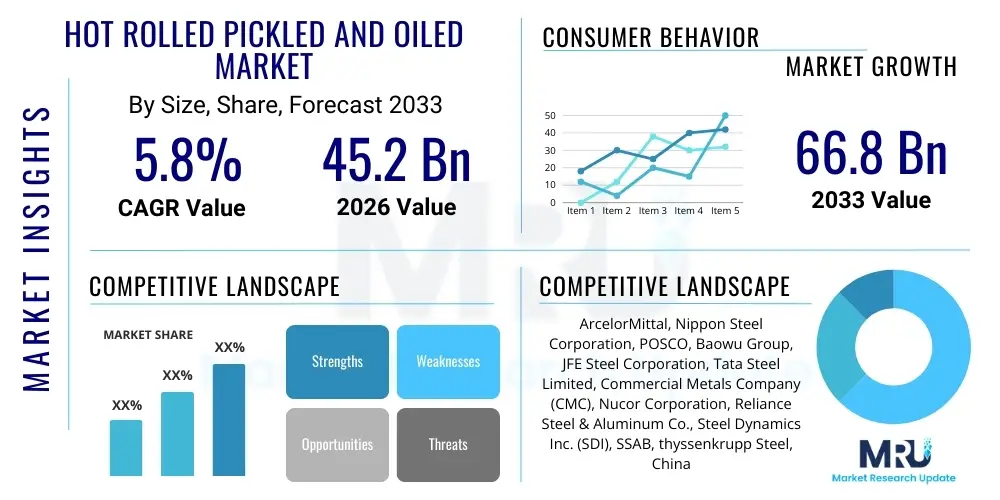

The Hot Rolled Pickled and Oiled Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 66.8 Billion by the end of the forecast period in 2033.

Hot Rolled Pickled and Oiled Market introduction

The Hot Rolled Pickled and Oiled (HRPO) steel market encompasses flat steel products that undergo specific processing steps post-hot rolling. The pickling process involves cleaning the steel surface to remove mill scale, typically using hydrochloric acid, resulting in a cleaner, more workable surface finish. Subsequently, the oiled coating is applied to prevent rust formation during transportation and storage, thereby maintaining the integrity and surface quality of the steel sheet. HRPO steel is a critical intermediate product, offering superior ductility and enhanced surface quality compared to standard hot rolled steel, making it ideal for processes requiring tight dimensional tolerances and further forming.

HRPO steel products are characterized by their uniformity, improved flatness, and enhanced adhesion properties for subsequent coatings or paint applications. These characteristics make HRPO essential across high-demand sectors, particularly automotive manufacturing, construction, heavy machinery, and pipe and tube production. In the automotive industry, HRPO is vital for structural components, chassis parts, and various stampings where weldability and formability are paramount. The reliability and cost-effectiveness of HRPO, positioned between standard hot rolled and more expensive cold rolled steel, solidify its role as a fundamental material in modern industrial applications demanding durability and moderate surface aesthetics.

Major driving factors influencing market expansion include robust demand from the global automotive sector, particularly the rising production of light commercial vehicles and SUVs, which utilize large volumes of HRPO for their structural integrity. Furthermore, increased investment in infrastructure projects and the expansion of the industrial manufacturing base in emerging economies, particularly in the Asia Pacific region, necessitate high-quality, formable steel products. The growing emphasis on lightweighting in various industries to meet stringent emission standards also indirectly fuels demand for high-strength low-alloy (HSLA) HRPO variants. However, volatility in raw material prices, particularly iron ore and coking coal, alongside fluctuating energy costs, presents periodic challenges to stable market growth and profitability.

Hot Rolled Pickled and Oiled Market Executive Summary

The Hot Rolled Pickled and Oiled market is experiencing steady expansion, primarily driven by strong rebound activity in global manufacturing and automotive sectors following pandemic-related disruptions. Key business trends include the consolidation of production capacity among major integrated steel mills and increasing vertical integration to control raw material sourcing and quality consistency. Furthermore, there is a distinct shift toward producing advanced high-strength steel (AHSS) and ultra-high-strength steel (UHSS) grades within the HRPO format to cater to safety and lightweighting demands in automotive design, positioning innovation as a core competitive advantage. Sustainability mandates are also influencing production, pushing manufacturers towards cleaner technologies and reduced acid consumption in the pickling process.

Regionally, Asia Pacific maintains its dominance in market volume, driven by China and India’s massive manufacturing and infrastructure developments. North America and Europe demonstrate mature market conditions characterized by stricter quality requirements and a preference for specialized, high-performance HRPO grades. While APAC focuses on volume and general industrial applications, Western markets emphasize precision, advanced alloying, and customization. Regulatory frameworks, such as those related to trade tariffs and environmental compliance, significantly shape regional supply chains, prompting localized production or strategic sourcing to mitigate risk and ensure uninterrupted supply to major end-users.

Segmentation trends indicate that demand is highly concentrated in the Automotive segment due to its high volume consumption and rigorous specification needs. Thickness segmentation shows robust growth in the intermediate thickness range (3mm to 6mm), which is versatile for structural components and heavy machinery. From a process perspective, the batch pickling method, while traditional, is being increasingly supplemented by continuous pickling lines in newer, larger facilities to achieve higher throughput and greater consistency, crucial for meeting the just-in-time requirements of large Original Equipment Manufacturers (OEMs).

AI Impact Analysis on Hot Rolled Pickled and Oiled Market

User inquiries regarding AI's influence in the HRPO market center around process optimization, quality control, and predictive maintenance. Common questions address how machine learning can minimize defects (like surface pitting or scale residue) during pickling, optimize acid consumption and regeneration efficiency, and predict equipment failure in high-stress environments such as hot rolling mills and acid tanks. Users are highly interested in leveraging computer vision for real-time surface inspection to replace manual quality checks, ensuring that HRPO material meets stringent OEM specifications before oiling and shipment. The overarching theme is the integration of AI to enhance operational efficiency, reduce waste, and improve the consistency and traceability of the steel product throughout its production lifecycle.

- AI-driven Predictive Maintenance: Utilizing sensor data from pickling lines and hot mills to forecast component failure (e.g., rollers, pumps, heating elements), thereby minimizing unscheduled downtime and improving overall equipment effectiveness (OEE).

- Optimized Process Control: Employing machine learning algorithms to dynamically adjust parameters such as acid concentration, temperature, and line speed based on real-time feedback, leading to reduced chemical usage and lower environmental discharge.

- Enhanced Quality Inspection: Implementation of deep learning-based computer vision systems to automatically detect and classify surface defects (including streaks, pits, and inadequate scale removal) at high speeds, ensuring higher material quality consistency compared to traditional methods.

- Supply Chain and Inventory Optimization: Using AI models to forecast demand accurately across key end-user segments (automotive, construction) and optimize inventory levels of HRPO coils, reducing warehousing costs and improving response times.

- Energy Efficiency Management: AI systems monitor energy consumption patterns in high-energy processes (heating, ventilation) within the mill environment, recommending operational adjustments to lower the carbon footprint and operating expenses associated with production.

DRO & Impact Forces Of Hot Rolled Pickled and Oiled Market

The Hot Rolled Pickled and Oiled market dynamics are heavily influenced by global macroeconomic trends and specific industry requirements. Key drivers include the revitalization of the automotive sector, ongoing urbanization, and significant investment in renewable energy infrastructure, all of which require high volumes of fabricated steel components where HRPO serves as a fundamental feedstock. Conversely, market growth is restrained by pronounced volatility in the price of key raw materials, primarily iron ore and energy carriers, which directly impact production costs and profitability margins. Additionally, the complex and highly regulated nature of chemical waste disposal from the pickling process necessitates substantial capital expenditure for environmental compliance, posing a barrier for smaller players. Opportunities lie in developing advanced, corrosion-resistant HRPO grades and expanding market penetration in emerging applications like specialized energy storage systems and high-efficiency tubing.

The key impact forces shaping the competitive landscape are technological advancements in continuous casting and pickling technology, which reduce processing time and enhance surface quality consistency, thereby differentiating leading manufacturers. Furthermore, the bargaining power of major automotive OEMs remains high; these buyers demand strict quality tolerances, just-in-time delivery, and competitive pricing, forcing suppliers to optimize their operational efficiencies relentlessly. Environmental regulations act as a critical external force, compelling the industry to invest in closed-loop pickling systems and acid regeneration plants to minimize environmental impact and comply with increasingly stringent global standards regarding effluent discharge.

The interaction of these factors dictates market performance. For instance, while high raw material costs are a restraint, the opportunity presented by AHSS/UHSS HRPO allows manufacturers to command premium prices, offsetting cost pressures partially. The push towards automation (AI) is a direct response to the impact forces of high labor costs and the need for zero-defect standards imposed by sophisticated end-users. Strategic investment in new, efficient production lines that minimize waste is essential for maintaining a competitive edge and successfully navigating the cyclical nature of steel demand.

Segmentation Analysis

The Hot Rolled Pickled and Oiled market is segmented primarily based on end-use application, thickness, and processing method. Segmentation by application is crucial as it dictates the required steel grade, quality tolerances, and volume consistency, with the Automotive and Construction sectors being the dominant consumers. Thickness segmentation provides insight into the usage profile, where thinner gauges are typically used for intricate stamping and parts (e.g., automotive panels), while thicker gauges are reserved for structural integrity in heavy machinery and large tubes. The differentiation by processing method, notably between continuous and batch pickling, reflects the scale and efficiency of the producer, impacting cost structures and throughput capacity.

- By End-Use Application:

- Automotive (Body structure, Chassis, Wheels, Stampings)

- Construction (Structural tubing, Metal decking, Framing)

- Pipe and Tube Manufacturing (API grade pipes, Mechanical tubing)

- Heavy Machinery and Equipment (Agricultural equipment, Industrial fabrication)

- Others (Appliances, Storage Tanks)

- By Thickness:

- Under 3 mm (Thin Gauge)

- 3 mm to 6 mm (Medium Gauge)

- Above 6 mm (Heavy Gauge)

- By Processing Method:

- Continuous Pickling

- Batch Pickling

- By Steel Grade:

- Commercial Steel (CS)

- Drawing Quality Steel (DQ)

- High Strength Low Alloy (HSLA) Steel

- Advanced High Strength Steel (AHSS)

Value Chain Analysis For Hot Rolled Pickled and Oiled Market

The HRPO value chain begins upstream with the sourcing of primary raw materials, predominantly iron ore, coking coal, and scrap steel, which are converted into slabs or billets through integrated steelmaking (blast furnace/BOF) or electric arc furnace (EAF) methods. These intermediate materials are then processed through the hot rolling mill, forming hot rolled coils. The critical transformation stage occurs when these coils enter the pickling line—either continuous or batch—to remove surface scale using acidic solutions (mostly hydrochloric acid), followed by the protective oiling process. Upstream cost management and securing consistent quality raw materials are foundational to profitability, as these costs constitute the largest portion of the final product price.

The downstream component involves distribution and ultimate fabrication. HRPO coils are sold directly to large captive consumers, such as automotive OEMs, or indirectly through specialized service centers and distributors. Service centers play a vital role by performing essential secondary processing steps like slitting, shearing, and blanking, customizing the HRPO material to specific end-user dimensions and just-in-time delivery schedules. The efficiency and geographic reach of the distribution network significantly influence market access and competitive pricing, especially for smaller or geographically diverse customers.

Distribution channels are bifurcated between direct sales, typically reserved for major volume buyers who require specialized specifications and long-term contracts (e.g., Tier 1 automotive suppliers), and indirect sales through service centers. Indirect channels provide flexibility and tailored inventory management for mid-sized fabricators and smaller construction firms. The trend towards digitalization in supply chain management is enhancing transparency and efficiency, allowing both direct and indirect channels to minimize lead times and react quickly to fluctuating demand signals in the highly cyclical steel market. Effective inventory management at the service center level is a key differentiator, reducing financial exposure for both the mill and the end-user.

Hot Rolled Pickled and Oiled Market Potential Customers

The primary customers for Hot Rolled Pickled and Oiled steel are industries that require high-volume, flat steel products with excellent surface cleanliness, superior formability, and reliable weld characteristics. The largest consumption base lies within the automotive sector, which uses HRPO extensively for structural components that are subsequently stamped, welded, and sometimes painted. These customers require materials that meet stringent mechanical property standards (like yield strength and elongation) and minimal surface defects to ensure high quality and safety in the finished vehicle.

Secondary major customers include manufacturers of pipes and tubes, especially mechanical tubing, which utilizes HRPO for its superior weldability and consistent gauge. The construction sector, particularly those involved in pre-engineered metal buildings, storage tanks, and large-scale industrial fabrication, also constitutes a substantial consumer base. These end-users value HRPO for its improved material yield during fabrication and its compatibility with various protective coatings necessary for long-term structural integrity in exposed environments. The selection of HRPO over standard HR steel is often dictated by the need for superior fit and finish, or when subsequent cold forming or plating processes are required.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 66.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, POSCO, Baowu Group, JFE Steel Corporation, Tata Steel Limited, Commercial Metals Company (CMC), Nucor Corporation, Reliance Steel & Aluminum Co., Steel Dynamics Inc. (SDI), SSAB, thyssenkrupp Steel, China Steel Corporation, Acerinox S.A., Gerdau S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Rolled Pickled and Oiled Market Key Technology Landscape

The technological landscape for the Hot Rolled Pickled and Oiled market is defined by advancements aimed at increasing efficiency, improving surface quality, and enhancing sustainability. A critical technology is the implementation of continuous pickling lines integrated with tandem cold mills (PL-TCM lines), enabling seamless, high-speed production of HRPO followed immediately by cold reduction, which dramatically improves productivity and reduces energy consumption compared to non-integrated processes. Furthermore, modern pickling lines predominantly utilize turbulent flow shallow bath technology, which reduces the required acid volume and reaction time, leading to faster throughput and minimized scale residue. These lines are crucial for handling the advanced high-strength steel grades that require precise and rapid pickling to maintain specific metallurgical properties.

Another significant technological focus is the optimization of the pickling process itself through advanced chemical management. This involves sophisticated hydrochloric acid regeneration systems (e.g., fluid bed regeneration) that recover the spent acid and iron oxide byproducts, minimizing waste discharge and lowering operational costs. The recovered iron oxide can often be repurposed, aligning with circular economy principles. Furthermore, automated tension leveling and flatness control systems integrated into the pickling line ensure that the final HRPO product exhibits superior flatness, a non-negotiable requirement for high-precision stamping operations, particularly in the automotive industry.

The application of computer vision and non-destructive testing (NDT) technologies is also rapidly gaining traction. High-resolution cameras and eddy current sensors are deployed post-pickling to scan the entire steel surface for minute defects or variations in oil film thickness, ensuring compliance with stringent customer standards before the coil is packaged. These technologies minimize human error and facilitate real-time process adjustments. The overall technology shift points toward highly automated, energy-efficient, and digitally monitored production environments capable of producing specialized, clean-surface steel grades consistently and sustainably.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global HRPO production and consumption, driven primarily by China and India. China's massive industrial base, coupled with its dominance in global automotive and machinery manufacturing, makes it the largest regional market by volume. The region benefits from lower production costs and rapid urbanization requiring extensive steel use in construction and infrastructure. Future growth is tied to Southeast Asia's expanding automotive manufacturing hubs (Thailand, Indonesia).

- North America: The North American market is characterized by high-quality demands, particularly from the US automotive industry, which places heavy emphasis on Advanced High-Strength Steel (AHSS) HRPO for lightweighting and safety standards. Production is highly concentrated among integrated domestic mills and large minimills. Growth is stable, focusing on premium product differentiation and technological upgrades in existing facilities to improve energy efficiency.

- Europe: Europe exhibits stringent regulatory environments concerning environmental protection, which necessitates significant investment in advanced acid regeneration and waste management systems among HRPO producers. Demand is robust, fueled by the German automotive sector and specialized machinery manufacturing. The market emphasizes precision, specialized grades, and adherence to sustainability standards, driving innovation toward greener steel production methods.

- Latin America (LATAM): LATAM, particularly Brazil and Mexico, serves as a significant regional hub, supported by a growing domestic automotive industry and infrastructure projects. Mexico benefits from trade agreements (USMCA) that integrate its steel supply chain with North American automotive assembly plants. Market volatility is higher here, linked closely to national economic stability and commodity price fluctuations.

- Middle East and Africa (MEA): This region is experiencing nascent growth, driven primarily by large-scale government-backed infrastructure and construction megaprojects in the GCC countries. Local production capacity is expanding, aimed at reducing reliance on imports, particularly for pipe and tube manufacturing used in the oil and gas and water sectors. Consumption is less diverse compared to mature markets, centering on standard structural grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Rolled Pickled and Oiled Market.- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Baowu Group

- JFE Steel Corporation

- Tata Steel Limited

- Commercial Metals Company (CMC)

- Nucor Corporation

- Reliance Steel & Aluminum Co.

- Steel Dynamics Inc. (SDI)

- SSAB

- thyssenkrupp Steel

- China Steel Corporation

- Acerinox S.A.

- Gerdau S.A.

- United States Steel Corporation (U. S. Steel)

- Hyundai Steel Company

- Shougang Group

- Jindal Steel and Power Limited (JSPL)

- EVRAZ plc

Frequently Asked Questions

Analyze common user questions about the Hot Rolled Pickled and Oiled market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between HRPO and standard Hot Rolled steel?

The primary difference is the surface condition. HRPO steel undergoes a chemical pickling process to remove mill scale (iron oxide layer) formed during hot rolling, followed by oiling for rust prevention. This treatment results in a clean, smooth surface with improved flatness and enhanced formability, making it suitable for subsequent processes like stamping and welding, unlike standard hot rolled steel which retains the rough, scaly surface.

Which end-use industry drives the highest demand for Hot Rolled Pickled and Oiled products globally?

The Automotive sector is the largest and most critical consumer of HRPO products globally. HRPO steel is essential for manufacturing vehicle chassis, structural body components, wheels, and various stamped parts, requiring materials with high strength, excellent ductility, and consistent surface quality for welding and paint adhesion.

How do environmental regulations impact the cost structure of HRPO steel production?

Environmental regulations significantly increase operational costs due to the necessity of installing and maintaining advanced acid regeneration plants and complex effluent treatment systems. These systems are mandatory to neutralize acidic waste and recover hydrochloric acid, minimizing environmental discharge but requiring substantial capital investment and specialized maintenance, ultimately affecting the final cost of HRPO material.

What role does High Strength Low Alloy (HSLA) steel play in the HRPO market?

HSLA steel is increasingly critical in the HRPO market as it offers superior strength-to-weight ratios compared to commercial steel grades. When processed as HRPO, HSLA allows end-users, particularly automotive manufacturers, to achieve material lightweighting without sacrificing structural integrity, thereby meeting stringent fuel efficiency and safety standards.

What is the current growth forecast for the Asia Pacific region in the HRPO market?

The Asia Pacific region is forecast to maintain the highest growth rate, primarily driven by substantial industrial growth in emerging economies like India and Southeast Asian nations, coupled with continued, high-volume manufacturing activities in China. This growth is supported by large infrastructure spending and sustained momentum in regional vehicle production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager