Hot swap controllers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439931 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Hot swap controllers Market Size

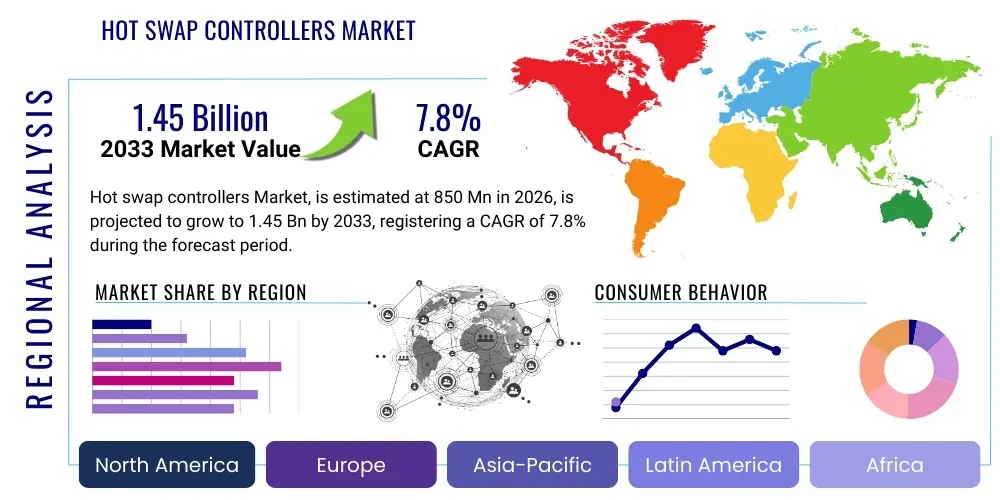

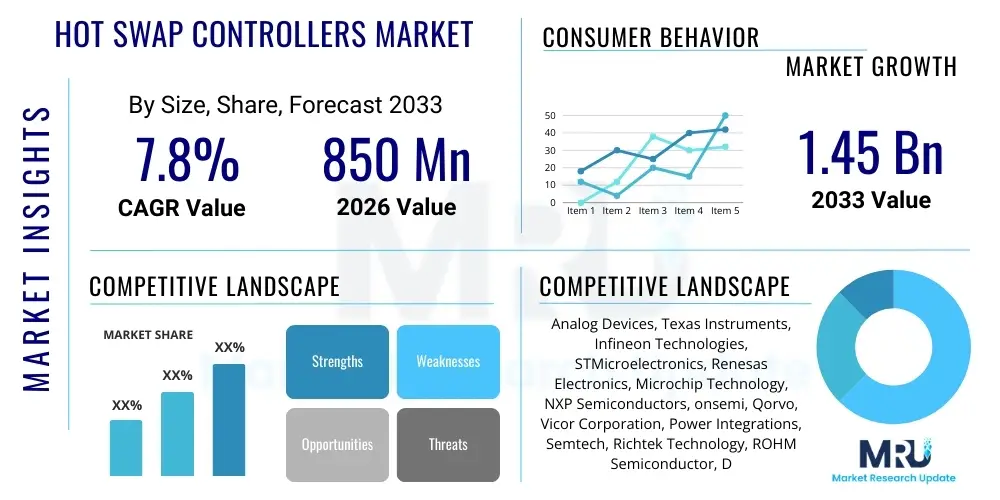

The Hot swap controllers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1.45 billion by the end of the forecast period in 2033.

Hot swap controllers Market introduction

The Hot swap controllers market encompasses integrated circuits and discrete components designed to facilitate the safe insertion and removal of circuit cards or other electronic modules into a live, powered backplane or system without interrupting its operation. These controllers are crucial for maintaining system uptime, reliability, and serviceability in applications where continuous operation is paramount, enabling technicians to perform maintenance or upgrades without powering down the entire system. Their primary function involves meticulously managing the power supply during insertion and removal events, preventing damaging current surges, and ensuring stable voltage levels across the system.

Products within this market range from simple current-limiting devices to highly integrated solutions offering advanced protection features, digital control, and communication interfaces. They are engineered to provide a controlled ramp-up of power upon insertion and a safe ramp-down upon removal, safeguarding sensitive components from electrical transients. Key features often include overcurrent protection, undervoltage lockout, overvoltage protection, and thermal shutdown, all designed to enhance system robustness and extend component lifespan. The sophistication of these controllers varies significantly based on application requirements, from basic power sequencing to complex load management and telemetry capabilities.

Major applications for hot-swap controllers span across diverse industries, predominantly in data centers, telecommunications, industrial automation, and automotive electronics. The increasing demand for high-availability systems, cloud computing infrastructure, 5G network deployment, and advanced driver-assistance systems (ADAS) are key driving factors. Benefits include enhanced system reliability, simplified maintenance procedures, reduced downtime, and improved operational efficiency. The continuous evolution of these applications, particularly the trend towards higher power densities and smaller form factors, further fuels innovation and market growth in the hot-swap controller segment, emphasizing efficiency, integration, and advanced protection.

Hot swap controllers Market Executive Summary

The Hot swap controllers market is currently experiencing significant expansion driven by persistent demand for high-availability systems across critical infrastructure, reflecting robust business trends in digital transformation and cloud computing. Global business trends indicate a strong push towards reducing operational downtime and enhancing system reliability, making hot-swap capabilities indispensable for modern server farms, telecommunication central offices, and industrial control systems. The ongoing proliferation of data centers, the rollout of 5G networks, and the burgeoning Internet of Things (IoT) ecosystem are collectively shaping market dynamics, compelling manufacturers to develop more integrated, efficient, and feature-rich hot-swap solutions capable of managing higher power densities and complex power-up/down sequences. Business strategies are increasingly focused on developing specialized controllers for specific voltage and current requirements, along with advanced diagnostic and predictive maintenance capabilities.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, largely due to rapid industrialization, increasing investments in IT infrastructure, and the expansion of data centers in countries like China, India, and Japan. North America and Europe, while more mature, continue to hold substantial market shares, driven by ongoing technological upgrades, stringent reliability standards in critical applications, and a strong presence of key technology developers and early adopters. Latin America, the Middle East, and Africa are showing nascent but steady growth, fueled by digital transformation initiatives and infrastructure development projects. These regional disparities reflect varying levels of technological adoption and investment in high-availability systems, influencing distribution channels and strategic partnerships across the globe.

Segment trends highlight a strong demand for multi-channel hot-swap controllers and those offering higher current ratings, especially in large-scale data center and enterprise storage applications where dense power management is crucial. The integration of advanced features such as digital control, PMBus (Power Management Bus) interface, and comprehensive fault protection mechanisms is becoming a standard expectation across most segments. Furthermore, the market is observing a shift towards more intelligent hot-swap controllers capable of communicating system status, performing self-diagnostics, and enabling remote management. This evolution underscores a broader trend towards smart power management solutions that contribute to overall system efficiency and resilience, impacting product development cycles and market offerings across various voltage and current ratings.

AI Impact Analysis on Hot swap controllers Market

The integration of Artificial Intelligence (AI) is poised to significantly transform the Hot swap controllers market by introducing advanced predictive capabilities and optimizing power management paradigms. Users frequently inquire about how AI can enhance the reliability and efficiency of systems utilizing hot-swap technology, specifically focusing on its potential for proactive fault detection, dynamic power allocation, and autonomous system health management. Common user questions often revolve around whether AI can predict potential failures in hot-swapable modules before they occur, how it can optimize energy consumption in real-time, and if it can automate complex power sequencing tasks. The key themes emerging from these inquiries highlight a strong expectation for AI to move hot-swap controllers beyond reactive protection to a proactive, intelligent system that minimizes downtime, extends component life, and improves overall operational efficiency, ultimately reducing total cost of ownership for complex electronic systems.

- Predictive Maintenance: AI algorithms can analyze historical and real-time operational data (e.g., voltage fluctuations, current spikes, temperature variations) from hot-swap controllers to identify patterns indicative of impending component failure. This enables proactive maintenance, reducing unplanned downtime.

- Dynamic Power Optimization: AI can optimize power delivery and consumption for hot-swappable modules by dynamically adjusting voltage and current limits based on workload, temperature, and system demands, enhancing energy efficiency and reducing heat generation.

- Autonomous Fault Management: AI-driven systems can autonomously respond to detected anomalies, initiating safe shutdown procedures for faulty modules, re-routing power, or reconfiguring system resources to maintain functionality without human intervention.

- Enhanced Diagnostic Capabilities: AI can process complex error logs and diagnostic data from hot-swap controllers to provide more granular insights into system health, root causes of failures, and recommendations for troubleshooting or preventative measures.

- Optimized Resource Allocation: In multi-module systems, AI can intelligently manage the insertion and removal sequences, prioritizing critical components, and ensuring stable power distribution to maximize system performance and availability.

- Self-Healing Systems: AI integration contributes to the development of self-healing systems where hot-swap controllers, guided by AI, can isolate failed modules and facilitate their replacement or bypass with minimal disruption to ongoing operations.

- Security Enhancements: AI can monitor power delivery and identify unusual power consumption patterns that might indicate security breaches or malicious activity, adding an extra layer of protection to critical infrastructure.

DRO & Impact Forces Of Hot swap controllers Market

The Hot swap controllers market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory and adoption across various industries. A primary driver is the relentless expansion of data centers and cloud computing infrastructure, which demands highly reliable and continuously operational systems, making hot-swap capabilities essential for seamless maintenance and upgrades without service interruption. The global rollout of 5G technology and the proliferation of IoT devices also contribute significantly, as these require robust, scalable, and highly available network equipment and edge computing devices. Furthermore, the increasing complexity and miniaturization of electronic systems, particularly in automotive electronics for ADAS and infotainment, necessitate sophisticated power management solutions that hot-swap controllers provide, ensuring system integrity during module insertion or removal. The growing emphasis on reducing system downtime and enhancing operational efficiency across critical sectors further amplifies the demand for these controllers.

Conversely, several restraints impede the market's full potential. The inherent design complexity associated with integrating hot-swap capabilities into new systems, especially those with stringent power budgets and thermal constraints, can be a significant challenge for product developers. The cost implications of implementing advanced hot-swap controllers, which often feature integrated MOSFETs, advanced protection mechanisms, and digital interfaces, can be a deterrent for cost-sensitive applications or smaller-scale deployments. Moreover, a lack of standardized protocols and diverse voltage requirements across different applications can lead to fragmentation in the market, complicating design choices and increasing development time. Managing thermal dissipation within compact hot-swap modules, especially for high-current applications, also presents a recurring engineering challenge that necessitates innovative design solutions and materials.

Despite these challenges, substantial opportunities exist for market growth and innovation. The emergence of edge computing, which requires distributed, resilient, and highly available computing resources closer to data sources, presents a fertile ground for hot-swap controller adoption. The integration of artificial intelligence (AI) and machine learning (ML) capabilities into hot-swap solutions offers an opportunity for predictive maintenance, dynamic power optimization, and autonomous fault management, transforming controllers into intelligent system guardians. Furthermore, the increasing adoption of renewable energy systems and smart grids necessitates reliable power management for modular components, creating new application areas. The development of more highly integrated solutions that reduce component count, improve power efficiency, and simplify design processes will unlock further market potential, addressing the existing design complexity restraints and fostering broader adoption in emerging industrial and automotive applications.

Segmentation Analysis

The Hot swap controllers market is segmented based on various critical parameters, including the type of controller, current rating, and diverse applications, to provide a granular understanding of its structure and dynamics. This segmentation allows for a detailed analysis of market demand drivers, technological preferences, and growth opportunities within specific industry verticals. The market's diverse end-user base necessitates a nuanced approach to product development and market penetration, with each segment exhibiting unique requirements for voltage tolerance, protection features, and communication interfaces. Understanding these segments is crucial for manufacturers to tailor their offerings effectively and for stakeholders to identify lucrative investment areas.

- By Type:

- Single-Channel Hot Swap Controllers: Designed for managing power to a single module or circuit path, typically used in simpler systems or where individual module protection is prioritized.

- Multi-Channel Hot Swap Controllers: Capable of managing power for multiple modules or complex systems, offering integrated solutions for power sequencing and fault management across several outputs.

- By Current Rating:

- Low Current Controllers (0-5A): Commonly used in low-power communication modules, consumer electronics, or less demanding industrial applications.

- Medium Current Controllers (5A-20A): Predominantly found in enterprise servers, networking equipment, and mid-range industrial automation systems.

- High Current Controllers (20A+): Essential for high-power applications such as data center racks, blade servers, and specialized industrial machinery requiring substantial current delivery and robust protection.

- By Application:

- Data Centers & Enterprise Storage: Critical for server farms, storage arrays, and network switches to ensure continuous operation and simplified maintenance.

- Telecommunications & Networking Equipment: Used in base stations, routers, and switches to maintain network uptime and facilitate module upgrades.

- Industrial Automation & Control: Applied in PLC systems, robotics, and factory automation to enhance system reliability and ease of repair in harsh environments.

- Automotive Electronics: Increasingly integrated into ADAS, infotainment systems, and powertrain modules for fault tolerance and modularity.

- Medical Devices: Ensures continuous operation and safety in critical medical equipment like diagnostic imaging systems and life support devices.

- Aerospace & Defense: Utilized in avionics, radar systems, and military computing for mission-critical reliability and ease of field serviceability.

- Consumer Electronics: Found in high-end consumer devices that require modularity and robust power protection, though less prevalent than in industrial applications.

- By End-User Industry:

- IT & Telecommunications: Encompasses the vast infrastructure of internet services, data storage, and communication networks.

- Manufacturing: Includes industrial automation, robotics, and process control systems.

- Automotive: Covers vehicle electronics, from infotainment to safety and powertrain systems.

- Healthcare: Pertains to various medical diagnostic, monitoring, and therapeutic devices.

- Energy & Utilities: Involves power generation, distribution, and smart grid infrastructure.

Value Chain Analysis For Hot swap controllers Market

The value chain for the Hot swap controllers market is a complex ecosystem beginning with the intricate design and manufacturing of semiconductor components and extending to the diverse end-user industries that integrate these crucial devices. At the upstream segment, the chain commences with raw material suppliers providing essential inputs such as silicon wafers, rare earth elements, and various chemicals required for semiconductor fabrication. This is followed by specialized semiconductor foundries and component manufacturers that transform these raw materials into silicon die and ultimately into integrated circuits. These manufacturers are responsible for the complex processes of wafer fabrication, packaging, and testing, ensuring the hot-swap controllers meet stringent performance, reliability, and quality standards. Research and development activities at this stage are vital for driving innovation in power management ICs, leading to controllers with higher integration, improved efficiency, and advanced protection features.

Moving downstream, the value chain involves the system integrators and Original Equipment Manufacturers (OEMs) who design and assemble complete electronic systems incorporating hot-swap controllers. These OEMs, primarily in sectors such as data centers, telecommunications, industrial automation, and automotive, purchase finished hot-swap controller ICs and integrate them into their circuit boards, power supplies, and modular systems. Their role involves extensive testing and validation to ensure compatibility and optimal performance of the hot-swap function within their larger product offerings. The relationship between controller manufacturers and OEMs is often collaborative, with customized solutions developed to meet specific application requirements, particularly concerning power delivery networks and system architecture.

Distribution channels for hot-swap controllers are typically a mix of direct and indirect sales models. Direct sales are common for large-volume customers, key strategic accounts, or specialized projects where direct technical support and customization are paramount. This allows for closer collaboration between the manufacturer and the end-user, ensuring optimal integration and troubleshooting. Indirect channels primarily involve a network of authorized distributors, resellers, and online electronics marketplaces. These channels play a crucial role in reaching a broader customer base, including small to medium-sized enterprises (SMEs) and individual developers, by providing a wide range of products, technical literature, and localized support. The efficiency of these distribution networks is critical for ensuring timely availability of components and supporting the diverse global market for hot-swap controllers across various voltage and current ratings.

Hot swap controllers Market Potential Customers

The Hot swap controllers market serves a broad and diverse base of potential customers, primarily comprised of industries and enterprises that prioritize high system availability, modularity, and simplified maintenance. These customers are typically end-users or original equipment manufacturers (OEMs) who design and deploy electronic systems where continuous operation is critical and downtime must be minimized. The demand for hot-swap capabilities is driven by the operational imperative to perform upgrades, replacements, or troubleshooting of components without disrupting the entire system, thereby preserving data integrity and service continuity. As such, these customers represent the key buyers and integrators of hot-swap controllers into their sophisticated electronic infrastructure.

Among the most significant potential customers are data center operators and cloud service providers, who demand unparalleled uptime for their servers, storage arrays, and networking equipment. Telecom companies also represent a substantial customer segment, utilizing hot-swap controllers in their base stations, routers, and switches to ensure uninterrupted communication services and facilitate rapid infrastructure upgrades. Industrial automation firms, including manufacturers of programmable logic controllers (PLCs), robotics, and process control systems, are increasingly adopting hot-swap solutions to enhance the reliability and serviceability of their production lines in harsh industrial environments, thereby reducing manufacturing downtime and improving overall efficiency.

Furthermore, automotive manufacturers are emerging as a growing customer base, integrating hot-swap controllers into advanced driver-assistance systems (ADAS), infotainment units, and other critical electronic modules to ensure fault tolerance and ease of repair in modern vehicles. Medical device manufacturers, particularly for critical care equipment such as diagnostic imaging systems and life support machines, also rely on hot-swap capabilities to guarantee continuous, fail-safe operation. The aerospace and defense sector represents another vital customer segment, where mission-critical applications in avionics and military computing demand robust and highly reliable hot-swap solutions to maintain operational readiness and simplify field maintenance. These diverse end-user industries collectively drive the innovation and demand within the hot-swap controllers market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1.45 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Analog Devices, Texas Instruments, Infineon Technologies, STMicroelectronics, Renesas Electronics, Microchip Technology, NXP Semiconductors, onsemi, Qorvo, Vicor Corporation, Power Integrations, Semtech, Richtek Technology, ROHM Semiconductor, Diodes Incorporated, Torex Semiconductor, Maxim Integrated (now Analog Devices), Linear Technology (now Analog Devices), Monolithic Power Systems (MPS), Intersil (now Renesas). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot swap controllers Market Key Technology Landscape

The technological landscape of the Hot swap controllers market is characterized by continuous innovation aimed at improving power management efficiency, enhancing protection features, and enabling more intelligent system interactions. A foundational technology involves the integration of low-resistance MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors) within the controller ICs. These integrated FETs are crucial for minimizing power loss and heat generation during current conduction, especially in high-current applications, which contributes significantly to the overall efficiency and thermal management of the hot-swap solution. The ongoing advancement in semiconductor fabrication processes allows for the integration of higher current-carrying capabilities and lower on-resistance, pushing the boundaries of what integrated hot-swap controllers can achieve in compact form factors.

Beyond basic power switching, modern hot-swap controllers incorporate a suite of advanced protection features crucial for system reliability. These include precise overcurrent protection (OCP), often implemented with foldback current limiting or fast trip mechanisms to prevent damage from short circuits or excessive load currents. Undervoltage lockout (UVLO) and overvoltage protection (OVP) ensure that components only operate within safe voltage ranges, guarding against power supply anomalies. Thermal shutdown mechanisms are also standard, protecting both the controller and downstream components from overheating. The trend is towards more sophisticated, adaptive protection schemes that can respond dynamically to varying system conditions, optimizing protection thresholds in real-time to balance reliability with performance.

The adoption of digital control and communication interfaces, such as the Power Management Bus (PMBus), represents a significant technological shift. PMBus-enabled hot-swap controllers allow for digital programmability of operating parameters (e.g., current limits, voltage thresholds, ramp rates), real-time telemetry (monitoring current, voltage, temperature), and comprehensive fault logging. This digital interface facilitates remote management, diagnostic capabilities, and predictive maintenance, integrating hot-swap functionality seamlessly into broader power management architectures. Furthermore, advancements in N+1 redundancy architectures and load-sharing techniques are critical for high-availability systems, where hot-swap controllers play a pivotal role in seamlessly transferring loads and ensuring continuous power delivery even during module failures or replacements. These technological developments collectively drive the evolution of hot-swap controllers from simple protection devices to intelligent power management subsystems.

Regional Highlights

- North America: This region holds a significant share of the Hot swap controllers market, driven by the strong presence of major technology companies, extensive investments in data centers and cloud infrastructure, and robust adoption in defense and aerospace sectors. The United States, in particular, leads in innovation and deployment of advanced hot-swap solutions.

- Europe: The European market demonstrates steady growth, fueled by increasing demand from industrial automation, automotive electronics (especially for ADAS and electric vehicles), and telecommunications infrastructure upgrades. Countries like Germany, the UK, and France are key contributors, emphasizing reliability and energy efficiency.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrialization, massive investments in IT and telecom infrastructure, and the booming data center market in countries such as China, India, Japan, and South Korea. The region's expanding manufacturing base also drives demand for industrial hot-swap applications.

- Latin America: This region exhibits emerging growth, supported by increasing digitalization initiatives, expanding telecommunications networks, and gradual industrial development. Brazil and Mexico are key markets, with growing investment in local data centers and cloud services.

- Middle East and Africa (MEA): The MEA market is at a nascent stage but shows potential, driven by ongoing infrastructure development projects, increased adoption of cloud services, and government initiatives aimed at digital transformation. Countries in the GCC region are leading the investment in modern IT infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot swap controllers Market.- Analog Devices

- Texas Instruments

- Infineon Technologies

- STMicroelectronics

- Renesas Electronics

- Microchip Technology

- NXP Semiconductors

- onsemi

- Qorvo

- Vicor Corporation

- Power Integrations

- Semtech

- Richtek Technology

- ROHM Semiconductor

- Diodes Incorporated

- Torex Semiconductor

- Monolithic Power Systems (MPS)

- Linear Technology (now part of Analog Devices)

- MaxLinear

- Skyworks Solutions

Frequently Asked Questions

Analyze common user questions about the Hot swap controllers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a hot-swap controller and why is it important?

A hot-swap controller is an electronic device that enables the safe insertion and removal of circuit boards or modules into a live, powered system without requiring a power shutdown. It's crucial for maintaining system uptime, reliability, and facilitating maintenance in critical applications like data centers, telecom, and industrial automation by preventing current surges and managing power transitions.

What are the primary applications of hot-swap controllers?

Hot-swap controllers are predominantly used in applications demanding high availability and continuous operation. Key sectors include data centers and enterprise storage, telecommunications and networking equipment, industrial automation and control systems, automotive electronics (e.g., ADAS), and mission-critical medical or aerospace devices.

How does AI impact the Hot swap controllers market?

AI is transforming hot-swap controllers by enabling predictive maintenance, allowing systems to anticipate failures before they occur. It also facilitates dynamic power optimization for energy efficiency and contributes to autonomous fault management, making systems more resilient and reducing operational downtime.

What are the key factors driving the growth of the Hot swap controllers market?

The market growth is primarily driven by the exponential expansion of data centers and cloud computing, the global rollout of 5G infrastructure, the proliferation of IoT devices, and the increasing demand for high-reliability systems in automotive electronics and industrial automation. The need for reduced downtime and simplified maintenance also plays a significant role.

What are the main types of hot-swap controllers available?

Hot-swap controllers are generally categorized by the number of channels they manage (single-channel or multi-channel) and their current rating (low, medium, or high current). Their features vary based on the specific voltage, power, and protection requirements of their intended application, ranging from basic current limiting to advanced digital control and telemetry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager