Hotel and Resort Coffee Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432390 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hotel and Resort Coffee Market Size

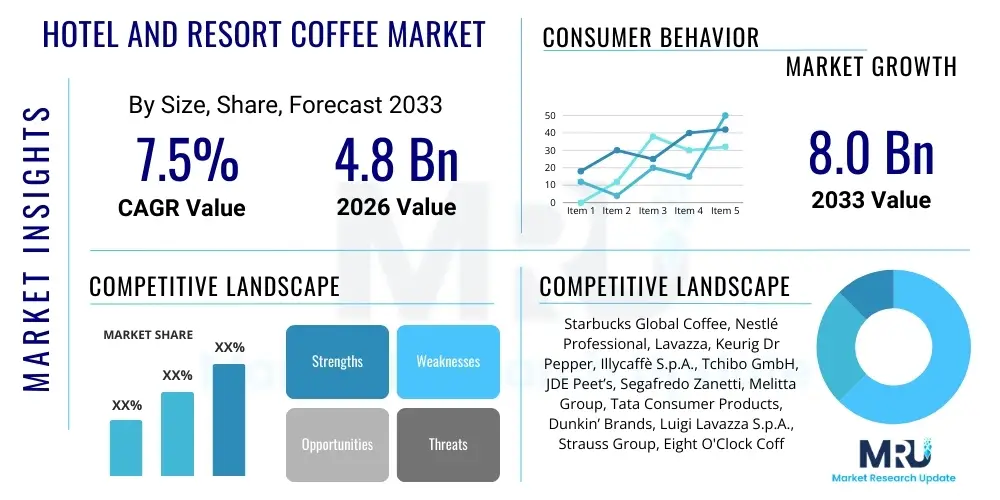

The Hotel and Resort Coffee Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the robust expansion of the global hospitality sector, coupled with an increasing demand for premium and specialty coffee experiences among discerning travelers. The shift towards in-room brewing solutions, coupled with high-end café offerings within hotel premises, significantly contributes to the escalating market valuation. Investment in advanced coffee preparation technology by major hotel chains further solidifies this market expansion.

Hotel and Resort Coffee Market introduction

The Hotel and Resort Coffee Market encompasses the sale and distribution of various coffee formats—including whole beans, ground coffee, instant coffee, and single-serve pods—specifically tailored for consumption within hospitality establishments such as hotels, resorts, cruise lines, and timeshares. This niche market is characterized by stringent quality requirements, focusing on consistent flavor profiles, ethical sourcing, and presentation standards that align with the hotel's brand image, whether budget, mid-range, or luxury. Products range from basic in-room instant sachets to sophisticated single-origin specialty blends utilized in hotel restaurants and dedicated coffee bars, catering to diverse guest expectations regarding convenience and gourmet quality. The core product description revolves around delivering a consistent, high-quality coffee experience that complements the overall guest stay, increasingly prioritizing sustainability certifications and traceability to meet modern consumer values.

Major applications of hotel coffee include in-room amenities (for self-service brewing), restaurant and banquet services (high-volume brewing), lobby cafes (specialty drink preparation), and catering events held on-site. The primary benefits driving the market include enhancing the overall guest experience, increasing customer satisfaction scores, and offering a significant revenue stream through premium beverage sales in F&B outlets. Providing high-quality, readily available coffee is now considered a standard expectation, particularly in the luxury segment where guests demand equivalent or superior coffee to what they access at home or at leading third-wave coffee shops. Furthermore, efficient coffee solutions, such as automated dispensing systems and robust pod machines, help hotels manage operational costs and ensure service consistency across multiple locations and departments.

Driving factors for this market include the global expansion of tourism and travel, rising disposable incomes leading to increased luxury hotel stays, and the pervasive ‘coffee culture’ which necessitates superior coffee offerings across all consumer touchpoints. Specifically, the strong consumer preference for single-serve systems, driven by convenience and reduced waste potential in hotel settings, continues to fuel demand for proprietary coffee pod and capsule systems. Additionally, competitive differentiation compels hotels to invest in partnerships with renowned coffee roasters or develop exclusive blends, transforming coffee service from a mere amenity into a key component of the hospitality brand identity and a focal point for positive guest reviews. The trend toward personalized service also encourages hotels to stock various milk alternatives and brewing styles, catering to a wider spectrum of dietary needs and flavor preferences.

Hotel and Resort Coffee Market Executive Summary

The Hotel and Resort Coffee Market is experiencing robust growth fueled by several key business trends, most notably the transition towards high-end, traceable, and sustainable coffee offerings, moving away from low-cost generic options. Business trends indicate a strong focus on strategic partnerships between global coffee conglomerates and multinational hotel operators to secure exclusive supply contracts and co-branded in-room offerings, enhancing both supply chain efficiency and brand perception. Furthermore, the increasing adoption of automated, high-precision coffee brewing equipment (e.g., bean-to-cup machines and sophisticated pour-over systems) is central to ensuring consistent quality and minimizing labor costs in high-volume settings. Investment in customized packaging and unique product formats tailored to the upscale hospitality environment represents a significant area of business development, reflecting an emphasis on premium presentation and environmental responsibility through biodegradable materials.

Regional trends highlight that North America and Europe remain the largest and most mature markets, characterized by high consumer awareness of specialty coffee and widespread adoption of single-serve technology in hotel rooms. However, the Asia Pacific (APAC) region is projected to register the fastest growth, driven by massive infrastructure development in key countries like China and India, rapidly increasing international and domestic tourist arrivals, and the burgeoning urbanization which is fostering a strong local coffee consumption culture. The Middle East and Africa (MEA) show promising growth, particularly in the luxury resort segment, where ultra-premium, ethically sourced coffee acts as a significant differentiator. These regional dynamics reflect varied consumption habits, ranging from high-volume batch brewing in the US to refined espresso culture prevalent in Southern Europe and increasingly specialized pour-over methods favored in parts of Asia.

Segment trends confirm that the whole bean and ground coffee segments, traditionally used in large F&B operations, continue to hold a significant market share, particularly for large banquets and breakfast service. However, the single-serve segment, encompassing pods and capsules, is demonstrating the highest CAGR due to its convenience, minimized waste, and enhanced hygiene appeal for in-room service, aligning perfectly with post-pandemic operational preferences. Within applications, the In-Room Service segment is dominating due to the expectation of premium complimentary amenities, closely followed by the Food and Beverage Outlets segment where specialty coffee commands higher pricing and profit margins. The demand for specialty and gourmet coffee varieties is steadily outpacing conventional commodity coffee, indicating a structural shift towards quality and provenance across all hotel tiers.

AI Impact Analysis on Hotel and Resort Coffee Market

Common user questions regarding AI's impact on the Hotel and Resort Coffee Market frequently center on themes of supply chain predictability, hyper-personalization of guest experience, and operational efficiency through automation. Users inquire about how AI can optimize purchasing (forecasting demand fluctuations based on occupancy rates and guest profiles), ensure inventory management for perishable goods like fresh coffee beans, and customize in-room coffee options based on previous guest preferences or loyalty program data. Key concerns often revolve around the initial investment cost for AI-integrated equipment and whether these systems can maintain the artisanal quality associated with high-end coffee preparation. The overarching expectation is that AI will streamline logistics and enhance the guest journey, transitioning coffee service from a static amenity to a dynamic, data-driven offering that maximizes both guest satisfaction and operational profitability. Users are particularly interested in AI-powered bean-to-cup machines that can learn and adjust flavor profiles automatically based on sensory input and real-time usage patterns.

- AI-driven demand forecasting optimizes coffee procurement, minimizing waste and ensuring optimal stock levels for various coffee formats (pods, beans, grounds).

- Predictive maintenance algorithms monitor specialized coffee equipment, reducing downtime and ensuring consistent quality during peak service hours.

- Personalized guest experiences are facilitated by AI analyzing reservation data and previous stay history to customize in-room coffee selections and automated recommendations.

- AI-enabled robotic baristas and automated dispensing systems increase efficiency in high-traffic hotel lobby cafes, improving speed of service and maintaining consistency.

- Data analytics derived from guest consumption patterns inform hotels’ coffee menu development and sourcing strategies, prioritizing high-profit specialty items.

- Sustainable sourcing and traceability are enhanced through AI platforms tracking environmental and ethical compliance across the complex global coffee supply chain.

DRO & Impact Forces Of Hotel and Resort Coffee Market

The Hotel and Resort Coffee Market is shaped by a confluence of influential forces: robust market drivers, critical restraints, and substantial opportunities. The primary driver is the global recovery and expansion of the tourism sector, directly translating to increased occupancy rates and higher demand for premium in-room amenities, particularly high-quality coffee. Simultaneously, the rising consumer expectation for gourmet and ethically sourced coffee products compels hotels to upgrade their offerings. Major restraints include the inherent volatility in global green coffee bean prices due to climate change and geopolitical factors, which challenges consistent pricing and profitability for hotels. Furthermore, the operational challenge of balancing convenience (single-serve pods) with environmental sustainability poses a significant constraint, demanding substantial investment in biodegradable alternatives. Opportunities lie in leveraging technological advancements, such as sophisticated bean-to-cup machines and customized digital ordering platforms, and expanding into niche specialty coffee segments like cold brew concentrates and premium instant options tailored for international travelers seeking authentic local experiences.

Impact forces within this market are categorized by intensity and immediacy. The competitive intensity among coffee suppliers is high, as companies vie for lucrative long-term contracts with major hotel brands, leading to continuous innovation in product format and machine technology. Regulatory impacts, especially those related to food safety, sustainability, and packaging waste (e.g., plastic restrictions), exert moderate but increasing pressure, forcing rapid transitions in product design. Supplier power is also high due to the concentrated nature of high-quality specialty coffee production and the inherent vulnerability to climate events, meaning hotels often face limited leverage over pricing for premium beans. Buyer power is moderate; while hotels are large volume purchasers, their dependence on consistent quality and reliable service limits their ability to frequently switch suppliers, especially once machinery is installed and standardized across their properties. These forces collectively dictate the market structure, driving hotel operators towards efficiency, consistency, and a premiumization strategy to maximize guest perceived value.

The key drivers specifically related to enhancing operational efficiency and guest experience include the widespread adoption of standardized single-serve systems which simplify logistics, reduce potential spillage/waste associated with traditional bulk brewing, and ensure consistent flavor delivery regardless of staff training level. Restraints concerning technological integration include the high capital expenditure required for installing advanced brewing systems and integrating them with existing hotel property management systems (PMS) for automated replenishment and billing. Key opportunities are centered on establishing strong, verifiable sustainability credentials (e.g., Fair Trade, Rainforest Alliance) as these not only appeal to environmentally conscious guests but also provide a strong marketing advantage in competitive tourism markets. The long-term success of hotel coffee suppliers relies heavily on offering scalable, environmentally friendly solutions that can adapt rapidly to changing international travel patterns and guest preferences.

Segmentation Analysis

The Hotel and Resort Coffee Market is meticulously segmented based on format, type, application, and distribution channel, providing a granular view of consumer preferences and operational requirements within the hospitality industry. Segmentation by format differentiates between whole bean, ground coffee, instant coffee, and single-serve units (pods/capsules), with single-serve capturing immense interest due to in-room convenience, while whole bean dominates high-volume, quality-focused F&B outlets. Type segmentation separates conventional coffee from specialty coffee (including organic, single-origin, and gourmet blends), reflecting the industry's significant shift towards premiumization to meet rising traveler expectations. Application segmentation distinguishes consumption between in-room service, hotel restaurants/cafes, banquets/events, and lobby/common areas, each requiring distinct brewing volumes and quality levels. Finally, the distribution channel analysis distinguishes between direct sales from roasters to hotels, bulk purchases via food service distributors, and specialized hotel amenity suppliers.

Analyzing these segments reveals critical trends. The Specialty Coffee segment is growing fastest, driven by younger, more affluent travelers who prioritize quality and provenance. Hotels leverage this segment to charge premium prices and enhance brand perception. Geographically, while North America and Europe lead in overall volume, APAC is rapidly adopting single-serve technology in its newly constructed, internationally branded luxury hotels. The high growth rate in the single-serve format poses challenges for suppliers to keep pace with demand for fully compostable or recyclable capsules, a major purchasing criterion for environmentally conscious hotel groups. Understanding the intersection of these segments is vital; for instance, a luxury resort in Europe might primarily use whole bean specialty coffee in its lobby café but rely exclusively on biodegradable specialty pods for its in-room amenity offering.

- By Format:

- Whole Bean

- Ground Coffee

- Instant Coffee

- Single-Serve Pods/Capsules

- By Type:

- Conventional Coffee (Standard blends, bulk supply)

- Specialty Coffee (Single-origin, Organic, Fair Trade)

- By Application:

- In-Room Service and Minibar

- Hotel Restaurants and Cafes (F&B Outlets)

- Banquets and Catering Services

- Lobby and Common Areas

- By Distribution Channel:

- Direct Supply (Roaster to Hotel Chain)

- Food Service Distributors

- Hospitality Amenity Providers

- By Hotel Classification:

- Luxury and Upper Upscale Hotels

- Midscale and Economy Hotels

- Resorts and Extended Stays

Value Chain Analysis For Hotel and Resort Coffee Market

The value chain for the Hotel and Resort Coffee Market is complex, beginning with upstream activities focused on the cultivation, harvesting, processing, and green coffee bean trading. Upstream efficiency is critical, involving intricate logistics from diverse global producing regions (e.g., Latin America, Africa, Asia) to centralized roasting facilities in consuming markets. Key considerations at this stage include sourcing ethics, quality control, and negotiating futures contracts to mitigate price volatility. Suppliers often invest heavily in relationship-building with specific farms or cooperatives to ensure a consistent supply of specialty beans, essential for maintaining the high standards demanded by luxury hotel brands. Roasting and packaging represent the critical middle layer, where raw beans are transformed into consumer-ready products, often involving proprietary blending and specific grind sizes tailored for hotel equipment, alongside the sophisticated manufacturing of branded single-serve pods or customized bulk packaging for F&B operations.

Downstream analysis focuses on the distribution, sales, and end-user consumption within the hotel environment. Distribution channels are varied, incorporating direct agreements between large roasters (like Nestlé Professional or Starbucks Global Coffee) and international hotel chains, alongside extensive networks of national and regional food service distributors (like Sysco or US Foods) that manage smaller, local hotel accounts. Indirect channels, primarily through specialized hospitality amenity providers who bundle coffee with other in-room supplies (shampoos, soaps), are particularly relevant for independent and boutique hotels. Successful downstream operations require seamless inventory management and just-in-time delivery to hotel storage facilities, minimizing holding costs and ensuring the freshness required for quality control. Direct channels offer greater quality assurance and better pricing control, while indirect channels provide convenience and simplified logistics for hotels sourcing multiple operational supplies.

The complexity of distribution is magnified by the varied equipment requirements—hotels need bulk filter coffee, espresso machines for cafes, and single-serve brewers for rooms—meaning the supplier must provide both the product and the requisite machinery maintenance and training. The transition of product ownership and quality responsibility, from the coffee farm to the guest's cup, relies heavily on strong, integrated supply chain partnerships. Hotels act as the ultimate point of sale and service delivery, where coffee becomes a crucial element of the brand experience, demanding flawless execution. Therefore, suppliers who offer comprehensive support, including equipment financing, staff training on brewing techniques, and sustainable disposal solutions for used pods, gain a substantial competitive edge within the highly specialized hotel and resort sector.

Hotel and Resort Coffee Market Potential Customers

The primary potential customers and buyers in the Hotel and Resort Coffee Market are fundamentally hospitality establishments seeking to enhance guest satisfaction and operational efficiency through high-quality beverage service. This includes a broad spectrum of entities, ranging from multinational, publicly traded hotel groups (e.g., Marriott International, Hilton Worldwide) that require standardized, global supply chains, to independent, boutique luxury hotels that prioritize unique, locally sourced specialty roasts and sophisticated equipment. Cruise lines also represent a significant customer segment, demanding high-volume, consistent supply solutions adapted for marine logistics. Additionally, institutional buyers such as large resorts, timeshare properties, and conference centers frequently procure substantial quantities of bulk and single-serve coffee for their diverse operational needs, encompassing daily breakfast service, event catering, and in-room amenities. These customers primarily value reliability, quality consistency, and robust technical support for the installed brewing systems.

The purchasing decisions of these entities are typically managed by centralized procurement departments for large chains, or by Food & Beverage Directors and General Managers for independent properties. These buyers focus on total cost of ownership, evaluating not just the price per pound or per pod, but also the longevity and maintenance costs of the equipment, the training required for staff, and the environmental impact of the packaging. The shift towards premiumization means that buyers are increasingly willing to pay higher prices for specialty certifications (e.g., USDA Organic, B Corp certifications) that align with their corporate social responsibility goals and resonate positively with their high-value clientele. Furthermore, corporate contracts often last several years, making the initial negotiation process highly competitive as suppliers strive to lock in long-term relationships through bundled offers encompassing coffee, machines, and maintenance services.

Secondary potential customers include specialized facility management companies and third-party catering firms contracted by hotels to manage F&B operations, who then dictate the specific coffee brands and formats used on-site. The evolving demands of the modern traveler—who often brings sophisticated coffee knowledge—means that the end-user (the hotel guest) exerts significant indirect influence on purchasing decisions. Hotels must consistently monitor guest feedback and adjust their coffee portfolio to remain competitive, ensuring that their offerings reflect current consumer trends, such as the increasing demand for cold brew, nitro coffee, and high-altitude, lighter roasted beans. Consequently, potential customers are continuously seeking suppliers who function more as strategic partners than mere vendors, providing market insights and innovative product solutions to keep the hotel's coffee offering relevant and attractive.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Starbucks Global Coffee, Nestlé Professional, Lavazza, Keurig Dr Pepper, Illycaffè S.p.A., Tchibo GmbH, JDE Peet’s, Segafredo Zanetti, Melitta Group, Tata Consumer Products, Dunkin’ Brands, Luigi Lavazza S.p.A., Strauss Group, Eight O'Clock Coffee, Peet's Coffee, Coffee Day Global, Massimo Zanetti Beverage Group, Farmer Bros. Co., The J.M. Smucker Company, Green Mountain Coffee Roasters |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hotel and Resort Coffee Market Key Technology Landscape

The technological landscape of the Hotel and Resort Coffee Market is increasingly focused on automation, consistency, and connectivity, driven by the need for simplified operations and enhanced guest experience. The key technology centers around advanced automated brewing systems, primarily high-precision bean-to-cup machines that minimize human error and ensure consistent quality across thousands of servings daily in F&B environments. These machines often incorporate telemetric capabilities, allowing suppliers to remotely monitor usage, schedule preventative maintenance, and track ingredient levels, significantly improving supply chain logistics and reducing unexpected downtime. For in-room service, the proliferation of sophisticated, branded single-serve capsule systems represents a major technological advancement, offering guests a quick, clean, and customized brewing experience with precise dosage control and minimal cleanup, effectively replacing older, less reliable drip machines.

Further technological integration is observed in the use of IoT (Internet of Things) devices within hotel premises. Smart coffee machines can integrate directly with the hotel's Property Management System (PMS) to facilitate automated ordering, billing, and personalized service requests based on guest check-in data. This connectivity allows hotels to optimize inventory based on real-time occupancy and forecast demand more accurately, especially for specific gourmet or specialty products. Moreover, advances in coffee processing technology, such as innovative flash freezing and grinding techniques used in creating premium instant and cold brew concentrates, offer hotels high-quality, shelf-stable options that reduce preparation time and specialized labor requirements, which is particularly beneficial for banquet operations or remote resort locations where highly trained baristas are scarce.

The rising focus on sustainability has also driven technological innovation in packaging materials. Suppliers are actively investing in R&D to develop fully compostable or highly recyclable coffee capsules and packaging films that meet rigorous environmental standards without compromising the shelf life or flavor integrity of the coffee. Technology also plays a crucial role in enhancing traceability; blockchain technology is being trialed by several major players to provide verifiable data on the provenance, ethical sourcing, and processing journey of specialty beans, offering the hotel guests complete transparency from farm to cup. This blend of operational efficiency, advanced connectivity, and sustainable material science defines the competitive technological edge in the contemporary Hotel and Resort Coffee Market, ensuring both premium quality and responsible business practices.

Regional Highlights

The global Hotel and Resort Coffee Market exhibits distinct regional characteristics influenced by local consumption patterns, tourism infrastructure, and economic development levels. North America currently holds the largest market share, characterized by a massive volume of business and leisure travel, high expectations for in-room amenities, and a dominant presence of major international hotel chains that enforce standardized coffee supply contracts. The region showcases a strong trend towards large-format, high-volume batch brewing for breakfast services and an extremely high adoption rate of Keurig and other single-serve capsule systems in guest rooms, prioritizing convenience and speed. The US market, in particular, drives demand for specialty and customized coffee offerings, pressuring hotels to offer diverse roasts and non-dairy alternatives.

Europe represents the second most significant market, where coffee consumption is deeply ingrained in the culture, leading to a strong emphasis on espresso-based drinks and traditional, high-quality Italian and German roasts. European hotel consumption is often dictated by regional coffee heritage; for instance, premium espresso machines are standard in Italian and Spanish hotels, while filter coffee remains important in Nordic countries. The growth is fueled by robust intra-European travel and the high concentration of luxury and independent boutique hotels demanding ethically sourced, often certified organic, coffee. Regulatory pressures regarding packaging waste, particularly in the European Union, are forcing rapid technological shifts toward compostable and aluminum-based single-serve capsules, making sustainability a key regional purchasing criterion.

Asia Pacific (APAC) is projected to be the fastest-growing region, benefiting from rapid urbanization, massive infrastructure investment, and burgeoning middle-class wealth driving both domestic and international tourism booms, particularly in China, India, and Southeast Asia. The demand in APAC is twofold: international hotels require globally standardized, familiar brands, while local resorts increasingly incorporate unique, regionally-sourced specialty coffees (e.g., Indonesian or Vietnamese specialty beans) to offer a localized luxury experience. The rapid installation of new hotels and resorts across key Asian metropolitan and tourist hubs provides suppliers with massive opportunities for new equipment installations and long-term supply contracts. The Middle East and Africa (MEA) market, particularly within the Gulf Cooperation Council (GCC) nations, shows high demand concentrated within the ultra-luxury resort and business travel segments, where the focus is exclusively on the highest quality, most exclusive specialty coffees, often involving high-cost, personalized service models.

- North America (US, Canada, Mexico): Market leader by volume and value; dominance of capsule systems in rooms; strong demand for specialty roasts and ethical sourcing; large-scale centralized procurement by major chains.

- Europe (Germany, UK, France, Italy): High value placed on espresso-based quality and traditional roasting techniques; rapid adoption of sustainable packaging mandated by EU regulations; maturity in the luxury and boutique hotel segments.

- Asia Pacific (China, India, Japan, ASEAN): Highest growth potential driven by tourism infrastructure expansion; balancing demand for global brands with localized specialty coffee offerings; significant investment in new hotel development creating major supply opportunities.

- Latin America (Brazil, Argentina, Colombia): Strong domestic coffee production influencing local hotel supply; reliance on high-volume, accessible formats; market growth tied closely to regional economic stability and tourism recovery.

- Middle East and Africa (UAE, Saudi Arabia, South Africa): Growth concentrated in the high-end luxury resort and five-star business hotel segment; premiumization and personalized service are critical differentiators; focus on imported, ultra-premium specialty beans.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hotel and Resort Coffee Market.- Starbucks Global Coffee

- Nestlé Professional

- Lavazza

- Keurig Dr Pepper

- Illycaffè S.p.A.

- Tchibo GmbH

- JDE Peet’s

- Segafredo Zanetti

- Melitta Group

- Tata Consumer Products

- Dunkin’ Brands

- Luigi Lavazza S.p.A.

- Strauss Group

- Eight O'Clock Coffee

- Peet's Coffee

- Coffee Day Global

- Massimo Zanetti Beverage Group

- Farmer Bros. Co.

- The J.M. Smucker Company

- Green Mountain Coffee Roasters

Frequently Asked Questions

Analyze common user questions about the Hotel and Resort Coffee market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Hotel and Resort Coffee Market?

The primary driver is the increasing global consumer expectation for premium, specialty, and ethically sourced coffee products, coupled with the necessity for convenient, high-quality, in-room single-serve brewing solutions to enhance the overall guest experience.

Which coffee format exhibits the highest growth rate in hospitality settings?

The single-serve pods and capsules segment shows the highest growth rate due to the convenience, portion control, hygiene benefits, and brand recognition offered by proprietary capsule systems for hotel in-room amenities.

How does sustainability influence hotel coffee purchasing decisions?

Sustainability is a crucial purchasing criterion, compelling hotels to prioritize suppliers offering Fair Trade, organic, and Rainforest Alliance certified beans, and demanding compostable or recyclable packaging to meet corporate responsibility goals and guest expectations.

What role does technology play in optimizing coffee service in hotels?

Technology, including IoT-enabled bean-to-cup machines and AI-driven demand forecasting, optimizes consistency, reduces labor costs, ensures preventative maintenance, and enables hyper-personalization of coffee offerings for guests.

Which geographical region is expected to experience the fastest market expansion?

The Asia Pacific (APAC) region is projected to witness the fastest market expansion, driven by massive investments in new tourism infrastructure, rapid growth in international travel, and the rising affluence of the middle class across key Asian economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager