Hotel Food and Beverage Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436689 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hotel Food and Beverage Service Market Size

The Hotel Food and Beverage Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 185.4 Billion in 2026 and is projected to reach USD 324.9 Billion by the end of the forecast period in 2033.

Hotel Food and Beverage Service Market introduction

The Hotel Food and Beverage (F&B) Service Market encompasses all dining, catering, banquet, room service, and bar operations executed within hotel properties globally. This sector is a critical revenue stream for the hospitality industry, often contributing significantly to the overall profitability and guest satisfaction metrics of a hotel. Historically, F&B services have evolved from basic room service menus to sophisticated, concept-driven restaurants, collaborating with celebrity chefs, and incorporating sustainable, local sourcing practices. The quality and diversity of F&B offerings are now pivotal determinants for travelers selecting accommodation, moving beyond mere necessity to becoming a core component of the luxury and leisure experience. The market includes diverse establishments, ranging from budget hotels offering essential breakfast services to large-scale luxury resorts boasting multiple fine-dining outlets, extensive banquet facilities, and specialized catering for events.

The primary applications of F&B services within the hotel setting are multifaceted. They serve fundamental guest needs such as breakfast, lunch, and dinner, while also facilitating revenue generation through large-scale meetings, incentives, conferences, and exhibitions (MICE) events, weddings, and private social functions. Product descriptions in this market include a vast array of consumables, kitchen equipment, service technology (POS systems, inventory management), and highly specialized human capital (chefs, sommeliers, service staff). The continuous innovation in menu engineering, coupled with the integration of technology for personalized ordering and enhanced efficiency, defines the modern operational landscape. Furthermore, the market is characterized by high operational complexity due to perishable inventory, fluctuating demand based on occupancy rates, and stringent health and safety regulations, necessitating robust management systems.

Key driving factors accelerating market expansion include the significant recovery of global tourism following periods of disruption, increasing disposable incomes in emerging economies fostering leisure travel, and the rising consumer demand for experiential dining. Hotels are increasingly positioning their F&B outlets as destination venues, open to non-staying guests, thereby maximizing utilization rates and brand exposure. Benefits derived from strong F&B service include enhanced customer loyalty, higher Average Daily Rate (ADR) attainment through bundled luxury packages, and diversification of revenue away solely from room sales. Moreover, successful F&B operations bolster the hotel's overall brand reputation, attracting premium clientele willing to pay for superior dining experiences and convenience, thereby strengthening market resilience against economic volatility. These trends collectively underscore the strategic importance of F&B services within the modern hospitality framework, driving substantial investment in service quality and infrastructure upgrades.

Hotel Food and Beverage Service Market Executive Summary

The Hotel Food and Beverage Service Market is undergoing rapid transformation, propelled by shifts in consumer preferences towards health-conscious, locally sourced, and technologically integrated dining experiences. Current business trends indicate a strong move towards asset-light strategies where hotels outsource or partner with established restaurant groups to manage their F&B operations, ensuring specialized expertise and reducing operational burden. Sustainability and ethical sourcing are no longer niche requirements but expected standards, driving investments in sustainable supply chains and waste reduction technologies. The competitive landscape is intensifying, characterized by fierce competition among traditional hotel chains, boutique operators, and specialized contract caterers, all vying to offer unique and memorable gastronomic journeys to a discerning global traveler base. Financial projections suggest robust growth, particularly in the premium and luxury segments, fueled by post-pandemic rebound in MICE activities and high-end leisure travel.

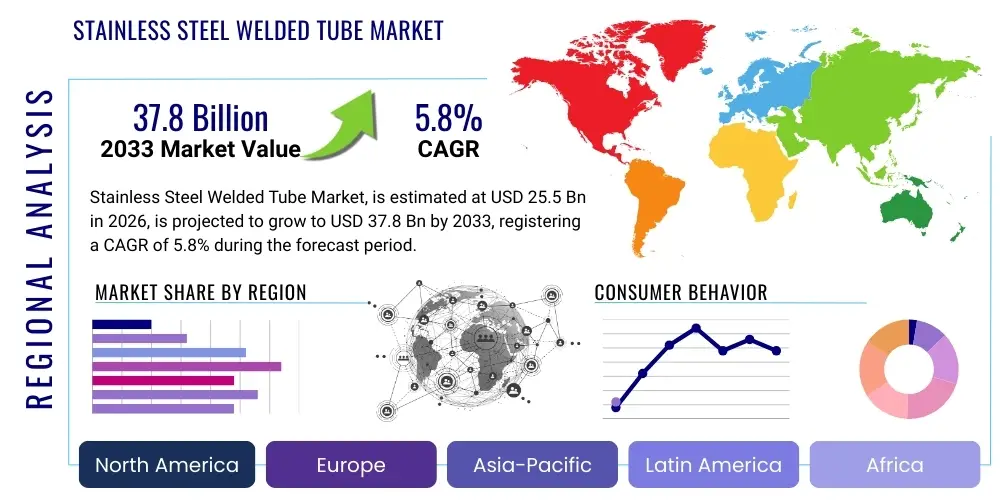

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily due to expanding urbanization, a burgeoning middle class, and significant infrastructural investments in new hotel properties, particularly in China, India, and Southeast Asian nations. North America and Europe maintain leading market shares, driven by established tourism infrastructures, high spending power, and early adoption of innovative hospitality technologies like automated service robots and AI-driven personalized menu recommendations. Conversely, regions like the Middle East and Africa (MEA) are witnessing substantial growth supported by government visions focusing on tourism diversification, such as Saudi Arabia's Vision 2030, leading to massive development projects that inherently require high-quality F&B infrastructure. These regional dynamics highlight differential growth drivers, ranging from pure volume expansion in APAC to premiumization and operational efficiency focus in Western markets.

Segmentation trends indicate that Full-Service Hotels dominate the market due to their comprehensive offering range, including multiple dining venues, extensive banquet halls, and dedicated room service. However, the Limited-Service Hotel segment is exhibiting accelerating growth, often through streamlined, high-quality offerings such as sophisticated grab-and-go options and curated self-service concepts that appeal to business travelers prioritizing speed and convenience. Regarding service type, the on-premise dining segment, including restaurants and bars, remains the largest revenue contributor, but banqueting and catering services are experiencing the most volatility and subsequent rebound potential, tied directly to the recovery of corporate and social event calendars. Beverage segmentation shows increasing demand for craft beverages, non-alcoholic specialty drinks, and curated wine lists, reflecting global trends towards quality over quantity and greater consumer health awareness, mandating hotels to continuously update their beverage programs.

AI Impact Analysis on Hotel Food and Beverage Service Market

User inquiries regarding AI's impact on the Hotel F&B Service Market primarily center on three core themes: operational efficiency, personalized guest experience, and labor displacement. Users frequently ask how AI can reduce food waste (via predictive inventory management), streamline service (using AI chatbots for ordering or robotic delivery systems), and how algorithms can predict individual guest preferences to customize menus or offers, thereby increasing profitability and customer satisfaction. Concerns often revolve around the initial investment costs of integrating AI, maintaining the human element in luxury service, and data privacy issues related to collecting extensive guest behavioral data. Expectations are high regarding AI's ability to solve perennial challenges like labor shortages, optimizing kitchen workflow, and ensuring consistent service quality across disparate hotel brands and locations.

- AI-Powered Inventory Management: Utilization of machine learning algorithms to forecast demand accurately, minimizing perishable food waste, optimizing stock levels, and ensuring just-in-time delivery for ingredients.

- Personalized Menu Recommendations: Analyzing guest data (past orders, stay history, dietary restrictions) to offer highly customized dining suggestions via digital menus or mobile applications, boosting per-guest spending.

- Automated Kitchen Operations: Deployment of robotics and AI-driven equipment (e.g., smart ovens, automated prep stations) to increase consistency, speed, and safety in high-volume production areas.

- Dynamic Pricing and Yield Management: AI systems adjusting F&B prices in real-time based on occupancy, time of day, event schedules, and local competitor pricing to maximize revenue yield from dining outlets and banquets.

- Enhanced Service Efficiency (Chatbots/Voice Assistants): Using AI interfaces for swift room service ordering, reservation management, and answering common dietary or ingredient questions, freeing human staff for complex interactions.

DRO & Impact Forces Of Hotel Food and Beverage Service Market

The market dynamics are shaped by a complex interplay of driving forces (Drivers), inhibiting factors (Restraints), and potential avenues for expansion (Opportunities). Primary drivers include the global resurgence in travel and tourism, emphasizing experiential dining as a key component of the overall vacation or business trip. Technological advancements, particularly in kitchen automation and guest service applications, further propel efficiency and elevate service standards. Restraints, conversely, include the persistent and intensifying global labor shortage within the culinary and service professions, leading to increased wage pressure and difficulties in maintaining consistent service quality. High operating costs, especially volatility in food and energy prices, also compress profit margins, requiring astute financial management and robust supply chain resilience. The impact forces determine the market's trajectory, with positive forces such as digital transformation accelerating growth, while regulatory pressures related to food safety and sustainability pose ongoing operational challenges.

Opportunities for growth are heavily concentrated in sustainable and health-focused offerings. Hotels that successfully integrate locally sourced, organic, and plant-based menus tap into premium segments demanding ethical consumption. Furthermore, leveraging technology to create unique, immersive dining experiences (e.g., virtual reality dining, interactive culinary stations) provides a competitive differentiator. The expansion of boutique and lifestyle hotels also creates an opportunity for hyper-localized F&B concepts that resonate deeply with local communities and culture-seeking tourists. Geopolitical stability and robust economic growth in emerging markets present long-term expansion avenues for major hotel operators seeking untapped consumer bases hungry for established international and luxury F&B brands.

The overall impact forces lean towards positive expansion, largely driven by fundamental shifts in consumer behavior—specifically, the willingness to allocate a larger portion of discretionary income towards high-quality, memorable dining experiences. However, the mitigating force of labor constraints requires continuous innovation in automation and human resource management to sustain profitability. Strategic responses to these forces involve diversification of service models (e.g., high-quality ghost kitchens operating from hotel premises for delivery), strategic partnerships to manage specialized outlets, and aggressive adoption of data analytics to optimize inventory and pricing. The cumulative effect of these forces suggests a market trajectory defined by premiumization, technological adoption, and a heightened focus on corporate social responsibility and environmental governance in F&B operations.

Segmentation Analysis

The Hotel Food and Beverage Service Market is comprehensively segmented based on several key operational and structural parameters, allowing for detailed market assessment and targeted strategy development. These segmentations are crucial for understanding which parts of the market are demonstrating the most robust growth and profitability. The primary segmentation categories include the type of hotel, which directly dictates the scale and complexity of F&B operations; the type of service offered, ranging from intimate room service to large-scale banquet operations; and the geographical regions, reflecting varying consumer tastes, regulatory environments, and tourism development levels. Understanding these defined segments aids stakeholders in tailoring investment decisions, optimizing operational models, and accurately forecasting demand within specific market niches, ensuring strategic alignment with evolving consumer demands and regulatory frameworks globally.

- By Hotel Type:

- Full-Service Hotels

- Limited-Service Hotels

- Resort Hotels

- Boutique Hotels

- By Service Type:

- On-Premise Dining (Restaurants, Cafés)

- Banquet and Catering Services (MICE, Weddings, Events)

- Room Service/In-Room Dining

- Bar and Lounge Services

- By Food & Beverage Offering:

- Food Services (Breakfast, Lunch, Dinner, Snacks)

- Beverage Services (Alcoholic, Non-Alcoholic, Hot Beverages)

- By Revenue Source:

- Guest Revenue (Included in Room Rate/Packages)

- Non-Guest Revenue (External Customers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Hotel Food and Beverage Service Market

The value chain for the Hotel F&B Service Market begins with upstream activities focused primarily on sourcing and procurement. This involves the identification, negotiation, and acquisition of raw materials—including fresh produce, meats, dairy, specialty ingredients, and beverages—from a complex global network of suppliers, distributors, and local farmers. Upstream analysis highlights the increasing importance of robust supply chain management, driven by demands for transparency, sustainability, and traceability, especially concerning ethical sourcing and mitigating risks associated with supply chain disruptions. Effective inventory management and warehousing systems are crucial at this stage to minimize spoilage of highly perishable goods, directly impacting operational costs and gross profit margins, thereby requiring advanced predictive analytics and strong vendor relationships.

Midstream activities involve the operational core of the hotel F&B segment, encompassing kitchen preparation, cooking, service execution, and quality control. This stage relies heavily on highly skilled labor (chefs, sommeliers) and significant capital investment in professional kitchen equipment, POS systems, and service technology. Distribution channels within the hotel F&B model are primarily direct, meaning the product (prepared meal or beverage) is delivered directly to the end consumer (hotel guest or event attendee) on-site, through restaurants, bars, or room service. However, indirect channels are growing, facilitated by partnerships with third-party food delivery platforms (e.g., DoorDash, Uber Eats), allowing hotel restaurants to capture external, non-guest revenue. This hybrid distribution strategy is vital for optimizing kitchen utilization during off-peak hours and expanding market reach beyond the physical hotel premises.

Downstream analysis focuses on consumption, customer relationship management (CRM), and feedback loops. Successful downstream activities depend on exceptional service quality, personalized guest interaction, and efficient billing and payment processes. Direct feedback mechanisms—through post-stay surveys, digital review platforms, and in-person guest interactions—are essential for continuous service improvement and maintaining brand reputation. The effectiveness of the overall value chain is measured by guest satisfaction scores, repeat business rates, and the profitability of individual F&B outlets. Optimization across the entire chain, from farm-to-table traceability to personalized service delivery, is necessary to sustain competitive advantage in this highly quality-sensitive market segment.

Hotel Food and Beverage Service Market Potential Customers

Potential customers for the Hotel Food and Beverage Service Market are broadly categorized into three distinct segments: in-house hotel guests, external local patrons, and corporate/social event organizers. In-house guests represent the primary, most consistent revenue source, utilizing services ranging from complimentary breakfast to fine dining and room service. Their needs prioritize convenience, speed, and quality that aligns with the hotel’s overall brand standard (e.g., a luxury guest expects world-class cuisine, while a budget traveler prioritizes affordability and efficiency). Understanding the length of stay, purpose of travel (business or leisure), and demographic profile of the core hotel clientele is paramount for menu planning and service staffing levels. Targeting this captive audience effectively through appealing packages and targeted promotions maximizes the F&B contribution to the total guest spend.

The second major customer group comprises external local patrons who visit the hotel’s restaurants, bars, or cafés specifically for the F&B offering, without staying overnight. This segment is highly sensitive to local trends, competitive pricing, and the reputation of the hotel’s culinary concepts. Hotels increasingly seek to establish their dining outlets as independent destination venues to attract this community, utilizing celebrity chef partnerships, distinct branding, and marketing campaigns separate from the hotel’s accommodation marketing. Success in capturing local patrons not only boosts F&B revenue but also enhances the hotel’s presence and relevance within the local community, creating a vibrant atmosphere beneficial to in-house guests.

The third, and often most lucrative, segment involves MICE (Meetings, Incentives, Conferences, and Exhibitions) organizers and social event planners (wedding planners, charity organizers). These customers require extensive catering and banqueting services, often involving large volumes and highly customized menus, significantly impacting short-term revenue spikes. Their purchasing criteria focus on capacity, audiovisual capabilities, menu customization flexibility, and the ability of the hotel F&B team to execute complex logistical requirements flawlessly. Winning large banqueting contracts requires specialized sales teams and highly efficient kitchen and service infrastructure capable of scaling operations rapidly while maintaining uncompromising quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.4 Billion |

| Market Forecast in 2033 | USD 324.9 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, Accor S.A., InterContinental Hotels Group (IHG), Four Seasons Hotels and Resorts, Mandarin Oriental Hotel Group, The Ritz-Carlton Hotel Company, Shangri-La Hotels and Resorts, Wyndham Hotels & Resorts, Radisson Hotel Group, Jumeirah Group, Belmond, Rosewood Hotel Group, Kimpton Hotels & Restaurants, Best Western Hotels & Resorts, Melia Hotels International, Kempinski Hotels, Aman Resorts, Soho House & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hotel Food and Beverage Service Market Key Technology Landscape

The technological landscape within the Hotel F&B Service Market is undergoing rapid digitization, fundamentally altering service delivery, back-of-house operations, and customer interaction. A pivotal technology is the widespread adoption of Point of Sale (POS) systems integrated with broader Property Management Systems (PMS), enabling seamless billing, inventory tracking, and data consolidation across multiple outlets. Advanced cloud-based POS systems now offer functionalities like mobile ordering, tableside payment processing, and real-time menu updates, significantly enhancing staff efficiency and reducing order errors. Furthermore, the integration of specialized kitchen display systems (KDS) optimizes workflow management in high-pressure kitchen environments, ensuring timely preparation and order accuracy, which is crucial for maintaining brand standards across extensive hotel chains. This technological integration allows F&B managers to leverage data analytics for yield optimization and labor scheduling.

The front-of-house experience is increasingly defined by guest-facing technology, including QR code menus, mobile ordering apps accessible via the guest's own device (BYOD), and sophisticated digital signage in dining areas. These solutions address guest demand for convenience and minimize physical touchpoints, aligning with post-pandemic safety protocols. In luxury segments, technology is being deployed for highly personalized service; for instance, Customer Relationship Management (CRM) platforms utilize AI to track dietary preferences, allergies, and past dining behavior, allowing service staff to proactively anticipate guest needs. Automated and semi-automated solutions, such as robotic food delivery within large resorts or automated bar service systems, are being trialed to mitigate labor shortages and provide novelty experiences, particularly in regions where labor costs are high or availability is scarce.

Back-of-house advancements are equally transformative, focusing heavily on operational efficiency and sustainability. Technologies such as automated stock management systems employing IoT sensors and AI predictive forecasting are minimizing food waste, a major industry concern. High-efficiency kitchen equipment, including induction cooking surfaces and energy-optimized ventilation systems, addresses the need for sustainability and reduced utility costs. Moreover, specialized software for compliance and traceability ensures adherence to stringent food safety regulations, providing digital documentation for every stage of the food preparation process. The collective impact of these technological shifts is the creation of a leaner, more responsive, and data-driven F&B operation capable of delivering high-quality experiences consistently while managing complex inventory and labor dynamics effectively.

Regional Highlights

- North America: This region holds a significant market share, characterized by high spending on leisure and business travel, leading to a strong demand for sophisticated F&B experiences. Key drivers include the early adoption of hospitality technology (e.g., mobile ordering, automation) and a pervasive culture of specialized dining concepts, often leveraging local and sustainable sourcing. The market is highly saturated and competitive, requiring continuous innovation in menu offerings and service delivery, particularly focusing on speed and personalized convenience for the high volume of corporate travelers. Major metropolitan areas in the US and Canada remain pivotal centers for luxury hotel F&B development and MICE activity rebound.

- Europe: Europe is a mature market where F&B services are often deeply integrated with local culinary traditions and cultural heritage, particularly in countries like France, Italy, and Spain. The market emphasis is strongly placed on quality, authenticity, and refined service, often featuring Michelin-starred or highly reputable independent dining partnerships within hotel premises. Growth is steady, driven by both international tourism and intra-regional travel. Regulatory compliance, especially concerning sustainable sourcing and labor laws, represents a significant operational consideration, driving demand for advanced compliance software and waste management technology.

- Asia Pacific (APAC): APAC is the engine of global growth, experiencing the highest CAGR fueled by rapid infrastructure development, expansion of the middle class, and rising international travel. Countries such as China, India, and Indonesia are seeing massive additions to hotel room inventory, necessitating proportional growth in F&B capacity. The market is characterized by a high degree of cultural diversity, requiring F&B operators to offer a vast range of international and highly localized menu options. Technology adoption is strong, particularly mobile payment solutions and robotics, aimed at catering to a digitally native customer base and overcoming structural labor deficits.

- Latin America: This region presents moderate growth, often linked to fluctuations in commodity prices and political stability, but demonstrates strong potential in established tourism centers like Mexico and Brazil. The F&B market is driven by experiential tourism, focusing on unique local ingredients, artisanal beverages, and authentic dining settings. Hotel F&B often plays a critical role in promoting regional gastronomy, attracting both international guests seeking cultural immersion and local patrons. Investment focus is on efficiency improvements and supply chain stabilization to counteract inflationary pressures.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), is witnessing explosive F&B growth, driven by massive government-backed tourism and entertainment projects. This segment demands the highest tier of luxury and international standards, often importing premium expertise and specialized ingredients. The focus is on establishing destination dining venues and handling large-scale banqueting for international events. Africa's market growth is slower but steady, concentrated in key tourist hubs, prioritizing resilient, locally relevant operational models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hotel Food and Beverage Service Market.- Marriott International

- Hilton Worldwide

- Hyatt Hotels Corporation

- Accor S.A.

- InterContinental Hotels Group (IHG)

- Four Seasons Hotels and Resorts

- Mandarin Oriental Hotel Group

- The Ritz-Carlton Hotel Company

- Shangri-La Hotels and Resorts

- Wyndham Hotels & Resorts

- Radisson Hotel Group

- Jumeirah Group

- Belmond

- Rosewood Hotel Group

- Kimpton Hotels & Restaurants

- Best Western Hotels & Resorts

- Melia Hotels International

- Kempinski Hotels

- Aman Resorts

- Soho House & Co.

Frequently Asked Questions

Analyze common user questions about the Hotel Food and Beverage Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hotel F&B Service Market?

The Hotel Food and Beverage Service Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033, driven primarily by recovery in global tourism and increasing consumer demand for high-quality, experiential dining within hospitality settings, particularly in the APAC region.

How is technology, specifically AI, influencing hotel F&B operations?

AI technology is significantly improving operational efficiency and personalization. Key applications include AI-driven predictive inventory management to reduce food waste, customized menu recommendations based on guest history, and automated kitchen systems to ensure speed and consistency, mitigating challenges posed by persistent labor shortages.

Which segment contributes the most revenue to the Hotel F&B Service Market?

The On-Premise Dining segment, which encompasses hotel-owned restaurants, cafes, and specialized dining concepts, consistently contributes the largest share of revenue. However, the Banquet and Catering Services segment, tied to MICE and social events, often generates the highest profit margins when occupancy and event calendars are strong.

What are the primary challenges facing the growth of the hotel dining sector?

The major challenges include high operational costs, specifically volatile food and energy prices, coupled with severe, widespread labor shortages across the service and culinary professions. Maintaining sustainable supply chains and adhering to evolving global food safety standards also pose ongoing restraints for operators.

Which geographical region is expected to lead market growth through 2033?

The Asia Pacific (APAC) region is forecasted to lead market growth, driven by substantial investment in new hotel infrastructure, increasing affluence among the regional population, and rising levels of domestic and international tourism, particularly across major economies like China and India.

The comprehensive market analysis presented here underscores the dynamic nature of the Hotel Food and Beverage Service industry, where innovation, technology integration, and alignment with evolving consumer values are paramount for sustained success. The shift towards experiential dining, coupled with critical efficiency gains through AI and robust supply chain management, defines the competitive edge in this highly sophisticated sector. Hotels that prioritize sustainable practices, exceptional service personalization, and strategic utilization of their F&B assets as destination points are best positioned to capture the accelerating growth trajectory forecasted through 2033. This rigorous assessment provides stakeholders with actionable insights into market size evolution, key segmentation performance, critical value chain drivers, and the transformative impact of digital technologies, facilitating informed strategic planning and investment allocation across diverse geographical and service domains. The market remains characterized by intense competition requiring operational excellence and continuous adaptation to macroeconomic shifts and fluctuating tourism demands, reinforcing the necessity of detailed market intelligence.

Detailed attention to the nuances of regional consumer behavior is essential, as demonstrated by the diverse growth drivers in APAC versus the premiumization focus in North America and Europe. For instance, successfully managing the labor deficit in Western markets necessitates greater reliance on automation and cross-training initiatives, whereas expansion strategies in the Middle East hinge on successfully attracting and retaining international culinary talent to maintain luxury standards. Furthermore, the role of F&B as a secondary revenue generator is increasingly being replaced by its status as a primary driver of overall guest satisfaction and hotel brand equity. Strategic alliances with renowned external restaurant groups allow hotels to leverage specialized expertise and reduce the operational complexity and risk associated with running high-end culinary venues, a trend expected to accelerate. Future market resilience will be heavily influenced by adherence to global environmental, social, and governance (ESG) standards, with consumers increasingly favoring hotel brands demonstrating clear commitment to ethical sourcing and waste reduction protocols.

The technological acceleration is not limited to guest-facing applications; back-of-house integration, particularly in utilizing IoT devices for equipment maintenance and operational monitoring, is crucial for minimizing downtime and ensuring 24/7 service availability, particularly critical for large resort properties. The investment cycle in kitchen technology is shortening as operators seek competitive advantages through efficiency gains, often necessitating specialized capital expenditure planning. Moreover, the segmentation analysis clearly indicates the growing importance of Limited-Service and Boutique hotels, which, while offering fewer outlets, are focusing on high-quality, curated F&B experiences—such as specialty coffee bars or hyper-local snack offerings—that maximize the value proposition for their targeted clientele. This highlights a market trend away from one-size-fits-all dining solutions towards highly differentiated, tailored F&B concepts designed to optimize revenue per available room (RevPAR) and total revenue per available customer (TRevPAC).

Regulatory compliance adds another layer of complexity, demanding proactive management of food safety certifications, allergen labeling, and increasingly, nutritional transparency. Hotels operating across multiple international jurisdictions must harmonize their F&B protocols to meet the strictest standards enforced, often requiring significant investment in staff training and specialized software platforms. The competitive pressure exerted by external food delivery services also mandates that hotel F&B operations continuously benchmark their quality, speed, and pricing against established local and national restaurant delivery networks. Successfully transitioning F&B from a cost center to a high-margin profit center requires a holistic management approach, integrating finance, operations, and marketing strategies to ensure every F&B outlet contributes maximally to the hotel's overall financial health and guest experience matrix. The long-term outlook remains positive, conditional on the industry's ability to effectively manage resource scarcity and technological disruption while satisfying the ever-increasing expectations of the modern global traveler.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager