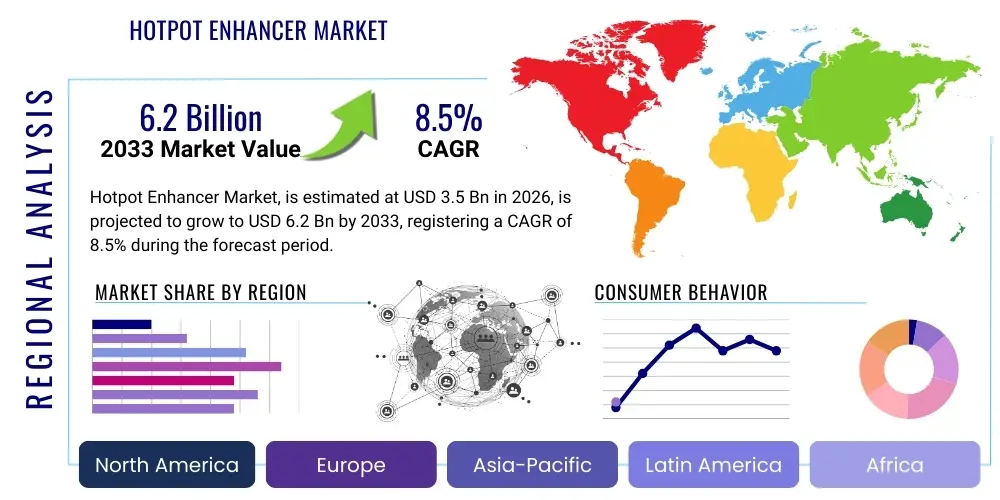

Hotpot Enhancer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438368 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hotpot Enhancer Market Size

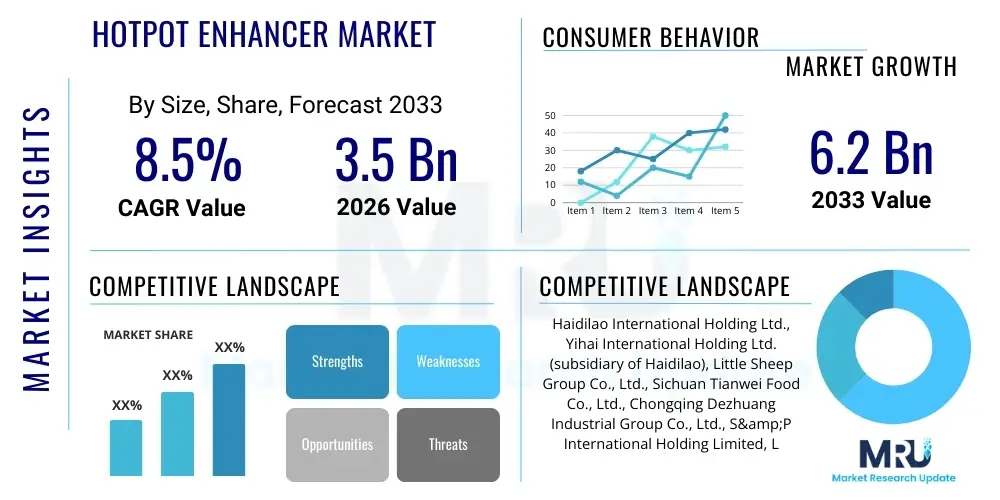

The Hotpot Enhancer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Hotpot Enhancer Market introduction

The Hotpot Enhancer Market encompasses a diverse range of products specifically designed to augment the flavor, aroma, texture, and overall sensory experience of hotpot dishes. These enhancers include concentrated soup bases, specialized dipping sauces, high-quality seasoning oils, unique spice blends, and functional ingredients such as flavor potentiators and texturizers. The core product category addresses the growing global demand for authentic, customizable, and high-quality home-based or restaurant-style hotpot experiences, driven significantly by the globalization of Asian culinary traditions, particularly Chinese, Korean, and Japanese hotpot variants. The market caters to both commercial dining establishments seeking consistency and complexity, and individual consumers desiring convenience and gourmet flavor profiles.

Major applications of hotpot enhancers span traditional dining settings, rapid-service commercial kitchens, and, increasingly, the burgeoning segment of ready-to-eat (RTE) and ready-to-cook (RTC) meal kits. The fundamental benefit provided by these products is standardization of flavor complexity and reduction of preparation time, allowing both amateur cooks and professional chefs to achieve deep, nuanced, and authentic broths without extensive ingredient sourcing or lengthy simmering processes. Furthermore, specialized enhancers address dietary trends, including low-sodium, vegetarian, and gluten-free formulations, expanding market accessibility and catering to evolving consumer health consciousness.

Key driving factors fueling market expansion include rapid urbanization in Asia Pacific countries, leading to increased disposable incomes and demand for convenient meal solutions; the widespread adoption of e-commerce and food delivery platforms, making specialized ingredients easily accessible; and aggressive product innovation focusing on new flavor fusion, cleaner labels, and sustainable ingredient sourcing. The cultural significance of hotpot as a communal dining experience globally reinforces its popularity, ensuring sustained demand for high-quality, reliable flavor enhancers that define the gastronomic outcome.

Hotpot Enhancer Market Executive Summary

The global Hotpot Enhancer Market exhibits robust growth, characterized by significant innovation in flavor profiles and ingredient sourcing, largely driven by shifting consumer preferences toward authentic yet convenient dining solutions. Business trends indicate a strong move towards premiumization, where consumers are willing to pay more for natural, high-quality, and regionally specific flavor bases, displacing cheaper, artificial alternatives. Furthermore, strategic partnerships between flavor houses, ingredient suppliers, and major food manufacturers are accelerating product development cycles, particularly in functional enhancers that offer benefits beyond taste, such as added nutrition or improved mouthfeel. The competitive landscape is becoming polarized between large, established food conglomerates offering mass-market convenience products and niche, specialized players focusing on artisanal, regional, or premium organic formulations.

Regional trends clearly delineate Asia Pacific (APAC) as the undisputed dominant force in terms of consumption volume and market innovation, primarily led by China, which boasts a deep-rooted hotpot culture and a sophisticated supply chain. However, North America and Europe are emerging as high-growth markets, fueled by diaspora populations, increased culinary adventurousness among mainstream consumers, and the successful marketing of hotpot as a versatile, customizable, and engaging communal meal format. These Western markets show a higher propensity for plant-based and novel fusion enhancers, reflecting local dietary and gastronomic trends.

Segment trends reveal that the Soup Base segment, particularly the concentrated and paste forms, maintains the largest market share due to its foundational role in hotpot preparation and its convenience. However, the Dipping Sauce segment is experiencing the fastest growth, driven by consumer demand for personalized flavor combinations and the availability of diverse, pre-mixed sauce packs that offer tailored spice and umami levels. Distributionally, the Online Retail channel is gaining immense traction, particularly for specialty and imported enhancers, complementing the sustained dominance of Supermarkets and Hypermarkets for everyday purchasing.

AI Impact Analysis on Hotpot Enhancer Market

User queries regarding AI's impact on the Hotpot Enhancer Market predominantly revolve around three key themes: how AI can revolutionize flavor development and ingredient synergy; how supply chain optimization powered by machine learning can ensure ingredient freshness and trace regional sourcing; and the role of AI-driven personalized recommendations in consumer-facing applications. Consumers and industry professionals are keenly interested in predictive modeling—specifically, the ability of AI algorithms to analyze vast datasets of regional consumer preferences, social media culinary trends, and existing ingredient interactions to rapidly formulate novel, commercially successful hotpot enhancer flavors. Concerns often center on the balance between AI-driven efficiency and maintaining the authentic, artisanal quality traditionally associated with premium food enhancers, alongside ethical sourcing transparency.

The application of Artificial Intelligence extends far beyond simple automation, fundamentally reshaping the product lifecycle of hotpot enhancers. AI algorithms are increasingly employed in sensory analysis labs to quantify and predict human perception of complex flavor profiles resulting from novel ingredient combinations. This predictive capability significantly reduces the time and cost associated with traditional R&D trials. Furthermore, natural language processing (NLP) and computer vision are being utilized to monitor raw material quality, identifying inconsistencies in herbs, spices, and oils sourced globally, thus ensuring that the final enhancer product maintains strict quality and flavor standards regardless of batch variation.

In the consumer realm, AI-powered recommendation systems embedded in e-commerce platforms and smart kitchen appliances are analyzing user purchase history, geographic location, and stated dietary restrictions to suggest highly personalized hotpot enhancer combinations, sauce recipes, and accompanying ingredients. This hyper-personalization drives higher engagement and basket size. Moreover, AI is critical for optimizing the cold chain logistics required for fresh or minimally processed enhancers, utilizing predictive analytics to mitigate spoilage and ensure efficient last-mile delivery, especially important for premium products with limited shelf life.

- AI-driven Flavor Formulation: Algorithms predict optimal ratios of spices and bases based on regional palates and existing flavor synergy data, accelerating R&D cycles.

- Predictive Supply Chain Optimization: Machine learning models forecast demand fluctuations and optimize inventory management for volatile raw materials, minimizing waste and ensuring freshness.

- Enhanced Quality Control: Computer vision systems inspect raw agricultural products (e.g., chili peppers, mushrooms) for defects, ensuring only high-grade ingredients enter the formulation process.

- Personalized Consumer Recommendations: AI engines suggest customized hotpot broth bases and dipping sauce mixtures to individual users based on past behavior and demographic data.

- Retail Trend Forecasting: NLP analyzes social media, culinary blogs, and restaurant menus to identify emerging regional flavor trends (e.g., unique fermented ingredients or rare chili varieties) suitable for new enhancers.

- Manufacturing Efficiency: AI monitors mixing and bottling processes in real-time, adjusting parameters to maintain consistent viscosity, color, and concentration of the enhancer product.

- Authenticity Verification: Blockchain integration, often managed by AI, provides enhanced traceability for premium, source-specific ingredients used in high-end hotpot bases.

- Automated Sensory Testing: AI systems correlate chemical composition data with desired sensory outcomes, reducing reliance on extensive human taste panels in initial stages.

- Sustainable Ingredient Sourcing: AI identifies suppliers adhering to strict environmental, social, and governance (ESG) criteria, facilitating the production of "clean label" hotpot enhancers.

- Dynamic Pricing Strategies: Machine learning algorithms adjust pricing for specialty or perishable enhancers based on real-time market conditions and inventory levels.

DRO & Impact Forces Of Hotpot Enhancer Market

The Hotpot Enhancer Market is profoundly shaped by complex interactions between compelling growth drivers, significant structural restraints, and evolving opportunities, all synthesized by powerful impact forces. A primary driver is the accelerating international adoption of hotpot as a culinary phenomenon, moving beyond Asian populations into mainstream Western dining, directly boosting demand for accessible, high-quality flavor components. This is coupled with the growing consumer desire for convenient gourmet solutions, making pre-packaged enhancers highly appealing. Conversely, the market faces strong restraints, primarily concerning raw material price volatility, especially for high-demand agricultural commodities like specific chili peppers, spices, and premium seafood extracts, alongside ongoing scrutiny regarding sodium content and artificial additives in mass-market enhancers, prompting regulatory pressure and demanding costly reformulations.

Opportunities for market players are abundant, centered on product innovation focusing on health and wellness attributes, such as natural, organic, low-sodium, and functional enhancers fortified with vitamins or probiotics. Significant opportunity lies in penetrating untapped emerging markets in Africa and Latin America where Asian cuisine influence is growing, and specializing in regional, artisanal flavor bases that command premium pricing and cater to highly specific consumer segments. The continuous expansion of e-commerce and specialized food delivery logistics also presents an opportunity to bypass traditional distribution hurdles and connect directly with discerning consumers seeking niche products.

The major impact forces driving the market’s trajectory include technological advancements in flavor encapsulation and shelf-life extension, which allow for global distribution of fresh-tasting enhancers, and intense competitive rivalry forcing continuous quality improvement and flavor differentiation. Regulatory environment shifts, particularly around food safety and labeling standards in key import markets like the EU and North America, act as a significant external force, compelling manufacturers to invest heavily in compliance and transparency. The confluence of these forces dictates that successful market participants must balance operational efficiency and cost management against the imperative of continuous, health-focused flavor innovation.

Segmentation Analysis

The Hotpot Enhancer Market is intricately segmented based on core product types, distinct flavor profiles, target end-user applications, and the nature of ingredients used. This detailed segmentation allows manufacturers to tailor their product offerings and marketing strategies precisely to meet the diverse culinary and dietary requirements of a global consumer base. The complexity of hotpot cuisine necessitates differentiation between foundational components like soup bases, which provide the primary flavor backbone, and supplementary products such as dipping sauces, oils, and specialized spices, which allow for individual customization at the point of consumption. Understanding these segments is critical for identifying high-growth niches, particularly the rapidly expanding plant-based and premium regional flavor segments.

- By Product Type:

- Soup Bases (Concentrated Paste, Liquid Concentrate, Powdered Mixes)

- Dipping Sauces and Condiments (Peanut/Sesame Paste, Soy Sauce Mixtures, Chili Oil, Fermented Tofu)

- Seasoning Oils (Mala Oil, Szechuan Pepper Oil, Shallot Oil)

- Specialty Spices and Dry Rubs

- By Flavor Profile:

- Spicy/Mala (Sichuan Style)

- Mushroom/Vegetarian

- Savory/Umami (Seafood, Beef, Pork Bone Broth)

- Sour/Spicy (Thai, Vietnamese Influences)

- Clear/Herbal (Traditional Chinese Medicine Infusions)

- By Ingredient Type:

- Natural Ingredients (Herbs, Spices, Natural Extracts)

- Synthetic/Artificial Ingredients (Flavorings, Colorants, Preservatives)

- By End-User:

- Commercial (Restaurants, Catering Services, Foodservice Chains)

- Household/Retail (Supermarkets, Online Retail, Convenience Stores)

- By Distribution Channel:

- Offline (Hypermarkets/Supermarkets, Traditional Grocery Stores, Specialty Food Stores)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Hotpot Enhancer Market

The value chain for the Hotpot Enhancer Market begins with upstream analysis, which involves the sourcing and meticulous processing of high-quality raw materials. These materials are highly diverse, ranging from staple agricultural products like chili peppers, ginger, garlic, and specific regional spices (e.g., Sichuan peppercorns, star anise) to complex derived ingredients such as animal bone extracts, seafood concentrates, fermented beans, and specialized oils. Efficiency and sustainability in this upstream segment are crucial, as ingredient quality directly impacts the flavor profile and premium positioning of the final enhancer product. Strong supplier relationships and rigorous quality control protocols are necessary to mitigate the risks associated with price volatility and seasonal variability of these agricultural commodities.

The midstream stage involves manufacturing and processing, where raw ingredients are transformed into commercial enhancers (pastes, liquids, powders). This segment is capital-intensive, requiring advanced blending, homogenization, and packaging technologies to ensure product consistency, shelf stability, and adherence to stringent food safety standards. Key activities include flavor blending using proprietary formulations, microbial control, and innovative packaging design that caters to both commercial bulk users and individual household consumers. Value addition at this stage is achieved through product innovation, particularly the development of clean-label, low-sodium, or organic certified enhancers, which appeal to modern health-conscious markets.

Downstream analysis focuses on distribution and sales. Distribution channels are bifurcated into direct and indirect routes. Direct channels predominantly serve large commercial end-users, such as restaurant chains and institutional foodservice providers, often involving tailored bulk formulations and specific delivery schedules. Indirect channels utilize extensive networks comprising hypermarkets, supermarkets, specialty Asian grocery stores, and the rapidly growing e-commerce sector. The growth of online platforms has dramatically shortened the distance between specialized regional producers and international consumers, driving global market penetration, while robust logistics infrastructure is required to handle packaged goods efficiently and maintain product integrity across varying climates.

Hotpot Enhancer Market Potential Customers

The potential customer base for the Hotpot Enhancer Market is highly expansive and can be categorized into commercial, institutional, and household segments, all exhibiting distinct purchasing drivers and preferences. Commercial customers, primarily large-scale hotpot restaurant chains, independent Asian restaurants, and centralized catering operations, seek highly consistent, cost-effective, and scalable solutions. Their purchasing decisions are driven by the need for standardization across multiple outlets, ease of preparation by kitchen staff, and the ability of the enhancer to deliver authentic, repeatable signature flavors that define their brand identity. For this segment, bulk packaging and highly concentrated formulas offering superior yield are preferred.

The household segment represents the largest volume market, encompassing individual consumers and families who utilize hotpot enhancers for in-home dining. This segment is driven by convenience, flavor variety, and the desire for personalized customization. Younger consumers are particularly drawn to RTE and RTC hotpot kits that incorporate high-quality enhancers, reducing cooking complexity while providing a fun, communal dining experience. A growing sub-segment within households includes health-conscious consumers who actively seek premium, all-natural, low-sodium, or plant-based enhancers, often sourced via specialty online retailers or organic food stores.

Institutional customers, including hospitality providers, university cafeterias, and specialized food manufacturers utilizing hotpot flavors in other products (e.g., instant noodles, snacks), represent a steady demand stream. These buyers prioritize reliable supply, rigorous adherence to food safety certifications, and specialized formulations that can withstand industrial processing or large-scale institutional use. Furthermore, the burgeoning demand from international markets, driven by the global appreciation of diverse Asian cuisines, means that potential customers increasingly include global supermarket chains and international distributors looking to stock authentic, high-quality Asian food products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Haidilao International Holding Ltd., Yihai International Holding Ltd. (subsidiary of Haidilao), Little Sheep Group Co., Ltd., Sichuan Tianwei Food Co., Ltd., Chongqing Dezhuang Industrial Group Co., Ltd., S&P International Holding Limited, Laoganma Special Flavour Foodstuffs Co., Ltd., Lee Kum Kee Co., Ltd., Nissin Foods Holdings Co., Ltd., Ajinomoto Co., Inc., McCormick & Company, Incorporated, Wei Chuan Foods Corp., Wangzhihe Group, Frito-Lay (PepsiCo), Samyang Foods Co., Ltd., Ottogi Corporation, Nongshim Co., Ltd., Kikkoman Corporation, Shanxi Zilin Vinegar Industry Co., Ltd., Maling Hoshine Foods Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hotpot Enhancer Market Key Technology Landscape

The technology landscape within the Hotpot Enhancer Market is continuously evolving, driven by the need for superior flavor delivery, extended shelf life, and enhanced nutritional profiles. A major technological focus is placed on advanced extraction and concentration methods, such as vacuum concentration and low-temperature drying, used to produce high-density soup bases and flavor pastes while preserving the volatile aromatic compounds inherent in traditional spices and herbs. These techniques ensure that the final product offers an authentic, robust flavor upon reconstitution, minimizing the degradation often associated with conventional high-heat processing. Furthermore, spray-drying technology is crucial for creating fine, instantly soluble powdered enhancers, highly valued for their convenience and consistent dosing in both commercial and household applications.

Another significant technological advancement involves microencapsulation techniques, particularly relevant for preserving highly sensitive ingredients like fresh spices, specialized oils, and volatile flavor extracts (e.g., Sichuan peppercorn essence). Microencapsulation involves coating these ingredients in protective matrices, typically starch derivatives or natural gums, which shields them from oxidation, moisture, and temperature fluctuations, thereby significantly extending the shelf life and ensuring the burst of fresh flavor is only released when mixed with hot liquid. This technology is vital for maintaining the premium quality of high-value regional enhancers during lengthy international distribution channels, addressing a key logistical restraint.

Beyond processing, packaging technology plays a critical role, focusing on sustainable and functional design. Innovations include multilayer barrier films that prevent moisture and oxygen ingress for pastes and liquids, flexible stand-up pouches that reduce material waste compared to traditional jars, and smart packaging solutions that can monitor temperature or time-since-manufacture, offering improved traceability and consumer trust. Research and development are also heavily invested in fermentation technology, utilizing specialized microbial strains to generate complex, natural umami flavors (e.g., fermented bean pastes and sauces) that substitute for artificial flavor enhancers, meeting the growing consumer demand for natural food ingredients.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Hotpot Enhancer Market, driven by deep-rooted cultural traditions, massive consumption volumes in China, and expanding hotpot popularity across Southeast Asia (e.g., Vietnam, Thailand, Singapore). China alone accounts for the majority of the regional market, characterized by intense regional flavor specialization (Sichuan Mala, Cantonese Clear Broth, Chaoshan Beef Hotpot). Market growth is accelerated by the rapid expansion of organized hotpot restaurant chains (like Haidilao and Little Sheep) and high consumer adoption of home-use packaged bases. India and Japan are also demonstrating growth, largely adopting hotpot concepts with localized flavor variations, offering significant opportunity for product customization and innovation in savory and vegetable-based enhancers.

- North America: North America represents a dynamic, high-growth market, primarily fueled by strong Asian diaspora communities and increasing culinary exploration by the mainstream population. Demand is characterized by a preference for convenient, high-quality, and often premium enhancers. Consumers here show a marked interest in clean-label products, low-sodium versions, and ethnic fusion flavors. The market is highly dependent on effective distribution through specialty Asian grocery stores and major e-commerce platforms, with key growth centered in metropolitan areas with diverse populations like New York, Los Angeles, and Vancouver. Regulatory scrutiny over food additives and labeling is higher here, influencing product formulation strategies towards natural ingredients.

- Europe: The European market is expanding steadily, driven by the increasing popularity of Asian food culture, particularly in urban centers across the UK, Germany, and France. Demand is relatively nascent compared to APAC but shows robust growth in the premium segment, where consumers seek authentic, imported flavor bases. The primary consumers are younger generations and culinary enthusiasts looking for interactive dining experiences. Logistics and import compliance pose some challenges, necessitating robust supply chains. The region shows a specific growing interest in vegan and vegetarian hotpot enhancers, aligning with broader European dietary trends.

- Latin America (LATAM): LATAM is an emerging market for hotpot enhancers, characterized by low current penetration but high potential, especially in major economies like Brazil and Mexico. Market growth is primarily driven by exposure to global culinary trends through media and the establishment of new Asian restaurants in major cities. Initial demand focuses on basic, highly versatile savory and spicy enhancers. Manufacturers must overcome challenges related to logistics, distribution cold chain integrity, and adapting packaging and formulation to local preferences and economic accessibility, often requiring smaller, more affordable pack sizes.

- Middle East and Africa (MEA): The MEA region is at an early stage of adoption, with demand concentrated in urban hubs and areas with significant expatriate populations (e.g., UAE, Saudi Arabia, South Africa). Market potential lies in the increasing demand for diverse international cuisines and the growth of foodservice sectors. Enhancers tailored to local taste preferences, such as halal-certified ingredients and non-pork formulations, are crucial entry points. Distribution primarily relies on specialized international food retailers and high-end supermarkets catering to wealthier consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hotpot Enhancer Market.- Haidilao International Holding Ltd.

- Yihai International Holding Ltd. (subsidiary of Haidilao)

- Little Sheep Group Co., Ltd.

- Sichuan Tianwei Food Co., Ltd.

- Chongqing Dezhuang Industrial Group Co., Ltd.

- S&P International Holding Limited

- Laoganma Special Flavour Foodstuffs Co., Ltd.

- Lee Kum Kee Co., Ltd.

- Nissin Foods Holdings Co., Ltd.

- Ajinomoto Co., Inc.

- McCormick & Company, Incorporated

- Wei Chuan Foods Corp.

- Wangzhihe Group

- Frito-Lay (PepsiCo)

- Samyang Foods Co., Ltd.

- Ottogi Corporation

- Nongshim Co., Ltd.

- Kikkoman Corporation

- Shanxi Zilin Vinegar Industry Co., Ltd.

- Maling Hoshine Foods Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hotpot Enhancer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hotpot Enhancer Market?

The Hotpot Enhancer Market is projected to grow at a robust CAGR of 8.5% during the forecast period from 2026 to 2033, driven by global expansion and rising demand for convenient, authentic Asian culinary products.

Which geographical region dominates the Hotpot Enhancer Market in terms of consumption and production?

The Asia Pacific (APAC) region, particularly driven by high consumption and cultural significance in China, dominates the global hotpot enhancer market. APAC leads in both manufacturing capacity and consumer demand for both traditional and innovative flavor bases.

What are the key differences between commercial and household hotpot enhancer products?

Commercial enhancers are typically sold in bulk, highly concentrated, and formulated for consistent performance across multiple restaurant batches, prioritizing cost-efficiency. Household enhancers focus more on convenience, diverse flavor profiles, smaller packaging, and adherence to clean-label or natural ingredient trends.

How is technological innovation affecting the quality and shelf life of hotpot enhancers?

Advanced technologies like vacuum concentration, low-temperature drying, and microencapsulation are utilized to preserve the volatile aromatics and flavor intensity of spices, significantly extending shelf life, reducing reliance on artificial preservatives, and ensuring superior authentic flavor delivery upon use.

What are the primary restraints challenging the growth of the Hotpot Enhancer Market?

Key restraints include the volatile pricing and inconsistent supply of high-quality agricultural raw materials (spices, herbs), coupled with increasing global consumer and regulatory scrutiny regarding high sodium content and the use of synthetic additives in mass-produced hotpot bases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hotpot Enhancer Market Size Report By Type (Flavor Enhancer, Spicy Enhancer, Others), By Application (Hotpot base, Hotpot product), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hotpot Enhancer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Spicy Enhancer, Flavor Enhancer, Others), By Application (Hotpot product, Hotpot base), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager