Household Decor Papers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433529 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Household Decor Papers Market Size

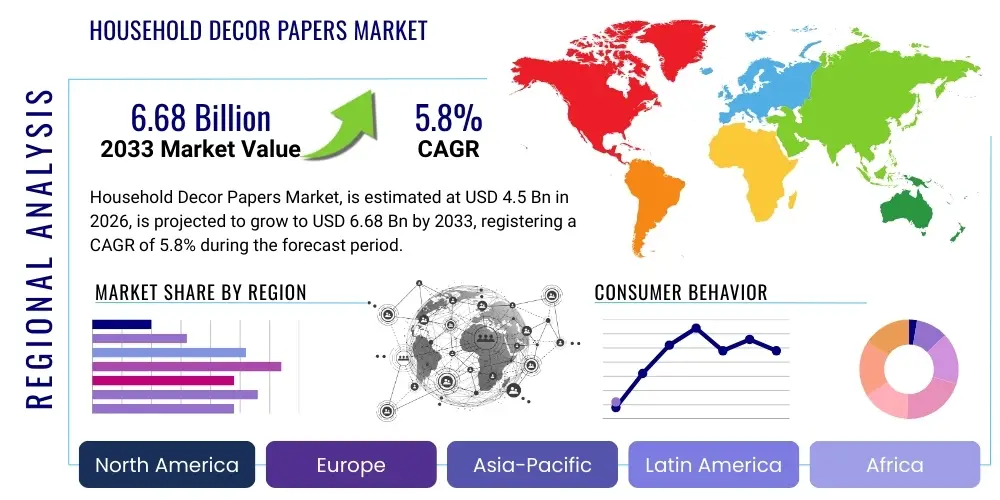

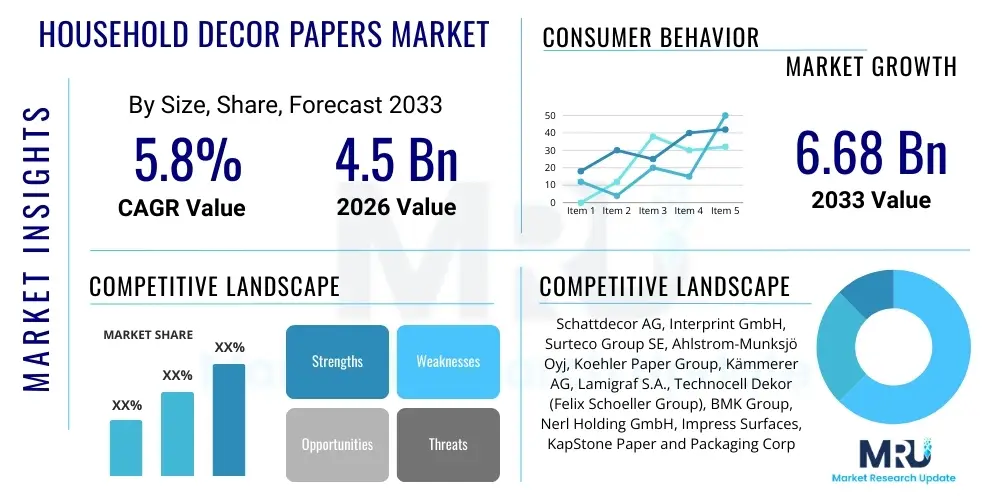

The Household Decor Papers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.68 Billion by the end of the forecast period in 2033.

Household Decor Papers Market introduction

The Household Decor Papers Market encompasses specialized paper products used primarily for surface lamination in residential furniture, flooring, and interior design applications. These papers are essential components in producing materials such as decorative laminates, melamine-faced panels (MFP), and continuous pressure laminates (CPL), offering aesthetic appeal, durability, and resistance to wear, moisture, and heat. The product spectrum includes print base papers, barrier papers, and finish foils, each serving a distinct function in the lamination process, allowing manufacturers to replicate sophisticated natural patterns like wood grain, stone, or abstract designs affordably and consistently. The rising global demand for ready-to-assemble (RTA) furniture and the increased focus on interior aesthetics among middle-income populations worldwide are central pillars supporting market expansion.

Major applications of decor papers are found extensively in kitchen cabinetry, wardrobes, tabletops, and engineered wood flooring, where they provide the final decorative layer. The inherent flexibility and cost-effectiveness of decor papers compared to solid wood or natural veneers drive their widespread adoption across various price points in the consumer goods and construction sectors. Furthermore, advancements in printing technology, such as sophisticated gravure and digital printing, enable high-definition, tactile finishes that closely mimic real materials, thus enhancing their perceived value and expanding design possibilities. Environmental benefits, including the use of sustainably sourced cellulose and the recyclability of certain paper types, also position decor papers favorably in an increasingly eco-conscious consumer landscape.

The primary benefit of utilizing decor papers lies in their ability to achieve mass customization and standardized quality while reducing manufacturing complexity and material costs. Key driving factors include rapid urbanization leading to smaller living spaces that require aesthetically pleasing and multifunctional furniture, the robust growth in the global construction and renovation sectors, particularly in Asia Pacific, and continuous innovation in paper substrates that enhance fire resistance and antibacterial properties, catering to stringent modern consumer requirements for hygiene and safety in the home environment.

Household Decor Papers Market Executive Summary

The Household Decor Papers Market is characterized by robust business trends centered around sustainability, digital integration, and material innovation. Manufacturers are increasingly prioritizing recycled content and developing papers that minimize formaldehyde emissions, aligning with stricter global regulatory standards and consumer preference for eco-friendly products. Business trends also indicate a shift towards advanced digital printing technologies, which dramatically shorten lead times, reduce inventory risks, and facilitate the quick introduction of new, highly customized design collections, moving away from traditional long-run gravure printing for smaller batches. Strategic collaborations between decor paper producers and chemical suppliers (resins and lacquers) are crucial for developing enhanced surface properties, such as anti-scratch coatings and matte finishes, which are currently highly sought after in modern interior design. Furthermore, market competition is intensifying, driven by capacity expansion in emerging economies, forcing established players to focus heavily on high-value specialty papers and unique textural effects to maintain competitive advantage.

Regionally, the Asia Pacific (APAC) stands out as the engine of growth, fueled by massive infrastructure projects, burgeoning residential construction in countries like China and India, and the rising consumer disposable income driving demand for high-quality, factory-finished furniture. Europe remains a mature but highly innovative market, setting global benchmarks for design trends and sustainable practices, emphasizing lightweight papers and advanced finish foils tailored for premium European furniture manufacturers. North America shows stable growth, primarily driven by the residential renovation boom and the increasing preference for laminate flooring and paneling over traditional materials, provided the decor papers offer high durability and authentic visual representation of hardwoods. The Middle East and Africa (MEA) and Latin America are emerging regional markets, characterized by initial adoption driven by imported technologies and increasing local manufacturing capabilities aimed at import substitution.

Segment-wise, the market sees dominant growth in the Printed Decor Paper segment, as it offers maximum design flexibility and color depth required for modern aesthetics. Within applications, the Furniture and Cabinetry segment maintains the largest market share due to its direct linkage with residential construction activity. There is also a notable upward trend in the demand for Lightweight Decor Papers, optimizing material consumption and transportation costs. The Finish Foil segment is gaining traction for cost-sensitive applications and interior decorative panels due to its pre-impregnated nature, simplifying the lamination process for smaller manufacturers. Overall, market segmentation reveals a clear shift towards products that combine aesthetic excellence with enhanced functional properties, such as improved heat resistance and dimensional stability under varying climate conditions.

AI Impact Analysis on Household Decor Papers Market

Common user inquiries regarding AI's influence in the Household Decor Papers Market typically center on how technology can revolutionize design ideation, streamline manufacturing efficiency, and enhance customer experience. Users frequently ask about AI's role in predicting future design trends, enabling hyper-realistic virtual modeling of interiors, and optimizing supply chain logistics related to specific paper stock and resin inventories. Key concerns revolve around the potential disruption of traditional design skills and the requirement for substantial initial investment in AI infrastructure, particularly regarding integrating sophisticated AI-driven inspection systems for quality control in high-speed printing environments. Summarizing these themes, users expect AI to primarily serve as an accelerator for customization and precision manufacturing, driving the market toward 'mass personalization' by offering instantaneous design visualization and minimizing material waste through predictive analytics in both design and production phases.

- AI-Powered Trend Forecasting: Utilizing machine learning algorithms to analyze interior design social media data, sales patterns, and architectural trends globally, enabling manufacturers to launch designs that preempt consumer demand, significantly reducing time-to-market for new collections.

- Optimized Printing and Quality Control: Implementing AI visual inspection systems (computer vision) on gravure and digital printing lines to detect microscopic color deviations, misregistration, and material defects in real-time, ensuring superior batch consistency and minimizing costly production errors.

- Customization and Visualization Tools: Deployment of AI and Augmented Reality (AR) tools allowing household consumers and designers to instantly visualize how specific decor paper designs will look in their physical space, significantly enhancing the buying decision process for lamination and panel products.

- Predictive Maintenance: Using AI to analyze sensor data from high-speed printing and impregnation machinery to predict potential equipment failures, thereby scheduling proactive maintenance and maximizing operational uptime, critical for high-volume paper production.

- Supply Chain and Inventory Management: AI algorithms optimize the procurement of base paper pulp and specialty chemicals (e.g., melamine resins) based on anticipated production schedules and demand forecasts, reducing storage costs and mitigating risks associated with material price volatility.

DRO & Impact Forces Of Household Decor Papers Market

The dynamics of the Household Decor Papers Market are governed by a complex interplay of internal and external forces summarized by the Drivers, Restraints, and Opportunities (DRO). The major driver is the accelerating urbanization and the corresponding increase in global residential construction and remodeling activities, especially in developing economies, creating a perpetual demand for cost-effective and aesthetically versatile interior surfacing materials. Coupled with this is the continuous technological refinement in printing, pigmentation, and resin impregnation, which has enabled decor papers to achieve visual and textural fidelity comparable to natural materials, thereby boosting their acceptance across mid-to-high-end furniture and flooring segments. The consumer preference for functional furniture that offers both durability and aesthetic appeal, facilitated by the protective laminate layers derived from decor papers, serves as a fundamental market propeller. Furthermore, regulatory support in many regions promoting engineered wood products over resource-intensive solid wood also indirectly stimulates demand for decor papers as the primary aesthetic surface material.

However, the market faces significant restraints, primarily stemming from the volatility in raw material prices, particularly wood pulp, specialized chemicals, and resins, which directly impact manufacturing costs and pricing stability. Another critical restraint is the increasing environmental scrutiny regarding the use of formaldehyde-based resins (urea-formaldehyde and melamine-formaldehyde) in the lamination process, forcing manufacturers to invest heavily in low-emission or formaldehyde-free alternatives, which are often more costly and technically challenging to implement. Furthermore, the rising competition from non-paper-based decorative surfaces, such as high-pressure digital prints on plastic films or direct printing technologies (DPT) onto panels, presents a technological substitution risk, especially where extreme durability or specific textural requirements are paramount. The long supply chains involved in sourcing specialty paper globally also introduce logistical vulnerabilities and reliance on efficient global shipping infrastructure.

Opportunities for growth are abundant and center primarily on sustainability and advanced customization. The shift towards sustainable decor papers made from recycled or certified fiber sources (FSC/PEFC) and the development of bio-based resins represents a massive opportunity to capture the premium segment focused on green building materials. Moreover, the integration of digital printing allows for unprecedented small-batch production and personalized designs, opening new niche markets in high-end bespoke furniture and limited-edition design collections. Geographically, penetrating underserved markets in Africa and specific Eastern European nations where residential construction is projected to accelerate offers untapped growth potential. Innovations focusing on functional surface papers, such as those with integrated antimicrobial properties or smart coatings that react to temperature or light, provide a distinct future market differentiation. The impact forces acting on the market show a high leverage of technological substitution risk and medium leverage of environmental regulations, demanding constant innovation to remain competitive.

Segmentation Analysis

The Household Decor Papers Market is predominantly segmented based on product type, application, end-user, and geographic region. Analyzing these segments provides strategic insights into market hotspots and evolving consumer preferences. The market is highly differentiated by the thickness and saturation level of the paper, directly influencing its final application properties. Key distinctions are made between raw base papers, printed papers, and pre-impregnated papers (finish foils), each catering to specific price points and manufacturing complexity requirements. Furthermore, end-use segmentation clearly distinguishes the demand characteristics between residential furniture, laminate flooring, and wall paneling, reflecting differing requirements for abrasion resistance and aesthetic fidelity, with residential furniture remaining the largest consumer segment globally due to sheer volume.

Growth trends show a clear segmentation preference toward Printed Decor Paper, which provides the critical aesthetic differentiation required by furniture and interior designers, allowing for complex, high-definition designs that capture market attention. Simultaneously, the finish foil segment, which utilizes lightweight, pre-treated paper, is witnessing increased adoption, especially in the fast-growing RTA furniture market, valued for its ease of use and reduced processing steps for manufacturers. Segment analysis confirms that technological advancements in digital printing are blurring the lines between traditional high-pressure laminates (HPL) papers and standard print base papers, leading to greater flexibility in production runs. The focus on sustainable paper types, such as those utilizing highly bleached elemental chlorine-free (ECF) pulp or recycled fibers, is emerging as a distinct premium segment driven by corporate social responsibility mandates and environmentally conscious consumers.

- By Product Type:

- Print Base Paper (Unprinted Decor Paper)

- Printed Decor Paper (Gravure and Digital Printed)

- Pre-impregnated Decor Paper (Finish Foils)

- Overlay Paper (Protective surface layer)

- Barrier Paper

- By Application:

- Furniture and Cabinetry (Kitchens, Wardrobes, Tables)

- Laminate Flooring

- Wall Paneling

- Countertops and Work Surfaces

- By End-User:

- Residential (New Construction and Renovation)

- Commercial (Hotels, Offices, Retail)

- By Printing Technology:

- Gravure Printing

- Digital Printing

Value Chain Analysis For Household Decor Papers Market

The value chain for the Household Decor Papers Market starts with intensive upstream analysis, focusing on the sourcing of high-quality cellulose pulp, which is the foundational raw material. Key upstream activities involve sustainable forest management, pulp processing, and the chemical industry providing specialized pigments, dyes, and performance resins (melamine, acrylics). The efficiency and cost-effectiveness of decor paper production are heavily reliant on stable, high-quality input from these suppliers. Fluctuations in wood pulp prices or stringent chemical regulations can exert significant pressure across the entire value chain. Paper manufacturers invest heavily in continuous paper machine technology to ensure uniform thickness, porosity, and wet strength—critical attributes for subsequent printing and impregnation processes.

The midstream comprises the core activities: printing and impregnation. Decor paper converters take the base paper and apply intricate designs using advanced gravure printing (for high volumes) or digital printing (for customization). Following printing, the paper is often impregnated with thermosetting resins, which turns the paper into a durable, workable material ready for lamination. The downstream segment involves the primary consumers of decor paper—laminate manufacturers, engineered wood panel producers (MDF, particleboard), and major furniture assembly companies. These players bond the impregnated paper onto substrates using heat and pressure to create the final decorative panels or flooring planks, emphasizing product performance and aesthetic matching.

Distribution channels are categorized into direct and indirect routes. Direct sales are predominant for large-volume, vertically integrated furniture producers who negotiate directly with decor paper manufacturers for customized designs and bulk supply. Indirect channels primarily involve specialized distributors, agents, and stockists who cater to smaller and medium-sized laminate producers and local interior fit-out companies. Effective logistics, including specialized packaging to prevent moisture damage and ensure the paper’s integrity during transit, are vital in maintaining the quality of the delicate finished product throughout the global distribution network. The trend is toward localized converting facilities, especially in APAC, to reduce transportation costs and expedite delivery times to furniture hubs.

Household Decor Papers Market Potential Customers

The primary consumers and end-users of household decor papers are concentrated within the construction, furniture manufacturing, and interior design sectors. These papers serve as a crucial input material, dictating the final aesthetic and durability of engineered products. The largest segment of potential customers includes large-scale Original Equipment Manufacturers (OEMs) specializing in ready-to-assemble (RTA) furniture, which heavily rely on standardized decor papers to finish mass-produced cabinetry, tables, and shelving units. These buyers prioritize consistent color matching, competitive pricing, and high supply reliability to support their lean manufacturing schedules. Their purchasing decisions are often centralized and long-term, focusing on bulk contracts for popular wood grain and solid color designs.

Another significant customer base comprises laminate and panel manufacturers (e.g., producers of High-Pressure Laminates and Continuous Pressure Laminates). These companies purchase large volumes of various paper types, including overlay and print base papers, which they process further into finished decorative sheets used by residential contractors and custom cabinet makers. These customers require papers with specific technical characteristics, such as precise resin absorption rates and high heat resistance, suitable for complex pressing cycles. Their procurement strategy often focuses on technical partnership with decor paper suppliers to co-develop papers suitable for innovative lamination techniques and new surface textures like synchronous pore finishes.

Finally, smaller custom furniture shops, interior designers, and renovation contractors act as indirect buyers, influencing demand through material specifications. While they do not purchase raw paper, their demand for specific laminate styles and finishes drives the ordering patterns of the midstream laminate producers. The residential construction and renovation market segment, encompassing individual homeowners undertaking DIY projects or working with local contractors, also constitutes a vital demand source, particularly for laminate flooring and pre-finished wall panels, where the aesthetics provided by decor papers are the primary consumer appeal.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.68 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schattdecor AG, Interprint GmbH, Surteco Group SE, Ahlstrom-Munksjö Oyj, Koehler Paper Group, Kämmerer AG, Lamigraf S.A., Technocell Dekor (Felix Schoeller Group), BMK Group, Nerl Holding GmbH, Impress Surfaces, KapStone Paper and Packaging Corporation, Liri Industriale S.r.l., ARPA Industriale S.p.A., Dixie Group Inc., Decotone Surfaces, Crown Paper Group, Pudumjee Paper Products Ltd., Kingdecor (Guangzhou) Co., Ltd., Greenlam Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Decor Papers Market Key Technology Landscape

The Household Decor Papers Market is heavily dependent on sophisticated manufacturing technologies that ensure high fidelity of design reproduction and superior performance characteristics of the final laminated product. The established technological backbone of the industry is high-speed gravure printing, which utilizes engraved cylinders to transfer ink onto the base paper. This technique is highly efficient for large-volume runs and achieving deep, saturated colors required for traditional wood grain and stone patterns. Recent advancements in gravure focus on electronic cylinder engraving and specialized ink formulations, particularly water-based inks, to improve sustainability profiles and comply with volatile organic compound (VOC) reduction mandates. Parallel to printing, the precision impregnation technology, involving the application of specialty resins (melamine or urea resins) under controlled temperature and moisture conditions, is critical for achieving the required durability, scratch resistance, and dimensional stability of the paper before pressing.

A transformative technology rapidly reshaping the landscape is digital printing, which leverages inkjet technology to print designs directly onto decor paper. Digital printing eliminates the need for expensive printing cylinders, drastically reducing setup costs and turnaround times, making it ideal for customized orders, small batches, and rapid design sampling. This technology enables virtually limitless design possibilities, including personalized murals, photographic realism, and textured effects that are difficult to achieve with conventional gravure. While digital printing currently has limitations in speed compared to large-scale gravure lines, advancements in single-pass inkjet printers are quickly closing this gap, positioning digital printing as a major disruptive force, particularly in the premium and bespoke segments where design flexibility outweighs marginal unit cost differences.

Furthermore, significant technological development is focused on the paper substrate itself and the lamination additives. Innovations include the production of highly bleached, porous specialty papers that optimize resin absorption, ensuring a flawless bond with the substrate, as well as the creation of advanced overlay papers with embedded micro-coatings that enhance antibacterial and anti-fingerprint properties—catering directly to modern hygienic requirements in kitchens and healthcare settings. Research is also heavily invested in developing more sustainable resin systems, exploring alternatives like bio-based thermosets or low-formaldehyde-emitting compounds, driven by stringent European and North American indoor air quality regulations such as CARB and TSCA Title VI. These material innovations are pivotal for future market competitiveness and are driving collaborative R&D efforts between paper manufacturers and chemical suppliers.

Regional Highlights

The global Household Decor Papers Market displays significant heterogeneity across key regions, driven by localized construction trends, regulatory environments, and prevailing consumer design aesthetics. Asia Pacific (APAC) currently dominates the market both in terms of production capacity and consumption volume. This dominance is intrinsically linked to the region's massive and ongoing infrastructure development, rapid urbanization, and a burgeoning middle class in countries like China, India, and Southeast Asia, leading to exceptionally high demand for new furniture and flooring solutions. China, in particular, acts as a global manufacturing hub for furniture, consuming vast quantities of decor paper. The growth in APAC is further supported by the localization of production facilities by major global players seeking proximity to these high-volume end-user markets, prioritizing cost-efficiency and quick delivery of standardized products.

Europe represents a mature yet highly influential market segment, setting global standards in design innovation, high-quality finishes, and sustainability. European consumers and manufacturers demand premium decorative papers characterized by superior realism, unique tactile surfaces (such as synchronized pore), and robust environmental certifications (e.g., eco-label compliance). Countries like Germany and Italy are major consumers due to their leading positions in high-end furniture and kitchen manufacturing. The market growth here is incremental, primarily driven by replacement demand, renovations, and the continuous adoption of highly specialized and value-added decor papers that utilize advanced digital printing and low-emission resins, maintaining a strong focus on circular economy principles and product longevity.

North America exhibits steady growth, predominantly propelled by the strong residential renovation and remodeling sector. Consumers in the US and Canada favor durable laminate flooring and cabinetry finishes that authentically mimic high-cost natural materials like exotic hardwoods and marble. The North American market emphasizes robust performance characteristics, including high abrasion resistance (measured by AC ratings for flooring) and compliance with stringent fire and safety standards. While traditionally reliant on imports, there is an increasing push for domestic production of specialty decor papers to mitigate supply chain risks. Latin America and the Middle East & Africa (MEA) are emerging regions offering high growth potential, characterized by increasing industrialization and a rising preference for modern, aesthetically appealing home interiors, signaling significant opportunities for market penetration by international suppliers, particularly in cost-effective printed and finish foil segments.

- Asia Pacific (APAC): Dominant market share and fastest growth; driven by massive construction, urbanization, and furniture manufacturing hubs (China, India). Focus on mass production and cost-efficiency.

- Europe: Mature market focused on high-quality, sustainability, and design innovation; slow but stable growth driven by renovation and premium furniture exports (Germany, Italy).

- North America (NA): Steady growth fueled by strong residential remodeling activities; demand centered on high durability, realistic wood grains, and regulatory compliance (TSCA).

- Latin America (LATAM): Emerging market with increasing industrialization and rising demand for affordable, modern interior solutions; potential for local production growth.

- Middle East & Africa (MEA): Growth driven by luxury construction projects and developing infrastructure; preference for imported, high-end designs, sensitive to geopolitical and economic stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Decor Papers Market.- Schattdecor AG

- Interprint GmbH

- Surteco Group SE

- Ahlstrom-Munksjö Oyj

- Koehler Paper Group

- Kämmerer AG

- Lamigraf S.A.

- Technocell Dekor (Felix Schoeller Group)

- BMK Group

- Nerl Holding GmbH

- Impress Surfaces

- KapStone Paper and Packaging Corporation

- Liri Industriale S.r.l.

- ARPA Industriale S.p.A.

- Dixie Group Inc.

- Decotone Surfaces

- Crown Paper Group

- Pudumjee Paper Products Ltd.

- Kingdecor (Guangzhou) Co., Ltd.

- Greenlam Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Household Decor Papers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between printed decor paper and finish foil?

Printed decor paper requires subsequent impregnation with resin and pressing by the laminate manufacturer, providing superior durability for high-pressure applications. Finish foil is already pre-impregnated and cured, making it suitable for lower-pressure lamination onto substrates like particleboard, offering an easier and more cost-effective solution often used in RTA furniture.

How is the Household Decor Papers market influenced by sustainability trends?

Sustainability significantly impacts the market through increasing demand for papers sourced from certified sustainable forests (FSC/PEFC) and the mandated transition to low-formaldehyde or non-formaldehyde-emitting resins. Manufacturers are prioritizing recycled content and developing papers that minimize environmental impact throughout the product lifecycle, appealing to eco-conscious consumers and regulatory bodies.

Which printing technology is driving market growth: gravure or digital?

While gravure printing remains the dominant technology for high-volume, standardized production due to cost efficiency, digital printing is the key driver of market growth in terms of innovation and flexibility. Digital technology enables rapid design changes, mass customization, and small-batch runs, catering to bespoke interior design trends and reducing inventory risk for manufacturers.

What major challenges does the market face concerning raw material supply?

The primary challenge is the volatile cost and secure supply of specialized bleached wood pulp (the base paper material) and thermosetting resins (melamine/urea). Global supply chain disruptions and fluctuations in commodity pricing directly increase the operational expenses for decor paper manufacturers, requiring robust hedging and inventory management strategies to maintain price stability.

Which geographic region offers the highest growth potential for decor papers?

Asia Pacific (APAC) currently offers the highest and fastest growth potential, particularly driven by rapid urbanization and soaring residential construction volumes in emerging economies such as India, Vietnam, and Indonesia. The massive scale of furniture manufacturing in China further cements APAC's role as the pivotal growth region for high-volume consumption of decor paper products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager