Household Dehumidifiers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433709 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Household Dehumidifiers Market Size

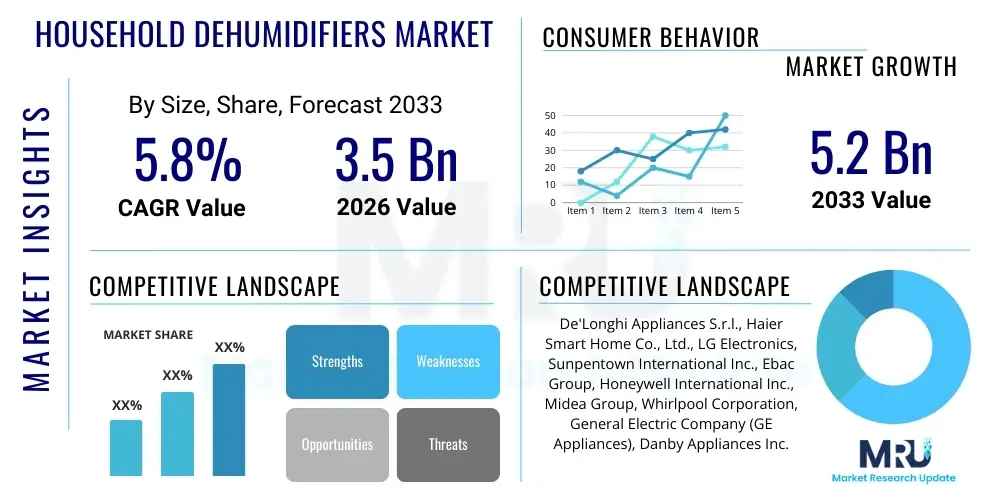

The Household Dehumidifiers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Household Dehumidifiers Market introduction

The Household Dehumidifiers Market encompasses the sale of devices designed to reduce the level of humidity in residential air spaces. These products operate by removing excess moisture, thereby mitigating issues related to mold growth, dust mites, mildew, and general discomfort associated with high humidity environments, such as basements, bathrooms, and laundry rooms. The market is primarily segmented by product type (refrigerant/compressor-based, desiccant, and whole-house systems), capacity, and application area. Increasing awareness regarding the adverse health effects of dampness, particularly respiratory issues and allergies, is a fundamental driver propelling market expansion across temperate and tropical zones globally.

Product descriptions vary widely, ranging from compact portable units suitable for small rooms to high-capacity industrial-grade models and integrated HVAC systems. Major applications include improving air quality, protecting structural integrity of homes (preventing wood warping and drywall damage), and enhancing overall occupant comfort. Benefits extend beyond health and structural protection to include energy efficiency in air conditioning systems, as dry air is easier and less energy-intensive to cool. The inherent value proposition of dehumidifiers—creating a healthier, more comfortable, and damage-resistant living environment—solidifies their status as essential household appliances, particularly in regions prone to seasonal high humidity or localized dampness issues.

Driving factors for this market include evolving climate patterns resulting in prolonged periods of high humidity, stricter building codes in some regions mandating moisture control, and the growing urbanization trend where smaller, potentially poorly ventilated living spaces necessitate mechanical moisture extraction. Furthermore, technological advancements leading to quieter, more energy-efficient models with smart connectivity features are significantly enhancing consumer adoption rates. The integration of high-efficiency particulate air (HEPA) filters and other air purification technologies into modern dehumidification units further broadens their appeal as comprehensive air quality management solutions.

Household Dehumidifiers Market Executive Summary

The Household Dehumidifiers Market is exhibiting robust growth, fundamentally driven by mounting health consciousness among consumers regarding indoor air quality and the necessity of moisture mitigation in residential settings. Business trends indicate a strong shift towards smart, interconnected devices, allowing users remote control and automated humidity management, which is particularly appealing to tech-savvy millennials and older generations seeking convenience. Manufacturers are focusing heavily on developing models that offer superior energy efficiency (Energy Star ratings) and reduced noise levels, addressing two primary historical friction points in consumer adoption. Furthermore, the market is characterized by intense competition among established appliance giants and specialized niche players, leading to rapid innovation cycles in sensor technology and moisture extraction mechanisms.

Regional trends reveal that North America and Europe remain mature, high-value markets, emphasizing premium features and whole-house dehumidification systems integrated with HVAC infrastructure. However, the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by increasing disposable income, rapid urbanization, and persistent humid conditions across Southeast Asia and coastal China. Governments in these developing economies are slowly beginning to prioritize indoor air quality regulations, further boosting demand. Meanwhile, regions like Latin America and MEA show nascent growth, driven primarily by localized residential construction booms and the need for localized humidity control in highly specialized climates.

Segmentation trends highlight the increasing dominance of the refrigerant (compressor-based) segment due to its efficiency and high capacity suitability for large areas, though desiccant dehumidifiers retain significant market share in cooler climates or for applications requiring lower relative humidity levels. In terms of capacity, the 30-50 Pint segment is seeing the highest volume sales, offering the best balance between performance and price point for average household usage. The retail distribution channel, including major home improvement stores and specialized electronics retailers, continues to dominate sales, although the e-commerce segment is rapidly gaining ground, providing consumers access to a wider variety of specialized brands and competitive pricing structures.

AI Impact Analysis on Household Dehumidifiers Market

Common user questions regarding AI's impact on household dehumidifiers center on enhanced operational efficiency, predictive maintenance capabilities, and seamless integration within smart home ecosystems. Users often inquire about how AI algorithms can optimize energy consumption by learning usage patterns and predicting weather-related humidity spikes. Key themes include the expectation of fully autonomous operation, where the dehumidifier anticipates necessary adjustments rather than reacting to current sensor readings, and concerns regarding data privacy associated with continuous environmental monitoring. Consumers anticipate that AI will eliminate the need for manual settings, leading to maximal comfort and minimal running costs, thereby driving the premium segment of the market towards sophisticated, self-learning appliances.

- AI algorithms enable predictive humidity control, adjusting settings proactively based on learned homeowner preferences, seasonal patterns, and real-time local weather forecasts, minimizing energy waste.

- Machine learning improves energy efficiency by optimizing compressor cycling and fan speed relative to the required moisture removal rate and existing air temperature, achieving high Energy Efficiency Ratios (EERs).

- Integration with smart home platforms (e.g., Alexa, Google Home) is enhanced by AI-driven natural language processing, allowing for complex voice commands and situational awareness within the connected ecosystem.

- AI facilitates anomaly detection and predictive maintenance by analyzing performance data (vibration, temperature, current draw) to notify users of potential component failures (e.g., filter clogging, coil icing) before a breakdown occurs.

- Advanced sensor fusion, processed by AI, allows dehumidifiers to differentiate between moisture sources (e.g., shower steam vs. basement seepage), leading to more accurate and targeted operation.

- Improved user interface design and personalized recommendation engines are driven by AI, helping users select the optimal mode or capacity for new installation areas based on historical data.

DRO & Impact Forces Of Household Dehumidifiers Market

The Household Dehumidifiers Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the escalating prevalence of moisture-related health issues, heightened consumer awareness regarding the benefits of air quality control, and climate change effects leading to increased humidity in many populated areas. Furthermore, the robust expansion of the smart home industry serves as a foundational driver, integrating advanced dehumidification features seamlessly into centralized home management systems. These factors collectively push the market forward, ensuring steady demand across both replacement and new construction sales channels, especially as regulatory pressure increases concerning energy efficiency standards for appliances.

However, the market faces significant restraints. High initial purchasing costs, particularly for whole-house systems and advanced desiccant models, often deter budget-conscious consumers. Operational costs associated with electricity consumption, although improving, remain a concern for prolonged use. Moreover, the lack of widespread consumer education in certain developing regions regarding the necessity and proper sizing of dehumidifiers often leads to under- or over-specified purchases, resulting in dissatisfaction and low market penetration. Seasonal dependency also acts as a natural restraint, as sales peak predominantly during summer and rainy seasons, necessitating sophisticated inventory management for manufacturers and retailers.

Opportunities abound, primarily driven by innovations in sustainable technologies, such as the development of non-compressor-based solid desiccant dehumidification systems that offer quieter operation and superior performance at lower temperatures. The expansion into commercial light usage (e.g., small offices, archival storage rooms) represents a critical growth pathway. Furthermore, leveraging direct-to-consumer (D2C) channels and aggressive digital marketing strategies focused on health benefits can capture untapped market segments. The impact forces indicate that technological advancement and environmental regulations are the most powerful accelerators, while price sensitivity and operational awareness remain the primary impediments requiring strategic manufacturer intervention.

Segmentation Analysis

The Household Dehumidifiers Market is comprehensively segmented across several critical dimensions, including product type, capacity, application, and distribution channel, providing a granular view of consumer preferences and market dynamics. Understanding these segments is vital for strategic planning, as different product types cater to distinct environmental conditions and performance needs, while capacity segmentation directly reflects the size of the area requiring treatment. The dominant segment remains compressor-based units due to their cost-effectiveness and efficiency in high-temperature, high-humidity scenarios typical of standard residential use. The application segmentation primarily targets basement/crawl space moisture control and living area comfort enhancement, indicating strong demand for permanent and portable solutions.

- By Product Type:

- Refrigerant/Compressor Dehumidifiers

- Desiccant Dehumidifiers

- Whole-House Dehumidifiers (Integrated Systems)

- By Capacity:

- Below 30 Pints

- 30 to 50 Pints

- Above 50 Pints

- By Application:

- Basement and Crawl Space

- Living Areas and Bedrooms

- Laundry and Bathroom

- By Distribution Channel:

- Offline Retail (Specialty Stores, Home Improvement Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Household Dehumidifiers Market

The value chain for household dehumidifiers begins with upstream activities involving the sourcing of core components, primarily compressors, heat exchangers (coils), specialized refrigerants (for refrigerant models), desiccant materials (for desiccant models), fan motors, and sophisticated humidity sensors/controls. Key upstream suppliers include major global compressor manufacturers and specialty chemical companies. Ensuring a stable and cost-effective supply of energy-efficient compressors, particularly those complying with strict environmental standards (e.g., R-32 refrigerant phase-out schedules), is crucial for maintaining competitive production costs and product performance integrity. Innovations in sensor technology and microelectronics also define the competitive landscape in the upstream segment, impacting the ‘smart’ capabilities of the final product.

Midstream activities involve core manufacturing, assembly, quality control, and branding. Manufacturing often takes place in Asia Pacific countries, leveraging established supply chains and economies of scale. Direct channel distribution involves sales through brand-owned e-commerce platforms and factory outlets, allowing manufacturers to control pricing and customer experience directly. Indirect channel distribution, which constitutes the majority of sales, relies heavily on large-scale partnerships with established offline retailers (e.g., Home Depot, Lowes) and dominant online marketplaces (e.g., Amazon, specialized appliance retailers). These intermediaries manage inventory, warehousing, and often provide installation or warranty services, absorbing significant logistical risk.

Downstream activities focus on marketing, retail, consumer purchasing, and after-sales services. The efficacy of the distribution channel dictates market penetration. Offline retailers provide consumers with the ability to physically examine the product and receive immediate expert advice, which is crucial for determining the correct capacity size. Online channels offer unparalleled convenience, detailed technical specifications, and comparative pricing, driving growth particularly in portable unit sales. Post-sale support, including warranty fulfillment, spare parts availability (especially filters and reservoirs), and repair services, significantly influences brand loyalty and overall customer lifetime value in this durable consumer goods market.

Household Dehumidifiers Market Potential Customers

Potential customers for household dehumidifiers are broad but are primarily categorized into homeowners residing in geographically humid climates (coastal, tropical, or highly seasonal regions) and individuals focused on health and structural preservation of their property. The largest segment of end-users comprises homeowners with basement or crawl space moisture issues, where high humidity levels are endemic and pose severe risks of mold, structural damage, and pest infestation. These buyers often seek high-capacity, dedicated units designed for continuous operation and gravity drainage systems, prioritizing reliability and capacity over aesthetic appeal or portability.

Another significant customer base includes allergy and asthma sufferers, or families with young children or elderly members, who are particularly sensitive to poor indoor air quality exacerbated by mold and dust mites thriving in damp conditions. These health-conscious consumers prioritize units that offer integrated air filtration (HEPA) and quiet operation, typically seeking portable units for living areas and bedrooms. Furthermore, collectors and enthusiasts who store valuable items susceptible to moisture damage—such as musical instruments, artwork, or archived documents—form a niche, high-value segment seeking precise humidity control and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De'Longhi Appliances S.r.l., Haier Smart Home Co., Ltd., LG Electronics, Sunpentown International Inc., Ebac Group, Honeywell International Inc., Midea Group, Whirlpool Corporation, General Electric Company (GE Appliances), Danby Appliances Inc., Frigidaire (Electrolux AB), Therma-Stor LLC, Condair Group, Quest Climate, Stadler Form Aktiengesellschaft |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Dehumidifiers Market Key Technology Landscape

The core technology landscape in the household dehumidifiers market is dominated by two established mechanisms: refrigeration (compressor-based) and desiccant materials. Compressor-based units utilize the vapor compression cycle, where moist air is cooled below its dew point via refrigerated coils, condensing water vapor into liquid water. Recent technological advancements in this segment focus on the integration of variable-speed compressors and environmentally friendly refrigerants (like R-32) to significantly boost efficiency, minimize power consumption, and comply with evolving global environmental regulations aimed at reducing Greenhouse Gas (GHG) emissions. The adoption of advanced microprocessors allows for precise temperature and humidity calibration, enhancing user control and operational stability.

Desiccant technology relies on hydrophilic materials, typically silica gel or specialized polymer rotors, which absorb moisture from the air. These systems are highly effective in cooler environments (below 65°F) where compressor units struggle due to coil icing, and they operate significantly quieter. Recent innovations in desiccant materials focus on increasing absorption capacity and reducing the energy required for the regeneration cycle (heating the material to release stored moisture), making them viable for a broader range of residential applications. Furthermore, the development of solid-state electronic dehumidifiers, utilizing Peltier effect or membrane technology, represents a burgeoning, though currently niche, segment focused on ultra-quiet, low-capacity applications.

The convergence of these core technologies with digital and smart capabilities is perhaps the most defining trend. This includes the proliferation of Wi-Fi and Bluetooth connectivity, enabling remote monitoring and control via mobile applications. Sophisticated sensors capable of tracking volatile organic compounds (VOCs) alongside humidity and temperature are now being integrated, transforming dehumidifiers into comprehensive Indoor Air Quality (IAQ) monitoring hubs. This technological push is essential for AEO, as consumers increasingly search for 'smart home humidity solutions' rather than just 'dehumidifiers,' demanding integration, efficiency, and automated performance reporting.

Regional Highlights

Regional dynamics play a crucial role in shaping the Household Dehumidifiers Market due to vast differences in climate, construction standards, and consumer spending power. Each major region presents unique demand characteristics and opportunities for manufacturers focusing on tailored product offerings.

- North America (NA): Represents a mature and high-value market, heavily characterized by the demand for high-capacity, basement-focused compressor units (above 50 Pints) and a rapid uptake of whole-house, integrated HVAC dehumidification systems. Driven by stringent mold remediation standards and high consumer awareness of health risks associated with dampness. Key market growth is seen in smart functionality integration and Energy Star compliant models, particularly in the humid coastal and southeastern states.

- Europe: Characterized by strong demand for smaller, more portable desiccant dehumidifiers, especially in Northern European countries where ambient temperatures are lower and houses often lack extensive basement structures. Central Europe shows a preference for energy-efficient compressor models for general indoor comfort. Regulatory pressure from the European Union on energy consumption and environmental performance (e.g., F-gas regulation) strongly dictates product design and innovation, favoring low-noise and highly efficient units.

- Asia Pacific (APAC): Expected to be the fastest-growing region during the forecast period due to high population density, rapid infrastructure development, and persistently high humidity levels across countries like China, India, and Southeast Asia. The market here is sensitive to price, leading to strong sales volumes in the mid-capacity (30-50 Pint) portable segment. Increasing disposable income and rising awareness of respiratory health issues are powerful accelerators, driving demand for affordable, yet reliable, solutions.

- Latin America (LATAM): A developing market segment where growth is steady but highly localized, concentrated primarily in urban centers and high-humidity coastal zones (e.g., Brazil, Mexico). The primary drivers are high seasonal humidity and new residential construction. The market often leans towards cost-effective portable units, with brand recognition and simple maintenance being key purchasing factors.

- Middle East and Africa (MEA): This region presents a complex demand profile. While overall ambient humidity might be low in desert regions, coastal areas (especially the Gulf Cooperation Council countries) experience extreme humidity. Demand is often linked to the specialized storage and climate control needs of luxury residences and commercial light applications, favoring specialized, industrial-grade or whole-house dehumidification systems integrated with powerful air conditioning units to combat both heat and moisture simultaneously.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Dehumidifiers Market.- De'Longhi Appliances S.r.l.

- Haier Smart Home Co., Ltd.

- LG Electronics

- Sunpentown International Inc.

- Ebac Group

- Honeywell International Inc.

- Midea Group

- Whirlpool Corporation

- General Electric Company (GE Appliances)

- Danby Appliances Inc.

- Frigidaire (Electrolux AB)

- Therma-Stor LLC (Santa Fe/Quest brands)

- Condair Group

- Stadler Form Aktiengesellschaft

- Mitsubishi Electric Corporation

- Gree Electric Appliances Inc. of Zhuhai

- Kenmore (Transformco)

- Carrier Global Corporation

- Trane Technologies plc

- Toshiba Carrier Corporation

Frequently Asked Questions

Analyze common user questions about the Household Dehumidifiers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between refrigerant and desiccant dehumidifiers?

Refrigerant (compressor) dehumidifiers work efficiently at higher temperatures (above 65°F) by condensing moisture using cold coils, making them ideal for basements and warm, humid climates. Desiccant dehumidifiers use moisture-absorbing material, performing better in cooler environments (below 65°F) and offering quieter operation, but often with higher regeneration energy costs.

How do I determine the correct capacity (pint size) for my home dehumidifier?

Capacity is determined by the size of the area (square footage) and the initial level of dampness. For slightly damp areas (500 sq ft), a 10-20 pint unit might suffice. For very wet, larger basements (2,000 sq ft or more), units above 50-70 pints are recommended. Always consult capacity charts provided by manufacturers based on standard conditions.

Are smart dehumidifiers significantly more energy efficient than standard models?

Yes, smart dehumidifiers, particularly those leveraging AI and advanced sensors, offer enhanced energy efficiency. They optimize operation by anticipating humidity spikes, adjusting fan speeds based on real-time data, and integrating with other HVAC components, ensuring the unit only runs when necessary, thereby significantly reducing power consumption over time.

What is the optimal indoor humidity level recommended for health and home preservation?

The optimal indoor humidity level is generally recommended to be maintained between 40% and 60% Relative Humidity (RH). Maintaining humidity within this range prevents the proliferation of mold, dust mites, and mildew, protects wood and structural integrity, and maximizes thermal comfort for occupants.

What are the primary factors driving the growth of whole-house dehumidifier systems?

The growth of whole-house systems is driven by their superior performance, seamless integration with existing HVAC, and convenience. These units provide uniform moisture control across the entire residence, eliminate the maintenance associated with multiple portable units, and significantly boost the overall quality and efficiency of the central air conditioning system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager