Household Food Storage Containers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440624 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Household Food Storage Containers Market Size

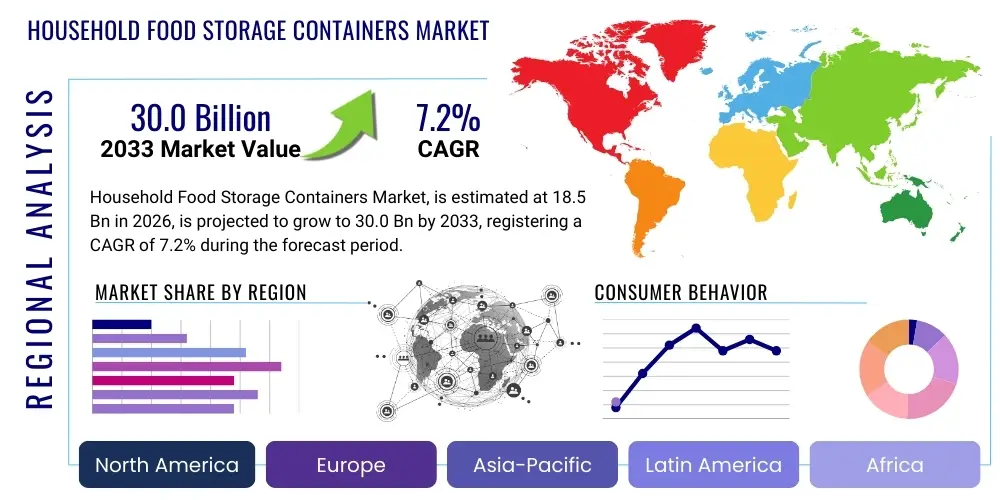

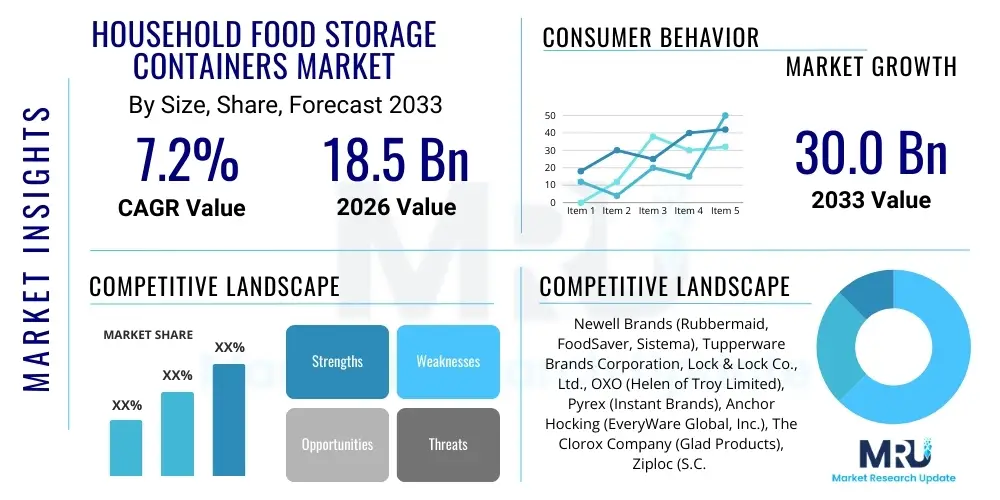

The Household Food Storage Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 30.0 Billion by the end of the forecast period in 2033.

Household Food Storage Containers Market introduction

The Household Food Storage Containers Market encompasses a wide array of products designed for preserving food freshness, organizing kitchens, and facilitating meal preparation and transportation in residential settings. These containers are essential tools in modern households, ranging from simple plastic boxes to sophisticated vacuum-seal systems, each tailored to specific needs such as refrigeration, freezing, pantry organization, or on-the-go meals. The market is characterized by continuous innovation in materials, design, and functionality, driven by evolving consumer lifestyles and increasing awareness about food waste and healthy eating habits. Products are designed to be durable, easy to clean, and often microwave, freezer, and dishwasher safe, providing convenience and extending the shelf life of various food items, from fresh produce to cooked meals.

The primary applications of household food storage containers are diverse and critical to daily domestic routines. They are extensively used for storing leftovers, preparing meals in advance (meal prepping), organizing pantry staples, packing lunches, and keeping ingredients fresh for longer periods. The versatility of these containers makes them indispensable for individuals and families seeking efficiency and economy in their food management. Beyond mere storage, they play a crucial role in maintaining food hygiene, preventing cross-contamination, and reducing reliance on single-use packaging, thereby contributing to more sustainable household practices. The benefits extend to significant cost savings by minimizing food spoilage and waste, coupled with the sheer convenience they offer in a fast-paced world where time-saving solutions are highly valued.

Several pivotal factors are driving the robust growth of the household food storage containers market. The accelerating trend of urbanization and the resulting busier lifestyles necessitate practical solutions for food preservation and meal management. Consumers are increasingly health-conscious, leading to a greater demand for home-cooked meals and meal prepping, which directly fuels the need for effective storage solutions. Furthermore, a growing global awareness regarding food waste and its environmental and economic impact is prompting households to invest in products that help extend food freshness. The expansion of e-commerce platforms has also significantly boosted market accessibility, making a wider range of innovative and specialized containers available to a global consumer base, further propelling market expansion.

Household Food Storage Containers Market Executive Summary

The Household Food Storage Containers Market is experiencing dynamic shifts, influenced by several overarching business trends that prioritize sustainability, technological integration, and premiumization. A significant business trend is the strong emphasis on eco-friendly materials, with a growing consumer preference for glass, stainless steel, and recycled or biodegradable plastics. Manufacturers are responding by innovating in sustainable product lines and promoting the long-term reusability of their offerings, aligning with global environmental concerns. Another prominent trend involves the integration of smart features, such as QR codes for inventory management or sensors for temperature and humidity control, though these are still niche. The market also observes a trend towards premiumization, where consumers are willing to invest in higher-quality, aesthetically pleasing, and more durable containers that offer enhanced functionality and a longer lifespan, often reflecting a minimalist or organized lifestyle approach.

Regionally, the market exhibits varied growth trajectories and consumption patterns. The Asia Pacific region stands out as a dominant market, driven by its vast population, increasing disposable incomes, and the cultural emphasis on home cooking and communal meals. Rapid urbanization and the burgeoning middle class in countries like China and India are particularly fueling demand. North America and Europe, while more mature markets, are characterized by high rates of innovation, strong adoption of eco-friendly products, and a significant demand for convenience-oriented solutions, such as specialized containers for meal prepping and portion control. Latin America and the Middle East & Africa regions are emerging markets, showing substantial growth potential due to improving economic conditions, expanding retail infrastructure, and increasing awareness regarding food hygiene and waste reduction, albeit with a greater focus on affordability.

Segmentation trends within the market highlight evolving consumer preferences and technological advancements. By material, while plastic containers continue to hold the largest market share due primarily to their affordability and lightweight nature, glass and stainless steel segments are experiencing the fastest growth rates. This surge is attributed to growing consumer concerns about plastic chemicals (BPA-free movement) and the perceived durability and aesthetic appeal of glass and steel. In terms of type, airtight and vacuum-seal containers are gaining significant traction due to their superior food preservation capabilities, catering to the rising demand for reducing food spoilage. The application segment sees strong growth in solutions for meal prepping and freezer storage, reflecting modern dietary habits and the desire for convenient, bulk-prepared meals. Distribution channels are shifting, with online retail increasingly challenging traditional supermarkets and hypermarkets by offering greater variety and competitive pricing.

AI Impact Analysis on Household Food Storage Containers Market

User questions regarding AI's impact on household food storage containers frequently revolve around concepts of smart kitchens, automated inventory management, and personalized food preservation advice. Consumers are curious about how AI can transform their daily routines, asking if future containers will automatically detect food spoilage, suggest meal plans based on available ingredients, or integrate seamlessly with smart home ecosystems like smart refrigerators and voice assistants. Key themes center on enhancing efficiency, reducing food waste through predictive analytics, and achieving a more convenient and intelligent approach to managing household groceries and cooked meals. There's an expectation that AI could move beyond mere passive storage to active, intelligent food management, offering solutions that make food freshness more predictable and meal preparation more streamlined.

- AI-powered smart containers could monitor food freshness using sensors, alerting users to spoilage and suggesting consumption timelines.

- Integration with smart kitchen appliances for automated inventory tracking, providing real-time updates on stored items.

- Personalized meal planning suggestions based on container contents, dietary preferences, and expiry dates, reducing food waste.

- Optimized storage recommendations (e.g., ideal temperature, humidity) for specific food types within the containers.

- Voice-activated commands for logging items in/out of containers or inquiring about stored food status.

- Automated grocery list generation based on depleted container contents and user consumption patterns.

- Enhanced food safety through AI monitoring of environmental conditions within containers to prevent bacterial growth.

DRO & Impact Forces Of Household Food Storage Containers Market

The Household Food Storage Containers Market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. A primary driver is the accelerating trend of consumers adopting healthier lifestyles and engaging in meal preparation, which directly fuels the demand for efficient and safe food storage solutions. The increasing awareness regarding food waste, coupled with rising disposable incomes globally, motivates households to invest in durable and effective containers that prolong food freshness and save costs. Furthermore, the convenience offered by these products for busy urban dwellers, enabling them to store leftovers, pack lunches, and organize their pantry effortlessly, acts as a strong market impetus. The expanding reach of e-commerce platforms also serves as a crucial driver, making a vast array of specialized products accessible to a wider consumer base, fostering competitive pricing and innovation.

Despite robust growth drivers, the market faces several notable restraints. Price sensitivity, particularly in emerging economies, can limit the adoption of premium or technologically advanced storage solutions, leading consumers to opt for cheaper, often less durable alternatives. Concerns about the environmental impact of certain materials, especially single-use plastics or non-recyclable container components, pose a significant challenge, pushing manufacturers to invest in more sustainable but potentially costlier alternatives. Durability issues with lower-quality plastic containers, leading to frequent replacements, can also create consumer dissatisfaction. Moreover, the lack of standardization in container sizes and shapes across different brands can sometimes hinder efficient organization and storage, acting as a minor restraint on consumer convenience and satisfaction.

Opportunities within the household food storage containers market are abundant, particularly in innovation and market expansion. There is a substantial opportunity for developing and commercializing containers made from genuinely sustainable and biodegradable materials, appealing to eco-conscious consumers. The integration of smart technologies, such as IoT sensors for freshness monitoring or AI-driven inventory management systems, presents a significant avenue for creating premium, high-value products that enhance user experience. Specialized container designs catering to niche dietary needs (e.g., keto, vegan meal prep), specific food types (e.g., avocado keepers, herb savers), or unique kitchen layouts can unlock new market segments. Emerging markets, with their growing middle classes and increasing urbanization, represent untapped potential for market expansion, particularly with affordable yet quality offerings. Furthermore, opportunities exist in promoting educational campaigns about food waste reduction and the long-term economic and environmental benefits of investing in quality storage solutions.

Segmentation Analysis

The Household Food Storage Containers market is extensively segmented by material, type, application, distribution channel, and capacity, reflecting the diverse needs and preferences of consumers. This comprehensive segmentation allows for a granular understanding of market dynamics, revealing key trends in product innovation, consumer adoption, and competitive strategies across various categories. Each segment plays a crucial role in defining the market landscape, from the dominant position of plastic containers to the rapidly expanding demand for sustainable materials like glass and stainless steel, and the growing importance of specialized designs for specific storage needs.

- By Material

- Plastic (Polypropylene (PP), Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Tritan)

- Glass (Borosilicate, Soda-Lime)

- Stainless Steel

- Silicone (Food-grade silicone)

- Ceramic

- Bamboo/Wood (for dry storage)

- By Type

- Airtight Containers

- Vacuum-Seal Containers

- Modular Containers

- Stackable Containers

- Collapsible Containers

- Bento Boxes

- Specialty Containers (e.g., produce keepers, cereal dispensers)

- By Application

- Refrigerator Storage

- Freezer Storage

- Pantry Storage

- On-the-Go/Lunchboxes

- Microwave Heating

- By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail (E-commerce platforms, Brand websites)

- Specialty Stores (Kitchenware stores, Home goods stores)

- Department Stores

- Convenience Stores

- By Capacity

- Small (<500 ml)

- Medium (500 ml - 1500 ml)

- Large (>1500 ml)

Value Chain Analysis For Household Food Storage Containers Market

The value chain for the Household Food Storage Containers Market is a complex and interconnected network, beginning with the sourcing of raw materials and culminating in the end-user purchase. The upstream analysis focuses on the procurement of essential raw materials, which include various types of plastic resins (such as polypropylene, PET, and Tritan), silica sand and soda ash for glass manufacturing, stainless steel alloys, and high-quality food-grade silicone. Key players in this stage are chemical manufacturers, glass producers, and metal refineries, whose pricing strategies, quality control, and supply chain reliability directly impact the cost and final quality of the storage containers. Innovations in sustainable materials and manufacturing processes at this initial stage are crucial for the overall ecological footprint and cost-effectiveness of the end products, driving competition and strategic partnerships.

Further along the value chain, the manufacturing and assembly phase involves companies converting raw materials into finished containers through processes like injection molding for plastics, glass blowing or pressing, and metal stamping. This stage also includes the integration of components such as lids, seals, and locking mechanisms, often requiring specialized expertise in design and engineering to ensure functionality, durability, and safety. Branding, packaging, and quality assurance are integral parts of this stage, as manufacturers strive to differentiate their products in a crowded market. The choice of manufacturing location, labor costs, and technological advancements in production lines significantly influence the final product's cost and market competitiveness, with many manufacturers leveraging global supply chains to optimize efficiency.

The downstream analysis primarily concerns the distribution and sales channels through which household food storage containers reach the end consumer. This segment includes a wide array of distribution channels, both direct and indirect. Indirect channels, which dominate the market, involve wholesalers, distributors, and various retail formats such as large supermarkets and hypermarkets (e.g., Walmart, Carrefour), specialty kitchenware stores (e.g., Sur La Table), and department stores. Online retail, encompassing major e-commerce platforms like Amazon and Alibaba, alongside brand-specific websites, represents a rapidly growing and increasingly significant direct channel, offering broad product ranges and competitive pricing. Effective logistics, inventory management, and marketing strategies are paramount at this stage to ensure product availability, consumer engagement, and market penetration, requiring robust partnerships between manufacturers and retailers to optimize market reach and sales performance.

Household Food Storage Containers Market Potential Customers

The primary potential customers for household food storage containers are diverse, predominantly comprising individual households and families across various demographic and socioeconomic segments. These end-users are driven by a fundamental need to preserve food freshness, reduce waste, and manage their culinary routines more efficiently. With increasing urbanization and busier lifestyles, individuals are actively seeking practical solutions for meal prepping, storing leftovers, and organizing their pantry spaces. The growing health consciousness among consumers, leading to a preference for home-cooked meals over takeout, further solidifies this segment's demand, as effective storage becomes indispensable for healthy eating habits. Families, in particular, represent a significant customer base due to their typically larger food consumption and the need for varied storage solutions for different family members, including lunchboxes for children and adults.

Beyond the traditional household, there is a substantial potential customer base in the commercial and institutional sectors, albeit often through B2B channels that may influence household-level choices. This includes restaurants, cafes, catering services, and other food service providers that require durable, food-grade containers for ingredient storage, meal preparation, and transportation. While these commercial entities might opt for industrial-grade solutions, the innovations and trends in household containers, particularly in terms of material safety and design, often influence professional standards. Additionally, offices and educational institutions represent an indirect customer segment, as employees and students increasingly rely on packed lunches and snacks, necessitating a personal investment in portable food storage solutions, often favoring leak-proof and microwave-safe designs for convenience and hygiene.

The evolving consumer landscape, marked by a growing emphasis on sustainability and eco-friendliness, has also cultivated a niche but rapidly expanding group of potential customers. These environmentally conscious individuals and families are actively seeking reusable, durable, and ethically produced food storage options, such as glass, stainless steel, or recycled plastic containers, as alternatives to single-use plastics. This segment is often willing to invest more in premium products that align with their values, highlighting an opportunity for brands to focus on sustainable innovation and transparent manufacturing practices. Furthermore, the rise of specialized diets and culinary hobbies (e.g., baking, fermenting) creates demand for specific types of containers, appealing to enthusiasts who prioritize specialized features and high-quality materials for their unique food preparation and storage needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.0 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Newell Brands (Rubbermaid, FoodSaver, Sistema), Tupperware Brands Corporation, Lock & Lock Co., Ltd., OXO (Helen of Troy Limited), Pyrex (Instant Brands), Anchor Hocking (EveryWare Global, Inc.), The Clorox Company (Glad Products), Ziploc (S.C. Johnson & Son, Inc.), IKEA, Glasslock (Samkwang Glass Ind. Co., Ltd.), Komax Industrial Co., Ltd., Bentgo (Kensington International), Takeya USA, Cambro Manufacturing Co., Sterilite Corporation, Progressive International, OXO Tot (Helen of Troy Limited), U-Konserve, Ello Products (Instant Brands), Trudeau Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Food Storage Containers Market Key Technology Landscape

The Household Food Storage Containers Market is continually evolving through advancements in material science and engineering, leading to improved functionality, safety, and durability. A significant technological focus is on enhancing the sealing mechanisms of containers to ensure airtight and leak-proof performance, which is critical for extending food freshness and preventing spills. This includes innovations in lid design, such as advanced silicone gaskets, four-sided locking systems, and vacuum-seal technologies that remove air to significantly slow down oxidation and bacterial growth. The development of BPA-free plastics, specifically Tritan and high-grade polypropylene, represents a major technological leap driven by health and safety concerns, offering shatter resistance with chemical inertness. Furthermore, advancements in glass tempering processes have led to more durable borosilicate glass containers that are thermal shock resistant, allowing them to go directly from freezer to oven or microwave, enhancing versatility and convenience for the consumer.

Beyond basic materials and sealing, the market is witnessing the integration of smart technologies, albeit in nascent stages, to revolutionize food management. This includes the incorporation of RFID or NFC tags for inventory tracking, allowing users to monitor contents and expiry dates via smartphone apps, which helps in reducing food waste and optimizing grocery shopping. Some containers are exploring embedded sensors that can detect temperature, humidity, or even gas levels to provide real-time freshness indicators, though widespread commercialization remains a future prospect. Antimicrobial coatings, either integrated into the material or as a surface treatment, are also emerging to inhibit bacterial growth and enhance hygiene, particularly in containers designed for meat or dairy products. These technological enhancements are aimed at not only preserving food longer but also providing a more informed, safer, and convenient user experience, pushing the boundaries of what a simple food container can achieve.

Another crucial aspect of the technology landscape involves manufacturing processes that enable complex designs and sustainable production. Precision injection molding techniques allow for the creation of intricate modular and stackable container designs that maximize storage efficiency in refrigerators and pantries. The development of collapsible silicone containers leverages advanced molding to create flexible, space-saving solutions when not in use. Furthermore, innovations in material recycling and the use of bio-based or recycled plastics are gaining traction, driven by consumer demand for environmentally friendly products. This requires sophisticated material science to ensure that recycled content maintains food-grade safety and performance standards. The continuous pursuit of materials that are lightweight yet durable, aesthetically pleasing yet highly functional, and environmentally responsible yet affordable, defines the core of technological innovation in this dynamic market, striving to balance consumer expectations with sustainable practices and manufacturing feasibility.

Regional Highlights

- North America: This region is a mature market characterized by high consumer awareness regarding food waste, a strong emphasis on convenience, and a high adoption rate of innovative products. The United States and Canada lead in demand for specialized containers for meal prepping, sustainable materials like glass and stainless steel, and smart storage solutions. High disposable incomes and busy lifestyles drive investments in premium, durable, and aesthetically pleasing storage options, with strong growth in online retail channels.

- Europe: European countries, particularly Germany, the UK, and France, showcase a robust market driven by stringent food safety regulations, a strong eco-conscious consumer base, and a preference for high-quality, long-lasting products. There is a significant focus on sustainable and BPA-free materials, alongside an increasing demand for vacuum-seal and modular systems. The region also exhibits strong growth in products that support home cooking and healthy eating, with a cultural emphasis on reducing food waste.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, propelled by its vast population, rising disposable incomes, rapid urbanization, and evolving dietary habits. Countries like China, India, and Japan are experiencing a surge in demand due to increasing household consumption, a growing middle class, and the expanding presence of modern retail formats. While affordability often dictates choices, there's a burgeoning segment for premium and sustainable options, reflecting a blend of traditional home cooking and modern convenience.

- Latin America: This region is an emerging market with significant growth potential, primarily driven by improving economic conditions, increasing urbanization, and greater exposure to global consumer trends. Brazil and Mexico are key markets, showing a growing demand for functional and affordable food storage solutions. Awareness regarding food hygiene and waste reduction is slowly increasing, paving the way for further market penetration, with a focus on value-for-money products.

- Middle East and Africa (MEA): The MEA region is characterized by steady growth, influenced by rising disposable incomes, expanding retail infrastructure, and increasing expatriate populations. The Gulf Cooperation Council (GCC) countries show a higher adoption rate for modern storage solutions due to their affluent consumer base. The emphasis is on convenience, hygiene, and products suitable for varying climates, with a growing interest in durable and versatile containers as part of home modernization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Food Storage Containers Market.- Newell Brands (Rubbermaid, FoodSaver, Sistema)

- Tupperware Brands Corporation

- Lock & Lock Co., Ltd.

- OXO (Helen of Troy Limited)

- Pyrex (Instant Brands)

- Anchor Hocking (EveryWare Global, Inc.)

- The Clorox Company (Glad Products)

- Ziploc (S.C. Johnson & Son, Inc.)

- IKEA

- Glasslock (Samkwang Glass Ind. Co., Ltd.)

- Komax Industrial Co., Ltd.

- Bentgo (Kensington International)

- Takeya USA

- Cambro Manufacturing Co.

- Sterilite Corporation

- Progressive International

- OXO Tot (Helen of Troy Limited)

- U-Konserve

- Ello Products (Instant Brands)

- Trudeau Corporation

Frequently Asked Questions

Analyze common user questions about the Household Food Storage Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most popular materials for household food storage containers?

The most popular materials include plastic (due to affordability and lightness), glass (for durability and non-reactivity), and stainless steel (for robustness and sustainability). Silicone is also gaining popularity for its flexibility and collapsibility.

How do household food storage containers help reduce food waste?

Containers extend the freshness of food by providing airtight seals, preventing spoilage, and allowing for organized storage of leftovers and meal-prepped items, thereby minimizing the amount of food that gets thrown away.

Are BPA-free plastic containers truly safe for food storage?

Yes, BPA-free plastic containers are considered safe for food storage as they are manufactured without Bisphenol A, a chemical that has raised health concerns. Many brands now prominently label their products as BPA-free to assure consumer safety.

What is the primary driver for the growth of the household food storage containers market?

The primary drivers are increasing awareness about food waste, growing consumer focus on healthier lifestyles and meal prepping, and the demand for convenient solutions for busy urban households.

Which region currently dominates the household food storage containers market?

The Asia Pacific region currently dominates the household food storage containers market, primarily due to its large population, rising disposable incomes, and the rapid pace of urbanization and modernization in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager