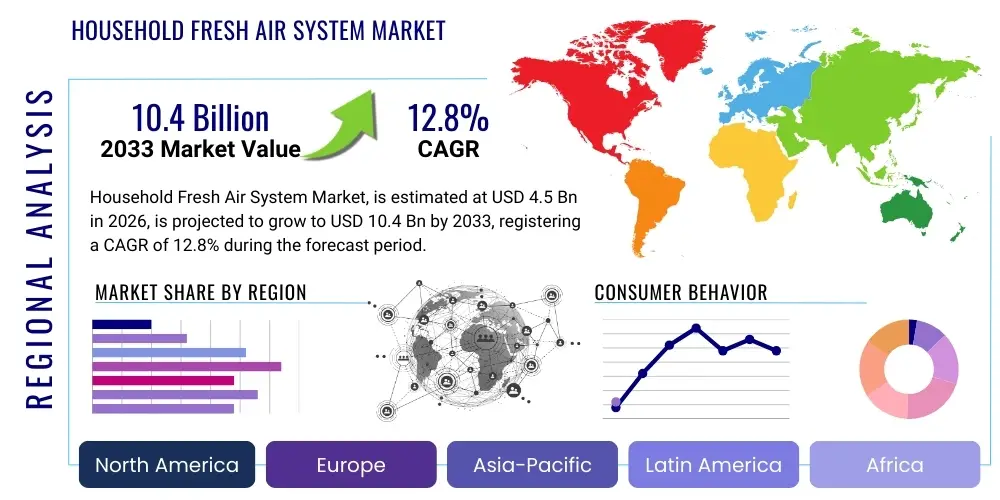

Household Fresh Air System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436416 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Household Fresh Air System Market Size

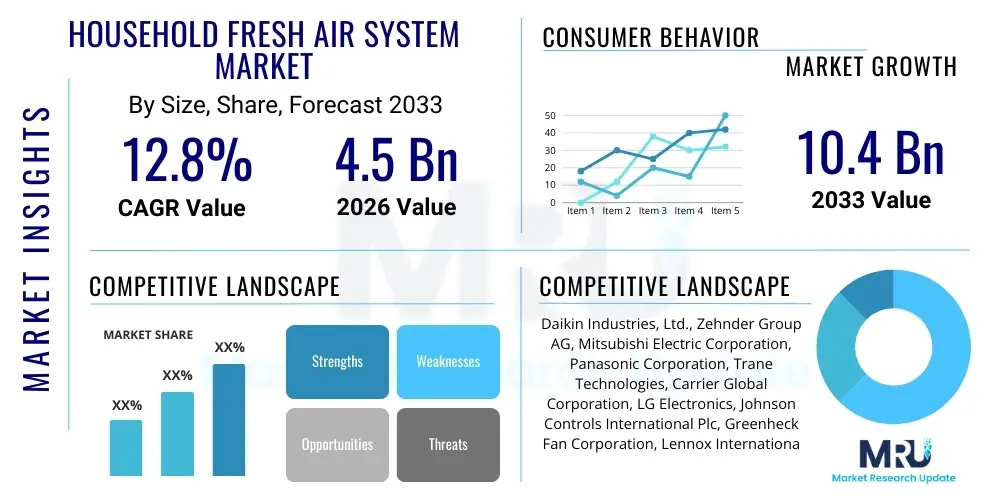

The Household Fresh Air System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Household Fresh Air System Market introduction

The Household Fresh Air System (HAFS) Market encompasses sophisticated ventilation technologies designed to provide filtered, temperature-conditioned, and continuously supplied outdoor air to residential spaces while efficiently exhausting stale indoor air. These systems, primarily consisting of Energy Recovery Ventilators (ERVs) and Heat Recovery Ventilators (HRVs), address the critical modern challenge of maintaining high indoor air quality (IAQ) in increasingly airtight, energy-efficient homes. Unlike simple air purification systems that recirculate and filter indoor air, HAFS introduces genuine fresh air, mitigating pollutants such as volatile organic compounds (VOCs), excess carbon dioxide (CO2), and moisture build-up, which are prevalent in sealed modern constructions.

The product description centers on units that manage both airflow and temperature transfer. HRVs transfer heat from outgoing exhaust air to incoming fresh air during colder months, while ERVs, additionally, manage humidity transfer, making them particularly crucial in mixed or humid climates. Major applications include high-end new residential construction and deep energy retrofits, where optimizing energy consumption while ensuring occupant health is paramount. The increasing integration of these systems with centralized HVAC controls and smart home platforms represents a significant technological evolution, moving HAFS from specialized equipment to mainstream essential home infrastructure.

Key benefits derived from HAFS deployment include significant improvements in occupant health, reduced instances of "sick building syndrome," decreased energy bills due to heat/humidity recovery efficiency, and enhanced structural longevity by controlling moisture levels. Driving factors fueling market expansion are stringent government regulations concerning residential energy efficiency, heightened public awareness regarding airborne diseases and pollution, and the rising consumer demand for premium, integrated smart home environmental controls that prioritize well-being. The correlation between urbanization, diminishing outdoor air quality, and the necessity for controlled indoor ventilation strongly reinforces the market's upward trajectory across all major global economies.

Household Fresh Air System Market Executive Summary

The Household Fresh Air System (HAFS) market is characterized by robust growth, primarily propelled by global regulatory shifts mandating energy-efficient building standards and a profound post-pandemic consumer emphasis on indoor health metrics. Business trends indicate a movement towards modular, highly integrated systems that incorporate advanced filtration—such as HEPA and activated carbon—and utilize DC inverter motors for variable airflow efficiency and silent operation. Strategic mergers and acquisitions among HVAC giants and specialized ventilation manufacturers are consolidating the market, focusing on comprehensive, whole-house solutions rather than standalone units. Furthermore, manufacturers are investing heavily in connectivity, ensuring seamless integration with existing smart thermostat platforms and voice-controlled ecosystems, transforming these functional devices into intelligent environmental managers.

Regional trends reveal distinct demand drivers. North America and Europe demonstrate mature market adoption, driven by strict passive house and Net-Zero energy standards, placing a premium on certified, high-efficiency Energy Recovery Ventilators (ERVs). Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market due to escalating urban pollution levels, high population density, and rapidly expanding new construction sectors, particularly in China and India. In APAC, the demand often leans towards dual functionality: ultra-high filtration efficiency to combat smog combined with basic ventilation, though ERV technology is gaining traction as energy costs rise.

Segment trends highlight the dominance of the ERV segment over HRVs, especially as global climate instability necessitates better humidity management. By application, the new construction segment currently holds a larger share due to easier installation and integration during the initial building phase, yet the retrofit market is exhibiting accelerated growth, supported by governmental rebates and incentives aimed at upgrading existing housing stock for better energy performance. Technology trends are overwhelmingly focused on sensor-driven automation, allowing systems to autonomously adjust ventilation rates based on real-time indoor air quality (IAQ) metrics like CO2 and VOC concentrations, thereby maximizing both air quality and energy savings for the end-user.

AI Impact Analysis on Household Fresh Air System Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Household Fresh Air System (HAFS) market frequently center on predictive capabilities, energy optimization, and seamless smart home operation. Key themes users are exploring include whether AI can genuinely reduce energy consumption beyond standard recovery mechanisms, how AI-driven diagnostics predict component failures (like filter replacement timing or motor issues), and the extent to which systems can learn and adapt to unique household occupancy patterns and regional climate shifts. The consensus expectation is that AI should transform reactive ventilation into a proactive, autonomous environmental management service, offering personalized air quality profiles while ensuring minimal energy waste.

AI's influence is pivotal in enhancing the intelligence and efficiency of HAFS operations. By employing machine learning algorithms, modern fresh air systems can analyze historical data regarding temperature fluctuations, occupancy schedules, localized pollution forecasts, and past fan usage, creating a precise operational profile for optimal performance. This data-driven approach allows the system to preemptively adjust ventilation rates or activate supplementary filtration stages before indoor air quality thresholds are breached, ensuring continuous comfort and health without manual intervention. For instance, if an AI model detects a consistent drop in indoor CO2 levels during specific nighttime hours, it can safely reduce fan speed, significantly lowering noise and energy consumption.

Furthermore, AI significantly simplifies the complexity inherent in managing whole-house ventilation. Through deep learning, systems can differentiate between normal short-term events (e.g., cooking exhaust) requiring temporary high-speed operation and long-term trends requiring permanent baseline adjustments. This intelligence contributes heavily to Generative Engine Optimization (GEO) efforts, as consumers actively search for "self-adjusting ventilation" and "predictive maintenance for HVAC." The resulting data insights, packaged as user-friendly reports on energy savings and air quality trends, enhance the perceived value and trustworthiness of the HAFS technology, driving consumer adoption in the premium and automated home segment.

- AI-driven Predictive Maintenance: Anticipates filter saturation and component failure, optimizing service intervals.

- Dynamic Flow Rate Optimization: Learns occupancy patterns and real-time IAQ data (CO2, VOC) to minimize energy expenditure while maintaining ideal air exchange.

- Seamless Smart Home Integration: Facilitates effortless communication with other IoT devices (thermostats, air purifiers, security systems) through unified control algorithms.

- Climate Adaptation: Automatically adjusts defrost cycles and humidity recovery settings based on hyperlocal weather forecasts.

- Personalized Air Quality Profiling: Creates and manages different ventilation strategies tailored to specific family members or times of the day.

DRO & Impact Forces Of Household Fresh Air System Market

The Household Fresh Air System market expansion is powerfully influenced by the interplay of key Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. A primary driver is the accelerating global recognition of poor indoor air quality (IAQ) as a significant public health hazard, compounded by increasing outdoor pollution, which necessitates controlled, filtered air exchange in residential buildings. This health imperative is synergized by global regulatory pressures, specifically energy efficiency mandates (e.g., European Union’s Energy Performance of Buildings Directive, North American building codes), which favor highly efficient ERV and HRV technologies essential for modern, airtight construction. These forces create a compelling dual mandate for manufacturers: improve health outcomes while drastically reducing the energy footprint of ventilation.

However, the market faces tangible restraints that impede broader adoption. The most substantial restraint is the high initial investment cost associated with purchasing and professionally installing a whole-house fresh air system, which can be prohibitive for the average homeowner or smaller residential developers. Furthermore, the complexity of installation, particularly in existing structures (retrofit projects), often requires specialized HVAC expertise and significant structural modifications, leading to higher labor costs and installation downtime. Lack of widespread consumer understanding about the crucial difference between simple air purification (recirculation) and dedicated fresh air exchange (ventilation) also acts as a psychological barrier, often leading consumers to opt for cheaper, less effective solutions.

Opportunities for growth are concentrated in technological advancements and untapped market segments. The growing feasibility of smart, decentralized ventilation systems (often referred to as 'through-the-wall' HRVs/ERVs) presents a major opportunity to penetrate the vast retrofit market where central ductwork installation is impractical. The advent of IoT and AI integration allows for the development of premium, data-driven service models, shifting focus from hardware sales to recurring revenue through filter subscription services and predictive maintenance. Impact forces such as climate change (demanding better humidity control via ERVs) and sustained global population shifts toward densely populated urban centers continue to structurally underpin the essential nature of controlled mechanical ventilation in residential environments, ensuring long-term sustainable demand.

Segmentation Analysis

The Household Fresh Air System Market is comprehensively segmented based on product type, application, and distribution channel, providing a clear framework for strategic market analysis. Product type segmentation distinguishes between the mechanisms used for energy recovery—Heat Recovery Ventilators (HRVs) and Energy/Enthalpy Recovery Ventilators (ERVs)—where ERVs, which transfer both heat and moisture, are increasingly favored globally due to their enhanced capabilities in maintaining indoor humidity balance across varying climates. Application segmentation divides demand between the New Construction sector, which finds integration easier and more cost-effective during the design phase, and the Retrofit sector, which represents a massive and burgeoning opportunity driven by government incentives aimed at improving the efficiency of existing housing stock.

- Product Type:

- Heat Recovery Ventilator (HRV)

- Energy Recovery Ventilator (ERV)

- Installation Type:

- Centralized/Ducted Systems

- Decentralized/Through-the-Wall Systems

- Application:

- New Residential Construction

- Residential Retrofit and Renovation

- Filtration Technology:

- Standard Filtration (MERV 8-12)

- High-Efficiency Filtration (MERV 13/HEPA equivalent)

- Distribution Channel:

- Offline (HVAC Contractors, Wholesalers, Retail Stores)

- Online (E-commerce Platforms, Direct Manufacturer Sales)

Value Chain Analysis For Household Fresh Air System Market

The value chain for the Household Fresh Air System market is characterized by several high-value activities spanning component manufacturing to post-installation service provision. Upstream analysis focuses on the highly specialized production of core components, including high-efficiency heat/enthalpy exchange cores (often polymer or aluminum), precision DC motors for quiet and variable operation, and sophisticated air quality sensors (for CO2, VOCs, and PM2.5). These components demand high capital investment and technical expertise. The supply side is becoming highly competitive, with a trend toward vertical integration by major OEMs to secure stable component supply and maintain quality control over proprietary energy recovery technologies, which are central to the system’s performance certification.

The midstream involves the original equipment manufacturers (OEMs) who design, assemble, and certify the final HRV/ERV units. This stage is crucial for innovation in system size reduction, noise attenuation, and seamless smart home compatibility. Downstream activities involve getting the finished product to the end-user. Distribution channels are predominantly indirect, relying heavily on professional HVAC wholesalers and specialized ventilation distributors who provide technical support and inventory management for complex projects. Direct sales, typically through dedicated brand websites, account for a smaller but growing portion, primarily targeting tech-savvy consumers or small-scale builders seeking specific niche products.

Installation and post-sales service constitute the final, most impactful stage of the value chain. Due to the complexity of duct sizing, air balancing, and integration with existing HVAC infrastructure, the role of skilled HVAC contractors and certified installers is indispensable. The quality of installation directly affects the system's longevity and energy performance. Furthermore, the provision of ongoing maintenance, particularly the replacement of specialized filters and system diagnostics, represents a crucial, high-margin, recurring revenue stream. The ability of OEMs to train and certify a reliable network of installers is a key differentiator in market success, ensuring customer satisfaction and maximizing the efficiency of the deployed technology.

Household Fresh Air System Market Potential Customers

The primary consumers of Household Fresh Air Systems are sophisticated homeowners, residential developers focused on high-performance buildings, and health-conscious urban dwellers prioritizing robust indoor environmental control. Affluent homeowners, particularly those residing in high-cost-of-living areas (e.g., major metropolitan suburbs in North America and Europe), represent a core market segment. These buyers possess high disposable income, are generally more receptive to investing in high-end, integrated smart home technology, and are heavily influenced by building certifications like LEED, Passive House, or WELL standards, which often mandate continuous, balanced ventilation for certification.

Another significant customer segment includes professional residential builders and developers specializing in multi-family units and luxury single-family homes. For these developers, installing HAFS is a critical competitive advantage, allowing them to market properties based on superior energy efficiency, guaranteed IAQ, and technological sophistication—factors increasingly demanded by educated property buyers. Builders seek reliable, easily installed centralized systems that meet or exceed local energy codes, viewing HAFS not just as an amenity but as a necessary compliance component and value enhancer that justifies a higher property valuation.

Furthermore, the growing segment of health-conscious residents in polluted urban environments, particularly in APAC and specific North American cities struggling with wildfire smoke, represents accelerating demand. These customers often seek retrofit solutions, such as high-filtration decentralized HRVs/ERVs, focusing heavily on filtration efficiency (HEPA or equivalent) to mitigate external pollutants (PM2.5) while ensuring adequate air exchange. This segment values quick installation, quiet operation, and clear performance data accessible via smartphone applications, emphasizing IAQ data monitoring over pure energy recovery metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin Industries, Ltd., Zehnder Group AG, Mitsubishi Electric Corporation, Panasonic Corporation, Trane Technologies, Carrier Global Corporation, LG Electronics, Johnson Controls International Plc, Greenheck Fan Corporation, Lennox International Inc., Broan-NuTone LLC, Aldes Group, Nortek Air Solutions, Systemair AB, Fantech, Unico System, RenewAire LLC, AeraMax Professional, Vent-Axia, VENTS Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Fresh Air System Market Key Technology Landscape

The technological landscape of the Household Fresh Air System market is rapidly evolving, driven by the demand for higher energy recovery efficiency, superior air filtration, and intelligent operational controls. Core technological advancements center on the heat/enthalpy exchange cores themselves. Modern ERV cores utilize highly engineered polymer membranes that allow for effective moisture transfer without cross-contamination, achieving seasonal efficiency ratios that significantly surpass older aluminum cores. Continuous innovation in core material science and geometric design is focused on minimizing static pressure loss, thereby reducing the electricity consumption required for fan operation and improving the overall system effectiveness. This focus on material innovation directly addresses the primary consumer trade-off between ventilation and energy costs.

The integration of advanced monitoring and control systems represents the most transformative aspect of the current landscape. Contemporary HAFS units incorporate sophisticated multi-sensor arrays capable of real-time detection of key indoor pollutants, including carbon dioxide (CO2), volatile organic compounds (VOCs), and particulate matter (PM2.5). These sensors interface with DC inverter fan motors, enabling instantaneous and precise modulation of airflow based on actual indoor air quality demands, rather than operating at fixed, often unnecessary, high speeds. This variable flow technology, coupled with seamless Internet of Things (IoT) connectivity, allows homeowners to monitor and control their ventilation via mobile applications, greatly enhancing user engagement and optimization of filter lifespan.

Furthermore, the focus on filtration technology has intensified, moving beyond standard MERV ratings to incorporate multi-stage filtering specifically tailored for residential use. This often involves combining pre-filters for large particulates with specialized high-efficiency particulate air (HEPA) or HEPA-equivalent filters (MERV 14+) to capture fine smoke, allergens, and airborne viruses. Acoustic engineering is also a vital technological domain; manufacturers are employing insulated casings, specially designed impellers, and advanced mounting hardware to ensure extremely low noise output, which is crucial for consumer acceptance in residential environments. The adoption of small, high-efficiency, decentralized (through-the-wall) HRV/ERV units is another significant trend, providing accessible, code-compliant ventilation solutions for apartment buildings and retrofitting applications where central duct installation is cost-prohibitive or physically impossible.

Regional Highlights

Regional dynamics heavily influence the adoption and type of Household Fresh Air Systems deployed globally, reflecting variations in climate, regulatory rigor, and consumer affluence. North America (NA), particularly the U.S. and Canada, represents a mature market characterized by strong regulatory drivers stemming from residential building codes such as ASHRAE 62.2, which mandates specific ventilation rates. The extreme seasonal temperature variations across the continent mean that both high-efficiency HRVs (for severe cold) and ERVs (for humid summer climate zones) see substantial demand. Furthermore, high disposable income and a proactive stance towards home automation and environmental health solidify North America’s position as a leader in adopting premium, smart, and centralized HAFS units, especially in new, high-performance housing developments.

Europe stands out due to its profound commitment to energy efficiency, epitomized by the Passive House standard, which places extremely stringent requirements on heat recovery efficiency (often mandating over 80% efficiency). Consequently, European markets, led by Germany, Scandinavia, and the UK, exhibit exceptionally high penetration rates of certified, ultra-efficient HRVs. The demand is heavily influenced by government incentives for energy retrofits and mandatory air permeability standards for new builds. Decentralized (through-the-wall) units are also gaining traction, offering minimally invasive solutions that help meet ventilation requirements in dense, historic urban centers where complex ducting is challenging. The emphasis in Europe is predominantly on energy savings and regulatory compliance.

The Asia Pacific (APAC) region is projected to be the engine of future market growth. This is primarily driven by rapid urbanization, massive infrastructural development, and, critically, critically high levels of air pollution (PM2.5, smog) in megacities across China, India, and Southeast Asia. Unlike Western markets where energy recovery is the historical core driver, in APAC, the initial adoption is often driven by the urgent need for high-efficiency filtration combined with ventilation. The market here is characterized by a strong mix of high-end central systems in luxury properties and a rapid uptake of affordable, decentralized units offering essential air exchange and filtration, catering to a vast and rapidly expanding middle-class consumer base increasingly concerned with respiratory health.

- North America: Focus on regulatory compliance (ASHRAE 62.2), premium centralized ERV/HRV systems, and high demand driven by wealthy homeowner segments and high adoption of smart home technology.

- Europe: Dominated by stringent energy efficiency standards (Passive House), high demand for certified HRVs (often >80% efficiency), strong government-backed retrofit programs, and growing acceptance of decentralized units for urban areas.

- Asia Pacific (APAC): Highest growth potential driven by extreme urbanization and severe outdoor air pollution. Demand is centered on high-efficiency particulate filtration combined with ventilation, particularly in new high-rise residential projects and mass market applications in China and India.

- Latin America and MEA: Emerging markets characterized by lower current penetration but significant growth potential in specific high-end construction sectors and regions with severe climate challenges (e.g., humidity control in the Middle East).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Fresh Air System Market.- Daikin Industries, Ltd.

- Zehnder Group AG

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Trane Technologies

- Carrier Global Corporation

- LG Electronics

- Johnson Controls International Plc

- Greenheck Fan Corporation

- Lennox International Inc.

- Broan-NuTone LLC

- Aldes Group

- Nortek Air Solutions

- Systemair AB

- Fantech

- Unico System

- RenewAire LLC

- AeraMax Professional

- Vent-Axia

- VENTS Group

Frequently Asked Questions

Analyze common user questions about the Household Fresh Air System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between an HRV and an ERV, and which is better for my home?

An HRV (Heat Recovery Ventilator) transfers only heat, making it ideal for cold climates where minimizing heat loss is critical. An ERV (Energy Recovery Ventilator) transfers both heat and humidity (enthalpy), making it superior for mixed or humid climates by preventing excessive moisture buildup indoors during summer and dryness during winter, thus optimizing comfort and energy use.

How much energy do Household Fresh Air Systems consume, and what are the primary energy savings?

Modern HAFS units consume minimal energy to operate the fans, especially those using DC inverter motors. The primary savings come from the recovery core, which can recover 60% to 90% of the energy already used to heat or cool the exhaust air, drastically reducing the load on the main HVAC system to condition the incoming fresh air.

Are Fresh Air Systems mandatory or necessary for new residential construction?

While not universally mandatory, fresh air systems are increasingly required under modern energy codes (like ASHRAE 62.2 and Passive House standards) for new, airtight construction. They are necessary to prevent indoor air quality degradation (high CO2, VOCs) that occurs when building envelopes are sealed for maximum energy efficiency, ensuring continuous, controlled ventilation.

What is the expected lifespan and typical maintenance routine for an HRV/ERV unit?

The operational lifespan of a high-quality HRV/ERV unit is typically 15 to 20 years. Routine maintenance primarily involves cleaning or replacing the filters every 3 to 6 months, depending on air quality, and annually cleaning the heat recovery core and condensate drain to maintain optimal efficiency and prevent microbial growth.

Can I install a Household Fresh Air System myself, or is professional installation required?

Due to the complexity of ductwork, precise air balancing, electrical wiring, and the need to meet local building codes, professional installation by a certified HVAC technician is highly recommended. Improper installation can severely compromise system efficiency, noise levels, and overall air quality performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager