Household Miter Saw Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437387 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Household Miter Saw Market Size

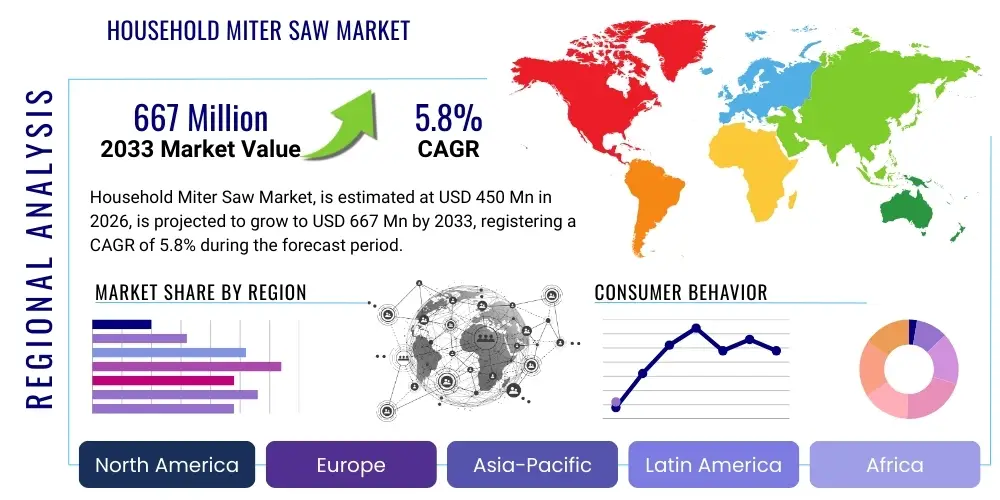

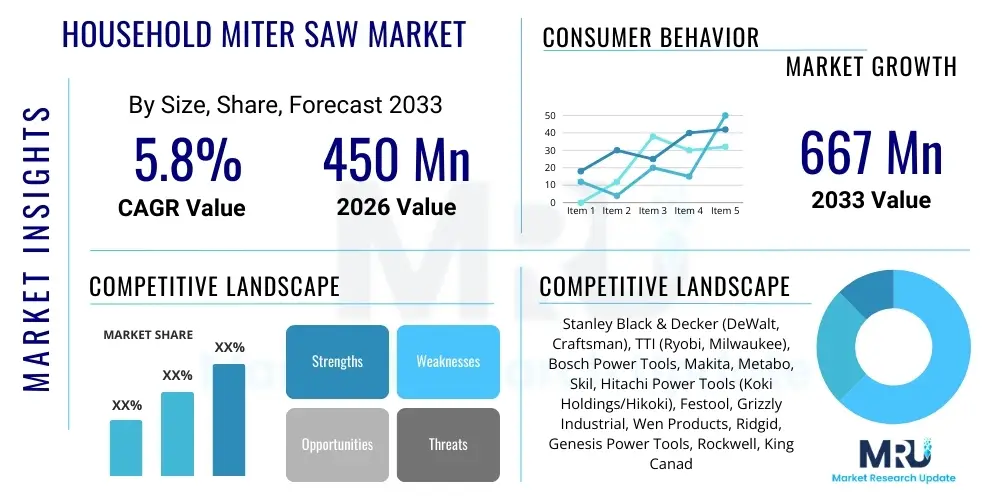

The Household Miter Saw Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 667 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the rising global interest in Do-It-Yourself (DIY) home improvement projects, coupled with advancements in cordless technology that enhance portability and user convenience for non-professional consumers.

Household Miter Saw Market introduction

The Household Miter Saw Market encompasses power tools designed specifically for consumer use, primarily for cutting angles and making crosscuts in wood, plastics, and sometimes soft metals, essential for applications ranging from crown molding installation to picture framing and general carpentry. These tools provide significantly higher precision and efficiency compared to manual methods, making them indispensable for DIY enthusiasts and hobbyist woodworkers. The primary product types include compound miter saws, which allow for bevel and miter cuts simultaneously, and sliding miter saws, which increase the cutting capacity for wider boards, addressing varied domestic project requirements.

Major applications of household miter saws revolve around interior and exterior home renovation, including flooring installation, deck building, trim work, and furniture construction. The key benefit propelling market growth is the high degree of accuracy and repeatability these saws offer, enabling users to achieve professional-grade finishes easily. Furthermore, modern household miter saws are incorporating features such as laser guides, dust management systems, and ergonomic designs, making the tools safer and more accessible to the average consumer with minimal training.

Driving factors for this market include the sustained trend of homeownership and renovation activities globally, fueled by affordable housing loans and an increased desire for personalized living spaces. Technological advancements, particularly the development of high-voltage lithium-ion battery packs, have significantly improved the performance and run-time of cordless models, removing the constraints associated with corded operation. This improved mobility is critical for household users who often work in varied environments without easy access to power outlets, thereby accelerating the adoption rate in suburban and rural areas.

Household Miter Saw Market Executive Summary

The Household Miter Saw Market is characterized by robust business trends focusing on innovation in portability, precision, and smart features, driving manufacturers to increasingly prioritize cordless battery platforms and connectivity options tailored for the non-professional segment. Regionally, North America maintains market dominance due to high rates of home ownership, a strong DIY culture, and consistent investment in residential infrastructure repair and aesthetic upgrades. Europe follows closely, driven by stringent energy efficiency standards prompting old building retrofits, which often require precise cutting tools for materials like insulation and specialized trim work, while the Asia Pacific region exhibits the fastest growth due to rapid urbanization, expanding middle-class income levels, and the resultant boost in small-scale home improvement spending.

Segment trends highlight a significant shift toward the adoption of sliding compound miter saws, as they offer the versatility of handling both wide stock and complex angled cuts, satisfying the majority of DIY project needs. The power source segment is overwhelmingly favoring cordless technology, reflecting consumer demand for flexibility and ease of use, even though corded models still retain a strong position among users prioritizing maximum continuous power output for intensive projects. Furthermore, digital integration, such as integrated apps for calculating cut angles and managing battery life, is becoming a decisive factor in consumer purchasing decisions, pushing manufacturers to invest heavily in smart tool development.

AI Impact Analysis on Household Miter Saw Market

User inquiries regarding AI's impact on household miter saws primarily center on concerns about safety automation, precision enhancement, and the potential for AI-driven maintenance diagnostics. Consumers are keen to understand if AI can reduce the risk of accidents by monitoring user posture or tool movement in real-time, or if it can automatically adjust blade speed and angle to optimize the cut quality for different materials. A key expectation is the integration of machine learning algorithms to analyze project specifications (potentially uploaded via a mobile app) and provide prescriptive guidance, such as the exact sequence of cuts or ideal material clamping points, effectively lowering the barrier to entry for complex woodworking projects. However, users also express concerns about the increased cost and potential complexity that AI integration might introduce into what is fundamentally a mechanical tool.

- AI-enabled automatic calibration for perfect bevel and miter angles.

- Real-time safety monitoring using computer vision to detect unsafe hand positioning.

- Predictive maintenance algorithms analyzing motor load and wear patterns.

- Integration with augmented reality (AR) apps for project planning and cut visualization.

- Automated material identification and optimization of cutting parameters (blade speed, feed rate).

DRO & Impact Forces Of Household Miter Saw Market

The Household Miter Saw Market is significantly driven by the expanding global DIY culture, particularly among millennials and younger homeowners who are actively engaging in minor repairs and renovations, alongside continuous technological improvements in battery performance that make powerful cordless saws practical for home use. However, market expansion faces notable restraints, including the inherent high purchase price of premium, feature-rich miter saws compared to basic hand tools, and a persistent concern among novice users regarding the perceived complexity and safety risks associated with operating high-powered cutting equipment. Opportunities abound in expanding the product range tailored for niche DIY activities, such as miniature woodworking or crafting, and leveraging e-commerce platforms to provide detailed tutorials and personalized sales experiences to overcome user hesitation.

The market is subject to intense impact forces from competitive pricing strategies, where Asian manufacturers offer cost-effective alternatives, challenging established premium brands. Furthermore, regulatory forces, especially those concerning noise pollution and dust extraction requirements, particularly in Europe, compel manufacturers to innovate consistently in these areas, often leading to enhanced product differentiation. The substitution threat remains moderate, primarily from table saws or circular saws that can perform some cross-cutting tasks, though they generally lack the angle precision required for intricate trim work. The buying power of consumers is high due to a saturated market offering numerous brands and features, necessitating continuous innovation in battery life and smart features to maintain market share.

Segmentation Analysis

The Household Miter Saw Market is meticulously segmented based on several critical parameters including the type of saw mechanism, the power source utilized, and the primary application or end-user demographic. This segmentation is crucial for manufacturers to tailor their marketing strategies and product development efforts, ensuring they meet the specific precision and portability requirements of various consumer sub-groups, ranging from basic hobbyists needing straightforward crosscuts to advanced DIYers tackling complex molding installations. The dominant segments currently reflect the strong consumer preference for versatility and freedom of movement, driving significant investment in sliding and cordless technologies, while corded units remain essential for heavy-duty, prolonged project applications.

- By Product Type:

- Compound Miter Saw

- Sliding Compound Miter Saw

- Laser Miter Saw

- By Power Source:

- Corded

- Cordless (Battery-Powered)

- By Application:

- Carpentry and Framing

- Trim and Molding

- Flooring and Decking

- Hobby and Crafting

- By Distribution Channel:

- Online Retail

- Offline Retail (Home Improvement Stores, Hardware Shops)

Value Chain Analysis For Household Miter Saw Market

The value chain for the Household Miter Saw Market begins with upstream activities focused on raw material procurement, encompassing high-grade aluminum and specialized plastics for housing components, and high-quality tungsten carbide for blade manufacturing. Key upstream suppliers include those specializing in motor components (brushes, armatures) and advanced lithium-ion battery cells, which represent a significant cost driver and technological bottleneck. Efficient supply chain management at this stage is crucial, particularly for battery technology, where pricing and supply stability directly impact the final product cost and performance, influencing competitiveness in the cordless segment.

Midstream activities involve core manufacturing, assembly, quality assurance, and packaging. Manufacturers invest heavily in automated assembly lines and precision machining to ensure the accuracy of the saw mechanisms, which is paramount for consumer acceptance. Quality control processes are rigorous, focusing on blade alignment, motor durability, and safety features. Differentiation often occurs through proprietary motor technologies (e.g., brushless motors) and ergonomic designs that enhance user comfort and safety, contributing significantly to the perceived value of the household miter saw.

Downstream analysis highlights the complexity of distribution. Direct channels, primarily through manufacturers' websites, offer greater control over pricing and customer feedback but lack widespread accessibility. Indirect channels, dominated by large format Home Improvement Retailers (e.g., Home Depot, Lowe's) and global e-commerce giants (Amazon, Alibaba), are essential for broad market penetration. These indirect channels require strong logistics capabilities and robust inventory management, as consumers expect immediate availability. E-commerce platforms, in particular, serve as crucial conduits for consumer education, featuring detailed product videos, user reviews, and comprehensive comparison tools that significantly influence the purchasing decision.

Household Miter Saw Market Potential Customers

The primary end-users and buyers of household miter saws are predominantly amateur DIY enthusiasts and hobbyist woodworkers who require precision cutting tools for personal projects ranging from simple shelving units to complex cabinetry and crown molding installations. These customers are typically homeowners, aged 25 to 55, possessing disposable income and a strong interest in home aesthetics and maintenance, often driven by the desire to save costs associated with hiring professional contractors. They seek tools that balance professional precision with user-friendly operation and enhanced safety features suitable for occasional use.

A secondary, rapidly growing customer segment includes small-scale contractors and specialized artisans (e.g., picture framers, furniture restorers) who utilize these smaller, more portable "household" or light-duty professional saws for mobile jobs where full-sized commercial equipment is overkill or too cumbersome. These users prioritize durability, sustained accuracy, and superior battery life, often opting for high-end cordless models that offer industrial performance within a manageable size profile. The purchasing decision for all potential customers is heavily influenced by factors such as brand reputation, warranty length, the breadth of the accompanying battery ecosystem, and overall tool weight and portability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 667 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker (DeWalt, Craftsman), TTI (Ryobi, Milwaukee), Bosch Power Tools, Makita, Metabo, Skil, Hitachi Power Tools (Koki Holdings/Hikoki), Festool, Grizzly Industrial, Wen Products, Ridgid, Genesis Power Tools, Rockwell, King Canada, Kobalt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Miter Saw Market Key Technology Landscape

The technological evolution of the Household Miter Saw Market is centered on enhancing precision, portability, and safety. A primary technological driver is the maturation of brushless motor technology, which offers superior energy efficiency, longer tool life, and higher power density compared to traditional brushed motors. This is particularly crucial in cordless models, where maximizing the run-time from a limited battery capacity is essential. Furthermore, the integration of advanced laser guidance systems, often dual-laser indicators, significantly improves cutting accuracy by clearly marking the kerf width on the material, reducing measurement errors for non-professional users and ensuring repeatable precision cuts.

Another significant area of focus is the development of next-generation lithium-ion battery platforms (e.g., 5.0 Ah and above) capable of delivering sustained, high-current output necessary for demanding cuts on dense materials. Manufacturers are pushing proprietary battery management systems that communicate with the tool to optimize power draw and prevent overheating, extending both the life of the battery and the motor. Dust management systems have also seen substantial innovation, moving beyond simple collection bags to integrated vacuum ports and cyclonic dust separators that capture airborne particulates more effectively, addressing both cleanliness and long-term user health concerns associated with woodworking.

Furthermore, digital technologies are increasingly embedded, including Bluetooth connectivity for linking the tool to companion mobile applications. These apps allow users to monitor battery status, register the tool, receive maintenance alerts, and, in some advanced models, calculate complex compound miter angles based on user-inputted wall angles and material dimensions. This push towards connectivity aids in streamlining the user experience and offers manufacturers valuable data on tool usage and common failure points, fostering a feedback loop for continuous product improvement and maintaining a competitive edge in a feature-driven consumer landscape.

Regional Highlights

The global Household Miter Saw Market exhibits distinct growth patterns influenced by regional economic development, cultural affinity for DIY, and housing market stability. North America commands the largest market share, characterized by high rates of single-family home ownership and a deeply ingrained culture of self-performed home improvement projects. The market here is mature but driven by premiumization, with consumers readily adopting high-voltage cordless systems and sophisticated sliding compound miter saws that offer maximum versatility for complex renovations and construction projects. Significant brand loyalty and robust distribution networks via large hardware chains further solidify this region's dominance.

Europe represents the second-largest market, focusing heavily on safety standards (e.g., CE compliance) and ergonomic design, particularly for precision-driven interior finish work typical of older European housing stock. Growth in this region is spurred by renovation incentives and a strong emphasis on energy-efficient upgrades, requiring high-precision tools for materials like engineered wood and specialized insulation panels. Germany, the UK, and France are key contributors, favoring brands known for precision engineering and advanced dust extraction capabilities to comply with regional health regulations.

Asia Pacific (APAC) is projected to register the fastest growth rate throughout the forecast period. This acceleration is primarily fueled by rapid urbanization, rising disposable incomes, and the consequent surge in demand for affordable, functional power tools among emerging middle-class consumers undertaking smaller-scale residential modifications and furniture assembly. While corded models still hold a strong position due to lower initial cost, the increasing availability of reliable, domestically manufactured cordless options is rapidly changing the market dynamics, particularly in key economies like China, India, and Southeast Asian nations where construction activity is booming.

- North America: Market leader; driven by extensive DIY culture, robust housing starts, and high adoption of premium cordless technologies.

- Europe: Strong focus on regulatory compliance (safety, dust control); growth fueled by renovation projects and demand for precision in finish carpentry.

- Asia Pacific (APAC): Highest projected CAGR; growth driven by urbanization, rising middle-class disposable income, and increasing access to affordable tools.

- Latin America (LATAM): Developing market characterized by price sensitivity; increasing demand due to residential construction activity and basic household maintenance needs.

- Middle East and Africa (MEA): Nascent market, primarily reliant on imports; growth tied to infrastructure development and expatriate communities importing DIY culture and high-quality tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Miter Saw Market.- Stanley Black & Decker (DeWalt, Craftsman)

- Techtronic Industries Co. Ltd. (TTI) (Ryobi, Milwaukee)

- Robert Bosch Power Tools GmbH

- Makita Corporation

- Koki Holdings Co., Ltd. (HiKOKI/Hitachi Power Tools)

- Metabo (Koki Holdings subsidiary)

- Skil Power Tools (Chervon Group)

- Festool GmbH

- Grizzly Industrial, Inc.

- WEN Products

- Positec Tool Corporation (Rockwell, Worx)

- Genesis Power Tools

- Rexon Industrial Corp., Ltd.

- Delta Power Equipment Corporation

- King Canada

- RIDGID (Emerson Electric Co. licensed)

- Kobalt (Lowe's brand)

- Chicago Electric Power Tools (Harbor Freight Tools)

Frequently Asked Questions

Analyze common user questions about the Household Miter Saw market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a compound miter saw and a sliding compound miter saw?

The main difference lies in cutting capacity. A standard compound miter saw can only cut stock as wide as its blade radius allows, while a sliding compound miter saw is built on rails, allowing the blade head to move forward and back, drastically increasing the saw's capacity to cut wider boards used for shelving, large floor planks, or wide trim materials.

Are cordless household miter saws powerful enough for continuous demanding DIY projects?

Yes, modern cordless miter saws, utilizing high-voltage (18V/20V or 40V/60V) brushless motor technology and advanced lithium-ion batteries (5.0 Ah and above), offer power output comparable to corded models, providing sufficient run-time and torque for continuous, demanding cross-cutting and light framing applications commonly encountered in household environments.

What safety features should consumers prioritize when purchasing a household miter saw?

Consumers should prioritize robust blade guards that automatically retract, electric brakes that stop the blade quickly upon release of the trigger, safety lock-off switches to prevent accidental startup, and effective material clamps or hold-downs to secure the workpiece firmly during the cutting operation, significantly reducing kickback risks.

Which power source, corded or cordless, is dominant in the current household market?

While corded models remain crucial for tasks requiring maximum sustained power without battery limitations, the cordless segment is experiencing faster growth and market uptake due to unparalleled portability, convenience, and continuous improvements in battery technology, making cordless the preferred choice for most intermittent household and DIY tasks.

How significant is the impact of e-commerce on miter saw distribution?

E-commerce is highly significant, acting as a pivotal distribution channel by offering broad product comparisons, competitive pricing, detailed technical specifications, and user reviews. This channel greatly facilitates consumer education and purchase decisions, particularly for specialized or high-end models, and is vital for manufacturers launching new technology platforms directly to consumers.

What role does the laser guide technology play in household miter saws?

Laser guide technology projects a visible line onto the material, indicating the exact path of the blade (kerf). This feature dramatically enhances accuracy for novice users, eliminates the need for repeated manual alignment checks, and speeds up the cutting process, ensuring cuts are made precisely on the marked line.

Are compound miter saws capable of making bevel cuts in addition to miter cuts?

Yes, compound miter saws are specifically designed to perform both miter cuts (angled cuts across the face of the board) and bevel cuts (angled cuts across the thickness of the board) simultaneously or independently, which is essential for creating complex joints found in crown molding, baseboards, and window trim installations.

What are the primary challenges restraining market growth in the Household Miter Saw sector?

Key restraints include the relatively high initial capital expenditure required for sophisticated sliding and cordless models, safety concerns among inexperienced users leading to reluctance to purchase, and potential market saturation in highly developed regions where many households already possess a basic miter saw model.

How are manufacturers addressing environmental concerns related to wood dust exposure?

Manufacturers are addressing environmental and health concerns by integrating highly efficient dust management solutions, including improved onboard collection bags, optimized vacuum ports designed for effective hookup to external dust extractors, and air-filtration systems built into the tool body, aiming for regulatory compliance and enhanced user safety.

What impact do brushless motors have on the longevity of a household miter saw?

Brushless motors significantly extend the longevity of miter saws by eliminating the need for carbon brushes, which are common wear-and-tear components. This results in less friction, less heat generation, superior battery efficiency, and fewer maintenance requirements over the tool's lifespan, appealing directly to the cost-conscious household user.

How does the quality of the blade affect the performance of a household miter saw?

The quality of the blade, particularly the number of teeth and the composition of the carbide tips, critically affects cutting performance. Higher tooth counts (e.g., 60T to 80T for an average 10-inch saw) provide smoother, finer finishes essential for trim work, while lower tooth counts are suitable for faster, rougher crosscuts in framing lumber.

Which geographical region shows the greatest opportunity for future market expansion?

The Asia Pacific (APAC) region presents the greatest opportunity for future market expansion due to ongoing economic development, increasing residential infrastructure investment, and the rising propensity among urban populations in countries like China and India to engage in minor home improvement and furniture assembly projects, boosting demand for entry-level and mid-range tools.

What is AEO and how is it relevant to this market report?

Answer Engine Optimization (AEO) focuses on structuring content (like this report) to directly answer user queries comprehensively and concisely, making the information easily extractable by advanced search engines and generative AI models. In this context, it ensures market insights are delivered rapidly and accurately, optimizing the report’s visibility and utility for immediate research needs.

What defines a "household" miter saw compared to a professional or commercial model?

Household miter saws are generally characterized by lighter weight, smaller motor sizes designed for intermittent use rather than continuous industrial duty, and a greater emphasis on user-friendly features such as simplified setup and enhanced portability. While professional models prioritize heavy-duty components and sustained power output, household models balance cost, performance, and ease of use.

How are manufacturers differentiating their products in a competitive market?

Differentiation is achieved through patented battery technology (extended runtime/faster charging), advanced safety mechanisms, smart tool integration (Bluetooth connectivity for angle calculations), superior dust collection efficiency, and extended warranty programs, targeting the consumer desire for convenience and long-term reliability.

What is the current trend regarding 10-inch versus 12-inch blades in the household segment?

While 10-inch saws offer better portability and lower cost, the trend is favoring 12-inch sliding compound miter saws. The 12-inch models provide substantially greater cutting depth and capacity, allowing household users to handle thicker materials and wider boards (e.g., 2x12 lumber) common in modern decking and framing, maximizing the tool's versatility.

How has the rise of prefabricated furniture impacted the need for miter saws?

While prefabricated furniture reduces the need for large-scale construction, it often increases demand for precision installation tools, such as miter saws, needed for customizing trim, molding, and finishing elements around the installed units, maintaining a sustained, albeit shifting, consumer necessity for these tools in home environments.

Is AI being used to enhance cutting precision in current household models?

Currently, AI is primarily limited to assisting features like optimized angle calculations via companion apps or advanced motor management. Full AI integration for real-time precision adjustment is still emerging, expected to be introduced in high-end models through sensors that monitor material density and adjust blade speed dynamically to prevent tear-out.

What factors contribute to North America's dominance in market share?

North America's dominance is attributed to high median household income, a strong cultural heritage of DIY repair and maintenance, readily available retail distribution through large big-box stores (Home Depot, Lowe's), and aggressive marketing by leading power tool manufacturers who frequently launch their latest innovations in this region first.

How critical is the ergonomics of a miter saw for the household user?

Ergonomics are extremely critical for the household user. Non-professionals typically lack the physical conditioning of tradesmen, making features like lightweight design, comfortable handle grips, accessible controls, and smooth sliding mechanisms essential factors that significantly influence tool preference and reduce fatigue during usage.

What specific materials can household miter saws cut efficiently?

Household miter saws are highly efficient at cutting common woodworking materials including softwoods, hardwoods, plywood, MDF, composite decking, and plastic trim. Specialized blades are required, but they can also efficiently cut aluminum and other soft non-ferrous metals often used in window frames or light construction.

How does the "Impact Forces" analysis assess the threat of substitution in this market?

The impact forces analysis assesses the substitution threat as moderate. While tools like circular saws or jig saws can substitute for some crosscuts, they cannot replicate the consistent, high-precision miter and bevel capabilities of a dedicated miter saw, meaning the core function remains relatively insulated from general tool substitution.

In the value chain, why is the procurement of lithium-ion cells a critical factor?

The procurement of lithium-ion cells is critical because battery technology is the cornerstone of the high-growth cordless segment. Quality, pricing, and stable supply of high-performance cells directly determine the cost-effectiveness and competitive advantage of a manufacturer’s entire cordless platform, impacting both product performance and profitability.

What are the implications of the shift towards brushless motor technology for the consumer?

For the consumer, the shift implies greater power efficiency resulting in longer battery life per charge, a lighter tool due to smaller motor size, reduced operational noise, and a substantially longer product lifespan with less maintenance required, justifying the typically higher initial investment.

How does the segmentation by application influence product design in this market?

Segmentation by application dictates core design elements. Saws targeted for "Trim and Molding" prioritize extremely high precision, finer blades, and delicate sliding mechanisms. Conversely, saws for "Carpentry and Framing" prioritize rugged construction, durability, and maximum capacity for handling large dimensional lumber, leading to distinct product lines.

What is the projected growth trajectory for the Cordless Miter Saw segment?

The Cordless Miter Saw segment is projected to grow faster than the overall market CAGR, driven by continuous innovation in battery technology that overcomes historical limitations of run-time and power. Its growth is expected to capture increasing market share from traditional corded models across all major geographies, especially North America and Europe.

Why is the Base Year for the forecast set as 2025 in this market report?

The Base Year 2025 provides a stable, finalized reference point for market data, allowing for the inclusion of recent market shifts, such as post-pandemic housing market adjustments and the full commercial rollout of 2024 product lines, thereby ensuring the forecast from 2026 to 2033 is grounded on the most current and validated economic and technological landscape.

How do regional regulatory standards affect manufacturers operating in Europe?

European manufacturers must adhere strictly to CE marking requirements, which include stringent noise emission limits and mandatory sophisticated dust extraction capabilities. These regulations necessitate substantial investment in engineering controls and often result in product designs unique to the European market, focusing heavily on safety and environmental impact reduction.

What is the role of technology standardization in the Household Miter Saw Market?

Standardization, particularly in battery platforms (e.g., 20V/18V systems), is crucial as it allows consumers to interchange batteries across a manufacturer's range of tools. This 'ecosystem' approach significantly enhances customer loyalty and reduces the total cost of ownership, becoming a key factor in driving consumer brand selection.

In the Executive Summary, what is the key takeaway regarding business trends?

The key takeaway regarding business trends is the pervasive focus on innovation toward portability and connectivity; manufacturers are rapidly transforming miter saws from simple mechanical cutting tools into sophisticated, battery-powered systems that integrate safety features and digital assistance for the modern DIY consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager