Household & Personal Care Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435029 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Household & Personal Care Products Market Size

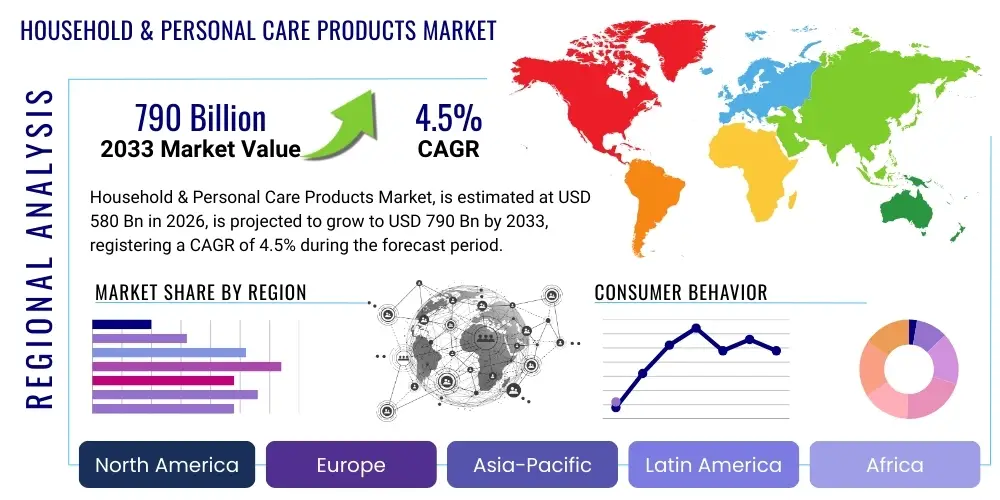

The Household & Personal Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $580 Billion USD in 2026 and is projected to reach $790 Billion USD by the end of the forecast period in 2033.

Household & Personal Care Products Market introduction

The Household & Personal Care Products Market encompasses a vast array of fast-moving consumer goods (FMCG) designed for consumer hygiene, sanitation, grooming, and general household maintenance. This sector is characterized by high volume, frequent purchases, and intense brand loyalty competition. Key product categories include skin care, hair care, oral hygiene, cosmetics, laundry detergents, surface cleaners, and air fresheners. These products are essential components of daily life, driving sustained demand irrespective of minor economic fluctuations, positioning the market as fundamentally resilient and necessary for modern standards of living globally. The persistent focus on health and wellness, particularly post-pandemic, has further cemented the importance of sanitizing and self-care categories.

Major applications span individual consumer use, commercial settings (such as hospitality and healthcare), and specialized industrial cleaning. The core benefits derived from these products are improved public health outcomes, enhanced personal appearance and well-being, and maintenance of hygienic living environments. Consumer demand is continually shaped by evolving standards of personal grooming, regulatory shifts concerning ingredient safety, and the rising global awareness regarding sustainability and ethical sourcing practices. Innovation often centers on efficacy, formulation complexity (e.g., natural ingredients, biotechnology), and packaging design to meet consumer convenience and environmental responsibility expectations.

The market growth is primarily driven by rapid urbanization in developing regions, leading to increased disposable incomes and greater access to modern retail infrastructure. Demographic shifts, notably the rising global middle class and increasing focus on anti-aging and specialized skin treatments, further propel the premium segment. Furthermore, aggressive product innovation, coupled with sophisticated digital marketing strategies across e-commerce platforms, facilitates deeper market penetration and allows manufacturers to address niche consumer needs, such as allergen-free formulations, personalized cosmetics, and concentrated cleaning products that reduce plastic waste.

Household & Personal Care Products Market Executive Summary

The Household & Personal Care Products market demonstrates robust growth, fundamentally underpinned by non-discretionary consumer spending and persistent innovation in sustainable and specialized product lines. Current business trends indicate a significant pivot towards direct-to-consumer (DTC) models and enhanced supply chain transparency, driven by consumer expectations for quick delivery and ethical sourcing. Strategic mergers and acquisitions are frequent as large conglomerates seek to absorb innovative, niche brands focused on clean labels or specific demographic segments (e.g., Generation Z-focused beauty products or specialized pet care items). The integration of digital technologies, particularly in personalized marketing and augmented reality try-on features for cosmetic products, is optimizing consumer engagement and reducing market friction.

Regionally, the Asia Pacific (APAC) market, particularly China and India, remains the dominant growth engine, propelled by expanding middle-class populations, increased hygiene standards, and rapid adoption of Westernized beauty routines. North America and Europe, while mature, are characterized by high per capita spending and a critical shift towards premiumization, cruelty-free, and refillable products, necessitating significant R&D investment from established players. Regulatory divergence across regions, particularly concerning cosmetic ingredients and environmental labeling, requires manufacturers to maintain highly localized product development strategies to ensure compliance and market acceptance.

Segment-wise, the Personal Care segment, particularly skin care and cosmetics, commands the highest value due to high-frequency usage and premium price points associated with performance ingredients (e.g., retinol, hyaluronic acid). Within Household Care, the shift from traditional detergents to eco-friendly, concentrated, and pod-based formulations is a key trend, reflecting consumer priorities toward convenience and environmental impact reduction. E-commerce distribution continues its explosive growth trajectory, challenging the traditional dominance of supermarkets and hypermarkets, especially for highly specific, specialized, or independent brand offerings that leverage digital discovery platforms.

AI Impact Analysis on Household & Personal Care Products Market

Analysis of common user questions reveals significant interest in how Artificial Intelligence (AI) and Machine Learning (ML) enhance product personalization, optimize the complex supply chain, and revolutionize consumer engagement within the Household & Personal Care sector. Users frequently inquire about AI's role in developing custom skincare routines based on biometric data, the efficiency gains realized through AI-driven demand forecasting, and the ethics surrounding AI-powered cosmetic recommendations. Key themes center around the expectation that AI will drive hyper-personalization, reducing product waste and increasing consumer satisfaction, while concerns focus on data privacy implications and the potential displacement of human roles in traditional retail and manufacturing oversight. The consensus suggests AI is moving beyond simple recommendation engines, becoming integral to core product formulation and automated quality control, fundamentally redefining the competitive landscape.

- AI-Driven Formulation Discovery: ML algorithms analyze vast chemical datasets to accelerate the identification of novel, safe, and effective ingredients, drastically reducing R&D time for new products.

- Hyper-Personalization: AI platforms analyze consumer genetic, environmental, and behavioral data to offer tailored product recommendations, especially in skincare and hair care.

- Optimized Demand Forecasting: Predictive analytics enhance supply chain efficiency by accurately forecasting localized demand, minimizing stockouts, and reducing inventory waste across global distribution networks.

- Automated Quality Control: Computer vision systems powered by AI perform rapid inspection of product packaging and consistency during manufacturing, ensuring adherence to stringent quality standards.

- Enhanced Customer Service: AI chatbots and virtual assistants provide 24/7 personalized consumer support, addressing product inquiries and managing returns efficiently.

- Ethical Marketing and Targeting: AI tools refine advertising placement, ensuring products are marketed ethically and effectively to relevant consumer segments while maintaining privacy compliance.

DRO & Impact Forces Of Household & Personal Care Products Market

The Household & Personal Care Market is shaped by a confluence of powerful forces: robust Drivers centered on global population growth and rising hygiene awareness; inherent Restraints such as intense pricing pressure and stringent ingredient regulation; and significant Opportunities derived from sustainability innovation and digital transformation. Collectively, these elements dictate strategic priorities for market leaders, forcing them to balance cost-efficiency with high R&D investment. The primary impact forces—consumer empowerment through digital channels and the global shift towards environmental consciousness—are accelerating the rate of product obsolescence and demanding radical transparency from manufacturers.

Key Drivers include sustained growth in emerging markets (APAC and LATAM), where increased discretionary income translates directly into higher spending on premium household cleaners and personal grooming items. Furthermore, the persistent media focus on public health and sanitation standards, reinforced by global health events, ensures continued high demand for hygiene products. Restraints often revolve around raw material volatility, particularly petrochemical derivatives, which pressures margins. Additionally, the increasing complexity of international regulatory frameworks, especially concerning microplastics, parabens, and sustainable packaging mandates, poses significant compliance challenges for multi-national corporations.

Opportunities are predominantly clustered around the Green Chemistry movement, enabling the development of high-performance, bio-based ingredients that appeal to the eco-conscious consumer. Digitalization offers opportunities for manufacturers to forge stronger, data-driven relationships with consumers, moving beyond traditional retail intermediation. The Impact Forces, particularly the competitive intensity and the power of social media influence, ensure that brands must remain agile, responsive to consumer feedback, and ethically aligned with global social values to maintain market relevance and brand equity in a highly fragmented competitive environment.

Segmentation Analysis

The Household & Personal Care Products market is highly diversified, segmented based on product category, distribution channel, ingredient composition, and end-use application. Analyzing these segments provides a clear understanding of consumer spending patterns and areas of fastest growth. The segmentation framework highlights the bifurcation of consumer priorities: efficacy and value in the household segment versus specialized, experiential, and premium features in the personal care segment. Understanding the relative market shares and growth rates across product types (e.g., differentiating between functional hair care and cosmetic hair styling) is critical for strategic resource allocation, particularly in R&D and targeted marketing campaigns designed to capture evolving consumer demands.

- By Product Type:

- Personal Care Products (Skin Care, Hair Care, Oral Care, Deodorants, Cosmetics/Makeup, Bath & Shower)

- Household Care Products (Laundry Care, Surface Cleaners, Dishwashing Products, Air Fresheners, Insecticides)

- Feminine Hygiene Products

- Baby Care Products

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Drug Stores

- E-commerce Platforms (Online Retail)

- Direct Selling

- By Ingredient Type:

- Natural and Organic

- Conventional/Synthetic

- Biotechnology-derived

- By Packaging Type:

- Plastic Bottles and Jars (Recycled PET, HDPE)

- Flexible Packaging (Pouches, Sachets)

- Aerosols and Sprays

- Glass and Metal Containers

Value Chain Analysis For Household & Personal Care Products Market

The value chain for Household & Personal Care products is complex, beginning with upstream sourcing of raw materials, moving through manufacturing and highly specialized formulation, and concluding with sophisticated downstream distribution. Upstream analysis focuses on securing essential ingredients, including specialty chemicals, natural oils, synthetic fragrances, and packaging materials. Volatility in commodity pricing (e.g., palm oil, petrochemicals) significantly impacts manufacturer margins, compelling firms to establish robust long-term sourcing contracts and invest in vertical integration where possible. Specialized ingredient suppliers, often highly regulated, hold significant leverage due to their proprietary formulas and ability to meet increasingly stringent "clean label" demands.

The manufacturing and formulation stage is characterized by high capital expenditure in production facilities and rigorous quality control protocols required to meet international safety standards (e.g., ISO, GMP). Midstream activities involve blending, packaging, and labeling, where automation and smart factory technologies are crucial for scaling production efficiently while ensuring batch consistency. Direct and indirect distribution channels define the downstream landscape. Direct channels, like DTC e-commerce and branded retail stores, allow for higher margin capture and direct consumer data collection. Indirect channels, which include massive partnerships with hypermarkets, wholesalers, and third-party e-tailers, ensure broad market penetration and logistical coverage, albeit with reduced pricing control.

The distribution channel efficiency is paramount to profitability, given the high volume and relatively low shelf-life of many products. The rise of e-commerce necessitates sophisticated last-mile logistics and a shift toward optimized packaging to withstand shipping stresses while minimizing environmental footprint. Companies that effectively manage the distribution pivot, utilizing omnichannel strategies that seamlessly link physical retail with digital fulfillment centers, are best positioned to dominate market share. Marketing and sales, often employing significant media spend and celebrity endorsements, constitute the final, crucial step in driving consumer pull and reinforcing brand loyalty across multiple distribution touchpoints.

Household & Personal Care Products Market Potential Customers

The end-users and buyers of Household & Personal Care Products are highly diverse, encompassing virtually every segment of the global population across consumer, commercial, and institutional sectors. The primary target audience consists of individual households, where purchasing decisions are often made by key household managers based on value, brand trust, and specific functional requirements (e.g., sensitive skin needs, specific cleaning performance). Within this group, key sub-segments include environmentally conscious millennials and Gen Z who prioritize sustainable and ethical products, and an aging population seeking high-efficacy anti-aging and wellness solutions.

Beyond the domestic consumer, a substantial segment involves commercial and institutional buyers, often categorized as Business-to-Business (B2B) customers. This includes hotels, hospitals, restaurants, educational institutions, and corporate offices that require high-volume, professional-grade cleaning, sanitation, and hygiene supplies. These customers prioritize efficacy, bulk packaging, regulatory compliance (especially in healthcare settings), and cost-effectiveness over premium branding features. This segment provides stable demand and often requires specialized formulations distinct from retail offerings.

Furthermore, niche markets such as specialized salons, spa services, and pet care providers represent growing segments. Salons and spas act as influential intermediaries, purchasing professional-grade hair and skin care products and endorsing retail versions to their clientele, driving demand for high-end professional lines. The purchasing behavior across all segments is increasingly influenced by online reviews, social media trends, and personalized recommendations, necessitating targeted digital engagement strategies tailored to each specific buyer persona.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Billion USD |

| Market Forecast in 2033 | $790 Billion USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever, L'Oréal S.A., Estée Lauder Companies, Johnson & Johnson, Colgate-Palmolive Company, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, Kao Corporation, Beiersdorf AG, Coty Inc., Shiseido Company, S. C. Johnson & Son, Church & Dwight Co., Inc., Amway Corp., Mary Kay Inc., LVMH Moët Hennessy Louis Vuitton, Revlon, Inc., Avon Products, Inc., The Clorox Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household & Personal Care Products Market Key Technology Landscape

The Household & Personal Care Products market is undergoing a significant technological transformation, moving towards precision formulation, sustainable manufacturing, and data-driven consumer interaction. Key technologies deployed include advanced biotechnology and synthetic biology, which enable the precise engineering of active ingredients, such as specific peptides, synthetic stem cells, and high-efficacy bio-ferments, minimizing reliance on traditional, sometimes unsustainable, natural sourcing. This allows for superior product performance and often addresses complex consumer demands like vegan or cruelty-free certifications. Furthermore, microencapsulation technology is widely utilized to improve the stability and targeted delivery of volatile ingredients like retinol or vitamins, extending shelf life and enhancing product efficacy upon application, thereby justifying premium pricing.

In manufacturing, Industry 4.0 technologies, including automated robotics, IoT sensors, and advanced process control systems, are being integrated into production lines. These technologies facilitate real-time monitoring of ingredient mixing and packaging precision, ensuring consistently high product quality while dramatically improving operational efficiencies and reducing energy consumption. Sustainable packaging innovations, such as plant-based polymers, refillable systems, and concentrated formulas that reduce water content and overall material use, are also central technological focuses, driven by regulatory pressures and consumer preference for eco-friendly solutions. Manufacturers are investing heavily in technologies that can recycle and reuse materials across the supply chain.

On the consumer front, digital technologies are redefining the shopping experience. Artificial Intelligence (AI) and Machine Learning (ML) underpin virtual try-on tools (particularly for cosmetics) and sophisticated diagnostic apps that analyze skin or hair condition via smartphone cameras, offering personalized product recommendations. Blockchain technology is also emerging as a critical tool for enhancing supply chain transparency, allowing consumers to verify the authenticity and ethical sourcing of ingredients from origin to shelf. These digital tools not only drive sales but also generate invaluable consumer data that feeds back into the R&D cycle, accelerating targeted product iteration and market adaptation.

Regional Highlights

Global demand for household and personal care products is regionally segmented, reflecting diverse cultural norms, economic development levels, and regulatory environments. The regional distribution of market value underscores areas of high growth potential and mature premiumization.

- Asia Pacific (APAC): Holds the largest market share and exhibits the highest growth rate, fueled by demographic tailwinds (large youth population), rising disposable incomes, and increasing Western influence on grooming and beauty standards. China and India are the pivotal markets, driving rapid growth in skin care and professional hair care segments.

- North America: Characterized by high per capita spending and a mature market focused on premium, specialized, and organic products. Innovation in clean beauty, men's grooming, and highly effective anti-aging solutions dictates regional trends. E-commerce penetration is among the highest globally.

- Europe: Highly regulated market where sustainability and ethical sourcing are paramount. Significant demand for certified organic, natural, and locally produced goods. Western Europe leads in refill and circular economy packaging solutions, influencing global best practices.

- Latin America (LATAM): High potential market driven by urbanization and strong demand for mass-market cosmetics and affordable personal hygiene products. Economic instability can restrain growth, but brand loyalty remains strong. Brazil is a regional powerhouse, particularly in hair care.

- Middle East and Africa (MEA): Growth is propelled by high birth rates and increasing influence of global beauty trends, particularly in the UAE and Saudi Arabia. Demand is high for high-end fragrances, sun protection, and specialized halal-certified products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household & Personal Care Products Market.- Procter & Gamble (P&G)

- Unilever

- L'Oréal S.A.

- Estée Lauder Companies

- Johnson & Johnson

- Colgate-Palmolive Company

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- Kao Corporation

- Beiersdorf AG

- Coty Inc.

- Shiseido Company

- S. C. Johnson & Son

- Church & Dwight Co., Inc.

- Amway Corp.

- Mary Kay Inc.

- LVMH Moët Hennessy Louis Vuitton

- Revlon, Inc.

- Avon Products, Inc.

- The Clorox Company

Frequently Asked Questions

What is driving the growth of the Household & Personal Care Products Market?

Market growth is primarily driven by three factors: sustained population expansion and urbanization, leading to an expanded consumer base; rising global awareness and investment in hygiene and wellness; and continuous product innovation focused on high-efficacy, personalized, and sustainable formulations that command premium pricing.

Which segment holds the highest share in the Personal Care Market?

The Skin Care segment (including face, body, and hand care) typically holds the highest market share within the Personal Care category. This dominance is due to daily usage frequency, high consumer willingness to pay for specialized treatments (e.g., anti-aging), and broad product diversification across multiple price points and demographic groups.

How significant is the shift towards sustainable packaging in this industry?

The shift towards sustainable packaging—including recycled materials (PCR), refill systems, and concentrated formulas—is extremely significant. It represents a mandatory strategic imperative, driven by stricter governmental regulations (especially in Europe) and increasingly powerful consumer preference for environmentally responsible brands, influencing major purchasing decisions across all product categories.

What is the role of E-commerce in the distribution of household and personal care items?

E-commerce plays a transformative role, offering rapid market entry for niche brands, providing consumers with unprecedented access to specialized products, and driving the implementation of sophisticated omnichannel retailing strategies by major players. Its market share is rapidly increasing, particularly for personalized and premium beauty products.

How does raw material volatility affect the profitability of manufacturers?

Raw material volatility, particularly in petrochemical derivatives, synthetic fragrances, and essential oils, significantly compresses manufacturer operating margins. Companies mitigate this by securing long-term contracts, investing in vertically integrated supply chains, and increasingly substituting traditional materials with cost-stable, biotechnology-derived alternatives, leading to enhanced R&D focus on biosourcing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager