Household Water Softener System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435749 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Household Water Softener System Market Size

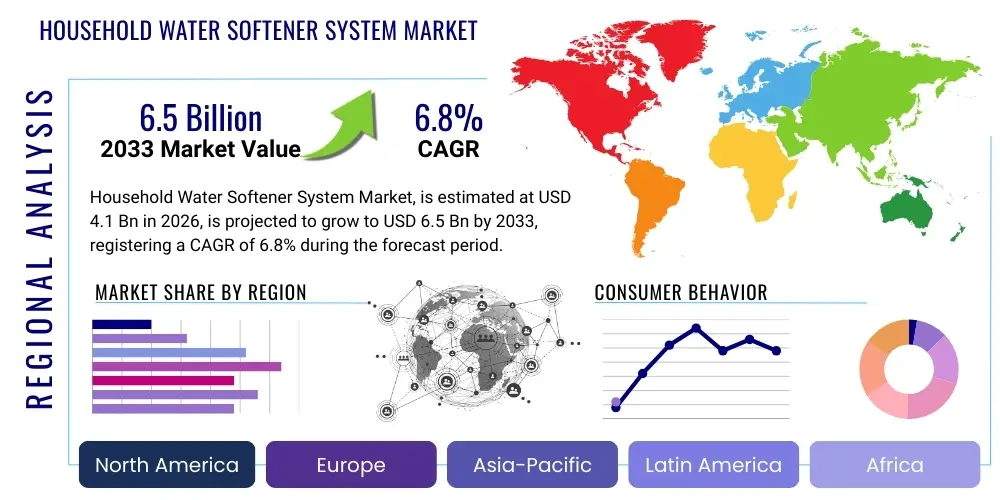

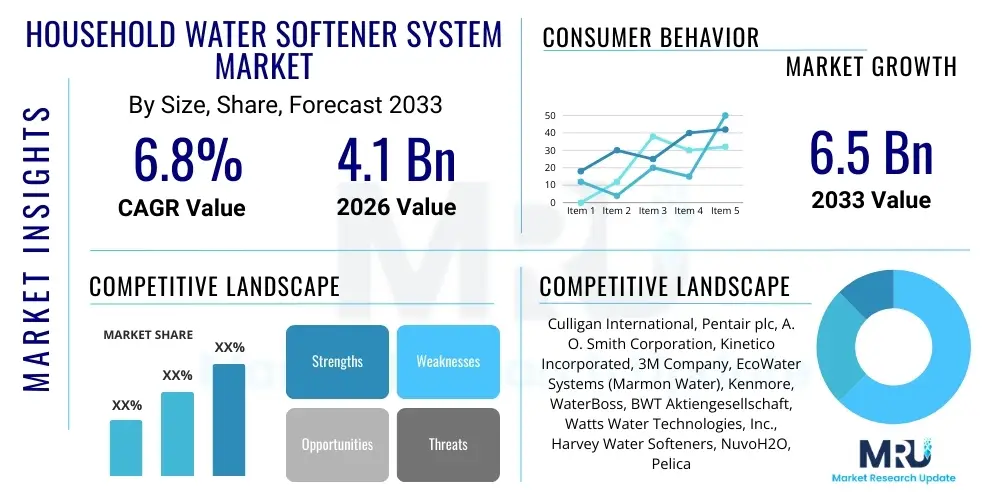

The Household Water Softener System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Household Water Softener System Market introduction

The Household Water Softener System Market encompasses devices and installations designed to remove high concentrations of dissolved minerals, primarily calcium and magnesium, which cause water hardness in residential settings. These systems utilize various technologies, predominantly ion exchange using resin beads, though alternative methods like salt-free (Template Assisted Crystallization - TAC) and electromagnetic systems are also gaining traction. The core function of these systems is to mitigate the adverse effects of hard water, such as scale buildup in plumbing, appliances, and fixtures, alongside improving the efficacy of soaps and detergents.

The primary applications of household water softeners are centered around improving water quality for consumption and daily use, extending the lifespan of household infrastructure, and reducing energy consumption associated with heating scale-encrusted elements. Major benefits include enhanced bathing and laundry experiences, protection of expensive appliances like water heaters and dishwashers, and overall reduction in maintenance costs associated with mineral accumulation. The necessity of these systems is particularly acute in regions characterized by geological formations that naturally lead to high mineral content in groundwater sources.

Market growth is substantially driven by increasing consumer awareness regarding the detrimental impacts of hard water on health and home assets, coupled with rising disposable incomes in emerging economies that enable investment in water quality infrastructure. Furthermore, stringent regulatory standards in developed regions concerning municipal water quality, often complemented by consumer preferences for softer water, propel the adoption rates. Technological advancements focused on increasing efficiency, reducing salt usage, and enabling smart monitoring further catalyze market expansion.

Household Water Softener System Market Executive Summary

The Household Water Softener System Market is experiencing robust growth, primarily propelled by heightened consumer consciousness regarding hard water consequences and significant advancements in system efficiency, notably in demand-initiated regeneration models. Business trends indicate a strong move toward sustainable and salt-free alternatives, addressing environmental concerns related to brine discharge. Key market participants are focusing on integrating IoT capabilities for remote monitoring, predictive maintenance, and optimized resource utilization, thereby enhancing the overall value proposition for homeowners seeking convenient, high-performance water treatment solutions.

Regional trends highlight North America as the dominant market due to high prevalence of hard water issues across the US Midwest and elevated consumer spending on home improvement and water quality solutions. However, the Asia Pacific region, particularly countries like China and India, is poised for the highest growth rate, fueled by rapid urbanization, declining water quality in metropolitan areas, and the expanding middle class investing in domestic health and wellness products. Europe maintains a mature, yet stable, market, with stringent regulations driving the adoption of high-efficiency, environmentally compliant softening technologies.

Segment trends underscore the continued leadership of the Ion Exchange (Salt-Based) technology due to its proven efficacy and cost-effectiveness, although the Template Assisted Crystallization (TAC) salt-free segment is expanding rapidly, appealing to environmentally conscious consumers. In terms of distribution, the Professional Contractors and Plumbers channel remains critical for installation and service, but the e-commerce segment is witnessing explosive growth, offering competitive pricing and direct-to-consumer accessibility, necessitating revised supply chain strategies for major manufacturers.

AI Impact Analysis on Household Water Softener System Market

Common user questions regarding AI's impact typically center on themes such as predictive maintenance, optimization of regeneration cycles, and personalized water management. Consumers frequently inquire about how AI can minimize salt and water waste, automate system diagnostics, and integrate seamlessly with smart home ecosystems. Concerns often revolve around data privacy, the complexity of setup for advanced systems, and the actual cost-benefit analysis of adopting AI-driven softeners versus traditional models. The underlying expectation is that AI should provide "set-and-forget" operational simplicity while dramatically improving efficiency and reducing operating costs over the system's lifespan.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational efficiency and user experience of household water softeners. AI algorithms analyze real-time water usage patterns, inlet water hardness levels, and flow rates to predict optimal regeneration times, moving beyond simple timer-based or fixed-volume regeneration. This predictive capability significantly reduces unnecessary salt and water consumption, leading to substantial savings and minimizing environmental impact associated with brine discharge. Furthermore, ML models are being trained on large datasets to identify subtle anomalies, enabling preventative maintenance alerts before critical failures occur.

AI is also critical in enhancing customer service and system diagnostics. Smart softeners equipped with AI can self-diagnose malfunctions and communicate detailed diagnostic reports directly to service providers or homeowners via mobile applications. This capability shortens repair times, improves first-time fix rates, and reduces the need for expensive, manual troubleshooting visits. As smart home adoption accelerates, AI-driven softeners are increasingly becoming integrated components within broader home management systems, optimizing energy usage and correlating water quality with appliance performance.

- Predictive Regeneration Optimization: AI analyzes consumption data to initiate regeneration only when necessary, maximizing efficiency.

- Smart Diagnostic Reporting: Automated identification and communication of system faults, reducing maintenance downtime.

- Resource Consumption Minimization: Machine Learning algorithms actively reduce excess salt and water waste.

- Seamless Smart Home Integration: Compatibility with platforms like Amazon Alexa and Google Home for voice control and centralized management.

- Personalized Water Profiles: Customizing water quality settings based on household activities and health requirements.

DRO & Impact Forces Of Household Water Softener System Market

The Household Water Softener System Market is driven by the imperative of protecting expensive household appliances and plumbing infrastructure from scale damage, coupled with enhanced health and aesthetic benefits derived from softened water. Restraints predominantly include the high initial capital expenditure associated with purchasing and installing ion exchange systems, the ongoing operational costs related to salt replenishment, and growing environmental scrutiny over brine discharge. Opportunities lie in the proliferation of highly efficient, salt-free crystallization technologies and expansion into underserved residential sectors, while impact forces such as urbanization and deteriorating municipal water infrastructure continue to exert pressure on consumer adoption decisions.

Key drivers include the demonstrable economic savings realized through prolonged appliance lifespan and reduced energy consumption (as scale inhibits heat transfer in water heaters). Furthermore, regulatory mandates in specific geographical areas concerning permissible hard water limits and the aggressive marketing by manufacturers highlighting lifestyle improvements contribute significantly to sustained demand. The increasing incidence of dermatological issues linked to hard water exposure also compels households, especially those with sensitive skin occupants, to invest in reliable softening solutions.

Counteracting these drivers are significant constraints. The complexity of installation often requires professional assistance, adding to the total cost of ownership. Moreover, in regions prone to drought or with high water conservation mandates, the water wasted during the backwash and regeneration cycle of traditional salt-based softeners presents a substantial barrier to adoption. Furthermore, the market faces competition from simpler point-of-use filtration devices that, while not providing whole-house softening, offer lower-cost alternatives for drinking water quality improvement.

The primary impact forces acting on the market are socioeconomic shifts and environmental concerns. Globally rising population density leads to increased pressure on natural water resources, often resulting in higher concentrations of minerals and contaminants, boosting the fundamental need for softeners. Simultaneously, the force of innovation, particularly in reverse osmosis (RO) hybrids and non-chemical softening methods, reshapes consumer choice and regulatory focus, pushing the industry toward more sustainable and environmentally benign technologies.

Segmentation Analysis

The Household Water Softener System Market is segmented across several critical dimensions, including product type, technology, distribution channel, and application. This granularity allows manufacturers and stakeholders to precisely target consumer needs based on factors such as water usage volume, geographic location, environmental priorities, and budget constraints. Ion exchange softeners dominate the technology segment due to their established effectiveness and scalability for whole-house treatment. Segmentation by distribution channel reflects the dual nature of sales: high-touch specialized sales requiring professional installation (plumbers, contractors) and low-touch retail for replacement systems and simpler models (DIY retailers, e-commerce).

The Product Type segmentation primarily differentiates between twin-tank and single-tank configurations. Twin-tank systems, offering continuous soft water supply even during regeneration, cater to larger households or those with very high water consumption requirements, prioritizing uninterrupted performance. Conversely, single-tank systems are the dominant choice for average residential use, balancing cost-effectiveness with adequate capacity. The ongoing trend toward high-efficiency, compact designs is influencing the segmentation, allowing robust performance even in smaller footprint systems suitable for urban residences where space is a premium.

- By Product Type:

- Single Tank Softeners

- Twin Tank Softeners

- By Technology:

- Ion Exchange (Salt-Based)

- Salt-Free (Template Assisted Crystallization, Electromagnetic, etc.)

- By Distribution Channel:

- Online Retail/E-commerce

- Offline Retail (DIY Stores, Hardware Stores)

- Professional Contractors and Plumbers

- By Application (Household Size):

- Small Households (1-2 members)

- Medium Households (3-4 members)

- Large Households (5+ members)

Value Chain Analysis For Household Water Softener System Market

The value chain for the Household Water Softener System Market begins with upstream activities involving the sourcing of raw materials, predominantly specialized ion exchange resins, fiberglass/polyethylene for tanks, and complex control valve mechanisms. The quality and type of resin (e.g., fine mesh, high capacity) are crucial determinants of the final product's efficiency and longevity. Key upstream suppliers include chemical manufacturers (for resins) and plastics/metal fabricators (for hardware components). Efficiency in the upstream supply chain is critical to maintaining competitive pricing in the downstream consumer market.

Midstream processes involve manufacturing, assembly, and quality control. Major original equipment manufacturers (OEMs) often assemble components sourced globally, focusing on optimizing valve programming and tank durability. Downstream activities encompass warehousing, marketing, and the ultimate distribution to end-users. The distribution channel is bifurcated: direct distribution through specialized water treatment dealers, which includes installation and service contracts (high value, high service), and indirect distribution through mass retail and e-commerce platforms (high volume, low service, typically targeting DIY installation or contractor purchase).

The distinction between direct and indirect distribution significantly impacts margin structures and customer engagement. Direct sales channels, utilizing professional plumbers or authorized local dealers, ensure correct sizing and installation, minimizing performance issues and fostering long-term service relationships. Indirect channels, particularly e-commerce, offer geographical reach and price transparency, capitalizing on consumers who are either performing system replacements or possess adequate technical skills for self-installation. Successful firms must manage both channels effectively, ensuring consistent brand experience and product quality regardless of the purchasing path.

Household Water Softener System Market Potential Customers

The primary end-users and buyers of household water softener systems are homeowners residing in areas with moderate to severe water hardness (typically above 7 grains per gallon). This demographic is highly concerned with preserving the lifespan and efficiency of major home appliances, such as tankless water heaters, boilers, and washing machines. These customers often exhibit higher disposable income and a proactive approach toward home maintenance and preventative infrastructure investment, recognizing the long-term cost savings associated with scale prevention.

A secondary, yet rapidly expanding, customer segment includes new home builders and property developers who incorporate water softeners as a standard feature, particularly in luxury or high-end residential projects, perceiving it as a significant value-add. Furthermore, customers with specific dermatological sensitivities, such as eczema or persistent dry skin, constitute a focused segment prioritizing the aesthetic and health benefits of softened water, driving demand for specialized, high-purity systems.

The market also targets environmentally conscious consumers who are shifting away from traditional salt-based systems toward salt-free alternatives. This segment prioritizes sustainability, minimizing water waste, and avoiding brine discharge, even if the initial investment for TAC or similar technologies is higher. Understanding the regional variations in water quality and consumer wealth is crucial for tailoring marketing efforts to these distinct customer profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Culligan International, Pentair plc, A. O. Smith Corporation, Kinetico Incorporated, 3M Company, EcoWater Systems (Marmon Water), Kenmore, WaterBoss, BWT Aktiengesellschaft, Watts Water Technologies, Inc., Harvey Water Softeners, NuvoH2O, Pelican Water Systems, Fleck Controls (Pentair), HydroFLOW, Halo Water Systems, GE Appliances (Haier), Morton Salt, Rheem Manufacturing Company, Aqua Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Water Softener System Market Key Technology Landscape

The technology landscape is dominated by ion exchange, which uses polymer resin beads charged with sodium ions to exchange calcium and magnesium ions as water passes through the tank. This mature technology is highly reliable and efficient for producing genuinely soft water across high flow rates. Continuous innovation within this segment focuses on optimizing resin life, developing higher capacity fine-mesh resins, and refining control valves (Fleck, Clack) to minimize water waste during the regeneration cycle, often using proportional brining techniques.

A significant shift is occurring with the rise of salt-free technologies, particularly Template Assisted Crystallization (TAC). TAC systems do not remove hard minerals but rather convert them into stable, non-scaling micro-crystals that pass harmlessly through plumbing. This appeals directly to the segment concerned about salt use, water conservation, and the environmental impact of brine discharge. While not producing chemically "soft" water, TAC offers a viable alternative for scale prevention, driving consumer acceptance and challenging the dominance of traditional ion exchange.

The most crucial emerging trend is the integration of digital and connectivity technologies. Modern systems incorporate volumetric controls, flow meters, and Wi-Fi connectivity, allowing for real-time monitoring and remote control via smartphone applications. This adoption of IoT enables features such as demand-initiated regeneration, low salt alerts, and system usage reports, significantly enhancing user convenience, efficiency, and allowing manufacturers to offer proactive service plans based on usage data.

Regional Highlights

The regional analysis reveals distinct market dynamics driven by geographical hard water prevalence, regulatory environments, and consumer spending power. North America, encompassing the United States and Canada, represents the largest and most established market segment. The high incidence of ground water hardness across major population centers, coupled with high per capita expenditure on residential amenities and robust distribution networks via home improvement retailers, ensures sustained market leadership. Furthermore, regulatory support and consumer awareness campaigns regarding water quality contribute to high penetration rates.

Europe constitutes a mature market where adoption is substantial, particularly in countries like the UK, Germany, and France, which experience localized severe hardness. The European market is characterized by a strong emphasis on efficiency and environmental compliance, driven by EU directives regarding water treatment and discharge standards. This focus promotes the adoption of technologically advanced, high-efficiency volumetric softeners and accelerates the shift toward non-polluting salt-free alternatives, maintaining a steady, albeit slower, growth trajectory compared to emerging markets.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. Factors fueling this growth include rapid infrastructural development, deteriorating municipal water quality resulting from industrialization, and the rapid expansion of the middle-class demographic in countries such as China, India, and Southeast Asian nations. Although penetration levels are currently lower than in the West, increasing urbanization and rising awareness about health and asset protection present immense untapped potential, with initial adoption often focusing on centralized softening solutions for high-rise residential complexes.

- North America (NA): Market leader; characterized by high consumer awareness, widespread hard water incidence, and robust investment in smart, connected water systems, particularly in the US Midwest and Southwest.

- Europe: Stable growth driven by strict environmental regulations and high demand for ultra-efficient, low-salt consumption systems; focus on regional brands and compliance with local standards.

- Asia Pacific (APAC): Highest CAGR anticipated due to rapid urbanization, increasing disposable incomes, and the urgent need for water quality improvement in developing economies; demand shifting from basic filtration to whole-house softening.

- Latin America (LATAM): Emerging market with increasing adoption in urban areas of Mexico and Brazil, driven by health concerns and protection of residential appliances; infrastructure investment is a critical growth precursor.

- Middle East and Africa (MEA): Growth concentrated in affluent urban centers, often requiring solutions tailored to extremely high salinity and specific desert region water profiles; adoption linked heavily to luxury residential construction projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Water Softener System Market.The competitive landscape of the Household Water Softener System Market is characterized by the presence of large, diversified multinational corporations and specialized water treatment firms. Market leadership is defined by technological innovation, brand trust, and the extent of the distribution and service network. Companies such as Culligan International, Pentair plc, and A. O. Smith Corporation maintain dominant positions globally, leveraging extensive product portfolios that span traditional ion exchange, salt-free alternatives, and high-tech digital control valves. Their strategies often involve strategic acquisitions to integrate niche technologies or expand geographical presence.

Mid-tier and specialized players, including Kinetico Incorporated and Harvey Water Softeners, focus intensely on niche segments, such as non-electric, kinetic-driven softeners (Kinetico) or high-efficiency twin-tank systems (Harvey), differentiating themselves through superior performance claims and lower operational costs. These companies often appeal to customers seeking highly engineered, premium solutions that promise long-term reliability and minimal environmental footprint. The successful integration of IoT capabilities and AI-driven monitoring is becoming a minimum requirement for all major players to maintain relevance in the smart home ecosystem.

The long-term competitive dynamics are increasingly influenced by e-commerce penetration, which favors manufacturers who can efficiently manage logistics, provide comprehensive online customer support, and offer easy-to-install DIY models (e.g., Kenmore, WaterBoss). Furthermore, the trend toward vertical integration, where companies control everything from resin manufacturing to final installation and service contracts, is strengthening the market positions of industry giants capable of ensuring consistent quality control and capturing greater profit margins across the value chain. Product differentiation based on certified efficiency ratings (like NSF certifications) remains a key tool for consumer trust.

- Culligan International

- Pentair plc

- A. O. Smith Corporation

- Kinetico Incorporated

- 3M Company

- EcoWater Systems (Marmon Water)

- Kenmore

- WaterBoss

- BWT Aktiengesellschaft

- Watts Water Technologies, Inc.

- Harvey Water Softeners

- NuvoH2O

- Pelican Water Systems

- Fleck Controls (Pentair)

- HydroFLOW

- Halo Water Systems

- GE Appliances (Haier)

- Morton Salt

- Rheem Manufacturing Company

- Aqua Systems

Frequently Asked Questions

Analyze common user questions about the Household Water Softener System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between salt-based and salt-free water softeners?

Salt-based (ion exchange) softeners chemically remove hardening minerals (calcium and magnesium) by replacing them with sodium ions, resulting in genuinely soft water. Salt-free systems (like Template Assisted Crystallization - TAC) condition the water by crystallizing minerals, preventing scale buildup, but the minerals remain in the water, meaning the water is technically still hard.

How often do household water softeners need maintenance?

Routine maintenance for ion exchange softeners primarily involves checking and replenishing the salt level in the brine tank, typically every 4 to 8 weeks, depending on water usage and hardness. Modern volumetric or AI-driven systems optimize regeneration, reducing the frequency of salt refill and internal wear, minimizing technical maintenance requirements.

Does softened water negatively affect health or plumbing?

Softened water is generally safe for consumption, but it contains a small amount of added sodium. Individuals on strict low-sodium diets should consult a physician or opt for a bypass line for drinking water. Softened water does not corrode plumbing; in fact, by removing scale-forming minerals, it protects pipes and appliances, extending their functional lifespan.

What is the typical lifespan and return on investment (ROI) for a water softener system?

A high-quality household water softener system typically has a lifespan of 10 to 15 years, with some components lasting longer. The ROI is realized through substantial savings on appliance repairs, reduced energy consumption (due to efficiency loss from scale buildup), and lower costs associated with soaps and detergents, often offsetting the initial investment within 3 to 5 years.

How does the hardness level of my water influence the required softener capacity?

Water hardness, measured in grains per gallon (GPG), is multiplied by the household's average daily water consumption to determine the total hardness removal capacity (grain capacity) needed between regenerations. High hardness levels (above 10 GPG) necessitate larger tank sizes and higher capacity resin to prevent excessive regeneration cycles and maintain performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager