HPL Boards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435282 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

HPL Boards Market Size

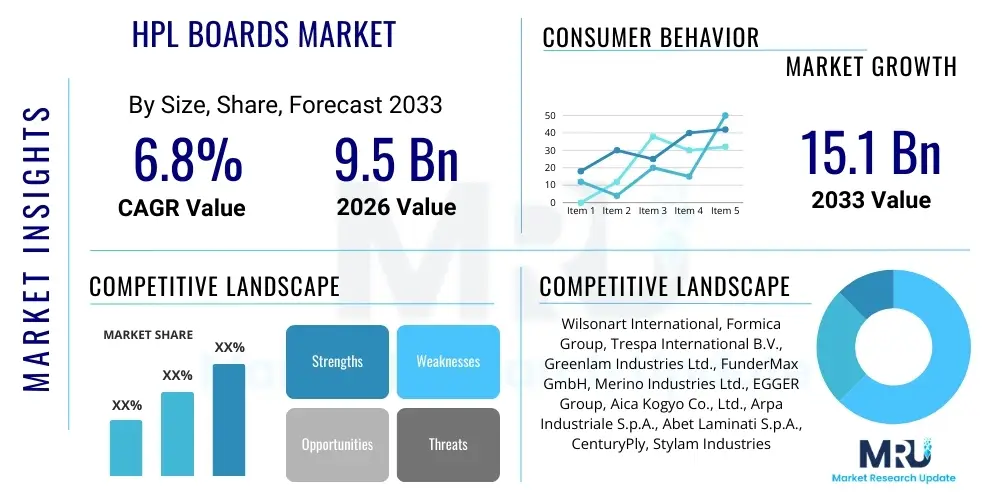

The HPL Boards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.1 Billion by the end of the forecast period in 2033.

HPL Boards Market introduction

The High-Pressure Laminate (HPL) Boards Market encompasses the manufacturing and distribution of decorative surface materials created by saturating layers of kraft paper with thermosetting resins, overlaying them with a printed decorative sheet, and then fusing them together under high pressure and temperature. This process results in a highly durable, scratch-resistant, and aesthetically versatile product widely utilized across various construction and interior design sectors. HPL boards are favored for their longevity and low maintenance requirements, making them an indispensable material in high-traffic commercial and residential environments globally. Their resistance to heat, moisture, and impact positions them superior to many traditional surfacing materials.

Major applications for HPL boards span furniture manufacturing, kitchen cabinetry, wall cladding, laboratory countertops, and high-wear flooring. The product's inherent benefits, such as customization options in terms of color, texture, and pattern, coupled with anti-bacterial and fire-retardant properties in specialized variants, significantly contribute to their market adoption. The driving factors for market growth include the burgeoning global construction industry, particularly in emerging economies, increasing consumer preference for aesthetically pleasing and durable materials, and stringent regulatory standards favoring sustainable and non-toxic building components. Furthermore, technological advancements leading to enhanced surface finishes, such as anti-fingerprint and soft-touch laminates, are expanding their appeal.

The core functionality of HPL boards lies in providing a protective and decorative surface layer for various substrates, typically particleboard, MDF, or plywood. The versatility of the product allows designers and architects to achieve diverse design goals, from mimicking natural wood and stone textures to introducing complex graphic patterns. As urbanization accelerates globally, the demand for efficient, space-saving, and long-lasting interior solutions drives the adoption of HPL boards in modular construction and prefabricated structures. Their suitability for both vertical and horizontal applications ensures a robust market presence across residential, commercial, healthcare, and educational infrastructure projects.

HPL Boards Market Executive Summary

The HPL Boards Market is poised for substantial growth driven by favorable macro-economic trends in infrastructure development and renovation activities across North America and Asia Pacific. Business trends indicate a shift towards sustainable manufacturing processes, with key players investing heavily in recycled materials and low-VOC (Volatile Organic Compound) resins to meet evolving environmental standards and consumer demands for green building products. Innovation in digital printing technology is enabling highly realistic and complex designs, thereby reducing the reliance on natural resources like rare woods and stones. Furthermore, consolidation is evident among manufacturers seeking to leverage economies of scale and optimize global distribution networks, impacting pricing strategies and competitive dynamics.

Regional trends highlight the Asia Pacific region as the dominant market, propelled by massive construction booms in countries like China, India, and Southeast Asian nations, fueled by rapid urbanization and government investments in smart city projects. North America and Europe maintain significant market shares, characterized by high demand for premium, specialized HPL products, including exterior grade compact laminates used for architectural cladding. Demand in these mature markets is often driven by renovation cycles and the pursuit of energy-efficient building envelopes, whereas growth in emerging regions is concentrated in basic decorative laminates for furniture and interior finishes.

Segment trends reveal that the Decorative HPL segment holds the largest market share due to its ubiquitous use in interior applications, but the Compact HPL segment is projected to exhibit the fastest growth rate. This accelerated growth is attributed to the increasing use of Compact HPL (which does not require a substrate) in heavy-duty applications such as laboratory furniture, exterior facades, and public restroom partitions, offering superior structural integrity and moisture resistance. The Residential end-use sector continues to be a major revenue contributor, however, the Commercial sector, encompassing hospitality, retail, and office spaces, is showing dynamic growth due to large-scale infrastructure projects requiring standardized, durable, and fire-resistant surfacing solutions.

AI Impact Analysis on HPL Boards Market

Common user questions regarding AI's impact on the HPL Boards market frequently center on efficiency gains in manufacturing (Can AI optimize resin mixing and pressing cycles?), supply chain resilience (How can AI predict raw material shortages or demand fluctuations?), and design personalization (Will AI tools allow for instantaneous, custom laminate design generation?). Users are keen to understand if AI can reduce material waste, improve quality control consistency by identifying minute surface defects instantaneously, and facilitate predictive maintenance on expensive production equipment. The overall sentiment suggests an expectation that AI will primarily drive operational excellence, leading to cost reduction and faster time-to-market for complex, custom designs, potentially altering the competitive landscape favoring manufacturers capable of early AI adoption in production lines and inventory management.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the HPL manufacturing process, moving beyond simple automation to sophisticated process optimization. In the initial stages, AI is being deployed for advanced quality control, where high-speed cameras coupled with ML models can analyze surface quality for flaws (e.g., bubbles, scratches, inconsistent coloration) far more accurately and quickly than human inspectors, ensuring higher product consistency. Furthermore, AI tools are enhancing supply chain forecasting by analyzing global commodity prices, logistics data, and construction project pipelines to predict demand spikes and optimize raw material (kraft paper, resins) procurement, minimizing inventory holding costs and mitigating potential disruptions.

In the domain of design and customer interaction, AI algorithms are enabling rapid prototyping and visualization. Designers can leverage generative AI tools to create thousands of unique, photorealistic HPL patterns and textures based on specific client inputs (color palettes, architectural styles, environmental factors), significantly reducing the design cycle time. For example, personalized HPL boards mimicking highly specific local wood grains or bespoke artistic patterns can be generated on demand. This shift towards mass customization, facilitated by AI-driven digital printing technologies, is expected to be a major differentiator, allowing manufacturers to cater precisely to niche market demands while maintaining production efficiency.

- AI-driven Predictive Maintenance: Optimizing press and impregnation machinery uptime, reducing unplanned maintenance costs by 15-20%.

- Enhanced Quality Control (QC): ML models detect microscopic surface imperfections, leading to a reduction in waste material and improvement in yield rate.

- Optimized Resin Formulation: AI algorithms fine-tuning resin ratios and curing parameters based on environmental variables and raw material batch variations for superior durability.

- Generative Design Systems: Rapid creation of custom, unique decorative HPL patterns based on user specifications, accelerating product launch cycles.

- Supply Chain Forecasting: Utilizing ML to predict fluctuations in paper pulp and resin pricing, securing favorable procurement contracts and inventory levels.

DRO & Impact Forces Of HPL Boards Market

The market dynamics of HPL Boards are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces influencing market expansion. The primary drivers include the inherent durability, hygienic properties, and aesthetic versatility of HPL boards, making them preferred materials in high-traffic and sensitive environments like healthcare and education facilities. The global trend towards urbanization and modular construction techniques significantly fuels demand, as HPL boards are ideal for factory-finished components. Opportunities arise from technological advancements, particularly the development of sustainable, formaldehyde-free, and specialty HPL products (e.g., anti-microbial, anti-fingerprint surfaces) that address specific end-user needs and command premium pricing. These forces create a positive momentum, establishing HPL as a foundational material in modern architecture.

However, the market faces significant restraints. The primary restraint is the volatility in the prices of key raw materials, namely kraft paper and thermosetting resins (phenolic and melamine resins), which are derivatives of petrochemicals, making production costs susceptible to crude oil price fluctuations. Furthermore, the increasing availability and competitive pricing of alternative surfacing materials, such as Medium Density Fiberboard (MDF) overlaid with low-pressure laminates (LPL) or specialized vinyl wraps, especially in budget-conscious residential markets, present a constraint. Regulatory hurdles related to fire safety and VOC emissions in certain geographies also necessitate costly retooling or reformulation efforts by manufacturers.

The collective impact forces suggest a moderately high growth potential, moderated by input cost pressures. The increasing global focus on sustainability acts as both a challenge and an opportunity: while it restrains traditional, less eco-friendly production methods, it simultaneously opens vast market potential for manufacturers who innovate towards bio-based resins and recycled content HPL boards. The durability factor remains the strongest positive impact force, ensuring HPL’s dominance over less resilient alternatives in commercial and heavy-duty industrial applications, guaranteeing sustained long-term demand despite short-term economic fluctuations in the construction sector.

Segmentation Analysis

The HPL Boards Market segmentation provides critical insights into the varied demands and growth dynamics across different product types, grades, end-use applications, and geographical regions. Segmentation by product type highlights the distinctions between standard HPL sheets, which are generally thinner and require a substrate, and Compact Laminates (CPL), which are significantly thicker, self-supporting, and designed for heavy-duty applications. Analysis by grade often separates the market into Interior Grade HPL, dominating the decorative market, and Exterior Grade HPL, which features enhanced UV resistance and weatherproofing essential for facade cladding. Understanding these segments is vital for manufacturers optimizing their product portfolios and distribution strategies to maximize penetration in specialized markets.

The end-use application segment further defines consumption patterns, primarily categorizing demand into Residential and Commercial sectors. The Residential sector drives volume through kitchen, bathroom, and general furniture applications, often prioritizing aesthetic appeal and cost-effectiveness. Conversely, the Commercial sector, encompassing healthcare, corporate offices, retail stores, and transportation, focuses intensely on performance criteria such as fire resistance, anti-microbial properties, and extreme durability, driving the demand for specialized and premium HPL boards. The growth rate of the Commercial segment is often tied directly to government and institutional spending on public infrastructure projects.

Furthermore, segmentation by resin type (Phenolic, Melamine, and Acrylic) is critical as it dictates the material properties, pricing, and suitability for specific environments. Phenolic resins provide the strength and core integrity, while melamine is used primarily for the decorative surface layer and wear resistance. Strategic focus on the fastest-growing segments, such as Compact Laminates and Exterior Grade HPL, especially in Asia Pacific and Europe, represents significant market opportunities for high-margin sales. Conversely, the standard Interior Grade segment remains highly competitive and price-sensitive, necessitating scale and efficiency improvements for profitability.

- By Type:

- Standard HPL Sheets

- Compact Laminates (CPL)

- Chemical Resistant Laminates

- Fire Retardant Laminates

- By Grade:

- Interior Grade HPL (Horizontal, Vertical)

- Exterior Grade HPL (Cladding, Balconies)

- By Application:

- Furniture and Cabinets

- Wall Cladding and Panels

- Flooring

- Countertops and Worksurfaces

- Laboratory Applications

- By End-Use Sector:

- Residential

- Commercial (Office, Retail, Hospitality)

- Institutional (Healthcare, Education)

- Industrial

Value Chain Analysis For HPL Boards Market

The HPL Boards market value chain commences with the upstream segment, dominated by raw material suppliers. Key raw materials include specialty kraft paper (impregnation paper), decorative papers (printed and overlay), and thermosetting resins, primarily phenolic resins for the core and melamine resins for the surface. The quality and stable supply of these materials directly impact the final product quality and manufacturing costs. Price volatility in petrochemical derivatives, which form the base for resins, necessitates robust procurement strategies, often involving long-term contracts and diversification of suppliers. Efficiency gains at this stage often revolve around adopting recycled content paper and developing bio-based resins to enhance sustainability credentials.

The midstream involves the manufacturing process itself, characterized by high-pressure presses and advanced impregnation lines. Manufacturers focus on maximizing production efficiency, minimizing material waste, and achieving consistent product quality through stringent temperature and pressure control during the lamination process. Key operational aspects include the specialization in different product grades (e.g., developing anti-microbial surfaces or specialized fire ratings) to capture specific vertical markets. Capital investment in modern, high-capacity machinery capable of handling various board dimensions and thicknesses is crucial for maintaining a competitive edge.

The downstream segment encompasses distribution, sales, and installation. HPL boards typically flow through a mix of direct and indirect distribution channels. Direct sales are common for large-scale commercial projects, where manufacturers supply directly to major construction contractors, original equipment manufacturers (OEMs) in the furniture sector, and specialized fabricators. Indirect channels rely on a network of distributors, wholesalers, and specialized retailers who manage inventory, provide localized cutting and edging services, and cater to smaller contractors and residential clients. Effective downstream management requires strong logistics capabilities and highly specialized sales teams familiar with architectural specifications and design trends, ensuring the product reaches the end-user efficiently and accurately for installation.

HPL Boards Market Potential Customers

The primary end-users and buyers of HPL boards span across the entire construction and design ecosystem, ranging from large-scale institutional developers to individual residential consumers and specialized industrial fabricators. Architectural firms and interior designers are highly influential potential customers, dictating material specifications for major commercial and institutional projects based on performance requirements (fire rating, anti-microbial needs) and aesthetic considerations. These specifiers often prefer manufacturers who offer comprehensive product catalogs, reliable technical support, and rapid access to samples and mock-ups. Understanding the specific compliance requirements of sectors like healthcare and food service is essential for targeting these high-value customers.

Another crucial group of potential customers comprises furniture manufacturers and OEMs, particularly those involved in modular kitchen and office furniture production. These buyers demand standardized product dimensions, competitive bulk pricing, and reliable long-term supply agreements, as HPL boards form the foundational surface material for their assembled goods. The growth of the flat-pack and ready-to-assemble furniture market globally provides a continuous high-volume demand base for HPL sheets. Furthermore, general contractors and construction companies represent direct buyers for products like exterior cladding and internal wall paneling in new construction and large renovation projects, prioritizing ease of installation and product warranty periods.

Specialized fabricators, who often purchase compact laminates, constitute a significant niche customer base, particularly serving laboratory equipment manufacturers, public transportation projects (trains, buses), and high-wear environment fit-outs (e.g., restrooms, lockers). These customers require specific structural grades and chemical resistance features. Finally, DIY enthusiasts and smaller residential renovation contractors purchase HPL boards through retail channels and distributors for small-scale improvements. Effective market penetration requires tailored marketing strategies addressing the technical needs of institutional buyers while offering accessible, appealing designs to the retail segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wilsonart International, Formica Group, Trespa International B.V., Greenlam Industries Ltd., FunderMax GmbH, Merino Industries Ltd., EGGER Group, Aica Kogyo Co., Ltd., Arpa Industriale S.p.A., Abet Laminati S.p.A., CenturyPly, Stylam Industries Ltd., Kronospan, OmniDecor, Polyrey SAS, Panolam Industries International, Royal Crown Laminates, Samrat Plywood. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HPL Boards Market Key Technology Landscape

The manufacturing technology for HPL boards centers on the saturation, drying, layering, and pressing processes, demanding high precision and consistency. Traditional batch pressing technology is gradually being supplemented or replaced by continuous pressing lines, particularly the double belt press system. Continuous presses offer significant advantages in terms of throughput, reduced material handling, and the ability to produce laminates in endless sheets or rolls, which reduces waste and increases operational efficiency, particularly for standardized products. This shift in machinery allows manufacturers to respond more flexibly to high-volume orders and maintain highly competitive pricing for standard HPL sheets, thereby defining the operational landscape for major global players.

Beyond the core pressing technology, advancements in decorative surface treatments and material formulation are pivotal. Digital printing technology is transforming the aesthetic versatility of HPL, allowing for high-resolution, photorealistic, and personalized designs that were previously impossible or cost-prohibitive. This technology facilitates mass customization, catering to niche market demands for unique textures, metallic effects, and precise color matching. Furthermore, nanotechnology is being integrated to engineer advanced performance characteristics, resulting in surfaces that are anti-fingerprint, self-healing against minor scratches, and possess enhanced anti-microbial properties, crucial for institutional applications like hospitals and laboratories.

Another essential technological trend is the focus on sustainability, necessitating innovation in resin chemistry and waste management. Manufacturers are increasingly utilizing formaldehyde-free phenolic resins and bio-based binding agents to comply with stringent European and North American air quality regulations (e.g., CARB and LEED standards). Additionally, advanced recycling processes are being developed to utilize post-industrial HPL waste, reducing landfill contribution and supporting a circular economy model. The convergence of high-precision digital printing, nanotechnology, and green chemistry represents the forefront of technological differentiation in the HPL Boards market, driving the transition from a commodity product to a high-performance, specialized material solution.

Regional Highlights

Geographically, the HPL Boards market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA), each presenting unique demand characteristics and growth drivers. The Asia Pacific region is expected to maintain its leadership position in terms of market share and exhibits the highest growth potential throughout the forecast period. This rapid expansion is primarily attributed to unprecedented infrastructural development, rapid urbanization, and massive investments in commercial and residential construction across China, India, and Southeast Asian nations like Vietnam and Indonesia. The sheer scale of population and ongoing housing projects ensures sustained demand for cost-effective and durable interior and exterior surfacing materials.

Europe represents a mature yet high-value market, characterized by stringent environmental regulations and a strong demand for specialized, high-performance HPL boards, particularly Exterior Grade Compact Laminates (CPL) used for sophisticated architectural facades and energy-efficient building envelopes. Countries like Germany, France, and the UK prioritize quality, design innovation, and sustainable production practices, driving market growth towards premium, low-VOC products. The renovation and retrofitting market, aiming to upgrade older building stock to modern energy standards, also provides a stable demand base for HPL solutions in this region.

North America, led by the United States and Canada, is a substantial consumer of HPL, driven by large-scale commercial constructions (corporate offices, healthcare), and a robust residential remodeling market. The region shows strong penetration of branded, customized products, with a high focus on performance specifications like fire rating and impact resistance mandated by commercial building codes. The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) countries, are witnessing increased demand fueled by ambitious mega-projects in hospitality, tourism, and real estate, requiring luxury yet durable interior finishes, often imported from European manufacturers.

- China: Dominant manufacturing base and largest consumer globally, driven by infrastructure scale and rapid urban housing projects. Focus on volume and domestic supply.

- India: High potential market experiencing significant growth due to government initiatives promoting affordable housing and expanding furniture manufacturing hubs.

- Germany: Key European market demanding high-quality, Exterior Grade HPL and prioritizing environmental certifications and sustainable production standards.

- United States: Large market driven by commercial construction and renovation cycles, strong demand for specialized and certified HPL products in healthcare and education sectors.

- GCC Countries (UAE, Saudi Arabia): High growth areas characterized by large-scale commercial and hospitality projects requiring durable and premium decorative laminates.

- Brazil: Leading Latin American market with increasing adoption of HPL in modular furniture manufacturing and residential construction improvements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HPL Boards Market.- Wilsonart International

- Formica Group

- Trespa International B.V.

- Greenlam Industries Ltd.

- FunderMax GmbH

- Merino Industries Ltd.

- EGGER Group

- Aica Kogyo Co., Ltd.

- Arpa Industriale S.p.A.

- Abet Laminati S.p.A.

- CenturyPly

- Stylam Industries Ltd.

- Kronospan

- OmniDecor

- Polyrey SAS

- Panolam Industries International

- Royal Crown Laminates

- Samrat Plywood

- Archidply Industries Ltd.

- Duroply Industries Limited

Frequently Asked Questions

Analyze common user questions about the HPL Boards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of HPL Boards over traditional LPL or veneers in commercial spaces?

HPL boards offer superior durability, high impact resistance, and enhanced resistance to moisture, heat, and chemicals compared to Low-Pressure Laminates (LPL) or traditional wood veneers. HPL is ideal for heavy-traffic commercial areas due to its longevity and lower maintenance requirements, often featuring anti-microbial variants crucial for institutional settings like hospitals.

How is the increasing focus on sustainability impacting the production and cost of HPL Boards?

Sustainability mandates are driving manufacturers to adopt formaldehyde-free resins and increase the use of recycled content in kraft paper, aligning with standards like LEED. While these changes may initially increase raw material costs, they provide a competitive advantage by meeting consumer and regulatory demands for green building materials, leading to higher long-term market acceptance and premium pricing for eco-friendly HPL variants.

What is the key difference between Standard HPL Sheets and Compact Laminates (CPL)?

Standard HPL sheets are thinner (typically 0.7mm to 1.5mm) and must be glued onto a substrate (MDF or particleboard). Compact Laminates (CPL) are much thicker (typically 3mm to 20mm), offering inherent structural rigidity and moisture resistance, allowing them to be self-supporting without a substrate. CPL is used primarily for heavy-duty applications like laboratory tables and exterior cladding.

Which geographical region exhibits the fastest growth potential for HPL Boards adoption?

The Asia Pacific (APAC) region, specifically emerging economies like India and Southeast Asia, exhibits the fastest growth potential. This is driven by massive, ongoing urbanization projects, increasing disposable income leading to higher demand for quality interior finishes, and rapid expansion of the modular furniture manufacturing sector in the region.

Are HPL boards suitable for exterior architectural cladding applications?

Yes, specialized Exterior Grade HPL boards, often thick Compact Laminates, are specifically engineered for architectural cladding. These products are manufactured with enhanced UV stabilizers and weather-resistant resins to prevent fading and delamination when exposed to harsh outdoor environmental conditions, adhering to specific building safety and fire resistance codes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HPL Boards Market Size Report By Type (6 - 8mm, 8 - 10mm, 10 - 12mm, 12 - 14mm, 14 - 16mm), By Application (Facades, Table Tops, Interior Decoration, Furniture, Kitchen Cabinets, Laboratory Counter Top, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- HPL Boards Market Statistics 2025 Analysis By Application (.), By Type (.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager