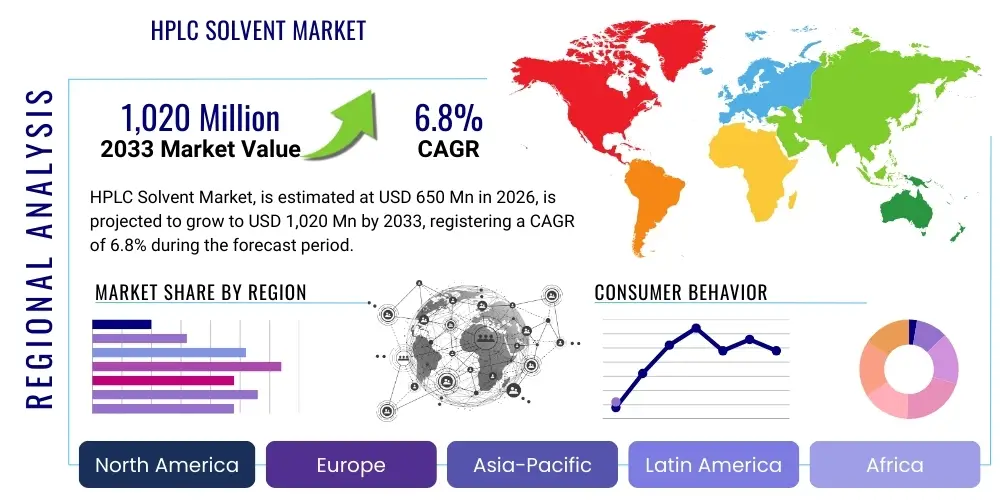

HPLC Solvent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435096 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

HPLC Solvent Market Size

The HPLC Solvent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

The consistent growth trajectory of the High-Performance Liquid Chromatography (HPLC) solvent market is fundamentally driven by the escalating demand for sophisticated separation and analytical techniques across critical industries such as pharmaceuticals, biotechnology, and food testing. As regulatory standards governing drug purity, environmental monitoring, and food safety become increasingly stringent globally, the reliance on high-quality, ultra-pure solvents for accurate and reproducible chromatographic results intensifies. This robust demand from regulated sectors, particularly for quality control and R&D activities, forms the backbone of the market's expansion, ensuring stable revenue streams throughout the forecast period.

Furthermore, technological advancements in HPLC instrumentation, including the widespread adoption of Ultra-High-Performance Liquid Chromatography (UHPLC) systems, necessitate solvents of even higher purity and lower particle contamination. UHPLC systems, characterized by faster analysis times and enhanced resolution, demand specialized, often gradient-grade, solvents to maximize performance and minimize column degradation. This trend is compelling solvent manufacturers to invest heavily in advanced purification and filtration technologies, thereby increasing the value proposition of premium solvent grades. The integration of automation and laboratory informatics systems further drives efficiency in laboratory operations, increasing the overall throughput and, consequently, the volume demand for high-grade HPLC solvents.

HPLC Solvent Market introduction

The HPLC Solvent Market encompasses the specialized segment of chemical reagents and mixtures specifically designed for use in High-Performance Liquid Chromatography (HPLC) and related techniques like UHPLC. These solvents, which function as the mobile phase, are critical components required for the separation, identification, and quantification of complex mixtures in various samples. Key product types include acetonitrile, methanol, water, tetrahydrofuran (THF), and various buffer solutions, all produced at ultra-high purity levels (such as LC-MS grade or gradient grade) to ensure minimal interference and baseline noise during chromatographic runs. The integrity and purity of these solvents directly influence the accuracy, sensitivity, and reproducibility of analytical results, making them indispensable consumables in modern analytical laboratories.

Major applications of HPLC solvents span quality control, drug discovery, clinical diagnostics, forensic science, and environmental analysis. In the pharmaceutical industry, they are extensively utilized for impurity profiling, stability testing, and active pharmaceutical ingredient (API) quantification, adhering strictly to pharmacopeial guidelines. The surging biotechnology sector leverages these solvents for protein and peptide analysis, proteomics, and therapeutic monitoring. The primary benefit of using certified HPLC solvents is the assurance of analytical integrity, reducing costly re-runs and method development failures. Driving factors for market growth include the rising prevalence of chronic diseases necessitating drug development, increasing investments in R&D infrastructure worldwide, and the burgeoning regulatory mandates requiring sophisticated chemical testing, particularly in emerging economies where industrial expansion is accelerating rapidly.

The complexity of modern separation science, coupled with the miniaturization of analytical systems and the push towards higher sensitivity detection methods (like coupling HPLC with Mass Spectrometry, i.e., LC-MS), continuously elevates the quality specifications for HPLC solvents. Manufacturers are focused on reducing trace metal impurities, non-volatile residues, and maximizing UV transparency. The transition towards greener chemistry and sustainable laboratory practices is also influencing the market, prompting the development and greater adoption of less toxic or bio-based solvent alternatives. This commitment to both purity and environmental responsibility ensures that the HPLC solvent market remains a dynamic and innovation-driven segment within the broader analytical instruments consumables landscape.

HPLC Solvent Market Executive Summary

The HPLC Solvent Market demonstrates robust resilience driven primarily by non-cyclical demand from the pharmaceutical and clinical research sectors, supported by sustained global investments in precision medicine and biopharmaceuticals. Business trends show a distinct shift towards premium, specialized grades, particularly LC-MS and UHPLC grades, as laboratories upgrade their instrumentation to achieve higher throughput and greater analytical sensitivity. Key market players are focusing on vertical integration, ensuring control over raw material sourcing and purification processes to maintain competitive pricing and certified quality standards. Strategic alliances and geographic expansions into high-growth APAC markets characterize the current competitive landscape, aiming to capitalize on increasing government funding for academic research and expanding contract research organization (CRO) activities.

Regionally, North America and Europe maintain dominance, owing to established pharmaceutical giants, stringent regulatory frameworks (FDA, EMA), and high adoption rates of advanced analytical techniques. However, the Asia Pacific region is forecast to exhibit the highest CAGR, propelled by rapid industrialization in China and India, significant growth in generic drug manufacturing, and improving accessibility to sophisticated laboratory equipment. Regional trends also show a localized preference for specific solvent types; for instance, methanol dominates general separation tasks due to cost-effectiveness, while acetonitrile retains its position for high-resolution, complex separations, often involving biotherapeutics. Regulatory pressures regarding solvent disposal and environmental impact are also influencing regional purchasing decisions, favoring suppliers who offer comprehensive waste management solutions or environmentally friendly alternatives.

Segment trends reveal that the volume segment remains significant, but the value growth is concentrated within the gradient and specialized solvent grades. By application, the Pharmaceutical & Biotechnology segment maintains the largest market share, driven by mandated quality control protocols and expansive R&D pipelines focused on novel therapeutics. Furthermore, the rising popularity of biosimilars and biologics increases the demand for specialized purification solvents, particularly those optimized for preparative chromatography. In terms of packaging, larger bulk containers are preferred in high-volume industrial settings, while small, pre-packaged volumes optimized for UHPLC systems are increasingly sought after by academic and R&D labs requiring stringent batch consistency and minimal solvent exposure. This strategic segmentation based on purity, application, and packaging configuration is crucial for market stakeholders to tailor their product offerings effectively.

AI Impact Analysis on HPLC Solvent Market

User queries regarding AI's influence on the HPLC Solvent Market primarily center on three themes: optimization of method development, prediction of solvent behavior (retention time/selectivity), and automation of chromatographic processes reducing human error and waste. Users are keen to know if AI can reduce reliance on trial-and-error methods, thereby minimizing the volume of solvents consumed during protocol establishment. Concerns often revolve around whether predictive models can accurately replace traditional wet-lab experiments, especially for complex chiral separations or challenging sample matrices. The general expectation is that AI will enhance efficiency, increase analytical throughput, and facilitate the transition towards greener, more sustainable chromatography by recommending optimal solvent mixtures and flow rates, ultimately impacting purchasing patterns towards more specialized, validated solvent kits optimized for AI-driven methods.

AI's role is not directly related to the manufacturing of the solvents themselves, but it profoundly influences the application side, which dictates solvent demand and grade specifications. Machine learning algorithms are now being used to analyze vast datasets generated by chromatographic runs, allowing for highly accurate predictions of separation quality based on mobile phase composition (solvent type, ratio, pH, temperature). This capability streamlines method validation and reduces the iterative steps required by traditional approaches, leading to faster time-to-market for new analytical methods. By predicting optimal conditions, AI reduces the duration and complexity of the experimentation phase, translating to less usage of solvents during the R&D process but potentially increasing demand for highly specialized, certified reference standards and high-purity solvents used in the final, optimized method.

Furthermore, the integration of AI with laboratory robotic systems and automated HPLC/UHPLC instruments allows for continuous, real-time monitoring and dynamic adjustment of mobile phase parameters. This optimization capability ensures maximum column life and efficiency, reducing the risk of baseline drift caused by solvent inconsistencies. While this precision might marginally reduce total volumetric consumption in certain R&D labs, the overall market growth remains strong due to the expanding base of pharmaceutical and environmental testing requirements. The primary long-term impact of AI is the standardization of chromatographic protocols, necessitating solvent suppliers to focus heavily on superior batch-to-batch consistency, which is a key requirement for AI model reliability and data integrity.

- AI optimizes chromatographic method development, reducing the solvent volume consumed during R&D phases.

- Machine Learning predicts optimal solvent composition and gradients, enhancing separation efficiency and reducing waste.

- AI-driven automation increases HPLC throughput, requiring consistent, high-purity solvent batches for reliable data generation.

- Predictive modeling favors the adoption of standardized, LC-MS grade, and certified reference solvents.

- Data analytics capabilities improve solvent quality control monitoring, enhancing supplier accountability regarding batch consistency.

DRO & Impact Forces Of HPLC Solvent Market

The dynamics of the HPLC Solvent Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical Impact Forces shaping its trajectory. The primary driver is the exponential growth in the global pharmaceutical and biotechnology industries, fueled by aging populations, increasing chronic disease prevalence, and a robust pipeline of novel drugs, including complex biologics. This sector requires high-volume, continuous consumption of ultra-pure solvents for mandatory R&D, quality control, and manufacturing purity testing. Simultaneously, strict global regulatory standards established by bodies like the FDA and EMEA mandate the use of high-performance analytical techniques, further cementing the essential nature of certified HPLC solvents. This strong, non-cyclical demand ensures market stability and consistent expansion.

However, the market faces significant restraints, primarily revolving around the high cost associated with the ultra-purification required for LC-MS and gradient-grade solvents, making them prohibitively expensive for smaller academic labs or developing economy markets. Furthermore, the volatility and price fluctuations of key raw materials, such as crude oil derivatives used to produce acetonitrile and methanol, directly impact solvent manufacturing costs and market pricing. A crucial constraint is the increasing environmental concern regarding the disposal of large volumes of organic solvents, leading to stricter waste management regulations. This regulatory pressure forces end-users to adopt expensive solvent recycling systems or seek greener alternatives, slowing the volume growth of traditional, high-consumption methods.

Opportunities for growth are concentrated in emerging technologies and geographic expansion. The rapid adoption of UHPLC and two-dimensional chromatography (2D-LC) creates specific demand for advanced, specialized solvent formulations capable of operating under extreme pressure and temperature conditions. Furthermore, the burgeoning field of clinical diagnostics and personalized medicine represents a significant opportunity, as HPLC-based methods are increasingly used for biomarker analysis and therapeutic drug monitoring (TDM). Geographically, untapped potential in the Asia Pacific and Latin American markets, characterized by improving healthcare infrastructure and expanding domestic pharmaceutical manufacturing capabilities, offers substantial avenues for market penetration and establishing new supply chains for both bulk and specialized solvent grades. These forces collectively propel the market forward while demanding continuous innovation in sustainability and purity standards.

Segmentation Analysis

The HPLC Solvent Market is meticulously segmented based on product type, grade, application, and region, reflecting the diverse and highly technical requirements of various end-user industries. Product type differentiation is critical as it relates directly to the chemical properties required for separation, with key segments including Acetonitrile, Methanol, Water (often ultrapure or deionized), and various specialized organic modifiers and buffers. Grade segmentation, arguably the most vital in terms of market value, separates standard HPLC grade from premium grades like Gradient Grade, UHPLC Grade, and the highly specialized LC-MS Grade, catering to advanced analytical needs requiring extremely low background noise and metal impurity levels. Application segmentation highlights the dominance of pharmaceuticals and environmental testing, where high analytical rigor is paramount.

- By Product Type:

- Acetonitrile

- Methanol

- Water (HPLC Grade)

- Tetrahydrofuran (THF)

- Buffer Solutions

- Others (e.g., Isopropanol, Hexane)

- By Grade:

- HPLC Grade

- Gradient Grade

- UHPLC Grade

- LC-MS Grade

- Preparative Grade

- By Application:

- Pharmaceutical & Biotechnology

- Academics & Research Laboratories

- Food & Beverage Testing

- Environmental Testing

- Clinical Diagnostics

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For HPLC Solvent Market

The value chain for the HPLC Solvent Market is characterized by highly specialized raw material sourcing, capital-intensive purification, sophisticated logistics, and direct distribution channels emphasizing technical support and quality assurance. Upstream analysis begins with the procurement of bulk, commodity-grade chemicals (like methanol and acetonitrile) typically derived from petrochemical or fermentation processes, along with ultra-pure water and various buffer components. The critical value addition stage involves rigorous purification, distillation, and filtration processes (often 0.2µm filtration for HPLC grade and sub-micron filtration for UHPLC/LC-MS grades) to remove trace metals, non-volatile residues, and particulates, ensuring the solvents meet stringent analytical standards. Investment in high-tech purification equipment and dedicated cleanroom facilities is essential at this stage, establishing high barriers to entry.

The distribution channel often involves a blend of direct sales models, particularly for large pharmaceutical accounts requiring highly customized supply logistics, and indirect distribution through specialized laboratory supply distributors (such as Thermo Fisher Scientific, VWR, etc.) who manage warehousing and rapid delivery to a diverse customer base, including academic institutions and smaller CROs. Direct sales allow manufacturers to maintain strict quality control throughout the supply chain and provide detailed technical documentation and certification of analysis (CoA) for every batch, which is mandatory for GMP-compliant environments. Distributors, conversely, provide inventory management and local market access, especially in geographically fragmented or emerging markets, offering crucial last-mile connectivity.

Downstream analysis focuses on the end-users—laboratories—who integrate these solvents into complex analytical workflows. The usage is driven by the application: high-volume consumption in quality control labs for routine testing, versus highly precise, low-volume consumption in advanced R&D and LC-MS labs. The value chain culminates in the proper disposal or recycling of the spent mobile phase, an increasingly regulated activity. Forward-thinking manufacturers are adding value by offering closed-loop systems, solvent management services, and technical consultation regarding method optimization, enhancing customer loyalty and reinforcing their position as comprehensive analytical solution providers rather than just chemical suppliers. This integrated approach ensures the efficiency and compliance of the entire analytical process, maximizing customer utility from the high-purity solvent purchase.

HPLC Solvent Market Potential Customers

Potential customers for the HPLC Solvent Market are primarily analytical laboratories across highly regulated and research-intensive industries, demanding consumables that ensure accuracy and compliance. The largest and most influential customer segment is the Pharmaceutical and Biotechnology industry, including major drug manufacturers, generics companies, and contract research organizations (CROs). These entities rely on HPLC solvents for critical processes such as API quantification, impurity analysis, stability studies, and large-scale preparative chromatography for purification, making them high-volume consumers of both standard and premium LC-MS grade solvents. Their purchasing decisions are heavily influenced by regulatory compliance (cGMP), consistency of batch quality, and reliable supply chains, often preferring suppliers who offer comprehensive quality documentation.

Academic and government research laboratories represent another significant customer base, often driven by government grants and foundational research mandates. While their individual purchasing volumes might be smaller than industrial consumers, their collective demand for a wide variety of specialized and high-purity solvents for method development, novel compound synthesis analysis, and fundamental chemical research is substantial. This segment often prioritizes cost-effectiveness but will procure specialized grades when required for high-impact publications or advanced separation techniques like proteomics. Furthermore, government regulatory and environmental agencies, such as the EPA, utilize HPLC techniques extensively for environmental monitoring (water quality, pesticide residue analysis) and forensic science, ensuring a stable, non-cyclical demand for certified solvents.

The Food and Beverage sector, along with Clinical Diagnostic labs, are rapidly expanding segments. Food safety testing requires HPLC for detecting contaminants, verifying ingredient authenticity, and analyzing nutritional content, particularly in processed foods and beverages, driving demand for solvents tailored for specific food matrices. Clinical laboratories utilize these solvents for therapeutic drug monitoring, toxicology screening, and newborn screening, often requiring UHPLC compatibility and extremely low background noise to ensure high sensitivity in complex biological samples. These diverse end-users collectively underscore the broad applicability of HPLC technology and ensure sustained demand across multiple, critical infrastructure sectors globally, validating the market's long-term growth potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor Inc., Thermo Fisher Scientific Inc., Honeywell International Inc., FUJIFILM Wako Pure Chemical Corporation, Waters Corporation, GFS Chemicals, Inc., Tedia Company, Inc., Regis Technologies, Inc., Bio-Rad Laboratories, Inc., Kanto Chemical Co., Inc., Loba Chemie Pvt. Ltd., Scharlab S.L., Spectrum Chemical Mfg. Corp., Daejung Chemicals & Metals Co., Ltd., EMD Millipore (A subsidiary of Merck KGaA), Sigma-Aldrich (A subsidiary of Merck KGaA), VWR International, LLC (Part of Avantor Inc.), J.T. Baker (Part of Avantor Inc.), Fisher Scientific (Part of Thermo Fisher Scientific). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HPLC Solvent Market Key Technology Landscape

The technology landscape for the HPLC Solvent Market is dominated by advanced purification and quality assurance methodologies aimed at achieving ultra-trace level purity essential for modern chromatography. The primary technology utilized is multi-stage distillation and proprietary filtration processes, often involving specialized membrane filters (pore sizes down to 0.1 µm or less) to eliminate particulate matter that could damage sensitive HPLC columns. For LC-MS grade solvents, manufacturers employ sophisticated, often proprietary, technologies to minimize non-volatile residues and trace metal ions, which are critical contaminants that cause significant ion suppression or enhancement in mass spectrometry detection. The reliance on these technologies directly correlates with the ability of a supplier to meet the exacting standards of the biopharmaceutical industry, where analytical consistency across global sites is non-negotiable.

Beyond purification, significant technological advances are seen in quality control and packaging technology. Modern solvent manufacturing relies on continuous online monitoring systems, employing high-sensitivity detectors like UV spectrophotometers and residual analysis instruments to confirm purity in real-time. Packaging technology has evolved to include inert, high-barrier materials (e.g., nitrogen-blanketed bottles or aluminum pouches) designed to prevent absorption of atmospheric contaminants, especially water and carbon dioxide, which can alter the mobile phase composition and affect retention times. This focus on packaging integrity ensures the solvent retains its certified purity from the moment of bottling until it is opened in the laboratory, a key factor for UHPLC applications that are highly sensitive to small environmental changes.

Furthermore, an emerging technological trend is the development of ‘green’ and sustainable chromatographic solvents and methodologies. This includes utilizing subcritical water as a mobile phase substitute, or developing bio-based alternatives to traditional petrochemical solvents like methanol and acetonitrile, such as those derived from agricultural waste streams. While these alternatives are still nascent, the underlying technology involves complex chemical synthesis and validation to ensure they match or exceed the performance characteristics of conventional solvents. The drive towards sustainability is also fostering technologies for robust laboratory solvent recycling systems, using fractional distillation and purification techniques to reuse spent organic phases, reducing hazardous waste volume and offering a cost-saving measure for high-throughput laboratories.

Regional Highlights

Regional dynamics play a significant role in shaping the demand patterns and regulatory compliance requirements within the HPLC Solvent Market. North America, specifically the United States, commands the largest market share globally. This dominance is attributed to the presence of the world's leading pharmaceutical and biotechnology companies, substantial government and private funding for life science research, and stringent regulatory environments established by the FDA. The high adoption rate of advanced analytical instruments, including state-of-the-art UHPLC and LC-MS systems, drives consistent demand for premium, specialized solvent grades, making the region a key driver of value growth. The robust ecosystem of academic research centers and contract testing laboratories further solidifies North America’s leading position.

Europe represents the second-largest market, characterized by strong regulatory compliance and a focus on innovation in areas such as food testing, environmental monitoring, and clinical diagnostics. Countries like Germany, the UK, and Switzerland host major pharmaceutical and chemical manufacturers who invest heavily in R&D and quality control, ensuring a steady demand for high-grade consumables. European Union mandates regarding environmental protection also accelerate the adoption of solvent recycling technologies and demand for suppliers who can demonstrate adherence to green chemistry principles. The mature market structure in Europe necessitates a focus on product differentiation, specialized application support, and rigorous supply chain management to maintain competitive advantage.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This rapid expansion is primarily driven by expanding generic drug manufacturing bases in India and China, increasing governmental investment in healthcare infrastructure, and the influx of foreign direct investment into local R&D centers. While cost sensitivity remains a factor in certain sub-segments, the growing need for quality control in export-oriented manufacturing and the rising demand for sophisticated testing in food safety (especially in high-population centers) are fueling the transition from standard to high-purity HPLC solvents. Localized manufacturing and optimized distribution channels are becoming critical success factors for international players seeking to capitalize on the vast growth potential offered by this diverse region.

- North America: Market leader, driven by major pharma R&D and high penetration of UHPLC/LC-MS technologies; high demand for premium grades.

- Europe: Strong regulatory focus (EMA), high adoption in environmental and food testing; emphasis on sustainable solvents and recycling technologies.

- Asia Pacific (APAC): Highest projected CAGR; fueled by generic drug manufacturing expansion, rising health expenditures, and increasing analytical quality control standards in China and India.

- Latin America & MEA: Emerging markets characterized by increasing investment in basic healthcare infrastructure and initial growth in domestic pharmaceutical production, creating opportunities for bulk solvent suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HPLC Solvent Market.- Merck KGaA

- Avantor Inc.

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- FUJIFILM Wako Pure Chemical Corporation

- Waters Corporation

- GFS Chemicals, Inc.

- Tedia Company, Inc.

- Regis Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Kanto Chemical Co., Inc.

- Loba Chemie Pvt. Ltd.

- Scharlab S.L.

- Spectrum Chemical Mfg. Corp.

- Daejung Chemicals & Metals Co., Ltd.

- EMD Millipore (A subsidiary of Merck KGaA)

- Sigma-Aldrich (A subsidiary of Merck KGaA)

- VWR International, LLC (Part of Avantor Inc.)

- J.T. Baker (Part of Avantor Inc.)

- Fisher Scientific (Part of Thermo Fisher Scientific)

Frequently Asked Questions

Analyze common user questions about the HPLC Solvent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for LC-MS grade HPLC solvents?

The primary driver is the increasing integration of Mass Spectrometry (MS) with HPLC (LC-MS) in pharmaceutical R&D and clinical diagnostics. LC-MS grade solvents ensure extremely low levels of non-volatile residues and metal ions, preventing ion suppression or enhancement, which is critical for achieving the high sensitivity and accuracy required in trace analysis applications, particularly in proteomics and impurity profiling.

How is the volatility of raw material prices impacting the HPLC solvent market?

Raw materials like acetonitrile and methanol are often derived from petrochemical processes, making their pricing highly susceptible to crude oil price volatility. This fluctuation directly impacts the cost of goods for solvent manufacturers, leading to price instability for end-users and challenging inventory management, particularly for high-volume consumers in generics manufacturing.

Which application segment holds the largest share in the HPLC Solvent Market?

The Pharmaceutical and Biotechnology segment consistently holds the largest market share. This dominance is due to mandatory quality control testing (stability, purity, dissolution), extensive drug discovery pipelines, and the high-volume consumption required for preparative chromatography used in the large-scale purification of APIs and therapeutic biologics.

What are the key technical differences between HPLC Grade and UHPLC Grade solvents?

UHPLC Grade solvents possess significantly lower particle counts and reduced non-volatile residues compared to standard HPLC Grade. This enhanced purity is necessary because Ultra-High-Performance Liquid Chromatography (UHPLC) systems use columns packed with smaller particles (sub-2µm), which are highly susceptible to clogging and baseline noise from impurities, demanding superior solvent filtration and consistency.

How are environmental regulations influencing the future development of HPLC solvents?

Environmental regulations are increasingly restricting the use and disposal of hazardous organic solvents. This trend is driving manufacturers and researchers toward developing greener alternatives, such as bio-based solvents, and implementing advanced laboratory solvent recycling technologies to minimize hazardous waste and improve overall laboratory sustainability and compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Microporous Membrane Filtration Market Statistics 2025 Analysis By Application (Dialysis, Fluid Clarification/Purification, Gas Filtration/Particle Control, Microbiological Investigations, HPLC Solvent Filtration, Sample Preparation, Other), By Type (Cellulose Acetate, Cellulose Nitrate (Collodion), Polyamide (Nylon), Polycarbonate, Polypropylene, Polytetrafluoroethylene, Ceramic Membrane, Metal Membrane, Molecular Sieve Composite Membrane), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- HPLC Solvent Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Normal Phase HPLC, Reverse Phase HPLC), By Application (Pharmaceutical, Biotechnology Industry, Life Sciences, Environmental Testing, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager