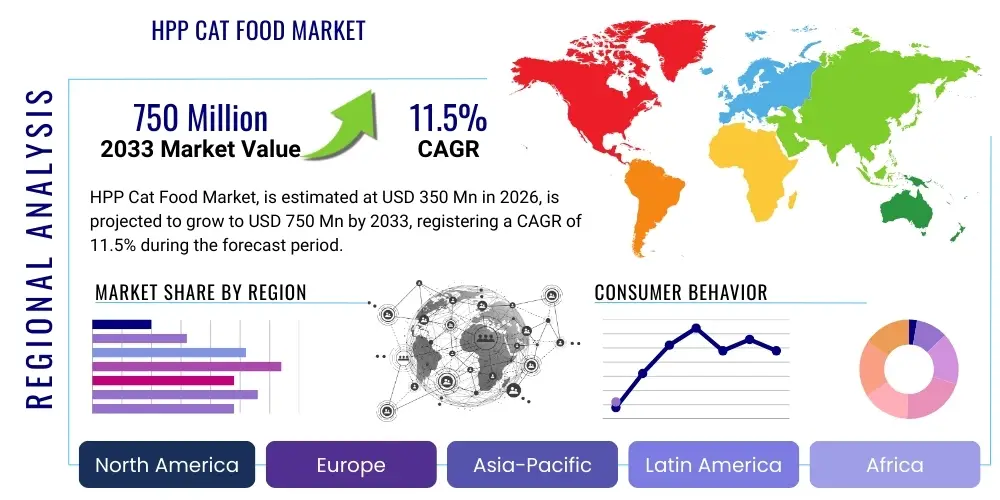

HPP Cat Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434988 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HPP Cat Food Market Size

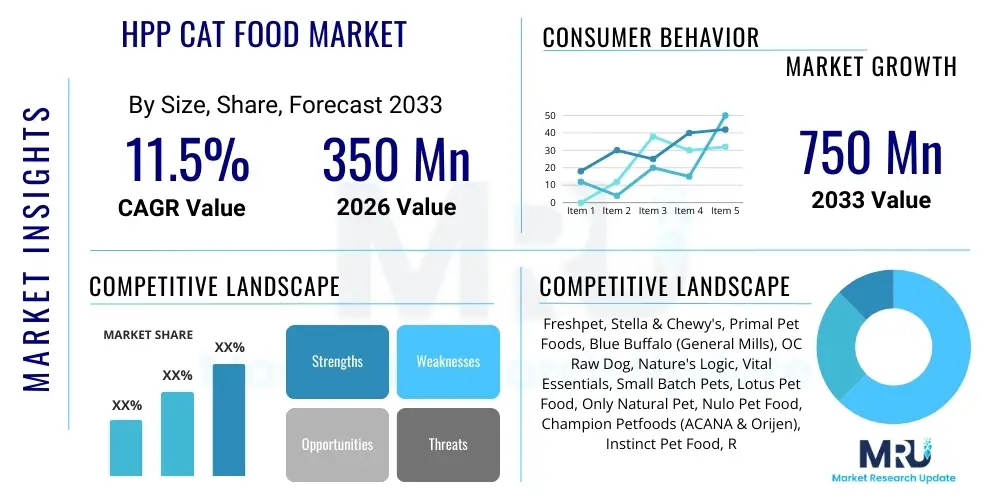

The HPP Cat Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 350 million in 2026 and is projected to reach USD 750 million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the increasing consumer preference for premium, minimally processed pet nutrition that retains superior nutritional integrity and palatability compared to traditionally heat-treated alternatives. The application of High-Pressure Processing (HPP) technology addresses critical concerns related to food safety in raw pet food diets while preserving essential vitamins, minerals, and natural flavors, positioning it as a key disruptive technology in the specialized pet food segment.

HPP Cat Food Market introduction

The High-Pressure Processing (HPP) Cat Food Market encompasses specialized feline nutritional products treated with ultra-high hydrostatic pressure (typically 400 to 600 MPa) to inactivate pathogenic microorganisms, such as Salmonella, E. coli, and Listeria, without relying on high temperatures. This non-thermal pasteurization technique is revolutionizing the raw and fresh pet food sectors by ensuring microbiological safety while maintaining the raw-like qualities of ingredients. The key applications of HPP technology in cat food include treating fresh refrigerated meals, raw frozen diets, and specific protein components used in limited ingredient formulations, thereby appealing directly to pet owners prioritizing food safety and holistic nutrition.

The primary benefits of HPP cat food products include significantly extended shelf life under refrigeration, superior nutrient retention compared to conventional cooking methods, enhanced palatability resulting from preserved natural textures and flavors, and a clean-label status due to the elimination of chemical preservatives. This technology allows manufacturers to offer products that align perfectly with the pet humanization trend, where consumers demand the same quality standards and processing transparency for their pets' food as they do for their own. The superior safety profile addresses the longstanding consumer and regulatory concerns associated with raw feeding, making HPP treated products a viable and highly sought-after compromise.

Driving factors for the market’s expansion are multifaceted, including the rising incidence of pet allergies and digestive sensitivities driving demand for novel protein and limited ingredient diets (LIDs), where HPP excels in preserving ingredient integrity. Furthermore, the strong expansion of the premium pet food segment, supported by rising disposable incomes in developed and rapidly developing economies, fuels investment in advanced processing technologies like HPP. The technological advancements leading to more efficient and cost-effective HPP equipment are also lowering barriers to entry for smaller, innovative pet food manufacturers, consequently accelerating product diversity and market availability across various distribution channels, particularly e-commerce and specialty retail.

- Market Introduction: Specialized feline nutrition treated using ultra-high hydrostatic pressure for pathogen inactivation and shelf life extension.

- Product Description: Raw or fresh refrigerated cat food that maintains superior nutrient and flavor profiles due to non-thermal pasteurization.

- Major Applications: Safety enhancement of raw diets, preservation of fresh meals, and treatment of limited ingredient formulations.

- Benefits: Extended refrigerated shelf life, superior nutrient retention, enhanced palatability, and microbiologically safer raw-like products.

- Driving Factors: Pet humanization trend, increasing demand for clean-label and minimally processed foods, rising concerns over raw food safety, and advancements in HPP equipment efficiency.

HPP Cat Food Market Executive Summary

The HPP Cat Food Market is characterized by robust growth, primarily propelled by fundamental shifts in consumer values towards pet wellness and premium nutrition. Business trends indicate a strong move towards vertical integration, with HPP equipment manufacturers partnering directly with pet food producers or offering HPP as a service (HPP tolling) to streamline operations and manage the high initial capital investment required for proprietary equipment. Furthermore, marketing strategies increasingly focus on clinical nutrition claims and scientific backing for the preservation benefits of HPP, differentiating these products from mass-market alternatives. The competitive landscape is heating up, with established premium brands adopting HPP to fortify their market position and numerous innovative startups entering the niche with highly specialized, single-protein formulations, often sold directly to consumers (D2C) via subscription models.

Regionally, North America currently dominates the HPP Cat Food Market, driven by high pet ownership rates, a deeply entrenched culture of pet humanization, and the early adoption of advanced food safety technologies. Europe follows closely, with countries like the UK, Germany, and France showing significant growth spurred by stringent food safety regulations and a growing willingness among consumers to pay a premium for certified, safe raw diets. The Asia Pacific region, particularly countries such as Japan and South Korea, is emerging as a high-potential market, characterized by rapidly increasing discretionary spending on pets and an appreciation for high-quality, scientifically validated nutritional products. Infrastructure development in cold chain logistics is crucial for the success of HPP products, which rely heavily on refrigerated storage and transport, especially in emerging markets.

Segment-wise, the market is broadly segmented by formulation (raw, fresh/refrigerated), ingredient type (single-protein, multi-protein), and distribution channel (specialty pet stores, e-commerce). The raw frozen segment, post-HPP treatment, remains particularly strong as it offers the nutritional benefits of raw feeding without the corresponding pathogen risk, positioning it as a hybrid solution. E-commerce is rapidly gaining traction as the preferred distribution channel, offering convenience, subscription flexibility, and direct access to niche brands that specialize exclusively in HPP-treated meals. This channel facilitates detailed transparency regarding processing and ingredient sourcing, which is highly valued by the target consumer base—affluent, educated pet owners focused on preventative health and wellness.

- Business Trends: Increased adoption of HPP tolling services, strategic partnerships between equipment providers and pet food brands, and enhanced focus on D2C subscription models for fresh, high-quality products.

- Regional Trends: North America maintaining dominance due to high consumer spending and technological acceptance; Asia Pacific emerging as the fastest-growing market driven by urbanization and rising disposable income allocated to pet care.

- Segments Trends: Significant demand growth in the raw frozen (HPP-treated) and fresh refrigerated segments; E-commerce solidifying its position as the primary sales channel for specialized premium foods.

AI Impact Analysis on HPP Cat Food Market

User queries regarding AI's influence in the HPP Cat Food Market typically center around optimizing production efficiency, enhancing food safety monitoring, and personalizing pet nutrition. Common questions ask how AI can predict ingredient supply chain disruptions, whether machine learning models can improve HPP cycle parameters for specific protein types (e.g., maximizing pathogen kill rate while minimizing nutrient degradation), and how data analytics can be used to tailor HPP product offerings based on specific breed dietary needs or geographical allergy prevalence. Users are keenly interested in the potential for AI-driven sensors to provide real-time microbial load assessment before and after HPP processing, providing an unprecedented level of quality assurance and traceability that surpasses current manual testing protocols. The overarching expectation is that AI will make the premium HPP products more accessible, safer, and highly customized.

In response to these concerns, AI is increasingly being integrated into the operational aspects of HPP cat food manufacturing. Predictive analytics models are deployed to forecast consumer demand patterns, optimizing inventory levels of perishable HPP products and reducing waste related to short shelf life. Furthermore, machine vision systems equipped with AI algorithms are used on the production line to ensure packaging integrity and identify subtle quality defects instantly, which is crucial for maintaining the sterility achieved through HPP. This technological integration enhances operational resilience, minimizes batch contamination risks, and supports manufacturers in scaling production without compromising the stringent quality required for minimally processed foods.

Beyond manufacturing, AI significantly impacts product development and customer relationship management. Deep learning models analyze complex data sets combining pet health records, dietary preferences, and localized veterinary recommendations to inform the creation of highly specialized HPP formulations, such as those targeting specific urinary health or coat conditions. Chatbots and AI-powered recommendation engines on D2C platforms provide personalized dietary advice and subscription management, enhancing customer engagement and driving repeat purchases. Thus, AI transforms HPP cat food from a niche premium product into a personalized, data-backed nutritional solution, reinforcing consumer trust and expanding the market’s perceived value proposition significantly.

- AI optimization of HPP machine cycles to enhance pathogen inactivation efficiency specific to protein matrix.

- Predictive supply chain analytics to minimize waste associated with the short shelf life of refrigerated HPP products.

- Implementation of AI-driven sensors for real-time monitoring of microbiological load and batch quality assurance.

- Machine learning for personalized nutritional recommendations based on pet genomics, health data, and regional environmental factors.

- Automated quality control using machine vision to verify HPP packaging seals and prevent post-processing contamination.

DRO & Impact Forces Of HPP Cat Food Market

The dynamics of the HPP Cat Food Market are shaped by powerful Drivers, inherent Restraints, and significant Opportunities, which collectively dictate the direction of growth and competitive intensity. The primary Driver is the relentless pet humanization trend, where pet owners prioritize nutrition and safety comparable to human-grade food standards, leading them to seek out minimally processed, clean-label options like HPP-treated meals. This is strongly supported by growing veterinary recognition of the benefits of raw or fresh diets, provided they meet strict safety criteria. The main Restraints stem from the high initial capital expenditure required for HPP machinery and the operating expenses (OPEX) associated with energy consumption and maintaining strict cold chain logistics. These costs translate into high retail prices, limiting accessibility predominantly to high-income consumer segments and restricting mass-market adoption. Opportunities abound in the expansion of HPP technology into ancillary cat products, such as functional toppers and treats, and through geographical expansion into high-growth Asia Pacific markets, leveraging the D2C model to educate consumers effectively on the safety and nutritional benefits.

The inherent cost structure of HPP technology significantly influences market dynamics, acting both as a barrier to entry for small players and a crucial competitive advantage for large corporations capable of achieving economies of scale. The complex regulatory environment, particularly the varying standards for pet food safety and claims across different geographies (e.g., AAFCO in the US, FEDIAF in Europe), necessitates substantial investment in compliance and testing, which disproportionately affects smaller entities. However, this restraint simultaneously strengthens the credibility of established HPP brands that can reliably demonstrate full regulatory adherence and safety validation, thereby building consumer trust in a highly sensitive product category where food safety is paramount.

The Impact Forces analysis highlights how competitive rivalry is intensifying, driven by product innovation and rapid technological iteration. The bargaining power of buyers remains moderately high because, despite the product's premium nature, consumers have alternative options (e.g., premium kibble, frozen raw, home-cooked meals). However, the bargaining power of suppliers, particularly specialized protein suppliers and HPP equipment providers, is significant due to the niche requirements and intellectual property associated with high-pressure systems. The threat of substitutes is present but mitigated by the unique combination of safety and nutrient preservation offered by HPP, which traditional processing methods cannot replicate. Furthermore, the threat of new entrants is moderate; while the market is attractive, the high cost of HPP infrastructure serves as a substantial deterrent, focusing new entry primarily on well-funded startups or established human food manufacturers diversifying into pet nutrition.

The ongoing opportunity to innovate within the HPP methodology itself—developing faster cycle times, reducing energy use, and engineering smaller footprint machines—is poised to gradually address the current cost restraint. As HPP adoption increases in the human food sector, the resulting volume efficiencies and shared service models (tolling centers) will inevitably benefit the pet food market, lowering the overall cost base and making HPP cat food more competitive against premium thermal-processed alternatives. This projected efficiency gain represents the most critical long-term factor balancing the current cost-driven restraints and solidifying HPP's position as the future standard for fresh, safe pet nutrition.

- Drivers: Pet humanization, demand for raw-like safety assurance, veterinary support for minimally processed diets, and superior nutrient retention.

- Restraints: High capital investment in HPP equipment, stringent cold chain requirements, high production costs leading to premium pricing, and complex regulatory compliance hurdles.

- Opportunity: Geographical expansion into fast-growing APAC markets, diversification into HPP-treated functional treats and toppers, and technological improvements in HPP efficiency and accessibility (tolling services).

- Impact forces: High barrier to entry (cost); moderate bargaining power of specialized equipment suppliers; competitive rivalry focused on quality and nutritional claims; moderate threat of substitutes due to unique safety/nutrient profile.

Segmentation Analysis

The HPP Cat Food Market is fundamentally segmented based on factors reflecting varying consumer preferences for texture, shelf stability, ingredient type, and purchasing habits. The segmentation provides critical insight into targeted product development and distribution strategies, allowing companies to focus their resources on the fastest-growing and highest-margin categories. The primary segmentation dimensions include product type (Raw Frozen, Fresh Refrigerated), ingredient sourcing (Organic, Natural, Conventional), distribution channel (E-commerce, Specialty Pet Retail, Veterinary Clinics), and life stage (Kitten, Adult, Senior). Each segment addresses a unique set of consumer needs, from the demand for the convenience of refrigerated meals to the stringent dietary requirements of senior or sensitive cats.

The Fresh Refrigerated segment is experiencing particularly rapid expansion, driven by urban consumers who value convenience and guaranteed freshness without the thawing requirements associated with raw frozen food. These products often have an optimized formulation that balances high meat content with supplemental vegetables and necessary taurine, appealing to pet owners seeking optimal feline nutritional balance. Conversely, the Raw Frozen segment, where HPP serves as a crucial safety intervention, maintains strong traction among traditional raw feeders who seek maximum biological appropriateness coupled with verifiable pathogen elimination. This segment heavily relies on transparent marketing regarding the HPP process to build consumer confidence.

From a distributional perspective, the shift towards E-commerce is transformative, enabling specialized HPP brands to bypass traditional retail limitations related to cold storage capacity and directly engage with consumers, facilitating loyalty programs and subscription services essential for perishable goods. Specialty pet stores continue to play a vital role, acting as crucial educational hubs where informed staff can explain the technical benefits and premium value proposition of HPP-treated diets. Understanding these nuanced consumer pathways and product requirements across segments is essential for any player aiming for sustainable growth within the highly specialized HPP cat food landscape.

- By Product Type:

- Raw Frozen (HPP Treated)

- Fresh Refrigerated Meals

- Semi-Moist Treats and Toppers (Niche application)

- By Ingredient Source:

- Organic/Grass-fed

- Natural/Human-Grade

- Conventional

- By Distribution Channel:

- E-commerce (Direct-to-Consumer, Online Retailers)

- Specialty Pet Retail Stores

- Veterinary Clinics

- Supermarkets/Hypermarkets (Limited cold storage availability)

- By Life Stage:

- Kitten

- Adult Maintenance

- Senior/Geriatric

- Weight Management/Therapeutic Diets

Value Chain Analysis For HPP Cat Food Market

The value chain for HPP cat food is notably complex and highly integrated, primarily due to the stringent requirements for ingredient quality and the critical processing step involving high-pressure technology. The upstream segment involves the sourcing of human-grade, high-quality proteins (meat, poultry, fish) and fresh produce, often necessitating relationships with certified organic or ethically raised suppliers. Given the 'raw-like' nature of the final product, the quality and microbiological safety of incoming raw materials are paramount, as HPP serves to sanitize, not mask, inferior quality inputs. Logistical complexities upstream involve rapid, temperature-controlled transport of raw ingredients to the manufacturing facility to maintain freshness before processing.

The midstream processing phase is the core differentiator. Once formulated and packaged, the product undergoes HPP treatment, either utilizing proprietary in-house HPP equipment or outsourcing to HPP tolling centers. This non-thermal treatment requires precise control over pressure and dwell time. Following HPP, products immediately enter the rigorous cold chain infrastructure. The downstream distribution is highly specialized. Direct distribution involves D2C sales via e-commerce platforms supported by advanced cold-chain shipping logistics (e.g., insulated packaging with dry ice or gel packs), facilitating nationwide delivery of perishable goods. Indirect channels include specialty pet retailers and veterinary clinics, which require dedicated refrigerated display units and strict inventory management protocols to prevent spoilage.

The emphasis on direct versus indirect channels often dictates brand strategy. Direct sales allow for higher margins, better inventory control, and direct consumer data collection essential for personalized marketing and feedback loops. Indirect sales, while offering broader visibility, necessitate careful selection of partners who can reliably maintain the cold chain integrity, ensuring the safety and quality promise inherent in HPP products is upheld throughout the consumer journey. The overall efficiency of the value chain relies heavily on minimizing dwell time at every stage and robust vertical coordination, as product freshness directly correlates with consumer value perception.

HPP Cat Food Market Potential Customers

The primary end-users and buyers of HPP cat food products are discerning pet owners who prioritize the longevity and optimal health of their feline companions, fitting squarely within the 'pet humanization' demographic. These consumers are typically highly educated, possess high disposable incomes, and are proactive in their approach to pet health, often viewing diet as a form of preventative medicine. They actively seek transparency regarding ingredient sourcing and processing methods, and they are willing to pay a significant premium for guaranteed safety and enhanced nutritional value, particularly those transitioning from traditional raw diets but concerned about microbial risks.

A secondary, but highly important, segment includes pet owners with cats suffering from chronic health issues, such as gastrointestinal sensitivities, dermatological conditions, or food allergies. For these buyers, the limited ingredient diets (LIDs) and highly digestible nature of HPP-treated fresh foods offer therapeutic advantages, often recommended or at least tolerated by holistic veterinarians. These purchases are less price-sensitive and more needs-driven, focused intensely on efficacy and perceived purity, which the HPP process substantiates by minimizing processing agents and maintaining the biological integrity of the ingredients.

Furthermore, veterinary clinics and specialty pet stores act as significant institutional customers, purchasing HPP products both for resale and for internal use (e.g., feeding hospitalized or sensitive patients). These institutional buyers value the HPP safety certification and clinical relevance of the formulations. Ultimately, the typical HPP cat food consumer is someone who conducts thorough research, relies on specialized advice (veterinary or specialized retail), and integrates premium, specialized nutrition as a core component of their pet care philosophy, making them loyal and high-lifetime-value customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 million |

| Market Forecast in 2033 | USD 750 million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freshpet, Stella & Chewy's, Primal Pet Foods, Blue Buffalo (General Mills), OC Raw Dog, Nature's Logic, Vital Essentials, Small Batch Pets, Lotus Pet Food, Only Natural Pet, Nulo Pet Food, Champion Petfoods (ACANA & Orijen), Instinct Pet Food, Rawz Natural Pet Food, Pure Pet Food, Tender & True, Honest Kitchen, Raised Right Pet Food, Just Food For Dogs, Darwin's Natural Pet Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HPP Cat Food Market Key Technology Landscape

The core technology underpinning the HPP Cat Food Market is the High-Pressure Processing system itself, which relies on the principle of isostatic pressure transmission. This technology uses water to uniformly apply high pressure—typically ranging between 400 and 600 MPa (or 4,000 to 6,000 bar)—to packaged food products. The key technological advantage is the non-thermal nature of the process; since temperature is kept low (usually below 40°C), thermal degradation of vitamins, flavor compounds, and protein structures is avoided, ensuring maximum nutrient retention and palatability. Equipment manufacturers, such as Hiperbaric and Avure Technologies, continually innovate by developing larger-capacity horizontal machines that enhance throughput and reduce processing costs per unit, making the technology more economically viable for the high-volume pet food industry.

Beyond the HPP equipment, the technological landscape involves advanced packaging solutions crucial for the success of these products. HPP-compatible packaging must be flexible enough to withstand extreme pressure changes (the "squish" effect) without rupturing. Materials typically include multi-layer flexible pouches or trays made of materials like Polypropylene (PP) or Polyethylene (PE). Innovations in sustainable packaging, such as recyclable mono-material films that retain HPP integrity, are a growing focus area. The integrity of the seal post-HPP is critical to prevent post-process contamination, leading to widespread adoption of vacuum sealing and modified atmosphere packaging (MAP) techniques before the pressure cycle begins.

Furthermore, the cold chain logistics technology plays a supporting yet vital role. This includes sophisticated temperature monitoring systems (wireless sensors, RFID tags) implemented during transport and storage to ensure the temperature profile remains stable, typically between 0°C and 4°C, from the factory gate to the consumer's freezer or refrigerator. The integration of advanced inventory management systems (IMS) is essential for handling products with shorter shelf lives than traditional kibble, enabling "just-in-time" delivery and minimizing inventory spoilage across the specialized distribution network. Future technological integration is anticipated in advanced sterilization verification methods, potentially leveraging biosensors for rapid, non-destructive pathogen detection following HPP treatment.

Regional Highlights

North America, encompassing the United States and Canada, stands as the most mature and dominant market for HPP cat food. This leadership position is attributed to the extremely high rate of pet humanization, where pets are treated as family members, leading to significant discretionary spending on premium nutrition. Consumers in this region are highly receptive to novel, science-backed food processing technologies that promise enhanced safety, particularly in the raw and fresh food segments where safety concerns previously deterred broader adoption. The presence of major HPP tolling centers and established distribution networks for refrigerated goods supports the market infrastructure necessary for scaling these premium products effectively. Furthermore, strong regulatory frameworks by entities like the FDA and AAFCO, which encourage rigorous testing for pathogens, implicitly favor technologies like HPP that provide verifiable safety assurances.

Europe represents the second-largest market, exhibiting strong growth momentum driven by a cultural emphasis on animal welfare and stringent European Union food safety standards, which resonate well with the benefits of HPP. Countries like Germany, the UK, and the Scandinavian nations show significant consumer uptake, primarily through specialized pet stores and high-end grocery channels. The European market sees a higher penetration of organic and sustainably sourced ingredients in HPP formulations, reflecting the region's broader environmental and ethical purchasing criteria. However, logistical challenges related to cross-border cold chain transport within the EU represent a minor impediment compared to the more unified North American supply chain, although continuous investment in refrigerated logistics is mitigating this constraint.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period. This growth is predominantly fueled by rapid urbanization, substantial increases in disposable incomes, and the corresponding shift toward smaller, high-maintenance companion animals, particularly in metropolitan areas of China, Japan, and South Korea. While the overall adoption rate of raw diets is historically lower than in the West, there is a burgeoning demand for premium, imported, and scientifically proven nutritional products. Manufacturers are strategically focusing on establishing local HPP infrastructure and localized product portfolios to cater to unique regional dietary needs and protein preferences (e.g., specific fish types), positioning HPP as a symbol of modernity, safety, and superior quality in the rapidly evolving pet food landscape.

- North America (US, Canada): Market dominance, driven by mature pet humanization trends, high consumer spending, early technological adoption, and robust existing cold chain logistics infrastructure. Focus on raw frozen and refrigerated meals.

- Europe (Germany, UK, France): Strong growth, fueled by stringent food safety regulations, high ethical sourcing demands, and increasing consumer willingness to pay a premium for natural, safe diets. Emphasis on organic and human-grade inputs.

- Asia Pacific (China, Japan, South Korea): Highest projected CAGR, spurred by rising urbanization, growing disposable incomes, and increasing demand for high-quality, scientifically safe imported or locally manufactured premium pet foods. Cold chain development remains a key focus area.

- Latin America (LATAM): Emerging market characterized by increasing awareness of pet health; growth concentrated in major urban centers like Brazil and Mexico City, relying heavily on imported HPP products initially, with potential for localized HPP tolling in the long term.

- Middle East & Africa (MEA): Niche market with high potential in affluent Gulf Cooperation Council (GCC) countries, driven by high net-worth individuals importing ultra-premium pet products. Growth is highly sensitive to efficient, temperature-controlled air freight and specialty retail availability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HPP Cat Food Market.- Freshpet

- Stella & Chewy's

- Primal Pet Foods

- Blue Buffalo (General Mills)

- OC Raw Dog

- Nature's Logic

- Vital Essentials

- Small Batch Pets

- Lotus Pet Food

- Only Natural Pet

- Nulo Pet Food

- Champion Petfoods (ACANA & Orijen)

- Instinct Pet Food

- Rawz Natural Pet Food

- Pure Pet Food

- Tender & True

- Honest Kitchen

- Raised Right Pet Food

- Just Food For Dogs

- Darwin's Natural Pet Products

Frequently Asked Questions

Analyze common user questions about the HPP Cat Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High-Pressure Processing (HPP) and how does it benefit cat food?

HPP is a non-thermal pasteurization technique using high hydrostatic pressure (up to 87,000 psi) to inactivate harmful pathogens like Salmonella and E. coli in packaged cat food. This benefits cat food by achieving a high level of microbial safety, particularly in raw diets, while preserving the natural flavor, texture, and essential nutrients (like vitamins and enzymes) that are typically degraded by traditional heat cooking methods.

Is HPP cat food considered truly raw, and is it safe for my cat?

HPP cat food is often marketed as "raw-like" or "safe raw." While the ingredients are not cooked, the pressure treatment changes the microbial structure, meaning it is microbiologically safer than untreated raw food. It maintains the nutritional profile of raw food without the associated food safety risks, making it highly safe and appealing for owners seeking the benefits of raw feeding with guaranteed pathogen elimination.

How does HPP technology affect the shelf life and storage of cat food?

HPP significantly extends the shelf life of perishable cat food, particularly fresh and refrigerated meals, often extending refrigeration viability from a few days to several weeks. Because HPP does not use chemical preservatives, the products must be maintained within the cold chain (refrigerated or frozen) throughout distribution and storage to ensure quality and safety.

What are the primary factors driving the premium pricing of HPP cat food?

The premium pricing of HPP cat food is driven by four main factors: the high capital and operational costs associated with HPP machinery, the stringent requirements for human-grade, high-quality ingredients, the complexities and costs of maintaining a consistent cold chain distribution network, and the intensive quality control and microbiological testing required to validate the safety claims of the HPP process.

Which distribution channels are most effective for selling HPP-treated cat food products?

E-commerce, particularly D2C subscription models, is the most rapidly growing and effective channel, allowing brands to manage cold chain logistics directly and offer convenience. Specialty pet retail stores are also crucial, serving as educational centers where staff can explain the technical benefits and justify the premium price point to the consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager