HR Consulting Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433738 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

HR Consulting Service Market Size

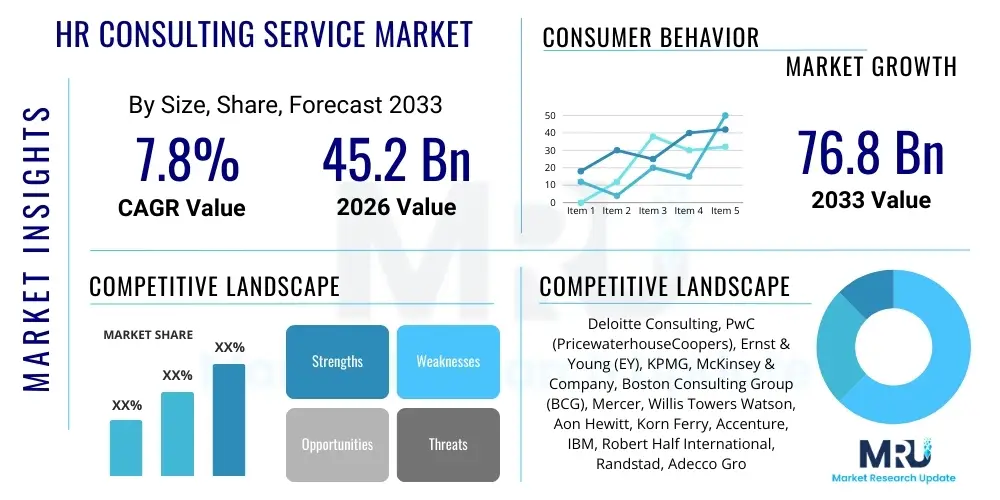

The HR Consulting Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $45.2 Billion in 2026 and is projected to reach $76.8 Billion by the end of the forecast period in 2033.

HR Consulting Service Market introduction

The HR Consulting Service Market encompasses a broad spectrum of advisory and implementation services designed to help organizations optimize their human capital management (HCM) functions. These services range from strategic areas like organizational design, change management, and talent strategy formulation, to transactional and operational domains such as compensation benchmarking, benefits administration, and compliance audits. The core objective of HR consulting is to enhance workforce productivity, ensure legal adherence, mitigate risks associated with human capital, and ultimately align the HR function with overarching corporate strategic goals. The market is characterized by high demand for specialized expertise, driven by increasing complexity in labor laws, rapid technological shifts necessitating workforce reskilling, and the growing global competition for specialized talent.

Major applications of HR consulting services span across numerous industries, including financial services, healthcare, technology, manufacturing, and public administration. Key areas of focus include designing effective performance management systems, developing robust employee engagement strategies, and managing large-scale transformation projects such as mergers and acquisitions (M&A) integration or digitalization initiatives. The product—which is expertise and actionable strategy—delivers critical benefits, including cost reduction through optimized HR processes, improved employee retention rates, enhanced regulatory compliance, and the successful navigation of complex organizational changes, thereby directly influencing the client organization's bottom line and long-term sustainability.

Driving factors for sustained market growth include the ongoing necessity for companies to adapt to hybrid and remote work models, requiring new consultation on culture management and communication infrastructure. Furthermore, the imperative for diversity, equity, and inclusion (DEI) initiatives is fueling demand for specialized consulting practices focused on workforce fairness and representation. Lastly, the increasing proliferation of advanced HR technology (such as AI-driven recruitment platforms and predictive analytics) mandates expert guidance on system integration and strategic utilization, positioning consultants as critical intermediaries between technology vendors and enterprise HR departments seeking digital transformation.

HR Consulting Service Market Executive Summary

The HR Consulting Service Market exhibits strong resilience and accelerating growth, fundamentally driven by pervasive business trends emphasizing digital transformation, globalization of workforces, and heightened regulatory scrutiny concerning labor practices and employee data privacy. Business trends highlight a significant shift from pure advisory services towards integrated solutions encompassing technology implementation and managed services, particularly in areas like payroll, benefits outsourcing, and sophisticated talent acquisition processes. Major corporations are increasingly seeking consulting partners capable of delivering global solutions and navigating diverse jurisdictional labor requirements, leading to consolidation among top-tier firms and the expansion of specialized boutique consultancies addressing niche needs such as change management in agile environments or advanced HR data analytics.

Regional trends indicate North America maintaining market dominance, propelled by high expenditure on digital HR infrastructure and stringent regulatory environments requiring continuous compliance consultation, especially in highly regulated sectors like pharmaceuticals and finance. Asia Pacific (APAC) is projected to experience the fastest growth, fueled by rapid economic expansion, increasing foreign direct investment, and the necessity for localized HR strategies to manage diverse cultural and regulatory landscapes across countries like China, India, and Southeast Asia. Europe remains a mature market, where growth is primarily driven by complex cross-border labor movement issues, the need for post-Brexit strategic workforce planning, and a strong focus on employee well-being and data protection standards like GDPR, driving consistent demand for specialized labor law consultation and well-being program design.

Segment trends demonstrate robust demand across all major service lines, with specific acceleration noted in Technology Consulting and Change Management services due to the pervasive nature of digital transformation projects. Recruitment and Talent Management consulting is seeing renewed vigor as organizations grapple with skill shortages and the Great Resignation phenomenon, necessitating innovative retention and acquisition strategies. Outsourcing services (HRO) remain a foundational segment, offering cost efficiencies, though increasingly focused on high-value, complex processes rather than simple transactional tasks. Overall, the market is pivoting towards outcome-based consulting models, where the integration of advanced data analytics and predictive modeling is crucial for consultants to demonstrate tangible value realization to their corporate clients.

AI Impact Analysis on HR Consulting Service Market

User questions related to the impact of Artificial Intelligence (AI) on the HR Consulting Service Market frequently revolve around two primary themes: displacement and augmentation. Clients and stakeholders commonly inquire whether AI-driven tools, capable of automating tasks such as candidate screening, policy drafting, and compensation analysis, will render traditional consulting services redundant. Conversely, there is significant interest in how consultants can leverage AI to provide superior insights, focusing questions on strategic workforce planning using predictive analytics, optimizing AI tool implementation, and mitigating algorithmic bias in high-stakes HR decisions (e.g., promotion or termination). Key user concerns center on data governance, the ethics of AI in employment practices, and the role of human judgment when AI provides prescriptive advice. Expectations are high that consultants must rapidly evolve into experts on AI integration and ethical governance, transforming the service model from data gathering and processing to strategic interpretation and change enablement.

The introduction of sophisticated generative AI and machine learning tools is fundamentally altering the HR service delivery model. While routine and data-intensive tasks—such as initial benefits inquiry handling or basic compliance checking—are increasingly automated, the demand for high-touch, strategic human consulting remains robust. AI capabilities enhance the consultant’s toolkit, allowing for real-time benchmarking against global standards, rapid scenario planning for organizational restructuring, and highly personalized employee experience design. The primary shift is that consultants are now expected to be architects of AI-powered HR systems and guides in navigating the organizational culture changes required to adopt these technologies successfully. This necessitates a steeper learning curve for consultants regarding data science and ethical AI frameworks.

Ultimately, the impact of AI is not displacement but transformation. The market for pure administrative HR consulting may shrink, but the market for strategic advisory services concerning AI governance, talent transformation (reskilling the workforce for an AI-enabled future), and complex organizational change management will grow exponentially. Consultants who successfully transition their value proposition to focus on mitigating the risks associated with AI adoption, ensuring fairness, and maximizing the strategic advantage derived from integrated HR technology platforms are poised to capture significant market share and command premium rates in this evolving technological landscape.

- AI enhances data analytics, enabling predictive modeling for turnover risk and skill gaps.

- Automation of routine HR tasks (e.g., payroll processing, initial screening) reduces need for basic transactional consulting.

- Increased demand for consulting focused on ethical AI implementation and bias mitigation in recruitment systems.

- Consultants pivot to strategic roles, focusing on AI system integration and change management within client organizations.

- AI-powered platforms offer enhanced benchmarking capabilities, improving the speed and accuracy of compensation consulting.

- New service lines emerge related to governance and compliance for HR data utilized by machine learning algorithms.

DRO & Impact Forces Of HR Consulting Service Market

The HR Consulting Service Market is subjected to a powerful combination of driving forces (D), restrictive challenges (R), and expansive opportunities (O), creating significant market impact forces. Key drivers include the increasing complexity of the global regulatory environment, particularly concerning labor laws, diversity mandates, and data privacy, which necessitates expert external guidance to ensure continuous compliance and mitigate legal risks. Furthermore, the persistent global shortage of highly skilled technical and managerial talent forces organizations to rely on consultants for advanced talent acquisition strategies, workforce planning, and tailored compensation packages designed for retention. The accelerated pace of digital transformation across all industries mandates consulting support for technology implementation, system integration, and critical change management initiatives required to ensure successful adoption by employees.

Conversely, the market faces several restraining factors that temper growth. The high cost associated with premium consulting services remains a significant barrier for Small and Medium Enterprises (SMEs), potentially limiting adoption to primarily large enterprise clients, although this is being partially mitigated by the emergence of platform-based, scalable consulting models. Economic volatility and recessionary fears can lead organizations to prioritize immediate cost-cutting measures, often resulting in temporary freezes or reductions in discretionary spending on advisory and non-essential transformation projects. Moreover, the increasing availability of sophisticated, self-service HR technology platforms (HRIS and HCM systems) provides internal HR teams with tools that previously required consultant intervention, potentially reducing demand for basic process optimization consultation.

However, significant opportunities exist for specialized growth. The burgeoning demand for organizational resilience consulting, focusing on pandemic preparedness, supply chain disruption management as it relates to human capital, and managing geopolitical risks, presents a new high-value service line. The growing emphasis on environmental, social, and governance (ESG) factors is creating demand for consultants specializing in workforce sustainability reporting, ethical supply chain labor practices, and measurable diversity and inclusion program design. Additionally, the shift towards a predominantly remote or hybrid work environment requires specialized consulting on redesigning organizational culture, performance measurement in remote settings, and ensuring equitable employee experiences irrespective of location, ensuring a long-term pipeline for strategic transformation projects.

Segmentation Analysis

The HR Consulting Service Market is rigorously segmented based on service type, organization size, and industry vertical, reflecting the diverse needs and operational scales of client organizations globally. The core segmentation is defined by the type of expertise delivered, generally categorized into Actuarial & Benefits Consulting, Talent Management Consulting, Human Resources Technology Consulting, and General HR Consulting (encompassing compliance and payroll advisory). This differentiation allows consulting firms to specialize and tailor their intellectual property and service delivery methodologies to address highly specific client pain points, such as designing complex defined benefit pension schemes or implementing integrated cloud-based HR Information Systems (HRIS). Market dynamics are heavily influenced by which service segments are currently experiencing peak demand due to macro-economic or regulatory shifts.

Further analysis by organization size reveals distinct service preferences; large enterprises typically require complex, multi-regional transformation projects and outsourcing solutions, commanding the majority of market revenue and opting for global, tier-one consulting firms. In contrast, SMEs often seek modular, cost-effective solutions focused on immediate compliance needs, basic policy development, or fractional HR support, driving growth in local and boutique consultancies. Industry vertical segmentation highlights varying levels of spending and focus; highly regulated sectors like financial services and healthcare prioritize compliance and risk management consultation, while the technology and manufacturing sectors focus heavily on talent acquisition, reskilling, and process automation consultation to maintain a competitive edge and optimize operational efficiency.

Understanding these segments is critical for both service providers and investors. For instance, the accelerating digitalization trend has rapidly amplified the importance of the Technology Consulting segment, moving it from a niche service to a strategic imperative. Simultaneously, the increasing complexity surrounding employee wellness and retirement plans, exacerbated by global financial market volatility, ensures sustained growth for the Actuarial & Benefits segment. Firms must strategically position their offerings across these matrices, often utilizing cross-functional teams to deliver integrated solutions that address both the strategic (e.g., workforce culture) and operational (e.g., system configuration) needs of their clients simultaneously to maximize market penetration and service stickiness.

- By Service Type:

- Actuarial & Benefits Consulting

- Talent Management Consulting (Recruitment, Performance Management, Training & Development)

- HR Technology Consulting & Implementation

- General HR Consulting (Compliance, Policy Development, Change Management)

- By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Pharmaceuticals

- Technology, Media, and Telecommunications (TMT)

- Manufacturing and Automotive

- Public Sector and Government

- Retail and Consumer Goods

Value Chain Analysis For HR Consulting Service Market

The value chain for HR consulting services commences with the upstream phase, which primarily involves the development and maintenance of intellectual property (IP). This includes investment in research and development to generate proprietary methodologies, benchmarking data, analytical models, and thought leadership necessary to differentiate service offerings. Upstream activities require significant investment in specialized human capital—data scientists, industrial psychologists, and specialized domain experts (e.g., compensation lawyers, benefits actuaries). The integrity and continuous updating of this foundational knowledge base are paramount, as the perceived value of consulting services is directly tied to the distinctiveness and applicability of the methodologies employed. Effective upstream management ensures the consultant can approach client problems with innovative, evidence-based solutions that are unavailable through general internal resources.

The midstream phase focuses on service delivery and customization. This stage involves needs assessment, proposal generation, project execution, and client collaboration. Consultants act as highly skilled integrators, adapting proprietary IP to the client's specific organizational culture, regulatory environment, and strategic objectives. This phase is characterized by intense human interaction and the application of change management expertise to ensure solutions are not only theoretically sound but also practically implementable within the client organization. Success at this stage relies heavily on the consultant's ability to communicate complex ideas clearly, manage stakeholder expectations, and maintain strict confidentiality regarding sensitive organizational data, ensuring high client satisfaction and repeat business.

The downstream segment encompasses the distribution channel and post-engagement support. Distribution channels are typically direct, leveraging existing client relationships, extensive internal sales forces, and strategic partnerships with HR technology vendors. Indirect channels are limited but include referrals from financial advisors, legal firms, or participation in industry associations. Post-engagement support, crucial for long-term customer relationships, involves monitoring implemented solutions, providing ongoing compliance updates (especially for retained services like benefits administration), and identifying new opportunities for service expansion. The efficiency of both direct and indirect channels is often enhanced by digital marketing, showcasing successful case studies, and leveraging a strong brand reputation built on successful delivery and ethical practice, which contributes significantly to the long-term enterprise value of the consulting firm.

HR Consulting Service Market Potential Customers

Potential customers and end-users of HR consulting services span the entire spectrum of corporate and organizational entities, ranging from multinational corporations to local non-profit organizations, with decision-making typically centralized within the Chief Human Resources Officer (CHRO) or the Chief Executive Officer (CEO) for high-stakes strategic projects. Large multinational corporations represent the most lucrative segment, requiring comprehensive, global solutions for talent mobility, cross-border M&A integration, complex executive compensation design, and large-scale HR technology implementation. These buyers seek expertise that can standardize processes across diverse geographic regions while remaining compliant with localized labor laws, placing a high value on consultants with global reach and deep jurisdictional knowledge. Their purchasing decisions are often based on proven track records, ability to manage large project scopes, and perceived quality of specialized proprietary data.

The second major category includes government and public sector organizations, which frequently engage HR consultants for civil service reform, public sector compensation restructuring, and modernizing talent acquisition processes to compete with the private sector. Procurement in this area is heavily influenced by strict regulations, necessitating consultants capable of navigating complex public tendering processes and demonstrating commitment to transparency and measurable outcomes within budget constraints. Furthermore, the burgeoning mid-market (SMEs with rapid growth trajectories) constitutes a rapidly expanding customer base. These organizations often lack the internal specialized HR resources necessary to manage scaling operations, requiring external support for foundational tasks such as developing employee handbooks, establishing performance management frameworks, and executing initial benefits enrollment schemes in a cost-effective manner, often preferring modular or subscription-based advisory packages.

Finally, industry-specific sectors drive unique consulting demands. For instance, private equity firms consistently engage HR consultants during due diligence and post-acquisition phases to rapidly assess organizational structure, identify leadership talent, and integrate acquired workforces, focusing on rapid value extraction and cost synergies. Healthcare providers, grappling with burnout and severe labor shortages, utilize consultants for sophisticated workforce planning, nurse retention strategies, and optimizing shift scheduling. Technology companies, characterized by rapid innovation, seek consultation primarily on competitive compensation structures, agile organizational design, and cultivating specialized technical talent pools, ensuring that the consulting offering is highly tailored to the specific industry challenges and operating speeds.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $45.2 Billion |

| Market Forecast in 2033 | $76.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte Consulting, PwC (PricewaterhouseCoopers), Ernst & Young (EY), KPMG, McKinsey & Company, Boston Consulting Group (BCG), Mercer, Willis Towers Watson, Aon Hewitt, Korn Ferry, Accenture, IBM, Robert Half International, Randstad, Adecco Group, ManpowerGroup, BDO, Grant Thornton, Cielo, Alight Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HR Consulting Service Market Key Technology Landscape

The technology landscape underpinning the HR Consulting Service Market is rapidly evolving, driven by cloud computing, advanced analytics, and artificial intelligence, shifting the focus from manual data collection to sophisticated data interpretation and strategic insights. Key technologies include integrated Human Capital Management (HCM) suites (e.g., Workday, SAP SuccessFactors, Oracle Cloud HCM) which serve as the foundational platform for many HR transformation projects. Consultants are increasingly utilizing proprietary analytical tools layered over these HCM systems, employing machine learning models to predict employee turnover, identify critical skill gaps, and optimize internal mobility strategies. The capability to seamlessly integrate multiple disparate HR technologies, ensuring a unified data environment for comprehensive workforce metrics, is now a primary technological competence expected of leading consulting firms.

The rise of specialized technologies focused on specific HR domains is also critical. In recruitment, AI-powered screening and applicant tracking systems (ATS) are being integrated, requiring consulting expertise to configure and manage the ethical implications of these tools. For benefits administration, blockchain technology is being explored for secure, transparent, and auditable management of sensitive employee data and transactions, especially in multi-national contexts. Furthermore, employee experience platforms, which leverage behavioral science and continuous listening technology (pulse surveys, sentiment analysis), are becoming essential tools for consultants focused on organizational culture and engagement, providing real-time data inputs that drive proactive strategic recommendations rather than relying on delayed annual surveys.

A significant technological trend is the proliferation of robotic process automation (RPA) within HR shared service centers, automating high-volume, repetitive administrative tasks like onboarding data entry, benefits enrollment processing, and routine query responses. HR consultants are instrumental in identifying suitable processes for RPA, designing the automation workflows, and managing the associated workforce impact and reskilling initiatives. The underlying technological imperative for consultants is the ability to leverage these tools not merely for efficiency gains, but to free up internal HR staff to focus on high-value, strategic partnership roles, fundamentally redefining the operational model of client HR departments through technology-enabled transformation.

Regional Highlights

The global HR Consulting Service Market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced by varying regulatory frameworks, economic maturity levels, and technological adoption rates. North America, comprising the United States and Canada, remains the largest and most mature market, characterized by high consulting expenditure, rapid adoption of sophisticated HR technology, and a complex legal environment that drives significant demand for compliance and benefits advisory services. The competitive intensity in this region is high, dominated by global tier-one firms and boutique specialists focusing on niche areas like executive coaching and highly specialized tech talent acquisition strategies, with spending heavily concentrated on large-scale digital transformation projects and ongoing regulatory risk mitigation, such as navigating evolving workplace safety and diversity mandates.

Europe, driven by powerful economies like Germany, the UK, and France, presents a market characterized by strong statutory protection for employees, necessitating extensive consultation on complex industrial relations, collective bargaining agreements, and GDPR compliance related to employee data. The European market sees robust demand for change management consulting, particularly in organizations navigating pan-European integrations and optimizing workforce structures following macroeconomic shifts. The focus on employee well-being and sustainability reporting (ESG mandates) is particularly pronounced here, creating a growth avenue for specialized consultancies focused on organizational culture, mental health programs, and measurable diversity and inclusion outcomes, often procured through established, long-term relationships.

Asia Pacific (APAC) is emerging as the fastest-growing region, presenting vast, untapped potential due to rapid industrialization, urbanization, and the increasing presence of multinational corporations expanding operations. Markets such as China, India, and Southeast Asia require localized HR strategy development to manage diverse labor pools, varying regulatory compliance requirements, and intense competition for local skilled labor. The primary drivers in APAC include consulting related to scaling operations, integrating disparate regional cultures, implementing standardized global HR technology platforms, and developing localized leadership pipelines to support aggressive business growth targets, often favoring consulting firms with strong local presence and deep understanding of cultural nuances and complex regulatory variance across jurisdictions.

- North America: Market leader, high tech adoption, strong focus on compliance (e.g., labor law, data privacy), and large-scale HRIS implementation projects. Key countries include the United States and Canada.

- Europe: Mature market, driven by complex labor relations, strong regulatory environment (GDPR), and high demand for change management and ESG-related workforce strategies. Key markets are the UK, Germany, and France.

- Asia Pacific (APAC): Fastest-growing region, fueled by economic growth, expanding multinational presence, and demand for localized talent management and operational scaling strategies. Key growth hubs are China, India, and Australia.

- Latin America (LATAM): Growth driven by economic stabilization, need for standardized HR practices across the region, and addressing challenges related to talent retention amid high inflation. Key markets include Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market characterized by large government transformation projects (e.g., Saudi Vision 2030), focus on nationalization and localization strategies, and development of specialized talent pools, requiring expertise in public sector HR reform.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HR Consulting Service Market.- Deloitte Consulting

- PwC (PricewaterhouseCoopers)

- Ernst & Young (EY)

- KPMG

- McKinsey & Company

- Boston Consulting Group (BCG)

- Mercer

- Willis Towers Watson

- Aon Hewitt

- Korn Ferry

- Accenture

- IBM

- Robert Half International

- Randstad

- Adecco Group

- ManpowerGroup

- BDO

- Grant Thornton

- Cielo

- Alight Solutions

Frequently Asked Questions

Analyze common user questions about the HR Consulting Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for HR Technology Consulting services?

The primary drivers are the necessity for enterprises to integrate sophisticated HCM systems (like Workday or SAP) for global operations, the increasing adoption of AI/ML for talent acquisition and management, and the need for external expertise to ensure secure data integration and compliance during digital transformation projects. Consultants guide clients through complex system selection, implementation, and change management processes, ensuring technology alignment with strategic business goals and mitigating implementation risk.

How is the rise of hybrid work models impacting the HR Consulting market?

Hybrid and remote work models have fundamentally shifted consulting focus toward organizational culture redesign, equitable performance management systems for dispersed teams, compensation geographically adjusted strategies, and ensuring compliance across varying remote work jurisdictions. Consultants are crucial for designing new operating models that foster collaboration, maintain productivity, and mitigate burnout risks associated with flexible work arrangements, requiring specialized change management expertise.

What are the most critical challenges facing the Talent Management Consulting segment?

The most critical challenges include the persistent global skill shortage, particularly in technology and specialized engineering fields, requiring innovative sourcing and retention strategies. Additionally, consultants must address high employee turnover rates (The Great Resignation) by redesigning employee value propositions (EVPs) and creating effective leadership development programs, focusing heavily on diversity, equity, and inclusion (DEI) metrics to ensure future workforce resilience and appeal.

Which geographical region is expected to show the highest growth rate (CAGR) in HR consulting?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid economic expansion, increasing foreign direct investment, growing regulatory complexity across diverse national jurisdictions, and the necessity for local companies to modernize their HR functions and compete effectively for international and domestic talent pools, resulting in significant spending on transformation and advisory services.

How do HR consultants ensure compliance with evolving global data privacy regulations like GDPR?

Consultants specializing in compliance and HR technology assist organizations by conducting comprehensive data audits, implementing robust HR information systems (HRIS) configured for regional regulatory adherence, developing formal data governance frameworks, and designing policies for the ethical use and cross-border transfer of employee data. Their role is pivotal in minimizing legal exposure related to data breaches and ensuring continuous adherence to complex global privacy laws.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager