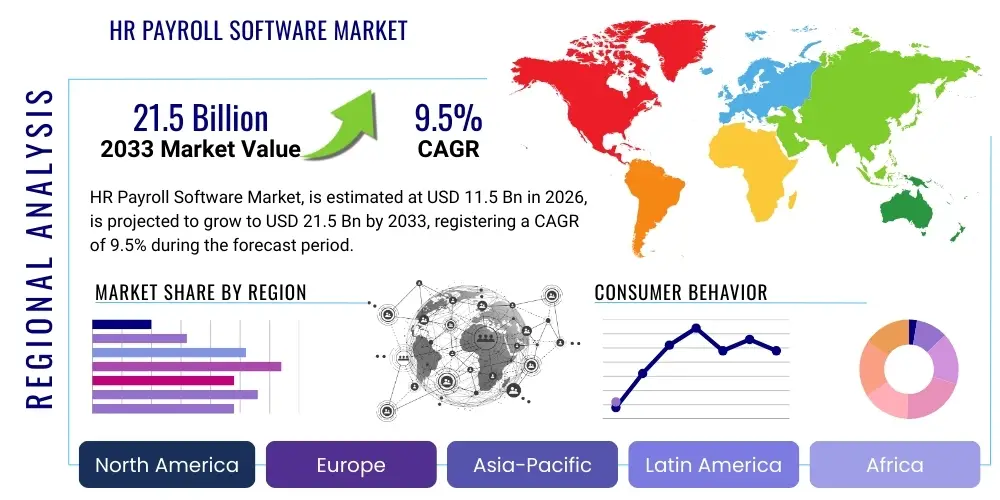

HR Payroll Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437224 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HR Payroll Software Market Size

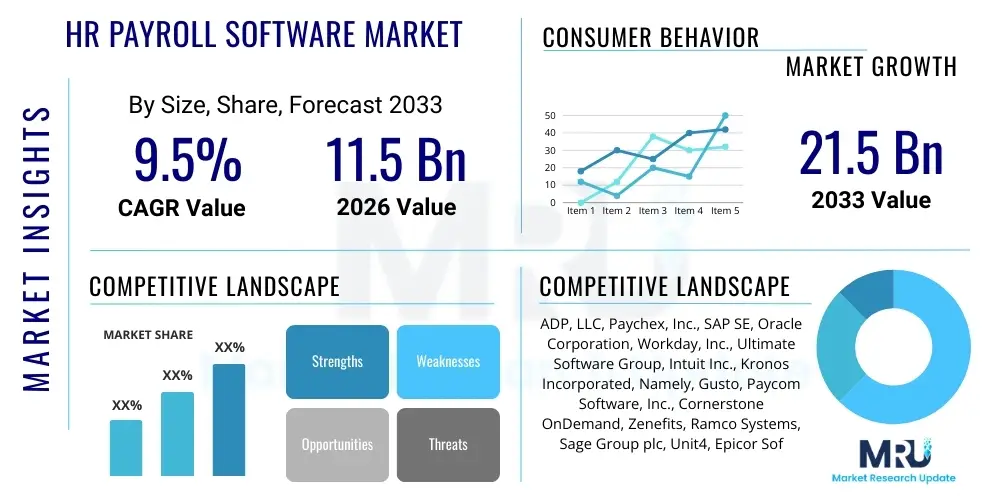

The HR Payroll Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $11.5 Billion USD in 2026 and is projected to reach $21.5 Billion USD by the end of the forecast period in 2033.

HR Payroll Software Market introduction

The HR Payroll Software Market encompasses specialized applications designed to manage core human resources functions, particularly compensation administration, statutory deductions, tax filing, and time and attendance tracking. These comprehensive Human Resource Information Systems (HRIS) transition organizations from legacy manual processing to integrated, automated digital workflows, significantly enhancing accuracy and ensuring stringent regulatory compliance across diverse geographies. The core function of these products is not merely calculation but providing a strategic platform for workforce management (WFM), integrating seamlessly with financial planning and analysis (FP&A) systems to offer real-time labor cost visibility.

Major applications of HR payroll software span across various industries, including Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Manufacturing, Healthcare, and Retail. The escalating demand for streamlined operations, reduction of human error in complex calculations, and the necessity for adhering to continuously evolving labor laws—such as minimum wage changes, new tax brackets, and industry-specific mandates—are paramount benefits driving market adoption. Furthermore, the shift towards remote work models and the proliferation of globally distributed teams necessitate robust, cloud-based payroll solutions capable of handling multi-country compliance and currency requirements efficiently.

Key driving factors propelling the market expansion include the mandatory requirement for enhanced data security standards, particularly concerning employee Personally Identifiable Information (PII), the widespread migration of enterprise workloads to scalable Software-as-a-Service (SaaS) models, and the increasing complexity of international taxation and benefits administration. Organizations, especially Small and Medium-sized Enterprises (SMEs), are actively seeking affordable, user-friendly solutions that reduce administrative overhead, allowing HR staff to focus on strategic initiatives like talent management and employee engagement rather than transactional payroll processing.

HR Payroll Software Market Executive Summary

The HR Payroll Software Market demonstrates robust growth, primarily fueled by rapid technological integration, notably the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and fraud detection in payment processing. Business trends indicate a definitive shift towards unified Human Capital Management (HCM) suites, where payroll functions are intrinsically linked with core HR, talent acquisition, and performance management modules, offering a single source of truth for employee data. This move towards holistic systems emphasizes employee self-service capabilities and mobile accessibility, catering to a modern, decentralized workforce. The competitive landscape is characterized by intense innovation, with providers focusing heavily on vertical specialization and deep integration capabilities via Application Programming Interfaces (APIs) to connect with third-party financial and benefits platforms.

Regional trends highlight North America and Europe as mature markets driving innovation through early adoption of advanced features like real-time payments and regulatory compliance automation (e.g., GDPR, CCPA adherence). Conversely, the Asia Pacific (APAC) region is poised for the highest growth trajectory, driven by rapid industrialization, massive digital transformation initiatives in developing economies like India and Southeast Asia, and a growing influx of multinational corporations establishing local operations that require sophisticated, localized payroll engines. Emerging markets are prioritizing cloud deployment due to lower initial capital expenditure and faster scalability.

Segmentation trends confirm that the Cloud-based deployment model significantly outpaces the traditional On-premise model, primarily due to its flexibility, lower Total Cost of Ownership (TCO), and automatic software updates ensuring continuous compliance. From an enterprise perspective, the Small and Medium Enterprise (SME) segment exhibits the highest growth rate, as these businesses increasingly recognize the strategic value of automating payroll to mitigate risks and improve operational efficiency. Furthermore, specialized features such as advanced tax management and global payroll processing capabilities are driving higher revenue yields within the Large Enterprise segment, which demands robust security and high-volume transaction processing.

AI Impact Analysis on HR Payroll Software Market

User queries regarding AI's influence on HR Payroll Software frequently revolve around the potential for complete automation of routine tasks, ensuring hyper-accuracy in compliance calculations, and the ethical implications of using predictive analytics for workforce planning and budgeting. Users are keen to understand how AI can handle complex, variable pay structures, such as commissions and bonuses, with minimal human intervention, effectively eliminating manual data entry errors. Furthermore, there is significant interest in AI's role in security, particularly in detecting anomalous payroll activities, identifying potential fraud patterns, and proactively flagging compliance risks before they result in penalties. Key expectations center on achieving ‘touchless payroll’ and leveraging ML to optimize cash flow management based on anticipated future staffing changes or regulatory adjustments.

The integration of Artificial Intelligence and Machine Learning algorithms is fundamentally reshaping the operational efficiency and strategic capability of HR payroll systems. AI enables sophisticated natural language processing (NLP) capabilities for rapid querying of complex HR rules and policies, enhancing the decision-making process for HR administrators. Beyond basic automation, AI models analyze historical data to predict peak staffing requirements, forecast future payroll obligations with greater precision, and automatically allocate costs across different departmental budgets, thereby providing invaluable support for financial planning and analysis (FP&A).

This technological shift transforms the payroll function from a purely transactional back-office task into a source of strategic business intelligence. AI-powered software constantly monitors changes in tax legislation across multiple jurisdictions, automatically updating rule sets and ensuring real-time regulatory compliance, drastically reducing the risk associated with transnational operations. This proactive compliance management, coupled with the ability to swiftly process massive datasets for global operations, cements AI's role as a critical enabler for scalability and operational resilience in the modern HR technology stack.

- Enhanced predictive payroll forecasting and budget accuracy using ML algorithms.

- Automated compliance monitoring and real-time legislative updates across multi-jurisdictional systems.

- Intelligent data validation and error detection, minimizing manual reconciliation efforts.

- Implementation of chatbots and virtual assistants for employee self-service payroll inquiries.

- Advanced fraud detection through anomaly monitoring in disbursement patterns and time card entries.

- Optimization of complex variable compensation calculations (e.g., commissions, bonuses) through algorithmic processing.

DRO & Impact Forces Of HR Payroll Software Market

The HR Payroll Software Market expansion is significantly propelled by the increasing need for operational efficiency and mandatory regulatory adherence, counterbalanced by persistent concerns related to data security and high initial deployment costs, while new opportunities arise through global expansion and technology integration. Drivers emphasize the shift from fragmented legacy systems to integrated Human Capital Management (HCM) suites, driven by the desire for unified data architecture and enhanced employee experience. Restraints predominantly focus on organizational resistance to change management during system migration and the complexity of integrating new payroll software with existing Enterprise Resource Planning (ERP) and financial systems. Opportunities are centered around leveraging advanced technologies like Blockchain for secure, transparent transaction verification and expanding market reach into burgeoning economies adopting cloud-first policies.

Impact forces currently prioritize market drivers, reflecting a powerful mandate for automation across all enterprise sizes. The rising global mobility of the workforce necessitates sophisticated solutions capable of managing expatriate payroll, multi-country taxation, and global benefits administration, pushing enterprises toward vendors offering comprehensive international payroll engines. However, the high visibility and sensitivity of payroll data mean that data breach risks act as a perpetual restraining force, compelling vendors to invest heavily in advanced encryption, multi-factor authentication, and strict adherence to global privacy frameworks like ISO 27001. The regulatory burden, while often viewed as a constraint due to complexity, simultaneously acts as a primary market driver, as non-compliance carries severe financial and reputational penalties, making robust software a necessity rather than an optional investment.

The cumulative effect of these forces suggests a market trajectory dominated by SaaS providers offering specialized compliance modules and superior data security guarantees. The high total cost of ownership (TCO) associated with customizations in large enterprise installations remains a key restraint, often prompting businesses to opt for standardized, scalable solutions. Conversely, the opportunity to utilize payroll data for strategic workforce analytics—such as determining return on investment for labor spending or optimizing shift schedules—is a powerful long-term growth lever, incentivizing continued investment in AI-enhanced platforms.

Segmentation Analysis

The HR Payroll Software Market is comprehensively segmented based on its core components, delivery mechanisms, and end-user requirements, reflecting a highly fragmented yet rapidly consolidating industry structure. Key segments include deployment type (Cloud vs. On-premise), enterprise size (SME vs. Large Enterprise), and specific application areas (e.g., core payroll, time and attendance, benefits management). This segmentation is crucial for understanding specific growth pockets, with the cloud-based solutions currently dominating market share due to their inherent scalability and lower infrastructure investment requirements. The demand for integrated solutions capable of managing the full employee lifecycle is further driving the convergence of traditional payroll systems with broader Human Resource Management (HRM) functionalities.

- By Component: Software, Services (Managed Services, Integration and Implementation Services, Consulting Services).

- By Deployment Type: On-premise, Cloud-based.

- By Enterprise Size: Small and Medium Enterprises (SMEs), Large Enterprises.

- By Application/Functionality: Core Payroll Management, Time and Attendance Management, Tax Management, Benefits Administration, Employee Self-Service, Compliance Management.

- By Industry Vertical: BFSI, IT & Telecom, Manufacturing, Healthcare, Retail, Government & Public Sector.

Value Chain Analysis For HR Payroll Software Market

The value chain of the HR Payroll Software Market commences with upstream activities involving core software development, intellectual property creation, and rigorous data compliance research. Software vendors invest heavily in developing sophisticated payroll engines, integration APIs, and security protocols compliant with international standards (e.g., SOC 1/2, ISO 27001). This phase focuses on modular architecture design and ensuring technological readiness for rapid deployment and scalability across various operating systems and cloud environments. Key inputs include advanced computational algorithms, regulatory databases, and expert knowledge in fiscal policy and labor law.

Midstream activities involve deployment, integration, and service delivery, where third-party implementation partners, specialized consulting firms, and managed service providers play a pivotal role. The complexity of integrating new payroll software with legacy financial systems necessitates robust integration services. Distribution channels are typically categorized as direct sales (for large enterprise accounts requiring bespoke contracts and deep relationship management) and indirect channels, primarily through reseller networks, strategic technology partners (e.g., ERP providers), and cloud marketplace platforms. The efficiency of managed payroll services, which often handle the entire payroll lifecycle, is critical in adding value at this stage, particularly for SMEs lacking internal payroll expertise.

Downstream activities focus on the end-user interaction, encompassing maintenance, continuous regulatory updates, technical support, and user training. Effective distribution relies on delivering software updates seamlessly (especially in SaaS models) and providing robust, localized customer service to handle urgent payroll queries and tax filing deadlines. The final value derived is improved accuracy, reduced compliance risk for the end-user, and the strategic utilization of payroll data for business intelligence. Continuous feedback loops from end-users drive product roadmap development, ensuring the software remains responsive to evolving legislative landscapes and technological expectations.

HR Payroll Software Market Potential Customers

Potential customers for HR Payroll Software span the entirety of the corporate and public sectors, fundamentally comprising any entity employing personnel, irrespective of industry or geographical presence. Primary buyers are organizations seeking efficiency gains and risk mitigation associated with complex payroll processing, tax remittance, and benefits administration. This includes small businesses requiring simple, scalable, out-of-the-box solutions to replace spreadsheets, mid-market companies needing integrated HRIS systems to manage growth, and large multinational corporations demanding highly customizable, multi-jurisdictional global payroll platforms.

Specifically, end-users are concentrated in sectors characterized by high employee turnover, complex regulatory environments, or geographically dispersed operations. The Manufacturing and Retail sectors are significant consumers, driven by the need for precise time and attendance tracking and complex shift differential calculations. The BFSI and Healthcare sectors prioritize software with the highest security clearance and compliance audit trails due to stringent regulatory oversight (e.g., HIPAA compliance in Healthcare and financial regulations in BFSI). Government and Public Sector agencies are also major buyers, requiring robust systems for high-volume transactions and strict adherence to public sector budgetary rules and pension plans.

Furthermore, the shift towards specialized buyers, such as Professional Employer Organizations (PEOs) and Business Process Outsourcing (BPO) firms, represents a crucial customer segment. These organizations purchase robust, white-labeled payroll platforms to offer managed services to their diverse client base. The common denominator among all potential customers is the strategic mandate to transform human capital management from a cost center into a strategic asset, leveraging automated payroll data for informed decision-making regarding labor investment and talent retention strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion USD |

| Market Forecast in 2033 | $21.5 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADP, LLC, Paychex, Inc., SAP SE, Oracle Corporation, Workday, Inc., Ultimate Software Group, Intuit Inc., Kronos Incorporated, Namely, Gusto, Paycom Software, Inc., Cornerstone OnDemand, Zenefits, Ramco Systems, Sage Group plc, Unit4, Epicor Software Corporation, Patriot Software, Ascentis, TriNet Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HR Payroll Software Market Key Technology Landscape

The contemporary HR Payroll Software landscape is predominantly defined by the dominance of the Software as a Service (SaaS) model, which facilitates rapid deployment, minimizes the client's burden of maintenance and updates, and ensures continuous access to the latest compliance features. SaaS architecture relies heavily on multi-tenant cloud environments, providing high scalability and cost-efficiency, crucial for accommodating fluctuating workforce sizes and global expansion needs. Modern systems utilize microservices architecture, allowing different modules (e.g., time tracking, core payroll calculation, tax engine) to operate independently, enhancing system resilience, facilitating quicker feature updates, and simplifying integration via standardized APIs.

Advanced integration capabilities, primarily through robust API gateways, are critical technological differentiators. These APIs allow seamless connections with diverse peripheral HR technologies, including applicant tracking systems (ATS), learning management systems (LMS), and third-party benefits brokers, ensuring centralized data management without proprietary lock-ins. Furthermore, the rising adoption of intelligent automation technologies, including Robotic Process Automation (RPA) for routine data reconciliation tasks and machine learning for predictive auditing, is enhancing the efficiency of back-office payroll processes and reducing the dependency on manual interventions for error correction and compliance verification.

Security technology remains paramount, driven by the sensitive nature of employee financial data. Key security implementations include advanced encryption protocols (end-to-end and at-rest), geo-fencing and tokenization for secure mobile access, and adherence to zero-trust security models to protect against unauthorized internal or external access. The future technological trajectory is moving toward Blockchain technology for immutable record-keeping of payment transactions and verification of employee identity, promising enhanced transparency, reduced fraud potential, and faster cross-border payments, positioning these distributed ledger technologies (DLT) as the next major disruptor in global payroll operations.

Regional Highlights

Regional dynamics play a significant role in shaping the HR Payroll Software Market, with varying levels of maturity, technological adoption, and regulatory complexity defining growth patterns across global territories. North America remains the leading revenue generator due to the presence of large multinational corporations, high technological readiness, and a strong culture of outsourcing complex HR functions. The region's market is highly competitive and mature, characterized by high investment in Artificial Intelligence (AI) and advanced analytics to optimize workforce performance and ensure stringent compliance with state-specific labor laws and federal tax mandates, such as the Fair Labor Standards Act (FLSA).

Europe represents a crucial market segment, distinguished by its highly fragmented regulatory landscape, necessitating payroll software capable of managing diverse languages, currencies, and unique national labor agreements (e.g., works council obligations). The strong enforcement of the General Data Protection Regulation (GDPR) mandates that European HR payroll providers offer superior data localization and privacy controls, driving innovation in secure cloud environments. The shift towards unified, cross-border European payroll platforms is a key trend, particularly as the UK’s departure from the EU has introduced new complexities in cross-channel payroll management, pushing companies toward highly flexible, automated solutions.

The Asia Pacific (APAC) region is projected to experience the fastest growth throughout the forecast period. This acceleration is fueled by massive urbanization, burgeoning industrial sectors, and government initiatives promoting digital transformation and cloud computing adoption, particularly in emerging markets like India, China, and Southeast Asian nations. APAC’s complexity arises from the lack of standardization across tax and regulatory systems within the region, driving demand for locally compliant, modular payroll systems. SMEs in APAC are rapidly transitioning from manual systems to SaaS-based solutions to manage their rapid growth and ensure adherence to diverse local labor laws.

Latin America (LATAM) and the Middle East and Africa (MEA) offer substantial untapped potential. LATAM markets are driven by the need to manage hyperinflationary environments and complex, bureaucratic tax reporting requirements, making software automation essential for accuracy. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is undergoing significant digital modernization, driven by national visions (like Saudi Vision 2030). The increasing number of expatriate workers necessitates robust systems for handling multi-currency payments, complex visa requirements, and end-of-service gratuity calculations, pushing demand for centralized, comprehensive payroll platforms.

- North America: Market leader, high penetration of cloud HCM, driven by complex federal/state tax compliance and investment in AI.

- Europe: Driven by GDPR requirements and the need for localized solutions to manage fragmented national labor laws and multi-country compliance.

- Asia Pacific (APAC): Fastest growing region, fueled by digital transformation, high SME growth, and the shift from manual processes to scalable SaaS solutions.

- Latin America (LATAM): Growth driven by need for automated compliance in unstable macroeconomic and complex regulatory environments.

- Middle East & Africa (MEA): Increasing adoption tied to government digitization mandates and managing large expatriate workforces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HR Payroll Software Market.- ADP, LLC

- Paychex, Inc.

- SAP SE

- Oracle Corporation

- Workday, Inc.

- Ultimate Software Group (now UKG)

- Intuit Inc.

- Kronos Incorporated (now UKG)

- Namely

- Gusto

- Paycom Software, Inc.

- Cornerstone OnDemand

- Zenefits

- Ramco Systems

- Sage Group plc

- Unit4

- Epicor Software Corporation

- Patriot Software

- Ascentis

- TriNet Group

Frequently Asked Questions

Analyze common user questions about the HR Payroll Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of cloud-based HR payroll software?

The primary driver is the need for continuous regulatory compliance updates, which SaaS models deliver automatically. Cloud platforms also offer lower Total Cost of Ownership (TCO), superior scalability for growth, and instant accessibility for remote and mobile workforces, significantly reducing IT infrastructure overhead.

How does AI impact compliance management within payroll systems?

AI significantly enhances compliance by using machine learning to monitor and automatically incorporate real-time changes in tax laws and labor regulations across multiple jurisdictions. This capability minimizes human error and reduces the risk of non-compliance penalties, especially in global organizations.

What differentiates global payroll software from localized systems?

Global payroll software offers centralized data management and a unified user interface capable of handling multiple currencies, varied tax laws, and different statutory filing requirements across numerous countries. Localized systems focus only on the specific legal and fiscal requirements of a single region.

Which enterprise segment is showing the highest growth rate in this market?

The Small and Medium Enterprise (SME) segment is exhibiting the highest growth rate. SMEs are increasingly migrating from manual methods to affordable, scalable, user-friendly SaaS solutions to manage increasing complexity, streamline operations, and ensure professional compliance without dedicated large internal HR teams.

What is the main challenge restraining market growth despite high demand?

The principal restraining challenge is the persistent concern over data security and privacy risks associated with handling sensitive Personally Identifiable Information (PII) and financial data. Organizations demand stringent security certifications and robust encryption, which necessitates high investment from software providers.

The comprehensive analysis of the HR Payroll Software market highlights critical trends shaping the future of workforce management (WFM) and Human Capital Management (HCM). Focus areas include global payroll processing, regulatory technology (RegTech) integration, and the strategic importance of employee self-service modules. Key technologies like API integration enable seamless connectivity between payroll systems and core ERP platforms, driving operational efficiencies. The shift toward unified HRIS platforms, such as those offered by major players like Workday and SAP, emphasizes the necessity of combining talent acquisition, performance management, and time and attendance with core payroll functions. Small and Medium Enterprises (SMEs) are leveraging solutions like Gusto and Patriot Software for simplified tax filing and compliance management, particularly in the North American market, where IRS regulations are complex. In terms of vertical application, the Healthcare industry requires specialized payroll capabilities to handle union contracts, complex shift differentials, and high regulatory scrutiny (e.g., minimum staffing levels impacting labor costs). The Manufacturing sector heavily relies on integrated Time and Attendance features, often requiring biometric data capture and real-time labor tracking to optimize production costs and ensure accurate wage calculation based on production bonuses or piece rates. The adoption of blockchain for cross-border payments is an emerging opportunity, offering enhanced security and reduced transaction fees compared to traditional banking rails, thus improving the efficiency of global payroll disbursements. Regional expansion strategies focus on capturing market share in Asia Pacific, where countries like Indonesia, Vietnam, and the Philippines are rapidly digitalizing their workforce management practices. Vendors must offer highly localized engines capable of handling mandatory social security contributions and fluctuating regional taxes. Data integrity and system resilience are core requirements across all regions, demanding compliance with SOC 2 Type II and regional data localization laws (e.g., data residency requirements in Europe and China). The ongoing evolution of the market is driven by competitive pressure to offer continuous innovation in user experience (UX) and system integration, making the market highly attractive for both established technology giants and agile SaaS startups focusing on niche compliance automation or specific vertical market segments. The growing acceptance of agile and flexible payment schedules, such as earned wage access (EWA), is also forcing payroll providers to adapt their disbursement systems, moving beyond traditional bi-weekly pay cycles. This financial flexibility for employees is becoming a strategic tool for talent retention, further integrating payroll platforms with financial wellness applications. The overall market trajectory indicates continued consolidation among vendors offering full-suite HCM solutions to deliver a truly unified employee experience. The sophistication of HR analytics derived from payroll data, including labor cost per employee, turnover analysis correlated with compensation, and budget variance reporting, is crucial for c-level decision-makers. Cloud deployment ensures that these strategic reports are available in real-time, empowering faster, data-driven management decisions. The implementation lifecycle for large enterprise payroll systems often involves complex change management and significant capital expenditure, acting as a natural barrier to entry for smaller or less mature software providers. Regulatory changes pertaining to contractor classification and gig economy workers (e.g., AB5 in California) necessitate flexible payroll software that can manage both traditional W-2 employees and 1099 contractors efficiently, driving demand for specialized functionality within core payroll platforms. Market penetration is deepest in the IT and Telecom sector, which leads in adopting advanced cloud solutions and predictive analytics for workforce optimization. Conversely, the public sector often lags in cloud adoption due to legacy system dependency and stringent security clearance requirements, though migration efforts are accelerating globally. Key technology trends include the move toward open API architectures, enabling easier customization and connection to niche third-party applications, supporting an ecosystem approach rather than monolithic software suites. This flexibility benefits enterprise buyers seeking best-of-breed solutions tailored to unique organizational structures. The security aspect is non-negotiable, with vendors increasingly utilizing behavioral analytics and AI to detect internal threats and unauthorized access attempts on confidential employee records. The market will see continued mergers and acquisitions (M&A) as large players acquire smaller, specialized firms to quickly integrate new compliance or geographical capabilities, maintaining a highly dynamic and competitive environment focused on ensuring global workforce payment accuracy and regulatory adherence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager