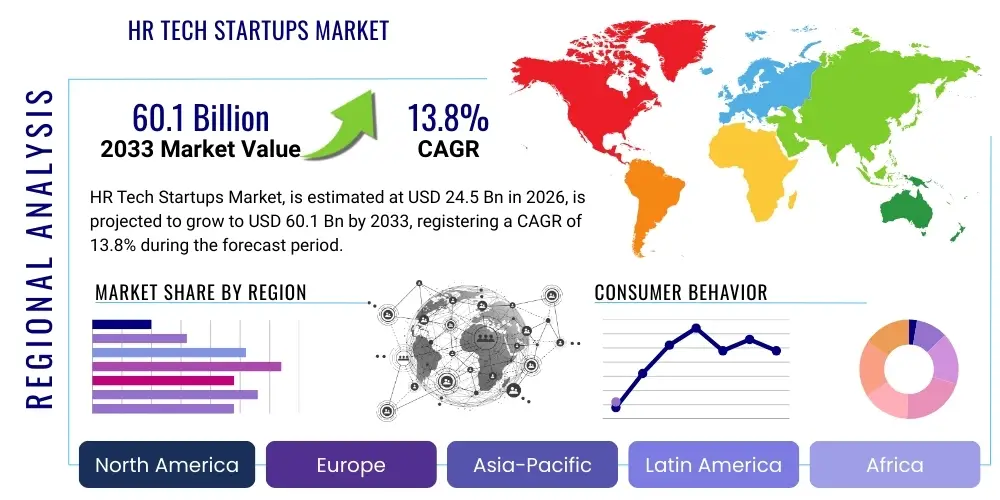

HR Tech Startups Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437778 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

HR Tech Startups Market Size

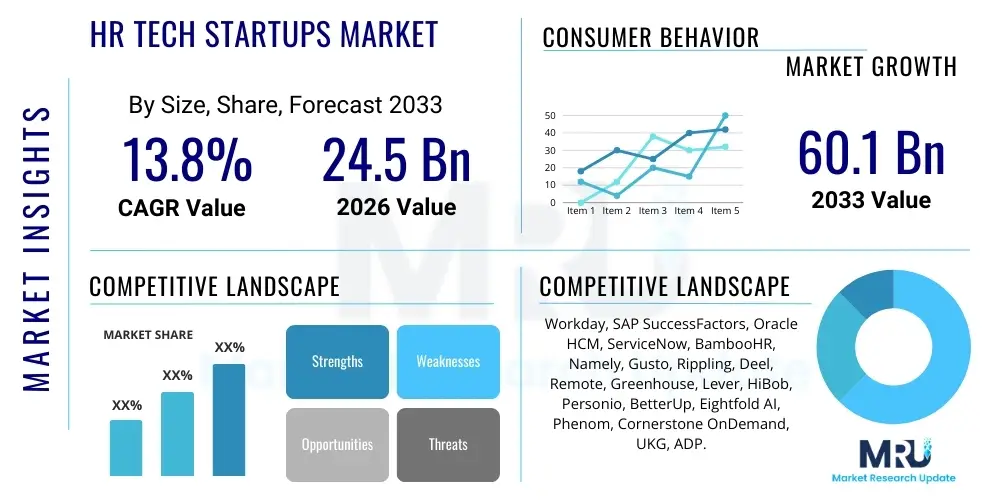

The HR Tech Startups Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $60.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the accelerated digital transformation of HR functions globally, coupled with the increasing demand for advanced solutions in talent acquisition, employee experience, and data-driven decision-making within enterprises of all sizes.

The valuation reflects a significant shift from legacy HR management systems (HRMS) to agile, cloud-native, specialized tools offered by startups. These startups leverage technologies like Artificial Intelligence (AI), Machine Learning (ML), and blockchain to address critical pain points, such as high employee turnover, skill gaps, and the complexity of managing a distributed, often remote, workforce. Furthermore, venture capital interest in the HR Tech domain remains consistently high, providing essential fueling for innovation and market expansion into new geographical regions and niche sectors like compliance technology and personalized learning platforms.

Market growth is also intrinsically linked to macro-economic factors, including labor market tightness in developed economies, necessitating sophisticated recruitment and retention tools. The adoption curve is steepest among mid-market companies seeking scalable, cost-effective solutions that can compete with the functionalities offered by large enterprise platforms, thereby democratizing access to cutting-edge HR technology. This competitive landscape, characterized by frequent mergers and acquisitions, further accelerates the deployment of novel HR solutions, ultimately driving the overall market value upwards toward the projected 2033 milestone.

HR Tech Startups Market introduction

The HR Tech Startups Market encompasses newly established, technology-driven companies focused on developing software and services designed to optimize Human Resources management processes. These solutions span the entire employee lifecycle, from pre-hire activities like recruitment and onboarding to ongoing management tasks such as performance evaluation, compensation, benefits administration, employee engagement, and offboarding. The core product offering often revolves around Software as a Service (SaaS) models, ensuring scalability, accessibility, and continuous updates, which contrasts sharply with traditional, inflexible on-premise solutions. These systems are essential tools in modern organizational structures, enabling HR departments to transition from purely administrative roles to strategic business partners.

Major applications of HR Tech solutions include automated talent acquisition platforms utilizing predictive analytics, personalized employee learning and development (L&D) systems, sophisticated workforce planning tools, and robust compliance management software tailored for global operations. A defining characteristic of these applications is their focus on improving the user experience for both HR professionals and employees. By simplifying complex processes through intuitive interfaces and mobile optimization, HR tech startups enhance efficiency, reduce administrative overhead, and significantly improve employee satisfaction and overall organizational productivity. The shift towards remote and hybrid work models has amplified the necessity for integrated communication and performance tracking tools, solid platforms for which these startups are providing.

The primary benefits derived from adopting HR Tech solutions include enhanced data visibility, allowing organizations to make informed, strategic decisions regarding their human capital; improved compliance with increasingly complex labor laws and regulations across different jurisdictions; and substantial cost reductions stemming from process automation. Driving factors fueling this market are multifaceted, including the global mandate for digital transformation across all business functions, the intense competition for high-skilled talent which necessitates superior recruitment technology, and the persistent need for organizations to foster positive, engaging employee experiences in a high-turnover environment. Moreover, technological advancements in cloud computing and data analytics provide the necessary infrastructure for these advanced applications to function effectively and integrate seamlessly with existing enterprise resource planning (ERP) systems.

HR Tech Startups Market Executive Summary

The HR Tech Startups Market is defined by aggressive innovation, driven primarily by the integration of sophisticated analytical capabilities and AI-powered automation across all functional areas of HR. Business trends indicate a strong prioritization of specialized, vertical solutions over monolithic HRMS platforms, with startups achieving success by dominating niche areas such as synchronous communication, global payroll compliance, and internal mobility platforms. Investment flows remain robust, targeting startups that demonstrate clear ROI through quantifiable improvements in retention rates and recruitment cycle times. Furthermore, the emphasis on organizational culture and mental health support, catalyzed by post-pandemic workplace shifts, is spawning a new generation of employee wellness and engagement platforms, significantly shaping the short-to-medium-term business trajectory.

Regionally, North America maintains its dominance due to high concentration of venture capital, early technology adoption, and a mature ecosystem of large corporations actively seeking transformative HR solutions. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, propelled by rapid industrialization, large youth populations entering the workforce, and governmental pushes for digitalization in emerging economies like India and Southeast Asia. Europe is characterized by stringent data privacy regulations (GDPR), which mandate sophisticated compliance features, thereby driving innovation specifically in secure data handling and pseudonymization techniques within HR systems. Startups focusing on cross-border employment and compliance, such as Employer of Record (EOR) services, are seeing exponential growth globally, reflecting the increasingly borderless nature of high-skilled labor markets.

Segmentation trends highlight the increasing importance of the Talent Acquisition segment, which remains the largest by revenue, heavily investing in AI for candidate sourcing and screening to overcome pervasive skill shortages. The Employee Experience (EX) segment, encompassing engagement, feedback, and wellness, is the fastest-growing area, reflecting the strategic realization that retention is often more cost-effective than constant recruitment. Technology adoption is skewing heavily towards cloud-based deployments, which offer the flexibility required by modern, scalable organizations. Within deployment models, hybrid solutions are gaining traction among large enterprises managing transitional phases, but pure SaaS remains the preferred model for new implementations and startups due to its inherent agility and lower total cost of ownership (TCO).

AI Impact Analysis on HR Tech Startups Market

User queries regarding the impact of AI on HR Tech Startups heavily focus on automation, ethical considerations, and the future role of HR professionals. Common questions include: "How does AI enhance talent acquisition fairness and reduce bias?", "What are the key AI applications beyond automated screening, such as performance prediction or personalized learning?", and "Will AI integration lead to significant job displacement within HR departments?" These themes reveal a collective expectation that AI will deliver substantial operational efficiencies and enhance data-driven decision-making, coupled with significant underlying concerns about algorithmic bias, data privacy, and the human element in employee relations. Users seek assurance that AI adoption will lead to augmentation rather than substitution of human judgment, particularly in sensitive areas like compensation and employee grievance handling.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the value proposition of HR tech startups, shifting them from simple data record keepers to strategic intelligence platforms. AI algorithms are increasingly deployed in predictive analytics, enabling companies to forecast future workforce needs, identify employees at risk of attrition, and determine the necessary training interventions to close skill gaps proactively. This capability allows HR departments to transition from reactive administrative management to proactive, strategic human capital management. Furthermore, natural language processing (NLP) is revolutionizing candidate communication and employee feedback mechanisms, enabling chatbots and conversational AI to handle routine inquiries 24/7, thereby freeing up HR specialists to focus on high-touch strategic tasks requiring empathy and complex problem-solving.

However, the ethical dimensions of AI deployment remain a critical area of focus, especially concerning algorithmic fairness and transparency. Startups are prioritizing the development of explainable AI (XAI) models to ensure hiring and promotional decisions are auditable and free from historical human biases embedded in training data. Regulatory bodies are beginning to scrutinize the use of AI in employment decisions, particularly in regions like the EU and specific US states, compelling HR tech startups to develop robust governance frameworks. Success in this market increasingly depends not just on technological sophistication but also on the ability to embed trust and ensure ethical accountability within AI-driven HR processes, thereby mitigating legal risks and fostering employee acceptance of automated systems. The competitive advantage is increasingly held by those who can responsibly integrate AI, ensuring it enhances, rather than detracts from, the employee experience.

- AI-driven personalized learning paths and skill gap identification.

- Enhanced candidate screening and sourcing efficiency via intelligent matching algorithms.

- Reduction of unconscious bias in hiring through anonymized screening tools.

- Predictive attrition modeling and proactive retention strategies.

- Automated performance management scoring and continuous feedback loops.

- Conversational AI chatbots for 24/7 employee support and FAQ resolution.

- Development of explainable AI (XAI) for transparent decision-making in promotion and pay.

- Optimization of workforce scheduling and resource allocation based on demand forecasts.

DRO & Impact Forces Of HR Tech Startups Market

The HR Tech Startups Market is strongly influenced by a confluence of powerful drivers and restraining factors, balanced by significant opportunities that dictate long-term strategic direction. Key drivers include the pervasive global need for digital transformation across HR functions, the persistent complexity and costs associated with manual HR processes, and the strategic recognition by enterprises that human capital management is a direct competitive advantage. These forces compel organizations to adopt advanced, specialized tools offered by startups. Conversely, significant restraints include the high initial implementation costs and integration complexities associated with transitioning from legacy HRIS systems, alongside pervasive organizational resistance to change and concerns over the security and privacy of sensitive employee data, particularly when adopting cloud solutions. Startups must navigate these opposing forces by demonstrating clear, rapid ROI and providing robust, secure integration frameworks.

Opportunities in the HR Tech space are abundant, particularly around emerging technologies and untapped geographical areas. The burgeoning global remote work trend presents a vast opportunity for platforms specializing in global payroll, compliance, and multi-jurisdictional tax management (e.g., Employer of Record services). Furthermore, the increased societal focus on Diversity, Equity, and Inclusion (DEI) and employee mental well-being creates significant white space for specialized analytics and support tools. Startups leveraging blockchain technology for secure credentials verification (e.g., academic records, professional certifications) and secure global payments represent a high-potential, transformative area. The market structure is highly competitive, meaning innovation cycles are short, making the ability to rapidly deploy novel solutions a critical competitive factor for startups seeking sustainable growth and high valuation.

The overall impact forces are overwhelmingly positive, favoring market expansion, though modulated by technological and regulatory risks. The push for hyper-personalization in the workplace, treating employees as internal customers, drives demand for highly flexible and customizable solutions, which startups are uniquely positioned to provide compared to entrenched, standardized enterprise software providers. The immediate impact of the COVID-19 pandemic accelerated the adoption timeline for essential tools like digital onboarding, remote performance monitoring, and engagement surveys, permanently shifting the market towards digital-first solutions. Long-term success is dependent on how effectively startups can address regulatory fragmentation across different regions while simultaneously maintaining a high degree of integration capability with the fragmented enterprise software ecosystem (e.g., ERP, CRM, and financial systems), positioning themselves as essential, interoperable components of the modern digital enterprise stack.

Segmentation Analysis

The HR Tech Startups Market is segmented primarily across three key dimensions: Type of Offering (Software vs. Services), Application Area (Talent Acquisition, Core HR, Workforce Management, etc.), and Deployment Model (Cloud vs. On-Premise). This granular segmentation is crucial for understanding specific market dynamics, identifying high-growth niches, and tailoring product development to meet precise organizational needs. The diversity in segmentation reflects the comprehensive nature of the modern HR function, which requires specialized tools for every stage of the employee lifecycle. The trend is moving towards integrated platforms that offer a suite of services but maintain modularity, allowing organizations to select and scale specific functionalities as required, thus bridging the gap between niche specialization and enterprise-wide integration.

- By Offering Type:

- Software (SaaS, Platform-as-a-Service)

- Services (Consulting, Managed Services, Implementation Support)

- By Application:

- Talent Acquisition and Onboarding (Recruitment Marketing, Applicant Tracking Systems (ATS), Background Checks)

- Core HR Management (Personnel Administration, Benefits Administration, Global Payroll)

- Workforce Management (Time and Attendance, Scheduling, Absence Management)

- Talent Management (Performance Management, Learning & Development (L&D), Succession Planning)

- Employee Experience and Engagement (Feedback Tools, Wellness Platforms, Internal Communications)

- By Deployment Model:

- Cloud-based (Public, Private, Hybrid Cloud)

- On-Premise (Declining, often limited to highly regulated industries)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- IT & Telecommunications

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Manufacturing

- Retail and CPG (Consumer Packaged Goods)

Value Chain Analysis For HR Tech Startups Market

The value chain for the HR Tech Startups Market begins with upstream activities centered on technology infrastructure providers and specialized data services. Upstream suppliers include cloud computing giants (like AWS, Azure, Google Cloud) that provide the foundational infrastructure (IaaS and PaaS) necessary for startups to deploy scalable SaaS solutions. Additionally, firms specializing in deep learning, natural language processing (NLP) libraries, and secure data storage protocols constitute the essential technological inputs. Startups must strategically manage these vendor relationships to ensure high uptime, data security compliance, and cost-effective scaling, as these factors directly influence the final product's performance and unit economics. The ability to efficiently consume and integrate these upstream technological components dictates the speed of innovation within the startup ecosystem.

Midstream activities involve the core development, customization, and continuous refinement of the HR software product. This phase includes agile software development, UX/UI design, data modeling for predictive analytics, and ensuring regulatory compliance features are embedded globally (e.g., GDPR, CCPA, specific payroll tax laws). Startups often differentiate themselves here through proprietary algorithms (e.g., bias mitigation in hiring AI) and highly focused integrations with existing enterprise systems. The value added at this stage is the transformation of raw technological capability into specific, scalable, and user-friendly HR solutions that solve concrete business problems, such as reducing time-to-hire or improving employee sentiment scores.

The downstream segment focuses on market access, distribution channels, and post-sales support. Distribution is predominantly direct-to-consumer via subscription-based models (SaaS), leveraging inside sales teams and extensive digital marketing efforts optimized for AEO/GEO. Indirect channels include strategic partnerships with HR consulting firms, Managed Service Providers (MSPs), system integrators (SIs), and existing large ERP providers (e.g., via marketplace integrations). Effective downstream management involves providing robust customer success services, continuous product training, and implementation support, as the complexity of integration into client ecosystems can be a significant barrier to adoption. Strong partnerships and a reliable support structure are crucial for client retention and driving high lifetime customer value (LTV).

HR Tech Startups Market Potential Customers

The primary customers for HR Tech Startups are organizations across all sizes and industry verticals that seek to modernize their human capital management processes. Potential customers are segmented by size: Small and Medium-sized Enterprises (SMEs) often adopt comprehensive, all-in-one platforms that simplify core HR functions due to limited internal resources, prioritizing ease of use and affordability. Large Enterprises, conversely, seek highly specialized, modular solutions that integrate seamlessly with their existing, complex HR ecosystems, often investing heavily in advanced areas like predictive analytics, global mobility management, and specialized learning platforms to maintain a competitive edge in talent management.

Furthermore, customers are defined by their digital maturity and regulatory environment. Highly regulated industries like Banking, Financial Services, and Insurance (BFSI) and Healthcare are key buyers for compliance-focused tools, secure data management systems, and specialized training platforms required for continuous regulatory adherence. Technology-intensive sectors (IT and Telecommunications) are early adopters of cutting-edge solutions like AI-driven recruitment and specialized employee performance tools optimized for remote or highly agile teams. The ultimate buyer, the decision-maker, usually ranges from the Chief Human Resources Officer (CHRO) or VP of HR to the Chief Information Officer (CIO), depending on the implementation scale and required technological integration.

The demographic shift towards a younger, digitally native workforce also defines the customer base indirectly, as companies must invest in modern, consumer-grade HR technologies to meet employee expectations for mobile access, intuitive design, and personalized service delivery. This demand for superior Employee Experience (EX) software drives purchasing decisions, making startups that excel in user interface and mobile functionality highly attractive. Geographically, customers in high-growth regions like APAC are rapidly expanding their adoption of cloud-based HR solutions, whereas customers in North America and Europe primarily focus on optimization, specialization, and regulatory compliance enhancements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $60.1 Billion |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Workday, SAP SuccessFactors, Oracle HCM, ServiceNow, BambooHR, Namely, Gusto, Rippling, Deel, Remote, Greenhouse, Lever, HiBob, Personio, BetterUp, Eightfold AI, Phenom, Cornerstone OnDemand, UKG, ADP. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HR Tech Startups Market Key Technology Landscape

The HR Tech Startups Market is defined by the rapid adoption and maturation of several core technological pillars. Cloud computing, particularly SaaS models, remains the foundational infrastructure, enabling startups to offer highly scalable, subscription-based services without demanding heavy capital investment from clients. This shift to the cloud is non-negotiable, as it facilitates immediate deployment, seamless integration with other enterprise tools, and continuous, rapid feature updates. Furthermore, the ubiquitous nature of mobile technology ensures that almost all modern HR solutions are mobile-optimized, facilitating accessibility for field employees and supporting the trend towards decentralized workforce management and communication, crucial for improving employee engagement metrics.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most significant transformative technology currently shaping the market. AI is not merely a feature but a core capability embedded in functions ranging from automated candidate screening (using NLP for resume parsing) and predictive analytics for turnover risk, to personalizing employee learning pathways based on performance data. Data analytics, leveraging large datasets gathered across the employee lifecycle, underpins all strategic HR tech applications. Startups are utilizing sophisticated business intelligence (BI) and visualization tools to transform raw HR data (e.g., engagement survey results, performance reviews, time stamps) into actionable insights for strategic planning, workforce optimization, and compliance auditing, thus moving HR from a cost center to a verifiable source of organizational value.

Emerging technologies like blockchain and robotic process automation (RPA) are gaining traction in niche areas. Blockchain is utilized to create highly secure, tamper-proof digital credentials for verification of qualifications and employment history, streamlining global hiring processes and enhancing data integrity, particularly relevant for cross-border transactions. RPA is applied to automate repetitive, rules-based administrative tasks, such as data entry for payroll or benefits enrollment, further increasing the efficiency gains promised by HR tech solutions. The strategic convergence of these technologies allows startups to offer integrated, hyper-efficient systems that minimize human error and maximize strategic HR output, driving the market towards greater automation and intelligence.

Regional Highlights

- North America: This region holds the largest market share, driven by a highly mature technology ecosystem, significant investment from venture capital firms, and a culture of early adoption of advanced analytics and AI-driven solutions. The US market, characterized by intense competition for skilled labor and complex state-level regulations, fuels demand for sophisticated talent acquisition, compensation benchmarking, and compliance management platforms. Major tech hubs in Silicon Valley and New York serve as global innovation centers for HR tech development, continuously setting global trends in areas such as employee experience (EX) and personalized wellness programs.

- Europe: The European market is characterized by strong demand for solutions focused on data privacy (driven by GDPR compliance), multilingual capabilities, and complex labor relations management (e.g., works councils and diverse employment contracts across member states). Countries like the UK, Germany, and France are leading adopters. Growth is steady, focused heavily on streamlining internal mobility, cross-border payroll, and ensuring equitable employee experiences across disparate national environments. Startups specializing in ethical AI and localized compliance tooling find a receptive market here.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, primarily fueled by rapid economic expansion, increasing digitalization efforts in countries like India, China, and Southeast Asia, and a large, young workforce entering the formal economy. The demand is high for core HR systems, affordable cloud-based payroll solutions, and mobile-first learning and development tools. The immense scale of the workforce in this region necessitates highly scalable and robust HR tech platforms, often leading to rapid deployment of solutions tailored for mass market adoption and multi-country operational efficiency.

- Latin America (LATAM): This region is an emerging market for HR tech, driven by a need for increased operational transparency, reduction of fraud in payroll and time tracking, and standardization of HR processes across different national regulatory frameworks. Brazil and Mexico lead the adoption curve, with strong interest in workforce management tools and specialized fintech solutions integrated with HR for payment processing and benefits administration. Affordability and localized support are key purchasing criteria.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, driven by significant government-led economic diversification and nationalization programs (e.g., Saudization). This results in high demand for robust talent planning, succession management, and performance monitoring systems to enhance local workforce productivity. Africa, particularly South Africa and Nigeria, shows potential in mobile-first recruitment and financial wellness platforms, addressing unique local banking and employment challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HR Tech Startups Market.- Workday

- SAP SuccessFactors

- Oracle HCM

- ServiceNow

- BambooHR

- Namely

- Gusto

- Rippling

- Deel

- Remote

- Greenhouse

- Lever

- HiBob

- Personio

- BetterUp

- Eightfold AI

- Phenom

- Cornerstone OnDemand

- UKG

- ADP

- Lattice

- Culture Amp

- Paycom

- Paylocity

- JazzHR

- Zenefits

- Papaya Global

- Globalization Partners

Frequently Asked Questions

Analyze common user questions about the HR Tech Startups market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high valuation and growth of HR Tech Startups?

The primary drivers are the accelerated global mandate for digital transformation in HR, the shift to hybrid/remote work requiring sophisticated management tools, and the massive influx of venture capital prioritizing specialized, AI-driven solutions for talent acquisition, retention, and superior employee experience (EX) platforms.

How is AI fundamentally changing the role of HR professionals through technology adoption?

AI is augmenting HR roles by automating administrative and repetitive tasks (RPA, chatbots) and providing strategic insights through predictive analytics (attrition risk, skill gap identification). This allows HR professionals to focus less on transactions and more on high-value, strategic decision-making and empathetic employee interaction.

What are the main segmentation trends concerning application areas in the HR Tech Market?

While Talent Acquisition remains the largest revenue segment, the fastest growing segments are Employee Experience (EX), which includes wellness and engagement tools, and Core HR/Global Compliance solutions, driven by the increasing complexity of managing multi-jurisdictional remote workforces and global payroll.

What are the biggest challenges HR Tech Startups face regarding enterprise adoption?

Major challenges include ensuring seamless, secure integration with diverse existing legacy HRIS and ERP systems, overcoming organizational resistance to change within conservative industries, and addressing stringent data privacy and regulatory compliance requirements, especially in Europe (GDPR).

Which geographical region is showing the highest growth potential for HR Tech investments?

The Asia Pacific (APAC) region, particularly emerging economies within Southeast Asia and India, exhibits the highest growth potential due to rapid workforce expansion, massive digitalization efforts across industries, and increasing corporate investment in modern, scalable, cloud-based HR infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager