HSC Milling Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431638 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

HSC Milling Machines Market Size

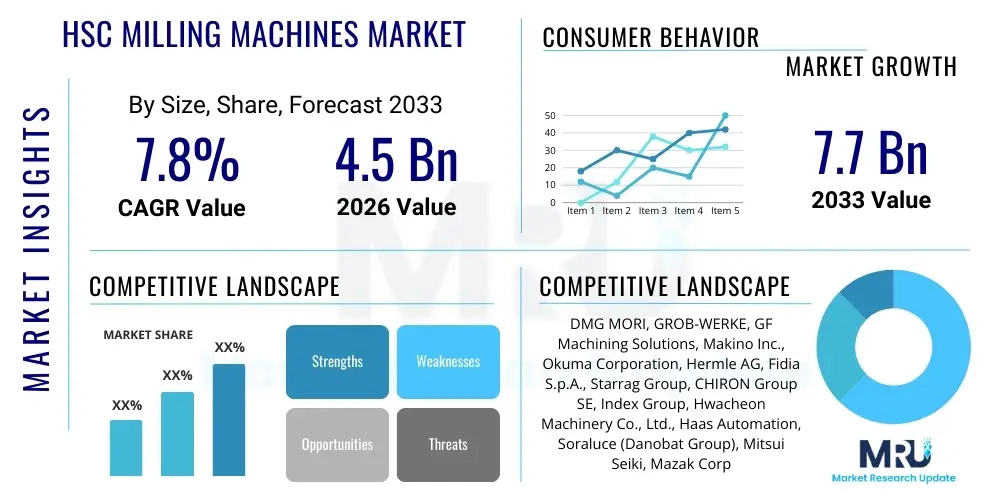

The HSC Milling Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.7 billion by the end of the forecast period in 2033. This robust expansion is primarily attributed to the increasing demand for precision components across high-value industries such as aerospace, automotive manufacturing, and medical device production, where tolerances are exceptionally strict and production speed is paramount. High-Speed Cutting (HSC) technology offers superior surface finish quality and material removal rates compared to conventional milling, making it indispensable for modern manufacturing processes seeking efficiency and accuracy.

HSC Milling Machines Market introduction

The High-Speed Cutting (HSC) Milling Machines Market encompasses advanced machining tools engineered to operate at extremely high spindle speeds (typically above 15,000 RPM) and feed rates, facilitating rapid material removal with minimal thermal distortion and exceptional surface integrity. These machines are characterized by rigid structures, high dynamic stiffness, advanced thermal management systems, and sophisticated control units that enable precise, multi-axis machining of complex geometries. The core product offering includes various configurations, primarily categorized by the number of axes (3-axis, 4-axis, and increasingly dominant 5-axis systems).

Major applications of HSC milling technology span across critical industrial sectors. In the mold and die industry, HSC machines are crucial for rapidly producing highly intricate molds for plastics and metals with superior surface finishes, reducing the need for extensive post-machining polishing. The aerospace sector relies heavily on HSC for machining challenging materials like titanium and nickel alloys used in turbine blades, structural components, and airframe parts, demanding both speed and material integrity. Furthermore, the burgeoning electric vehicle (EV) market and the medical sector, particularly in orthopedic implant manufacturing, are significant adopters, driving continuous technological evolution in tool design and control software.

The primary benefits driving market adoption include significantly reduced cycle times, which directly translates to lower operational costs and increased throughput. The enhanced surface quality achieved by HSC often eliminates secondary finishing operations, streamlining the overall manufacturing workflow. Key driving factors involve the global shift towards lightweight materials (especially in automotive and aerospace), the relentless pressure for miniaturization and complexity in component design, and the continuous innovation in tooling materials and machine kinematics, which further enhances the efficiency and applicability of HSC technology.

HSC Milling Machines Market Executive Summary

The HSC Milling Machines Market is experiencing a period of significant growth driven by industrial automation trends and the necessity for high-precision manufacturing solutions across mature and emerging economies. Key business trends indicate a strong focus on incorporating digital manufacturing solutions, notably the integration of IoT sensors, data analytics, and Artificial Intelligence (AI) to facilitate predictive maintenance and optimize cutting parameters in real-time. Equipment manufacturers are prioritizing the development of highly dynamic 5-axis machines, which represent the fastest-growing segment due to their ability to complete complex parts in a single setup, minimizing handling errors and improving geometric accuracy. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical reach, particularly into the rapidly industrializing regions of Southeast Asia, are central to the competitive strategy of major market players.

Regionally, the Asia Pacific (APAC) continues to lead the market in terms of volume consumption, propelled by massive investments in automotive manufacturing, electronics, and precision engineering across China, Japan, and South Korea. However, Europe maintains a dominant position in terms of technological innovation and value, especially within the high-end aerospace and mold & die segments, driven by German and Italian manufacturers. North America shows stable growth, primarily fueled by defense spending and the resurgence of domestic manufacturing capabilities, demanding highly automated and integrated HSC solutions. The competitive landscape is intensely focused on providing comprehensive lifecycle services, including application engineering support, software updates, and maintenance contracts, to secure long-term client relationships.

Segment trends reveal that the 5-axis machine segment is rapidly outpacing conventional 3-axis systems, reflecting the increasing complexity of modern component design and the need for greater manufacturing flexibility. By application, the aerospace and defense sectors remain high-value contributors, demanding machines capable of handling exotic, high-strength alloys. Simultaneously, the general machinery and job shop segment is witnessing increased adoption of entry-level and mid-range HSC machines as the technology becomes more accessible. This democratization of high-speed technology, combined with advances in cutting tool materials such as ceramics and specialized coatings, ensures continuous performance improvements and wider industrial applicability across diverse material types, from hardened steels to composite materials.

AI Impact Analysis on HSC Milling Machines Market

Users frequently inquire about how AI and machine learning (ML) contribute to minimizing material waste, reducing tool wear, and improving overall machine uptime in HSC operations, which are inherently complex and sensitive to parameter variations. The key themes revolve around the automation of process planning, the feasibility of autonomous operation, and the economic justification for adopting expensive AI-driven software solutions. Concerns often focus on data security, the reliability of predictive algorithms in highly variable production environments, and the necessary integration standards required to connect disparate machine control systems with centralized AI platforms. The general expectation is that AI will move HSC milling beyond simple programmed cycles into a realm of self-optimizing manufacturing, delivering unprecedented levels of efficiency and surface finish consistency, especially when machining delicate or difficult-to-cut components.

AI is transforming HSC milling by enabling highly precise parameter optimization that surpasses human capabilities. Machine learning algorithms analyze vast datasets encompassing sensor readings (vibration, temperature, current draw), historical cutting parameters, and achieved surface quality to dynamically adjust spindle speed, feed rate, and depth of cut in real time. This adaptive control prevents chatter, maximizes material removal rates (MRR) without compromising component integrity, and significantly extends tool life by identifying subtle wear patterns before catastrophic failure occurs. Furthermore, AI contributes substantially to enhancing energy efficiency by optimizing motor usage based on the actual load and material requirements, aligning with global sustainability goals.

The implementation of AI also facilitates advanced process planning and simulation. AI models can predict the outcome of various toolpath strategies, minimizing trial-and-error setups, which are time-consuming and costly, particularly when using expensive exotic materials. This capability is crucial for the efficient manufacturing of prototypes and low-volume, high-mix components common in aerospace and medical sectors. The integration of AI-powered digital twins allows manufacturers to simulate the entire machining process in a virtual environment, testing machine response to extreme conditions and training predictive maintenance systems, thereby ensuring maximum operational resilience and reducing unplanned downtime.

- AI-driven Predictive Maintenance (PdM) minimizes unexpected machine failure and downtime.

- Real-time adaptive cutting parameter optimization increases material removal rates (MRR) by up to 15%.

- Machine Learning (ML) algorithms predict and mitigate tool wear and breakage, extending tool life.

- Automated process planning and simulation reduces setup time and material waste.

- AI enhances thermal compensation strategies, improving geometric accuracy under high dynamic loads.

- Integration of Computer Vision systems with AI detects surface defects instantaneously during machining.

DRO & Impact Forces Of HSC Milling Machines Market

The HSC Milling Machines Market is fundamentally shaped by the convergence of stringent quality requirements in end-user industries and ongoing advancements in materials science. Drivers include the increasing global production of complex aerospace components requiring 5-axis capabilities and the rapid transition of the automotive industry toward electric vehicle (EV) platforms, which necessitate precision machining of lightweight battery housings, motor components, and sophisticated molds. Opportunities arise primarily from the synergistic integration of HSC milling with additive manufacturing (AM) processes, creating hybrid machines that allow for rapid repair, feature addition, and finishing of complex printed parts. However, significant restraints challenge market growth, notably the extremely high initial capital investment required for top-tier HSC systems, the substantial operational costs related to specialized high-frequency tooling, and a persistent global shortage of highly skilled operators and programmers capable of maximizing the efficiency of these advanced systems. These forces collectively dictate investment cycles and technological priorities within the market.

A primary driver is the accelerating trend toward miniaturization and high geometric complexity across electronics and medical devices. HSC milling is uniquely suited to produce micro-components and intricate features with the necessary sub-micron precision and surface finish. The pressure to reduce part weight without sacrificing strength, particularly evident in the aerospace sector's 'buy-to-fly' ratio reduction efforts, fuels demand for machines optimized to handle hard metals like titanium and Inconel efficiently. Furthermore, government initiatives promoting domestic manufacturing capability and high-tech industrial parks in various regions are acting as macroeconomic drivers, encouraging capital expenditure on advanced machine tools.

Conversely, the complexity of programming and operating modern 5-axis HSC machines poses a significant restraint. These systems require highly specialized Computer-Aided Manufacturing (CAM) software and personnel proficient in advanced collision avoidance and thermal management strategies. The initial investment hurdle is substantial, often pricing smaller job shops out of the high-end market, leading to a concentration of advanced capacity among Tier 1 suppliers. Opportunities, nevertheless, are found in the expansion of high-speed machining into non-traditional materials such as ceramics, advanced composites, and bio-compatible plastics. Furthermore, the development of smaller, more affordable high-speed vertical machining centers (VMCs) aimed at general machining tasks offers an avenue for market expansion in the mid-range segment.

The key impact forces driving the market include competitive intensity among leading global machine tool manufacturers, focused on offering integrated solutions combining hardware, software, and services. Technological substitution risk remains low, as no other technology currently rivals HSC in speed and precision for material removal in complex geometries, though additive manufacturing is increasingly competitive for initial part creation. Regulatory standards, particularly in aerospace (e.g., AS9100) and medical (e.g., ISO 13485), necessitate verifiable process control and high repeatability, inherently favoring the stable, high-precision performance of modern HSC milling technology, thereby solidifying its indispensable role in critical manufacturing sectors.

Segmentation Analysis

The HSC Milling Machines Market is systematically segmented based on Type, Application, and End-User Industry to provide a granular view of market dynamics and adoption patterns. The segmentation by Type is critical, differentiating machines based on their kinematic capabilities, with the 5-axis category demonstrating superior growth due to its versatility in handling increasingly complex component geometries found in high-value industries. Segmentation by Application highlights the areas where HSC technology provides the most significant competitive advantage, with Mold & Die manufacturing historically dominating, though Aerospace is quickly becoming the most demanding and financially rewarding segment due to high component cost and strict performance requirements. Understanding these segments allows manufacturers to tailor their product development and marketing strategies effectively.

The End-User Industry segmentation clarifies the diverse adoption across various manufacturing verticals. The Automotive sector, particularly focusing on engine components, transmission parts, and stamping dies, remains a massive consumer base, undergoing modernization driven by the shift towards electric vehicle production requiring new types of high-precision battery trays and motor housings. Furthermore, the Electronics and ICT sector utilizes HSC milling for producing intricate components for consumer electronics, communication hardware, and specialized semiconductor equipment. Analyzing these segments confirms the market's reliance on sectors prioritizing high precision, excellent surface finish, and rapid prototyping capabilities.

- By Type:

- 3-Axis HSC Milling Machines

- 4-Axis HSC Milling Machines

- 5-Axis HSC Milling Machines

- By Spindle Speed:

- 15,000 – 24,000 RPM

- 24,001 – 40,000 RPM

- Above 40,000 RPM

- By Application:

- Mold & Die Manufacturing

- Aerospace & Defense Component Production

- Automotive Parts Manufacturing

- Medical Implants and Devices

- General Engineering and Job Shops

- Electronics and ICT

- By End-User Industry:

- Aerospace

- Automotive

- Medical

- Electronics

- Precision Engineering

- Tool and Die

Value Chain Analysis For HSC Milling Machines Market

The Value Chain for the HSC Milling Machines Market is complex, beginning with the upstream supply of specialized high-precision components and culminating in comprehensive after-sales support provided directly to the end-users. The upstream segment is dominated by highly specialized suppliers providing critical, proprietary technologies such as high-frequency spindles, advanced computer numerical control (CNC) systems, linear motors, high-resolution encoders, and specialized thermal management components. The competitive edge of machine manufacturers often relies heavily on securing reliable and innovative component sourcing, particularly for spindle technology, which determines the machine's ultimate high-speed capability and accuracy. Key considerations at this stage involve raw material pricing stability (e.g., high-grade steel and specialized alloys) and logistical efficiency.

The core manufacturing stage involves the precision assembly and rigorous testing of the machine tools. Leading Original Equipment Manufacturers (OEMs) integrate these advanced components, often utilizing proprietary casting and thermal stabilization techniques to ensure the structural integrity required for high dynamic performance. This stage includes intensive R&D focused on machine kinematics, vibration dampening, and software integration (CAD/CAM compatibility). Distribution channels are predominantly indirect, leveraging established networks of specialized distributors and agents who provide localized sales, technical consultation, and financing options, particularly for small to medium-sized enterprises (SMEs). Direct sales are typically reserved for large, strategic accounts in aerospace or defense, where specialized configuration and long-term service contracts are negotiated directly with the OEM.

Downstream activities are dominated by comprehensive after-sales services, which are critical for customer retention and profitability. This includes machine installation, operator training, ongoing maintenance, spare parts supply, and sophisticated application engineering support to help users optimize cutting parameters for new materials or challenging geometries. The shift towards digital services means that remote diagnostics, software updates, and predictive maintenance contracts are becoming standard offerings. The quality and responsiveness of this downstream service significantly influence customer lifetime value. Effective management of the value chain, from securing high-quality upstream components to delivering seamless downstream support, is essential for maintaining a competitive advantage in this capital-intensive market.

HSC Milling Machines Market Potential Customers

The primary consumers (End-Users/Buyers) of HSC Milling Machines are high-precision manufacturers across a concentrated range of industrial sectors that demand exceptional surface finish, tight dimensional tolerances, and efficient machining of complex or hard materials. These customers typically operate in high-mix, low-volume production environments or require rapid prototyping capabilities. Key potential customers include Tier 1 and Tier 2 suppliers in the aerospace and defense sector, such as component manufacturers specializing in turbine blades, engine casings, and structural components crafted from titanium, Inconel, or specialized aluminum alloys. These customers prioritize machine reliability, certified process control, and advanced 5-axis kinematics to meet stringent industry standards.

Another major segment comprises manufacturers within the mold, tool, and die industry. These companies require HSC machines to produce injection molds, casting patterns, and stamping dies used in the mass production of consumer goods, automotive parts, and packaging. The ability of HSC to directly machine hardened steel molds to final surface finish eliminates or drastically reduces laborious manual polishing, directly impacting time-to-market. These buyers seek machines that balance speed and finish, often favoring mid-to-high RPM range machines (24,000–40,000 RPM) with robust thermal stability for extended operational runs.

Furthermore, the medical device manufacturing industry, encompassing orthopedic implant producers (hips, knees) and dental laboratories, represents a rapidly growing customer base. HSC milling is essential for machining biocompatible materials like titanium and specialized medical-grade plastics with the exact geometries and superior surface quality necessary for implantation. These customers place high value on validated processes, specialized software for complex contouring, and integrated quality control systems. Finally, high-tech general engineering job shops that cater to diverse industries and require flexible, high-precision capacity represent a large, distributed customer pool, often seeking highly automated systems to address fluctuating demand and varied material requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DMG MORI, GROB-WERKE, GF Machining Solutions, Makino Inc., Okuma Corporation, Hermle AG, Fidia S.p.A., Starrag Group, CHIRON Group SE, Index Group, Hwacheon Machinery Co., Ltd., Haas Automation, Soraluce (Danobat Group), Mitsui Seiki, Mazak Corporation, Hurco Companies, Inc., FANUC Corporation, Schuler Group, WFL Millturn Technologies, Doosan Machine Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HSC Milling Machines Market Key Technology Landscape

The technological landscape of the HSC Milling Machines Market is characterized by continuous innovation focused on improving dynamic performance, thermal stability, and operational intelligence. Central to this is the evolution of spindle technology, moving towards high-frequency direct-drive spindles capable of reaching speeds well above 40,000 RPM while maintaining ultra-low runout and vibration. Manufacturers are heavily investing in liquid-cooled ceramic bearing technology to manage the excessive heat generated at high speeds, ensuring prolonged spindle life and consistent accuracy. Simultaneously, the transition from traditional ball screws to highly responsive linear motor technology is paramount, providing the necessary rapid traverse rates and dynamic acceleration required for complex contouring and simultaneous 5-axis movement with zero backlash, significantly contributing to better surface quality.

Another crucial technological advancement is the sophisticated integration of Computer Numerical Control (CNC) systems optimized for high-speed computation. Modern CNC controllers utilize look-ahead features and powerful processors to analyze thousands of geometric data points per second, translating complex CAM paths into smooth, continuous machine movements. This optimization, known as "High-Speed Machining (HSM) optimization," is essential for maintaining constant tool engagement and avoiding micro-pauses that degrade surface finish. Furthermore, integrated measurement systems, including laser tool setters, high-accuracy probes, and in-process thermal compensation algorithms, are standard features that actively monitor and correct environmental and operational drift, ensuring parts meet increasingly strict tolerance requirements under varying shop floor conditions.

The market is also witnessing a shift toward automation and connectivity, driven by Industry 4.0 principles. The adoption of Industrial Internet of Things (IIoT) sensors enables continuous monitoring of critical machine parameters (vibration, acoustics, power consumption) for predictive analytics. Collaborative robots (cobots) are increasingly being deployed for automated part loading, unloading, and deburring, enabling lights-out manufacturing and maximizing spindle utilization time. The development of hybrid machines, integrating laser deposition or powder bed fusion technology alongside traditional HSC spindles, represents the cutting edge, offering manufacturers the ability to repair high-value components or create complex internal features that were previously impossible, effectively merging additive and subtractive manufacturing capabilities into a single, high-efficiency platform.

Regional Highlights

The HSC Milling Machines Market exhibits distinct regional dynamics reflecting varying levels of industrialization, technological maturity, and governmental support for manufacturing sectors.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by massive capital expenditure in key manufacturing economies like China, Japan, South Korea, and emerging Southeast Asian nations. This region benefits from rapid expansion in automotive production (including EVs), electronics manufacturing, and a maturing aerospace supply chain. Chinese manufacturers are rapidly closing the technological gap with European and North American counterparts, focusing on automating production lines to handle high-volume, precision consumer goods. Japan and South Korea remain leaders in high-end, customized HSC solutions for precision tooling and mold making.

- Europe: Europe represents the technological core of the HSC market, dominated by Germany, Switzerland, and Italy. These countries house global leaders in machine tool innovation, focusing on ultra-high precision, 5-axis systems for the high-value aerospace, medical, and specialized mold & die segments. European demand is characterized by a high emphasis on sophisticated software integration, energy efficiency, and long-term machine performance, reflecting rigorous engineering standards and demanding compliance regulations.

- North America: North America demonstrates steady growth, driven largely by the defense, aerospace, and energy sectors, which demand robust, high-performance machines capable of machining hard alloys. Investment is channeled towards highly automated solutions, often integrated with robotic cells and centralized manufacturing execution systems (MES). The focus here is on reducing labor dependency and enhancing operational security, pushing demand for resilient, high-duty cycle HSC machines.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets with growth concentrated in specific sectors. Latin America, particularly Brazil and Mexico, sees demand linked to automotive assembly and localized energy production. The Middle East, driven by diversification efforts away from hydrocarbon dependence, is investing in aerospace maintenance (MRO) and domestic manufacturing capabilities, necessitating modern HSC installations for high-precision component repair and production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HSC Milling Machines Market.- DMG MORI

- GROB-WERKE GmbH & Co. KG

- GF Machining Solutions (Georg Fischer Ltd.)

- Makino Inc.

- Okuma Corporation

- Hermle AG

- Fidia S.p.A.

- Starrag Group

- CHIRON Group SE

- Index Group

- Hwacheon Machinery Co., Ltd.

- Haas Automation, Inc.

- Soraluce (Danobat Group)

- Mitsui Seiki Kogyo Co., Ltd.

- Mazak Corporation

- Hurco Companies, Inc.

- FANUC Corporation (Control Systems)

- Doosan Machine Tools (Now DN Solutions)

- Schuler Group

- WFL Millturn Technologies GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the HSC Milling Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of 5-axis HSC milling over traditional 3-axis systems?

The primary benefit of 5-axis HSC milling is the ability to machine complex component geometries in a single setup, eliminating multiple reclamping stages. This reduces setup time, minimizes potential fixturing errors, improves overall geometric accuracy, and optimizes tool path strategies for superior surface finish, particularly essential for aerospace and medical parts.

How does the integration of AI affect the total cost of ownership (TCO) for HSC machines?

While AI integration involves higher initial software and sensor costs, it significantly reduces TCO in the long run. AI-driven systems maximize operational efficiency through predictive maintenance, reducing unplanned downtime and minimizing expensive tooling replacement costs by optimizing cutting parameters and extending tool life, thereby improving throughput and reducing labor input.

Which industrial sector is the largest driver of demand for high-end HSC machines?

The Aerospace and Defense sector is the largest driver of demand for high-end, simultaneous 5-axis HSC machines. This is due to the sector's stringent requirements for machining complex, high-value components made from challenging materials (like titanium and nickel alloys) where precision, material integrity, and regulatory compliance are paramount.

What are the key technical specifications defining a machine as "High-Speed Cutting" capable?

Key specifications include a spindle speed typically exceeding 15,000 RPM (often reaching 40,000 RPM or more), rapid traverse rates above 60 m/min, high acceleration/deceleration capabilities (high G-forces), and the use of sophisticated CNC systems with advanced look-ahead functions for smooth, continuous tool movements.

What role does thermal management play in maintaining the accuracy of HSC milling?

Thermal management is critical. The high spindle speeds and rapid machine movements generate significant heat. Sophisticated cooling systems and integrated thermal compensation software are required to counteract thermal expansion and contraction of the machine structure, ensuring that dimensional accuracy and repeatability are maintained across long, high-speed machining cycles.

How do lightweight materials like carbon fiber composites influence HSC machine design?

The machining of composites, while less demanding on power, requires extremely high spindle speeds (often >50,000 RPM) to minimize delamination and achieve optimal edge quality. This drives machine manufacturers to focus on highly dynamic, lightweight machine structures with specialized dust and chip evacuation systems, and non-contact cutting strategies like ultrasonic assistance.

Is the shortage of skilled labor significantly impacting market growth?

Yes, the shortage of highly skilled operators and programmers capable of leveraging the full potential of complex HSC machines is a primary constraint. This scarcity forces end-users to rely heavily on advanced automation, intelligent software, and comprehensive training programs provided by machine tool manufacturers, driving the need for more intuitive and AI-assisted control interfaces.

What is the competitive advantage of European HSC machine manufacturers?

European manufacturers, particularly those in Germany and Switzerland, maintain a competitive advantage through superior innovation in machine kinematics, robust mechanical design (often utilizing proprietary mineral casting for vibration dampening), and advanced software integration, catering primarily to the ultra-high-precision, high-value aerospace and medical markets where reliability is prioritized over volume cost.

How are hybrid manufacturing systems changing the HSC market landscape?

Hybrid systems, which combine additive manufacturing (e.g., laser metal deposition) and subtractive HSC milling on one platform, are creating new market opportunities by enabling faster prototyping, material savings, and specialized repair capabilities for complex, high-cost components, particularly in the MRO (Maintenance, Repair, and Overhaul) sector of aerospace and defense.

What is 'lights-out' manufacturing and its relevance to HSC machines?

'Lights-out' manufacturing refers to fully automated production operations running unattended overnight or over weekends. HSC machines support this through high reliability, automated tool changers, pallet systems, robotic loading, and advanced monitoring systems (often AI-enabled) that manage processes and diagnostics without human intervention, maximizing capital utilization.

What role do linear motors play in modern HSC machine performance?

Linear motors replace traditional ball screws for axis movement, offering extremely fast acceleration, high dynamic stiffness, and precise positioning accuracy without mechanical backlash. This capability is essential for executing the high-speed, intricate tool paths required for optimal surface finish and contouring in simultaneous 5-axis operations.

Why is the Mold & Die industry a historical key segment for HSC technology?

The Mold & Die industry relies on HSC to directly machine hardened steel and alloy molds to a near-final surface quality. This dramatically reduces the need for time-consuming and labor-intensive manual polishing, offering significant cost savings and faster lead times for mold production, which is crucial for consumer product launches.

How does the shift towards electric vehicles (EVs) impact demand for HSC machines?

EV manufacturing drives demand for HSC machines for producing precision components such as lightweight battery enclosures, complex cooling system parts, and precise motor components. Furthermore, the specialized molds required for new types of plastic and composite automotive interior parts necessitate high-speed, high-precision tooling capabilities.

What are the typical maintenance requirements for a high-speed spindle?

High-speed spindles require specialized maintenance focused primarily on bearing monitoring and lubrication management. Due to the high rotational speeds, precision ceramic bearings are often used and require dedicated liquid cooling systems and precise dynamic balancing. Predictive monitoring of vibration and temperature is standard to prevent catastrophic failure.

How is tool life maximized in HSC operations?

Tool life is maximized through a combination of elements: advanced coating technologies (e.g., TiAlN, DLC), optimized cutting strategies (constant chip load, trochoidal milling), high-pressure coolant or Minimum Quantity Lubrication (MQL) delivery, and sophisticated AI algorithms that adapt feed rates to maintain optimal cutting conditions and prevent thermal spikes.

What is the significance of the 'buy-to-fly' ratio in aerospace manufacturing?

The 'buy-to-fly' ratio compares the weight of the raw material purchased to the weight of the final finished component. HSC milling helps reduce this ratio by efficiently removing large volumes of material from expensive billets (often titanium or Inconel) while maintaining structural integrity, minimizing waste, and maximizing material utilization efficiency.

Which region shows the highest volume consumption of HSC milling machines?

The Asia Pacific (APAC) region, driven by extensive manufacturing bases in China and surrounding high-volume economies, consistently shows the highest volume consumption of HSC milling machines, although Europe often leads in terms of the value and technological sophistication of machines purchased.

How do new composite materials affect tooling and cutting parameter choices?

Machining composite materials requires extremely hard, sharp tools (often diamond-coated or polycrystalline diamond - PCD) and very high spindle speeds combined with low feed rates to ensure clean cuts, minimize delamination, and prevent fiber pull-out. Specialized dust extraction and spindle protection systems are also crucial due to abrasive particle generation.

What is the role of digital twins in the context of HSC machining?

A digital twin is a virtual replica of the HSC machine and its operation. It allows programmers to simulate entire machining processes, verify tool paths, detect potential collisions, and optimize cutting parameters in a risk-free environment before execution, leading to significant reductions in setup time and scrap material.

Why is high dynamic stiffness critical for HSC machine structures?

High dynamic stiffness (rigidity) is critical because HSC machines operate at very high speeds and acceleration rates. Stiffness ensures that the machine structure resists vibrations and deflection (chatter), maintaining precise geometric control of the cutting tool relative to the workpiece, which is essential for achieving the required surface finish and accuracy.

What are the primary applications of HSC machines in the medical device industry?

In the medical device industry, HSC machines are primarily used for manufacturing orthopedic implants (e.g., hip, knee, spine components), dental prosthetics, and surgical instruments. The need for biocompatibility, precise fits, and mirror-like surface finishes on materials like titanium and cobalt-chrome makes HSC technology indispensable.

How does MQL (Minimum Quantity Lubrication) benefit HSC operations?

MQL delivers a precise, minute amount of oil aerosol directly to the cutting zone. This offers superior lubrication and cooling compared to dry cutting, minimizes environmental impact, reduces cleaning processes post-machining, and aids in rapid chip evacuation, often improving surface finish and extending tool life in high-speed applications.

What are the current trends in control system technology for HSC machines?

Current trends emphasize open architecture, seamless integration with MES/ERP systems, advanced user interfaces (HMI), and high-speed processing for complex contouring. Controllers increasingly feature integrated AI modules for real-time process monitoring and adaptive control, simplifying complex programming tasks for multi-axis operations.

What differentiates a high-end HSC machine from a standard high-speed VMC (Vertical Machining Center)?

High-end HSC machines are differentiated by superior component quality (e.g., linear motor drives, hydrostatic/aerostatic bearings), advanced thermal management (liquid-cooled axes/spindles), extremely high spindle accuracy (low runout), and proprietary kinematics and control algorithms optimized specifically for complex 5-axis simultaneous motion and precision contouring.

Is the cost of specialized tooling a significant factor in HSC operational expense?

Yes, specialized high-frequency tooling, including high-performance end mills and ball nose cutters, often coated with advanced materials, represents a significant portion of the operational expense. The necessity of frequent tool changes and the high cost per tool unit demand efficient process optimization to maximize tool life and justify the investment.

How do global trade policies affect the HSC Milling Machines Market?

Global trade policies, including tariffs and export control regulations (especially for 5-axis machines used in aerospace/defense applications), significantly influence market dynamics. They can lead to localized manufacturing shifts, impact supply chain costs, and restrict the transfer of the most advanced technology to certain regions or end-users, affecting competitive strategy.

What are the challenges associated with machining hardened steels using HSC?

Machining hardened steels requires maintaining high temperatures at the cutting edge for effective material removal, demanding extremely rigid setups and tools with high hot hardness. Challenges include managing thermal shock, ensuring chip evacuation, and preventing premature tool wear due to the abrasive nature and high material hardness.

In what ways is the automotive industry leveraging HSC technology beyond traditional engine components?

The automotive industry is using HSC technology extensively for the rapid production of stamping dies and injection molds for lightweight body panels, sophisticated headlight lenses, and complex interior components, as well as for prototyping new chassis parts and precision motor shafts in the rapidly expanding electric vehicle supply chain.

What is the expected lifespan and depreciation rate of a top-tier HSC machine?

A top-tier HSC machine, with proper maintenance, can have an operational lifespan exceeding 15 to 20 years. However, technological depreciation is faster, often necessitating upgrades or replacement within 8 to 12 years to keep pace with new efficiency standards, particularly regarding control systems, software integration, and spindle speed capabilities.

How does the demand for smaller batch sizes influence the HSC market?

The trend towards smaller, highly customized batch sizes (High-Mix, Low-Volume) drives demand for highly flexible HSC machines, especially 5-axis systems, that can be quickly reprogrammed and retooled. This requires high levels of automation integration, automated setup verification, and robust CAM simulation capabilities to ensure rapid changeovers and maximize utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager