HTCC Slurry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433949 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HTCC Slurry Market Size

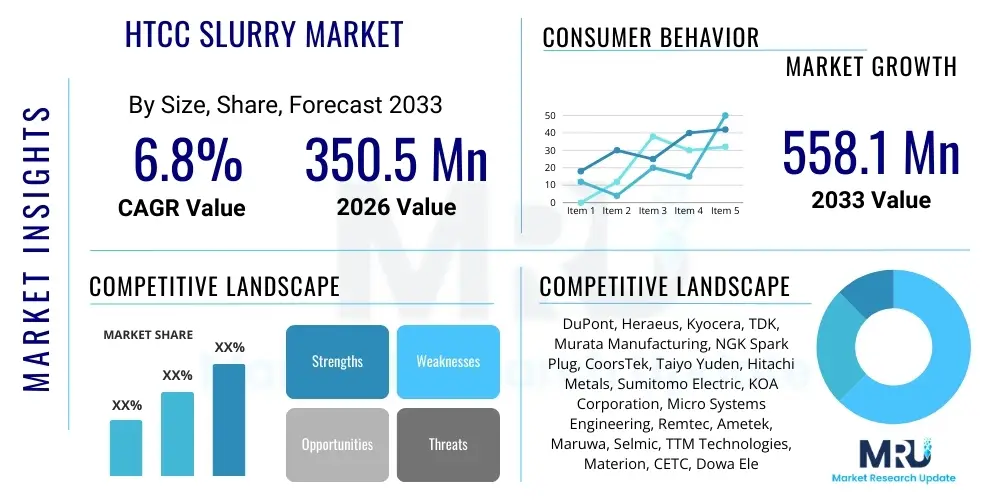

The HTCC Slurry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 558.1 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily attributed to the increasing demand for electronic components capable of operating reliably under extreme thermal and mechanical stress, particularly in high-power modules and harsh environment applications such as aerospace and electric vehicles (EVs). The inherent material properties, including superior thermal conductivity and mechanical strength at elevated temperatures, solidify the position of HTCC technology as essential for next-generation packaging solutions, driving significant market expansion globally.

HTCC Slurry Market introduction

The High-Temperature Co-fired Ceramic (HTCC) Slurry Market involves the supply of specialized composite pastes and suspensions utilized in the manufacturing of multi-layer ceramic electronic packages and substrates. HTCC technology involves co-firing ceramic tape (formed from the slurry) and refractory metallization (like tungsten or molybdenum) at extremely high temperatures, typically above 1500°C. The resulting structure provides hermetic sealing, excellent thermal dissipation, and high-frequency performance, making it indispensable for critical electronic applications where reliability is paramount. The slurry itself is a precise mixture of ceramic powders (usually alumina), organic binders, plasticizers, and solvents, carefully formulated to ensure consistent tape quality, optimal green strength, and controlled shrinkage during the sintering process.

Product Description: HTCC slurry is a flowable, homogeneous suspension necessary for the tape-casting process, which forms the ceramic green sheet. The quality of the slurry directly dictates the density, strength, and thermal characteristics of the final ceramic component. Key constituents include high-purity alumina (>92%) for structural integrity and dielectric properties, along with complex binder systems designed to burn out cleanly during high-temperature firing without leaving carbon residues that could compromise electrical performance. Precise control over particle size distribution and viscosity is crucial for the stability and uniformity required in large-scale manufacturing processes.

Major Applications and Benefits: HTCC substrates and packages are vital components in power electronics, sensor housings, military and defense systems, and high-intensity LED lighting. Benefits include exceptional thermal stability, high flexural strength, superior hermeticity, and compatibility with high-power circuit integration. Driving factors include the push towards higher power density in semiconductor devices, the rapid expansion of 5G and satellite communication infrastructure requiring robust RF components, and stringent reliability standards mandated by the automotive industry for electric vehicle power modules and battery management systems. The ability of HTCC to integrate multiple layers of circuitry within a compact, resilient package further accelerates its adoption across diverse high-performance sectors.

HTCC Slurry Market Executive Summary

The global HTCC Slurry market is characterized by robust growth, driven primarily by the escalating demand for reliable power modules in the electric vehicle sector and sophisticated packaging solutions in military and aerospace electronics. Business trends indicate a strong focus on advanced material formulations, particularly those enhancing thermal dissipation characteristics and enabling finer line patterning for increased circuit density. Key industry players are investing heavily in optimizing slurry homogenization techniques and developing proprietary binder systems to achieve tighter dimensional tolerances and improve yields in complex multi-layer designs. Geographically, the Asia Pacific region maintains market dominance due to high concentration of electronics manufacturing and significant investment in 5G and EV infrastructure, although North America exhibits strong growth fueled by high-reliability defense contracts and specialized industrial applications.

Regional Trends: Asia Pacific (APAC) leads the market, leveraging its position as the global hub for ceramic manufacturing and advanced electronics assembly. Countries like Japan, South Korea, and China are significant consumers and producers, driven by the mass production of consumer electronics and the rapid deployment of electric vehicle technologies. Europe and North America represent high-value markets, emphasizing premium HTCC products utilized in critical applications such as specialized medical devices, high-frequency RF modules, and high-reliability aerospace components, where performance often outweighs cost considerations. This geographical segmentation highlights a market dichotomy between high-volume, cost-sensitive production in APAC and high-specification, specialized manufacturing in Western economies.

Segments Trends: The application segment is experiencing dynamic shifts, with the Automotive sector emerging as the fastest-growing segment, primarily due to the transition to silicon carbide (SiC) and gallium nitride (GaN) power modules requiring exceptionally robust thermal management solutions provided by HTCC substrates. Furthermore, the defense and aerospace segment consistently demands HTCC for radar systems and electronic warfare components, ensuring steady, high-margin revenue streams. Material trends focus on developing alternative ceramic compositions beyond standard alumina, such as AlN (Aluminum Nitride) based slurries, which offer significantly enhanced thermal conductivity, although these materials currently present higher manufacturing complexity and cost challenges for slurry preparation.

AI Impact Analysis on HTCC Slurry Market

User queries regarding AI's influence on the HTCC Slurry market primarily revolve around optimizing material composition, automating quality control in the slurry production process, and using predictive modeling for component performance and yield forecasting. Users are keenly interested in how Artificial Intelligence can address the inherent complexities of ceramic processing, specifically reducing defects related to tape casting and sintering shrinkage. Key themes include utilizing Machine Learning (ML) algorithms to correlate raw material characteristics (e.g., powder particle morphology, binder molecular weight) with final component properties (e.g., dielectric constant, thermal conductivity), thereby accelerating R&D cycles and ensuring batch-to-batch consistency. Furthermore, there is significant interest in AI-driven process control systems that can dynamically adjust slurry viscosity and dispensing parameters in real-time, minimizing waste and enhancing manufacturing efficiency, which is critical given the high cost of ceramic raw materials.

- AI-driven formulation optimization for enhanced thermal properties and reduced shrinkage variation.

- Predictive modeling of slurry stability and shelf life, minimizing material degradation.

- Machine learning for non-destructive inspection of ceramic green sheets, identifying flaws before costly firing.

- Automation of quality control during tape casting via real-time image analysis and viscosity monitoring.

- Optimizing furnace firing profiles (temperature ramps and dwell times) using simulation and AI feedback loops for defect minimization.

- Accelerated R&D by simulating the interaction between different binder systems and ceramic powders.

DRO & Impact Forces Of HTCC Slurry Market

The market's dynamics are shaped by a strong interplay of technical drivers and economic constraints, alongside evolving application requirements. The primary driver is the pervasive need for robust electronic packaging in environments characterized by high operating temperatures, extreme vibrations, and stringent power cycling demands. HTCC inherently satisfies these requirements due to its chemical inertness, high mechanical strength, and superior thermal characteristics compared to organic substrates. However, market expansion is constrained by the relatively high capital expenditure required for setting up HTCC manufacturing facilities, coupled with the technical difficulties in achieving ultra-high dimensional accuracy, which often leads to costly wastage and necessitates sophisticated processing expertise.

Opportunities for growth are concentrated in emerging technologies that demand high performance, such as the transition to wide bandgap (WBG) semiconductors (SiC and GaN) in power electronics, which operate at higher temperatures and require highly effective thermal management substrates like HTCC. Furthermore, the increasing complexity of multi-chip modules (MCMs) and system-in-package (SiP) solutions for dense electronic integration favors HTCC’s multi-layer capabilities. The main impact force driving strategic decisions is technological substitution; while HTCC offers unparalleled reliability, competitive technologies like Low-Temperature Co-fired Ceramic (LTCC) and advanced direct-bonded copper (DBC) substrates offer performance trade-offs at potentially lower manufacturing costs, forcing HTCC manufacturers to continually innovate in material science and process efficiency to maintain market share.

In summary, the market is primarily propelled by technological advancements in power electronics and the expanding military and aerospace sectors, which prioritize reliability above all else. Restraints center around high production costs and complexity, particularly concerning the necessary high-temperature processing steps and the challenges associated with achieving consistently low porosity and zero defects. Strategic opportunities lie in leveraging HTCC’s capabilities in rapidly expanding sectors like electric vehicle charging infrastructure and high-frequency satellite communications, necessitating specialized slurry formulations designed for extremely demanding performance specifications and large-volume production scalability.

Segmentation Analysis

The HTCC Slurry market is primarily segmented based on the type of ceramic material used, the application sector of the final ceramic component, and the specific function of the manufactured product. This segmentation allows manufacturers to tailor slurry characteristics—such as viscosity, particle size, and binder composition—to meet the precise technical requirements of distinct end-user industries. The segmentation by material type is crucial as it dictates the final thermal and electrical properties, with alumina-based slurries dominating due to their cost-effectiveness and good overall performance, while specialized materials like aluminum nitride (AlN) command a premium for applications requiring extreme thermal dissipation capabilities. Understanding these segments is key for strategic market entry and product differentiation.

- Segmentation by Material Type:

- Alumina (Al2O3) Slurry: Standard and most widely used, offering excellent mechanical strength and electrical isolation.

- Aluminum Nitride (AlN) Slurry: Used for applications requiring high thermal conductivity, crucial in high-power modules.

- Zirconia (ZrO2) Slurry: Utilized in specialized sensors and components requiring high fracture toughness.

- Mullite and Other Composite Slurries: Employed for unique dielectric and mechanical requirements.

- Segmentation by Application:

- Automotive Electronics: Primarily for power control units (PCUs), inverters, and battery management systems (BMS) in EVs.

- Aerospace and Defense: High-reliability sensors, radar modules, and electronic warfare systems.

- Industrial Electronics: High-power motor control, lighting systems (LED), and large industrial sensors.

- Telecommunications: RF packages, base stations, and satellite communication components.

- Medical Devices: Hermetic packaging for implants and high-frequency diagnostic equipment.

- Segmentation by Function:

- HTCC Substrates: Used as base layers for circuit assembly, emphasizing thermal management.

- HTCC Packages: Multi-layer ceramic enclosures providing hermetic sealing and structural support for integrated circuits.

- HTCC Heating Elements: Specialized resistive heating components requiring high thermal stability.

Value Chain Analysis For HTCC Slurry Market

The value chain for HTCC slurry manufacturing begins with the upstream sourcing of highly refined, ultra-high-purity raw materials. This stage involves acquiring fine ceramic powders (predominantly alumina, AlN), specialized organic polymers for binder systems, and high-pgrade solvents and plasticizers. The quality and consistency of these raw materials are foundational, as any impurity or variance in particle morphology can severely impact the final ceramic component’s electrical and mechanical reliability. Key players in this upstream segment include specialized chemical and material suppliers who adhere to stringent quality control standards demanded by the electronics industry. This focus on purity translates directly into the final component’s performance metrics, especially in demanding applications like aerospace where failure tolerance is non-existent.

The intermediate stage involves the manufacturing of the HTCC slurry itself, where specialized techniques are employed for mixing, milling, and homogenization to create a stable, defect-free suspension suitable for tape casting. This manufacturing expertise involves intellectual property related to binder chemistries and milling processes that ensure uniform particle dispersion, low porosity, and consistent shrinkage behavior during sintering. Following slurry production, the material is used by HTCC component manufacturers who utilize advanced tape casting machines to create green sheets, pattern them via screen printing with refractory metals, stack and laminate them, and then co-fire the structure at high temperatures. These manufacturers often specialize in specific component types, such as multi-layer packages or thick-film power substrates, requiring precise customization of the slurry rheology.

The downstream distribution channel includes direct sales from component manufacturers to Tier 1 suppliers in automotive, defense contractors, and specialized industrial OEMs. The distribution often relies on a direct sales model due to the highly technical nature of the product and the need for close collaborative development between the component supplier and the end-user concerning design specifications and material performance. Indirect distribution may involve specialized distributors who handle smaller orders or niche markets, though the high-value, low-volume nature of many HTCC applications favors a direct supply relationship. The final end-users integrate these HTCC components into critical electronic systems, where reliability under harsh conditions justifies the technology’s premium cost, reinforcing the value proposition across the chain.

HTCC Slurry Market Potential Customers

Potential customers for HTCC components, and consequently the users driving the demand for HTCC slurry, are concentrated within sectors where operational longevity, thermal robustness, and high electrical performance are non-negotiable prerequisites. The largest and fastest-growing customer segment is the automotive industry, particularly manufacturers focused on electrification. These buyers include Tier 1 suppliers of power modules, inverters, and converters (such as Bosch, Continental, and Denso) that integrate HTCC substrates for managing the high thermal loads generated by SiC and GaN semiconductors used in electric drivetrains. The inherent reliability of HTCC ceramics under continuous thermal cycling makes them ideal for these high-stakes vehicular applications.

Another major customer group resides in the aerospace and defense industry, including major defense contractors and specialized avionics manufacturers (e.g., Lockheed Martin, Northrop Grumman, Raytheon). These entities require HTCC components for mission-critical systems such as radar transmit/receive modules, electronic warfare systems, and high-frequency satellite communication payloads. In these fields, the hermeticity and radiation tolerance of HTCC packages are key differentiators. Furthermore, the industrial electronics sector represents significant potential, specifically manufacturers of high-power LED lighting arrays and industrial motor controllers, where the demand for efficient heat dissipation and robust packaging in challenging industrial environments directly translates into adoption of HTCC technology.

In summary, the primary end-users are specialized electronic assemblers and original equipment manufacturers (OEMs) who prioritize reliability and thermal performance over cost. These buyers require materials capable of supporting high-density integration and superior heat management. The customer base includes leading semiconductor packaging houses, high-reliability sensor manufacturers, and producers of advanced telecommunication infrastructure (5G base stations, high-power RF amplifiers). The selection process for HTCC components is highly technical, involving extensive qualification and collaborative design efforts between the slurry producer, the component manufacturer, and the final end-user.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 558.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Heraeus, Kyocera, TDK, Murata Manufacturing, NGK Spark Plug, CoorsTek, Taiyo Yuden, Hitachi Metals, Sumitomo Electric, KOA Corporation, Micro Systems Engineering, Remtec, Ametek, Maruwa, Selmic, TTM Technologies, Materion, CETC, Dowa Electronics Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HTCC Slurry Market Key Technology Landscape

The technology landscape for the HTCC slurry market is defined by continuous innovation focused on improving material purity, optimizing rheological properties, and integrating advanced manufacturing techniques. A pivotal technological focus is on developing highly tailored slurry formulations that allow for the precise co-firing of ceramic and refractory metal layers with minimal warpage and controlled shrinkage. This involves sophisticated binder systems that decompose cleanly at specific temperature profiles, ensuring that the final ceramic body is dense, defect-free, and achieves optimal mechanical and dielectric performance. Furthermore, specialized milling and homogenization techniques, such as bead milling and high-shear mixing, are critical to ensuring the ceramic powder particles are uniformly dispersed, which directly impacts the green sheet uniformity and subsequently the final component yield and reliability.

A significant area of R&D is the development of next-generation ceramic materials, particularly focusing on aluminum nitride (AlN) based slurries. AlN offers thermal conductivity several times greater than standard alumina, making it essential for high-power applications involving SiC and GaN devices. However, AlN processing is inherently complex due to its sensitivity to oxygen contamination during sintering. Manufacturers are developing proprietary slurry chemistries and atmospheric controls to mitigate these challenges, enabling reliable, mass-producible AlN HTCC components. These technological advancements are moving HTCC beyond traditional packaging into advanced thermal management solutions that can withstand temperatures exceeding 300°C continuously, a capability crucial for future aerospace and deep-well drilling electronics.

The emergence of additive manufacturing (AM) techniques, specifically ceramic stereolithography (SLA) or binder jetting applied to ceramics, is beginning to influence the slurry market. While traditional HTCC relies on tape casting, AM allows for the creation of intricate three-dimensional structures and complex internal cooling channels that are impossible with conventional lamination methods. Slurry producers are responding by formulating ceramic suspensions suitable for AM processes—requiring specific photochemical reactivity or extremely high solid loading and low viscosity—thereby broadening the application scope of HTCC technology into highly integrated heat exchangers and novel sensor architectures. This technological pivot ensures HTCC remains competitive against alternative substrate technologies by enabling unparalleled design complexity and functional integration.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the HTCC Slurry market, accounting for the largest market share due to its entrenched position as the global manufacturing hub for electronics, semiconductors, and automotive components. The demand is heavily fueled by mass consumer electronics production in China, South Korea, and Taiwan, coupled with aggressive government initiatives supporting the electric vehicle transition in China and Japan. Furthermore, the region is witnessing substantial deployment of 5G infrastructure, necessitating high-performance ceramic packages for RF and power amplifiers. APAC manufacturers often focus on scaling production volumes and achieving cost efficiencies, driving continuous innovation in high-throughput slurry production and tape casting techniques. The presence of major global ceramic component manufacturers, such as Kyocera and Murata, solidifies the region’s leadership in both supply and consumption.

- North America: North America represents a critical, high-value segment characterized by demand for specialized, high-reliability HTCC components, particularly from the aerospace, defense, and high-end industrial sectors. The market here is less driven by volume and more by stringent performance specifications, long product life cycles, and extreme operating conditions (e.g., deep-sea, space, high-altitude). The region sees continuous investment in advanced sensor technologies and electronic warfare systems, which mandate the hermetic sealing and superior thermal management capabilities provided by HTCC. Key growth drivers include government defense spending and the localized development of advanced power electronics utilizing wide bandgap semiconductors.

- Europe: The European HTCC market is strongly influenced by its robust automotive industry, particularly Germany and France, which are leaders in the development and manufacturing of high-performance electric vehicles. This necessitates reliable HTCC substrates for inverters and power control modules. Additionally, Europe holds a significant position in specialized industrial electronics, including high-power lasers and medical devices, where reliability and precise thermal control are paramount. Regulatory pressures for efficiency and safety in industrial and transport applications further propel the adoption of HTCC solutions. Investment is concentrated on optimizing material properties for stricter environmental compliance and enhancing integration capabilities for complex multi-chip solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but are exhibiting promising growth potential, primarily tied to localized infrastructure development projects, including smart grids, renewable energy installations, and telecommunications expansion. In the MEA, particularly the Gulf Cooperation Council (GCC) countries, significant investment in defense technology and industrial process control creates niche demand for HTCC components requiring extreme resilience to heat and dust. Growth in LATAM is more gradual, linked primarily to foreign direct investment in automotive manufacturing and electronics assembly, pushing modest but consistent demand for stable electronic packaging materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HTCC Slurry Market.- DuPont

- Heraeus

- Kyocera

- TDK

- Murata Manufacturing

- NGK Spark Plug

- CoorsTek

- Taiyo Yuden

- Hitachi Metals

- Sumitomo Electric

- KOA Corporation

- Micro Systems Engineering

- Remtec

- Ametek

- Maruwa

- Selmic

- TTM Technologies

- Materion

- CETC

- Dowa Electronics Materials

Frequently Asked Questions

Analyze common user questions about the HTCC Slurry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between HTCC and LTCC technology?

The primary difference lies in the firing temperature and associated metallization. HTCC (High-Temperature Co-fired Ceramic) fires above 1500°C, requiring high-melting point refractory metals like tungsten or molybdenum. LTCC (Low-Temperature Co-fired Ceramic) fires below 1000°C, enabling the use of high-conductivity metals like gold or silver. HTCC offers superior mechanical strength, thermal conductivity, and robustness for high-power applications, while LTCC provides better electrical conductivity for high-frequency applications.

Why is HTCC Slurry essential for Electric Vehicle (EV) power modules?

EV power modules, particularly those utilizing SiC and GaN semiconductors, generate intense heat loads that must be reliably dissipated to ensure performance and longevity. HTCC substrates, often based on alumina or aluminum nitride, provide exceptional thermal conductivity and mechanical robustness to withstand constant thermal cycling and high operating temperatures, making them critical for the reliability of inverters and converters in EV powertrains.

What are the main technical challenges in HTCC slurry production?

The major technical challenges include ensuring ultra-fine particle dispersion and homogeneity to prevent porosity defects, maintaining precise rheological stability for consistent tape casting thickness, and developing binder systems that burn out completely and cleanly during the high-temperature firing process. Achieving minimal and uniform shrinkage control across complex multi-layer structures is also a significant manufacturing hurdle that slurry formulation directly influences.

Which ceramic material is growing fastest in the HTCC market and why?

Aluminum Nitride (AlN) based HTCC slurry is exhibiting the fastest growth due to its exceptionally high thermal conductivity, which is crucial for modern high-power density applications. The rapid adoption of high-performance wide bandgap (WBG) semiconductors in telecommunications, aerospace, and especially electric vehicles is driving demand for AlN substrates capable of managing the extreme heat loads generated by these advanced chips.

How does the quality of HTCC Slurry impact final component reliability?

The quality of the HTCC slurry is directly correlated with the final component's reliability. Poor quality slurry, characterized by agglomeration or inconsistent particle sizes, leads to defects such as voids, cracks, or warping after sintering. These structural imperfections compromise the component's hermeticity, thermal performance, and mechanical integrity, leading to premature failure in harsh operational environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager