Human Fibrinogen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434304 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Human Fibrinogen Market Size

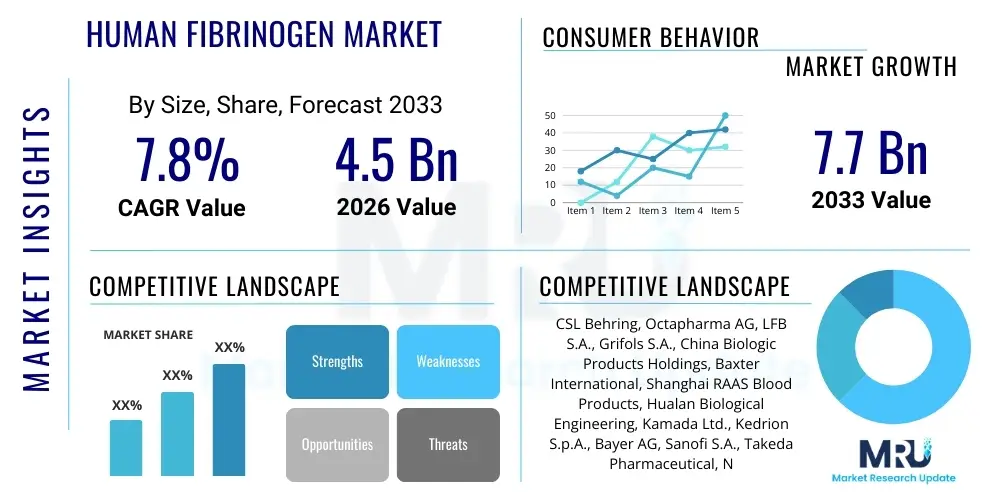

The Human Fibrinogen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Human Fibrinogen Market introduction

The Human Fibrinogen Market encompasses the global trade and utilization of fibrinogen concentrates derived primarily from human plasma. Fibrinogen, also known as coagulation factor I, is a critical glycoprotein in the blood clotting cascade, essential for forming stable fibrin clots. The therapeutic application of human fibrinogen concentrates focuses predominantly on treating congenital fibrinogen deficiency (afibrinogenemia, hypofibrinogenemia, or dysfibrinogenemia) and managing severe bleeding episodes in acquired deficiencies, often encountered during complex surgeries, trauma, or massive blood loss scenarios. The market’s growth is fundamentally driven by the increasing incidence of cardiovascular and trauma-related injuries necessitating rapid hemostatic intervention, coupled with advancements in blood product processing technologies ensuring higher purity and safety profiles.

The product portfolio within this market includes various formulations of fibrinogen concentrate, characterized by different purification methods (like cryoprecipitation and subsequent viral inactivation processes) and intended routes of administration, primarily intravenous infusion. Major applications span surgical hemostasis, critical care medicine, and obstetric hemorrhage management, where timely restoration of coagulation capacity is paramount to patient survival. Furthermore, novel applications of fibrinogen in regenerative medicine and as a component in specialized tissue sealants and glues are expanding the commercial scope beyond traditional deficit replacement therapy. These advanced therapeutic uses highlight fibrinogen's versatility as a biological scaffold material.

Key benefits driving market adoption include the highly targeted approach to correcting fibrinogen deficiency, offering a standardized dose and reduced risk profile compared to historical alternatives like cryoprecipitate. Driving factors such as enhanced diagnostic capabilities leading to earlier identification of congenital deficiencies, rigorous global standards for plasma sourcing and processing, and expanding access to specialized critical care services in emerging economies are propelling market expansion. The shift towards component therapy and away from whole blood transfusions further solidifies the essential role of purified fibrinogen concentrates in modern clinical practice, supported by robust clinical guidelines advocating for goal-directed hemostatic management.

Human Fibrinogen Market Executive Summary

The Human Fibrinogen Market is characterized by robust commercial dynamics driven by increasing global surgical volumes and the growing recognition of acquired coagulopathy, particularly in massive transfusion protocols. Business trends indicate a strong focus on strategic acquisitions and partnerships among major pharmaceutical and bioprocessing firms to secure plasma supply chains and expand geographical reach, particularly into high-growth regions like Asia Pacific. There is a sustained investment in research and development aimed at improving viral safety measures, enhancing product purity, and exploring recombinant production technologies, although plasma-derived products currently dominate the landscape. Furthermore, the market is experiencing moderate pricing stability, influenced heavily by regulatory scrutiny and the necessity for extensive clinical data to support label expansions for trauma and surgical settings, moving beyond the niche indication of congenital deficiencies.

Regional trends reveal North America and Europe maintaining dominant market shares due to established healthcare infrastructures, high awareness levels among clinicians, and favorable reimbursement policies for plasma-derived therapies. However, the Asia Pacific region is anticipated to exhibit the highest CAGR, spurred by rapid economic development, increasing access to advanced medical treatment, rising incidence of road traffic accidents and trauma, and the continuous construction of specialized surgical centers. Governments in these developing regions are also improving their blood banking systems and adopting international standards for plasma component preparation, which in turn facilitates greater market penetration for concentrated products. Latin America and the Middle East & Africa are developing markets, showing gradual uptake driven by targeted educational initiatives regarding severe hemorrhage management.

Segmentation trends highlight the dominance of the plasma-derived segment in terms of revenue, primarily due to established manufacturing pathways and proven clinical efficacy. However, the recombinant fibrinogen segment is garnering significant investment, presenting a potential long-term shift towards non-plasma sources, offering theoretical benefits in viral safety and supply consistency, though currently facing high production costs. Application-wise, the acquired bleeding segment (trauma, surgical bleeding, and obstetric complications) holds the largest share and is the primary volume driver, while the congenital deficiency segment, though smaller, offers stable, high-value demand. Distribution channels are increasingly sophisticated, relying heavily on hospital pharmacies and specialized blood centers, ensuring temperature-controlled and rapid delivery essential for emergency medicine.

AI Impact Analysis on Human Fibrinogen Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Human Fibrinogen Market often revolve around three core themes: improving the safety and efficiency of plasma donor screening and processing; accelerating the development and validation of next-generation or recombinant fibrinogen products; and enhancing clinical decision support for goal-directed therapy. Users seek assurance that AI can minimize human error in manufacturing, optimize yield from plasma fractionation, and, most critically, provide real-time predictive analytics to clinicians regarding which patients will benefit most from fibrinogen concentrate administration in acute hemorrhage scenarios. There is also significant interest in how AI algorithms can analyze complex pharmacodynamic data to personalize dosing and improve patient outcomes post-surgery or trauma, ultimately driving higher, more targeted consumption of fibrinogen products while maximizing clinical efficacy.

The application of AI in the early stages of the value chain focuses on optimizing plasma collection and screening. Machine learning models can analyze vast datasets of donor health records, geographic location, and plasma quality metrics to predict optimal collection schedules and identify potential contamination risks with higher sensitivity than traditional methods. This predictive capability significantly reduces batch discard rates, enhances the safety profile of the starting material, and secures a more reliable supply of high-quality plasma, thereby stabilizing the availability of human fibrinogen concentrates. Furthermore, AI-driven process optimization in the complex Cohn fractionation process allows manufacturers to fine-tune purification parameters, leading to increased yield and greater homogeneity of the final product, directly addressing supply constraints and cost efficiency challenges prevalent in the plasma-derived therapeutics industry.

In the clinical setting, AI integration facilitates advanced hemostasis management. By leveraging predictive algorithms that incorporate patient specific data—such as viscoelastic test results (e.g., ROTEM or TEG), vital signs, and baseline comorbidities—AI tools can recommend optimal timing and dosage of fibrinogen concentrate administration in trauma or critical surgery. This shift towards data-driven, personalized coagulation management minimizes unnecessary transfusions, improves the effectiveness of fibrinogen concentrate use, and ultimately enhances patient prognosis. This sophisticated clinical adoption, guided by AI, validates the economic benefit of fibrinogen concentrates, fostering stronger acceptance and potentially expanding the addressable patient population under evidence-based protocols.

- AI optimizes plasma donor screening and risk assessment, improving raw material safety and reliability.

- Machine learning enhances plasma fractionation efficiency, increasing yield and reducing production costs of concentrates.

- Predictive analytics support goal-directed therapy, aiding clinicians in personalized dosing for acute bleeding management.

- AI accelerates the discovery and optimization of recombinant fibrinogen molecule design and manufacturing processes.

- Natural Language Processing (NLP) helps analyze clinical trial data and real-world evidence faster for regulatory submissions and label expansion.

DRO & Impact Forces Of Human Fibrinogen Market

The dynamics of the Human Fibrinogen Market are heavily influenced by a confluence of accelerating drivers (D), persistent restraints (R), and emerging opportunities (O), creating complex impact forces that shape investment and commercial strategies. Key drivers include the robust increase in complex surgical procedures globally, such as cardiovascular and orthopedic surgeries, which frequently require substantial hemostatic support, alongside the rising prevalence of acquired coagulopathy in emergency settings like massive trauma and postpartum hemorrhage. Simultaneously, restraints primarily center on the dependence on highly regulated and often constrained human plasma supply chains, presenting inherent challenges related to donor availability, geographical sourcing limitations, and the stringent regulatory burden associated with maintaining viral safety standards. Opportunities, however, are abundant, particularly in the development of safer, scalable recombinant products and the expansion of fibrinogen use into advanced medical applications like tissue engineering and drug delivery systems, offering avenues for diversification beyond traditional replacement therapy.

Impact forces dictate the competitive intensity and market profitability. Regulatory pressures and public concern regarding plasma safety act as significant restraining forces, mandating continuous investment in sophisticated viral inactivation and removal technologies, thereby increasing production costs. Conversely, the successful adoption of evidence-based hemorrhage management guidelines—which explicitly recommend fibrinogen replacement based on laboratory monitoring—acts as a powerful driving force, establishing fibrinogen concentrates as a standard of care rather than a discretionary treatment. Furthermore, the high barrier to entry for new competitors, requiring vast capital investment in fractionation facilities and extensive clinical validation, stabilizes the market structure, concentrating power among a few established players. The critical medical need for effective hemostasis ensures consistent demand, mitigating economic downturn risks, but the long and complex approval process for new indications slows down market expansion compared to less regulated pharmaceutical sectors.

The equilibrium between supply chain stability (a constant pressure point) and expanding clinical indications (a significant growth accelerator) defines the market’s trajectory. Manufacturers are strategically addressing the plasma shortage restraint by innovating in recombinant technology, transforming this long-term opportunity into a critical future investment area. The market forces emphasize quality, safety, and supply consistency over radical pricing competition. The increasing acceptance of point-of-care diagnostics, which rapidly identify low fibrinogen levels, further strengthens the commercial imperative for maintaining ready availability of high-quality concentrates in critical care and operating rooms worldwide, ensuring that the clinical need translates directly into sustained market demand.

Segmentation Analysis

The Human Fibrinogen Market is primarily segmented based on product type, application, and end-user, allowing for a nuanced understanding of market dynamics and targeted strategic development. Product segmentation distinguishes between plasma-derived fibrinogen and recombinant fibrinogen, with plasma-derived products dominating due to maturity and widespread clinical experience, while recombinant technology represents the high-growth, innovation-driven segment aimed at mitigating plasma supply volatility. Application segmentation highlights the crucial difference between inherited deficiencies (such as afibrinogenemia, a niche, stable market) and acquired deficiencies (such as massive trauma, surgery, and obstetric hemorrhage, which represent the largest volume market and highest growth potential due to increasing global surgical volumes). End-user segmentation focuses on the primary consumption points, predominantly hospitals and surgical centers, which are equipped to handle complex blood component management and emergency critical care.

- By Product Type:

- Plasma-Derived Fibrinogen

- Recombinant Fibrinogen

- By Application:

- Congenital Fibrinogen Deficiency (Afibrinogenemia, Hypofibrinogenemia, Dysfibrinogenemia)

- Acquired Fibrinogen Deficiency (Surgical Bleeding, Trauma, Postpartum Hemorrhage, Liver Disease)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics and Trauma Centers

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (Japan, China, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (South Africa, GCC Countries)

Value Chain Analysis For Human Fibrinogen Market

The value chain for the Human Fibrinogen Market is complex, beginning with highly regulated upstream processes of plasma procurement and extending through specialized manufacturing, distribution, and final clinical application. Upstream analysis focuses intensely on donor recruitment, screening, and collection, where quality control and safety protocols are paramount due to the biological source material. Plasma must be ethically sourced, strictly screened for pathogens, and processed rapidly. Major players often manage integrated plasma collection centers or maintain long-term agreements with specialized plasma fractionators to ensure a stable, compliant supply, which is a significant determinant of final product cost and availability. The technological sophistication required for this stage creates a high barrier to entry, concentrating upstream power among established firms.

The core manufacturing stage involves sophisticated fractionation (primarily using the Cohn process modified for enhanced yield) and rigorous purification, viral inactivation, and final formulation into lyophilized concentrate. This midstream process requires specialized infrastructure and adherence to Good Manufacturing Practices (GMP). Companies invest heavily in technologies like solvent/detergent treatment and nanofiltration to ensure optimal viral safety, which distinguishes premium products. Optimization of yield during the fractionation process is critical for profitability given the expensive raw material. This process is followed by packaging and labeling, tailored for precise dosage and prolonged shelf life under specific storage conditions.

Downstream analysis involves the distribution channel, which is highly specialized due to the critical nature and temperature sensitivity of the product. Distribution channels are predominantly indirect, utilizing specialized pharmaceutical logistics providers equipped for cold chain management to deliver products primarily to large hospital systems, blood banks, and trauma centers. Direct sales forces and specialized medical science liaison teams are crucial for educating clinicians on appropriate usage, dosing protocols, and integrating the concentrates into existing hemorrhage management guidelines. The distribution efficiency and responsiveness are critical, particularly for emergency use in trauma centers, making reliable inventory management a key competitive differentiator in the final market reach.

Human Fibrinogen Market Potential Customers

The primary end-users and buyers of human fibrinogen concentrates are institutions that manage high-acuity medical conditions requiring immediate and effective hemostasis intervention. Hospitals, particularly those with large surgical departments (e.g., cardiac, orthopedic, neurosurgery), specialized trauma centers, and maternity wards, represent the largest customer segment due to the frequency of massive blood loss events. These institutions prioritize products based on safety profile, consistency of supply, ease of preparation, and compatibility with institutional hemorrhage control protocols. Purchasing decisions are often centralized and influenced by pharmacy and therapeutics committees that evaluate cost-effectiveness and clinical evidence supporting fibrinogen use over alternatives like cryoprecipitate or fresh frozen plasma.

Another crucial customer segment includes regional blood banks and centralized plasma product procurement agencies, especially those responsible for maintaining national or regional reserves of critical blood components. These entities act as large-scale purchasers, driven by public health mandates and the need for standardized, high-quality products that can be deployed across various affiliate hospitals in emergency situations. For congenital deficiencies, specialized hematology clinics and rare disease centers constitute a stable, albeit smaller, customer base that relies on long-term supply agreements for chronic patient management. The increasing use of fibrinogen in ambulatory surgical centers, particularly for complex outpatient procedures where bleeding risk might be higher, marks a minor but growing segment, reflecting the broader decentralization of surgical care.

Ultimately, the clinical decision-makers—anesthesiologists, trauma surgeons, hematologists, and intensivists—are the key influencers in product adoption. Their increasing reliance on viscoelastic testing (e.g., TEG and ROTEM) to diagnose functional fibrinogen deficiencies in real-time drives prescription rates. Therefore, manufacturers must engage these professionals through continuous medical education and clinical support to ensure that the product is appropriately integrated into evidence-based critical care pathways. The expansion of fibrinogen use into off-label or emerging applications, such as biological sealants in specific niche surgeries, also broadens the potential customer base to specialized surgical teams focusing on wound healing and tissue reconstruction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CSL Behring, Octapharma AG, LFB S.A., Grifols S.A., China Biologic Products Holdings, Baxter International, Shanghai RAAS Blood Products, Hualan Biological Engineering, Kamada Ltd., Kedrion S.p.A., Bayer AG, Sanofi S.A., Takeda Pharmaceutical, Novo Nordisk A/S, Prometic Life Sciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Fibrinogen Market Key Technology Landscape

The technological landscape of the Human Fibrinogen Market is dominated by advancements in plasma fractionation and purification techniques aimed at maximizing yield while ensuring exceptional viral safety. The foundation remains the modified Cohn process, which utilizes differential precipitation based on pH, ethanol concentration, and temperature to separate plasma proteins. However, modern manufacturing employs significant enhancements, including chromatography (ion-exchange and affinity chromatography) for high-purity isolation of fibrinogen, minimizing co-purification of unwanted proteins. A critical technological component is viral inactivation and removal, involving steps such as solvent/detergent (S/D) treatment and nanofiltration. These processes are constantly being refined to effectively neutralize enveloped and non-enveloped viruses, satisfying the increasingly stringent regulatory demands set by global health authorities and thereby strengthening market confidence in plasma-derived products.

A major area of technological focus and investment is the development and scaling of recombinant human fibrinogen (rHF). This technology utilizes genetically engineered cell lines (such as Chinese Hamster Ovary cells or other eukaryotic systems) to produce fibrinogen in a controlled, non-human environment. Recombinant technology fundamentally addresses the key restraint of supply volatility and eliminates the theoretical risk of unknown human plasma pathogens. While challenging due to the complex dimeric structure of the fibrinogen molecule (which requires three different polypeptide chains to be correctly synthesized and assembled), successful scale-up promises an unlimited, standardized supply. Currently, rHF is approved in certain regions, signaling a pivotal technological shift that, once cost-efficient, could significantly disrupt the dominance of plasma-derived products and expand accessibility globally.

Furthermore, technology related to advanced diagnostics, specifically viscoelastic hemostatic assays (VHAs) like Thromboelastography (TEG) and Rotational Thromboelastometry (ROTEM), significantly influences the market's commercial success. These point-of-care devices provide rapid, functional assessments of the coagulation cascade, allowing clinicians to diagnose functional fibrinogen deficiency quickly and accurately in critical settings. The integration of VHAs mandates the use of targeted therapeutics, directly driving the demand for concentrated fibrinogen products over less specific alternatives. Innovations in formulation, such as stabilizers that extend the product’s shelf-life and reduce reconstitution time, also contribute to the technological edge, improving logistical efficiency in fast-paced clinical environments like emergency rooms and operating theaters.

Regional Highlights

- North America: This region holds the largest market share, driven by sophisticated healthcare infrastructure, high incidence of cardiac and trauma surgeries, and widespread adoption of goal-directed hemostasis protocols utilizing viscoelastic testing. The U.S. represents the core market, benefiting from robust R&D investment, established plasma collection networks, and favorable reimbursement policies for plasma-derived therapies. High awareness among critical care specialists and hematologists regarding the clinical efficacy of fibrinogen concentrates further solidifies its market leadership.

- Europe: Europe represents the second-largest market, characterized by centralized blood component processing, strong governmental support for plasma donation, and widespread adherence to European Union quality and safety standards (e.g., EMA guidelines). Major markets, including Germany, the UK, and France, exhibit high per capita usage due to established transfusion protocols for treating perioperative bleeding, and a strong history of using plasma derivatives.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, driven by rapid urbanization, substantial improvement in healthcare infrastructure spending, and escalating awareness of advanced hemostatic products. China, Japan, and India are the primary growth engines, characterized by massive populations, increasing incidence of road traffic accidents and trauma, and expanding access to advanced surgical care.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets with moderate but accelerating growth. LATAM growth is primarily concentrated in Brazil and Mexico, fueled by increasing investment in public and private hospitals and efforts to standardize critical care. MEA, particularly the GCC countries, shows growth driven by high healthcare expenditure, medical tourism, and the adoption of Western clinical guidelines for trauma care.

North America’s dominance is supported by the concentration of key market players and a robust regulatory framework (FDA) that encourages innovation while maintaining strict quality control. The high expenditure on specialized medical equipment and the prevalence of well-equipped trauma centers ensure that fibrinogen concentrates are readily available for rapid deployment. Moreover, the increasing elderly population undergoing complex vascular and orthopedic surgeries contributes consistently to high consumption rates. The competitive landscape is mature, focusing on product differentiation through enhanced safety measures and expanded clinical evidence, particularly for major surgical indications.

The region is also at the forefront of adopting recombinant technologies, with substantial investment directed towards clinical trials for next-generation products. This technological readiness, combined with a willingness to integrate cutting-edge diagnostics (like advanced ROTEM systems), ensures that North America maintains its position as the primary revenue generator and a key indicator of future global trends in coagulation management.

Growth in Europe is steady, supported by extensive clinical research advocating for early intervention with fibrinogen concentrates in trauma and massive hemorrhage. Countries like Germany and Austria, known for pioneering viscoelastic testing, show particularly high penetration rates. Regulatory bodies prioritize patient safety, maintaining rigorous standards for plasma sourcing, which drives manufacturers to invest continuously in advanced viral inactivation technologies. The region's aging demographic and associated increase in complex surgical interventions ensure sustained underlying demand.

However, the European market faces challenges related to pricing pressure and variations in reimbursement across different member states, necessitating localized market strategies. The region serves as a crucial hub for plasma fractionation, hosting several major global players, which contributes to its strategic importance in the global supply chain, both for internal consumption and as a source for export.

The market in APAC is currently experiencing a transition from reliance on traditional cryoprecipitate to purified concentrates, particularly in private healthcare settings and major metropolitan hospitals. China and India are undertaking major initiatives to professionalize their plasma collection and fractionation industries, which is pivotal for long-term growth. Increasing disposable incomes and the proliferation of international-standard surgical centers are driving the adoption of premium plasma products.

Despite the high growth potential, the region faces regulatory fragmentation and challenges in establishing standardized, large-scale plasma collection networks. Local manufacturers compete fiercely on price, but multinational companies are strategically entering the market through partnerships and localization strategies to leverage the rising demand for high-quality, internationally approved fibrinogen products, particularly in trauma management.

In both LATAM and MEA, market penetration is lower than in developed regions, constrained by limited access to specialized critical care, variable reimbursement systems, and less established plasma collection infrastructure. However, the adoption of international training protocols for acute hemorrhage management is raising awareness about the benefits of targeted fibrinogen replacement.

Multinational companies generally address these regions through import models, focusing sales efforts on large urban centers and specialized governmental institutions. Growth is expected to remain contingent upon improvements in healthcare budget allocation and the establishment of reliable cold chain logistics to support the distribution of these critical, temperature-sensitive biological therapeutics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Fibrinogen Market.- CSL Behring

- Octapharma AG

- LFB S.A.

- Grifols S.A.

- China Biologic Products Holdings

- Baxter International

- Shanghai RAAS Blood Products

- Hualan Biological Engineering

- Kamada Ltd.

- Kedrion S.p.A.

- Bayer AG

- Sanofi S.A.

- Takeda Pharmaceutical

- Novo Nordisk A/S

- Prometic Life Sciences

Frequently Asked Questions

Analyze common user questions about the Human Fibrinogen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of human fibrinogen concentrate in medicine?

Human fibrinogen concentrate is primarily used to treat and prevent excessive bleeding in patients with congenital fibrinogen deficiencies (e.g., afibrinogenemia) or severe acquired deficiencies often encountered during massive trauma, complex surgery, or postpartum hemorrhage. It is administered intravenously to restore the necessary protein levels for effective blood clot formation.

How does plasma-derived fibrinogen compare to recombinant fibrinogen?

Plasma-derived fibrinogen currently dominates the market due to established manufacturing and extensive clinical experience. Recombinant fibrinogen, produced using genetically engineered cell lines, offers theoretical advantages in viral safety and supply consistency, eliminating reliance on human plasma sourcing, but currently faces higher production costs and complex regulatory hurdles for widespread adoption.

Which geographical region exhibits the fastest growth rate for the Human Fibrinogen Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, increasing surgical volumes, rising incidence of trauma, and growing adoption of advanced hemostasis management protocols in key economies like China and India.

What are the key technological advancements influencing the future of fibrinogen production?

Key technological advancements include enhanced plasma purification and viral inactivation techniques (like nanofiltration) to maximize product safety, the development and commercial scaling of recombinant human fibrinogen (rHF) technology to ensure supply stability, and the increased clinical reliance on point-of-care viscoelastic testing (ROTEM/TEG) for precise patient diagnosis and dosing.

What are the major restraints affecting the growth of the fibrinogen market?

The primary restraints include the high dependence on the availability and consistent supply of human plasma, which is heavily regulated and subject to donor pool constraints, leading to supply chain volatility. Additionally, the stringent regulatory requirements for product safety and the high initial investment required for fractionation facilities pose significant entry barriers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Human Fibrinogen Market Size Report By Type (Pure Human Fibrinogen, Fibrinogen Concentrate (Human)), By Application (Congenital Fibrinogen Deficiency, Surgical Procedures), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fibrinogen Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Human Fibrinogen Concentrate, Animal Fibrinogen Concentrate), By Application (Congenital Fibrinogen Deficiency, Surgical Procedures), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager