Human Microbiome-Based Drugs and Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431828 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Human Microbiome-Based Drugs and Diagnostics Market Size

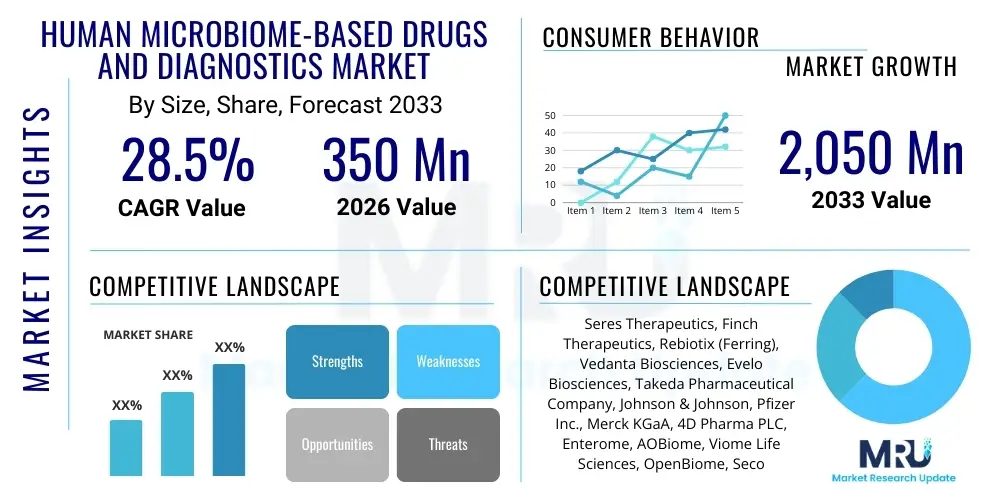

The Human Microbiome-Based Drugs and Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 2,050 Million by the end of the forecast period in 2033.

Human Microbiome-Based Drugs and Diagnostics Market introduction

The Human Microbiome-Based Drugs and Diagnostics Market focuses on therapeutic and diagnostic products derived from or targeting the complex communities of microorganisms residing in the human body, particularly the gut. These products are developed based on the understanding that the microbiome plays a crucial role in maintaining health, influencing metabolism, immunity, and even neurological function. Drugs primarily encompass live biotherapeutic products (LBPs), prebiotics, and postbiotics designed to restore balance (eubiosis) or treat conditions linked to microbial dysbiosis, such as inflammatory bowel disease (IBD), Clostridioides difficile infection (CDI), allergies, and certain metabolic disorders. Diagnostics involve advanced sequencing technologies and bioinformatics tools used to profile the microbial composition of a patient to identify disease biomarkers, predict treatment response, and stratify patient populations for personalized medicine approaches.

The market is rapidly advancing due to breakthroughs in metagenomic sequencing and computational biology, allowing researchers to accurately map the vast diversity and functional capabilities of the human microbiota. Major applications span oncology, infectious diseases, gastroenterology, and central nervous system (CNS) disorders, recognizing the profound gut-brain axis influence. Benefits of these novel approaches include the potential for highly targeted therapies with fewer systemic side effects compared to traditional pharmaceuticals, particularly in chronic diseases where inflammation and immune system modulation are key factors. Furthermore, diagnostics offer non-invasive methods for early disease detection and continuous monitoring of microbial health, setting a new standard for preventative medicine.

Driving factors include the escalating prevalence of chronic diseases heavily linked to lifestyle changes and altered microbiomes, such as obesity and Type 2 diabetes, coupled with substantial investment from venture capital and pharmaceutical companies recognizing the untapped potential of microbial engineering. Regulatory agencies, particularly the FDA and EMA, are establishing clearer pathways for the approval of LBPs, providing a necessary framework for commercial success. The growing scientific validation linking microbial composition to diverse health outcomes, coupled with patient demand for natural or biological treatments, further propels market expansion globally.

Human Microbiome-Based Drugs and Diagnostics Market Executive Summary

The Human Microbiome-Based Drugs and Diagnostics Market is experiencing robust growth, driven by significant advancements in sequencing technologies and increasing clinical evidence validating the microbiome's role in health and disease. Business trends indicate a shift toward strategic partnerships between specialized biotech firms focused on microbiome discovery and large pharmaceutical companies possessing the necessary clinical development and commercialization infrastructure. Regional trends show North America maintaining dominance due to high R&D spending, a sophisticated healthcare ecosystem, and favorable regulatory support for pioneering therapies, while the Asia Pacific region is emerging as a high-growth area driven by increasing awareness and improving healthcare infrastructure. Segment trends highlight the dominance of the therapeutic segment, particularly Live Biotherapeutic Products (LBPs), which are moving swiftly through clinical trials toward commercialization, though the diagnostics segment is critical for providing the necessary data foundation for personalized treatments and companion diagnostics, securing its steady expansion.

Key strategic activities observed across the competitive landscape include extensive intellectual property acquisition focused on specific microbial strains or metabolites, and technological innovation centered on advanced delivery systems to ensure viability and targeted release of microbial agents within the gastrointestinal tract. Furthermore, companies are increasingly leveraging AI and machine learning to sift through complex metagenomic data, accelerating target identification and biomarker discovery, thereby shortening the drug development cycle. The market faces inherent challenges related to manufacturing scalability and maintaining product stability for live organisms, necessitating specialized infrastructure development which represents a major investment area for market participants.

Overall market dynamics suggest a transition from broad spectrum antibiotics and general probiotic use to highly specific, targeted microbial interventions. Investors are closely monitoring Phase III clinical readouts for flagship LBP candidates, as successful outcomes are expected to unlock substantial market value and validate the entire therapeutic modality. The integration of diagnostic tools with therapeutic regimes is essential, ensuring that treatments are administered to patients most likely to benefit, thereby enhancing clinical efficacy and strengthening market penetration across high-impact disease areas like oncology (where gut flora affects immunotherapy efficacy) and neurological disorders.

AI Impact Analysis on Human Microbiome-Based Drugs and Diagnostics Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Human Microbiome market predominantly revolve around three critical themes: efficiency in data interpretation, acceleration of drug discovery, and precision of diagnostic predictions. Users frequently ask how AI can manage the massive, complex datasets generated by next-generation sequencing (NGS) of microbial communities (metagenomics), which are often too vast for traditional statistical analysis. There is significant interest in AI's role in identifying novel therapeutic targets (strains or metabolites) associated with specific disease phenotypes, thereby speeding up the translational research timeline. Furthermore, users are concerned with how machine learning algorithms can improve diagnostic accuracy by integrating microbiome profiles with patient clinical data (such as genetics, diet, and lifestyle) to predict disease progression or response to existing therapies, enhancing the promise of personalized microbiome medicine.

AI’s contribution is fundamentally transformative, addressing the inherent complexity and dimensionality of microbiome data. Machine learning models, particularly deep learning networks, excel at pattern recognition in heterogeneous data, allowing researchers to distinguish between pathogenic and beneficial microbial signatures more reliably than conventional methods. This capability is paramount for biomarker discovery, where specific compositional or functional shifts in the microbiome serve as predictive indicators for diseases ranging from chronic inflammation to certain types of cancer. AI also facilitates the design of synthetic microbial consortia, optimizing strain combinations for maximum therapeutic effect while minimizing off-target interactions, moving beyond serendipitous discovery toward rational design.

The integration of AI systems into diagnostic platforms is poised to revolutionize patient stratification. By employing algorithms to analyze a patient's microbiome alongside clinical metadata, physicians will gain actionable insights into individualized risk profiles and treatment optimization. For drug development, AI models are currently being utilized to predict the stability, viability, and host-interaction characteristics of live biotherapeutic products (LBPs) during manufacturing and ingestion, mitigating common formulation challenges. This analytical power enhances quality control and reduces the high attrition rate typically associated with biological product development, leading to accelerated market readiness for promising therapeutic candidates.

- AI accelerates metagenomic data processing and identification of functional microbial pathways.

- Machine learning identifies novel biomarkers for early disease detection and prognostication.

- AI predicts efficacy and safety profiles of Live Biotherapeutic Products (LBPs) by modeling host-microbe interactions.

- Algorithms optimize clinical trial design by precisely segmenting patients based on their microbiome signatures.

- AI facilitates high-throughput screening of microbial metabolites for potential drug leads (postbiotics).

- Predictive modeling enhances manufacturing yield and stability control for live organism therapies.

DRO & Impact Forces Of Human Microbiome-Based Drugs and Diagnostics Market

The market growth is primarily propelled by increasing scientific understanding and validation (Driver) of the gut-microbiome-axis connection to various systemic diseases, coupled with substantial funding directed toward novel biotherapeutic development. However, the market faces significant hurdles due to complex and evolving regulatory pathways (Restraint) for Live Biotherapeutic Products (LBPs) and inherent challenges in the large-scale, standardized manufacturing of live microbial agents. The primary Opportunity lies in expanding applications beyond gastroenterology into oncology (improving immunotherapy response) and CNS disorders (targeting the gut-brain axis). These factors create an intense competitive environment where technological superiority in sequencing and bioinformatics acts as a potent Impact Force, determining which companies successfully translate research into approved products. The cost-effectiveness and successful patient adoption of first-generation FDA-approved LBPs will exert substantial influence over future investment and market penetration, acting as a critical feedback loop.

Drivers: The global burden of chronic diseases such as inflammatory bowel disease, irritable bowel syndrome, and metabolic disorders, all closely linked to microbial dysbiosis, necessitates alternative therapeutic options. Advancements in Next-Generation Sequencing (NGS) technologies have made comprehensive microbiome profiling affordable and accessible, leading to exponential data generation that fuels research. Furthermore, successful clinical trials and regulatory approvals, such as those for Fecal Microbiota Transplantation (FMT)-derived therapies targeting recurrent CDI, provide a clear precedent and instill confidence among investors and clinicians regarding the modality's potential.

Restraints: Significant regulatory uncertainty remains a major impediment, as the distinction between traditional drugs, biologics, and food/dietary supplements often blurs when dealing with live organisms, complicating the path to market. Technical restraints include the difficulty in standardizing microbial products—ensuring consistent strain composition, viability, and activity across batches is a formidable manufacturing challenge. Additionally, public perception and acceptance, especially concerning invasive procedures like FMT or the long-term safety profile of genetically modified organisms (GMOs) used in some LBPs, introduce cautious adoption rates in certain demographics.

Opportunities: Untapped therapeutic potential exists in adjacent areas such as dermatology, autoimmune diseases, and neurodegenerative conditions where the link to microbial health is being progressively established. The diagnostics segment presents an immense opportunity for developing companion diagnostics (CDx) that ensure therapeutic agents are administered only to patients whose microbial profile indicates a high likelihood of response, maximizing efficacy and reducing healthcare costs. Personalized nutrition and preventative health services, leveraging microbiome data to recommend dietary or lifestyle interventions before disease onset, also represent lucrative, long-term market niches.

Impact Forces: The concentration of specialized expertise, particularly in bioinformatics and synthetic biology, exerts a powerful influence on market leadership. Intellectual property control over key proprietary strains and novel delivery technologies is critical for establishing market entry barriers. Collaborative innovation between academia, biotech, and pharmaceutical giants accelerates the translation of basic science into clinical application. The eventual establishment of clear, harmonized global regulatory standards will be the single most powerful impact force determining the speed of market growth over the next decade.

Segmentation Analysis

The Human Microbiome-Based Drugs and Diagnostics Market is meticulously segmented based on product type, application, disease indication, and technological platform, reflecting the diverse approaches utilized in this therapeutic area. The primary product segmentation differentiates between therapeutic agents, which dominate revenue, and diagnostic tools, which provide essential support and insight. Within therapeutics, the focus is highly stratified, targeting specific disease categories that demonstrate the strongest correlation with microbial dysbiosis, such as gastrointestinal disorders, which currently command the largest share due to direct mechanistic links. Technology segmentation highlights the reliance on advanced molecular techniques like Next-Generation Sequencing (NGS) for discovery and characterization, juxtaposed with traditional culture-based methods used in manufacturing.

Analysis of the applications segment reveals a strong pipeline concentration in areas with high unmet clinical needs. While infectious diseases, specifically recurrent CDI, have served as the initial validation point for the market, oncology and metabolic diseases are forecast to experience the fastest growth, driven by compelling clinical results showing the microbiome's influence on patient response to checkpoint inhibitors and insulin sensitivity. Geographic segmentation underscores the disproportionate influence of North American and European research institutions and commercial activities, although governmental initiatives in Asia Pacific are rapidly closing the gap through targeted R&D funding and establishment of biobanks.

The market structure is defined by the necessity of complex integration across segments. For instance, the successful deployment of a Live Biotherapeutic Product (LBP) requires an accompanying diagnostic framework to screen patients (Diagnostics segment) for specific microbial markers (Technology segment) linked to their inflammatory condition (Disease Indication segment). This interconnectedness drives strategic collaborations, ensuring comprehensive solutions rather than isolated product offerings. The long-term viability of the market depends on moving beyond strain replacement therapies to complex consortia and genetically engineered microorganisms, further increasing the technological complexity and demanding specialized manufacturing expertise.

- By Product Type:

- Drugs (Live Biotherapeutic Products (LBPs), Microbial Consortia, Phages)

- Diagnostics (Sequencing Services, Kits, Analytical Tools)

- Supplements (Prebiotics, Probiotics, Synbiotics, Postbiotics)

- By Application:

- Gastrointestinal Disorders (e.g., IBD, IBS, CDI)

- Infectious Diseases

- Metabolic Disorders (e.g., Obesity, Diabetes)

- Oncology (Immuno-oncology enhancement)

- Neurological Disorders (e.g., Parkinson's, Autism Spectrum Disorder)

- Others (Allergies, Dermatology)

- By Technology:

- Sequencing-Based Diagnosis (16S rRNA sequencing, Shotgun Metagenomics)

- Culture-Based Techniques

- Bioinformatics and AI Platforms

- Microbial Gene Editing/Synthetic Biology

- By End User:

- Hospitals and Clinics

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Human Microbiome-Based Drugs and Diagnostics Market

The value chain for the Human Microbiome market is highly specialized and begins with intensive upstream activities centered around discovery and basic research. This phase involves extensive sample collection, advanced sequencing (metagenomics), and the establishment of proprietary microbial strain libraries (biobanks). Academic institutions and small biotech firms typically dominate this discovery phase, focusing on identifying functional strains or therapeutic metabolites correlated with human health outcomes. The reliance on sophisticated bioinformatics and AI platforms for data analysis is paramount at this stage, enabling the selection of viable drug candidates. The successful execution of upstream activities dictates the novelty and effectiveness of subsequent therapeutic or diagnostic products.

The midstream phase involves process development and manufacturing, which are particularly complex for Live Biotherapeutic Products (LBPs). Manufacturing requires specialized facilities capable of culturing, formulation, stabilization (e.g., lyophilization), and quality control of live organisms while adhering to stringent Good Manufacturing Practices (GMP). This phase often involves large Contract Manufacturing Organizations (CMOs) or the internal scaling capabilities of major pharmaceutical partners. For diagnostics, the midstream focuses on kit production, validation, and regulatory approval (e.g., FDA clearance for diagnostic sequencing panels), ensuring reliability and standardization across clinical labs.

Downstream activities include clinical development, regulatory approval, and commercialization. Distribution channels are varied: direct sales teams target hospitals and specialized gastroenterology clinics for complex LBP therapies, while diagnostic kits are primarily distributed through clinical laboratory networks. Indirect channels include licensing agreements and co-development partnerships, allowing biotech firms to leverage the established marketing and distribution reach of major pharmaceutical companies. Successful commercialization depends heavily on payer reimbursement policies and clinician adoption, often requiring extensive medical education to communicate the clinical value of these novel, mechanism-driven therapies.

Human Microbiome-Based Drugs and Diagnostics Market Potential Customers

The primary end-users and buyers of Human Microbiome-Based Drugs and Diagnostics are broadly categorized into clinical healthcare providers, research institutions, and large biopharmaceutical corporations. Hospitals and specialized clinical centers, particularly those focused on gastroenterology, infectious diseases, and oncology, are crucial customers, purchasing approved therapeutic products (LBPs for recurrent CDI) and utilizing diagnostic services for patient stratification. Academic and government research institutions constitute a major buyer segment for diagnostic kits, sequencing services, and analytical software, driving the discovery and preclinical validation pipeline. These organizations utilize the tools to expand the foundational knowledge linking the microbiome to various pathologies.

Pharmaceutical and biotechnology companies represent the largest commercial customers, both as consumers of diagnostic tools and research services during the preclinical and clinical trial phases, and as ultimate distributors of the therapeutic products. They invest heavily in licensing early-stage assets, procuring large volumes of research reagents, and engaging specialized Contract Research Organizations (CROs) for clinical trial support. Furthermore, payers and insurance providers indirectly influence the market by determining reimbursement rates and coverage policies for both diagnostic tests and novel microbiome therapies, making them critical stakeholders that market participants must satisfy through robust clinical and economic evidence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 2,050 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Seres Therapeutics, Finch Therapeutics, Rebiotix (Ferring), Vedanta Biosciences, Evelo Biosciences, Takeda Pharmaceutical Company, Johnson & Johnson, Pfizer Inc., Merck KGaA, 4D Pharma PLC, Enterome, AOBiome, Viome Life Sciences, OpenBiome, Second Genome, uBiome (Pending Restructure), BCD Bioscience, Gnubiotics Sciences, Biomica, Microba Life Sciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Microbiome-Based Drugs and Diagnostics Market Key Technology Landscape

The technological landscape of the Human Microbiome market is dominated by high-throughput sequencing and advanced bioinformatics, which serve as the foundation for both discovery and diagnostics. Next-Generation Sequencing (NGS), particularly shotgun metagenomics, provides a comprehensive functional and taxonomic inventory of microbial communities, moving beyond simple 16S rRNA profiling. This deep sequencing generates the raw data necessary to understand microbial diversity (alpha and beta diversity), functional genes, and metabolic pathways. The effective handling and interpretation of this massive genomic data necessitate sophisticated bioinformatics platforms that utilize cloud computing and specialized algorithms, enabling researchers to correlate specific microbial features with clinical phenotypes efficiently.

In the therapeutic domain, the technology is centered around the development and delivery of Live Biotherapeutic Products (LBPs) and microbial metabolites (postbiotics). LBPs require specialized culturing techniques, including anaerobic conditions and custom growth media, to ensure the viability and scalability of sensitive, obligate anaerobic strains. Crucially, successful LBPs rely on innovative encapsulation and delivery systems, such as spore formation or specialized enteric coatings, designed to protect the live organisms from stomach acidity and ensure targeted release in the lower gastrointestinal tract. This area of formulation science is a key competitive battleground, driving significant intellectual property filing.

Furthermore, synthetic biology and microbial gene editing (e.g., CRISPR/Cas systems) are emerging technologies utilized to engineer microbial strains for enhanced therapeutic efficacy, stability, or targeted drug production within the host. This represents the next frontier of microbiome therapy, allowing researchers to create designer microbes capable of performing specific functions, such as localizing anti-inflammatory compound production or selectively eliminating pathogens. Alongside these therapeutic innovations, rapid point-of-care diagnostic tools based on microfluidics or targeted PCR are being developed to bring microbiome analysis closer to the clinical setting, offering quicker turnaround times for actionable patient data.

Regional Highlights

- North America: This region maintains its dominant position in the global market, primarily driven by the United States, which hosts the highest concentration of specialized biotechnology firms, leading academic research institutions, and substantial venture capital funding specifically targeting microbiome therapeutics. The region benefits from early regulatory framework establishment for LBPs (e.g., FDA guidance) and high healthcare expenditure supporting expensive, novel therapies. Furthermore, strong intellectual property protection and a mature ecosystem for clinical trials contribute significantly to North America’s sustained leadership in product development and commercialization.

- Europe: Europe represents the second-largest market, characterized by strong governmental investment in basic research, particularly in countries like the UK, Germany, and Switzerland. The European Medicines Agency (EMA) is actively defining regulatory guidelines for live biotherapeutics, striving for harmonization across member states. Collaborative research projects and initiatives focusing on large-scale cohort studies (e.g., in IBD and obesity) provide rich data sources for product development. Market growth is further stimulated by the presence of large pharmaceutical companies, such as Ferring, which are aggressively expanding their microbiome portfolios.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by increasing prevalence of metabolic diseases and a rapid expansion of modern healthcare infrastructure, particularly in China, Japan, and South Korea. These nations possess strong traditional medicine frameworks that often intersect with probiotic and microbial concepts, contributing to high consumer acceptance of dietary supplements and bio-based products. Government initiatives focused on developing biobanks and enhancing domestic biotechnology capabilities are key drivers, attracting foreign investment and establishing regional centers for clinical development and manufacturing scale-up.

- Latin America (LATAM): The LATAM market is nascent but shows potential, largely driven by improving access to advanced diagnostic technologies in major economies like Brazil and Mexico. The focus remains heavily on infectious diseases and basic probiotic applications, with market penetration constrained by fluctuating economic conditions and fragmented regulatory environments. Investment is primarily directed towards public health research and partnerships to import Western technologies and therapeutic candidates.

- Middle East and Africa (MEA): Growth in the MEA region is centered around wealthy Gulf Cooperation Council (GCC) countries, which are investing heavily in specialized clinical facilities and research centers to combat rising rates of lifestyle-related chronic diseases (e.g., diabetes). Adoption is currently limited by the high cost of advanced diagnostic sequencing services and the general lack of localized LBP manufacturing capabilities, necessitating reliance on imported products and technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Microbiome-Based Drugs and Diagnostics Market.- Seres Therapeutics

- Finch Therapeutics

- Rebiotix (Ferring Pharmaceuticals)

- Vedanta Biosciences

- Evelo Biosciences

- 4D Pharma PLC

- Takeda Pharmaceutical Company

- Johnson & Johnson

- Pfizer Inc.

- Merck KGaA

- Enterome

- AOBiome Therapeutics

- Viome Life Sciences

- OpenBiome

- Second Genome

- Synlogic

- Microbiome Insights Inc.

- Biomica

- Gnubiotics Sciences SA

- Microba Life Sciences

Frequently Asked Questions

Analyze common user questions about the Human Microbiome-Based Drugs and Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary disease target for current FDA-approved microbiome therapies?

The primary clinical indication for which the first generation of microbiome-based therapies, specifically fecal microbiota transplantation (FMT)-derived products, has received regulatory clearance is the treatment of recurrent Clostridioides difficile infection (CDI), due to the strong causal link between microbial depletion and disease relapse.

How do Live Biotherapeutic Products (LBPs) differ from traditional probiotics?

LBPs are defined by regulatory bodies (e.g., FDA) as biological drug products containing live organisms intended for therapeutic use, requiring rigorous clinical development and quality control standards, unlike traditional probiotics, which are typically marketed as dietary supplements with less stringent regulatory oversight.

What technological challenge is most critical for advancing microbiome-based drugs?

The most critical technological challenge is the manufacturing scalability and stabilization of live microbial consortia, ensuring consistent high viability and functionality of anaerobic organisms across large clinical and commercial batches, demanding specialized formulation and cold chain logistics.

Which application segment is expected to show the fastest growth rate?

The oncology segment, particularly therapies focused on modulating the gut microbiome to enhance the efficacy and reduce the toxicity of immune checkpoint inhibitors (cancer immunotherapies), is projected to exhibit the highest growth rate due to groundbreaking clinical research findings.

How does artificial intelligence contribute to microbiome diagnostics?

AI significantly enhances microbiome diagnostics by employing machine learning algorithms to process complex metagenomic sequencing data, enabling rapid identification of subtle microbial biomarker patterns that correlate with disease states, treatment response, and risk prediction, thereby facilitating personalized medical decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager