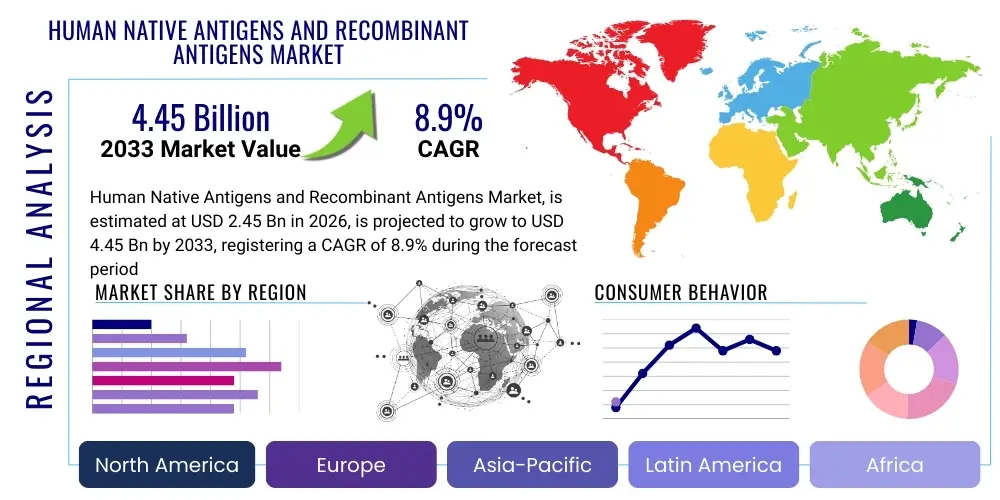

Human Native Antigens and Recombinant Antigens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439125 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Human Native Antigens and Recombinant Antigens Market Size

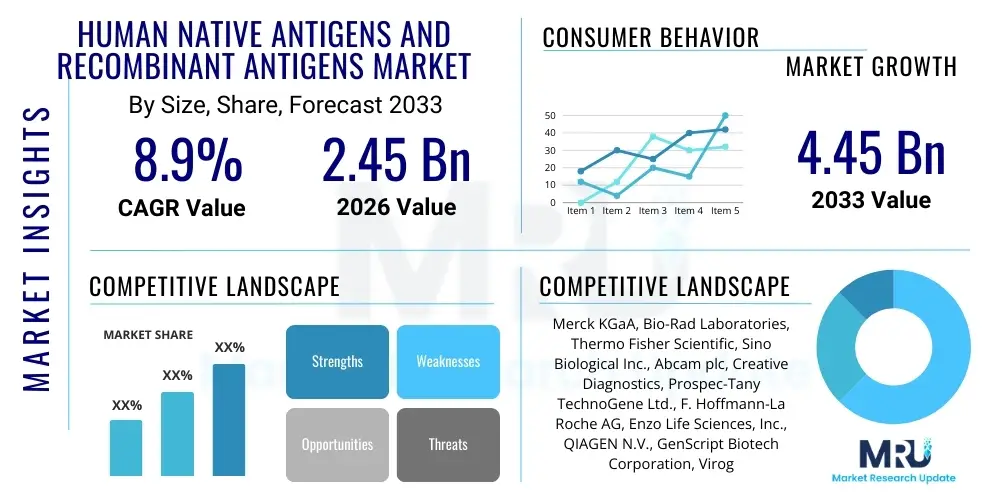

The Human Native Antigens and Recombinant Antigens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 2.45 Billion in 2026 and is projected to reach USD 4.45 Billion by the end of the forecast period in 2033.

Human Native Antigens and Recombinant Antigens Market introduction

The Human Native Antigens and Recombinant Antigens Market encompasses critical biological reagents essential for fundamental research, diagnostic assays, and therapeutic development, particularly in immunology and infectious disease fields. Native antigens are derived directly from natural sources, often requiring complex purification steps, while recombinant antigens are synthetically produced using genetic engineering techniques, offering high purity, specificity, and batch-to-batch consistency. These molecules are fundamental tools for detecting specific antibodies, stimulating immune responses, or understanding disease pathogenesis, serving as the backbone for various diagnostic kits, including ELISA and lateral flow assays, and driving innovation in prophylactic and therapeutic vaccine research.

Major applications of these antigens span across clinical diagnostics, drug discovery, and academic research. In diagnostics, antigens are utilized to identify the presence of specific antibodies in patient samples, crucial for diagnosing infectious diseases (like COVID-19 or HIV), autoimmune disorders, and allergies. The shift toward high-throughput screening and personalized medicine has intensified the demand for highly characterized and scalable antigen supplies. Recombinant technology, in particular, allows for the large-scale, cost-effective production of specific epitopes, addressing the historical limitation of scarcity and heterogeneity associated with native antigen sources.

The market is significantly driven by the escalating global prevalence of chronic and infectious diseases, coupled with substantial governmental and private sector investments in biomedical research and vaccine development. Benefits associated with modern antigen production include improved stability, reduced complexity in assay development due to high specificity, and accelerated timelines for therapeutic target identification. Furthermore, technological advancements in protein expression systems (e.g., mammalian, insect, yeast) and purification techniques are continuously enhancing the quality and accessibility of both native and recombinant antigens, thereby expanding their utility across complex biological applications.

Human Native Antigens and Recombinant Antigens Market Executive Summary

The Human Native Antigens and Recombinant Antigens Market exhibits robust growth propelled by increasing outsourcing of drug discovery activities and heightened demand for accurate and rapid diagnostic solutions. Key business trends indicate a strong focus among manufacturers on expanding their portfolio of highly specific recombinant antigens for emerging infectious diseases and complex autoimmune targets. Strategic mergers, acquisitions, and collaborations between academic institutions and commercial entities are accelerating product development and market penetration, particularly for customized antigen libraries. Furthermore, the adoption of specialized fermentation and expression platforms to enhance yield and reduce production time represents a significant operational trend across the industry.

Regionally, North America maintains the largest market share, driven by a well-established biotechnology industry, substantial R&D expenditure, and the presence of major pharmaceutical companies and leading academic research centers. However, the Asia Pacific (APAC) region is poised to demonstrate the fastest growth rate throughout the forecast period. This rapid expansion is attributed to improving healthcare infrastructure, rising incidence of infectious diseases, increasing government initiatives to support vaccine manufacturing, and the emergence of cost-effective antigen production capabilities in countries like China and India. Europe also represents a mature market, heavily supported by rigorous diagnostic regulations and ongoing investments from the European Union into infectious disease preparedness.

Segment trends reveal that the Recombinant Antigens segment is projected to grow faster than the Native Antigens segment, largely due to superior purity, scalability, and consistency offered by recombinant technology, making it the preferred choice for clinical diagnostics and vaccine production. By application, the Diagnostic segment holds the dominant share, underscoring the vital role antigens play in clinical testing and disease surveillance. Within end-users, pharmaceutical and biotechnology companies are the primary revenue generators, driven by intense efforts in developing novel biologics and next-generation prophylactic vaccines that require large quantities of high-quality antigens for screening and validation processes.

AI Impact Analysis on Human Native Antigens and Recombinant Antigens Market

User queries regarding the integration of Artificial Intelligence (AI) in the Human Native Antigens and Recombinant Antigens Market frequently center on how AI can accelerate epitope discovery, improve the predictive success rate of antigen design, and optimize expression system selection. Common concerns include the cost-benefit analysis of implementing complex AI algorithms, the need for high-quality, vast biological datasets to train these models effectively, and the ethical implications concerning intellectual property derived from AI-driven discoveries. Users are keen to understand if AI can significantly lower the time and cost associated with traditionally resource-intensive empirical testing cycles in antigen validation and purification processes.

The impact of AI is transformative, primarily by enabling the rapid identification and design of highly immunogenic antigens and optimizing the parameters for their successful large-scale production. AI algorithms are crucial for predicting protein structure, mapping complex epitopes, and selecting the most effective variants required for diagnostics or vaccine candidates, thereby drastically reducing the reliance on laborious trial-and-error methodologies. By analyzing vast genomic and proteomic data, AI can pinpoint specific targets with high sensitivity and specificity, making antigen development more focused and resource-efficient. This capability directly translates into faster turnaround times for assay development and faster progression of therapeutic candidates through preclinical stages.

Furthermore, AI and Machine Learning (ML) are being deployed to optimize the manufacturing workflow for recombinant antigens, specifically in process parameters like fermentation conditions, media composition, and downstream purification protocols. Predictive maintenance models minimize production failures, while optimization algorithms maximize yield and purity, which is critical for clinical-grade materials. This integration of computational power ensures that the quality and consistency of commercial antigens meet stringent regulatory standards, facilitating quicker market entry for new diagnostic and prophylactic tools and positioning AI as an indispensable tool in modern antigen manufacturing and discovery pipelines.

- AI accelerates epitope mapping and structural prediction, enhancing antigen specificity.

- Machine learning optimizes expression hosts and fermentation parameters, increasing recombinant antigen yield.

- In silico screening reduces the requirement for expensive, time-consuming empirical validation of candidates.

- AI improves quality control and batch consistency by predicting potential purification challenges.

- Integration facilitates the rapid design of novel antigens in response to pandemic threats (e.g., viral variants).

DRO & Impact Forces Of Human Native Antigens and Recombinant Antigens Market

The dynamics of the Human Native Antigens and Recombinant Antigens Market are primarily shaped by strong fundamental drivers rooted in global health crises and scientific progress, balanced by specific restraining factors related to production complexity and regulatory hurdles. The core drivers include the increasing global burden of infectious and chronic diseases, which mandates continuous innovation in diagnostics and vaccine development. Technological advancements, particularly in genomics and proteomics, provide opportunities for identifying highly specific novel antigen targets. Restraints often revolve around the high initial capital expenditure required for establishing cGMP-compliant production facilities and the inherent instability and batch variation issues, particularly with native antigens. The market is propelled by the opportunity presented by emerging markets with improving healthcare infrastructure and the vast unmet need in personalized medicine, particularly in oncology and autoimmune conditions, driving demand for specialized, custom-synthesized antigens.

Impact Forces: The market is influenced by several potent forces. The Bargaining Power of Suppliers is moderate, as raw materials (expression media, purification resins) are generally available, but specialized expression vectors or host systems may confer higher power to select suppliers. The Bargaining Power of Buyers is also moderate to high; large pharmaceutical and diagnostic companies often purchase in bulk, demanding stringent quality standards and competitive pricing. Threat of New Entrants is low to moderate due to the high regulatory barriers (FDA, EMA compliance), significant intellectual property required, and the need for sophisticated technical expertise. The Threat of Substitutes is low, as antigens are fundamental, irreplaceable components of immunological assays and vaccine formulations, though advances in synthetic peptide technology pose a minor substitutional threat in specific niche areas. Lastly, Intensity of Competitive Rivalry is high, characterized by continuous product differentiation, competitive pricing strategies, and aggressive patent filing among leading global and specialized regional manufacturers.

Segmentation Analysis

The Human Native Antigens and Recombinant Antigens Market is comprehensively segmented based on the product type, application, end-user, and geographic region, allowing for a nuanced understanding of market dynamics and growth pockets. The core segmentation by product type—Native Antigens and Recombinant Antigens—highlights the preference shift towards recombinant methodologies due to scalability and purity advantages. Applications span clinical diagnostics, which dominates the revenue, and therapeutic research, including vaccine development and drug screening. End-users, ranging from pharmaceutical companies to academic research institutes, drive demand based on their specific research and commercial requirements, creating distinct market behaviors within each segment.

- By Product Type:

- Native Antigens

- Recombinant Antigens

- By Application:

- Diagnostics (Infectious Diseases, Autoimmune Diseases, Allergy Testing)

- Drug Discovery & Development

- Vaccine Development

- Research & Academic Use

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Human Native Antigens and Recombinant Antigens Market

The value chain for the Human Native Antigens and Recombinant Antigens Market is complex, beginning with upstream activities focused on genetic design and host system selection and concluding with downstream distribution to end-users such as diagnostic labs and biotech firms. The upstream segment involves intensive R&D, gene synthesis, and cloning into appropriate expression systems (e.g., bacterial, yeast, insect, or mammalian cells). This initial phase requires significant intellectual capital and specialized equipment to ensure the correct folding and post-translational modifications of the target protein, particularly for complex human antigens.

The middle segment of the value chain is centered on large-scale manufacturing and purification. This involves fermentation or cell culture, followed by rigorous downstream processing, including chromatography, filtration, and quality control testing (QC). Maintaining batch consistency and achieving clinical-grade purity are critical value additions at this stage. Regulatory compliance (cGMP standards) profoundly impacts operational costs and market access, making the manufacturing step a high-value, high-barrier component of the chain. Companies that can efficiently scale production while adhering to quality standards gain a significant competitive advantage.

The downstream component involves distribution and sales. Distribution channels are bifurcated into direct sales to large pharmaceutical clients and indirect channels utilizing third-party distributors or specialized scientific supply houses, especially for reaching academic laboratories and smaller diagnostic companies globally. Effective cold chain logistics are essential for maintaining product integrity. Potential customers primarily include diagnostic kit manufacturers seeking bulk reagents, vaccine developers requiring specific immunogens for preclinical and clinical trials, and university researchers conducting basic immunology studies. The technical support and comprehensive data provided alongside the product significantly enhance its perceived value to the end-user.

Human Native Antigens and Recombinant Antigens Market Potential Customers

The potential customers for human native and recombinant antigens are diverse, representing various stages of the biotechnology and healthcare ecosystem. Diagnostic kit manufacturers represent a major customer base, requiring high volumes of validated antigens for the production of commercially available immunoassays used in clinical settings, such as those detecting infectious disease markers or tumor-associated antigens. These manufacturers prioritize consistency, certification, and large-scale supply capabilities from antigen providers, making supplier reliability paramount in purchasing decisions. The demand from this segment is highly sensitive to shifts in public health needs and regulatory approvals for new diagnostic platforms.

Pharmaceutical and biotechnology companies constitute another vital customer segment, utilizing these antigens extensively in their drug discovery pipelines, specifically for target identification, antibody screening, and validating the efficacy of therapeutic vaccines. These end-users demand customized antigen services, including specific post-translational modifications or complex multimeric constructs, often engaging in long-term contracts for bulk supply. Research institutions and academic laboratories also form a substantial customer group, focusing on fundamental research into human physiology, immune response mechanisms, and disease pathogenesis, typically purchasing smaller, highly specialized batches for experimental use.

Furthermore, Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) serve as indirect yet critical customers, purchasing antigens on behalf of their biopharma clients for use in preclinical testing, toxicology studies, and process development. The CRO segment relies on a broad range of high-quality antigens to support diverse projects, ranging from personalized medicine initiatives to global infectious disease programs. Their purchasing decisions are driven by the need for quick turnaround, technical sophistication, and compliance with stringent quality assurance protocols to support client regulatory filings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 4.45 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Bio-Rad Laboratories, Thermo Fisher Scientific, Sino Biological Inc., Abcam plc, Creative Diagnostics, Prospec-Tany TechnoGene Ltd., F. Hoffmann-La Roche AG, Enzo Life Sciences, Inc., QIAGEN N.V., GenScript Biotech Corporation, Virogen Corporation, Antigenix America Inc., Rockland Immunochemicals, Becton, Dickinson and Company (BD) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Native Antigens and Recombinant Antigens Market Key Technology Landscape

The technology landscape for human antigens is dynamic, driven by continuous innovation aimed at improving yield, purity, and functional integrity. Key technologies involve sophisticated protein expression systems, which form the foundation of recombinant antigen production. Mammalian expression systems (e.g., CHO or HEK293 cells) are highly favored for producing complex human antigens that require native folding and specific post-translational modifications (PTMs), crucial for clinical applications. While bacterial systems (E. coli) remain cost-effective for simpler, non-glycosylated proteins, the growing demand for highly accurate immunogens is pushing adoption toward more complex eukaryotic hosts, including yeast (Pichia pastoris) and insect cell systems (Baculovirus Expression System), offering a balance between scalability and correct protein processing.

Advancements in genetic engineering, such as CRISPR-Cas9 technology, are revolutionizing antigen design by enabling precise modification of host cells and optimizing gene expression for higher yields. Furthermore, advanced purification techniques are central to maintaining the competitive edge in the market. Chromatography methods, including affinity chromatography (using techniques like His-tag or Strep-tag systems) and size exclusion chromatography, are indispensable for achieving the ultra-high purity required for clinical diagnostics and therapeutic vaccine research, where minimal impurities are tolerated. The transition towards single-use systems in manufacturing is also streamlining production, reducing cross-contamination risks, and lowering turnaround times.

The convergence of computational biology and high-throughput screening (HTS) represents a significant technological shift. HTS platforms allow for the rapid screening and validation of large libraries of antigen variants, significantly speeding up the discovery phase. Additionally, microfluidics and automation are being integrated into upstream and downstream processing to miniaturize reactions and improve process control. The development of synthetic biology techniques for cell-free protein synthesis is emerging as a disruptive technology, promising highly scalable and rapid production of antigens independent of live cell culture constraints, which is particularly beneficial for rapid response needs during pandemics or disease outbreaks, further enhancing the technological sophistication of the market.

Regional Highlights

- North America: Dominates the global market share, attributed to exceptionally high R&D spending by pharmaceutical and biotechnology giants, strong government funding for disease prevention research (e.g., NIH grants), and the mature presence of specialized Contract Development and Manufacturing Organizations (CDMOs). The region, particularly the U.S., is a hub for high-end diagnostic testing and holds significant intellectual property related to antigen production technologies.

- Europe: Represents a significant, established market driven by rigorous healthcare standards, centralized public health initiatives (like the European Medicines Agency), and high adoption rates of advanced diagnostic technologies. Countries such as Germany, the U.K., and Switzerland lead in academic research and vaccine development, fostering consistent demand for high-quality native and recombinant antigens for both research and clinical application.

- Asia Pacific (APAC): Projected as the fastest-growing regional market. Growth is fueled by rapid expansion of the medical tourism sector, increasing prevalence of infectious diseases (requiring mass testing and vaccine campaigns), and substantial governmental investments in local biopharmaceutical manufacturing capabilities, particularly in China, South Korea, and India, where cost-effective production is a key driver.

- Latin America (LATAM): Exhibits nascent but accelerating growth, driven by improving access to healthcare and the expansion of local diagnostic laboratory networks. Market penetration is often focused on essential diagnostic antigens for prevalent regional infectious diseases, supported by increasing collaborations with international organizations to enhance public health infrastructure.

- Middle East and Africa (MEA): Currently holds the smallest share but shows growth potential, particularly in the Gulf Cooperation Council (GCC) countries due to high investments in healthcare diversification and biomedical research centers. Demand is primarily focused on importing high-grade diagnostic reagents and supporting local academic research endeavors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Native Antigens and Recombinant Antigens Market.- Merck KGaA

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Sino Biological Inc.

- Abcam plc

- Creative Diagnostics

- Prospec-Tany TechnoGene Ltd.

- F. Hoffmann-La Roche AG

- Enzo Life Sciences, Inc.

- QIAGEN N.V.

- GenScript Biotech Corporation

- Virogen Corporation

- Antigenix America Inc.

- Rockland Immunochemicals

- Becton, Dickinson and Company (BD)

- Fitzgerald Industries International

- Lee Biosolutions

- Advanced Biotechnologies Inc.

- Immunogenex (a subsidiary of Bio-Rad)

- Novus Biologicals (a subsidiary of Bio-Techne)

Frequently Asked Questions

Analyze common user questions about the Human Native Antigens and Recombinant Antigens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for recombinant antigens over native antigens?

The primary factor driving the preference for recombinant antigens is their superior purity, high batch-to-batch consistency, and scalability of production. Recombinant technology allows for precise epitope engineering and large-scale manufacturing necessary for standardized diagnostic assays and clinical-grade vaccine components.

Which application segment holds the largest share in the Human Native Antigens and Recombinant Antigens Market?

The Diagnostics segment holds the largest market share. Antigens are fundamental irreplaceable components in various commercial diagnostic kits, including ELISA and rapid testing platforms used for infectious disease screening and the diagnosis of autoimmune disorders globally.

How does Artificial Intelligence (AI) influence the antigen discovery pipeline?

AI significantly influences the pipeline by accelerating the identification of novel immunogenic targets and optimizing complex protein expression and purification parameters. This computational approach reduces the need for extensive empirical wet lab experiments, lowering costs and speeding up therapeutic development.

Which geographic region is expected to experience the fastest market growth through 2033?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by growing governmental investments in local pharmaceutical manufacturing, rapidly expanding healthcare infrastructure, and the high regional burden of infectious diseases.

What are the main technical challenges in the production of native human antigens?

The main technical challenges for native antigens include low yield from natural sources, potential contamination with host cell proteins or other biological molecules, and inherent difficulty in ensuring batch consistency, which necessitates complex and expensive purification protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager