Human Parainfluenza Viruses Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435636 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Human Parainfluenza Viruses Diagnostics Market Size

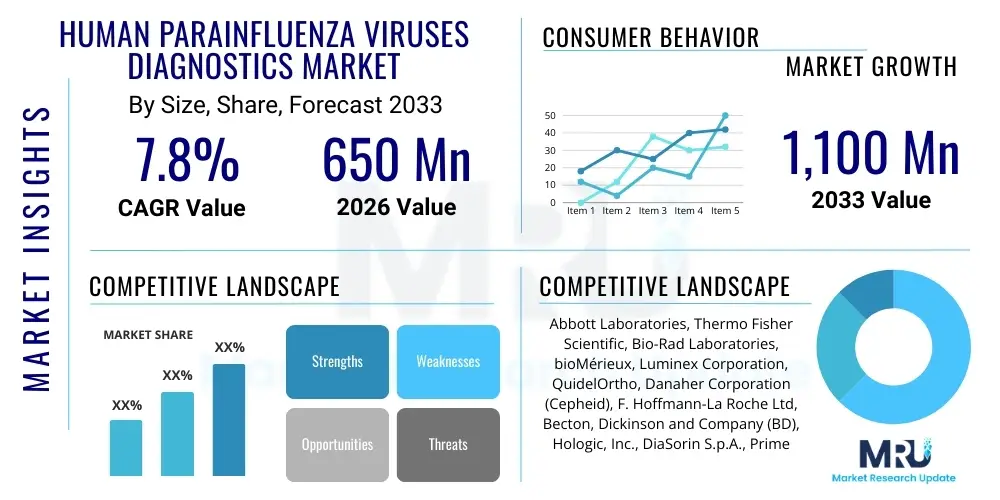

The Human Parainfluenza Viruses Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,320 Million by the end of the forecast period in 2033.

Human Parainfluenza Viruses Diagnostics Market introduction

The Human Parainfluenza Viruses (HPIV) Diagnostics Market encompasses all technologies and products utilized for the accurate and timely identification of HPIV types 1, 2, 3, and 4 in human samples. HPIVs are common respiratory pathogens, particularly affecting infants, young children, immunocompromised individuals, and the elderly, often leading to conditions like croup, bronchitis, bronchiolitis, and pneumonia. The primary products driving this market include molecular diagnostic assays, such as Real-Time Polymerase Chain Reaction (RT-PCR), which offer high sensitivity and specificity, along with traditional methods like viral culture and antigen detection immunoassays. The continuous evolution of diagnostic platforms, favoring rapid turnaround times and multiplex capabilities, is central to market development.

Major applications of HPIV diagnostics are concentrated within clinical laboratories and hospital settings, serving the critical need for differential diagnosis of respiratory tract infections (RTIs). Accurate identification of HPIV is crucial because its symptoms often overlap with those caused by other major respiratory viruses, including Influenza and Respiratory Syncytial Virus (RSV). The benefits derived from timely HPIV diagnosis include optimized patient management, reduced unnecessary use of broad-spectrum antibiotics, improved infection control protocols within healthcare facilities, and facilitation of epidemiological surveillance. These diagnostic tools are increasingly being integrated into syndromic panels that test for multiple pathogens simultaneously.

The market is significantly driven by the rising global prevalence of pediatric and geriatric respiratory infections requiring definitive diagnosis. Furthermore, continuous advancements in molecular biology techniques, coupled with increasing governmental and organizational focus on managing healthcare-associated infections (HAIs), propel the adoption of advanced diagnostic platforms. The shift toward decentralized testing models, including Point-of-Care (POC) testing, also serves as a crucial driving factor, enabling faster decision-making and isolation procedures, thereby minimizing viral spread in community and clinical environments.

Human Parainfluenza Viruses Diagnostics Market Executive Summary

The global Human Parainfluenza Viruses Diagnostics Market is characterized by robust growth, primarily fueled by the increasing demand for rapid and accurate molecular diagnostic solutions capable of handling large testing volumes during seasonal outbreaks. Business trends indicate a strong move towards consolidation, with major diagnostic companies acquiring specialized molecular technology firms to enhance their multiplex assay portfolios. Manufacturers are heavily investing in integrating automation and miniaturization into diagnostic instruments, making high-throughput testing more feasible for clinical laboratories globally. Furthermore, strategic partnerships between assay developers and reference labs are vital for refining testing protocols and validating new generations of diagnostic kits, focusing on improving sensitivity and reducing overall cost per test.

Regional trends highlight North America and Europe as dominant forces, driven by established healthcare infrastructures, high awareness of respiratory infection management, and favorable reimbursement policies for molecular testing. However, the Asia Pacific (APAC) region is poised for the fastest expansion due to rapidly modernizing healthcare systems, increasing investment in diagnostic infrastructure, and a substantial, often vulnerable, population base. Specific segment trends show that the Molecular Assays segment, particularly RT-PCR and next-generation sequencing approaches, maintains the largest market share owing to its superior performance characteristics. Concurrently, the End-User segment sees hospitals and clinics remaining primary consumers, although the penetration of diagnostic laboratories offering specialized syndromic panels is growing rapidly, reflecting the broader integration of sophisticated testing into routine care.

The market trajectory is significantly shaped by ongoing technological refinement focused on speed and comprehensive pathogen detection. The increasing prevalence of immunocompromised patients, who require prompt and precise pathogen identification to guide targeted antiviral or supportive therapy, underscores the necessity for high-reliability diagnostics. Overall, the market remains competitive, defined by innovation in assay design, efforts to achieve regulatory approvals for new POC devices, and strategic pricing to gain traction in emerging economies where cost remains a significant adoption hurdle. The imperative to manage seasonal respiratory surges efficiently continues to reinforce the essential nature of HPIV diagnostics within the global infectious disease landscape.

AI Impact Analysis on Human Parainfluenza Viruses Diagnostics Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the Human Parainfluenza Viruses Diagnostics Market frequently center on its role in improving diagnostic accuracy, accelerating data analysis, and predicting outbreak patterns. Key themes emerging from these discussions include the potential for AI-driven image analysis (especially in viral culture or cytology), optimization of laboratory workflows, and leveraging machine learning (ML) models to correlate patient symptoms and clinical risk factors with rapid test results. Users also express interest in how AI could manage the complex data generated by highly multiplexed molecular panels, helping clinicians filter out noise and identify co-infections efficiently. Concerns often revolve around data privacy, the need for robust validation datasets, and the regulatory pathway for integrating AI decision support tools into routine diagnostic practice, ensuring clinical reliability and minimizing algorithmic bias.

The primary expectation is that AI will transform HPIV diagnostics from a purely reactive testing process to a proactive surveillance and management system. AI algorithms are anticipated to significantly enhance laboratory throughput by automating sample prioritization and quality control steps in high-volume RT-PCR testing environments. Furthermore, integrating diagnostic results with electronic health records (EHRs) allows ML models to provide real-time epidemiological insights, identifying geographical clusters of HPIV infections earlier than traditional surveillance systems. This capability is crucial for public health agencies seeking to implement timely intervention strategies, such as targeted vaccination campaigns or communication of infection control guidelines during peak seasons.

Ultimately, AI’s influence extends beyond mere technical automation to generating actionable clinical intelligence. By analyzing complex biomarkers and genetic sequencing data generated during HPIV detection, AI can assist in predicting disease severity, identifying potential drug resistance mechanisms (if relevant to supportive treatments), and personalizing patient isolation protocols. The successful deployment of AI tools hinges on the collaboration between diagnostic manufacturers, clinical informaticists, and regulatory bodies to ensure that these advanced analytical capabilities are seamlessly and securely integrated into the existing diagnostic infrastructure, delivering enhanced value to healthcare providers and improving patient outcomes related to HPIV infections.

- AI-powered enhancement of image analysis for viral culture confirmation and automated quantification of results, reducing inter-operator variability.

- Implementation of Machine Learning models for predictive epidemiology, forecasting HPIV outbreak intensity and spread based on real-time diagnostic data inputs.

- Optimization of laboratory workflow and resource allocation through AI-driven scheduling and robotic automation of sample preparation and analysis processes.

- Development of decision support systems using AI to integrate complex multiplex PCR results with patient clinical data, aiding in differential diagnosis against co-circulating pathogens like RSV and Influenza.

- Acceleration of R&D efforts for new diagnostic assay development by using algorithms to analyze genomic variance and identify optimal target regions for HPIV strains.

DRO & Impact Forces Of Human Parainfluenza Viruses Diagnostics Market

The dynamics of the Human Parainfluenza Viruses Diagnostics Market are dictated by a powerful interplay of driving forces (D), restrictive challenges (R), emerging opportunities (O), and external impact factors. The predominant driver is the high global incidence and prevalence of acute respiratory infections, particularly among vulnerable populations, which necessitates reliable and rapid pathogen identification for effective clinical management and infection control. This demand is further amplified by continuous technological leaps in molecular diagnostics, offering faster turnaround times and simultaneous detection of multiple respiratory pathogens (multiplexing). Healthcare systems worldwide are increasingly adopting these advanced platforms to minimize hospital stays and prevent the transmission of respiratory viruses, contributing substantially to market momentum. The commitment of organizations like the World Health Organization (WHO) to improve surveillance of respiratory viruses also mandates the deployment of sophisticated diagnostic tools.

However, the market faces significant restraints that slow its potential growth. A major challenge is the substantial initial capital investment required for high-throughput molecular diagnostic instruments and the recurring costs associated with specialized reagents and skilled labor. In many emerging markets, these high costs pose a severe barrier to adoption, limiting the widespread integration of advanced testing methods. Furthermore, the lack of standardized testing protocols across different geographical regions and clinical settings can sometimes lead to inconsistencies in results and difficulty in comparative epidemiological reporting. While HPIV is a clinically relevant pathogen, its perceived lower severity compared to influenza often results in delayed or selective testing, particularly in resource-constrained environments, which restricts market volume growth.

The primary opportunities for market stakeholders lie in the development and commercialization of next-generation Point-of-Care (POC) testing devices. These compact, user-friendly platforms promise to bring rapid HPIV diagnosis closer to the patient, facilitating immediate clinical decisions, especially in outpatient and emergency settings. Another significant opportunity is the increasing integration of HPIV detection into comprehensive syndromic panels that test for 20 or more respiratory pathogens simultaneously, maximizing the utility of a single sample and streamlining differential diagnosis. Impact forces, such as global pandemics and localized outbreaks, have profoundly increased public health awareness and governmental funding for infectious disease diagnostics, accelerating the regulatory approval and adoption cycle for new diagnostic technologies, thereby acting as a powerful external catalyst for market expansion and infrastructural investment.

Segmentation Analysis

The Human Parainfluenza Viruses Diagnostics Market is comprehensively segmented based on various factors, including the type of test utilized, the end-user setting, and the geographical region. Analyzing these segments provides a granular view of market dynamics, revealing preferred technologies and key adoption hubs. The segmentation by Test Type is crucial, distinguishing between highly sensitive molecular methods and more traditional serological or culture-based techniques. Molecular Assays, particularly RT-PCR, dominate this categorization due to their ability to provide definitive, rapid results early in the course of infection, which is paramount for clinical management. The continuous refinement of these molecular platforms, integrating microfluidics and automation, ensures their sustained leadership in the diagnostic landscape.

Segmentation by End-User reflects where diagnostic demand originates and how services are consumed. Hospitals and specialized critical care clinics remain the largest consumers, driven by the need for immediate diagnosis in acutely ill patients, particularly children presenting with severe respiratory distress. However, the fastest growth is observed in the Diagnostic Laboratories segment, which serves as a centralized hub for high-volume testing, managing samples referred from primary care facilities and broader community surveillance efforts. Academic and research institutes also constitute a vital segment, focusing on epidemiological monitoring, strain typing, and the validation of novel diagnostic targets, which drives early market adoption of cutting-edge technologies.

Geographical segmentation demonstrates the disparity in diagnostic resource allocation and technology adoption globally. North America and Europe possess the regulatory and infrastructural maturity to rapidly adopt and utilize sophisticated molecular diagnostics, ensuring high market saturation. Conversely, high-growth potential is centered in the Asia Pacific (APAC) region, where improvements in healthcare expenditure, increasing health literacy, and a large, dense population susceptible to seasonal respiratory outbreaks are rapidly driving demand for scalable HPIV testing solutions. Understanding these segmental dynamics is essential for stakeholders developing targeted marketing strategies and product portfolios suited to specific clinical needs and economic environments.

- By Test Type:

- Molecular Assays (e.g., RT-PCR, Isothermal Nucleic Acid Amplification)

- Immunoassays (e.g., Direct Fluorescent Antibody (DFA), Enzyme-Linked Immunosorbent Assay (ELISA))

- Viral Culture

- By Product:

- Kits and Reagents

- Instruments (Analyzers and PCR Systems)

- By End-User:

- Hospitals and Clinics

- Diagnostic Laboratories

- Academic and Research Institutes

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Human Parainfluenza Viruses Diagnostics Market

The value chain for the Human Parainfluenza Viruses Diagnostics Market begins with the upstream segment, primarily involving the sourcing and development of core components. This stage focuses on molecular biology research, genetic sequencing, and the synthesis of highly specific primers, probes, and antibodies essential for diagnostic kits. Key upstream activities include the isolation and characterization of current HPIV strains to ensure assay accuracy, procurement of high-quality raw materials (e.g., enzymes, buffers, plastics for consumables), and the rigorous development of proprietary software for instrument control and data analysis. Technological intellectual property is a central element here, with leading manufacturers investing heavily in R&D to maintain a competitive edge in terms of assay sensitivity, stability, and shelf-life.

Moving into the midstream, manufacturing and assembly processes take precedence, where raw components are transformed into final diagnostic products, including ready-to-use kits, reagents, and specialized diagnostic instruments (PCR cyclers, automated systems). Stringent quality control and regulatory compliance (e.g., FDA, CE-IVD) are critical at this juncture to ensure product safety and efficacy. Following manufacturing, the distribution channel plays a pivotal role. The market relies on both direct and indirect distribution strategies. Direct channels are often utilized for large institutional clients, such as major hospital networks and reference laboratories, where customized service contracts and technical support are paramount. Indirect channels, involving specialized diagnostic distributors and third-party logistics providers, facilitate market penetration into smaller clinics, regional labs, and international territories, leveraging established regional networks and supply chain expertise.

The downstream segment centers on market access, end-user adoption, and post-sales support. This includes clinical validation studies, clinician education on the appropriate use and interpretation of HPIV tests, and managing reimbursement negotiations with payers. The end-users—hospitals, labs, and research institutions—perform the actual testing and utilize the results for patient management and public health reporting. Continuous technical support, instrument servicing, and timely reagent supply are crucial for maintaining customer satisfaction and operational uptime. The overall efficiency of the value chain relies heavily on seamless integration between manufacturers and distributors to ensure that sophisticated, time-sensitive diagnostic tools reach the point of need rapidly, especially during peak respiratory seasons, maximizing their clinical utility.

Human Parainfluenza Viruses Diagnostics Market Potential Customers

The potential customers and end-users of Human Parainfluenza Viruses diagnostics span a diverse group within the healthcare ecosystem, all sharing the requirement for accurate and timely identification of respiratory pathogens. The largest and most immediate consumer segment comprises acute care settings, specifically hospital microbiology departments, emergency rooms, and intensive care units (ICUs). These facilities cater to severely ill patients, particularly pediatric and geriatric populations, where rapid diagnosis is vital for guiding therapeutic interventions, implementing strict isolation protocols to prevent nosocomial spread, and managing antimicrobial stewardship programs effectively. Demand from these customers is high-volume and characterized by a preference for automated, multiplexed systems capable of differentiating HPIV from other common respiratory viruses swiftly.

The second major cohort of potential buyers includes large, independent reference laboratories and national public health laboratories. These entities act as centralized testing hubs, processing samples referred from smaller clinics, physician offices, and community health centers. Their demand is focused on high-throughput, cost-efficient molecular testing solutions necessary for large-scale epidemiological surveillance, strain tracking, and maintaining robust quality assurance standards. These labs often drive the adoption of fully automated platforms and are instrumental in establishing best practice guidelines for HPIV testing within their respective jurisdictions, prioritizing scalability and overall operational efficiency.

Finally, the academic and research community represents a vital customer segment, although their purchasing behavior differs from clinical settings. Universities, research hospitals, and pharmaceutical R&D labs require HPIV diagnostics for investigative purposes, including vaccine development efficacy studies, antiviral drug testing, and fundamental research into viral pathogenesis. Their needs often lean towards specialized reagents, highly sensitive research-use-only assays, and instruments that offer flexibility for customization and advanced genomic analysis, contributing to the development and validation of future diagnostic breakthroughs and informing global health policies regarding respiratory infections.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,320 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Abbott Laboratories, Bio-Rad Laboratories, Quidel Corporation, Hologic, Inc., Thermo Fisher Scientific, Becton, Dickinson and Company (BD), Luminex Corporation, DiaSorin S.p.A., Seegene Inc., Fast-track Diagnostics, Altona Diagnostics, Meridian Bioscience, F. Hoffmann-La Roche Ltd., Danaher Corporation, bioMérieux, Enzo Biochem, Inc., GenMark Diagnostics, Inc., QIAGEN N.V., BioFire Diagnostics (A part of bioMérieux) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Parainfluenza Viruses Diagnostics Market Key Technology Landscape

The technological landscape of the Human Parainfluenza Viruses Diagnostics Market is heavily influenced by rapid innovations in molecular biology, focusing on enhancing speed, accuracy, and multiplexing capabilities. The gold standard remains Real-Time Polymerase Chain Reaction (RT-PCR), which offers the highest sensitivity and specificity for detecting HPIV genetic material (RNA). Recent advancements within this technology involve integrating highly automated sample-to-answer systems, minimizing manual steps, and reducing the risk of contamination, making it suitable for high-throughput clinical settings. These automated platforms are crucial as they allow simultaneous testing for HPIV alongside other critical respiratory viruses in a single run, providing a comprehensive diagnostic profile essential for managing complex cases.

Beyond traditional RT-PCR, Isothermal Nucleic Acid Amplification Technologies (NAATs), such as Loop-Mediated Isothermal Amplification (LAMP), are gaining traction. NAATs offer rapid results (often under 30 minutes) without the need for sophisticated thermal cycling equipment, positioning them as ideal candidates for Point-of-Care (POC) applications and use in decentralized settings with limited infrastructure. Furthermore, the increasing adoption of syndromic testing panels, often utilizing multiplexed microarrays or film array technology, allows for the detection of multiple HPIV types (1-4) and other respiratory pathogens from a single nasal swab specimen. This approach significantly streamlines the diagnostic process, improving efficiency and resource utilization in clinical laboratories managing seasonal respiratory surges.

The emerging technologies that hold significant promise include Next-Generation Sequencing (NGS) and digital PCR (dPCR). While NGS is currently mostly utilized in research and surveillance for comprehensive genomic characterization and tracking of viral evolution, its cost-efficiency is improving, suggesting potential future clinical applications for deeply understanding viral co-infections and resistance markers. Digital PCR, offering absolute quantification of viral load with ultra-high sensitivity, is used in specialized settings, particularly for monitoring immunocompromised patients. The market’s future direction is clearly moving toward fully integrated, highly complex molecular solutions that offer simplicity of use, rapid results, and comprehensive pathogen detection profiles to support tailored clinical decisions.

Regional Highlights

- North America: North America holds the dominant market share, primarily due to the presence of technologically advanced diagnostic infrastructure, high healthcare expenditure, and stringent regulatory guidelines mandating accurate infectious disease reporting. The U.S. and Canada benefit from widespread adoption of sophisticated molecular diagnostic platforms and favorable reimbursement policies for multiplex respiratory panels. Significant investment in public health surveillance and early adoption of automated, high-throughput systems in large hospital networks solidify this region's leading position.

- Europe: Europe represents a mature and highly competitive market, characterized by strong governmental support for infectious disease control and established clinical guidelines that emphasize rapid diagnostics for respiratory illnesses. Countries like Germany, the U.K., and France are key contributors, driven by a strong base of pharmaceutical and diagnostic companies, centralized national reference laboratories, and increasing integration of RT-PCR-based assays into routine clinical care across both primary care and specialized hospital settings.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is attributed to massive population size, improving economic conditions leading to higher healthcare spending, and increasing awareness of respiratory infection management. Market expansion is particularly notable in populous nations like China and India, where governments are investing heavily in establishing modern diagnostic laboratories and addressing the significant burden of pediatric respiratory diseases, fostering demand for cost-effective molecular solutions.

- Latin America: This region presents moderate growth opportunities, primarily driven by expanding access to healthcare services and increasing initiatives to combat infectious diseases. However, market adoption faces challenges related to infrastructure limitations and pricing sensitivity. The key markets, including Brazil and Mexico, are increasingly adopting modern diagnostic kits, although reliance on international imports for specialized reagents remains significant, leading to strategic focus on simpler, more robust diagnostic methods.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in high-income Gulf Cooperation Council (GCC) countries which possess modern healthcare facilities and high per-capita healthcare expenditure. The adoption of advanced HPIV diagnostics is often limited by disparities in healthcare accessibility across the region. However, increasing international aid and regional efforts to improve infection control standards are gradually expanding the deployment of diagnostic technology, particularly in urban clinical centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Parainfluenza Viruses Diagnostics Market.- Roche Diagnostics

- Abbott Laboratories

- Bio-Rad Laboratories

- Quidel Corporation

- Hologic, Inc.

- Thermo Fisher Scientific

- Becton, Dickinson and Company (BD)

- Luminex Corporation

- DiaSorin S.p.A.

- Seegene Inc.

- Fast-track Diagnostics

- Altona Diagnostics

- Meridian Bioscience

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- bioMérieux

- Enzo Biochem, Inc.

- GenMark Diagnostics, Inc.

- QIAGEN N.V.

- BioFire Diagnostics (A part of bioMérieux)

Frequently Asked Questions

Analyze common user questions about the Human Parainfluenza Viruses Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Human Parainfluenza Viruses Diagnostics Market?

The Human Parainfluenza Viruses Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven by increasing adoption of molecular testing and rising incidence of respiratory tract infections globally.

Which diagnostic technology holds the largest market share in HPIV testing?

Molecular Assays, particularly Real-Time Polymerase Chain Reaction (RT-PCR), hold the largest market share. This technology is preferred due to its superior sensitivity, high specificity, and compatibility with comprehensive multiplexed respiratory panels.

What are the primary factors driving the growth of the HPIV diagnostics market?

Market growth is primarily driven by the high prevalence of respiratory infections in vulnerable populations, significant technological advancements in automated and rapid molecular diagnostics, and the crucial need for accurate differential diagnosis against viruses like Influenza and RSV for effective patient management.

Which geographical region is expected to show the fastest growth in the market?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest market growth, fueled by rapid expansion of healthcare infrastructure, increased governmental investment in public health surveillance, and a large population base susceptible to seasonal respiratory outbreaks.

How is Point-of-Care (POC) testing influencing the HPIV diagnostics market?

POC testing is a major opportunity, enabling decentralized, rapid diagnosis of HPIV outside central laboratories. This speeds up clinical decision-making, allows for quicker isolation protocols, and enhances patient management efficiency in emergency and outpatient settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager