Human Resource Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438295 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Human Resource Outsourcing Market Size

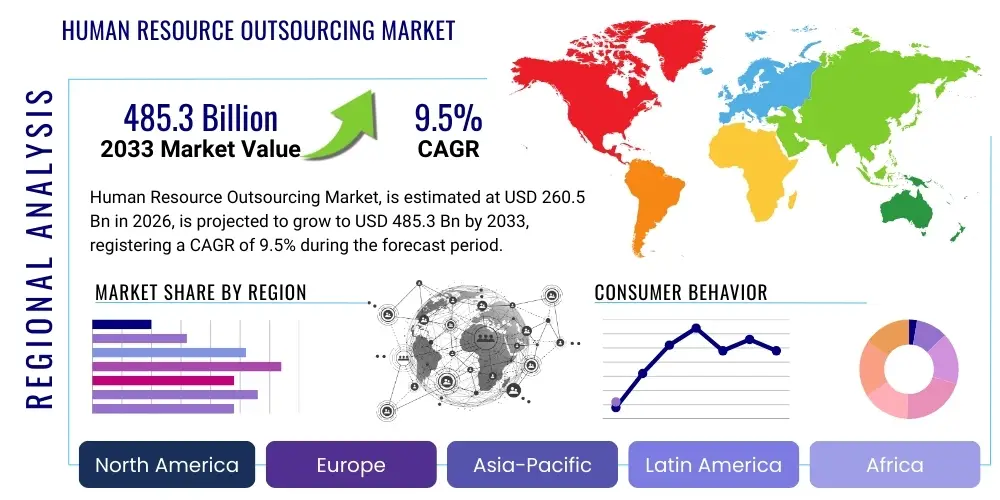

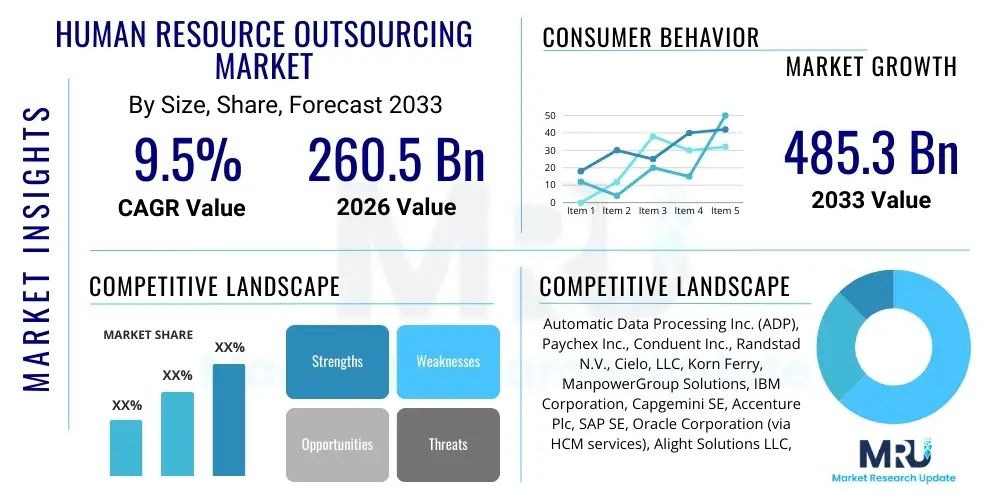

The Human Resource Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 260.5 Billion in 2026 and is projected to reach USD 485.3 Billion by the end of the forecast period in 2033.

Human Resource Outsourcing Market introduction

The Human Resource Outsourcing (HRO) market encompasses the practice where organizations transfer the management of specific HR functions or entire HR operations to external, specialized providers. This strategic business model allows companies to streamline administrative burdens, ensure compliance with complex regulatory frameworks, and refocus internal resources on core competencies and strategic initiatives. Key outsourced services typically include payroll processing, benefits administration, recruitment process outsourcing (RPO), learning and development, and comprehensive human resource management systems (HRMS) hosting.

The core product offering in HRO revolves around delivering scalable, technology-enabled services that enhance operational efficiency and reduce overhead costs associated with maintaining internal HR infrastructure. Major applications span across small and medium-sized enterprises (SMEs) seeking cost-effective solutions to large multinational corporations requiring standardized global HR platforms. The inherent benefits derived from HRO include improved data accuracy, enhanced regulatory compliance—especially crucial in industries like BFSI and Healthcare—and access to specialized HR expertise that may be cost-prohibitive to develop internally. Furthermore, outsourcing provides scalability, enabling businesses to manage workforce fluctuations without significant internal restructuring.

The primary factors driving market expansion are the increasing global complexity of labor laws, the continuous pressure on organizations to reduce operational costs, and the rapid advancement of cloud-based HR technology. Digital transformation mandates that HR departments become more strategic; outsourcing non-core, transactional tasks frees up internal HR teams to focus on talent management, employee engagement, and organizational development. The shift toward remote and hybrid work models has also accelerated the need for robust, standardized, and globally accessible outsourced HR systems, further solidifying the necessity of HRO services across diverse industry verticals.

Human Resource Outsourcing Market Executive Summary

The Human Resource Outsourcing market is characterized by a fundamental shift toward digitally integrated, advisory-focused service models, moving beyond traditional transaction processing. Current business trends indicate a strong demand for specialized services, particularly Recruitment Process Outsourcing (RPO) and multi-process HRO (MPHRO), driven by the global war for talent and the necessity for sophisticated talent acquisition strategies. Technological advancements, notably the integration of AI and machine learning into service delivery, are enabling higher automation, predictive capabilities in workforce planning, and superior employee experience platforms. This transformation is positioning HRO providers as strategic partners rather than mere cost centers, significantly influencing vendor selection criteria and long-term contract structures.

Geographically, market growth is heavily influenced by rapid industrialization and the establishment of complex regulatory environments in the Asia Pacific (APAC) region, making it the fastest-growing market for HRO services. North America remains the dominant revenue contributor, characterized by mature market penetration and a high adoption rate of sophisticated, technology-intensive solutions, particularly cloud-based and Software-as-a-Service (SaaS) models for core HR functions. Europe demonstrates stable growth, propelled by strict data protection regulations (like GDPR) which necessitate expert external compliance management, and a strong preference for multi-country payroll and benefits harmonization.

Segmentation trends highlight the sustained dominance of large enterprises in terms of overall contract value, although the SME segment is showing the highest growth rate due to the availability of tailored, scalable HRO packages. By service type, Benefits Administration and RPO segments are experiencing robust expansion, reflecting the heightened organizational focus on employee welfare and strategic talent acquisition. The integration of advanced analytics within HRO deliverables—providing insights into workforce productivity, retention rates, and organizational efficiency—is emerging as a critical competitive differentiator across all service segments, dictating investment priorities for leading market players.

AI Impact Analysis on Human Resource Outsourcing Market

User inquiries regarding the impact of Artificial Intelligence on the Human Resource Outsourcing market predominantly center around three key themes: the potential for mass job displacement within transactional HRO roles, the expected enhancements in efficiency and service quality, and the strategic implications for data security and personalization of employee experiences. Users are concerned about whether AI integration will lead to a commoditization of basic HRO tasks, pushing human consultants into purely high-value, advisory roles. Conversely, there is significant expectation that AI tools—such as chatbots for employee self-service and predictive analytics for turnover risk—will substantially improve accuracy, reduce processing times, and enable HRO vendors to offer highly customized solutions at a lower operational cost. The consensus suggests AI will fundamentally restructure the HRO value chain, automating repetitive tasks while augmenting the capabilities of human HR professionals and outsourcing staff.

- Automation of transactional processes, including payroll entry, expense report verification, and basic benefits enrollment inquiries, leading to significant cost reduction for providers.

- Enhanced decision-making through predictive analytics for workforce planning, talent identification, and optimizing recruitment funnel efficiency.

- Deployment of sophisticated AI-powered chatbots and virtual assistants to provide 24/7 employee support and instantaneous resolution of common HR queries.

- Improved compliance management and risk mitigation by utilizing AI algorithms to monitor vast changes in regulatory landscapes and flag potential non-compliance issues proactively.

- Personalization of the employee experience, from tailored learning pathways to customized benefits recommendations, driven by machine learning insights into employee behavior and preferences.

DRO & Impact Forces Of Human Resource Outsourcing Market

The dynamics of the Human Resource Outsourcing market are currently governed by a powerful combination of accelerating drivers and persistent restraints, creating critical impact forces that shape market trajectory. Key drivers include the escalating complexity of global labor regulations and tax requirements across diverse jurisdictions, which necessitate specialized compliance expertise often best managed externally. Furthermore, the imperative for organizations to focus on strategic core business activities, coupled with significant cost pressures, compels executives to offload non-core administrative functions like payroll and benefits administration to specialized outsourcing partners. The continuous digital transformation within enterprises, demanding integration of advanced HR technology platforms (cloud, mobile access), further fuels outsourcing adoption as vendors provide immediate access to best-in-class systems without large capital expenditure.

However, the market faces considerable restraints, primarily revolving around concerns related to data security and the confidentiality of sensitive employee information. High-profile data breaches can severely undermine client trust and deter outsourcing adoption, particularly in highly regulated sectors like finance and healthcare. Additionally, the complexity and potential disruption associated with transitioning large-scale HR operations to an external vendor, including the difficulty of integrating legacy systems with new HRO platforms, often acts as a significant barrier to entry or expansion. Managing multi-vendor relationships and ensuring service consistency across global contracts also poses a challenge for large multinational corporations, demanding stringent Service Level Agreements (SLAs).

Opportunities within the HRO space are expansive, driven largely by emerging technology and global workforce shifts. The increasing prevalence of remote and hybrid work models presents a demand for global employment outsourcing (GEO) and Employer of Record (EOR) services, enabling rapid, compliant global expansion. Specialized HRO services focusing on niche areas such as diversity and inclusion management, high-level talent analytics consulting, and personalized employee wellness programs represent high-growth areas. The potential for integrating blockchain technology to enhance data integrity and security within HRO transactions offers a long-term opportunity to mitigate the current data security restraint, creating more secure and trustworthy outsourcing frameworks.

Segmentation Analysis

The Human Resource Outsourcing market is analyzed across several critical dimensions, including the type of service offered, the size of the organization utilizing the services, and the specific industry vertical or end-use application. Service segmentation provides insight into where organizations prioritize external support, with multi-process outsourcing (MPHRO) reflecting comprehensive strategic partnerships, while specialized segments like Recruitment Process Outsourcing (RPO) and Payroll focus on specific, high-volume functions. Analyzing organizational size reveals distinct needs: large enterprises typically seek global standardization and complex integration capabilities, whereas SMEs prioritize scalability, affordability, and streamlined compliance solutions designed for localized operations. The end-use segmentation highlights industry-specific demand drivers, such as high compliance requirements in BFSI and Healthcare, versus high-volume staffing needs in the IT and Retail sectors.

- By Service Type:

- Multi-Process HRO (MPHRO)

- Recruitment Process Outsourcing (RPO)

- Payroll Outsourcing

- Benefits Administration Outsourcing

- Learning Services Outsourcing

- Human Resources Management Systems (HRMS) Outsourcing

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-Use Industry:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunication

- Healthcare and Pharmaceuticals

- Manufacturing

- Retail and Consumer Goods

- Government and Public Sector

- Others (Energy, Transportation)

Value Chain Analysis For Human Resource Outsourcing Market

The HRO value chain begins with upstream activities centered on foundational technology and specialized expertise development. This includes technology providers who supply cloud-based HR platforms, Enterprise Resource Planning (ERP) vendors offering HR modules, and specialized software developers focusing on AI/ML for automation and analytics. Upstream analysis also involves the highly specialized talent pool required—HR consultants, legal experts specializing in labor law, and security architects—whose intellectual property and knowledge form the core asset of the outsourcing firm. Strategic partnerships with technology vendors (e.g., Workday, SAP SuccessFactors) are crucial upstream for maintaining a competitive edge in platform modernization and seamless integration.

Mid-stream activities are defined by service delivery and operational execution, encompassing the actual transactional processing, managed services, and ongoing client relationship management. This stage involves the infrastructure (data centers, secure networks), process design, and the management of geographically dispersed service delivery centers (onshore, nearshore, offshore). Distribution channels play a vital role here, often bifurcated into direct sales models, where large HRO firms manage complex, long-term contracts directly with multinational corporations, and indirect channels, which often involve partnerships with regional consulting firms, HR technology resellers, or advisory services targeting the mid-market or specialized geographic areas.

Downstream analysis focuses on the end-users and the realization of value. The primary downstream consumers are the client organizations, including their HR leadership, departmental managers, and, ultimately, their employees who interact with the outsourced services. Value realization is measured through tangible outcomes such as cost savings, compliance adherence, improved employee satisfaction metrics, and strategic insights provided by the HRO partner. The shift in the value proposition is increasingly moving towards advisory and transformational services, where the outsourcing partner helps redesign the client's internal HR processes, thereby increasing the strategic weight of the downstream engagement and fostering long-term contractual relationships.

Human Resource Outsourcing Market Potential Customers

Potential customers for Human Resource Outsourcing services span a wide array of organizations, though certain characteristics make specific entities more prone to outsourcing adoption. The primary end-users or buyers are organizations experiencing rapid growth, either through market expansion or mergers and acquisitions (M&A), as HRO provides necessary scalability and the immediate harmonization of disparate HR systems. Companies operating across multiple international jurisdictions represent a crucial customer segment, driven by the need for centralized management of complex, country-specific payroll and regulatory compliance, making multi-national enterprises (MNEs) continuous high-value clients.

Industries burdened by significant regulatory overhead, such as the BFSI, Healthcare, and Government sectors, are consistently strong adopters of specialized HRO services, particularly for benefits administration, compliance auditing, and highly secure data management. These sectors often face stringent internal requirements for data security and accuracy, making the expertise and robust infrastructure provided by major HRO vendors indispensable. Furthermore, mid-market companies (SMEs) struggling with resource constraints find HRO appealing as it grants them access to enterprise-grade technology and expert HR staff that they could not afford to hire internally, allowing them to remain competitive in areas like talent acquisition and employee benefits.

In addition to traditional businesses, the technology and IT sectors are major customers, largely due to their high demand for recruitment process outsourcing (RPO) to manage rapid, high-volume, and specialized talent acquisition needs. Potential buyers are actively seeking providers who not only manage transactional tasks but also offer strategic workforce planning tools, comprehensive talent management systems, and consulting services focused on optimizing organizational design and enhancing employee engagement in a digitally native environment. The decision to outsource is generally centralized within the Chief Financial Officer (CFO) and Chief Human Resources Officer (CHRO) offices, reflecting the dual strategic goals of cost optimization and talent enhancement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 260.5 Billion |

| Market Forecast in 2033 | USD 485.3 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Automatic Data Processing Inc. (ADP), Paychex Inc., Conduent Inc., Randstad N.V., Cielo, LLC, Korn Ferry, ManpowerGroup Solutions, IBM Corporation, Capgemini SE, Accenture Plc, SAP SE, Oracle Corporation (via HCM services), Alight Solutions LLC, TriNet Group Inc., Insperity Inc., Ultimate Kronos Group (UKG), TMF Group, Wipro Limited, Exela Technologies, Mercer (Marsh & McLennan). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Resource Outsourcing Market Key Technology Landscape

The technology landscape underpinning the Human Resource Outsourcing market is rapidly evolving, driven primarily by the shift from on-premise solutions to integrated, cloud-native platforms. Modern HRO services heavily rely on robust Cloud Human Capital Management (HCM) systems provided by major software vendors. These cloud solutions offer enhanced scalability, accessibility, and real-time updates, which are essential for managing a global, distributed workforce. The implementation of standardized, highly configurable HCM suites allows HRO providers to offer unified platforms for core processes like talent management, performance monitoring, and self-service portals, significantly improving the overall employee and managerial experience.

Robotic Process Automation (RPA) and Artificial Intelligence (AI) represent the next wave of technological disruption in HRO. RPA is widely deployed to automate repetitive, high-volume administrative tasks such as data entry, compliance checks, and generation of standard reports, leading to dramatic reductions in processing errors and operational costs for outsourcing vendors. AI and machine learning capabilities are being integrated into specialized areas like Recruitment Process Outsourcing (RPO) for candidate screening and predictive analytics, enabling HRO providers to forecast workforce requirements, analyze turnover risk, and personalize employee training pathways with unprecedented accuracy. These tools transform the HRO service from merely transactional to deeply consultative.

Furthermore, technology adoption is concentrating on enhancing security and connectivity. Mobile applications and secure web portals are standard features, ensuring employees can access HR services anytime and anywhere, catering to the needs of modern workforce flexibility. Security architecture is increasingly important, with vendors exploring the use of technologies like blockchain for securing employee records and ensuring immutable audit trails, particularly crucial for sensitive data like payroll and medical benefits. The convergence of secure cloud platforms, pervasive mobile accessibility, and advanced automation driven by AI defines the current state of technology implementation within the competitive Human Resource Outsourcing sector.

Regional Highlights

The global distribution of the Human Resource Outsourcing market exhibits significant variances in maturity, growth trajectory, and service demand based on regional economic and regulatory conditions.

- North America (NA): Represents the largest and most mature HRO market globally, characterized by high adoption rates across both large enterprises and the robust mid-market segment. Key drivers include stringent regulatory compliance requirements (especially in healthcare and finance), a strong imperative for technological innovation (cloud HCM adoption), and an acute demand for sophisticated talent management and RPO services. The U.S. remains the dominant country, focusing heavily on technology-enabled solutions and multi-process HRO contracts.

- Europe: The European market shows steady, substantial growth, heavily influenced by the complexity of the European Union’s labor laws and data privacy regulations (GDPR). Demand is particularly high for pan-European payroll harmonization, benefits administration across multiple jurisdictions, and localized compliance expertise. Countries such as the UK, Germany, and France are primary contributors, requiring HRO partners to provide flexible, compliant cross-border solutions.

- Asia Pacific (APAC): Positioned as the fastest-growing regional market, APAC's expansion is fueled by rapid industrialization, increasing foreign direct investment (FDI), and the formalization of HR processes in emerging economies like India, China, and Southeast Asia. Organizations in this region seek HRO services to manage rapid expansion, navigate diverse and evolving local labor laws, and implement standardized, scalable HR technology platforms for the first time.

- Latin America (LATAM): Growth in LATAM is driven by economic instability and the consequent need for cost optimization, alongside highly complex and often rapidly changing local tax and labor laws, making payroll and compliance services critical HRO components. Brazil and Mexico are core markets, exhibiting strong demand for localized expertise and multi-country compliance solutions.

- Middle East and Africa (MEA): This region is witnessing nascent but accelerating growth, largely spurred by large government-led infrastructure projects and diversification efforts. Demand is concentrated in major economies like Saudi Arabia and the UAE, where large multinational companies require assistance with local workforce mandates, visa processing, and specialized expatriate management services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Resource Outsourcing Market.- Automatic Data Processing Inc. (ADP)

- Paychex Inc.

- Conduent Inc.

- Randstad N.V.

- Cielo, LLC

- Korn Ferry

- ManpowerGroup Solutions

- IBM Corporation

- Capgemini SE

- Accenture Plc

- SAP SE (via HCM services)

- Oracle Corporation (via HCM services)

- Alight Solutions LLC

- TriNet Group Inc.

- Insperity Inc.

- Ultimate Kronos Group (UKG)

- TMF Group

- Wipro Limited

- Exela Technologies

- Mercer (Marsh & McLennan)

Frequently Asked Questions

Analyze common user questions about the Human Resource Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Human Resource Outsourcing Market?

The Human Resource Outsourcing Market is expected to exhibit a Compound Annual Growth Rate (CAGR) of 9.5% during the forecast period from 2026 to 2033, driven by digitalization and increasing regulatory complexity.

Which service segment holds the largest share in the HRO market?

Multi-Process Human Resource Outsourcing (MPHRO) typically holds the largest share, encompassing comprehensive services that combine payroll, benefits administration, and core HR functions under a single strategic contract.

How is AI transforming HRO service delivery?

AI is transforming HRO by automating high-volume transactional tasks via Robotic Process Automation (RPA), providing advanced predictive analytics for talent management, and enhancing employee self-service capabilities through intelligent chatbots.

Which region is anticipated to demonstrate the fastest growth in HRO?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid economic expansion, increasing foreign investment, and the growing corporate requirement to standardize HR compliance across diverse emerging markets.

What are the primary factors restraining the HRO market?

The primary restraints include significant concerns regarding data security and the protection of sensitive employee information, alongside the inherent complexity and high initial costs involved in migrating legacy HR systems to new outsourcing platforms.

The detailed analysis of the Human Resource Outsourcing (HRO) market indicates a robust growth trajectory, fundamentally propelled by two converging forces: the global proliferation of complex regulatory environments and the necessity for enterprises to leverage advanced cloud technology for competitive advantage. The market’s shift towards highly specialized, digitally integrated solutions reflects a maturity where clients seek strategic partnerships over transactional cost savings. This strategic imperative is particularly pronounced in Recruitment Process Outsourcing (RPO) and Benefits Administration, areas where specialized expertise yields quantifiable competitive advantages in talent acquisition and retention.

From a technological standpoint, the future of HRO is inextricably linked to the successful deployment of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are not merely automating existing processes but are creating entirely new service capabilities, such as prescriptive talent analytics and hyper-personalized employee experiences. This technological reliance also accentuates the critical market restraint—data security. As HRO providers handle increasingly sensitive and comprehensive employee data across various jurisdictions, their ability to guarantee robust, auditable security frameworks (potentially utilizing blockchain) will be the cornerstone of future client acquisition and contract retention.

Geographically, while North America and Europe provide the majority of current revenue due to their established corporate infrastructures, the significant untapped potential lies within the Asia Pacific (APAC) region. Rapid economic development in emerging APAC economies is generating unprecedented demand for scalable, compliant HR systems, making it the focal point for vendor expansion and investment in local delivery capabilities. The sustained high growth forecast of 9.5% CAGR validates the HRO sector's integral role in supporting modern, globalized business operations, transforming it from a back-office function into a key enabler of organizational strategy and efficiency across all enterprise sizes and industry verticals.

Focusing on segmentation, the Small and Medium-sized Enterprises (SME) segment is proving exceptionally dynamic. Historically underserved, SMEs are now engaging HRO providers through modular, cost-effective, cloud-based packages that offer immediate access to sophisticated compliance tools and payroll systems. This trend is crucial as SMEs represent a vast, global pool of potential clients seeking external support to manage increasing complexity without expanding their internal administrative headcount. The continuous evolution of service offerings, moving toward integrated multi-process models complemented by strategic consulting, ensures the HRO market remains resilient against economic fluctuations by delivering both immediate cost efficiencies and long-term strategic value to clients.

In conclusion, the competitive landscape is dominated by large, integrated providers who combine deep domain expertise with cutting-edge technology platforms. Success in this market increasingly hinges on the ability to manage complex global contracts, ensure impeccable regulatory compliance across disparate jurisdictions, and innovate using AI to deliver actionable workforce insights. The necessity for robust cybersecurity, flexibility in service delivery models (e.g., EOR/GEO services for remote work), and continuous investment in cloud HCM infrastructure define the strategic priorities for leading market players aiming to capture the nearly doubling market valuation projected by 2033.

The strategic dynamics influencing vendor selection have evolved significantly. Clients are now prioritizing HRO providers that offer deep industry-specific expertise, particularly in highly regulated sectors such as BFSI and Healthcare. The ability of an HRO firm to demonstrate proactive compliance management, rather than reactive reporting, is a crucial differentiator. This shift elevates the importance of specialized legal and regulatory consulting integrated into the service package. Furthermore, the global expansion of many mid-sized companies has intensified the demand for providers with reliable global footprint capabilities, requiring robust infrastructure that supports multi-country payroll and harmonized benefits administration under a centralized management structure, ensuring consistency in employee experience worldwide.

Investment trends within the HRO ecosystem show a strong preference for enhancing digital core capabilities. Leading companies are channeling capital into developing proprietary analytics engines that move beyond descriptive reporting to offering prescriptive recommendations on issues like employee retention, compensation benchmarking, and organizational structure optimization. This move ensures HRO providers maintain their relevance as strategic advisors to the C-suite. Simultaneously, managing the intricate security requirements imposed by regional privacy laws, such as Europe’s GDPR and emerging data residency requirements in APAC, necessitates continuous infrastructure upgrades and specialized training for delivery staff, constituting a significant operational cost that vendors must absorb and efficiently manage to remain competitive.

The impact of external economic forces cannot be overstated. Periods of economic downturn often boost the HRO market as organizations aggressively seek cost-reduction strategies by outsourcing high-volume administrative tasks. Conversely, during periods of economic expansion, demand for Recruitment Process Outsourcing (RPO) services surges as companies compete intensely for talent, particularly in specialized technical fields. This counter-cyclical and cyclical dynamic provides inherent stability to the overall HRO market. The flexibility offered by outsourcing models allows client organizations to scale HR capacity up or down rapidly, providing operational agility that is highly valued in the current volatile global business environment.

The evolution of core services illustrates the market's response to client needs. While payroll remains a foundational necessity, the highest growth rates are observed in sophisticated areas like change management consulting, global mobility services, and wellness program administration. This transition highlights that HRO is moving away from basic execution toward strategic partnership in the realm of Human Capital Management (HCM). HRO vendors are increasingly taking responsibility for improving employee engagement scores and driving organizational culture initiatives, utilizing their advanced data aggregation and benchmarking capabilities to provide comparative market intelligence and actionable insights that internal HR departments often lack the resources or specialization to generate.

Furthermore, technology platforms are enabling new collaboration models. The implementation of integrated self-service portals, powered by AI, dramatically reduces the volume of routine inquiries directed toward both the client's internal HR team and the outsourcing provider's helpdesk, allowing human expertise to be reserved for complex, sensitive issues. This efficiency gain not only enhances cost savings but significantly improves employee satisfaction by providing instantaneous answers. The market must continue to innovate in user experience design and mobile accessibility to cater effectively to a digitally native workforce that expects seamless and immediate interaction with all corporate services, including HR functions.

Understanding the intricacies of the supply chain reveals that strong supplier relationships, particularly with core HR software vendors (e.g., SAP, Oracle, Workday), are essential for service providers. These relationships ensure access to the latest technological features and patches, critical for maintaining service excellence and data integrity. Any disruption or fragmentation in the technology supply chain could significantly impact the HRO firm's ability to deliver high-quality, continuous services. Therefore, vendor alliances and certification programs remain crucial elements of the competitive strategy for major HRO players aiming to offer reliable, cutting-edge technology as a managed service.

Finally, the long-term outlook for the HRO market is overwhelmingly positive, underpinned by globalization, the persistent need for compliance expertise, and technological convergence. While challenges related to contractual complexity and intellectual property management persist, the documented value proposition—focusing internal efforts on strategy, accessing specialized technology, and achieving significant cost predictability—ensures sustained enterprise demand across all geographic and industry segments. Future growth will be increasingly concentrated in sophisticated, end-to-end multi-process HRO solutions and highly specialized consulting services that offer genuine competitive differentiation to the client organization.

To elaborate on the segmentation by End-Use Industry, the BFSI sector's demand for HRO is characterized by extreme regulatory scrutiny regarding employee certifications, training records, and compensation disclosures. Outsourcing payroll and benefits administration in banking is driven by the need for meticulous auditing capabilities and compliance with anti-money laundering regulations related to employee transactions. In contrast, the Healthcare industry relies heavily on HRO for managing complex staffing ratios, licensure tracking, and the administration of specialized, high-cost employee benefits packages, requiring vendors with deep vertical knowledge and HIPAA compliance expertise in North America.

The IT and Telecommunications sector, characterized by rapid innovation and high employee turnover, prioritizes Recruitment Process Outsourcing (RPO) and sophisticated talent retention analytics. These companies need HRO providers who can rapidly scale hiring operations globally and implement compensation structures sensitive to fast-changing market demands for technical skills. Meanwhile, the Manufacturing sector utilizes HRO primarily for workforce management, time and attendance tracking in shift-based environments, and managing industrial relations, where reliable payroll and compliance with extensive safety regulations are non-negotiable requirements.

The Retail and Consumer Goods sector, marked by large volumes of seasonal and part-time workers, uses HRO for high-volume, variable payroll processing and employee onboarding efficiency. The ability to quickly and compliantly onboard large cohorts of temporary staff, particularly during peak seasons, makes HRO a critical operational tool. The Government and Public Sector increasingly adopts HRO, particularly for IT modernization and payroll processing, driven by pressures to improve efficiency, standardize processes, and manage large, often unionized, workforces while adhering to strict public procurement and transparency regulations.

This industry-specific diversification confirms that the HRO market is not monolithic; successful vendors tailor their technological stack and service delivery protocols to address the unique compliance, talent, and operational challenges inherent to each vertical, driving greater market penetration through specialized domain expertise rather than generic service delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Human Resource Outsourcing (HRO) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Human Resource Outsourcing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Business Process HR Outsourcing, Shared Service HR Outsourcing, Application (and facilities) Service HR Outsourcing), By Application (Large Enterprises, Small and Mid-sized Enterprises (SMEs)), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager