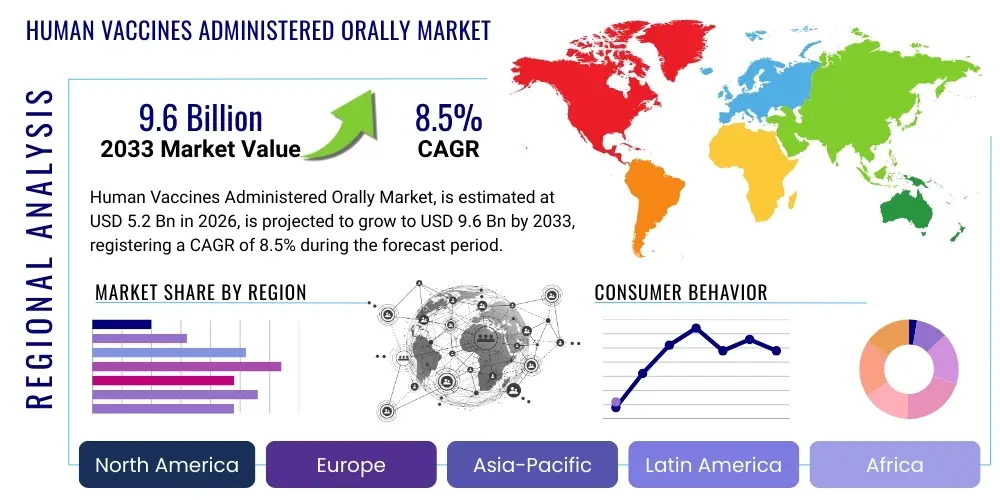

Human Vaccines Administered Orally Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437120 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Human Vaccines Administered Orally Market Size

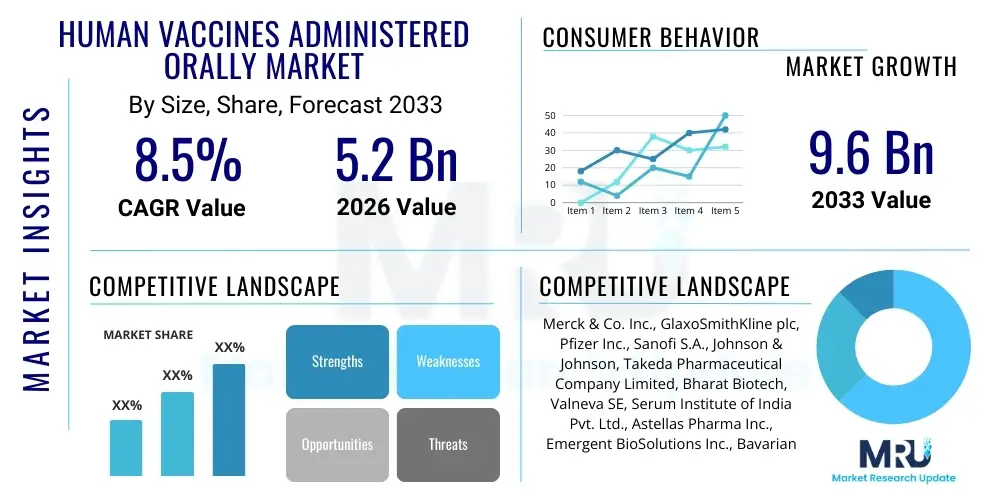

The Human Vaccines Administered Orally Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Human Vaccines Administered Orally Market introduction

The Human Vaccines Administered Orally Market encompasses pharmaceutical products designed for immunization against infectious diseases, utilizing the oral route of administration rather than traditional injections. These vaccines leverage the mucosal immune system, providing localized immunity in the gastrointestinal tract, which is particularly crucial for enteric diseases like cholera and rotavirus. The convenience of oral delivery significantly enhances vaccine compliance, especially in mass vaccination campaigns and pediatric populations where fear of needles is a major deterrent. This ease of administration simplifies logistics, often requiring less specialized personnel for deployment, making these vaccines ideal for low and middle-income countries (LMICs) and remote areas.

The primary applications of oral vaccines currently focus on preventing diseases such as rotavirus, poliomyelitis, cholera, and typhoid fever, which have significant public health burdens globally. Product descriptions often highlight stable formulations, sometimes involving encapsulated or lyophilized components, designed to withstand the harsh acidic environment of the stomach and ensure effective delivery to the Peyer's patches in the small intestine, where immune induction occurs. The inherent benefits include improved scalability, reduced risk of blood-borne pathogen transmission associated with injections, and the potential for stimulating both systemic and mucosal immunity, offering a broader protective response than solely systemic vaccines.

Key driving factors accelerating the adoption of oral vaccines include robust backing from global health organizations like the WHO and Gavi, which prioritize accessible and easy-to-deploy immunization tools. Furthermore, advancements in formulation technologies, such as microencapsulation and targeted delivery systems, are overcoming historical limitations regarding antigen stability and immunogenicity. The increasing incidence of vaccine-preventable enteric diseases, particularly in regions with poor sanitation infrastructure, sustains the essential demand for effective, non-invasive oral immunization strategies.

Human Vaccines Administered Orally Market Executive Summary

The Human Vaccines Administered Orally Market is experiencing dynamic growth driven by evolving global health priorities and technological breakthroughs aiming to improve patient compliance and logistical efficiency. Business trends indicate a strong focus on partnerships between large pharmaceutical companies and biotechnology firms specializing in mucosal delivery systems, aiming to develop next-generation thermostable oral formulations. There is a palpable shift towards optimizing existing oral vaccines, particularly Rotavirus and Polio vaccines, for improved efficacy profiles and reduced manufacturing costs, simultaneously expanding their reach into emerging markets which represent the largest patient pool for these diseases. Investment is also surging into novel oral vaccine platforms targeting respiratory viruses and other non-enteric pathogens, capitalizing on the potential of mucosal immunity.

Regionally, Asia Pacific and Africa are emerging as the fastest-growing markets due to high birth rates, persistent high incidence of enteric diseases, and governmental support for widespread immunization programs. North America and Europe, while having established immunization schedules, drive innovation, focusing on clinical trials for new indications and advanced delivery technologies. Segment trends highlight the dominance of the Live Attenuated Vaccines segment, largely attributable to established products like the Oral Poliovirus Vaccine (OPV) and Rotavirus vaccines. However, significant R&D spending is flowing into subunit and inactivated oral vaccine segments, seeking formulations with better stability, reduced reactogenicity, and tailored immune responses, thereby mitigating the risks associated with live virus shedding.

The market faces operational challenges, notably the technical difficulty of ensuring antigen survival through the digestive tract and achieving consistent immunogenicity comparable to injected counterparts. Nonetheless, the overarching trend is positive, anchored by the compelling economic and public health advantages of needle-free administration. Successful commercialization is increasingly linked to demonstrating robust performance in diverse settings, addressing cold chain independence through thermostable variants, and securing procurement contracts from major global immunization initiatives. This summary underscores a market ripe for disruptive innovation focused on accessibility and enhanced formulation science.

AI Impact Analysis on Human Vaccines Administered Orally Market

User inquiries regarding AI's influence on the oral vaccines market predominantly revolve around three key themes: how AI accelerates the identification of highly effective mucosal adjuvants, its role in optimizing complex oral vaccine formulations (especially microencapsulation parameters), and the use of machine learning (ML) to predict clinical outcomes and immunogenicity based on preclinical data. Users are keen to understand if AI can overcome the long-standing challenge of low immunogenicity often associated with oral delivery by designing novel delivery vehicles that target specific Peyer’s patch receptors. Concerns also focus on whether AI-driven predictive modeling can significantly shorten the often decade-long development timeline for new oral vaccine candidates, ultimately reducing the cost and improving the stability and efficacy of these essential public health tools.

The application of Artificial Intelligence and Machine Learning algorithms is proving transformative in the challenging domain of oral vaccine development. By leveraging large datasets encompassing immunological responses, formulation stability metrics, and antigen characteristics, AI models can rapidly screen thousands of potential adjuvant candidates, identifying compounds that effectively promote robust mucosal immune responses. Furthermore, AI optimizes the complex physicochemical parameters necessary for successful oral delivery systems, such such as determining optimal particle size, coating materials, and release kinetics for microencapsulated antigens to ensure survival in the stomach and targeted release in the intestine.

This computational approach significantly reduces the time and resources traditionally consumed by iterative laboratory testing. In clinical development, AI assists in designing adaptive trials and analyzing high-dimensional immune profiling data, providing deeper insights into vaccine mechanism of action and identifying patient subsets that respond optimally to specific oral formulations. This ultimately enhances the predictability of clinical success and facilitates the tailored development of more stable and effective human oral vaccines, thereby accelerating time-to-market and expanding the pipeline of viable oral immunization options.

- AI-driven identification of novel mucosal adjuvants to boost local immunity.

- Machine Learning optimization of microencapsulation processes (e.g., polymer selection, particle size).

- Predictive modeling for assessing antigen stability against gastric degradation.

- Accelerated design and analysis of complex clinical trials for oral vaccine candidates.

- Enhanced understanding of personalized immune response variations in oral vaccination.

DRO & Impact Forces Of Human Vaccines Administered Orally Market

The market dynamics for Human Vaccines Administered Orally are significantly shaped by the interplay of compelling drivers related to public health benefits, logistical restraints linked to formulation stability, and opportunities arising from advanced technological breakthroughs. The primary driving force is the inherent patient convenience and the superior compliance rates associated with needle-free administration, particularly critical for large-scale pediatric immunization programs in developing nations. Opportunities are concentrated in developing next-generation thermostable oral formulations and leveraging targeted delivery systems to enhance immunogenicity, thereby expanding the applicability of oral vaccines beyond traditional enteric diseases.

However, the market growth is moderately restrained by the technical complexities inherent in oral delivery. Specifically, the challenges of ensuring antigen viability as it passes through the highly acidic stomach environment, coupled with the difficulty in achieving consistent and sufficiently high immune responses compared to parenteral injections, act as barriers. Impact forces, particularly the high regulatory scrutiny surrounding vaccine manufacturing and efficacy demonstration, necessitate substantial R&D investment. Moreover, the strong commitment from global health organizations (GHOs) provides a powerful positive force, driving demand, funding clinical trials, and facilitating market entry into high-need populations, offsetting some of the technical restraints.

The key impact forces also include competitive pressure from highly effective injectable vaccines and the necessity to continuously innovate to provide superior cost-effectiveness. Successfully navigating these forces requires manufacturers to focus on robust formulation science, regulatory excellence, and strategic pricing models tailored for global procurement agencies. The development of platform technologies that allow for rapid modification of oral vaccine antigens (e.g., for pandemic response) represents a crucial positive impact force promising market resilience and sustained long-term growth.

Segmentation Analysis

The Human Vaccines Administered Orally Market is fundamentally segmented based on the type of vaccine technology utilized, the target disease, and the end-user setting where administration occurs. Segmentation by product type reveals a division primarily between Live Attenuated Vaccines and Inactivated/Subunit Vaccines, reflecting different approaches to inducing mucosal immunity and addressing concerns about virulence and stability. The Rotavirus segment currently dominates the disease-based segmentation due to high global burden and successful immunization programs utilizing oral vaccines. Understanding these segments is crucial for manufacturers to tailor R&D investments, regulatory strategies, and commercialization efforts to specific market needs and regulatory landscapes.

The technological landscape within the segments is rapidly evolving. For instance, while Live Attenuated Vaccines (like OPV) offer potent, broad immunity, their instability and the risk of reversion necessitate continuous monitoring and the push towards developing stable, safer alternatives. In contrast, the Inactivated and Subunit segments, though facing challenges in achieving adequate immunogenicity upon oral delivery, benefit from advancements in novel encapsulation technologies that promise higher purity, better control over dosing, and enhanced safety profiles. This technological race drives competition and innovation within the defined segments.

Geographically, market penetration varies significantly; emerging economies drive the volume demand for essential oral vaccines like Polio and Rotavirus, whereas developed markets focus on optimizing existing schedules and integrating newer, highly engineered oral candidates. The end-user segment reflects the primary channels of delivery, ranging from large-scale government immunization programs facilitated by Vaccination Centers to localized distribution through Hospitals and Clinics. Strategic segmentation helps stakeholders prioritize investments in regions and technologies that yield the highest public health and commercial returns.

- By Product Type:

- Live Attenuated Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- By Disease Indication:

- Rotavirus

- Poliomyelitis (Polio)

- Cholera

- Typhoid

- Others (e.g., Emerging mucosal vaccines)

- By End-User:

- Hospitals and Clinics

- Vaccination Centers

- Government and Public Health Programs

- By Distribution Channel:

- Direct Sales

- Distributors

- Online Pharmacy

Value Chain Analysis For Human Vaccines Administered Orally Market

The value chain for the Human Vaccines Administered Orally Market begins with intensive upstream research and development, focusing on antigen identification, optimizing mucosal adjuvants, and engineering robust delivery systems capable of surviving gastric transit. This upstream phase is highly capital-intensive and relies heavily on biopharma expertise, academic partnerships, and regulatory guidance. Key upstream activities include selecting appropriate microbial strains for live attenuated vaccines, large-scale fermentation, purification, and the critical step of lyophilization or microencapsulation to ensure stability and bioavailability in an oral formulation. Maintaining the cold chain, though sometimes less stringent than for injectables, remains a vital upstream component for product integrity.

The midstream phase involves manufacturing, quality control, packaging, and regulatory submission. Given the unique challenges of oral formulation—particularly the need for high concentration and stability—manufacturing processes must adhere to stringent Good Manufacturing Practices (GMP). The value is added significantly at this stage through efficiency gains, batch consistency, and successful compliance with global regulatory standards like those set by the FDA or EMA. Distribution channels are then activated, primarily categorized into direct sales to major purchasers (governments, NGOs like UNICEF, Gavi) and indirect sales through national distributors reaching hospitals and public health clinics.

Downstream activities center on deployment, administration, and post-market surveillance. For oral vaccines, deployment is often simpler than for injectables, reducing training requirements and improving campaign scalability. Direct distribution often dominates sales to Gavi-supported countries, ensuring maximum coverage in target populations. The efficiency of the distribution network, particularly the "last mile" delivery, directly impacts the vaccine's public health utility. Overall, the value chain is highly integrated, requiring seamless coordination from initial R&D through to mass administration, with regulatory approval acting as a constant gatekeeper for value progression.

Human Vaccines Administered Orally Market Potential Customers

The primary end-users and buyers of Human Vaccines Administered Orally are predominantly large-scale government health agencies, international public health organizations, and pediatric healthcare providers. These customers prioritize vaccines that offer high efficacy, ease of administration, robust supply chain resilience, and competitive pricing, particularly when procured in high volumes for national immunization programs. The fundamental appeal of oral vaccines lies in their ability to facilitate widespread coverage and significantly reduce the logistical burden inherent in injection-based campaigns, directly addressing the needs of nations struggling with limited healthcare infrastructure.

Major international procurement entities, such as UNICEF, the Pan American Health Organization (PAHO), and organizations supported by Gavi, the Vaccine Alliance, constitute crucial potential customers, driving global demand through bulk tenders and long-term supply agreements focused on diseases like Rotavirus and Polio. These organizations demand strict adherence to WHO prequalification standards and often necessitate specialized packaging or thermostability features to ensure viability in challenging environments. The shift towards Sustainable Development Goals (SDGs) reinforces the continuous need for highly accessible and effective oral vaccines, positioning developing nations as the largest volume purchasers.

In developed economies, while penetration is lower for routine oral vaccines (excluding established products like Rotavirus), potential customers include private pediatric practices and specialized travel clinics that stock vaccines for cholera and typhoid, particularly catering to international travelers. Future customer expansion will be driven by the successful development of oral vaccines targeting prevalent respiratory infections (like flu or COVID-19), expanding the end-user base to general adult populations and occupational health sectors seeking convenient, needle-free prophylactic options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck & Co. Inc., GlaxoSmithKline plc, Pfizer Inc., Sanofi S.A., Johnson & Johnson, Takeda Pharmaceutical Company Limited, Bharat Biotech, Valneva SE, Serum Institute of India Pvt. Ltd., Astellas Pharma Inc., Emergent BioSolutions Inc., Bavarian Nordic, Vaxart, Inc., AltruVax Inc., Inovio Pharmaceuticals Inc., Vaxine Pty Ltd., Sinovac Biotech Ltd., Panacea Biotec Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Vaccines Administered Orally Market Key Technology Landscape

The technological landscape of the Human Vaccines Administered Orally Market is dominated by innovations aimed at overcoming the primary hurdle of gastric degradation and enhancing mucosal immunogenicity. Core technologies include microencapsulation and enteric coating systems, which protect sensitive antigens from the harsh acidic environment of the stomach, ensuring their safe passage to the intestine where immune cells (Peyer’s patches) reside. Polymer-based delivery systems, utilizing materials like alginate or polylactic-co-glycolic acid (PLGA), are critical for achieving targeted release kinetics and promoting effective uptake by antigen-presenting cells (APCs). The optimization of these coating and encapsulation methods, often through high-throughput screening and AI-assisted design, is essential for unlocking the full potential of oral vaccines.

Another crucial area involves the development and incorporation of powerful mucosal adjuvants. Traditional injectable adjuvants are often ineffective when administered orally; thus, researchers are focusing on compounds that safely stimulate the dendritic cells and other immune components within the gut-associated lymphoid tissue (GALT). Technologies exploring bacterial toxins, heat-labile enterotoxin (LT), or novel synthetic ligands that activate toll-like receptors (TLRs) are prominent. These adjuvants are vital for generating a robust secretory IgA response, which is the hallmark of effective mucosal immunity, providing protection at the point of pathogen entry. Success in this area is paramount for expanding oral vaccines beyond live attenuated forms.

Furthermore, significant technological advances are being made in developing platform technologies for expressing antigens in non-traditional vectors, such as modified yeast, bacteria, or plants (edible vaccines), which can inherently protect the antigen. The continuous push toward developing thermostable, lyophilized formulations also represents a significant technological challenge and achievement. Thermostability reduces dependence on the cold chain, fundamentally lowering logistical costs and improving accessibility in resource-constrained settings, thereby revolutionizing the scalability and global reach of oral immunization programs and cementing its position as a key technological driver in modern vaccinology.

Regional Highlights

The global market for Human Vaccines Administered Orally exhibits distinct regional growth patterns influenced by disease burden, healthcare infrastructure, and government policies. Asia Pacific (APAC) and the Middle East & Africa (MEA) are recognized as high-growth regions, primarily driven by the high prevalence of enteric diseases such as cholera, rotavirus, and typhoid, coupled with large pediatric populations and ongoing initiatives by Gavi and WHO to expand immunization coverage. These regions represent the highest volume demand for essential oral vaccines, focusing heavily on affordability and ease of deployment in large-scale public health programs. The market expansion here is contingent upon robust manufacturing capacity and effective local distribution networks.

North America and Europe constitute mature markets characterized by stringent regulatory environments and a focus on innovation. While routine oral vaccinations are established (e.g., Rotavirus), these regions drive the R&D landscape, specializing in advanced formulation technologies (e.g., targeted delivery, novel adjuvants) and exploring new applications for oral vaccines, such as those targeting respiratory pathogens. High investment in biotechnology and strong intellectual property protection support continuous technological innovation, aiming for best-in-class efficacy and stability, often resulting in higher average selling prices compared to developing markets.

Latin America shows moderate but stable growth, influenced by regional public health policies and the procurement strategies of organizations like PAHO, which facilitate access to vital oral vaccines across the continent. Regional manufacturers are gaining prominence, focusing on producing cost-effective alternatives. Overall, the market remains bifurcated: high-volume, low-margin opportunities dominate emerging markets where vaccines address immediate public health threats, while high-margin, innovative product development characterizes the strategic focus of established Western markets.

- Asia Pacific (APAC): Highest volume consumer due to endemic diseases (Rotavirus, Cholera) and vast pediatric populations. Strong governmental support for immunization programs and increasing domestic manufacturing capacity.

- North America: Leader in R&D and technological innovation, particularly in advanced oral delivery platforms and novel disease targets. Focus on premium, highly effective formulations.

- Europe: Mature market with established immunization protocols. High regulatory standards drive quality and innovation. Significant involvement in global health initiatives and funding R&D through EU programs.

- Middle East & Africa (MEA): Critical market driven by severe disease burden (Polio eradication efforts, Cholera outbreaks). High reliance on procurement through GHOs and demand for thermostable, affordable vaccines.

- Latin America: Growing market supported by public procurement policies and regional cooperation to ensure widespread vaccine access and affordability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Vaccines Administered Orally Market.- Merck & Co. Inc.

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Sanofi S.A.

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Bharat Biotech

- Valneva SE

- Serum Institute of India Pvt. Ltd.

- Astellas Pharma Inc.

- Emergent BioSolutions Inc.

- Bavarian Nordic

- Vaxart, Inc.

- AltruVax Inc.

- Inovio Pharmaceuticals Inc.

- Vaxine Pty Ltd.

- Sinovac Biotech Ltd.

- Panacea Biotec Ltd.

- AstraZeneca plc

- Crucell N.V. (now part of Johnson & Johnson)

Frequently Asked Questions

Analyze common user questions about the Human Vaccines Administered Orally market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of oral vaccines over traditional injectable vaccines?

The primary advantage is needle-free administration, which significantly improves patient compliance, reduces the need for trained personnel, simplifies logistics, and specifically stimulates mucosal immunity crucial for protection against enteric pathogens.

What are the major challenges in developing effective oral vaccines?

Major challenges include ensuring the antigen survives degradation by stomach acid and digestive enzymes, achieving sufficient and consistent immunogenicity in the gut, and maintaining long-term stability without a stringent cold chain.

Which diseases are currently targeted by commercially available oral vaccines?

Commercially available oral vaccines primarily target infectious diseases such as Rotavirus (a leading cause of severe diarrhea in children), Poliomyelitis (Polio), Cholera, and Typhoid Fever.

How is technology addressing the stability issues of oral vaccine formulations?

Technology addresses stability through microencapsulation and enteric coating systems, which protect the active antigens during transit through the upper gastrointestinal tract, and through the development of thermostable, lyophilized formulations reducing cold chain dependency.

What role does the Gavi, the Vaccine Alliance play in the oral vaccines market?

Gavi plays a critical role as a major procurer and funder, driving volume demand for affordable oral vaccines (especially Rotavirus and Polio) in low-income countries and incentivizing manufacturers to meet strict public health and accessibility requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager