Hunting and Fishing Eyewear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433422 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hunting and Fishing Eyewear Market Size

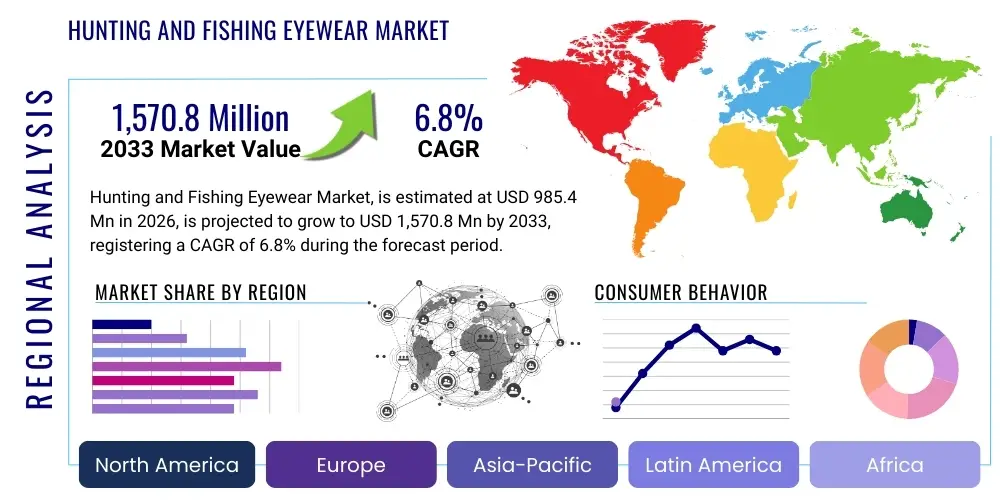

The Hunting and Fishing Eyewear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 985.4 million in 2026 and is projected to reach USD 1,570.8 million by the end of the forecast period in 2033.

Hunting and Fishing Eyewear Market introduction

The Hunting and Fishing Eyewear Market encompasses specialized optical protective and performance-enhancing gear designed for extreme outdoor environments prevalent in hunting and angling activities. These products, ranging from sunglasses and goggles to highly specialized scope lenses, integrate features like polarization, ballistic protection, anti-fog coatings, and specific lens tints (such as amber, copper, or vermillion) optimized for enhancing contrast and depth perception across varied lighting conditions. The core product description centers on delivering superior optical clarity, rugged durability, and reliable eye protection against physical hazards (e.g., flying debris, hooks, branches) and harmful UV radiation, which are constant concerns for outdoor sportsmen and sportswomen.

Major applications of this specialized eyewear include enhancing visual acuity necessary for target acquisition during hunting, minimizing glare off water surfaces for improved fish spotting in angling, and providing critical safety protection in rugged terrain. The primary benefits derived by users are reduced eye fatigue from prolonged exposure to bright sunlight and glare, improved operational efficiency through enhanced visual contrast, and adherence to necessary safety standards. The market is primarily driven by the escalating global participation rates in recreational outdoor activities, coupled with significant technological advancements in lens materials and coatings that address the specific, demanding needs of these niche sports. Furthermore, growing consumer awareness regarding the long-term dangers of UV exposure is propelling demand for high-quality, specialized protective optics.

The market landscape is characterized by constant innovation focused on ergonomics and specialized optics. Driving factors include the rise of professional competitive hunting and fishing circuits which mandate peak visual performance, the consumer preference for premium, brand-name safety gear, and the continuous evolution of lightweight, high-strength frame materials like specialized polycarbonates and titanium alloys. The need for eyewear that can seamlessly integrate with other protective equipment, such as hats, helmets, and hearing protection devices, also acts as a crucial design consideration and market driver, ensuring comfort and compatibility across diverse field applications.

Hunting and Fishing Eyewear Market Executive Summary

The Hunting and Fishing Eyewear Market is poised for substantial growth, underpinned by robust business trends focusing on product specialization, premiumization, and strategic collaborations between eyewear manufacturers and leading outdoor equipment brands. A significant business trend involves the introduction of modular eyewear systems, allowing users to quickly swap lenses based on changing environmental conditions, thus maximizing utility across various terrains and times of day. Furthermore, direct-to-consumer (D2C) sales channels, bolstered by strong digital marketing focused on technical specifications and performance testimonials, are gaining traction, challenging traditional retail dominance and improving margin capture for specialized brands. Investment in sustainable manufacturing practices and materials also represents an emerging trend, appealing to the environmentally conscious outdoor enthusiast demographic.

Regionally, North America maintains the largest market share due to deeply ingrained traditions of hunting and fishing, high disposable incomes allocated to specialized recreational equipment, and a well-developed infrastructure for distribution and retail. However, the Asia Pacific (APAC) region is demonstrating the fastest growth rate, fueled by rising middle-class wealth, increasing adoption of Western recreational sports, and urbanization which ironically creates a demand for quality gear for escapes into nature. European markets show stable, mature growth, driven primarily by demand for high-end, technologically sophisticated products and stringent adherence to protective eyewear standards, particularly in professional contexts.

In terms of segment trends, the polarized lens technology segment dominates, especially within the fishing category, given its critical function in cutting water glare, a non-negotiable requirement for successful angling. By material, polycarbonate lenses are favored across both segments due to their superior impact resistance and lightweight properties, offering maximum protection without compromising comfort. The application segment sees hunting eyewear emphasizing ballistic protection and specific contrast-enhancing tints for low-light conditions, while fishing eyewear focuses heavily on polarization efficiency and hydrophobic coatings. The overall market trajectory emphasizes integration—blending protection, optical performance, and ergonomic design into seamless, high-performance packages demanded by the discerning consumer.

AI Impact Analysis on Hunting and Fishing Eyewear Market

Common user inquiries concerning the impact of Artificial Intelligence on the Hunting and Fishing Eyewear Market revolve predominantly around how AI can enhance visual performance, customize optics, and integrate data logging capabilities. Users frequently ask about the feasibility of "smart" eyewear that utilizes AI algorithms for real-time analysis of environmental light and contrast, automatically adjusting lens tint or focus to optimize the view, or incorporating features that utilize image recognition to tag potential targets (wildlife or fish locations) without violating ethical or legal regulations. Concerns also surface regarding data privacy, battery life, and the potential complexity of integrating advanced digital interfaces into traditionally rugged and simple equipment. The overarching user expectation is for AI to provide a competitive edge and enhance safety through predictive vision assistance, moving beyond simple passive optics into active, cognitive visual aids.

AI's influence is beginning to manifest in several areas, particularly in the design and manufacturing phases, rather than purely in the end-user product interface. AI is utilized in computational optics design to simulate light refraction and lens performance across thousands of environmental scenarios, leading to faster prototyping of optimal lens geometry and specialized coatings. This allows manufacturers to tailor lens specifications precisely for specific activities, like optimizing polarization angles for glare at different latitudes or designing contrast curves tailored for tracking fast-moving targets in dense foliage. Furthermore, AI-driven analysis of consumer feedback and biomechanical data (e.g., facial structure scans) facilitates the development of custom-fit, ergonomically optimized frame designs, significantly enhancing user comfort and secure fit, which are paramount for high-exertion outdoor sports.

While fully autonomous "smart vision" systems are still nascent, the application of machine learning in material science is accelerating the development of self-tinting (photochromic) lenses that react more rapidly and predictably to changing light intensity than current chemical-based systems. AI models are also being employed to analyze vast datasets related to accidental eye injuries in the field, enabling manufacturers to design protective eyewear that specifically addresses the most common failure points and hazard profiles encountered during hunting and fishing, thereby raising the overall safety standard of the products available in the market. The integration of augmented reality components, guided by simple AI processing, may eventually offer features like range estimation overlays or GPS coordinates without distracting the user's primary vision focus.

- AI enhances computational optics design, optimizing lens geometry and coatings for specific environmental light conditions.

- Machine learning accelerates the development of faster, more responsive photochromic lens technologies.

- AI-driven consumer feedback analysis improves ergonomic frame design and secure fit for high-activity use.

- Predictive modeling aids in designing ballistic and protective eyewear tailored to specific hazard profiles in hunting and fishing environments.

- Potential future integration includes basic AR overlays for range estimation or environmental data, guided by onboard processing.

DRO & Impact Forces Of Hunting and Fishing Eyewear Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the impact forces influencing industry growth and market penetration. Key drivers center on the global surge in interest in recreational outdoor activities, the stringent requirement for eye safety mandated by increasing regulations and personal awareness, and continuous innovation in optical technology, particularly polarization and high-definition clarity. These driving forces create a perpetual demand loop where improved performance justifies premium pricing, attracting further investment into research and development. Restraints, however, include the high cost associated with premium, specialized optics, which can deter casual participants, and the market fragmentation caused by numerous niche competitors, sometimes leading to consumer confusion regarding true performance differences. Furthermore, the inherent durability challenges in maintaining scratch-free, high-tech coatings in rugged environments pose a structural constraint that requires constant technological mitigation.

Opportunities within this market are significant, primarily driven by expanding geographical participation, particularly in emerging markets across Asia and Latin America, where disposable incomes are rising and outdoor leisure is becoming accessible. Another crucial opportunity lies in the integration of specialized functions, such as digital camera integration or sophisticated connectivity, into eyewear, transforming protective gear into multi-functional technological accessories, appealing to the tech-savvy younger demographic. Furthermore, the growing focus on environmental sustainability presents opportunities for brands to develop and market products using recycled materials and environmentally friendly manufacturing processes, tapping into a premium segment willing to pay for ethical sourcing. Successfully navigating the balance between maintaining high optical standards and reducing manufacturing costs remains a core challenge.

The impact forces are categorized by consumer awareness, technological momentum, and regulatory environments. High consumer awareness regarding UV damage and the performance advantage offered by specialized lenses exerts a powerful positive force on demand. Technological momentum ensures a continuous stream of innovative products, such as next-generation photochromic and polarization films, which prevent market stagnation. Regulatory impact, while sometimes restraining through certifications, fundamentally drives the adoption of safer, higher-quality products, ensuring that even standard models meet robust protection criteria. The competitive intensity among leading global brands and nimble specialized startups remains high, forcing constant product differentiation and aggressive marketing strategies focusing on field-tested reliability and brand heritage.

Segmentation Analysis

The Hunting and Fishing Eyewear Market is segmented based on critical attributes including product type, lens material, lens technology, and distribution channel, providing a granular view of market dynamics and consumer preferences. Product segmentation differentiates traditional sunglasses from specialized goggles or shooting glasses, each designed for distinct requirements regarding peripheral vision, ballistic protection, and secure fit. Lens material segmentation highlights the dominant role of polycarbonate due to its exceptional impact resistance, while glass and specialized Trivex materials cater to niche demands for ultimate optical clarity and scratch resistance, often at a higher price point. Technological segmentation is crucial, differentiating simple tinted lenses from complex polarized or photochromic variants, which offer dynamic performance adjustments necessary for unpredictable outdoor environments.

- Product Type:

- Sunglasses (Standard and Wrap-around)

- Goggles (e.g., used for specific marine or extreme hunting environments)

- Shooting Glasses/Safety Eyewear

- Lens Material:

- Polycarbonate

- Glass

- Acrylic

- Trivex

- Lens Technology:

- Polarized

- Photochromic (Self-adjusting)

- Interchangeable Lenses

- Anti-reflective and Hydrophobic Coatings

- Application:

- Hunting (Wildlife tracking, target shooting)

- Fishing (Freshwater, Saltwater, Fly Fishing)

- Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Sports Stores, Department Stores, Gun Shops)

Value Chain Analysis For Hunting and Fishing Eyewear Market

The value chain for hunting and fishing eyewear commences with the upstream segment, dominated by raw material suppliers specializing in advanced polymers (like optical-grade polycarbonate and specialized nylon for frames) and chemical compounds necessary for advanced lens coatings (e.g., polarization films, UV absorbers, anti-scratch layers). This segment requires significant investment in material science R&D, as the performance of the final product hinges directly on the quality and formulation of these basic inputs. Strategic partnerships with specialized material producers are critical for maintaining a competitive edge, ensuring suppliers can consistently deliver inputs that meet stringent optical and impact resistance standards necessary for outdoor sports equipment, where failure is not an option.

Manufacturing and assembly form the core processing phase, involving high-precision lens molding, grinding, coating application (often performed in highly controlled cleanroom environments), and subsequent frame injection molding or machining. Brands must manage a complex supply chain, often sourcing components globally to achieve cost efficiencies while maintaining intellectual property over proprietary lens tints and frame designs. Quality control is paramount in this stage, involving rigorous testing for optical distortion, impact resistance (meeting standards like ANSI Z87.1 or European equivalents), and long-term durability against environmental factors such as saltwater corrosion and extreme temperature variations. The complexity of integrating multiple lens technologies, such as layered polarization and photochromic elements, adds significant value at this stage.

The downstream segment focuses on distribution and retail. Distribution channels are bifurcated into direct channels (brand e-commerce and flagship stores) and indirect channels (wholesalers, specialty outdoor retailers, large sporting goods chains, and independent gun/tackle shops). Specialty retailers are particularly influential, as consumers often seek expert advice before investing in premium technical eyewear, valuing in-person fitting and specialized product knowledge. Marketing efforts heavily leverage endorsements from professional hunters and anglers, focusing content on durability, optical performance benefits, and lifestyle integration. Efficient logistics, especially managing inventory across seasons and reacting quickly to popular new lens technologies, defines success in the final stages of the value chain, ensuring product accessibility where and when the end-user needs it most.

Hunting and Fishing Eyewear Market Potential Customers

Potential customers for hunting and fishing eyewear represent a diverse, yet highly focused group of outdoor enthusiasts, professional guides, and competitive athletes who prioritize safety, durability, and specialized visual performance. The primary segment comprises serious recreational hunters and anglers who engage in these activities frequently and are willing to invest in premium gear to enhance their success rate and comfort. These buyers often possess high brand loyalty and seek products backed by robust warranty policies and demonstrable field performance. Their purchasing decisions are heavily influenced by the specific environment (e.g., deep sea vs. freshwater, dense forest vs. open field) and the light conditions they anticipate encountering, necessitating access to a broad range of specialized lens tints and technologies.

A secondary, but highly critical, customer segment includes professional hunting and fishing guides, outfitters, and competitive sport shooters/anglers. For this group, the eyewear is a professional tool; optical failure or performance inadequacy translates directly into reduced income or competitive disadvantage. Consequently, they demand the highest level of optical clarity, impact protection (often requiring military-grade standards), and ergonomic design for all-day wearability. This segment serves as crucial early adopters and influential advocates for emerging high-technology products, shaping mainstream consumer perceptions of performance and quality. Their detailed, real-world feedback is often invaluable for manufacturers in developing the next generation of products.

Beyond the core enthusiast, there is a substantial market for general protective eyewear used in ancillary outdoor activities or by casual participants. These buyers seek reliable, comfortable, and affordably priced safety glasses that still offer basic UV protection and scratch resistance. Furthermore, the market includes customers seeking prescription options integrated into high-performance frames, a challenging segment that requires complex custom manufacturing and specialized dispensing networks. Targeting specific demographics based on activity type, such as fly fishermen requiring maximum polarization and minimal distortion for wading in clear water, allows manufacturers to refine their product offerings and marketing communication for maximum resonance and conversion rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 985.4 million |

| Market Forecast in 2033 | USD 1,570.8 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oakley, Inc., Maui Jim, Costa Del Mar, Smith Optics, Wiley X, Revision Military, Bollé Safety, Safilo Group, ZEISS Group, Ray-Ban (EssilorLuxottica), Spy Optic, Gargoyles Eyewear, Serengeti, Hunter's Specialties, Pilla Sport Eyewear, Tifosi Optics, Native Eyewear, RHEOS Gear, Strike King, Orvis |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hunting and Fishing Eyewear Market Key Technology Landscape

The technology landscape of the Hunting and Fishing Eyewear Market is driven primarily by advancements in lens chemistry, material science, and computational optics, all focused on maximizing clarity, protection, and dynamic light management. The most critical technology is polarization, which employs layered films or specialized coatings to selectively filter horizontal light waves, effectively eliminating glare reflected off water, snow, and flat surfaces—a non-negotiable feature for serious anglers. Modern polarization technology seeks to improve visual acuity by minimizing distortion and maintaining true color perception, contrasting with older films that often introduced color shifts. Furthermore, photochromic technology, which allows lenses to automatically darken or lighten in response to UV exposure, is becoming increasingly sophisticated, offering faster activation times and a wider dynamic range, crucial for sportsmen transitioning quickly between shaded forest and open sunlit areas.

Material innovation centers on enhancing durability and safety. Polycarbonate lenses, already standard for their superior impact resistance, are being augmented with proprietary surface hardening techniques to resist scratches, which are the primary cause of functional failure in rugged environments. Trivex material, offering superior optical clarity combined with high impact resistance, is gaining traction in the high-end segment, competing directly with glass for visual performance while retaining safety features. Frame technology also plays a crucial role, utilizing materials such as Grilamid TR90 or advanced nylon polymers known for their flexibility, lightweight properties, and resistance to environmental stress cracking, ensuring the frame maintains its shape and security under extreme conditions.

Advanced lens coatings represent another significant area of technological investment. Hydrophobic and oleophobic coatings repel water, sweat, and oil, keeping the lens surface clear, which is vital during inclement weather or strenuous physical activity. Anti-reflective (AR) coatings are applied to the back surface of the lens to prevent light reflected off the interior from bouncing back into the user’s eye, a feature particularly important in high-glare, open environments. The integration of ballistic protection standards, derived from military specifications, into recreational shooting and hunting eyewear continues to elevate safety, ensuring protection against high-velocity fragments, thereby attracting professional and safety-conscious consumers to specific product lines.

Regional Highlights

Regional dynamics heavily influence the consumption patterns and market maturity of hunting and fishing eyewear, reflecting local traditions, regulatory environments, and economic factors.

- North America (United States and Canada): This region dominates the global market both in terms of value and volume due to a massive, affluent consumer base with long-standing traditions in recreational and professional hunting and fishing. The demand here is driven by premiumization, with consumers actively seeking high-end brands offering advanced polarization (e.g., Costa Del Mar, Maui Jim) and ballistic protection (e.g., Wiley X). The presence of major industry trade shows and strong retail networks ensures rapid adoption of new technologies. Safety regulations related to shooting ranges and certain hunting activities also drive consistent demand for certified protective eyewear. The market is highly competitive, emphasizing marketing based on heritage and field-tested performance.

- Europe (Germany, France, UK, Scandinavia): The European market demonstrates steady, mature growth, characterized by strong demand for technologically advanced products adhering to strict European safety standards (CE markings). Scandinavian countries show high consumption rates due to extensive fishing and hunting culture, requiring eyewear optimized for low-light conditions and glare reduction on snow and ice. German and UK markets focus on precision optics and durable, sophisticated designs. Consumers are sensitive to environmental claims and often prefer brands that demonstrate sustainable practices and high ethical standards in sourcing and manufacturing.

- Asia Pacific (APAC) (China, Japan, Australia): APAC is the fastest-growing region, driven by expanding recreational spending, rising disposable incomes, and the increasing westernization of leisure activities, particularly in China and Southeast Asia. Australia and New Zealand represent mature segments within APAC, with high per-capita spending on quality fishing eyewear tailored for harsh UV environments. The regional growth is accelerating the adoption of specialized eyewear over general sunglasses, though market penetration remains lower than in North America, signaling vast future opportunities for targeted marketing and localized product offerings.

- Latin America (Brazil, Mexico): Market growth in Latin America is primarily tied to economic stability and the development of organized recreational industries. Brazil, with its extensive coastline and waterways, presents a significant market for fishing eyewear. Affordability is a major factor, leading to stronger sales in the mid-range and entry-level segments, though premium demand is emerging among professional tourists and guides. Infrastructure challenges sometimes affect distribution logistics, favoring established global brands with strong regional partnerships.

- Middle East and Africa (MEA): This region represents a smaller but expanding market, concentrated mainly in countries with developing tourism, specialized desert hunting, and deep-sea fishing operations. Demand focuses heavily on robust protective features against sand, dust, and intense UV radiation. Growth is localized, with luxury spending driving the high-end segment in the Gulf countries, while safety and durability are the core requirements across other African hunting tourism destinations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hunting and Fishing Eyewear Market.- Oakley, Inc.

- Maui Jim

- Costa Del Mar

- Smith Optics

- Wiley X

- Revision Military

- Bollé Safety

- Safilo Group

- ZEISS Group

- Ray-Ban (EssilorLuxottica)

- Spy Optic

- Gargoyles Eyewear

- Serengeti

- Hunter's Specialties

- Pilla Sport Eyewear

- Tifosi Optics

- Native Eyewear

- RHEOS Gear

- Strike King

- Orvis

Frequently Asked Questions

Analyze common user questions about the Hunting and Fishing Eyewear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical feature in fishing eyewear?

The most critical feature is polarization technology. Polarization eliminates glare reflected off the water surface, allowing anglers to see beneath the surface to spot fish, structures, and potential hazards, which is essential for maximizing success rates and ensuring safety near water.

Which lens material offers the best balance of impact resistance and optical clarity for hunting?

Polycarbonate offers the superior balance, providing exceptional impact resistance (often meeting military or ANSI ballistic standards) and being lightweight, which is crucial for hunting eyewear where eye protection against debris, brass casings, and recoil stress is paramount. For absolute clarity, Trivex is often preferred but at a higher cost.

How significant are prescription options in the Hunting and Fishing Eyewear Market?

Prescription options are highly significant and are a growing subsegment. Many high-end manufacturers offer customized prescription lens integration directly into performance frames, recognizing that a large portion of the enthusiast demographic requires corrective vision without compromising on safety or specialized optical performance like high-contrast tints.

What role do photochromic lenses play in specialized outdoor eyewear?

Photochromic lenses, which automatically adjust their tint based on UV exposure, are vital for users who frequently move between varied environments, such as tracking game from dense cover into open fields. They ensure optimal light transmission and contrast without the need to physically swap lenses, enhancing safety and performance continuity.

What is driving the market premiumization trend in hunting and fishing optics?

Premiumization is driven by consumer awareness of the direct correlation between high-definition optics and performance success. Serious enthusiasts are investing in proprietary lens technologies, superior anti-scratch coatings, lightweight durable frames, and professional brand endorsements, viewing the eyewear as essential, mission-critical equipment rather than merely a protective accessory.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager