Hunting Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434143 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hunting Apparel Market Size

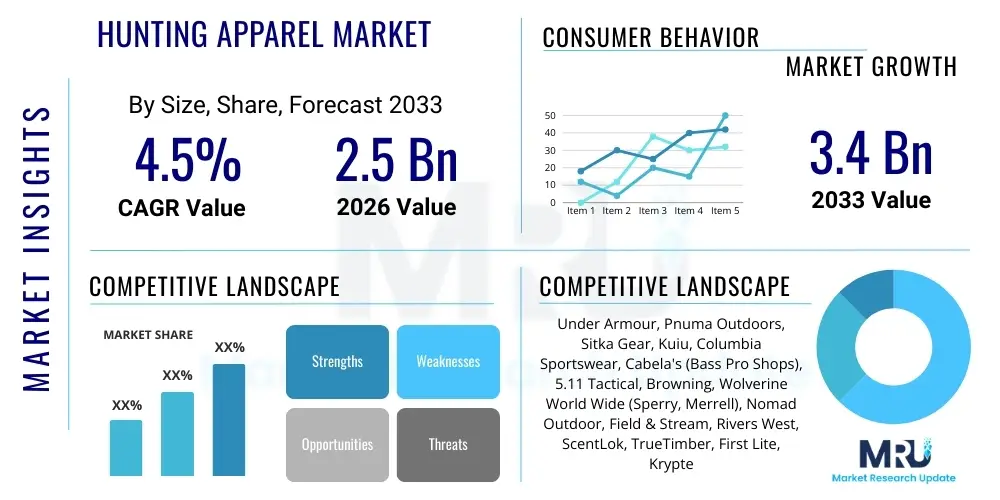

The Hunting Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at 2.5 Billion USD in 2026 and is projected to reach 3.4 Billion USD by the end of the forecast period in 2033.

Hunting Apparel Market introduction

The Hunting Apparel Market encompasses specialized clothing and gear designed to enhance the safety, comfort, and effectiveness of hunters across various environments and weather conditions. These products are engineered with technical specifications, including advanced camouflage patterns, waterproof and breathable materials, thermal insulation, scent control technologies, and durable construction to withstand rugged outdoor use. The primary product segments include jackets, pants, base layers, footwear, gloves, and headwear, tailored specifically for different hunting types such as big game, waterfowl, and upland bird hunting. The evolution of hunting apparel is marked by a shift towards high-performance textiles that integrate smart features, moving beyond traditional cotton and wool toward proprietary synthetic blends that offer superior moisture management and noise reduction, crucial factors for successful hunting.

Major applications of hunting apparel revolve around environmental protection, concealment, and regulatory compliance. Concealment is achieved through photorealistic and digitally rendered camouflage patterns that break up the human silhouette and blend with specific terrains, such as forests, snow, or marshlands. Furthermore, safety regulations in many jurisdictions mandate the use of blaze orange clothing to ensure visibility to other hunters, driving demand for specific high-visibility accessories and outer layers. The market's growth is inherently linked to participation rates in hunting and outdoor recreational activities, disposable incomes in key regions, and continuous innovation in textile science focused on enhancing user performance and minimizing environmental impact. The development of specialized apparel for extreme weather, particularly in North America and Scandinavian regions, represents a significant focus area for market manufacturers.

Key driving factors fueling market expansion include the increasing focus among consumers on professional-grade gear that enhances the ethical and successful pursuit of game, the rising popularity of recreational hunting as a leisure activity, and stringent governmental regulations regarding safety standards (e.g., mandated use of hunter orange). Benefits derived from utilizing high-quality hunting apparel include improved thermal regulation, protection against harsh elements (rain, wind, snow), superior scent concealment through carbon-activated materials, and enhanced stealth due to silent fabric construction. The incorporation of lightweight, durable, and ethically sourced materials is also a growing trend, catering to environmentally conscious consumers seeking sustainable and long-lasting outdoor gear, thereby sustaining the market's positive trajectory.

Hunting Apparel Market Executive Summary

The Hunting Apparel Market is characterized by robust growth, driven primarily by technological advancements in materials science, leading to the proliferation of lightweight, multi-functional, and high-performance garments. Business trends indicate a strong move toward direct-to-consumer (D2C) models and digital marketing strategies, leveraging detailed product specifications and environmental narratives to connect with specialized consumer bases. Key manufacturers are focusing on integrating advanced scent-control and noise-dampening technologies, alongside increasing the sustainability profile of their products. Regionally, North America maintains its dominance due to high hunting participation rates and established outdoor retail infrastructure, while the Asia Pacific region is demonstrating the fastest growth potential, driven by rising disposable incomes and expanding recreational activities. Segment trends highlight the increasing demand for specialized technical outerwear, particularly products incorporating GORE-TEX and proprietary camouflage systems, emphasizing versatility for varying climates. The market also sees continued segmentation based on gender and specific hunting disciplines (e.g., archery vs. rifle hunting), prompting manufacturers to offer highly tailored and specialized collections.

AI Impact Analysis on Hunting Apparel Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Hunting Apparel Market often center on three main themes: enhanced product design and customization, optimized supply chain logistics, and improved retail and purchasing experiences. Users are keenly interested in how AI can analyze vast datasets concerning terrain, climate conditions, and animal behavior to generate optimal camouflage patterns and fabric performance requirements, moving beyond traditional, static designs. There are expectations that AI-driven predictive analytics could lead to the creation of 'smart apparel' capable of dynamically adjusting insulation or ventilation based on real-time biometric data and environmental changes. Furthermore, consumers anticipate AI algorithms will revolutionize the manufacturing process, reducing waste, predicting demand spikes for seasonal gear, and offering highly personalized fitting and styling advice, ensuring that the hunting apparel purchased perfectly matches the specific needs and body type of the individual hunter. This focus on precision, personalization, and operational efficiency forms the core of user expectations regarding AI's transformative potential in this specialized apparel sector.

- AI-driven optimization of camouflage algorithms, synthesizing satellite imagery and environmental data to create hyper-realistic and effective patterns.

- Predictive analytics for inventory management, forecasting seasonal demand for specialized gear (e.g., waterfowl vs. mountain hunting) and reducing stockouts.

- Integration of smart textiles with AI algorithms for real-time biometric monitoring (heart rate, temperature) and dynamic microclimate adjustments within the garment.

- AI-powered virtual fitting rooms and personalized recommendation engines to match apparel specifications (insulation level, water resistance) to the user's specific hunting environment and activity level.

- Automation of quality control in manufacturing using machine vision systems to identify fabric defects or inconsistencies in advanced material layering.

DRO & Impact Forces Of Hunting Apparel Market

The market dynamics of hunting apparel are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively determining the market's impact forces. Key drivers include sustained interest in outdoor recreational hunting, technological advancements in fabric engineering leading to lighter, more durable, and more effective garments, and the critical need for safety compliance (such as the mandatory use of blaze orange). Restraints largely involve fluctuating raw material costs, the seasonal and often niche nature of the market which limits mass production economies of scale, and growing regulatory scrutiny regarding ethical sourcing and environmental impact of synthetic textiles. Opportunities emerge through the expansion into adjacent tactical and outdoor gear markets, the development of specialized apparel for emerging hunting niches like drone-assisted scouting or urban hunting, and the utilization of e-commerce platforms to bypass traditional retail limitations. The combined impact forces suggest a market trajectory favoring companies that prioritize innovation in sustainable and performance-enhancing textiles while effectively navigating the stringent demands of niche consumer specialization and regulatory environments.

Segmentation Analysis

The Hunting Apparel Market is segmented primarily across product type, material, application, distribution channel, and end-user, reflecting the diverse needs within the hunting community. Product segmentation focuses on the functional role of the garment, ranging from insulating base layers to protective outerwear. Material analysis distinguishes between traditional natural fibers and advanced synthetic blends, particularly those incorporating specialized technologies for scent control and weatherproofing. Application segmentation is crucial, differentiating gear needed for sedentary stand hunting versus active stalking, or requirements specific to varied environments like extreme cold or humid tropical forests. Analyzing distribution channels highlights the pivotal role of specialty outdoor retailers alongside rapidly growing direct-to-consumer online sales. This multi-faceted segmentation ensures that manufacturers can precisely target specific hunter demographics with gear optimized for their unique requirements, maximizing both market penetration and perceived value.

- By Product Type:

- Outerwear (Jackets, Vests, Pants)

- Mid-Layers (Fleece, Insulating Layers)

- Base Layers (Thermal Underwear)

- Headwear and Gloves

- Footwear and Gaiters

- By Material:

- Synthetic (Polyester, Nylon, Proprietary Blends)

- Natural (Wool, Cotton, Leather)

- Hybrid/Technical Materials (GORE-TEX, Scent-Control Fabrics)

- By Application:

- Big Game Hunting (Deer, Elk, Moose)

- Waterfowl Hunting (Ducks, Geese)

- Upland Bird Hunting (Pheasant, Turkey)

- Predator Hunting

- By Distribution Channel:

- Specialty Stores

- Online Retail

- Department Stores/Mass Merchandisers

- By End-User:

- Men

- Women

- Youth

Value Chain Analysis For Hunting Apparel Market

The value chain for the Hunting Apparel Market begins with upstream activities focused on raw material sourcing, which is highly specialized. This stage involves the procurement of advanced synthetic polymers (like specialized polyester or nylon), high-performance membranes (like PTFE or PU), and natural fibers, often including merino wool for thermal base layers. A critical upstream component is the development and licensing of proprietary technologies, such as advanced camouflage patterns (e.g., Kryptek or Mossy Oak) and chemical treatments for scent control (e.g., activated carbon or zeolite treatments). Manufacturers invest heavily in research and development to optimize fabric construction for specific criteria, including noise reduction, moisture wicking, and durability, thereby transforming raw materials into technical textiles suitable for demanding outdoor conditions. Efficient management of the upstream supply chain is paramount, as the reliance on specialized, high-cost technical materials directly impacts final product pricing and performance.

The midstream phase involves the manufacturing and assembly of the apparel. This requires highly specialized cutting and sewing operations, particularly for garments featuring complex layering systems, sealed seams for waterproofing, and precision pattern matching for camouflage effectiveness. Quality control at this stage is rigorous, ensuring textiles maintain their technological properties (like hydrostatic head ratings for waterproofing) after assembly. Downstream activities encompass the distribution and retail of the finished goods. The distribution channel is bifurcated: direct distribution utilizes proprietary e-commerce platforms and brand-owned outlets, offering maximum control over branding and pricing; indirect distribution relies on third-party channels, including major sporting goods chains, specialty outdoor retailers, and increasingly, large third-party online marketplaces. Successful downstream strategy requires effective logistics to handle seasonal demand fluctuations and robust marketing emphasizing product technical superiority and specific hunting applications.

Direct channels offer manufacturers higher margins and direct access to customer feedback, which is crucial for continuous product iteration in a technology-driven market segment. However, indirect channels provide broader market access, especially in highly regulated or geographically dispersed regions. Specialty outdoor retailers remain vital as they offer expert advice and the physical ability for customers to try on gear, a necessary component for fit-critical items like high-end outerwear and footwear. The efficient coordination between advanced material suppliers (upstream) and knowledgeable retail partners (downstream) dictates the overall effectiveness and profitability of the hunting apparel value chain. Companies that integrate sustainability practices and transparent sourcing into their operations gain a competitive advantage by appealing to the increasingly informed and ethically conscious hunting consumer base.

Hunting Apparel Market Potential Customers

The core customer base for the Hunting Apparel Market consists of active recreational and subsistence hunters, categorized by their commitment level, preferred hunting discipline, and geographic location. High-value customers, often referred to as 'serious' or 'prosumer' hunters, are characterized by their willingness to invest significantly in premium, technical gear designed for extreme conditions and extended duration hunts. These customers prioritize features like industry-leading scent control, exceptional waterproofing (e.g., GORE-TEX Pro), and specialized insulating materials (e.g., PrimaLoft). Their buying decisions are heavily influenced by performance metrics, field testing reviews, and brand reputation within the hunting community. They are typically early adopters of new textile technologies and represent the primary target for high-margin products, seeking apparel that provides a distinct tactical advantage.

Secondary potential customers include general outdoor enthusiasts, wildlife photographers, and tactical professionals (e.g., military, law enforcement) who require durable, low-visibility, and functional clothing for demanding environments, though they may not require strict scent control. The market also segments by gender, with increasing focus on the rapidly growing segment of female hunters, who demand apparel designed specifically for female body geometry rather than simply resized male clothing. Furthermore, new entrants to hunting, particularly younger demographics, represent a future customer base, often entering the market through mid-range product lines and gradually upgrading their gear as their commitment to the activity deepens. Manufacturers must tailor their marketing and product lines to address the varying price sensitivities and technical requirements across this diverse customer spectrum, ranging from the occasional weekend hunter to the dedicated backcountry explorer.

The purchasing cycle for hunting apparel is highly seasonal, peaking before major hunting seasons, particularly in the fall. Therefore, retailers must ensure inventory alignment with regional regulatory seasons. Beyond individual consumers, institutional buyers represent another segment, including outfitters, guides, and conservation organizations that require high volumes of durable, standardized gear for their staff. These buyers prioritize bulk pricing, long-term durability, and uniform corporate branding. Effective engagement with potential customers requires robust educational content, often utilizing professional hunters and outdoor influencers to demonstrate the performance benefits of advanced apparel in real-world scenarios, thereby building trust and justifying the often-premium price points associated with technical hunting wear.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 2.5 Billion USD |

| Market Forecast in 2033 | 3.4 Billion USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Under Armour, Pnuma Outdoors, Sitka Gear, Kuiu, Columbia Sportswear, Cabela's (Bass Pro Shops), 5.11 Tactical, Browning, Wolverine World Wide (Sperry, Merrell), Nomad Outdoor, Field & Stream, Rivers West, ScentLok, TrueTimber, First Lite, Kryptek, Carhartt, Arctic Shield, Gamehide, Mossy Oak |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hunting Apparel Market Key Technology Landscape

The Hunting Apparel Market is characterized by intense technological competition centered on enhancing three core performance metrics: scent control, environmental protection, and silent operation. Scent control technology is paramount, often employing activated carbon fibers (such as those pioneered by ScentLok) or specialized zeolite treatments integrated into the fabric structure to absorb and neutralize human odors, thereby mitigating a hunter's detection by game animals. Recent advancements focus on combining these physical absorption methods with antimicrobial treatments to inhibit odor-causing bacterial growth, offering a multi-layered approach to concealment. Environmental protection relies heavily on advanced membrane technology, notably polytetrafluoroethylene (PTFE) and polyurethane (PU) laminates, which provide high degrees of waterproofing and wind resistance while maintaining breathability (moisture vapor transfer rate), crucial for regulating body temperature during exertion.

Fabric construction techniques are evolving rapidly to meet the demand for stealth. This includes the use of brushed, micro-fleece, and proprietary synthetic blends that minimize fabric noise during movement, a critical factor in close-quarters hunting like bow hunting. Furthermore, the development of specialized insulation materials, such as synthetic polyfill derived from recycled materials (addressing sustainability concerns) or down treated for water resistance, allows manufacturers to achieve high warmth-to-weight ratios, offering hunters lightweight yet effective protection in cold environments. Digital and photorealistic camouflage technologies are continually refined, moving beyond simple patterns to utilize advanced color science and computer modeling to replicate specific natural textures and lighting conditions, maximizing visual disruption across different spectral ranges.

Future technological convergence points involve the integration of flexible electronics and smart textile components. While still nascent, this includes small, integrated heating elements powered by external battery packs for extreme cold, or embedded sensors for real-time monitoring of body vitals and environmental data, communicating information to a hunter's device. Manufacturers are also focusing on durable water repellent (DWR) finishes that are PFAS-free, responding to environmental and regulatory pressures concerning per- and polyfluoroalkyl substances. The technical barrier to entry remains high due to the necessity of licensing or developing complex, proprietary material science solutions that can withstand the rigorous demands of the hunting environment while maintaining crucial functional characteristics like waterproofing, silence, and scent mitigation.

Regional Highlights

- North America: This region holds the largest market share, primarily driven by the deeply ingrained cultural tradition of hunting in the United States and Canada, coupled with high rates of participation and significant disposable income dedicated to outdoor recreational activities. The U.S. market is characterized by strong brand loyalty to established domestic players and a high demand for advanced, specialized gear across diverse climates, from the Alaskan tundra to the humid southern swamps. Mandatory blaze orange regulations in many states also ensure consistent demand for safety-compliant outerwear.

- Europe: Europe presents a mature yet highly regulated market, where hunting traditions vary significantly by country. The market is strong in Scandinavian countries, Germany, and France. Demand here focuses on classic, high-quality, durable materials, often with an emphasis on sustainability and traditional aesthetics. Regulatory requirements often dictate specific color palettes (e.g., olive, brown, dark green) and less aggressive camouflage patterns compared to North America.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, although starting from a smaller base. Growth is fueled by increasing middle-class incomes, rising interest in recreational shooting and outdoor sports, particularly in countries like Australia, New Zealand, and emerging markets in Southeast Asia. The demand is often focused on durable, lightweight gear suitable for humid and tropical climates, and the region is also a major manufacturing hub, influencing global supply dynamics.

- Latin America: This region is characterized by a fragmented market where local manufacturers often cater to specific environmental needs. While market penetration of premium global brands is growing, price sensitivity remains a key factor. Demand is focused on durable, utility-oriented clothing suitable for dense forest and mountain hunting environments in countries like Argentina and Brazil.

- Middle East and Africa (MEA): The MEA market is largely driven by specialized demand for high-end safari and professional outfitting gear, particularly in South Africa. Demand is concentrated among high-net-worth individuals and guided tourism. Technical requirements focus on extreme durability, resistance to heat, and effective protection against harsh desert or savannah conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hunting Apparel Market.- Under Armour

- Pnuma Outdoors

- Sitka Gear

- Kuiu

- Columbia Sportswear

- Cabela's (Bass Pro Shops)

- 5.11 Tactical

- Browning

- Wolverine World Wide (Sperry, Merrell)

- Nomad Outdoor

- Field & Stream

- Rivers West

- ScentLok

- TrueTimber

- First Lite

- Kryptek

- Carhartt

- Arctic Shield

- Gamehide

- Mossy Oak

Frequently Asked Questions

Analyze common user questions about the Hunting Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological advancements are currently driving the Hunting Apparel Market?

The market is primarily driven by innovations in specialized textiles, including advanced scent-control technologies using activated carbon and antimicrobial treatments, high-performance waterproof and breathable membranes (e.g., GORE-TEX), and digitally rendered, terrain-specific camouflage patterns that optimize visual concealment across various environmental conditions.

How significant is the role of scent control technology in modern hunting apparel?

Scent control is highly significant, particularly for serious big game hunters, as it directly impacts success rates. Apparel incorporates highly porous materials or chemical treatments designed to adsorb human odors. This technology is viewed by consumers as a non-negotiable feature in premium base layers and outerwear designed for close-range hunting disciplines like archery.

Which geographic region dominates the global Hunting Apparel Market in terms of revenue?

North America currently dominates the global Hunting Apparel Market. This leadership is attributed to the high cultural acceptance of hunting, a large population of active participants, robust retail infrastructure, and high consumer spending on technical outdoor and recreational gear in the United States and Canada.

What are the primary challenges facing the sustainability of hunting apparel materials?

The primary challenge involves reducing reliance on petroleum-based synthetic materials, which are essential for performance (waterproofing, durability). Manufacturers are addressing this by integrating recycled synthetic fibers, utilizing ethically sourced natural fibers (like certified merino wool), and eliminating environmentally harmful fluorochemicals (PFAS) from durable water repellent (DWR) finishes.

How are distribution channels changing in the Hunting Apparel sector?

Distribution is shifting significantly toward Direct-to-Consumer (D2C) online models. While specialty outdoor stores remain crucial for tactile product experience and expert advice, D2C platforms allow niche, technical brands to reach specialized consumer segments directly, offering lower overheads and greater control over brand messaging and customer data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager