Hunting Rangefinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432795 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hunting Rangefinders Market Size

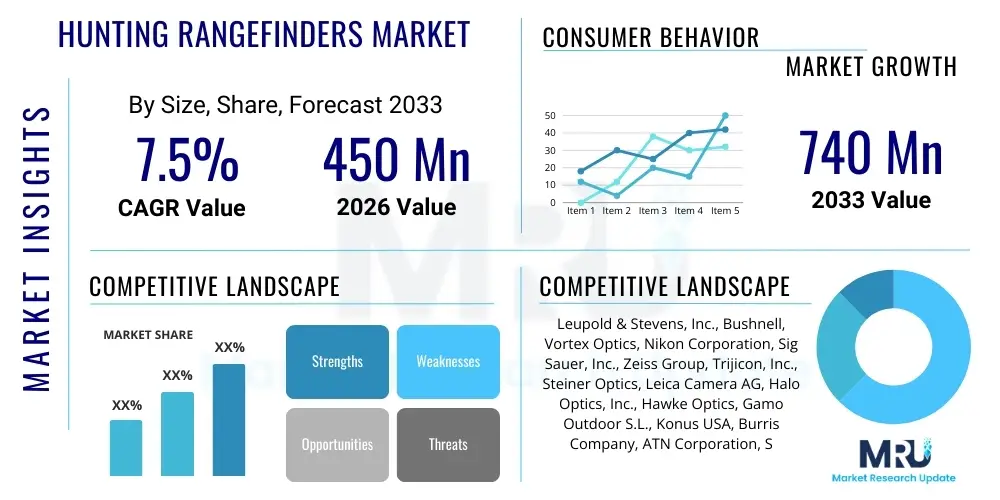

The Hunting Rangefinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 740 Million by the end of the forecast period in 2033.

Hunting Rangefinders Market introduction

The Hunting Rangefinders Market encompasses devices specifically designed to measure the distance from the hunter to a target animal or object, utilizing advanced laser or optical technology. These instruments are crucial for ensuring ethical and accurate shot placement, particularly in challenging environments where visual estimation of distance is unreliable. Modern rangefinders integrate features such as angle compensation, ballistic data calculation, and extreme weather resilience, making them indispensable tools for both competitive shooters and recreational hunters seeking improved performance and precision. The core product functions revolve around emitting a laser pulse, measuring the time taken for the reflection to return, and translating this data into an exact linear distance displayed instantaneously to the user, enhancing situational awareness significantly.

The market is predominantly driven by increasing participation in hunting and outdoor sports, coupled with continuous technological advancements that enhance product accuracy, durability, and feature integration. Rangefinders are utilized across major hunting applications, including big game hunting, bow hunting, and varmint control, where precise distance measurement is non-negotiable for success and safety. The increasing consumer preference for high-quality, reliable optics that offer complex computational capabilities, such as those that account for incline or decline (tru-distance measurement), further fuels market expansion globally.

Key benefits derived from using hunting rangefinders include enhanced ethical hunting practices by minimizing the risk of non-fatal shots, increased success rates due to reliable trajectory calculations, and improved safety awareness in diverse terrains. Major driving factors include rising disposable incomes in emerging economies, robust product innovation focusing on miniaturization and extended range capabilities, and the growing regulatory emphasis in certain regions that encourages the use of technology to ensure humane hunting standards. The shift towards long-range hunting necessitates sophisticated measurement tools, solidifying the rangefinder's position as essential gear rather than a luxury accessory.

Hunting Rangefinders Market Executive Summary

The Hunting Rangefinders Market is experiencing robust growth, primarily propelled by favorable business trends such as technological convergence and consumer demand for superior optical performance. Manufacturers are investing heavily in integrating high-definition displays (like OLED), faster processing speeds, and multi-functional platforms that combine rangefinding with observation capabilities, minimizing the equipment burden on hunters. Regional trends indicate that North America remains the dominant market due to a deeply entrenched hunting culture and high spending power, while the Asia Pacific region is demonstrating the highest growth trajectory, spurred by increasing recreational outdoor activities and rising middle-class income levels, particularly in countries like Australia and New Zealand. Strategic mergers and acquisitions among key industry players are reshaping the competitive landscape, focusing on consolidating market share and achieving economies of scale in manufacturing advanced components.

Segment trends highlight the dominance of laser rangefinders over traditional optical models due to their unparalleled accuracy and speed. Within the product type segmentation, the market observes accelerated adoption of models incorporating ballistic compensation features, which automatically adjust distance readings based on predetermined bullet drop data or bow trajectory, catering directly to the needs of serious hunters and precision shooters. Distribution channel trends show a pronounced shift towards e-commerce platforms, offering consumers greater access to a wide variety of models, comprehensive reviews, and competitive pricing, although specialized sporting goods stores maintain importance for personalized advice and demonstration of high-end equipment.

Overall market dynamics suggest that future growth will be concentrated in intelligent rangefinding systems. These systems utilize advanced software algorithms to not only calculate distance but also analyze environmental variables such as wind speed, temperature, and atmospheric pressure to provide highly optimized aiming solutions. The ethical and regulatory pressures surrounding hunting continue to necessitate the use of accurate distance measurement, providing a stable foundation for sustained market expansion. Furthermore, the diversification of products to cater specifically to archery (short-range, high-angle compensation) versus rifle hunting (long-range, ballistic calculation) is enabling deeper penetration into niche customer segments.

AI Impact Analysis on Hunting Rangefinders Market

Analysis of common user questions reveals significant interest concerning how artificial intelligence and advanced machine learning models could revolutionize the rangefinding experience. Users frequently inquire about the feasibility of AI optimizing ballistic solutions in real-time, adapting to rapidly changing environmental conditions without manual input. Key concerns center on the reliability, battery consumption, and the regulatory implications of integrating AI into hunting devices, specifically questioning if such advanced assistance crosses ethical boundaries within traditional hunting practices. Expectations are high regarding features such as AI-powered image stabilization for long-range targets, automated target recognition (distinguishing species), and highly personalized ballistic profiles learned and refined over multiple uses. Users are seeking assurances that AI integration will enhance, not complicate, the core function of quick and accurate distance calculation.

The integration of AI into hunting rangefinders moves beyond simple data storage and processing into predictive and adaptive assistance. AI algorithms can be deployed to analyze proprietary or publicly available ballistic databases, factoring in minute variables like Coriolis effect and spin drift, offering a truly optimized holdover solution. Furthermore, AI can enhance the user interface by prioritizing crucial information based on the current scenario, effectively filtering out noise and simplifying complex calculations for the hunter under pressure. While adoption is still nascent, the competitive advantage offered by predictive targeting systems is compelling manufacturers to aggressively explore these capabilities, potentially leading to a premium tier of highly automated rangefinders that define the cutting edge of precision hunting technology.

- AI-enhanced Ballistic Solvers: Real-time, adaptive calculation factoring complex environmental variables (e.g., wind patterns, air density).

- Automated Target Recognition and Tracking: Using visual data to identify the target and stabilize the reticle instantly.

- Predictive Ranging: Machine learning models predicting target movement patterns in dynamic scenarios.

- Optimized Power Management: AI managing laser emissions and display brightness to maximize battery life efficiently.

- Personalized User Profiles: Creating adaptive user experiences based on stored historical shot data and rifle performance.

- Smart Environmental Sensors Integration: Seamless data fusion from built-in thermometers, barometers, and inclinometers via AI.

DRO & Impact Forces Of Hunting Rangefinders Market

The Hunting Rangefinders Market is shaped by significant Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate its growth trajectory. The primary driver is the global increase in hunting participation and recreational shooting, coupled with a growing consumer understanding of the necessity of precision equipment for ethical hunting. Technological leaps, particularly in laser accuracy, miniaturization, and integration of complex digital features like built-in atmospheric sensors, further push market demand. Restraints predominantly involve the high initial cost associated with premium, feature-rich rangefinders, which can deter budget-conscious consumers, and increasing regulatory scrutiny in certain regions regarding the use of advanced electronic devices during hunting seasons. Opportunities are abundant, centering on market penetration in emerging economies, diversification into multi-purpose devices (combining rangefinding with thermal imaging), and exploiting the trend toward long-range shooting that mandates highly accurate measurement tools.

Impact forces illustrate a balancing act between accessibility and technological sophistication. The intense rivalry among key manufacturers drives rapid innovation, continuously lowering the barrier to entry for mid-tier rangefinders while simultaneously pushing the capabilities of high-end models. Regulatory changes, especially concerning hunting licenses and mandated equipment standards, can act as either a driver (if precision tools are required) or a restraint (if electronic devices are prohibited in specific hunting zones). Consumer influence is paramount; demand for ruggedized, waterproof designs and intuitive user interfaces compels product development toward enhanced durability and simplicity, overcoming the traditional complexity associated with ballistic computers.

Another major impact force is substitution threat, particularly from advanced smartphone applications offering ballistic calculations. However, these applications lack the essential, rapid laser distance measurement capability that defines rangefinders, ensuring the core product remains essential. The increasing focus on digital integration, allowing rangefinders to communicate wirelessly with other devices like smartphones or smart rifle scopes, creates a powerful ecosystem that locks in customer loyalty and justifies the premium pricing. This connectivity, driven by standardization efforts in data protocols, will be a defining factor in market leadership.

Segmentation Analysis

The Hunting Rangefinders Market is extensively segmented based on criteria such as Product Type, Technology, Application, and Distribution Channel, allowing for detailed analysis of consumer preferences and market dynamics. Understanding these segments is crucial for manufacturers tailoring their products and marketing strategies effectively. Product type segmentation distinguishes between general hunting rangefinders and specialized models, such as those optimized for bow hunting (featuring specialized angle compensation) or long-range shooting (requiring extended measurement capacity and robust ballistic calculation capabilities). Technology is primarily segmented into laser rangefinders, which dominate due to accuracy, and less common, older optical rangefinders.

Application segmentation typically separates the market based on the type of hunting undertaken, recognizing the distinct requirements of big game, small game, and bird hunting, with big game requiring longer range capabilities. The distribution channel breakdown reveals the dichotomy between traditional retail channels, such as specialty sports stores and pro shops, and modern e-commerce platforms, which are gaining traction due to convenience and competitive pricing. The segmentation analysis confirms the market trend towards high-feature devices, with consumers increasingly favoring products that offer connectivity and multi-functionality, signaling a premiumization trend across several key segments.

- Product Type:

- Standard Rangefinders

- Ballistic Rangefinders (with Angle Compensation)

- Technology:

- Laser Rangefinders

- GPS and Hybrid Rangefinders

- Application:

- Rifle Hunting (Long Range)

- Bow Hunting (Short Range/High Angle)

- Recreational Shooting/Target Practice

- Distribution Channel:

- Online Retail (E-commerce)

- Offline Retail (Specialty Stores, Sporting Goods Chains)

Value Chain Analysis For Hunting Rangefinders Market

The value chain for the Hunting Rangefinders Market begins with upstream activities focused on the sourcing and manufacturing of critical components, including high-precision laser diodes, specialized optical lenses, microprocessors, and robust housing materials (often polymer or aluminum alloys). Upstream suppliers specializing in military-grade optics or specialized electronics often hold significant leverage due to the need for miniaturized, durable, and highly accurate components. Component quality dictates the final product's performance and longevity, making strong supplier relationships and rigorous quality control paramount during this phase. Innovation in display technology, particularly the shift towards OLED or high-transmissivity LCDs, also takes place upstream, impacting the consumer experience substantially.

Midstream activities involve the assembly, integration of software/firmware (especially for ballistic calculators), calibration, and stringent quality assurance testing. This stage adds significant value through proprietary ballistic algorithms, ergonomic design, and waterproofing/fog-proofing capabilities. Effective manufacturing processes minimize waste and optimize throughput, essential for maintaining competitive pricing. Direct distribution involves manufacturers selling rangefinders through their own websites or dedicated flagship stores, allowing for maximum margin control and direct customer feedback. Indirect distribution relies on a network of wholesalers, regional distributors, and large-scale retailers, which provides wide market reach but necessitates shared margins.

Downstream activities center on marketing, sales, and post-sales service. Specialty hunting and outdoor goods retailers play a crucial role in providing hands-on demonstrations and expert advice, particularly for high-end models. The distribution channel mix is strategic; e-commerce channels offer extensive product comparison tools and reach a global audience efficiently, while traditional retail ensures physical availability and tactile evaluation. Post-sales support, including warranty services and software updates for integrated ballistic systems, is increasingly important for maintaining customer satisfaction and brand reputation in a technology-driven market.

Hunting Rangefinders Market Potential Customers

The primary end-users and potential buyers of hunting rangefinders fall into distinct segments based on their engagement level, budget, and specific hunting requirements. The largest segment comprises recreational hunters, ranging from those who hunt big game like deer and elk to those pursuing smaller game, all requiring dependable distance measurement for ethical shooting. This group typically seeks mid-range, durable devices offering essential features such as angle compensation and reliable performance in varied weather conditions. Their purchase decision is heavily influenced by ease of use, brand reputation, and value for money.

A second crucial segment consists of precision shooters and long-range enthusiasts. These customers demand high-end, technologically advanced rangefinders with extended measuring capabilities (often exceeding 1,500 yards) and integrated ballistic computing systems. They are willing to pay a significant premium for features like atmospheric sensor integration, customizable ballistic profiles, and connectivity with external devices (e.g., Kestrel weather meters or smart scopes). This sophisticated user group drives demand for AI and complex algorithms within the market.

A third group includes archery hunters, who require rangefinders optimized for extremely short distances and high angles. Their primary needs revolve around precise angle compensation to ensure true horizontal distance, vital for accurate arrow trajectory. Finally, outdoor professionals, including wildlife managers, game wardens, and land surveyors who utilize rangefinders for non-hunting tasks such as monitoring distances and mapping terrain, also constitute a niche customer base, emphasizing durability and versatility in their purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 740 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leupold & Stevens, Inc., Bushnell, Vortex Optics, Nikon Corporation, Sig Sauer, Inc., Zeiss Group, Trijicon, Inc., Steiner Optics, Leica Camera AG, Halo Optics, Inc., Hawke Optics, Gamo Outdoor S.L., Konus USA, Burris Company, ATN Corporation, Swarovski Optik, Cabela's Inc., Crimson Trace, Redfield, Revic Optics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hunting Rangefinders Market Key Technology Landscape

The technological landscape of the Hunting Rangefinders Market is characterized by continuous refinement of laser measurement systems and sophisticated digital integration. The core technology remains the Pulsed Laser Diode (PLD) and receiver, which must achieve sub-yard accuracy consistently across challenging targets and long distances. Recent innovations focus on improving beam divergence and sensitivity to allow accurate reading through light rain, fog, or brush, historically major limitations. Furthermore, the adoption of advanced optics, including complex lens coatings and prismatic systems, ensures superior light transmission and clarity, vital for use in low-light hunting conditions. The speed of measurement has also dramatically improved, with modern rangefinders delivering readings in milliseconds, essential for targeting moving game.

A major development in the landscape is the widespread integration of advanced microprocessors capable of running complex ballistic algorithms directly within the device. These built-in ballistic calculators transform the rangefinder from a simple distance tool into a comprehensive aiming solution, accounting for elevation, atmospheric pressure, temperature, and cartridge specifics. Connectivity technologies, specifically Bluetooth Low Energy (BLE), are vital, enabling seamless data transfer between the rangefinder and other smart devices (e.g., smartphones for profile management or smart scopes for automatic adjustments). This system integration maximizes user efficiency and accuracy, forming a robust digital ecosystem around the hunter.

Future technological advancements are heavily leaning towards enhanced display technology, with OLED (Organic Light-Emitting Diode) displays replacing traditional LCDs in premium models. OLEDs offer superior clarity, customizable reticles, and high contrast, making them highly visible against dark backgrounds or in bright sunlight. Furthermore, research into improving Angle Range Compensation (ARC) features ensures accurate readings for bow hunters facing steep inclines/declines. The push for miniaturization without sacrificing range or durability remains a constant technological driver, making devices lighter and more compact while improving their ruggedness against harsh hunting environments.

Regional Highlights

Regional analysis of the Hunting Rangefinders Market reveals diverse adoption rates and specific market drivers influenced by cultural factors, regulatory frameworks, and economic indicators across major geographical zones.

- North America (United States and Canada)

North America holds the largest market share due to a deeply ingrained culture of recreational hunting and shooting, robust disposable incomes, and the presence of major global manufacturers. The U.S., in particular, exhibits high demand for high-end ballistic rangefinders, driven by the popularity of precision rifle shooting and long-range hunting across vast territories. Regulatory environments are generally favorable, supporting the use of advanced hunting technology. The market here is highly competitive, characterized by frequent product launches and strong brand loyalty among consumers. Furthermore, high technological awareness drives rapid adoption of connected and smart rangefinders capable of communicating with other smart optics and external meteorological devices.

The demand landscape in North America is highly segmented, with bow hunters driving demand for short-range, specialized angle-compensating models, while rifle hunters focus on extended range and comprehensive ballistic solutions. The proliferation of major outdoor retail chains and extensive e-commerce penetration ensures high product availability. This region serves as the benchmark for innovation, often introducing cutting-edge features like built-in weather stations and advanced AI algorithms before they become widespread globally. Sustained interest in ethical hunting practices also encourages investment in highly accurate measurement tools.

- Europe

The European market for hunting rangefinders is mature but subject to stricter and more varied national hunting regulations regarding the use of electronic aids. Countries in Scandinavia and Central Europe demonstrate substantial demand, driven by traditional hunting practices and a focus on high-quality optics. Consumers in this region often prioritize premium European brands known for their optical excellence and durable construction, such as Leica, Zeiss, and Swarovski Optik. The market is moderately fragmented, with localized distribution networks playing a crucial role.

Growth in Europe is steady, supported by rising participation in stalking and driven hunts. While acceptance of highly computerized ballistic rangefinders varies by country, there is consistent demand for reliable, rugged, and optically superior rangefinders. The trend leans towards dual-purpose devices that integrate traditional binocular function with rangefinding capability, maximizing utility while minimizing gear bulk. Economic stability and a high appreciation for precision equipment contribute significantly to the high average selling price of rangefinders in this region.

- Asia Pacific (APAC)

The Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rising disposable incomes, urbanization leading to greater spending on recreational activities, and increasing interest in outdoor sports and hunting, particularly in countries like Australia, New Zealand, and increasingly in Southeast Asia. While hunting regulations vary significantly, the overall market is expanding as consumers look to import high-quality Western brands.

The market faces challenges related to infrastructure and distribution logistics, but the rapid growth of e-commerce platforms is overcoming these hurdles. Demand is shifting from basic rangefinders towards mid-range models with essential features like angle compensation. Manufacturers are focusing on tailored products that meet the specific climatic and environmental challenges of the region, such as devices with superior moisture resistance and higher light transmission capabilities for humid conditions. Investment in manufacturing capabilities within the region is also contributing to lower import costs and increased accessibility.

- Latin America (LATAM)

The Latin American market is characterized by moderate growth, primarily concentrated in countries with established hunting traditions and sufficient land dedicated to outdoor recreational shooting, such as Argentina and Brazil. Market penetration is lower compared to North America and Europe, largely due to economic volatility and stricter import duties on specialized sporting optics. However, steady economic improvements and the liberalization of certain recreational shooting regulations are gradually expanding the potential customer base.

The market in LATAM is price-sensitive, with strong demand for entry-level and mid-range rangefinders that offer essential accuracy without the high-end ballistic features. Distribution relies heavily on specialized importers and regional distributors. Educational initiatives promoting ethical hunting and the benefits of precision equipment are key strategies used by manufacturers to drive long-term market acceptance and growth in this region.

- Middle East and Africa (MEA)

The MEA region presents a developing market with significant potential, particularly in the Gulf Cooperation Council (GCC) countries where high-net-worth individuals participate in specialized hunting and safari activities. The demand in the Middle East is often focused on ultra-premium and specialized long-range devices, reflecting high purchasing power and a preference for technologically superior equipment. Africa, particularly South Africa, has an established market linked to regulated game hunting and conservation efforts, where rangefinders are essential tools for professional outfitters and clients.

Growth drivers include tourism-related hunting activities and governmental investments in specialized security and surveillance applications which often overlap with rangefinder technology. Restraints include complex geopolitical environments and varied regulatory landscapes. The market tends to prioritize ruggedness and extreme environmental resistance due to the harsh desert and savanna climates. E-commerce penetration is rising, but specialized retail channels remain important for premium product sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hunting Rangefinders Market.- Leupold & Stevens, Inc.

- Bushnell

- Vortex Optics

- Nikon Corporation

- Sig Sauer, Inc.

- Zeiss Group

- Trijicon, Inc.

- Steiner Optics

- Leica Camera AG

- Halo Optics, Inc.

- Hawke Optics

- Gamo Outdoor S.L.

- Konus USA

- Burris Company

- ATN Corporation

- Swarovski Optik

- Cabela's Inc. (Bass Pro Shops)

- Crimson Trace

- Redfield

- Revic Optics

Frequently Asked Questions

Analyze common user questions about the Hunting Rangefinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hunting Rangefinders Market?

The Hunting Rangefinders Market is projected to grow at a CAGR of 7.5% between the forecast years of 2026 and 2033, driven by increasing adoption of precision shooting sports and continuous technological advancements in ballistic integration.

How does technological advancement influence the price of hunting rangefinders?

Technological integration, particularly features like advanced ballistic calculators, OLED displays, and AI-powered sensors, increases the complexity and manufacturing cost, positioning these highly-featured devices in the premium price segment of the market, thereby raising the overall average selling price.

Which geographical region holds the largest market share for hunting rangefinders?

North America, specifically the United States and Canada, currently holds the largest market share due to its established hunting culture, high consumer purchasing power, and strong presence of both domestic and international optical manufacturers.

What is the primary difference between a standard rangefinder and a ballistic rangefinder?

A standard rangefinder provides only the linear distance to the target, whereas a ballistic rangefinder integrates internal sensors and software to calculate the "true distance" or required holdover, accounting for incline, temperature, and specific projectile data for improved shooting accuracy.

Are laser rangefinders safe for human eyes during operation?

Modern hunting rangefinders typically utilize Class 1 lasers, which are generally considered safe for normal use. Manufacturers adhere to stringent safety standards to ensure the power output is minimized to prevent eye damage during operation.

What challenges does the Hunting Rangefinders Market face regarding regulatory compliance?

The market faces challenges related to varied national and regional hunting regulations; some jurisdictions impose restrictions or outright prohibitions on the use of electronic or highly automated aiming devices, impacting product sales and necessary feature customization.

How significant is the role of e-commerce in the distribution of hunting rangefinders?

E-commerce platforms are increasingly vital, offering wide geographical reach, competitive pricing, and detailed product comparisons, significantly contributing to the market's growth, especially for high-volume, mid-range devices globally.

Which segment of the market is expected to show the fastest growth?

The Ballistic Rangefinders segment, categorized by Product Type, is projected to exhibit the fastest growth, driven by professional hunters and precision shooters demanding highly accurate, compensated distance readings for complex shooting scenarios.

What materials are commonly used in the construction of durable rangefinder housing?

High-durability materials such as aircraft-grade aluminum and ruggedized polymers are commonly used for rangefinder housing to ensure protection against impact, moisture, and extreme temperature variations encountered in diverse hunting environments.

What is the key technological focus for manufacturers in the next five years?

The key technological focus will be on enhancing smart integration, specifically developing seamless wireless connectivity between rangefinders and other optics, and incorporating predictive AI algorithms for real-time ballistic analysis and environmental assessment.

Does the market cater differently to bow hunters versus rifle hunters?

Yes, the market segments products specifically; bow hunters require rangefinders optimized for angle compensation and shorter, precise measurements, while rifle hunters need extended range capacity and comprehensive ballistic drop solutions.

What impact does battery life have on consumer preference?

Battery life is a critical factor influencing consumer preference, particularly for devices with integrated displays and ballistic features. Consumers prefer long-lasting power sources, prompting manufacturers to optimize power management and utilize high-efficiency components.

How do leading companies ensure the accuracy of their rangefinders over extreme distances?

Leading companies achieve accuracy over extreme distances by utilizing high-quality laser emitters with low beam divergence, highly sensitive optical receivers, and sophisticated noise-reduction algorithms to filter out environmental interference and ensure a clear return signal.

What role does the Asia Pacific (APAC) region play in the global market growth?

The APAC region is projected to be the fastest-growing market, contributing significantly to global growth due to rising middle-class disposable incomes, increased interest in outdoor recreation, and improving access to high-quality international sporting goods.

What are the primary restraints affecting market expansion?

The primary restraints affecting market expansion include the high upfront cost of advanced rangefinders, which limits affordability for budget-conscious users, and complex, restrictive hunting regulations concerning the use of electronic devices in certain jurisdictions.

How are Hunting Rangefinders integrated into the broader smart hunting ecosystem?

Rangefinders are integrated using Bluetooth technology to share accurate distance and ballistic data instantaneously with other smart devices, such as smartphone apps, GPS systems, or connected rifle scopes, optimizing the overall aiming solution for the hunter.

What differentiates premium European brands in the rangefinder market?

Premium European brands are typically differentiated by superior optical quality, exceptional light transmission rates, ruggedized build construction, and a traditional focus on combining rangefinding functionality with high-performance binocular optics.

Is there a noticeable trend towards miniaturization in rangefinder design?

Yes, miniaturization is a significant trend, driven by consumer demand for lighter, more compact gear that maintains high performance, enabling manufacturers to integrate advanced features into smaller, more ergonomically favorable form factors.

What is the importance of Angle Range Compensation (ARC) in hunting rangefinders?

ARC is critical as it measures the angle of incline or decline between the hunter and the target, calculating the true horizontal distance required for accurate bullet or arrow trajectory, especially important in mountainous or uneven terrain.

How do manufacturers maintain quality control during the production process?

Quality control is maintained through rigorous testing of component reliability, precise factory calibration of laser accuracy, environmental testing for waterproofing and shock resistance, and strict adherence to optical performance standards before final assembly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager