Hunting Spotlight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438665 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hunting Spotlight Market Size

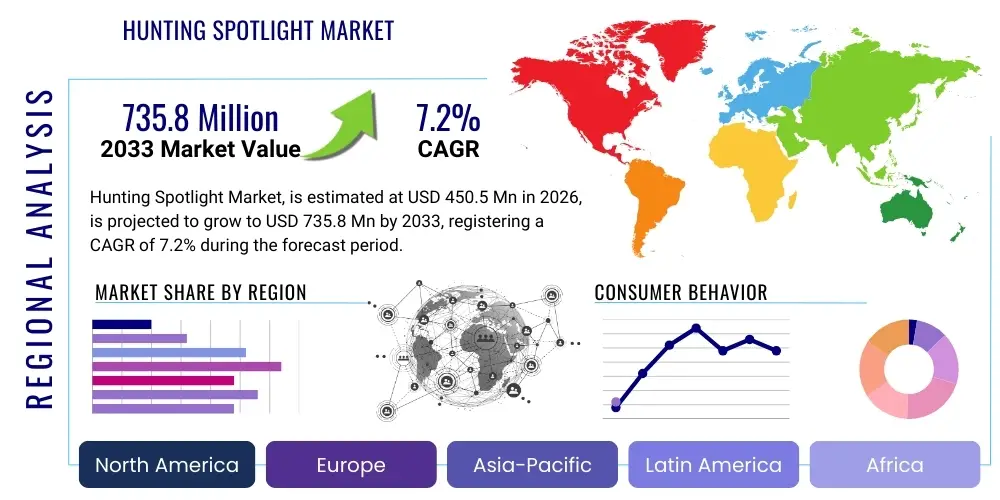

The Hunting Spotlight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 735.8 Million by the end of the forecast period in 2033.

Hunting Spotlight Market introduction

The Hunting Spotlight Market encompasses the manufacturing, distribution, and sale of high-intensity portable lighting devices specifically engineered for hunting activities, primarily during low-light conditions or nighttime. These devices are critical tools for identification, tracking, and ensuring safety in remote environments. Modern hunting spotlights have evolved significantly from traditional incandescent or halogen lamps, now predominantly utilizing high-efficiency LED (Light Emitting Diode) and HID (High-Intensity Discharge) technologies, coupled with advanced lithium-ion battery systems to ensure extended runtime and maximum lumens output. Key product characteristics demanded by consumers include extreme durability, resistance to harsh weather conditions (waterproofing and shock resistance), and long-range beam throw capability, often exceeding 1,000 meters.

Major applications of hunting spotlights extend beyond simply illuminating game; they are essential for navigating complex terrain, identifying blood trails, and signaling. The market growth is fundamentally driven by the rising popularity of recreational hunting globally, especially in North America and Europe, coupled with technological advancements that significantly improve product performance metrics such as beam quality (color temperature, focus), battery life, and ergonomic design. Furthermore, the integration of specialized filters (such as red, green, or amber) designed to minimize spooking certain types of game animals represents a major product differentiator and a driving factor for specialized segment growth. Regulatory environments, while imposing constraints on spotlight use in some regions, also standardize performance and safety requirements, pushing manufacturers towards higher quality and compliant product lines.

The core benefits derived from employing specialized hunting spotlights include enhanced hunter safety, increased tracking efficiency, and compliance with ethical hunting practices requiring clear target identification before firing. Driving factors involve continuous innovation in power-to-weight ratio technologies, making units more portable and powerful. The shift toward rechargeable lithium polymer batteries, offering lighter weight and faster charging cycles compared to older lead-acid batteries, has solidified market demand. Additionally, the growing consumer interest in hands-free operation has spurred the development of specialized vehicle-mounted and headlamp-style spotlights with comparable power to traditional handheld units, thereby diversifying the product offerings available to the end-user.

Hunting Spotlight Market Executive Summary

The Hunting Spotlight Market is experiencing robust expansion, characterized by a fundamental technological shift from traditional halogen sources to high-lumen LED arrays, focusing intensely on efficiency, portability, and ruggedness. Current business trends indicate a strong focus on sustainable and reliable power solutions, with manufacturers prioritizing modular battery designs and rapid charging capabilities to cater to professional hunters and guides who demand zero downtime. Regional growth is prominently led by North America, attributed to a large established hunting culture and permissive regulations allowing spotlight use under specific conditions, followed closely by the Asia Pacific region, where increasing disposable incomes are fueling demand for high-end outdoor equipment, particularly in Australia and New Zealand. Europe exhibits steady, albeit more fragmented, growth due to diverse national regulations concerning nocturnal hunting activities.

Segmentation trends highlight the increasing dominance of the rechargeable handheld spotlight segment, driven by improvements in lithium-ion technology, offering superior energy density and lifecycle compared to disposable battery alternatives. The vehicle-mounted spotlight segment is also growing substantially, particularly in regions where hunting requires extensive off-road travel, valuing powerful, fixed-position lighting for long-distance observation and safety. Furthermore, the market is seeing significant innovation in smart lighting accessories, including spotlights integrated with thermal imaging or night vision optics, appealing to the premium segment seeking multi-functional devices for surveillance and tracking. Competition remains fierce, compelling manufacturers to invest heavily in supply chain optimization to maintain competitive pricing while incorporating premium features like IPX-rated waterproofing and aerospace-grade aluminum construction.

In terms of strategic direction, major market participants are focusing on expanding their direct-to-consumer digital footprints and forging strong partnerships with specialized hunting and outdoor retailers to enhance product visibility and accessibility. Pricing strategies reflect a clear divergence between premium brands, emphasizing extreme performance and reliability for professional use, and value-oriented brands targeting the casual hunter with essential functionality. The underlying market dynamic suggests that while overall unit sales are strong, the average selling price (ASP) is increasing, driven by the consumer preference for durable, high-specification products that minimize the need for frequent replacement. This focus on durability and long-term value is a major characteristic shaping both manufacturing processes and consumer purchasing decisions within this specialized outdoor equipment category.

AI Impact Analysis on Hunting Spotlight Market

User inquiries regarding AI's influence on the Hunting Spotlight Market frequently revolve around integration capabilities with existing hunting technology (e.g., smart scopes, drones), automated decision support systems, and enhanced battery management. Key concerns address whether AI can optimize beam patterns dynamically based on environmental conditions (fog, rain) or target distance, and if integrated sensors, powered by AI algorithms, could differentiate between permitted game and non-target species, thereby improving ethical compliance and safety. Expectations are centered on creating 'smart spotlights' that minimize manual intervention, optimize power consumption through predictive analytics, and ultimately provide a technological advantage in tracking and safety, transforming a passive illumination tool into an active, intelligent hunting aid.

The application of Artificial Intelligence within the Hunting Spotlight sector is primarily focused on optimization and smart functionality, moving beyond simple illumination. AI algorithms can be deployed within embedded systems to analyze environmental data, such as ambient light levels, humidity, and atmospheric particulate density, to instantaneously adjust the beam intensity and focus for optimal visual clarity, ensuring the light output is maximized without unnecessary power drain. This level of dynamic adaptation significantly enhances the user experience and addresses the critical concern of battery life management during prolonged hunting excursions. Furthermore, machine learning models can process usage patterns over time, leading to predictive maintenance alerts for rechargeable battery systems, extending their usable lifespan and ensuring reliability when needed most.

A more sophisticated layer of AI impact involves integration with broader hunting ecosystems. For example, spotlights could use visual recognition algorithms to stabilize the beam on a specific tracked target, compensating for minor hand movements, which is particularly useful in high-magnification observation scenarios. While full autonomous target identification raises significant ethical and regulatory questions, AI enhances safety by integrating geo-fencing data, automatically limiting maximum beam throw in areas near urban centers or protected zones where powerful spotlights could cause hazards or violate local laws. This fusion of computational power with robust lighting hardware positions future hunting spotlights as intelligent peripherals rather than standalone tools.

- AI-driven Predictive Battery Management: Algorithms optimize power output based on remaining charge and ambient temperature, maximizing effective runtime.

- Dynamic Beam Adjustment (DBA): Real-time analysis of atmospheric conditions (fog, dust) to automatically refine beam focus and intensity for optimal visibility.

- Integrated Target Stabilization: Machine learning models compensate for minor handheld movements, keeping the beam locked onto a specific area or distant target.

- Geo-Fencing Compliance: AI systems can integrate GPS data to regulate beam intensity or usage based on local hunting regulations and restricted zones.

- Enhanced Data Logging: Spotlights connected to smart hunting apps can log usage metrics (duration, location, intensity used), offering insights into efficient resource application.

DRO & Impact Forces Of Hunting Spotlight Market

The Hunting Spotlight Market is driven by several key factors (Drivers), principally the continuous technological enhancement in LED efficiency and battery technology, which allows for smaller, lighter units with significantly higher lumen output and extended operational life. This performance leap directly addresses core hunter requirements for reliability and portability. Concurrently, increasing global participation in recreational and professional hunting, especially in well-regulated markets, bolsters demand for specialized, high-quality gear. The primary Restraint on the market is the stringent and often restrictive regulatory environment surrounding the use of artificial light sources for hunting, with many jurisdictions completely banning or severely limiting spotlight use for nocturnal game harvesting, thus capping potential market expansion in certain geographical areas. Opportunities arise from the burgeoning demand for specialized, color-filtered spotlights (red, green, IR), which appeal to niche segments requiring specific wavelengths for thermal imaging integration or minimized visibility to certain wildlife species. These forces collectively shape the competitive landscape and technological roadmap for market participants.

The impact forces influencing the market are multifaceted, encompassing technological push, economic pull, and legislative constraints. Technologically, the rapid adoption of specialized optics, such as TIR (Total Internal Reflection) lenses and sophisticated reflectors, allows for unparalleled beam control, converting raw lumens into effective, focused light at extreme distances, a necessity for long-range hunting. Economically, the increasing disposable income in emerging economies allows hunters to upgrade from rudimentary lighting systems to premium, durable spotlights, driving revenue growth in the higher-margin segments. However, the cyclical nature of hunting seasons and the dependence on outdoor activity also mean the market is vulnerable to adverse weather patterns or global health crises that restrict travel and outdoor participation. The overall impact force is moderately positive, driven by performance improvements, but constrained significantly by legal limitations.

A critical analysis of the opportunity landscape reveals that strategic partnerships with night vision and thermal imaging manufacturers present substantial avenues for growth, allowing spotlight producers to offer integrated illumination solutions that enhance existing high-tech surveillance gear. Furthermore, the market for rugged, vehicle-mounted systems for utility and search-and-rescue (SAR) operations often overlaps with the hunting segment, providing dual-use potential that broadens the addressable market beyond core hunting consumers. To mitigate the restraint posed by regulations, manufacturers are developing spotlights with customizable intensity settings and proof of compliance features (e.g., maximum power limits or automatic shutdown protocols), positioning their products as responsible and legal hunting aids. This focus on compliance and integration represents the most significant ongoing effort to overcome external market pressures.

Segmentation Analysis

The Hunting Spotlight Market is segmented based on product type (Handheld, Vehicle-Mounted, Headlamp), light source (LED, HID, Halogen), power source (Rechargeable, Non-Rechargeable), and end-user (Professional Hunters, Recreational Enthusiasts). This segmentation provides a granular view of consumer preferences and technological adoption rates across different usage scenarios. Handheld spotlights dominate the revenue share due to their versatility and portability, while rechargeable units, particularly those utilizing advanced lithium-ion chemistries, are the fastest-growing power segment, reflecting a strong consumer desire for cost-effective and environmentally conscious operation. The end-user analysis confirms that recreational hunters represent the largest volume purchaser, though professional users drive demand for the highest-specification, premium-priced units where reliability is paramount.

Further segmentation refinement reveals important trends regarding light source preference. Although LED technology is rapidly replacing older light sources due to superior efficiency and lifespan, a small niche still prefers HID for its color rendering and extremely high-lumen output for specific ultra-long-range applications, despite the higher heat generation and fragility. The market structure emphasizes products tailored for specific game types (e.g., hog hunting requiring different beam characteristics than deer tracking) and geographic climates (e.g., extreme cold battery performance). This detailed segmentation helps companies tailor their marketing and distribution strategies, ensuring product alignment with regional regulatory mandates and consumer needs. The focus on specialized accessories, such as colored lens filters (red for stealth, green for blood tracking), is creating lucrative micro-segments within the overall accessory market.

- Product Type:

- Handheld Spotlights

- Vehicle-Mounted Spotlights (Remote and Fixed)

- Headlamp Spotlights (High-Power Variants)

- Light Source:

- LED (Light Emitting Diode)

- HID (High-Intensity Discharge)

- Halogen

- Power Source:

- Rechargeable (Lithium-ion, Lithium Polymer)

- Non-Rechargeable (Disposable Batteries, Vehicle Power)

- Beam Distance:

- Short Range (Below 500 Meters)

- Mid Range (500m to 1000 Meters)

- Long Range (Above 1000 Meters)

- Distribution Channel:

- Online Retail

- Specialty Outdoor Stores

- Departmental Stores and Mass Merchants

Value Chain Analysis For Hunting Spotlight Market

The Value Chain for the Hunting Spotlight Market begins with upstream activities focused heavily on raw material sourcing and critical component manufacturing. This includes the acquisition of high-grade aerospace aluminum and durable polymers for housing, specialized optical components (reflectors, lenses, TIR optics), and, most critically, the sourcing of high-performance LED chips (from suppliers like Cree, Luminus, or Osram) and advanced lithium-ion battery cells. Upstream analysis highlights that supply chain resilience and component quality assurance, particularly concerning LED binning and battery safety certification (e.g., UN 38.3), are major cost and differentiation drivers. Manufacturers often focus heavily on R&D for proprietary thermal management systems, essential for maintaining maximum lumen output without compromising LED lifespan or battery integrity.

Midstream processes involve manufacturing, assembly, rigorous quality control testing (including IP rating certification for water and dust resistance), and final packaging. Efficiency in assembly is crucial, often relying on automated processes for soldering and electronic integration, followed by manual steps for lens and seal installation to ensure waterproofing. Downstream analysis focuses on distribution and sales. The primary distribution channels are segmented into direct sales (via e-commerce platforms and brand websites), indirect sales through specialty outdoor and hunting gear retailers, and large-scale distribution through general sporting goods stores. Indirect channels require strong margin negotiation and retailer training to effectively communicate the technical specifications and superior performance characteristics of premium spotlights.

The preference for distribution channels is shifting, with direct-to-consumer (D2C) online sales growing rapidly, allowing manufacturers better control over branding, pricing, and direct customer feedback. However, specialty retail remains crucial for providing hands-on demonstrations, especially for high-end, technically complex products where consumers prefer to test beam throw and ergonomics before purchase. Effective value chain management, particularly optimizing logistics for seasonal demand peaks coinciding with various hunting seasons, is essential for minimizing inventory costs and maximizing market responsiveness. Furthermore, the reliance on global component suppliers, particularly in Asia, necessitates robust risk management strategies concerning geopolitical stability and tariffs.

Hunting Spotlight Market Potential Customers

The Hunting Spotlight Market serves a diverse range of end-users, fundamentally categorized into professional guides and recreational enthusiasts, each having distinct requirements regarding performance, durability, and budget. Professional hunting guides and outfitters represent the premium end-users; they require military-grade reliability, extended battery runtime (often requiring hot-swappable batteries), and extreme weather resilience, as their livelihood depends on the gear's functionality in critical situations. These customers are less price-sensitive and prioritize features like warranty, maximum effective beam distance, and seamless integration with other specialized equipment like GPS trackers and thermal viewers. Their purchasing decisions are heavily influenced by word-of-mouth reputation and product reviews within the professional community.

Recreational hunting enthusiasts form the largest volume customer base. This group includes casual hobbyists, serious weekend hunters, and landowners engaging in wildlife management. Their needs are broader, spanning from basic, affordable handheld units for general camp use to mid-range performance spotlights offering a balance between lumen output, battery life, and cost. This segment is highly responsive to promotions, seasonal sales, and is heavily influenced by digital content, product reviews, and influencer endorsements on social media platforms dedicated to outdoor activities. A growing sub-segment within recreational users are those focused on pest control (e.g., feral hog control), who often demand specialized vehicle-mounted setups for sustained, high-power illumination over vast agricultural areas.

Beyond traditional hunters, the adjacent markets represent significant potential customer pools. These include search-and-rescue (SAR) teams, law enforcement agencies (for tactical illumination during perimeter control), and industrial users in remote areas (mining, construction inspection). While these users may require slightly different specifications (e.g., specific color filters or mounting protocols), the core demands for durability, power, and long-throw capability align closely with those of high-end hunting spotlights. Targeting these adjacent markets through specialized product variants and compliance certifications offers manufacturers a stable revenue stream outside the highly seasonal core hunting market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 735.8 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Streamlight, Fenix, Cyclops, Nitecore, Olight, Lightforce, Golight, SureFire, Black Diamond, Ledlenser, Klarus, Princeton Tec, Pelican, Nightstick, Wuben, AceBeam, Imalent, ThruNite, Elzetta, Maglite |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hunting Spotlight Market Key Technology Landscape

The technological landscape of the Hunting Spotlight Market is primarily defined by the ongoing revolution in solid-state lighting, centering on high-power LED arrays. The shift is not only about maximizing lumen output but also about achieving superior beam characteristics through advanced optical engineering, including the use of precision-machined reflectors and complex lens systems (like TIR optics) to minimize light loss and maximize throw distance while maintaining a usable spill beam for peripheral awareness. Thermal management is a critical technology, utilizing sophisticated heat sinks and internal sensors to prevent overheating, which is essential for maintaining consistent high-output performance and preventing premature LED degradation, particularly in tropical or high-temperature hunting environments. Manufacturers are increasingly integrating active cooling solutions, such as internal fans or phase-change materials, into their highest-output models.

Power source technology forms the second pillar of innovation. The prevalence of 18650 and 21700 lithium-ion battery cells is standardizing performance across the industry, offering excellent energy density. However, key manufacturers are differentiating themselves through specialized battery protection circuits and proprietary charging systems (e.g., magnetic charging ports or integrated USB-C charging) that enhance user convenience and robustness. Furthermore, battery management systems (BMS) are becoming smarter, providing real-time power level indicators and optimizing discharge rates to ensure prolonged runtimes, addressing a primary pain point for hunters who need reliable power throughout extended nocturnal periods. The development of lighter, more robust battery packs is directly contributing to the growth of high-powered headlamps, shifting utility away from solely handheld devices.

Finally, connectivity and material science represent significant technological advances. The integration of Bluetooth or Wi-Fi connectivity allows for remote control, firmware updates, and synchronization with other hunting electronics, such as rangefinders or cameras. In terms of materials, the utilization of aerospace-grade aluminum alloys (6061 and 7075) and specialized polymer composites enhances durability against drops, impacts, and extreme temperatures, while maintaining a manageable weight. Surface finishing technologies, such as Type III hard anodizing, provide superior scratch and corrosion resistance. The cumulative impact of these technologies is a market offering devices that are exponentially more powerful, durable, and energy-efficient than those available a decade ago, justifying the higher average selling prices of premium brands.

Regional Highlights

- North America (U.S. and Canada)

North America holds the dominant market share in the Hunting Spotlight sector, largely driven by the deeply ingrained hunting tradition, favorable regulatory framework (despite specific state restrictions), and a high concentration of professional and recreational hunters. The United States, in particular, exhibits high demand for premium, long-range LED spotlights, often integrated with vehicle-mounted systems, catering to large-game hunting and expansive property management across states like Texas, Alaska, and regions in the Mountain West. Technological adoption is rapid, with consumers readily investing in the latest high-lumen, rechargeable models. Manufacturers benefit from a well-established retail infrastructure, including major sporting goods chains and specialized outdoor retailers, ensuring broad product accessibility. Safety and quality certifications are paramount to consumer confidence in this region.

Market growth in North America is further supported by the strong presence of key domestic manufacturers who push R&D boundaries in beam control and thermal regulation. The demand for accessories, such as colored filters for reducing animal visibility and pressure-switch activation systems for momentary lighting, is robust. The region also exhibits the highest penetration of vehicle-mounted systems (e.g., remote-controlled rooftop lights) used extensively for tracking and observation activities permitted under local laws. Economic stability and high disposable income ensure that replacement cycles for high-end gear remain relatively short, sustaining continuous demand for cutting-edge products, which often serve as the global benchmark for performance.

- Europe

The European market presents a mixed landscape, characterized by high regulatory complexity and diverse national hunting laws. In many Central and Western European countries, nocturnal hunting using artificial light is heavily restricted or outright banned for certain game, thus restraining the potential market for high-powered spotlights. However, countries with large estates, extensive forestry, and specific wildlife management mandates (e.g., Scandinavian countries and parts of Eastern Europe) still show substantial demand, particularly for spotlights used for tracking wounded game, safety, and general navigation rather than direct harvesting. The European consumer prioritizes high build quality, environmental compliance, and ergonomic design suitable for diverse terrains.

Growth in Europe is primarily focused on versatile, multi-functional lighting tools that can serve hunting, hiking, and general outdoor needs, reflecting a more cautious investment approach compared to North America. Germany and the UK are key markets where quality and precision engineering (often sourced from local specialized manufacturers) are highly valued. The regulatory constraint, however, forces manufacturers to focus on mid-to-high efficiency products that meet stringent local power consumption standards and safety directives. Furthermore, the rising popularity of specialized low-signature lighting, such as infrared (IR) illuminators coupled with passive night vision, indirectly influences the high-end spotlight segment.

- Asia Pacific (APAC)

The Asia Pacific market is demonstrating the fastest growth rate, fueled by rising middle-class income, especially in Australia, New Zealand, and Southeast Asia. Australia and New Zealand, in particular, possess a robust recreational hunting sector and extensive rural areas requiring long-distance lighting for pest control and farm management. These regions often mimic North American demand patterns for high-powered vehicle-mounted and handheld spotlights due to large geographical hunting zones and similar game management practices. The demand for robust, weather-resistant units is critical given the extreme environmental conditions prevalent across the region.

In other parts of APAC, market penetration is lower but accelerating. China and India are emerging as major manufacturing hubs, both for domestic consumption (where local regulations permit) and global export. The focus here is increasingly on balancing cost-effectiveness with performance, leading to fierce competition in the mid-range segment. As regulations standardize and outdoor activities become more popular in countries like Japan and South Korea, the demand for specialized, high-quality gear is expected to grow, driving local distribution partnerships and increased marketing efforts focused on durability and technological features such as extended warranties and superior waterproofing capabilities, crucial for the humid climates typical of many Southeast Asian regions.

- Latin America

The Latin American market is characterized by fragmented demand and varying regulatory oversight. Countries with large rural populations and extensive agricultural areas, such as Brazil and Argentina, show consistent demand for spotlights used in ranching, security, and regulated hunting activities. The primary consumer base often prioritizes affordability and robustness over maximum technological advancement, favoring durable, high-capacity, rechargeable units that can withstand challenging environmental conditions and lack of reliable charging infrastructure in remote areas. Distribution often relies heavily on local importers and wholesalers rather than large centralized retailers.

Market dynamics are highly sensitive to economic fluctuations and currency volatility, which can impact the import cost of advanced lighting components and finished goods. Opportunities exist in targeting professional agricultural users and land managers who require powerful, reliable lighting for perimeter security and wildlife monitoring. Technological upgrades, though slower than in developed markets, are focused on improving battery longevity and enhancing the shock resistance of units. The segment for simpler, more robust Halogen or basic LED spotlights remains relevant due to their lower maintenance needs and lower initial purchase price.

- Middle East and Africa (MEA)

The MEA region presents a niche market, driven by specialized hunting practices and significant security applications. In the Middle East, demand is concentrated among affluent consumers for high-performance, luxury-grade spotlights used in traditional hunting and falconry, where extreme beam throw and precision optics are highly valued. These consumers are typically less price-sensitive and favor brands offering the highest lumens and superior aesthetic design. South Africa represents a major regional hub for both manufacturing and consumption, supporting a large hunting industry, including game reserve management and culling operations, driving demand for powerful, professional-grade equipment.

The African market is diverse, with growth primarily concentrated in areas with commercial game management. Here, ruggedness and reliability in extreme heat are key technical requirements. The application of spotlights in anti-poaching and conservation efforts also creates a steady, high-specification demand stream. Challenges include logistical complexity, high import duties, and limited specialized retail infrastructure outside of key urban and commercial centers. Manufacturers entering this market must offer products specifically engineered to withstand harsh desert or savanna environments, focusing on heat dissipation and dust ingress protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hunting Spotlight Market.- Streamlight

- Fenix

- Cyclops

- Nitecore

- Olight

- Lightforce

- Golight

- SureFire

- Black Diamond

- Ledlenser

- Klarus

- Princeton Tec

- Pelican

- Nightstick

- Wuben

- AceBeam

- Imalent

- ThruNite

- Elzetta

- Maglite

Frequently Asked Questions

Analyze common user questions about the Hunting Spotlight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hunting Spotlight Market?

The Hunting Spotlight Market is projected to grow at a CAGR of 7.2% between 2026 and 2033, driven primarily by technological advances in LED and battery efficiency.

Which light source technology dominates the Hunting Spotlight Market?

LED (Light Emitting Diode) technology currently dominates the market due to its superior efficiency, long lifespan, robustness, and ability to deliver high lumen output with advanced thermal management.

How do regulations impact the growth of the Hunting Spotlight Market?

Strict and varying regional regulations concerning the use of artificial light for nocturnal hunting act as a significant restraint, limiting market expansion in some European and Asian jurisdictions where use is heavily restricted or banned.

Which geographical region holds the largest market share for hunting spotlights?

North America, encompassing the U.S. and Canada, holds the largest market share due to its established hunting culture, high consumer spending on outdoor gear, and relatively permissive regulatory frameworks.

What emerging technologies are being integrated into modern hunting spotlights?

Key emerging technologies include AI-driven predictive battery management systems, dynamic beam adjustment (DBA) based on atmospheric conditions, and connectivity features for synchronization with other smart hunting gear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager