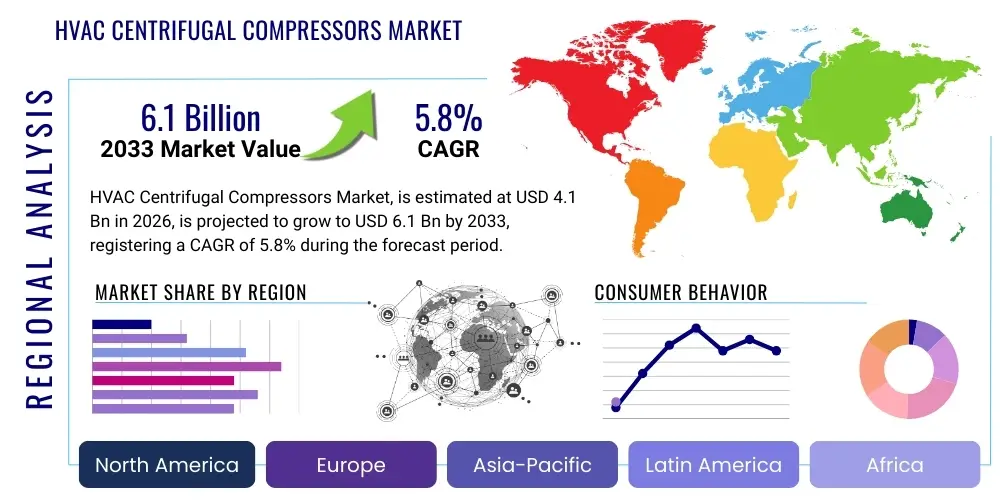

HVAC Centrifugal Compressors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438962 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

HVAC Centrifugal Compressors Market Size

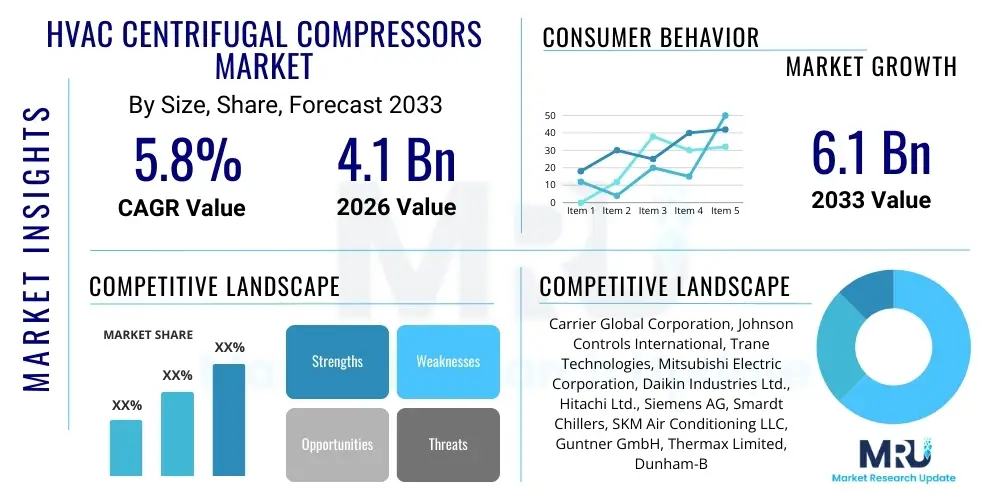

The HVAC Centrifugal Compressors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

HVAC Centrifugal Compressors Market introduction

The HVAC Centrifugal Compressors Market encompasses the global trade and utilization of high-efficiency compressors specifically designed for integration into large-scale Heating, Ventilation, and Air Conditioning (HVAC) chiller systems. These compressors function by accelerating gas radially using an impeller, converting the kinetic energy into pressure energy, a mechanism particularly suitable for handling large volumes of refrigerant flow required in major cooling applications. Centrifugal compressors are predominantly utilized in commercial buildings, industrial complexes, district cooling systems, and large institutional facilities due to their superior efficiency, capacity, and minimal maintenance requirements compared to positive displacement alternatives.

The core product description centers on highly reliable, oil-free or oil-lubricated units characterized by their dynamic compression process, which offers exceptional part-load efficiency, a critical factor in meeting modern energy conservation standards. Major applications span across critical infrastructure such as hospitals, data centers, airports, universities, and large manufacturing plants where uninterrupted, precise temperature control is paramount. The fundamental benefit driving adoption is the outstanding energy efficiency achieved, often enabling systems to meet stringent global energy performance indexes like ASHRAE 90.1 or European Ecodesign directives. Furthermore, their design inherently leads to fewer moving parts that wear out, translating to extended operational life and reduced noise pollution.

Driving factors propelling market growth include rapid urbanization, particularly in emerging economies across Asia Pacific and the Middle East, necessitating the construction of large commercial and mixed-use complexes. Increasing regulatory mandates focused on phase-out of high Global Warming Potential (GWP) refrigerants, pushing manufacturers towards advanced designs compatible with low-GWP refrigerants such as R-1234ze or R-513A, further stimulates innovation and replacement demand. The continuous emphasis on sustainable building design and the imperative to reduce operational costs through energy savings solidify the market trajectory for high-performance centrifugal compressor technology.

HVAC Centrifugal Compressors Market Executive Summary

The HVAC Centrifugal Compressors Market demonstrates robust growth driven by stringent global energy efficiency standards and the widespread construction of massive commercial and institutional infrastructure projects. Current business trends highlight a significant shift towards magnetic bearing and oil-free centrifugal technologies, which promise enhanced reliability, reduced operational friction, and superior lifecycle cost savings, making them highly attractive to building owners seeking minimized maintenance downtime. Key players are aggressively investing in R&D focused on optimization algorithms and integration capabilities with Building Management Systems (BMS) to capitalize on the rising demand for 'smart' HVAC solutions, ensuring compressors operate precisely at optimal load conditions and contributing significantly to the reduction of a building’s overall carbon footprint.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market expansion, fueled by massive industrialization, rapid deployment of data centers, and massive government investment in infrastructure development across China, India, and Southeast Asian nations. North America and Europe, while mature, exhibit strong replacement demand, particularly driven by legislative pressures forcing the retirement of older, less efficient equipment and the mandatory conversion to environmentally benign refrigerants. Segment trends underscore the dominance of multi-stage centrifugal compressors due to their flexibility in handling higher pressure ratios, although single-stage, oil-free designs are rapidly gaining market share, especially in medium-capacity commercial chiller applications, reflecting a strong preference for sustainable and technologically advanced cooling solutions.

The competitive landscape remains moderately concentrated, with established global HVAC giants dominating market share through extensive service networks and integration capabilities. However, specialized component manufacturers focusing solely on core centrifugal technology are disrupting the market by offering highly specialized, customized, and often more efficient oil-free designs. Successfully navigating this market requires manufacturers to prioritize connectivity, energy performance certification, and comprehensive lifecycle support, aligning their product portfolios with the global trajectory towards decarbonization and smart building intelligence.

AI Impact Analysis on HVAC Centrifugal Compressors Market

User queries regarding the impact of Artificial Intelligence (AI) on the HVAC Centrifugal Compressors Market overwhelmingly center on themes of predictive maintenance, energy consumption optimization, and automated fault detection. Users are primarily concerned with how AI integration can extend the lifespan of expensive compressor units, minimize unplanned downtime, and achieve verifiable energy savings beyond standard variable speed drive (VSD) optimizations. The underlying expectation is that AI algorithms, leveraging vast datasets from sensors tracking vibration, temperature, pressure, and power consumption, will move the industry from reactive or preventative maintenance schedules to highly efficient, prescriptive maintenance models, transforming how large-scale chiller plants are managed and maintained globally. This integration promises a higher degree of operational resilience and drastically improved system performance across varying load demands.

AI's immediate influence involves sophisticated control logic embedded within chiller plant controllers. These systems use machine learning to predict optimal compressor staging, speed adjustments, and head pressure settings in real-time based on external weather forecasts, occupancy patterns, and historical performance data. This level of optimization allows the centrifugal compressor to run closer to its peak efficiency envelope for longer periods, maximizing output per unit of energy consumed. Furthermore, the analysis of acoustical and vibrational signatures through AI pattern recognition allows for the early identification of subtle mechanical anomalies, such as bearing degradation or impeller imbalance, months before conventional alarm systems would trigger, enabling proactive scheduling of repairs during off-peak hours.

In the long term, AI is expected to revolutionize compressor design itself. Generative design tools, powered by AI, are being employed to simulate and optimize impeller geometry, diffuser vanes, and casing configurations to maximize aerodynamic efficiency under a wider array of operating conditions, leading to the development of next-generation centrifugal units that are smaller, quieter, and significantly more efficient. This technological evolution transforms the centrifugal compressor from a standalone mechanical component into a fully integrated, intelligent node within a cohesive Building Energy Management System (BEMS), dramatically improving the overall effectiveness and sustainability of modern building operations.

- AI-driven predictive maintenance forecasts component failure, minimizing unplanned downtime.

- Machine learning optimizes compressor staging and speed for maximum energy efficiency at part-load.

- Real-time anomaly detection reduces maintenance costs and extends equipment longevity.

- AI algorithms facilitate integration with smart grids for demand response optimization.

- Generative design optimizes impeller aerodynamics for superior performance and reduced noise.

- Automated fault detection diagnoses system inefficiencies based on operational sensor data.

DRO & Impact Forces Of HVAC Centrifugal Compressors Market

The HVAC Centrifugal Compressors Market is influenced by strong drivers related to global energy efficiency mandates and significant restraints concerning initial capital outlay and technical expertise requirements. Opportunities abound in the development of modular and standardized compressor units compatible with low-GWP refrigerants and integrated smart technologies. These internal factors are further governed by external impact forces such as volatile raw material costs and accelerating technological obsolescence due to rapid innovation in magnetic bearing technology. These forces collectively define the market dynamics, pushing manufacturers towards continuous improvement in performance while balancing cost and regulatory compliance.

Drivers are predominantly centered around the global push for decarbonization, which necessitates the adoption of high-efficiency HVAC solutions. The expansion of commercial and industrial sectors, particularly data centers requiring massive, continuous cooling capacity, acts as a sustained demand driver. Furthermore, the longevity and reliability of centrifugal compressors make them the preferred choice for large infrastructure projects where operational resilience is paramount. This includes the massive wave of infrastructure modernization projects across North America and Europe aimed at replacing aging, environmentally non-compliant cooling equipment with modern, high-performance chillers.

Restraints primarily involve the high upfront cost associated with sophisticated centrifugal units, particularly those incorporating advanced magnetic bearing technology, which can deter smaller enterprises or facilities with restricted capital budgets. Another significant restraint is the specialized technical knowledge required for the installation, commissioning, and long-term maintenance of these complex machines, leading to reliance on highly skilled, and therefore expensive, labor. Market growth is also marginally hindered by the cyclical nature of the construction industry, where large project delays can temporarily suppress demand for high-capacity cooling equipment.

Opportunities lie in the proliferation of oil-free magnetic bearing technology, which eliminates oil management systems, simplifying maintenance and improving overall efficiency. There is a vast opportunity in developing markets for modular and scalable centrifugal compressor solutions suitable for district cooling networks. Furthermore, the integration of IoT and AI capabilities into compressor control systems creates opportunities for service providers to offer high-value, recurring revenue streams through predictive maintenance contracts and energy performance guarantees. The continuous demand for environmentally friendlier equipment presents a perpetual opportunity for innovation in low-GWP refrigerant handling.

Impact Forces include the accelerating regulatory environment regarding refrigerant phase-downs, forcing manufacturers to redesign units rapidly, creating both cost challenges and innovation cycles. The global supply chain volatility, particularly affecting key components like advanced electronics, steel, and specialized rare-earth magnets used in motor assemblies, exerts continuous pressure on manufacturing costs and lead times. Competitive pressure from alternative cooling technologies, such as absorption chillers in specific industrial contexts, also influences market strategy, although centrifugal units maintain dominance in general HVAC applications due to their superior Coefficient of Performance (COP).

Segmentation Analysis

The HVAC Centrifugal Compressors Market is comprehensively segmented based on various technical and application-specific criteria, providing detailed insights into demand patterns across different end-use sectors and technological preferences. Key segments include product type, capacity range, and application, each exhibiting unique growth trajectories influenced by localized regulatory landscapes and technological adoption rates. Understanding these segments is crucial for strategic planning, enabling manufacturers to tailor product development and marketing efforts precisely to the needs of commercial, industrial, and institutional customers globally. The shift towards higher efficiency and larger capacity installations is particularly pronounced in the high-capacity segment driven by the proliferation of mega-scale infrastructure projects.

The segmentation by product type, differentiating between single-stage and multi-stage compressors, reveals a foundational split in design preference. Single-stage compressors are typically favored for medium-lift, high-volume applications where simplicity and cost-effectiveness are priorities, such as many commercial office towers. Conversely, multi-stage units, capable of achieving higher pressure ratios, are essential for extreme cooling requirements or complex industrial processes requiring tighter temperature control and handling diverse operational envelopes. The distinction between oil-lubricated and oil-free types further highlights the trend towards sustainability and reduced maintenance, with oil-free magnetic bearing technology experiencing the most rapid adoption due to its reliability and reduced environmental footprint.

Application-based segmentation provides the clearest view of end-user demand, dominated by the commercial sector, encompassing hospitals, hotels, and retail complexes, all requiring robust and reliable climate control. The industrial sector, including pharmaceuticals, food and beverage processing, and heavy manufacturing, demands highly customized and robust units capable of withstanding harsh operational environments. Institutional applications, such as large university campuses and government buildings, prioritize long-term efficiency and acoustic performance, making oil-free, low-noise units highly desirable. This granular segmentation allows stakeholders to focus resources on the most lucrative and rapidly evolving demand centers, particularly those driven by stringent performance specifications.

- By Product Type:

- Single Stage Centrifugal Compressors

- Multi Stage Centrifugal Compressors

- Oil-Free Centrifugal Compressors (including Magnetic Bearing)

- Oil-Lubricated Centrifugal Compressors

- By Capacity:

- Low Capacity (Below 500 Tons)

- Medium Capacity (500 Tons to 1500 Tons)

- High Capacity (Above 1500 Tons)

- By Application:

- Commercial Buildings (Office, Retail, Hospitality)

- Industrial Facilities (Manufacturing, Process Cooling, Data Centers)

- Institutional and Residential (Hospitals, Universities, District Cooling)

Value Chain Analysis For HVAC Centrifugal Compressors Market

The value chain for HVAC Centrifugal Compressors begins with upstream activities focused on the procurement of critical raw materials and highly specialized components. This stage involves sourcing high-grade alloys (steel, aluminum) for impellers and casings, advanced magnetic materials for oil-free bearings, and high-precision electronic components for control systems and Variable Speed Drives (VSDs). Upstream suppliers are characterized by specialized manufacturing expertise and often operate under stringent quality control standards, making this segment highly critical to the final product quality. Strategic partnerships with reliable component suppliers, especially those providing proprietary magnetic bearing technology, are essential for maintaining competitive advantage and managing supply chain resilience.

The manufacturing stage involves the complex assembly, integration, and precision testing of the core compressor unit. Leading Original Equipment Manufacturers (OEMs) invest heavily in proprietary aerodynamic designs, advanced machining capabilities, and rigorous quality assurance processes to ensure maximum efficiency and reliability under diverse operational conditions. This stage is capital intensive, requiring highly automated production lines and skilled engineering talent. Post-manufacturing, the distribution channel plays a vital role, often categorized into direct and indirect routes. Direct distribution involves large OEMs selling directly to major infrastructure developers, district cooling providers, and critical industrial clients, offering bundled installation and long-term maintenance contracts.

Indirect distribution relies heavily on a network of certified distributors, wholesalers, and HVAC contractors who handle sales, installation, and after-market service for smaller commercial projects and localized markets. These intermediaries are crucial for market penetration and providing localized support, though OEMs maintain tight control over product specifications and service standards through mandated training and certification programs. Downstream analysis focuses on end-user utilization and aftermarket services, including maintenance, repairs, and modernization/retrofit projects. The long operational lifespan of centrifugal compressors makes the aftermarket service segment highly lucrative, often involving the sale of replacement parts, refrigerant management services, and software upgrades for optimized performance, creating strong customer stickiness for manufacturers.

HVAC Centrifugal Compressors Market Potential Customers

The potential customers for HVAC centrifugal compressors are predominantly large-scale entities that require vast and continuous cooling capacity for their operations, making reliability and energy efficiency the paramount purchasing criteria. The primary customer base includes owners and operators of large commercial real estate portfolios, specifically those managing Grade A office buildings, regional shopping malls, and large hospitality chains. These customers purchase compressors either as part of new construction chiller plant installations or during major equipment replacement cycles, driven by a need to meet strict environmental certifications (e.g., LEED, BREEAM) and reduce exorbitant utility costs through superior Coefficient of Performance (COP).

A second major category comprises institutional buyers, including healthcare providers and educational establishments. Large hospitals and medical centers require mission-critical cooling for operating theaters and specialized equipment, making unit redundancy and reliability non-negotiable purchasing factors. Similarly, large university campuses and government complexes invest in centrifugal chillers for centralized cooling plants, often favoring highly efficient, low-noise units that meet governmental procurement mandates for sustainability. These buyers often engage in long-term service contracts, valuing robust supplier relationships and guaranteed long-term technical support.

The fastest-growing segment of potential customers includes operators of industrial facilities, most notably hyperscale data centers, pharmaceutical manufacturing plants, and food and beverage processing facilities. Data centers, in particular, require immense, uninterrupted cooling to manage server heat loads, demanding the highest capacity and reliability features available, often leading them to prefer the latest magnetic bearing, oil-free centrifugal technology for maximum uptime and efficiency. These industrial customers typically possess deep technical knowledge and prioritize highly customized solutions tailored to specific process cooling requirements and tight operational tolerances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carrier Global Corporation, Johnson Controls International, Trane Technologies, Mitsubishi Electric Corporation, Daikin Industries Ltd., Hitachi Ltd., Siemens AG, Smardt Chillers, SKM Air Conditioning LLC, Guntner GmbH, Thermax Limited, Dunham-Bush, Midea Group, Broad Group, Multistack LLC, Hanbell Precise Machinery, Aerzen USA Corporation, Mayekawa Mfg. Co. Ltd., BITZER SE, KAESER KOMPRESSOREN SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVAC Centrifugal Compressors Market Key Technology Landscape

The technology landscape of the HVAC Centrifugal Compressors Market is defined by continuous innovation focused on enhancing energy efficiency, reliability, and environmental compliance. A cornerstone of modern compressor technology is the widespread adoption of Variable Speed Drives (VSDs) or Variable Frequency Drives (VFDs), which allow the compressor motor speed to be precisely modulated according to real-time cooling load demands. This modulation capability is essential because centrifugal compressors operate most efficiently at part-load conditions, which constitute the majority of their operational hours in commercial buildings. VSDs dramatically reduce energy consumption compared to fixed-speed units, positioning them as a fundamental feature for high-performance chillers aiming for superior efficiency ratings.

A second, transformative technology is the integration of magnetic bearings, which facilitates oil-free operation. Magnetic bearings suspend the rotor shaft using electromagnetic forces, eliminating mechanical contact and the need for lubrication systems. This innovation drastically reduces frictional losses, significantly boosts energy efficiency, and eliminates the maintenance associated with oil changes and contamination, leading to vastly improved system reliability and reduced lifecycle costs. Oil-free magnetic bearing technology is particularly attractive to critical applications like data centers where maximizing uptime and minimizing routine maintenance are strategic priorities. This technology is moving from a high-end specialty item to a mainstream offering across medium to high-capacity segments, demonstrating rapid market penetration.

Furthermore, significant technological developments are occurring in the aerodynamic design of the compressor components, specifically the impellers and diffusers. Manufacturers employ advanced computational fluid dynamics (CFD) modeling and iterative testing to optimize impeller geometry, ensuring maximum pressure lift and flow capacity while minimizing parasitic losses. This constant refinement, often supported by AI-driven generative design, results in compressors that can achieve higher Coefficients of Performance (COP) using smaller physical footprints. Coupled with the necessary redesigns for compatibility with low Global Warming Potential (GWP) refrigerants, these aerodynamic advancements ensure that centrifugal compressors remain the technology of choice for high-capacity, energy-conscious cooling applications globally.

Regional Highlights

The global HVAC Centrifugal Compressors Market exhibits distinct regional growth patterns driven by differing regulatory environments, construction activities, and climate requirements. Asia Pacific (APAC) commands the largest market share and is projected to experience the highest growth rate throughout the forecast period. This rapid expansion is primarily attributable to explosive urbanization, extensive infrastructure investments in commercial real estate and industrial parks, and the construction of numerous hyperscale data centers across China, India, and Southeast Asian countries. Governments in these regions are also increasingly pushing for energy efficiency standards in new constructions, indirectly boosting demand for high-performance centrifugal units.

North America and Europe represent mature markets characterized by high adoption rates and advanced technological maturity. Demand in these regions is heavily focused on replacement and retrofit projects, driven by aging infrastructure and increasingly stringent energy and environmental regulations. Specifically, regulations targeting the phase-down of hydrofluorocarbon (HFC) refrigerants are forcing facility owners to upgrade to chillers compatible with newer, low-GWP refrigerants, typically necessitating the replacement of the entire compressor unit. This regulatory push sustains strong, stable demand for high-efficiency, oil-free centrifugal technologies, particularly within commercial and institutional segments.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, present a unique and high-demand market due to extreme climate conditions and massive public investment in mega-projects such as smart cities, airports, and extensive district cooling networks. These projects require vast, continuous cooling capacity, placing centrifugal compressors at the heart of their HVAC strategies. While the African sub-region exhibits slower growth due to economic and infrastructural constraints, the MEA overall is a critical market characterized by demand for the highest capacity and most robust compressor units capable of operating reliably in high ambient temperatures.

- Asia Pacific (APAC): Highest growth driven by urbanization, industrialization, data center proliferation, and mandatory governmental energy efficiency programs in China and India.

- North America: Stable demand primarily driven by regulatory-mandated retrofitting of aging equipment and strong adoption of oil-free magnetic bearing chillers in commercial buildings and healthcare facilities.

- Europe: Replacement market fueled by HFC phase-down regulations (F-Gas Regulation) and focus on meeting nearly zero-energy building (nZEB) standards; strong adoption in central chilling plants and institutional sectors.

- Middle East and Africa (MEA): Critical market defined by extreme climate necessitating large-capacity centrifugal units for district cooling systems and governmental mega-projects in the GCC nations.

- Latin America (LATAM): Moderate growth driven by commercial building development in major economies like Brazil and Mexico, focusing on balancing initial cost with efficiency gains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVAC Centrifugal Compressors Market.- Carrier Global Corporation

- Johnson Controls International

- Trane Technologies

- Mitsubishi Electric Corporation

- Daikin Industries Ltd.

- Hitachi Ltd.

- Siemens AG

- Smardt Chillers

- SKM Air Conditioning LLC

- Guntner GmbH

- Thermax Limited

- Dunham-Bush

- Midea Group

- Broad Group

- Multistack LLC

- Hanbell Precise Machinery

- Aerzen USA Corporation

- Mayekawa Mfg. Co. Ltd.

- BITZER SE

- KAESER KOMPRESSOREN SE

Frequently Asked Questions

Analyze common user questions about the HVAC Centrifugal Compressors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of centrifugal compressors over screw or reciprocating compressors in HVAC systems?

Centrifugal compressors are preferred for large-scale HVAC applications due to their superior energy efficiency, especially at part-load conditions (higher COP), higher cooling capacity range, greater reliability due to fewer moving parts, and lower operational noise levels. They are the standard for massive chiller plants in commercial and institutional settings.

How is the global phase-down of HFC refrigerants impacting the design and sales of centrifugal compressors?

The phase-down mandates the redesign of compressors to operate efficiently with low Global Warming Potential (GWP) refrigerants such as R-1234ze or R-513A. This regulatory pressure accelerates the replacement cycle for older equipment and drives manufacturers to innovate new impeller and casing designs optimized for these new refrigerant properties, ensuring environmental compliance and sustained market relevance.

What role does magnetic bearing technology play in the modern centrifugal compressor market?

Magnetic bearing technology eliminates the need for oil lubrication systems by using magnetic fields to levitate the shaft. This results in superior energy efficiency by eliminating frictional losses, reduces maintenance complexity and cost, and drastically increases the overall reliability and uptime, making oil-free units the premium choice for critical cooling applications like data centers.

Which geographical region is currently leading the demand and growth in the HVAC Centrifugal Compressors Market?

The Asia Pacific (APAC) region is leading both demand and projected growth due to extensive infrastructure development, rapid urbanization, and massive government and private investments in commercial buildings, industrial facilities, and hyperscale data centers, particularly in countries such as China and India.

What is the typical operational lifespan of a modern HVAC centrifugal compressor, and what factors affect its longevity?

A well-maintained HVAC centrifugal compressor typically has an operational lifespan of 20 to 30 years. Key factors affecting longevity include the use of sophisticated predictive maintenance systems, consistent water and oil quality management (for lubricated units), minimizing continuous operation outside design parameters, and adopting advanced technologies like oil-free magnetic bearings which inherently reduce mechanical wear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager