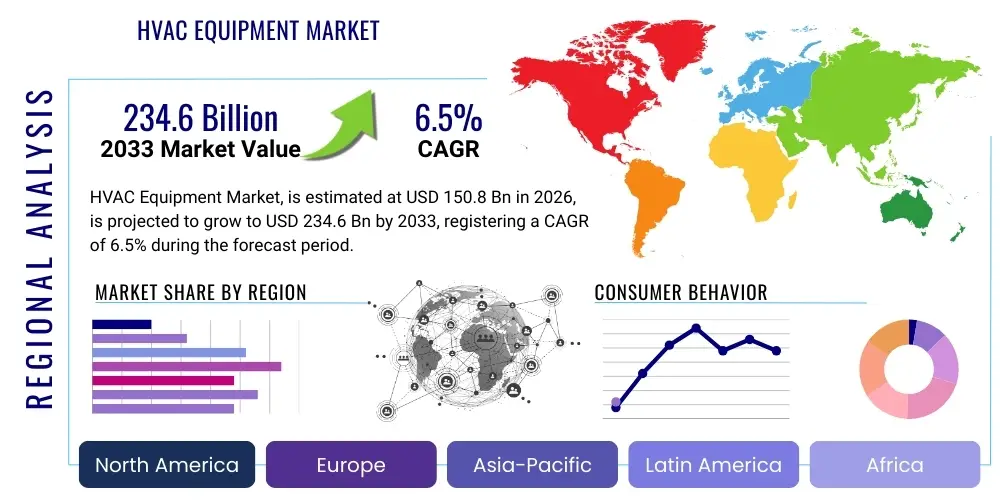

HVAC Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437857 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

HVAC Equipment Market Size

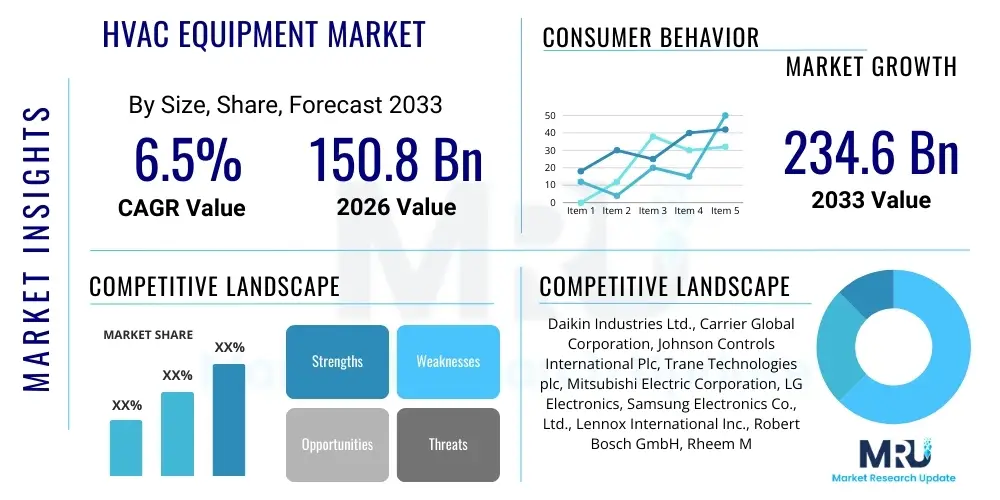

The HVAC Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 150.8 Billion in 2026 and is projected to reach USD 234.6 Billion by the end of the forecast period in 2033.

HVAC Equipment Market introduction

The HVAC (Heating, Ventilation, and Air Conditioning) Equipment Market encompasses a broad range of technologies designed to maintain acceptable indoor air quality and thermal comfort. This market includes essential components such as unitary air conditioners, chillers, heat pumps, furnaces, boilers, and specialized ventilation systems. These products are crucial for temperature regulation, humidity control, and air purification across diverse environments, ranging from residential homes and large commercial complexes to specialized industrial manufacturing facilities. The fundamental purpose of HVAC equipment is to optimize energy usage while simultaneously enhancing the health and productivity of building occupants, a requirement increasingly formalized through global energy efficiency standards and building codes.

Major applications of HVAC equipment span the residential sector, driven by new housing construction and replacement demand; the commercial sector, dominating consumption through office buildings, retail spaces, data centers, and healthcare facilities; and the industrial sector, where precise temperature and environmental control are mandatory for manufacturing processes and equipment protection. Key benefits derived from modern HVAC systems include significant reductions in energy consumption through inverter technology and smart thermostats, improved occupant comfort, and enhanced health outcomes via superior filtration and ventilation techniques, particularly crucial in mitigating airborne diseases and allergens. The technological progression towards systems utilizing low Global Warming Potential (GWP) refrigerants further solidifies the market's alignment with stringent global environmental mandates.

Driving factors propelling market expansion include rapid global urbanization, leading to extensive infrastructure development and increased demand for conditioned spaces in emerging economies, particularly across Asia Pacific. Furthermore, regulatory mandates focusing on decarbonization and energy performance in mature markets like North America and Europe necessitate the widespread adoption of high-efficiency, sustainable HVAC solutions, such as magnetic bearing chillers and integrated heat pump systems. The growing consumer awareness regarding indoor air quality (IAQ) and the integration of advanced connectivity features (IoT and AI) into HVAC units further stimulate market growth, transforming these essential utilities into core components of modern, energy-efficient building management systems.

HVAC Equipment Market Executive Summary

The global HVAC Equipment Market is poised for substantial growth, primarily fueled by stringent energy efficiency regulations and the accelerating integration of smart building technologies. Business trends indicate a strong industry shift towards sustainability, characterized by intense R&D investment in heat pump technology, which offers superior energy performance compared to traditional boiler/furnace setups, especially in residential and light commercial applications. Key market leaders are focusing on vertically integrating smart services, offering predictive maintenance, and optimizing system performance through cloud-based analytics, thereby transitioning from pure equipment providers to comprehensive climate control solution providers. Consolidation among smaller regional players by large conglomerates is also a notable trend, aimed at expanding geographic reach and acquiring specialized technology patents related to AI-driven building automation.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by massive infrastructure spending, rising middle-class disposable incomes, and the necessity for cooling solutions in rapidly developing urban centers, particularly India and China. North America and Europe, while being mature markets, exhibit high growth potential in the replacement and retrofitting segment, mandated by governmental schemes promoting the decommissioning of older, less efficient systems and the mandatory adoption of low-GWP refrigerants. Regulatory frameworks like the European Union's F-Gas Regulation and efficiency targets set by the U.S. Department of Energy are key mechanisms accelerating the sales cycle for high-efficiency, sustainable equipment across these regions.

Segmentation trends reveal that the Heat Pumps segment is experiencing disproportionately high growth across all major end-user verticals, primarily due to their dual functionality (heating and cooling) and exceptional efficiency ratings. Within the application segment, the Commercial sector remains the largest consumer, driven by continuous expansion in data centers, healthcare infrastructure, and logistics facilities, all requiring robust, reliable, and energy-conscious climate control. Technologically, the adoption of Inverter Technology, which allows variable compressor speed, is standardizing across all product categories, offering superior load matching capabilities and reducing overall operating costs, thus driving consumer preference across both residential and commercial purchasers seeking long-term value.

AI Impact Analysis on HVAC Equipment Market

Common user questions regarding the impact of AI on the HVAC Equipment Market frequently revolve around quantifying energy savings, understanding the complexity and cost of integration, and assessing the future necessity of human intervention in system management. Users are highly interested in how AI can move systems beyond simple programmed schedules to true predictive optimization, answering questions like: "How much energy can I realistically save using AI vs. a standard smart thermostat?" and "Will AI integration require a complete system overhaul or just software upgrades?" The core themes emerging from this analysis include the potential for radical operational efficiency improvements, the shift toward proactive fault detection rather than reactive repair, and the increasing reliance on data analytics to fine-tune indoor climate based not just on temperature but on occupancy patterns and external weather forecasts. Users expect AI to deliver highly personalized comfort with minimal energy wastage, pushing manufacturers to develop robust, secure, and user-friendly AIoT platforms.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally transforming the operating paradigm of HVAC systems, moving them from static components to dynamic, self-optimizing ecosystems. AI algorithms process vast amounts of data collected from thousands of sensor points—including occupancy sensors, temperature probes, humidity detectors, and external weather feeds—to build complex models of building energy consumption and thermal dynamics. This data-driven approach allows the system to accurately predict future heating or cooling needs and modulate operation proactively, ensuring optimal comfort is achieved just-in-time while minimizing unnecessary run cycles. For instance, in commercial buildings, AI learns daily and seasonal occupancy patterns, ensuring specific zones are conditioned only when required, leading to demonstrable reductions in utility expenses and extending equipment lifespan through reduced stress.

Furthermore, AI significantly enhances the maintenance and reliability of high-value HVAC assets. By continuously monitoring operational parameters such as vibration, refrigerant pressure, and motor current draw, ML models can identify subtle anomalies that precede catastrophic failures. This predictive maintenance capability allows facility managers to schedule interventions—such as replacing a failing bearing or topping off refrigerant—before the system breaks down entirely, drastically reducing downtime and the associated costs of emergency repairs. This shift to predictive fault detection not only improves operational efficiency but also provides a powerful competitive differentiator for manufacturers offering these advanced digital services, monetizing data alongside hardware sales. The ability of AI to rapidly diagnose and resolve issues remotely further reduces the carbon footprint associated with maintenance visits, aligning with broader sustainability goals.

- AI enables predictive maintenance, reducing unplanned downtime by up to 30%.

- Generative modeling optimizes system setpoints based on real-time occupancy and thermal load, achieving 10-20% energy savings.

- Machine Learning facilitates autonomous fault detection and diagnosis (AFDD), improving system reliability and extending asset life.

- AI algorithms are crucial for optimizing complex integrated building management systems (BMS), coordinating HVAC, lighting, and security.

- Natural Language Processing (NLP) integration enhances user interfaces, allowing verbal control and personalized comfort settings.

DRO & Impact Forces Of HVAC Equipment Market

The HVAC Equipment Market dynamics are characterized by a strong interplay between regulatory pressure and technological advancement. The primary Drivers include global legislative efforts focused on reducing greenhouse gas emissions and improving building energy performance, which necessitate the adoption of energy-efficient products like variable refrigerant flow (VRF) systems and high-efficiency heat pumps. These regulatory requirements, coupled with rapid urbanization and industrial growth in developing economies, ensure a persistent, high demand for new and replacement units. Conversely, significant Restraints challenge market expansion, primarily stemming from the high upfront capital cost of installing advanced, efficient systems compared to conventional equipment, which can deter adoption in price-sensitive emerging markets or smaller residential projects. Furthermore, a substantial gap exists in the availability of skilled technicians trained to install, maintain, and troubleshoot complex, AI-integrated HVAC equipment, posing a limitation on service delivery and market scalability.

Opportunities for growth are concentrated in the realm of sustainable technology and digitalization. The global mandate to phase out high Global Warming Potential (GWP) refrigerants (e.g., R-410A) under international agreements like the Kigali Amendment creates a massive opportunity for manufacturers investing in low-GWP alternatives such as R-32, R-290, and R-1234yf, driving a complete cycle of system replacement. Additionally, the growing focus on Indoor Air Quality (IAQ) following global health crises presents a significant opportunity for advanced ventilation, filtration (e.g., HEPA and UV-C purification systems), and humidity control equipment integration into standard HVAC offerings. The digitalization of the built environment through IoT, Big Data, and cloud services opens up new revenue streams through subscription-based predictive maintenance and energy optimization services, fundamentally altering traditional business models.

The Impact Forces governing this market are characterized by intense competition centered on efficiency standards and technological leapfrogging. Regulatory impact forces compel continuous innovation, ensuring that manufacturers must consistently meet or exceed minimum efficiency ratings (e.g., SEER, EER) to remain competitive. Economic forces, such as fluctuating raw material costs (e.g., copper, steel) and energy prices, directly influence production costs and end-user adoption rates, making supply chain resilience a crucial competitive factor. The rapid evolution of impact forces tied to digitalization means that companies that successfully integrate seamless connectivity and AI capabilities into their core product offerings will capture premium segments of the commercial and high-end residential markets, while traditional hardware-centric firms face accelerated margin erosion. This environment necessitates robust lobbying efforts to shape future regulatory landscapes and substantial investment in training the next generation of HVAC service professionals.

Segmentation Analysis

The HVAC Equipment Market is comprehensively segmented based on product type, technology adopted, end-user application, and regional distribution, offering a granular view of market dynamics. Analysis of these segments is vital for understanding specific demand drivers and investment priorities across the industry value chain. The product segmentation, covering foundational units like chillers and furnaces, highlights the core mechanical requirements, while the technology segmentation, focusing on inverter and smart features, reflects the pace of digital transformation and energy optimization. End-user segmentation reveals the differing demands and scale requirements between highly decentralized residential consumers and large, complex commercial/industrial facilities, which prioritize reliability and customization.

- By Equipment Type:

- Unitary Air Conditioners (Split, Window, Packaged)

- Heat Pumps (Air-to-Air, Ground Source)

- Chillers (Scroll, Screw, Centrifugal)

- Furnaces

- Boilers

- Ventilation Equipment (Air Handling Units, Air Purifiers, Fans)

- By Technology:

- Inverter Technology

- Non-Inverter Technology

- Smart/Connected HVAC Systems

- By Application (End-User):

- Residential

- Commercial (Office, Retail, Hospitality, Healthcare, Education)

- Industrial (Manufacturing, Data Centers, Power Generation)

- By Refrigerant Type:

- HFCs

- Natural Refrigerants (Ammonia, CO2, Hydrocarbons)

- HFOs and Blends

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For HVAC Equipment Market

The Value Chain for the HVAC Equipment Market begins with the upstream activities centered on the procurement and processing of fundamental raw materials, including metals such as copper, aluminum, and steel, alongside critical electronic components like microprocessors, sensors, and compressors. Upstream analysis reveals that price volatility in key commodities significantly impacts manufacturing costs, making supplier relationship management and long-term procurement contracts essential for maintaining competitive pricing and stable production. Core component manufacturing, particularly for high-efficiency compressors (e.g., variable speed and scroll compressors) and microcontrollers, often involves specialized, patented technology, positioning these component suppliers as critical choke points within the chain. Successful market participants must secure reliable and quality-assured sources for these complex parts, as component quality directly determines the efficiency rating and longevity of the final HVAC unit.

Midstream activities involve the complex processes of manufacturing, assembly, and integration. This stage is dominated by large, multinational Original Equipment Manufacturers (OEMs) who leverage advanced automation and lean manufacturing principles to produce diverse product lines, adhering to country-specific regulatory standards (like SEER ratings in the US or Eurovent certification in Europe). The integration of smart features, connectivity modules (IoT), and proprietary control algorithms occurs during this phase. Distribution channels are highly varied, relying heavily on specialized wholesale distributors, original equipment manufacturers’ direct sales forces, and increasingly, specialized certified contractors. The complexity of installation and the necessity for specific regulatory compliance means that direct-to-consumer sales remain limited, primarily confined to simpler window or portable units, emphasizing the dominant role of the professional channel.

Downstream analysis focuses on installation, maintenance, and end-of-life service. Direct and indirect distribution channels operate concurrently: direct sales are typically reserved for large, customized commercial or industrial projects (e.g., selling large chillers directly to hospitals or data centers), ensuring close control over project specifications and commissioning. Indirect channels, predominantly through authorized dealers and certified HVAC contractors, manage the bulk of residential and light commercial sales. These contractors are crucial for translating product specifications into successful installations and are the primary touchpoint for recurring revenue generated through maintenance contracts and replacement cycles. The increasing adoption of digital services, such as remote diagnostics and predictive maintenance platforms, is shifting the downstream focus from purely mechanical service to a blend of hardware support and software management, requiring distributors and contractors to rapidly upskill their workforce.

HVAC Equipment Market Potential Customers

The primary end-users and potential customers of the HVAC Equipment Market are broadly categorized into three major sectors: residential, commercial, and industrial, each possessing distinct procurement criteria and scale requirements. Residential customers, driven primarily by comfort, energy savings, and initial investment cost, constitute a highly distributed market segment. Key drivers for residential purchases include new home construction, mandated replacement cycles for aging units, and voluntary upgrades prompted by utility rebates or the desire for smart home integration. This segment often favors standardized, easy-to-install units like split systems and ducted furnaces, with a rapidly increasing preference for high-efficiency heat pumps due to governmental incentives aimed at decarbonization.

The Commercial sector represents the largest value segment, encompassing diverse sub-segments such as retail, corporate offices, educational institutions, hospitality (hotels), and critical healthcare facilities. Commercial buyers prioritize total cost of ownership (TCO), system reliability, redundancy, and adherence to strict indoor air quality (IAQ) and energy codes. For instance, hospitals require specialized HVAC systems with stringent air filtration and pressure control, while large office complexes focus on centralized, highly efficient chiller systems and integrated Building Management Systems (BMS). Procurement decisions in this segment are characterized by long sales cycles involving engineering consultants, facility managers, and institutional budget approvals, often favoring customizable Variable Refrigerant Flow (VRF) or centralized chiller plants capable of managing multiple zones effectively.

Industrial users, including manufacturing plants, data centers, and specialized processing facilities, constitute a unique segment where process control often supersedes human comfort as the primary driver. Data centers, in particular, represent a high-growth market demanding robust, continuous cooling capacity with zero tolerance for downtime, driving the adoption of specialized precision cooling technologies and redundant chiller arrangements. Manufacturing facilities, conversely, may require temperature control for product quality (e.g., pharmaceuticals or electronics) or specialized ventilation equipment to manage contaminants. Industrial procurement emphasizes reliability, scalability, and adherence to severe operational requirements, often leading to direct sales relationships with OEMs for custom-engineered HVAC solutions that must integrate seamlessly with complex plant automation systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.8 Billion |

| Market Forecast in 2033 | USD 234.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin Industries Ltd., Carrier Global Corporation, Johnson Controls International Plc, Trane Technologies plc, Mitsubishi Electric Corporation, LG Electronics, Samsung Electronics Co., Ltd., Lennox International Inc., Robert Bosch GmbH, Rheem Manufacturing Company, York International Corporation (JCI subsidiary), CIAT Group (Carrier subsidiary), Danfoss A/S, Honeywell International Inc., Siemens AG, Panasonic Corporation, Nortek Global HVAC, Ingersoll Rand Inc., Midea Group Co., Ltd., Fujitsu General Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVAC Equipment Market Key Technology Landscape

The HVAC Equipment Market is undergoing a rapid technological transformation, primarily driven by the imperatives of energy efficiency, connectivity, and environmental sustainability. A cornerstone of this evolution is the pervasive adoption of Variable Speed or Inverter Technology, which allows the compressor motor speed to be adjusted dynamically to match the exact cooling or heating load required, rather than operating in a simple on/off cycle. This capability drastically reduces energy consumption, improves humidity control, and minimizes wear and tear, making inverter-driven units the industry standard across unitary ACs and heat pumps. This technological shift is complemented by significant advancements in compressor design, including the use of magnetic bearings in large-scale centrifugal chillers, which eliminate oil and friction losses, achieving market-leading Coefficient of Performance (COP) ratings essential for major commercial installations.

A second crucial technological vector is the rapid digitalization of HVAC systems, transforming isolated units into interconnected components of the Internet of Things (IoT) and smart building platforms. Modern HVAC units are embedded with advanced sensors, communication modules (Wi-Fi, Zigbee, BACnet), and powerful edge computing capabilities. This connectivity facilitates features such as remote monitoring, diagnostics, and over-the-air software updates, enabling seamless integration with Building Management Systems (BMS) and third-party energy optimization software. Furthermore, the convergence of HVAC with sophisticated indoor air quality (IAQ) management technologies, including advanced HEPA filtration, specialized UV-C light sterilization systems, and carbon dioxide monitoring, has become paramount. This integration allows systems to modulate ventilation rates based on real-time IAQ parameters, improving occupant health while maintaining energy efficiency.

Finally, material science and fluid dynamics are driving innovation in system efficiency and environmental impact. The development and mandated transition toward low Global Warming Potential (GWP) refrigerants, such as HFOs (hydrofluoroolefins) and natural alternatives (e.g., propane, CO2), require significant redesigns of heat exchangers and system components to safely and efficiently handle these new working fluids, some of which are mildly flammable. This transition necessitates manufacturers to invest heavily in material compatibility and safety features. Another emerging technology is geothermal HVAC, or ground source heat pumps, which utilize the stable temperature of the earth to provide extremely efficient heating and cooling, particularly favored in regions with supportive regulatory frameworks and suitable geological conditions, offering a highly sustainable, albeit complex, installation alternative.

Regional Highlights

Regional variations in climate, regulatory standards, economic development, and energy infrastructure profoundly shape the dynamics of the HVAC Equipment Market globally. The market is broadly classified into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA), each presenting unique growth trajectories and technological adoption patterns. Understanding these regional nuances is critical for manufacturers developing market entry and product localization strategies. Regulatory stringency, such as mandated efficiency minimums or refrigerant phase-downs, often dictates the pace of technology adoption within a specific geographic area.

North America: This region is characterized by a mature market heavily influenced by stringent energy efficiency standards, notably SEER (Seasonal Energy Efficiency Ratio) mandates in the U.S. and equivalent standards in Canada. The market exhibits high demand for replacement and retrofitting of aging commercial infrastructure. Growth is strongly correlated with the increasing demand for high-efficiency heat pumps, driven by state-level decarbonization goals and significant utility incentive programs encouraging the transition away from fossil-fuel-based heating. The commercial sector, particularly data centers and large institutional buildings, drives the demand for specialized, high-capacity chillers and advanced centralized Building Management Systems (BMS).

Europe: The European market is the global leader in legislative mandates promoting sustainable HVAC solutions, notably the F-Gas Regulation driving the phase-down of high-GWP refrigerants and the Energy Performance of Buildings Directive (EPBD). This legislative pressure has established Europe as the most rapidly growing market for high-efficiency air-to-water and air-to-air heat pumps, often integrated with renewable energy sources. Scandinavian countries and Germany lead in the adoption of district heating and sophisticated ventilation systems prioritizing IAQ. The focus here is less on basic cooling and more on integrated heating and ventilation solutions that meet near-zero energy building requirements.

Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, fueled by unprecedented infrastructure development, rapid urbanization, and rising middle-class disposable incomes, particularly in China, India, and Southeast Asian nations. The demand is dominated by residential and light commercial cooling equipment. While price sensitivity remains a factor, there is increasing demand for inverter technology due to grid stability issues and rising electricity costs. Manufacturers prioritize scaling production capacity and developing affordable, reliable products tailored to diverse climatic conditions, ranging from tropical heat to extreme continental cold.

Latin America: This region presents localized growth pockets, particularly in major economies like Brazil and Mexico, driven by commercial expansion and residential cooling needs. Market penetration of advanced technologies, while growing, often lags behind mature markets, with a prevalence of simpler, non-inverter-based unitary AC systems still dominating the residential landscape. Political and economic instability can temper growth, leading manufacturers to prioritize strong local distribution networks and flexible product financing options to encourage adoption.

Middle East & Africa (MEA): The Middle East, characterized by extreme cooling requirements and large construction projects (commercial and hospitality), drives high demand for robust, reliable, and powerful chillers and ducted systems. Energy efficiency is a key consideration due to the region's intense energy consumption profile. Africa remains a nascent market, with growth focused on key economic hubs and driven by infrastructure investment and urbanization, presenting opportunities for durable, easily maintainable, mid-efficiency equipment designed for challenging environmental conditions.

- North America: Focuses on high-efficiency heat pumps and regulatory compliance (SEER/EER standards); strong retrofitting market.

- Europe: Driven by F-Gas phase-down, EPBD requirements, and leading adoption of air-to-water heat pumps for decarbonization.

- Asia Pacific: Largest growth region, dominated by residential cooling demand, new construction, and rapid adoption of inverter technology in key urban centers.

- Latin America: Characterized by growth in major economies (Brazil, Mexico) and increasing commercial infrastructure development.

- Middle East & Africa: High demand for robust cooling capacity (chillers) and specialized systems in new mega-projects; efficiency driven by intense energy usage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVAC Equipment Market.- Daikin Industries Ltd.

- Carrier Global Corporation

- Johnson Controls International Plc

- Trane Technologies plc

- Mitsubishi Electric Corporation

- LG Electronics

- Samsung Electronics Co., Ltd.

- Lennox International Inc.

- Robert Bosch GmbH

- Rheem Manufacturing Company

- York International Corporation (JCI subsidiary)

- CIAT Group (Carrier subsidiary)

- Danfoss A/S

- Honeywell International Inc.

- Siemens AG

- Panasonic Corporation

- Nortek Global HVAC

- Ingersoll Rand Inc.

- Midea Group Co., Ltd.

- Fujitsu General Ltd.

Frequently Asked Questions

Analyze common user questions about the HVAC Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of new HVAC equipment?

The primary driver is stringent governmental regulations globally focused on energy efficiency (e.g., SEER standards, EPBD in Europe) and environmental mandates requiring the phase-out of high Global Warming Potential (GWP) refrigerants, compelling consumers and businesses to upgrade to sustainable, high-efficiency systems like heat pumps and inverter technology units.

How is AI impacting the maintenance of commercial HVAC systems?

AI integration facilitates predictive maintenance, moving away from scheduled or reactive repairs. Machine Learning algorithms analyze real-time operational data to detect subtle anomalies, predicting equipment failure before it occurs, which significantly reduces downtime, lowers operational costs, and extends the lifespan of expensive assets.

Which HVAC equipment segment is growing the fastest?

The Heat Pumps segment (both air-to-air and air-to-water) is currently experiencing the fastest growth across residential and light commercial applications, primarily due to global policy shifts promoting electrification of heating systems as a key strategy for achieving decarbonization goals.

What challenges do manufacturers face in adopting low-GWP refrigerants?

Manufacturers face significant challenges including the need for substantial system redesigns to safely handle mildly flammable refrigerants (like R-32 or R-290), higher initial manufacturing costs, and the necessity to train installation and service personnel extensively on new safety protocols and handling requirements.

What is the forecast for the HVAC equipment market size by 2033?

The HVAC Equipment Market is projected to reach approximately USD 234.6 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period (2026-2033), driven mainly by infrastructure expansion in Asia Pacific and efficiency mandates in developed economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HVAC Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Air Conditioning Equipment, Heating Equipment, Heat Pumps, Dehumidifiers & Humidifiers), By Application (Residential, Industrial, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Hvac Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Split Systems, Hybrid Split Systems, Duct-Free Systems, Packaged Heating and Air Systems), By Application (Residential, Commercial, Industrial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager