HVAC Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432162 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

HVAC Services Market Size

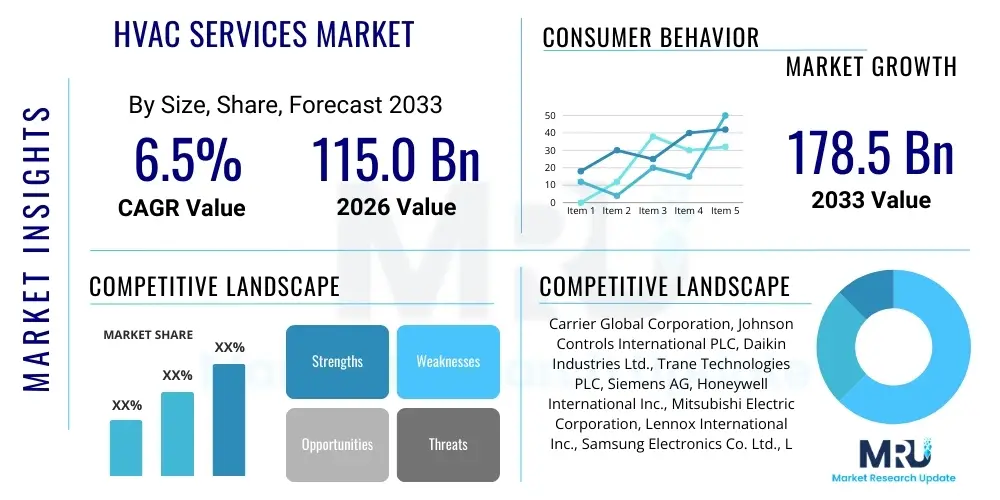

The HVAC Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 115.0 Billion in 2026 and is projected to reach USD 178.5 Billion by the end of the forecast period in 2033.

HVAC Services Market introduction

The HVAC Services Market encompasses all professional activities related to the installation, maintenance, repair, and replacement of Heating, Ventilation, and Air Conditioning systems across residential, commercial, and industrial sectors. These services are foundational to ensuring optimal indoor air quality, thermal comfort, and energy efficiency of buildings. The necessity for reliable HVAC services is fundamentally driven by global climate variability, stringent governmental regulations concerning energy consumption and carbon emissions, and the growing complexity of modern smart HVAC systems that require specialized expertise for upkeep and integration. Furthermore, preventative maintenance services, a significant component of this market, are gaining traction as building owners seek to extend the lifespan of expensive equipment and reduce operational downtime, shifting the market focus from purely reactive repair to proactive, long-term asset management strategies.

Modern HVAC systems are sophisticated pieces of technology, integrating advanced sensors, digital controls, and connectivity features, which significantly broadens the scope of services required. Key applications of these services extend beyond simple temperature control; they include humidity management, air filtration (crucial for health institutions and clean rooms), and integrated building management systems (BMS) optimization. The primary benefits derived from professional HVAC services include substantial reductions in energy costs due to optimized system performance, improved occupant health and productivity resulting from superior indoor air quality (IAQ), and compliance with various environmental, health, and safety standards. The sustained urbanization across developing economies, coupled with significant growth in the construction of energy-efficient ‘green’ buildings, is continuously creating robust demand for skilled service technicians capable of handling these high-tech installations and adhering to rigorous performance benchmarks.

Major driving factors sustaining the market's robust growth trajectory include the accelerating adoption of smart home and smart building technologies, which necessitate complex integration services. Simultaneously, the global imperative to transition away from ozone-depleting refrigerants (as mandated by international agreements like the Kigali Amendment) is spurring massive retrofitting and replacement cycles, particularly in developed regions. Additionally, extreme weather events, which increase the dependency on climate control systems, necessitate urgent and frequent repair and maintenance services, contributing significantly to market volume. The rising public awareness regarding the critical importance of IAQ, amplified by recent global health crises, has also made regular, high-standard ventilation and air purification services indispensable across all market segments.

HVAC Services Market Executive Summary

The HVAC Services Market is characterized by steady growth driven by regulatory compliance, technological evolution, and increasing consumer focus on energy efficiency and indoor health. Business trends indicate a strong move towards service contracts and subscription-based maintenance models, providing stable, recurring revenue streams for service providers. Consolidation among small and medium-sized enterprises (SMEs) is prevalent as larger market players seek to acquire specialized technical expertise and expand geographical coverage, particularly in fragmented service regions. The industry is also witnessing significant investment in digital tools for field service management (FSM), including mobile applications and remote diagnostics, enhancing technician efficiency and customer responsiveness. Furthermore, the push for smart connectivity facilitates predictive maintenance, shifting the business model from break-fix to data-driven operational optimization, resulting in enhanced customer satisfaction and maximized equipment uptime across commercial and industrial installations.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market due to rapid industrialization, massive infrastructure development, and increasing disposable incomes leading to higher adoption of comfort cooling solutions in residential settings. North America and Europe, while mature, maintain leading market shares owing to stringent governmental mandates regarding carbon neutrality, mature building codes requiring high-efficiency systems, and significant opportunities arising from aging infrastructure replacement and commercial building retrofitting projects. These developed markets are pioneers in adopting IoT-enabled HVAC systems and integrating services with sophisticated Building Energy Management Systems (BEMS). The Middle East and Africa (MEA) exhibit specific demand patterns, heavily skewed towards cooling services due to extreme climatic conditions, driving substantial investment in large-scale cooling infrastructure and specialized maintenance contracts for district cooling systems.

Segmentation trends highlight the increasing dominance of the maintenance and repair segment, which consistently generates the highest revenue due to the cyclical nature of equipment servicing required to sustain operational warranties and efficiency standards. Within end-users, the commercial sector, encompassing offices, retail spaces, and hospitality, accounts for the largest market share, driven by mandatory regulatory checks and high occupancy rates demanding reliable climate control. Technology-wise, the trend is unequivocally favoring services for high-efficiency variable refrigerant flow (VRF) systems and heat pump technologies, reflecting the global transition towards electrified heating and cooling. Service providers are increasingly specializing in system integration—combining heating, cooling, ventilation, and air quality monitoring into unified, centrally managed service packages to maximize system synergy and client value proposition.

AI Impact Analysis on HVAC Services Market

Common user questions regarding AI in the HVAC Services Market center on how artificial intelligence can move maintenance beyond the traditional scheduled or reactive model. Users frequently inquire about the reliability of AI-driven predictive failure detection, the necessary investment in sensing equipment, and the training required for technicians to utilize AI-generated insights effectively. Key themes revolve around expected cost savings from minimized breakdowns, the viability of real-time energy optimization algorithms in complex building environments, and the competitive disruption AI poses to traditional service companies. There is significant interest in understanding how AI can personalize climate control based on occupant behavior and how service providers will handle the cybersecurity risks associated with networked, AI-managed building systems, making data privacy and system vulnerability a central concern for end-users contemplating advanced AI adoption.

The implementation of Artificial Intelligence is fundamentally transforming the delivery of HVAC services by enabling genuine predictive maintenance (PdM). AI algorithms analyze vast datasets streaming from IoT sensors embedded in HVAC units—data including vibration metrics, temperature fluctuations, pressure readings, and run times—to accurately predict potential equipment failures days or weeks before they occur. This capability allows service companies to schedule repairs proactively, minimizing costly downtime for commercial and industrial clients, and ensuring technicians arrive with the correct parts and tools, boosting first-time fix rates significantly. This data-driven approach shifts service operations from reactive emergency calls to highly efficient, planned interventions, maximizing asset lifespan and optimizing technician routing and workload distribution based on criticality assessments.

Beyond maintenance, AI significantly contributes to energy efficiency optimization. Machine learning models continuously monitor building usage patterns, external weather conditions, and internal thermal loads to adjust system setpoints and operational parameters in real-time, far surpassing the capabilities of static programmed schedules. This dynamic optimization ensures that systems only consume the necessary energy to maintain desired comfort levels, resulting in measurable operational cost reductions for building owners. AI also aids in system commissioning and calibration, rapidly identifying discrepancies between designed and actual performance, thereby accelerating the deployment of new, complex HVAC installations and ensuring immediate peak efficiency performance upon handover to the client, further cementing its role as a core technological driver in the services sector.

- Increased implementation of Predictive Maintenance (PdM) models, reducing unforeseen system failures.

- Real-time energy optimization algorithms for autonomous system adjustments based on occupancy and weather.

- Enhanced remote diagnostics and troubleshooting, minimizing the need for immediate physical site visits.

- Optimization of field service logistics, including improved technician scheduling and inventory management.

- Development of AI-powered digital twins for simulated testing of repair scenarios and system upgrades.

- Improved customer experience through personalized climate control and automated issue reporting.

- Data analytics leading to faster identification of root causes for recurrent system inefficiencies.

DRO & Impact Forces Of HVAC Services Market

The HVAC Services Market is substantially influenced by the synergy of stringent environmental regulations (Drivers), the substantial capital costs associated with system replacement (Restraints), and the emerging opportunities in integrating smart technologies and sustainable cooling solutions (Opportunities). The primary impact forces include government mandates pushing for decarbonization and energy performance standards, creating a non-discretionary demand for high-efficiency system maintenance and retrofitting services. Furthermore, the volatility of energy prices directly increases the financial incentive for end-users to invest in performance optimization services, ensuring maximum efficiency from their installed base. These dynamics ensure that even during economic downturns, the essential nature of climate control and compliance obligations sustains the core demand for professional HVAC services, especially in the commercial and industrial segments where uptime is critical.

Drivers: A paramount driver is the rising global construction activity, particularly in residential and commercial real estate in Asia and the Middle East, necessitating initial installation and subsequent maintenance contracts. Complementing this is the aging installed base in developed economies (North America and Europe), which mandates frequent repairs, retrofitting, and eventual replacement services to meet modern efficiency standards and refrigerant phase-down timelines. Health and safety concerns, especially post-pandemic, have propelled investments in advanced ventilation, filtration, and air purification services (IAQ), establishing these once optional services as core components of modern building maintenance protocols. Finally, the proliferation of IoT-enabled HVAC systems demands specialized, technology-savvy service technicians, driving training and high-value service offerings.

Restraints: Significant restraints include the shortage of skilled and certified HVAC technicians capable of servicing complex, interconnected modern systems, leading to labor cost inflation and delays in service delivery, particularly in rural or specialized technical niches. High initial investment costs for commercial-grade HVAC equipment and complex retrofit projects, sometimes causing building owners to postpone upgrades, also restrict market growth velocity. Additionally, the fragmented nature of the market, characterized by numerous small, independent local service providers, poses challenges for standardization, quality control, and widespread implementation of advanced digital service models, though market consolidation is partially mitigating this.

Opportunities: Key opportunities lie in the expansion of long-term service agreements (LTSAs) focused on preventative and predictive maintenance, ensuring stable, recurring revenue streams and deeper client relationships. The integration of renewable energy sources, such as solar thermal and geothermal heat pumps, alongside conventional systems, presents a niche but growing demand for specialized hybrid system integration and servicing expertise. Furthermore, the burgeoning demand for specialized data center cooling services, which require 24/7 high-precision environmental control, represents a high-growth, high-margin opportunity due to the mission-critical nature of these facilities and the required technical sophistication.

Segmentation Analysis

The HVAC Services Market segmentation provides a granular view of service revenue streams and application areas, allowing companies to tailor their offerings and operational focus. The market is primarily segmented based on the type of service provided—installation, maintenance, repair, and retrofitting—reflecting the full lifecycle requirement of HVAC assets. Maintenance and repair form the recurring core of the market, essential for preserving system warranties and operational efficiency, while installation and retrofitting capture the growth from new construction and regulatory-driven upgrades. Understanding these service distinctions is vital, as the required expertise, pricing models, and competitive landscape vary significantly between initial capital installation projects and ongoing operational expenditure services.

Further analysis by end-user category—residential, commercial, and industrial—highlights the varying demands in complexity, scale, and contractual length. Commercial and industrial segments typically require complex, centralized systems with demanding service level agreements (SLAs), driving higher average contract values and sophisticated system monitoring needs. The residential sector, although characterized by smaller individual transactions, benefits significantly from high volume driven by general comfort needs, requiring fast, geographically localized service provision. Moreover, segmentation by HVAC system type, such as centralized versus decentralized, is crucial, as centralized systems (common in large commercial buildings) require specialized, complex maintenance schedules managed by sophisticated Building Management Systems (BMS), contrasting sharply with the simpler, modular maintenance required for decentralized residential units.

The strategic differentiation of services enables market participants to optimize resource allocation; for instance, focusing on the high-margin retrofitting segment requires specialized engineering and project management capabilities to replace legacy equipment with high-efficiency alternatives, often tied to government incentive programs. Conversely, a focus on routine residential maintenance relies on efficient logistical planning and extensive local coverage. The future evolution of segmentation is expected to be influenced by the growing integration of digital services, potentially creating a new segment dedicated entirely to data analytics, BEMS optimization, and cybersecurity services for interconnected HVAC infrastructure, linking physical service provision seamlessly with digital asset management solutions.

- By Service Type:

- Installation

- Maintenance and Repair (Preventive, Reactive, Predictive)

- Retrofitting and Replacement

- By End-User:

- Residential

- Commercial (Offices, Retail, Hospitality, Healthcare, Education)

- Industrial (Manufacturing, Data Centers, Logistics)

- By HVAC System:

- Centralized Systems (Chillers, Cooling Towers, AHUs)

- Decentralized Systems (Split Units, Packaged Units, Heat Pumps)

- By Application:

- Heating

- Ventilation (Air Filtration, IAQ Management)

- Cooling

Value Chain Analysis For HVAC Services Market

The HVAC Services value chain begins upstream with the core manufacturers of HVAC equipment, components (compressors, heat exchangers, fans), and critical control systems (sensors, thermostats). This stage is characterized by intense R&D focusing on energy efficiency, refrigerant compliance, and smart technology integration (IoT). Manufacturers often exert considerable influence downstream, providing proprietary diagnostic tools and certified training programs required for servicing their specific equipment, creating a barrier to entry for unauthorized service providers and ensuring technical competency within their ecosystem. Furthermore, component suppliers play a crucial role in the availability and pricing of replacement parts, directly impacting the profitability and speed of repair services offered by maintenance companies.

The midstream of the value chain is dominated by distributors, wholesalers, and specialized service contractors—the core providers of HVAC services. The distribution channel involves complex logistics for delivering large, specialized equipment and stocking essential parts for maintenance operations. Direct channels are increasingly utilized by major original equipment manufacturers (OEMs) who maintain large in-house service divisions, allowing them direct control over service quality and customer relationships, particularly for high-value commercial contracts. Indirect channels rely on certified third-party service contractors and small local firms, which benefit from geographical reach and specialized local knowledge but depend heavily on distributor pricing and manufacturer training updates. The efficiency of this midstream stage is critical, determining the response time and overall cost-effectiveness of service delivery to the end-user.

The downstream segment involves the end-users—residential homeowners, commercial facility managers, and industrial operators—who consume the services. Success in the downstream market hinges on customer satisfaction, retention rates, and the ability to secure long-term service and maintenance contracts. Value-added services, such as remote monitoring, energy auditing, and proactive reporting, are key differentiators in this segment. The increasing trend of digitally connecting HVAC assets ensures a continuous data feedback loop, allowing service providers to transition from transactional relationships to consultative partnerships, guiding end-users on asset replacement strategies, energy capital expenditure planning, and long-term sustainability goals. This shift toward integrated asset management services represents the highest value point in the current HVAC services ecosystem.

HVAC Services Market Potential Customers

The potential customers for HVAC services are vast and diverse, spanning every sector that requires controlled indoor environments for occupant comfort, process stability, or equipment preservation. Residential homeowners constitute a high-volume customer base driven primarily by comfort and health, demanding responsive and cost-effective repair and scheduled preventative maintenance services for decentralized systems. This segment is particularly sensitive to local marketing efforts and relies heavily on trust and local reputation when selecting service providers. The primary buyers in this segment are individual homeowners or residential property management companies looking to minimize tenant complaints and maximize rental property values through reliable appliance functionality.

The commercial sector represents the largest and most valuable customer base, including owners and operators of office buildings, shopping centers, hotels, hospitals, and educational institutions. These customers prioritize system reliability and energy performance, often requiring complex, centralized maintenance contracts (LTSAs) that include 24/7 remote monitoring and guaranteed response times, given that HVAC failure can directly halt business operations or compromise critical functions (e.g., in operating rooms). Key buyers here are facility managers, Chief Operating Officers (COOs), and procurement departments, who base decisions on service contract value, demonstrable energy savings capabilities, and the provider's adherence to stringent safety and regulatory compliance protocols.

Industrial customers are a highly specialized segment, including data centers, manufacturing plants, pharmaceutical facilities, and cold storage warehouses. For these end-users, HVAC services are mission-critical; a failure might lead to product spoilage, machinery overheating, or data loss. Their demand is skewed towards specialized services like precision cooling, cleanroom ventilation, and services for highly corrosive or volatile environments. The buying decisions are complex, driven by engineering specifications, system redundancy requirements, and the service provider’s demonstrated expertise in highly specialized industrial cooling and ventilation systems, often forming long-term relationships with providers who act as trusted technical advisors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.0 Billion |

| Market Forecast in 2033 | USD 178.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carrier Global Corporation, Johnson Controls International PLC, Daikin Industries Ltd., Trane Technologies PLC, Siemens AG, Honeywell International Inc., Mitsubishi Electric Corporation, Lennox International Inc., Samsung Electronics Co. Ltd., LG Electronics, Emerson Electric Co., Bosch Thermotechnology, Systemair AB, Rheem Manufacturing Company, Toshiba Carrier Corporation, Ingersoll Rand, Comfort Systems USA, Baker Group, ServiceLogic, Groupe Atlantic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVAC Services Market Key Technology Landscape

The technological landscape of the HVAC Services Market is rapidly evolving, driven by the convergence of information technology and operational technology (IT/OT). The most critical advancements center on the integration of the Internet of Things (IoT) sensors and connected devices into HVAC infrastructure. These IoT technologies enable real-time data collection on system performance, energy consumption, and environmental metrics (temperature, humidity, CO2 levels), which is foundational for delivering advanced service offerings. This connectivity allows service providers to offer high-value remote monitoring and diagnostic services, often bundled into comprehensive service contracts, effectively reducing the need for costly unscheduled site visits and transforming service delivery efficiency across the commercial portfolio.

A second major technological trend is the widespread adoption of Building Energy Management Systems (BEMS) and Building Automation Systems (BAS). The complexity of integrating HVAC functionality within these larger BEMS frameworks requires specialized service expertise for system configuration, software updates, and ongoing optimization. Furthermore, advancements in specialized refrigerants and heat pump technology, particularly Variable Refrigerant Flow (VRF) systems, demand continuous training for technicians. Service companies are increasingly investing in sophisticated diagnostic tools, augmented reality (AR) aids for field technicians, and secure cloud platforms for storing and analyzing operational data, ensuring they remain competent in servicing the latest generation of complex, digitally controlled HVAC equipment.

The deployment of sophisticated data analytics and machine learning algorithms (AI) stands out as the core technology influencing future service delivery models. These analytical tools allow service companies to move beyond simple fault detection to true root cause analysis and predictive scheduling. Additionally, digital twin technology is emerging, allowing service providers to create virtual models of the HVAC system within a building, enabling simulation of maintenance impacts and performance upgrades before any physical work begins. This level of technological precision minimizes risk for complex retrofitting projects and guarantees optimized performance for the customer, solidifying technology as a crucial competitive differentiator in the modern HVAC services marketplace.

Regional Highlights

Regional dynamics are shaped by varying climatic conditions, economic development rates, and the stringency of local environmental regulations, creating distinct market opportunities and challenges globally. North America, characterized by a highly mature market and aging infrastructure, offers substantial revenue opportunities in system replacement and sophisticated energy-efficiency retrofitting services. The US and Canada are pioneers in adopting IoT and AI-driven predictive maintenance models, leveraging high levels of connectivity in commercial real estate. Demand is consistently high across both heating and cooling applications, with a regulatory emphasis on transitioning to low-GWP refrigerants and high-efficiency heat pump systems, driving specialized service demand.

Asia Pacific (APAC) is projected to experience the fastest growth, fueled by massive urbanization, rapidly expanding construction sectors (particularly in China, India, and Southeast Asia), and rising middle-class disposable incomes, leading to increased demand for comfort cooling services. While basic installation and repair dominate the current market, there is a clear and accelerating trend towards adopting energy-efficient and smart HVAC systems in commercial and premium residential complexes. This creates immediate, high-volume demand for installation services and long-term potential for high-complexity maintenance contracts as the installed base matures and regulatory pressure mounts, particularly regarding air quality and energy consumption standards in major metropolitan areas.

Europe presents a service market dominated by stringent decarbonization targets and mandates such as the Energy Performance of Buildings Directive (EPBD). This legislative framework drives demand for expert retrofitting services aimed at improving the energy ratings of existing structures and aggressively mandates the phase-out of fossil fuel heating systems in favor of heat pumps. The European market focuses heavily on heating and ventilation services, requiring highly trained technicians specialized in complex heat recovery, ventilation systems (HRV/ERV), and integration with renewable energy sources. This region emphasizes service quality, certification, and compliance documentation, making technical competence and adherence to standards primary drivers for service contractor selection.

- North America: Focus on sophisticated digital services, large-scale commercial retrofits, and compliance with stringent energy performance codes (e.g., California’s Title 24). High adoption rate of smart thermostats and BEMS servicing.

- Europe: Driven by environmental legislation (EPBD, F-Gas Regulation), leading to intense demand for heat pump installation, boiler replacement, and energy efficiency auditing services. Emphasis on sustainable and low-carbon solutions.

- Asia Pacific (APAC): Characterized by rapid market expansion fueled by new construction, particularly in cooling installations. Emerging demand for centralized, high-efficiency systems and IAQ services in developing urban centers.

- Middle East & Africa (MEA): Market concentration on cooling services and district cooling maintenance due to extreme climate. Significant opportunities in servicing large infrastructure projects, data centers, and specialized industrial cooling.

- Latin America (LATAM): Growth driven by economic recovery and infrastructure investment. Focus on standard repair and maintenance services, with increasing adoption of energy-efficient systems in commercial properties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVAC Services Market.- Carrier Global Corporation

- Johnson Controls International PLC

- Daikin Industries Ltd.

- Trane Technologies PLC

- Siemens AG

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Lennox International Inc.

- Samsung Electronics Co. Ltd.

- LG Electronics

- Emerson Electric Co.

- Bosch Thermotechnology

- Systemair AB

- Rheem Manufacturing Company

- Toshiba Carrier Corporation

- Ingersoll Rand Inc.

- Comfort Systems USA Inc.

- Baker Group

- ServiceLogic

- Groupe Atlantic

Frequently Asked Questions

Analyze common user questions about the HVAC Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the HVAC Services Market?

The primary factor driving growth is the increasing global focus on energy efficiency and regulatory mandates (e.g., refrigerant phase-downs and building performance codes). This necessitates frequent maintenance, retrofitting of aging systems, and specialized services for complex, high-efficiency equipment like heat pumps and VRF systems, ensuring sustained demand for professional servicing.

How is predictive maintenance (PdM) changing HVAC service delivery?

PdM, powered by IoT and AI analytics, transforms service delivery by shifting from reactive repairs to proactive scheduling. It uses real-time data to predict equipment failure before it occurs, drastically reducing unplanned downtime, optimizing technician labor, and improving the operational lifespan of high-value HVAC assets, particularly in the commercial and industrial sectors.

Which geographical region exhibits the highest growth potential for HVAC services?

Asia Pacific (APAC) is projected to exhibit the highest growth potential. This is attributed to rapid urbanization, robust expansion in commercial and residential construction across developing economies, and the growing adoption of air conditioning technology driven by rising regional incomes and increasing climate control needs.

What are the key challenges facing the HVAC Services Market?

The primary challenges include a significant shortage of skilled and certified technicians capable of servicing sophisticated, digitally integrated HVAC systems. Other restraints involve the high initial capital investment required for energy-efficient system upgrades (retrofitting) and the highly fragmented nature of the local service provider landscape.

Why is Indoor Air Quality (IAQ) becoming a critical component of HVAC service contracts?

IAQ is critical because heightened public health awareness, particularly post-pandemic, requires advanced ventilation, air filtration (HEPA filters), and humidity control services. Commercial and healthcare facilities are increasingly incorporating specialized IAQ management into their standard service contracts to ensure occupant health and regulatory compliance, boosting demand for specialized ventilation services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager