HVAC Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431545 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

HVAC Valve Market Size

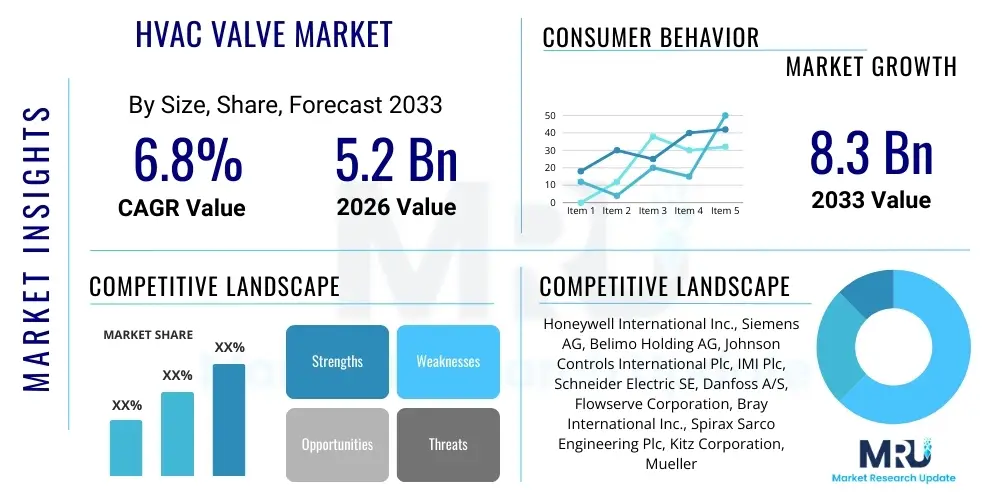

The HVAC Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

HVAC Valve Market introduction

The HVAC (Heating, Ventilation, and Air Conditioning) Valve Market encompasses the manufacturing and distribution of components critical for regulating the flow of fluids (water, steam, refrigerant) within HVAC systems. These valves are essential for maintaining precise temperature, pressure, and humidity levels, thereby ensuring optimal indoor climate control and energy efficiency in various building types. Key product categories include ball valves, globe valves, butterfly valves, and gate valves, differentiated primarily by their operation mechanism and application requirements. Modern HVAC systems increasingly rely on sophisticated, often automated, valves to meet stringent energy conservation standards and complex building management protocols, especially in large commercial and industrial settings where precise control is paramount.

Major applications for HVAC valves span commercial infrastructure, including corporate offices, hotels, hospitals, and educational institutions, where high occupancy rates necessitate robust and reliable climate control. Furthermore, the residential sector, driven by the increasing adoption of central HVAC systems and smart home technologies, represents a significant growth area. The primary benefit derived from high-performance HVAC valves is enhanced energy efficiency, as precise flow control minimizes wasted heating or cooling energy, leading to substantial operational cost savings over the lifespan of the building infrastructure. This emphasis on sustainability and lower operational expenditure solidifies the foundational demand for advanced valve technologies.

Driving factors for the sustained market growth include rapid urbanization and subsequent construction activities globally, particularly in emerging economies where new commercial and residential developments necessitate HVAC installations. Simultaneously, stringent governmental regulations mandating energy efficiency in buildings, coupled with the rising consumer awareness regarding sustainable practices, compel the adoption of advanced, technologically integrated valve solutions, such as those compatible with Building Management Systems (BMS). The necessity of replacing or retrofitting aging infrastructure in developed regions further contributes to demand, pushing market participants toward innovation in materials, actuation, and digital communication capabilities to enhance longevity and performance.

HVAC Valve Market Executive Summary

The global HVAC Valve Market is characterized by a significant shift toward smart, connected, and highly efficient valve solutions, reflecting broader trends in Building Automation Systems (BAS) and the Internet of Things (IoT). Business trends indicate fierce competition focused on miniaturization, material innovation to enhance durability against corrosion, and the integration of sophisticated electronic actuators for finer control capabilities. Major companies are strategically investing in research and development to offer plug-and-play solutions that simplify installation and maintenance while maximizing integration potential with diverse BMS platforms, thus catering directly to the needs of system integrators and facility managers seeking comprehensive, centralized control over climate systems across large campuses or multi-story buildings.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, large-scale infrastructural development projects, and favorable government incentives promoting green building initiatives, especially in countries like China and India. North America and Europe, while mature markets, maintain high revenue share driven by stringent regulatory frameworks concerning energy performance (e.g., European Union's Energy Performance of Buildings Directive) and a high propensity for replacing older, less efficient components with high-end, digitally controlled smart valves during facility upgrades and refurbishment cycles. The focus in these developed regions remains firmly on optimizing operational expenditures through superior energy management provided by advanced valve technology, pushing demand for predictive maintenance features.

Segment trends reveal that the actuated valve segment, particularly electric actuators, dominates the market due to their precision, reliability, and ease of integration into digital control systems compared to manual valves. By product type, ball valves remain highly popular across both residential and commercial applications owing to their simplicity and robust sealing capabilities, though globe valves maintain dominance in applications requiring proportional flow control, such as coil control in Variable Air Volume (VAV) systems. Furthermore, the commercial end-user segment continues to command the largest market share, driven by the size and complexity of commercial HVAC installations which require multiple control points and often demand higher pressure and temperature resistance capabilities, ensuring market dynamics are largely governed by large-scale construction cycles.

AI Impact Analysis on HVAC Valve Market

User queries regarding the impact of Artificial Intelligence (AI) on the HVAC Valve Market predominantly revolve around how AI can enhance operational efficiency, minimize energy wastage, and shift maintenance from reactive to predictive models. Common themes include the capabilities of AI in optimizing valve positioning based on real-time occupancy data, integrating AI algorithms directly into smart actuators for autonomous flow adjustments, and analyzing sensor data streams to detect potential valve failures or wear patterns before they manifest as critical system malfunctions. There is strong user expectation that AI will lead to a step change in energy savings by allowing HVAC systems to learn environmental demands and dynamically adapt valve operations far beyond the fixed scheduling or simple feedback loops currently employed by standard BMS, requiring specialized, AI-ready valve hardware.

The implementation of AI algorithms, typically hosted within central Building Management Systems but increasingly distributed to edge devices and smart valve controllers, allows for continuous optimization of fluid flow and mixing processes. This sophistication means valves are no longer merely open/close or simple proportional control devices; they become integral components in a complex optimization loop, dynamically adjusting flow rates based on predictive models that incorporate external factors like weather forecasts, anticipated building occupancy schedules, and historical performance data. This level of granular control maximizes energy output while minimizing consumption, extending the operational life of the entire HVAC system by reducing unnecessary stress on pumps and chillers through optimized hydronic balancing.

Furthermore, AI significantly impacts the servicing and maintenance landscape. By analyzing high-frequency data (e.g., actuator torque, valve position accuracy, temperature differentials across the valve) collected via embedded IoT sensors, AI can accurately predict the remaining useful life (RUL) of a valve component. This predictive maintenance capability allows facility managers to schedule replacements or servicing precisely when needed, minimizing system downtime, reducing unexpected catastrophic failures, and lowering overall maintenance costs associated with unnecessary preventative replacements. This shift is driving demand for valves equipped with advanced data communication protocols and computational capabilities capable of handling localized AI processing tasks.

- AI enables predictive maintenance, reducing unexpected valve failures and minimizing system downtime.

- Optimization of flow control algorithms based on real-time and predictive environmental data, maximizing energy efficiency.

- Integration of machine learning into Building Management Systems (BMS) for autonomous, demand-driven valve actuation.

- AI aids in system-wide hydronic balancing, ensuring optimal distribution of heated or chilled water.

- Improved anomaly detection, identifying minor operational deviations that signal potential component degradation.

DRO & Impact Forces Of HVAC Valve Market

The HVAC Valve Market is profoundly influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal/external Impact Forces. Key drivers include the global push for sustainable infrastructure and the mandatory adoption of energy-efficient building codes, especially in developed economies, which necessitate the replacement of antiquated pneumatic or manual valves with modern, digitally controlled alternatives. This is complemented by strong governmental investment in smart city initiatives and regulatory incentives, pushing the construction sector toward higher standards of energy performance. Concurrently, the increasing prevalence of advanced Building Management Systems (BMS) naturally integrates smart valves as essential components for centralized, fine-tuned environmental control across large-scale facilities, reinforcing market growth through technological necessity.

Conversely, significant restraints hinder growth, notably the high initial investment cost associated with advanced smart valves and electronic actuators compared to traditional mechanical counterparts. This cost barrier can deter smaller construction projects or budget-constrained facility upgrades, particularly in price-sensitive developing markets. Furthermore, the technical complexity involved in installing, configuring, and maintaining sophisticated networked valve systems requires specialized labor and integration expertise, leading to potential implementation delays and operational hurdles. Concerns about data security and the vulnerability of networked components within the IoT ecosystem also pose a restraint, requiring manufacturers to invest heavily in robust cybersecurity features, which further contributes to the overall product cost and complexity.

Opportunities for market expansion are vast, primarily driven by the massive potential within the retrofit and renovation market globally, where millions of aging commercial buildings require efficiency upgrades to comply with new climate mandates. The emergence of standardized communication protocols (like BACnet and Modbus) simplifies interoperability, making it easier for facility managers to adopt multi-vendor solutions. Moreover, the increasing demand for ultra-precise climate control in specific high-value sectors such as data centers (to manage heat dissipation) and the pharmaceutical industry (to maintain strict cleanroom conditions) opens lucrative, niche application opportunities for high-performance, specialized valves that can offer reliability and extreme accuracy under demanding operating conditions. These opportunities incentivize continuous innovation in actuator speed, flow characteristics, and diagnostic capabilities, transforming market focus from simple flow control to integrated environmental optimization.

Segmentation Analysis

The HVAC Valve Market segmentation provides a detailed structure for analyzing market dynamics based on critical attributes, including product type, material, function, application, and end-user. This segmentation helps identify specific high-growth areas and dominant technologies within the overall market landscape. Analyzing the market through these lenses highlights the dominance of actuated valves over manual ones, reflecting the universal move toward automation in modern buildings. Furthermore, the segmentation by end-user clearly distinguishes between the high-volume, standardized requirements of the residential sector and the complex, high-performance needs of the commercial and industrial segments, which often demand specialized materials like stainless steel or bronze for resilience against high pressure and corrosive media.

By product type, the market is broadly segmented into ball valves, globe valves, butterfly valves, and others, with ball and globe valves typically capturing the largest share due to their versatility in handling various fluid types and control functions, from simple isolation to precise proportional control. Actuation methods—manual, pneumatic, hydraulic, and electric—are critical segmentation points, with electrically actuated valves showing the strongest growth trajectory driven by their integration benefits with centralized Building Management Systems (BMS) and superior energy efficiency compared to their pneumatic counterparts. This detailed breakdown ensures targeted marketing strategies and product development efforts can be aligned with specific end-user demands and regional regulatory environments, ultimately optimizing resource allocation for manufacturers.

The functional segmentation, including isolation, control, and balancing valves, underscores the different roles valves play within a complex hydronic circuit. Control valves, especially those designed for proportional regulation, are witnessing rapid technological advancements, incorporating features like self-calibration and integrated diagnostics to enhance system performance. Application segmentation often separates the market into chiller applications, air handling units (AHUs), and fan coil units (FCUs), each requiring valves tailored to specific flow rates and pressure classes. This granular segmentation allows industry participants to understand precise demand patterns, such as the increasing need for compact and lightweight valves suitable for decentralized FCU installations in modern modular construction projects, ensuring comprehensive market coverage.

- By Product Type: Ball Valves, Globe Valves, Butterfly Valves, Gate Valves, Pressure Independent Control Valves (PICVs).

- By Actuation: Manual Valves, Actuated Valves (Electric, Pneumatic, Hydraulic).

- By Material: Cast Iron, Steel (Carbon Steel, Stainless Steel), Bronze, Brass, Engineered Plastics.

- By Application: Air Handling Units (AHUs), Chillers and Boilers, Fan Coil Units (FCUs), Radiant Panels, Terminal Units.

- By End-User: Commercial (Office Buildings, Retail, Healthcare, Hospitality), Residential (Multi-Family, Single-Family), Industrial (Data Centers, Manufacturing, Pharmaceutical).

Value Chain Analysis For HVAC Valve Market

The value chain for the HVAC Valve Market begins with the upstream procurement of raw materials, primarily metals such as iron, steel, brass, and bronze, alongside high-performance plastics and rubber compounds for seals and specialized components. Raw material costs and availability significantly impact the overall manufacturing economics, leading many major valve manufacturers to establish strong, long-term relationships with material suppliers to ensure quality control and stable pricing, especially concerning specialized alloys required for demanding applications. Manufacturing activities involve precision casting, forging, machining, assembly of mechanical components (body, trim, seals), and the integration of actuators and electronic controls. Quality assurance and compliance with international standards (e.g., ISO, CE) are critical steps at this stage, dictating the overall reliability and market acceptance of the final product.

Downstream activities center around distribution, marketing, and installation. The market utilizes a mixed distribution channel strategy. Direct sales often cater to large Original Equipment Manufacturers (OEMs) who integrate valves into complete HVAC units (like chillers or AHUs) and major engineering, procurement, and construction (EPC) firms involved in large infrastructural projects. Indirect distribution relies heavily on a network of specialized mechanical distributors, wholesale plumbing and HVAC suppliers, and independent sales representatives who cater primarily to the aftermarket segment, smaller contractors, and MRO (Maintenance, Repair, and Operations) buyers. The effectiveness of the indirect channel is highly dependent on inventory management and the technical expertise of distributors to advise clients on complex valve selection.

Installation and servicing constitute the final crucial stages of the value chain. Professional HVAC contractors and specialized systems integrators are responsible for physically installing the valves and integrating smart valves into the overarching Building Management System (BMS) infrastructure. The increasing complexity of electronic actuators and digital interfaces requires sophisticated commissioning and calibration processes, driving demand for specialized training and technical support from manufacturers. Post-installation, the value chain extends to aftermarket services, including routine maintenance, repair, and replacement of parts, which provide a stable, recurring revenue stream for manufacturers and distributors, particularly as the installed base of automated valves continues to grow globally and demand for predictive diagnostics increases.

HVAC Valve Market Potential Customers

The primary customer base for HVAC valves encompasses a diverse range of entities involved in the construction, operation, and maintenance of built environments where precise climate control is essential. Construction and engineering firms, including general contractors and specialized mechanical, electrical, and plumbing (MEP) contractors, are key buyers during the initial construction phase, purchasing valves in bulk for integration into new building projects. Original Equipment Manufacturers (OEMs) of HVAC equipment, such as manufacturers of chillers, boilers, and air handling units, represent another significant customer segment, as they require large volumes of standardized valves for assembly into their final product offerings before shipping them to the construction site.

Facility management companies and property owners constitute a critical and recurring customer base, particularly in the aftermarket segment. These end-users are responsible for maintaining optimal operational efficiency in commercial buildings, hospitals, universities, and large residential complexes. Their procurement decisions are heavily influenced by the long-term reliability, energy savings potential, and ease of integration of replacement valves, favoring high-quality, smart, and durable products during maintenance and renovation cycles. This segment drives the demand for Pressure Independent Control Valves (PICVs) and other advanced balancing solutions that simplify system optimization post-installation.

Furthermore, specialized industrial sectors represent high-value potential customers. Data centers, due to their immense heat generation, rely on highly accurate, robust valves to manage vast cooling loops and prevent catastrophic overheating failures. Similarly, pharmaceutical, biotechnology, and food processing facilities require valves made of specific materials (like stainless steel) that can handle strict sanitation requirements and corrosive media, demanding valves certified for specific pressure and temperature ratings far exceeding typical commercial building standards. The military and naval sectors also rely on highly customized, durable valves designed to withstand extreme environments, representing a smaller but highly profitable niche market segment for specialized valve manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Siemens AG, Belimo Holding AG, Johnson Controls International Plc, IMI Plc, Schneider Electric SE, Danfoss A/S, Flowserve Corporation, Bray International Inc., Spirax Sarco Engineering Plc, Kitz Corporation, Mueller Industries, Caleffi S.p.A., Gruner AG, Nexus Valve, Rotork Plc, Vexve Oy, AVK Holding A/S, Dixon Valve & Coupling Company, Oventrop GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVAC Valve Market Key Technology Landscape

The HVAC Valve Market technology landscape is rapidly evolving, driven primarily by the need for superior energy management and connectivity within the wider ecosystem of smart buildings. A core technological advancement is the widespread adoption of Pressure Independent Control Valves (PICVs), which revolutionize hydronic balancing by maintaining a constant flow rate irrespective of pressure fluctuations in the system, thereby ensuring energy efficiency and optimizing the performance of chillers and boilers. These PICVs often integrate advanced microprocessor-based controls and embedded flow sensors, allowing for precise measurement and adjustment of flow, which is crucial for modern Variable Air Volume (VAV) systems. Furthermore, the push towards integrating these valves with IoT platforms necessitates robust communication technologies, typically leveraging standard protocols like BACnet, Modbus, or specialized wireless standards like ZigBee or LoRaWAN for simplified connectivity and remote diagnostics, moving beyond traditional hardwired installations.

Another significant area of innovation lies in actuator technology, moving away from bulky, slow-response pneumatic systems toward compact, high-torque, and highly precise electronic actuators. Modern electric actuators feature brushless DC motors for extended lifespan, fine incremental positioning capabilities, and integrated diagnostics that monitor operational health, reporting parameters such as torque, cycle count, and temperature back to the BMS. This integration is vital for implementing predictive maintenance strategies powered by AI. Material science also plays a crucial role; manufacturers are developing advanced corrosion-resistant alloys and high-performance polymer compounds for internal valve components (seals and seats) to extend durability and reduce the risk of fouling or leakage, especially in systems utilizing specialized fluids or facing harsh environmental conditions like coastal regions.

The convergence of valve technology with data intelligence is redefining product value. Manufacturers are embedding advanced sensors, including temperature, pressure, and acoustic sensors, directly into the valve body to collect comprehensive operational data. This data facilitates continuous self-optimization of the valve's performance profile, allowing it to adapt to changing system loads without manual intervention. The development of self-calibrating and self-diagnosing valves is a key technological trend, significantly reducing the commissioning time required during installation and ensuring sustained optimal performance throughout the valve’s operational life. This technological sophistication positions the valve as a critical data collection node, contributing real-time insights to the overall Building Management System, thereby improving system-wide resource allocation and response times.

Regional Highlights

- Asia Pacific (APAC): This region exhibits the highest growth rate, driven primarily by rapid urbanization, massive infrastructural investments (especially in China, India, and Southeast Asia), and increasing middle-class demand for improved indoor climate control. Government initiatives promoting energy conservation in new commercial and residential buildings heavily influence valve adoption, pushing demand for competitively priced, technologically advanced products.

- North America: A mature market characterized by stringent energy codes (e.g., ASHRAE standards) and a high replacement rate for older systems. Demand is strong for smart, high-reliability actuated valves, particularly in the commercial and industrial sectors, where integration with sophisticated Building Management Systems (BMS) is standard. Investment focuses heavily on retrofit projects and specialized applications like data center cooling.

- Europe: Growth is primarily fueled by mandatory regulatory frameworks, such as the EU's Energy Performance of Buildings Directive (EPBD), which drives the replacement of inefficient systems. There is a strong preference for Pressure Independent Control Valves (PICVs) and products emphasizing sustainability and superior energy savings. Germany, the UK, and France are key contributors, focusing on integrating valves into decentralized heat and energy networks.

- Latin America (LATAM): Market growth is moderate but steady, tied closely to economic stability and commercial construction activities in key markets like Brazil and Mexico. Price sensitivity remains a factor, but increasing foreign investment in high-end commercial properties is driving limited demand for premium, energy-efficient valve solutions.

- Middle East and Africa (MEA): Demand is robust in the GCC countries (UAE, Saudi Arabia) due to large-scale, climate-controlled commercial and residential developments and severe climatic conditions requiring powerful, reliable HVAC systems. Investment in smart city projects (e.g., NEOM) is creating significant, albeit sporadic, high-volume opportunities for technologically advanced valve manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVAC Valve Market.- Honeywell International Inc.

- Siemens AG

- Belimo Holding AG

- Johnson Controls International Plc

- IMI Plc

- Schneider Electric SE

- Danfoss A/S

- Flowserve Corporation

- Bray International Inc.

- Spirax Sarco Engineering Plc

- Kitz Corporation

- Mueller Industries

- Caleffi S.p.A.

- Gruner AG

- Nexus Valve

- Rotork Plc

- Vexve Oy

- AVK Holding A/S

- Dixon Valve & Coupling Company

- Oventrop GmbH & Co. KG.

Frequently Asked Questions

Analyze common user questions about the HVAC Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for smart HVAC valves?

The primary driver is stringent global energy efficiency regulations, compelling building owners and operators to adopt advanced, digitally controlled valves, such as Pressure Independent Control Valves (PICVs) and electrically actuated valves, to minimize energy consumption and comply with mandatory building performance standards. Integration with Building Management Systems (BMS) for centralized, optimized control is also a critical accelerating factor for this demand.

How does the type of actuator affect valve performance and market segment share?

Electric actuators currently dominate the market share due to their precision, reliability, silent operation, and seamless compatibility with modern digital control systems and IoT networks, offering superior energy savings compared to manual or pneumatic actuators. Pneumatic actuators are still preferred in high-torque or high-speed applications but are generally losing ground in commercial HVAC installations due to complex infrastructure requirements.

Which geographical region exhibits the fastest growth potential for HVAC valves?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by unprecedented infrastructure development, rapid urbanization across countries like China and India, and significant governmental investment in smart city initiatives that require new, high-efficiency HVAC systems and components for modern commercial and residential complexes.

What role does AI play in optimizing HVAC valve operation?

AI is crucial for predictive optimization; it analyzes real-time sensor data, occupancy patterns, and external weather data to autonomously adjust valve positioning and flow rates, ensuring precise climate control while drastically reducing energy wastage. Furthermore, AI enables predictive maintenance by detecting anomalies in valve performance before critical failure, maximizing operational uptime.

What are the key technical challenges facing the widespread adoption of smart HVAC valves?

The main technical challenge involves the high initial investment cost, which is significantly higher than that of traditional manual valves. Additionally, integrating diverse smart valve hardware and software from multiple vendors into a unified Building Management System (BMS) often requires specialized technical expertise and can be complex, leading to integration hurdles and potential data security concerns that need robust addressing.

This comprehensive report provides an in-depth analysis of the HVAC Valve Market, detailing growth forecasts, technological trends, regional dynamics, and key competitive landscapes, structured for maximum optimization across generative and answer engines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager