HVDC Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433547 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

HVDC Systems Market Size

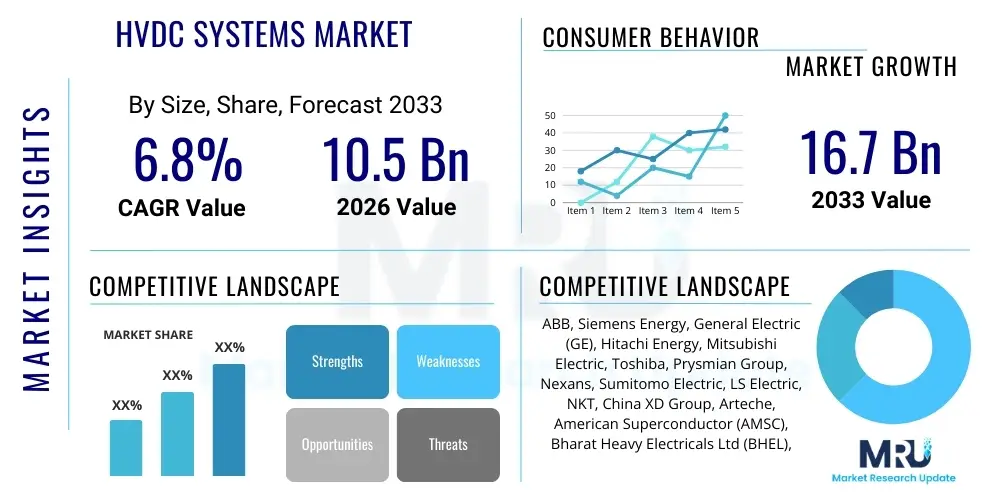

The HVDC Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $16.7 Billion by the end of the forecast period in 2033.

HVDC Systems Market introduction

The High-Voltage Direct Current (HVDC) systems market encompasses technologies designed for bulk power transmission over long distances, offering superior efficiency and lower transmission losses compared to traditional AC systems. These systems are critical for connecting asynchronous grids, integrating remote renewable energy sources (such as large-scale offshore wind farms and distant solar installations), and stabilizing complex modern power networks. Key components include converter stations—utilizing technologies like Line Commutated Converters (LCC) or Voltage Source Converters (VSC)—DC cables or overhead lines, and sophisticated control and protection systems. The inherent ability of HVDC to facilitate inter-regional power exchange while mitigating synchronization issues positions it as foundational infrastructure for global energy transition efforts.

The primary applications of HVDC technology are diverse, spanning cross-border interconnections, underground and submarine cable links, and integrating high-capacity renewable energy facilities often located far from consumption centers. HVDC systems offer distinct benefits, particularly in managing the intermittency of renewable generation and ensuring grid stability during high-load conditions or system disturbances. The adoption of VSC technology has been a major accelerator, enabling more flexible power flow control, black start capabilities, and integration into existing AC networks with greater ease, thereby expanding the potential use cases, especially in urban areas requiring underground transmission.

Market growth is predominantly driven by global initiatives focused on decarbonization and enhancing energy security. The rapid expansion of offshore wind capacity, particularly in Europe and Asia-Pacific, necessitates robust HVDC transmission infrastructure to bring power onshore efficiently. Furthermore, government mandates encouraging grid modernization, coupled with the necessity of overcoming regulatory hurdles related to land use for overhead AC lines, bolster the demand for underground and subsea HVDC links. The continuous advancement in power electronics and semiconductor materials, leading to higher efficiency and reduced converter station footprints, further solidifies the economic viability and technical appeal of HVDC solutions in the contemporary energy landscape.

HVDC Systems Market Executive Summary

The global HVDC Systems market trajectory is characterized by significant investment in high-capacity transmission corridors driven by the imperative to integrate large volumes of intermittent renewable energy into existing power grids. Business trends indicate a strong shift towards modular and standardized Voltage Source Converter (VSC) technology, which offers enhanced system flexibility and quicker deployment times compared to traditional Line Commutated Converters (LCC). Key industry players are focusing on strategic partnerships and mergers to offer comprehensive turnkey solutions, encompassing advanced power electronics, cable manufacturing, and sophisticated control software, reflecting the project complexity inherent in ultra-high voltage (UHVDC) and multi-terminal configurations.

Regional trends highlight Asia Pacific (APAC), particularly China and India, as the dominant market drivers, largely due to massive investments in UHVDC projects designed to transmit hydro and thermal power from remote generation sites to densely populated coastal and industrial regions. Europe shows robust growth fueled by extensive infrastructure development for offshore wind farms and cross-border grid synchronization aimed at establishing a cohesive European supergrid. North America's growth is primarily concentrated on grid resiliency projects, replacing aging infrastructure, and connecting distributed renewable sources across vast geographical distances, particularly involving VSC technology for dynamic power management.

In terms of segmentation, the VSC technology segment is anticipated to witness the highest CAGR, overtaking LCC due to its technical superiority in enabling multi-terminal DC grids and its applicability in smaller, intricate urban projects. The Component segment sees high demand for advanced DC cables and sophisticated semiconductor devices (IGBTs and MOSFETs), crucial for improving the efficiency and reliability of converter stations. Application-wise, submarine and underground applications are experiencing rapid proliferation, directly correlated with the growth of offshore wind and the need to minimize environmental and aesthetic impact in dense population areas, establishing these segments as key growth areas within the forecast period.

AI Impact Analysis on HVDC Systems Market

Common user questions regarding AI's impact on HVDC systems frequently revolve around themes of predictive maintenance, operational efficiency, grid resilience optimization, and the potential for autonomous control. Users seek clarity on how machine learning algorithms can enhance fault detection in complex UHVDC lines, optimize power flow decisions in multi-terminal DC grids, and manage the increasing cybersecurity risks associated with advanced digital control systems. There is high expectation that AI will move HVDC operations from reactive maintenance schedules to proactive, condition-based monitoring, maximizing uptime and reducing operational expenditures, thereby fundamentally altering the long-term economics of these capital-intensive projects.

The integration of Artificial Intelligence and machine learning (ML) is set to revolutionize the operation and maintenance protocols of HVDC infrastructure. AI algorithms can process vast streams of real-time operational data—including cable temperature, voltage fluctuations, converter valve performance, and ambient conditions—to build highly accurate models for predicting potential equipment failures well before they occur. This predictive capability minimizes unscheduled outages, significantly extending the lifespan of critical assets like converter valves and DC cables. Furthermore, AI contributes substantially to enhanced grid stability by enabling ultra-fast, optimized responses to system disturbances, fine-tuning power transmission in complex meshed DC networks, an increasingly important feature as grids become more interconnected and dependent on fluctuating renewable sources.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data for early detection of faults in converter stations and cable insulation, reducing downtime.

- Optimized Power Flow Control: Machine learning models improve dynamic stability and optimize power transmission efficiency in multi-terminal HVDC grids.

- Improved Grid Resilience: AI facilitates faster restoration following outages and better management of transient system events, enhancing overall reliability.

- Automated System Diagnostics: Implementation of digital twins utilizing AI allows for virtual testing and simulation of various operational scenarios, refining control strategies.

- Cybersecurity Enhancement: AI detects anomalous network behavior and potential intrusions in the Supervisory Control and Data Acquisition (SCADA) systems managing HVDC operations.

DRO & Impact Forces Of HVDC Systems Market

The HVDC Systems market dynamics are primarily shaped by robust growth drivers, significant regulatory and technological restraints, and emerging opportunities that collectively dictate the future investment landscape. The primary drivers include the urgent global necessity for long-distance bulk power transmission, particularly for integrating renewable energy from remote locations, and the technical superiority of HVDC in enabling cross-border grid interconnections without synchronous stability issues. Restraints largely center on the extremely high capital expenditure required for converter stations, which form the most complex and costly component, alongside regulatory complexity surrounding multi-jurisdictional infrastructure planning and permitting. Opportunities lie prominently in the commercialization of modular and compact VSC technology, the development of standardized DC circuit breakers necessary for reliable multi-terminal DC grids, and expansion into emerging markets focusing on rural electrification via microgrids connected to bulk power corridors. These forces create a dynamic environment where technical innovation is essential to mitigate financial barriers and accelerate widespread adoption.

The dominant driving force remains the aggressive pursuit of renewable energy targets by nations worldwide. As fossil fuel dependence decreases, the reliance on high-capacity transmission solutions like UHVDC (Ultra-High Voltage DC) to deliver gigawatts of power from isolated hydro, solar, and wind resources becomes non-negotiable for grid operators. This driver is augmented by technological maturation, specifically in the VSC domain, which has reduced the footprint and improved the functional flexibility of converter stations. However, the high initial investment costs and the shortage of highly specialized engineering expertise required for designing, installing, and maintaining complex HVDC links pose significant restraints. Furthermore, achieving consensus and standardized protocols among various national grid operators for cross-border projects introduces substantial political and regulatory friction, slowing down implementation timelines.

Opportunities for growth are abundant, particularly in the realm of creating true DC grids, moving beyond point-to-point links. This transition requires commercially viable DC circuit breakers and sophisticated protection schemes, which are rapidly nearing maturity. Moreover, the increasing demand for resilient and reliable power delivery in densely populated urban centers drives the opportunity for advanced underground HVDC cable installations. The impact forces acting on the market are multifaceted: high initial CAPEX acts as a gravitational restraint, pulling down market speed, while government subsidies and carbon reduction policies exert a strong accelerative force, propelling investment forward. The ongoing reduction in semiconductor costs (for power electronics) serves as a stabilizing force, gradually mitigating the restraint of high equipment cost, thereby ensuring sustained, albeit measured, market expansion.

Segmentation Analysis

The HVDC Systems market is segmented based on Component, Technology, Voltage Level, and Application, providing a granular view of market dynamics and investment pockets. The component segmentation includes critical infrastructure such as converter stations (valves, cooling systems, transformers), high-specification DC cables, smoothing reactors, and protection equipment like circuit breakers and filters. Technology segmentation differentiates between older, robust Line Commutated Converters (LCC) and the technologically advanced, highly flexible Voltage Source Converters (VSC), which are driving contemporary projects. Analysis of these segments is vital for stakeholders to understand where technological innovation and procurement spending are concentrated, guiding product development and supply chain strategy in the evolving energy transmission landscape.

Segmentation by Voltage Level divides the market based on transmission capacity and distance, ranging from below ±400 kV (often used for regional interconnections or offshore platforms) up to Ultra-High Voltage DC (UHVDC) systems exceeding ±600 kV, designed for intercontinental or national-scale bulk power delivery over thousands of kilometers. The UHVDC segment, predominantly utilizing LCC technology due to its cost-effectiveness at massive scale, remains critical in emerging economies like China. Conversely, the mid-voltage range frequently employs VSC for dynamic support and connecting renewable clusters. The Application segment categorizes installations into Overhead Lines, Submarine Cables, and Underground Cables, reflecting the physical deployment environment, with submarine applications seeing explosive growth due to offshore wind proliferation.

The convergence of technological advancement and environmental necessity is particularly visible in the VSC and Submarine Cable segments. VSC technology, characterized by its ability to control active and reactive power independently and its minimal filtering requirements, is becoming the preferred choice for multi-terminal projects and dynamic system integration. Simultaneously, regulatory pressures and public acceptance issues are pushing transmission projects into underground or subsea corridors, making DC cable technology, especially extruded XLPE cables for VSC systems, a high-growth component area. Strategic planning must acknowledge this shift, recognizing that future market leadership will hinge on integrated solutions that combine compact VSC stations with high-performance DC cable systems for non-overhead deployments.

- Component:

- Converter Stations (AC Filters, DC Filters, Smoothing Reactors, Converter Valves, Cooling Systems, DC Circuit Breakers)

- DC Cables and Accessories

- Control and Protection Systems

- Technology:

- Line Commutated Converter (LCC)

- Voltage Source Converter (VSC)

- Voltage Level:

- Below ±400 kV

- ±400 kV to ±600 kV

- Above ±600 kV (UHVDC)

- Application:

- Submarine Transmission

- Underground Transmission

- Overhead Transmission

Value Chain Analysis For HVDC Systems Market

The value chain for the HVDC Systems market is complex, beginning with upstream raw material suppliers and culminating in the long-term maintenance and operation of sophisticated transmission assets. Upstream activities primarily involve the procurement of highly specialized components, notably high-purity silicon for power semiconductors (IGBTs), copper/aluminum for conductors, and polymeric materials for cable insulation (XLPE). Manufacturers of power electronics, such as specialized semiconductor producers and large electrical equipment conglomerates, dominate this initial phase, demanding stringent quality control and reliability standards due to the mission-critical nature of converter valves. The efficiency of the upstream supply chain directly impacts the final system cost and reliability, creating a strong impetus for backward integration or long-term supplier agreements among major system integrators.

The core midstream segment involves the system integrators—global giants specializing in power transmission solutions (like ABB, Siemens, Hitachi)—who manage the engineering, procurement, and construction (EPC) of the entire link. This phase includes the manufacturing of specialized converter transformers, DC cables (often manufactured by separate cable specialists like Prysmian or Nexans), and the design of intricate control and protection systems. Distribution channels are predominantly direct, owing to the bespoke nature and massive scale of HVDC projects. System integrators bid directly for tenders issued by national Transmission System Operators (TSOs) or large utility companies, involving long sales cycles, complex contract negotiation, and specialized technical consultation, minimizing the role of indirect sales channels or distributors.

Downstream analysis focuses on the installation, commissioning, and long-term operation/maintenance of the HVDC links. End-users, chiefly TSOs and utility companies, take ownership after rigorous testing. Maintenance is critical, often managed via long-term service agreements (LTSAs) with the original equipment manufacturers (OEMs). This downstream phase is service-intensive, involving specialized field engineering crews, sophisticated diagnostic tools, and software updates, which generate a stable and high-margin recurring revenue stream for the key players. The value chain is characterized by high barriers to entry at the system integration level due to required technological expertise, extensive patent portfolios, and the necessity of demonstrating a proven track record of successful, reliable large-scale project execution.

HVDC Systems Market Potential Customers

The primary consumers and end-users of HVDC systems are entities responsible for the generation, transmission, and distribution of electrical power over vast distances or across complex geopolitical boundaries. This market is dominated by state-owned and private Transmission System Operators (TSOs) and Independent System Operators (ISOs) who utilize HVDC technology to enhance grid stability, manage congestion, and facilitate inter-regional power trading. These customers require high reliability, efficient transmission capacity, and solutions that meet stringent governmental and regulatory compliance standards, often viewing HVDC as a strategic asset for national energy security and maximizing the return on investment in new generation facilities.

Another significant segment of potential customers includes large utility companies and independent power producers (IPPs), particularly those investing heavily in remote, large-scale renewable energy projects such as massive onshore or offshore wind farms and large hydro projects. For these developers, HVDC is the only technically and economically feasible method to transport generated power to distant load centers with minimal loss. Furthermore, the growing momentum in establishing multi-terminal DC grids, particularly in Europe and parts of Asia, means that inter-utility consortiums and regional power pools are increasingly becoming coordinated buyers, seeking standardized, interoperable HVDC solutions capable of dynamic power routing and enhanced flexibility.

The third significant customer group involves industrial and governmental bodies initiating specific, large-scale infrastructural developments. This includes entities involved in cross-border energy corridors or national electrification programs in developing economies. For instance, countries seeking to establish large-scale energy trade routes or modernize aging infrastructure often rely on HVDC for its technical advantages in long-haul transmission and grid isolation capabilities. These procurement decisions are driven not only by technical specifications but also by project financing availability, regulatory support for green infrastructure, and the vendor's ability to provide complete, robust, and long-lasting turnkey solutions with favorable maintenance contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $16.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens Energy, General Electric (GE), Hitachi Energy, Mitsubishi Electric, Toshiba, Prysmian Group, Nexans, Sumitomo Electric, LS Electric, NKT, China XD Group, Arteche, American Superconductor (AMSC), Bharat Heavy Electricals Ltd (BHEL), Shanghai Electric, Xian Electric Engineering Co., Ltd., ZTT. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVDC Systems Market Key Technology Landscape

The HVDC systems technology landscape is predominantly defined by the evolution from Line Commutated Converters (LCC) to Voltage Source Converters (VSC), with VSC technology now spearheading innovation across most new project deployments, especially those requiring dynamic grid support or connection to weak AC systems. LCC technology, relying on thyristors, remains cost-effective and robust for extremely high power, long-distance point-to-point links (UHVDC) but suffers from high reactive power consumption and dependence on a strong AC network for commutation. VSC technology, utilizing Insulated Gate Bipolar Transistors (IGBTs) or similar power electronics, offers superior control over reactive power, enabling independent control of active and reactive power flow, making it ideal for connecting asynchronous grids, facilitating multi-terminal systems, and integrating intermittent renewables with enhanced operational flexibility.

A crucial area of ongoing technological innovation centers around modular multilevel converters (MMC), a specific VSC topology. MMCs are the state-of-the-art, offering scalability, high efficiency, lower harmonic content, and greater redundancy, significantly reducing the size and complexity of AC filters. The advancement in power semiconductors, particularly moving towards higher voltage and current ratings for IGBTs and researching Silicon Carbide (SiC) devices, promises further reductions in losses and physical footprints of converter stations. This miniaturization and efficiency gain are critical for expanding the viability of offshore converter platforms and space-constrained urban installations, directly impacting the overall project economics and environmental footprint of the transmission infrastructure.

Furthermore, the development of reliable and ultra-fast DC circuit breakers is a transformative technology necessary for realizing the ultimate goal of meshed, multi-terminal DC grids. Unlike simple AC circuit breakers, DC fault interruption is challenging due to the lack of natural current zero crossing. Companies are intensely focused on developing hybrid mechanical and solid-state DC circuit breakers that can detect and interrupt DC faults within milliseconds, ensuring localized fault isolation and preventing system collapse in a large DC network. Coupled with sophisticated digital control and protection systems, these innovations in DC switching and power electronics are fundamentally transforming HVDC from specialized point-to-point links into a core component of future interconnected, resilient, and highly managed global power supergrids.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for HVDC systems, dominated by ambitious infrastructure projects in China and India. China's continued investment in UHVDC technology is unparalleled globally, aimed at transporting massive hydropower and coal-fired generation from the west to the dense industrial and coastal load centers in the east. This region is driven by immense population growth, rapid industrialization, and significant governmental commitment to grid expansion and modernization. India, similarly, is undertaking numerous HVDC projects to strengthen its national grid and manage inter-regional power imbalances, utilizing both LCC for long-haul projects and VSC for city-infeed solutions. The high demand for long-haul, bulk power transmission ensures APAC maintains its market dominance throughout the forecast period.

- Europe: Europe is characterized by a strong focus on renewable energy integration, particularly vast offshore wind farm connections in the North Sea and the Baltic Sea. The push towards creating a unified European supergrid and synchronized cross-border interconnectors is a primary driver. European projects heavily favor VSC technology due to its superior performance in complex multi-terminal arrangements and its minimal reactive power requirements, which are crucial for integrating intermittent offshore generation. Regulatory clarity, coupled with major investments from TSOs in countries like Germany, the UK, and Norway, ensures high-value, albeit shorter-distance, HVDC project execution focusing on reliability and grid flexibility.

- North America: The North American market is driven primarily by grid reliability enhancements, modernization of aging infrastructure, and the necessity to transmit power from remote renewable generation sites (e.g., wind farms in the Midwest, hydro in Canada) to major coastal and urban demand centers. Regulatory frameworks, particularly in the US, are increasingly supporting grid separation projects and non-synchronous connections facilitated by VSC back-to-back stations. The market is also seeing increased demand for underground HVDC links in metropolitan areas, where right-of-way acquisition for overhead lines is increasingly difficult and costly, reinforcing the use of robust DC cable solutions.

- Middle East and Africa (MEA): Growth in the MEA region is emerging, fueled by large-scale solar projects and regional energy trade agreements aimed at connecting disparate national grids. The Middle East, with its extensive solar energy potential, is exploring long-distance HVDC for inter-Gulf cooperation and potential connection to European grids. In Africa, HVDC is crucial for transmitting hydro power (e.g., from Ethiopia and Congo) across vast, sparsely populated territories to reach consuming centers, often serving as critical backbone infrastructure for nascent continental power pools. The development pace is highly dependent on international financing and political stability regarding cross-border agreements.

- Latin America: The Latin American market, particularly Brazil and Chile, is driven by the necessity of transmitting hydropower and increasingly, large-scale solar power, from remote generation sites over very long distances. Brazil has utilized LCC and UHVDC technology extensively for its hydro transmission needs. Future growth is tied to investments in new renewable capacity, grid expansion into challenging geographical areas, and the strengthening of internal grids to handle intermittent generation, positioning HVDC as the optimal solution for these long, high-capacity transmission requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVDC Systems Market.- ABB

- Siemens Energy

- General Electric (GE)

- Hitachi Energy

- Mitsubishi Electric

- Toshiba

- Prysmian Group

- Nexans

- Sumitomo Electric

- LS Electric

- NKT

- China XD Group

- Arteche

- American Superconductor (AMSC)

- Bharat Heavy Electricals Ltd (BHEL)

- Shanghai Electric

- Xian Electric Engineering Co., Ltd.

- ZTT

- Jiangsu Dagang Cable Co., Ltd.

- TBEA Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the HVDC Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between LCC and VSC technologies in HVDC systems?

The primary difference lies in the power electronics utilized and operational flexibility. Line Commutated Converters (LCC) use thyristors, are highly efficient for ultra-long-distance, high-power transmission (UHVDC), but require a strong AC grid for commutation. Voltage Source Converters (VSC) use IGBTs or similar devices, offer independent control of active and reactive power, enable multi-terminal grids, and can connect to weak or passive AC networks, making them ideal for offshore wind integration.

Why is HVDC increasingly preferred over HVAC for long-distance power transmission?

HVDC is preferred because it incurs significantly lower transmission losses (often 30-50% less) over long distances, requires fewer conductors, and enables asynchronous interconnection of different AC grids without stability issues. This efficiency and technical flexibility render HVDC more economical for bulk power transfer over hundreds or thousands of kilometers.

What role do HVDC systems play in renewable energy integration?

HVDC systems are crucial for integrating remote renewable energy sources, such as massive offshore wind farms and distant solar complexes, by transporting the generated power efficiently to urban load centers. VSC technology, in particular, is vital for stabilizing the grid against the inherent intermittency of these renewable sources and managing dynamic power flows.

What are the main restraints hindering faster HVDC market adoption?

The main restraints are the exceptionally high upfront capital expenditure required for building converter stations, which form the most costly component, alongside the complexity and time-consuming nature of obtaining regulatory approvals and land rights for large, transnational transmission infrastructure projects.

How will the future development of DC circuit breakers impact HVDC networks?

The successful commercialization of reliable DC circuit breakers is essential for transitioning from simple point-to-point HVDC links to complex, meshed multi-terminal DC grids (DC Supergrids). These breakers enable rapid fault isolation, dramatically improving the resilience and operational flexibility of interconnected DC transmission networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager